Why Property Owners End Up Fighting Their Insurance Company

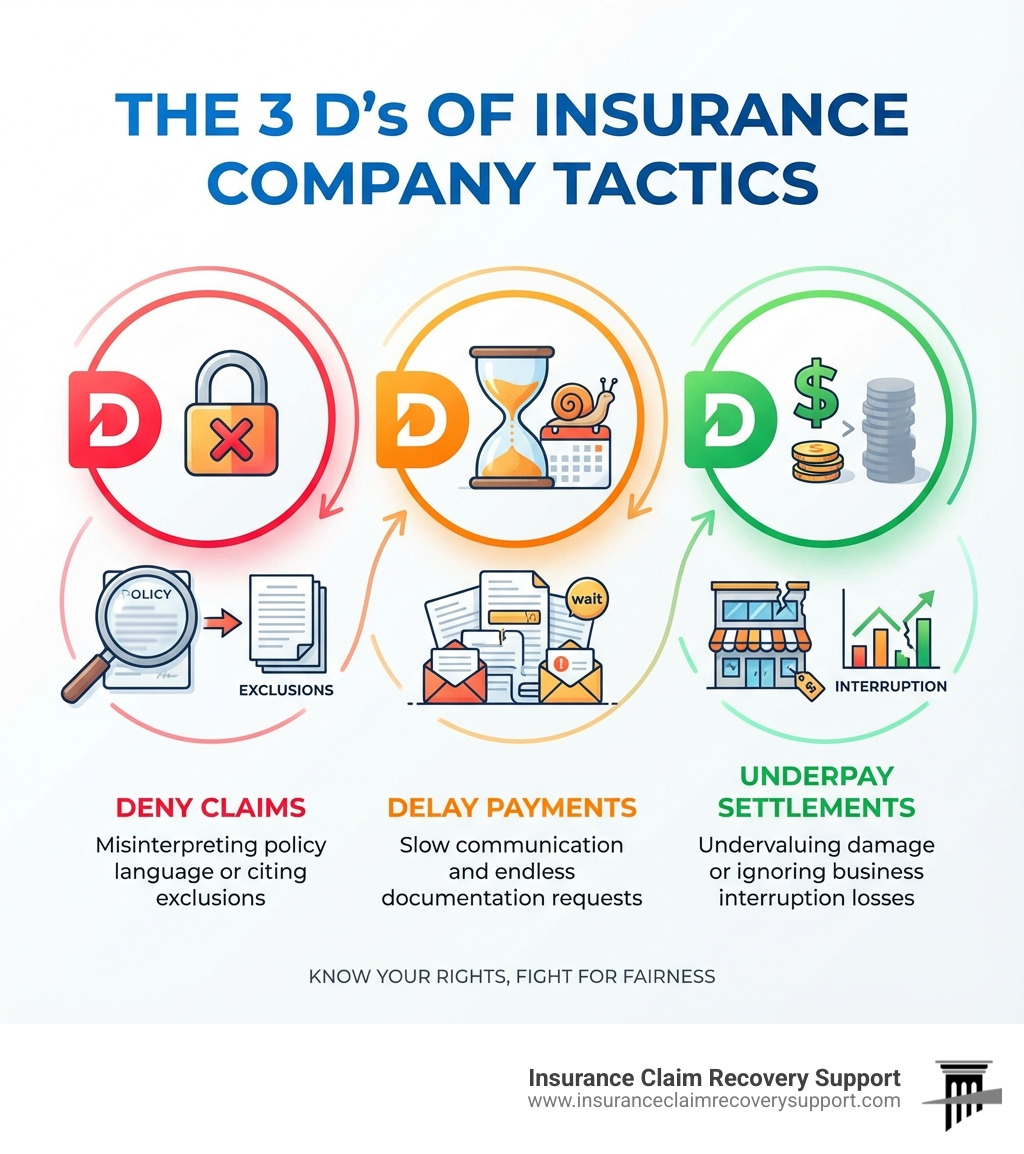

When you need a lawyer to fight insurance company tactics, you’re likely facing a denied, delayed, or drastically underpaid claim. Insurance companies often use the “3 D’s” to protect their profits: Deny valid claims, Delay payments, and Underpay settlements. This leaves commercial property owners struggling to recover.

Many assume a lawsuit is the only answer, but litigation is expensive and slow. A skilled public adjuster can often secure a maximum settlement through strategic negotiation, avoiding court entirely.

When to Hire a Lawyer vs. a Public Adjuster:

- Hire a lawyer for bad faith actions, breach of contract lawsuits, or complex legal issues.

- Hire a public adjuster first for denied or underpaid claims to maximize settlement value through expert documentation and negotiation, often avoiding litigation.

- Key difference: Lawyers handle lawsuits; public adjusters handle the claim valuation and negotiation process.

What is an insurance dispute and why do they happen?

An insurance dispute is a disagreement over your policy’s coverage or the value of your claim. They happen because your goal (full recovery) conflicts with the insurer’s goal (profitability). This is especially common in complex commercial claims involving fire, hurricanes, tornadoes, winter storms, and business interruption, where interpretations of damage and policy language differ.

What are common tactics insurance companies use to deny or delay claims?

Understanding these maneuvers helps you recognize when you’re being treated unfairly:

- Lowball Settlement Offers: Offering far less than the actual cost of repairs, hoping you’ll accept out of desperation.

- Misinterpreting Policy Language: Using ambiguous clauses in their favor to deny coverage.

- Unreasonable Documentation Requests: Making the process so burdensome that you give up.

- Claiming Pre-existing Damage: Blaming damage on “wear and tear” or poor maintenance instead of a covered event.

- Slow Communication and Delays: Dragging out the process to wear you down.

- Inadequate Investigation: Conducting a superficial inspection that misses the full scope of damage.

What constitutes ‘bad faith’ by an insurance company?

Bad faith is unethical or wrongful behavior by an insurer that breaches their contractual duty to act fairly. While a simple disagreement over a claim’s value isn’t bad faith, certain actions cross the line. According to the legal principle of insurance bad faith, insurers have an implied duty of good faith and fair dealing.

Actions that may be considered bad faith include:

- Denying a claim without a proper investigation or valid reason.

- Unreasonably delaying claim processing or payment.

- Failing to conduct a thorough investigation.

- Misrepresenting facts or policy provisions.

- Offering a settlement that is substantially less than the claim’s known value.

- Failing to communicate in a timely manner.

If you suspect bad faith, you may need a lawyer to fight insurance company tactics, as you could be entitled to damages beyond the original claim amount.

Choosing Your Advocate: Public Adjuster or Lawyer to Fight an Insurance Company

When your insurance company isn’t cooperating, you have two main advocates: a public adjuster or a lawyer. The right choice depends on whether you need to maximize your claim’s value through negotiation or pursue legal action against the insurer. Our goal is to help you get the best settlement, ideally without a costly lawsuit.

Fact vs. Myth: Do You Always Need a Lawsuit to Get a Fair Settlement?

Myth: A lawsuit is the only way to fight a denied or underpaid claim.

Fact: Most disputes can be resolved through expert negotiation and meticulous documentation by a public adjuster.

A lawsuit is a last resort, not the first step. Legal action is necessary for clear cases of bad faith, breach of contract, or complex legal disputes. For most commercial property claims, a skilled public adjuster can achieve maximum recovery without litigation, as evidenced by our 90% settlement success rate.

How does a lawyer to fight an insurance company handle a case?

When a lawsuit is necessary, the process is lengthy and complex. A lawyer will:

- File a Lawsuit: Formally sue the insurer for breach of contract or bad faith.

- Conduct Findy: Exchange information through written questions, document requests, and sworn testimonies (depositions).

- Attend Mediation: Attempt to negotiate a settlement with the help of a neutral third party.

- Go to Trial: If no settlement is reached, the case is presented to a judge or jury. This process can take years.

Most lawyers for these cases work on a contingency fee (typically 33-40% of the recovery) and must file before the statute of limitations expires.

How can a public adjuster help you win without a lawsuit?

A public adjuster is your exclusive advocate, working only for you to maximize your settlement without litigation. We focus on expert claim preparation and strategic negotiation.

Here’s our process:

- Detailed Damage Assessment: We conduct a thorough inspection to find all damage, including issues the insurer’s adjuster missed.

- Expert Policy Interpretation: We analyze your commercial policy to ensure all covered damages are claimed.

- Meticulous Claim Documentation: We build a professional claim package with photos, estimates, and reports that leaves little room for dispute.

- Strategic Negotiation: We handle all communications, countering lowball offers with fact-based arguments to secure the maximum settlement.

| Feature | Public Adjuster (e.g., ICRS) | Lawyer to Fight Insurance Company |

|---|---|---|

| Primary Focus | Maximizing claim settlement through documentation, negotiation, and policy expertise. | Pursuing legal remedies (breach of contract, bad faith) through litigation. |

| When to Engage | Ideal for denied, delayed, or underpaid claims where the insurer is not acting in bad faith, or as a first step to avoid litigation. | Necessary when bad faith is evident, the insurer refuses to negotiate fairly, or a lawsuit is the only path to recovery. |

| Cost Structure | Contingency fee (percentage of the recovered amount), typically not paid until settlement. | Contingency fee (percentage of recovered amount) for litigation, potentially hourly fees for consultation or specific tasks. |

| Timeline | Generally faster, aiming for resolution through negotiation. Can take months, but significantly quicker than litigation. | Often lengthy, involving findy, mediation, and potentially trial. Can take years to resolve. |

| Process | Inspects damage, interprets policy, compiles documentation, negotiates with insurer, handles communications. | Files lawsuit, conducts findy (depositions, interrogatories), attends mediation, represents in court. |

| Relationship | Advocate for the policyholder’s financial recovery. | Legal representative for the policyholder in court. |

| Avoids Litigation | Yes, aims to resolve claims without needing a lawsuit. | No, their primary function is litigation. |

| Expertise | Deep knowledge of insurance policies, construction costs, and property damage assessment. | Expertise in legal strategy, court procedures, and insurance law. |

| ICRS USP | 90% settlement success rate without unnecessary lawsuits; specialized in large-loss commercial, multifamily, and specialty property claims in Texas and other licensed states. | N/A |

What are the potential outcomes and next steps for your claim?

With a public adjuster, you can achieve a faster settlement, avoid the stress and cost of litigation, and maximize your financial recovery. We are your first line of defense, leveling the playing field to get you back to business quickly. If the insurer still acts in bad faith, our detailed claim file provides a strong foundation for your legal team.

Don’t let a disputed claim derail your business. If you need help, it’s time to act. Get help with your denied claim by contacting us today.

FAQ: Common Questions from Commercial Property Owners

Do I need a lawyer or a public adjuster for my property damage claim?

For most denied, delayed, or underpaid commercial property claims, start with a public adjuster. We specialize in maximizing your claim’s value through documentation and negotiation, often avoiding court. You need a lawyer to fight insurance company tactics if you have a clear case of bad faith, need to file a lawsuit for breach of contract, or face complex legal issues.

What if my claim was denied or underpaid?

A denial is not the final word. Contact a public adjuster like ICRS. We will re-evaluate your damages, analyze your policy, and prepare a comprehensive claim package to challenge the insurer’s decision. We handle all negotiations to reverse the denial or significantly increase the underpaid amount.

How long does the claims process take?

Timelines vary, but a large commercial claim can take several months to negotiate. State laws in places like Texas set initial deadlines for insurers, but the full process can be lengthy. Our goal is to expedite your settlement through expert preparation, which is significantly faster than a lawsuit that can take years.

Can I recover my legal fees if I win?

In a successful lawsuit, a court may award attorney fees, especially in bad faith cases. Lawyers often work on contingency, taking a percentage of the final award. Similarly, public adjusters at ICRS work on a contingency fee basis, so you pay nothing upfront. Our fee is a percentage of the recovered funds, aligning our interests with yours.

What makes ICRS different in helping resolve insurance disputes?

- Policyholder-Exclusive Representation: We only represent you, never the insurance company.

- Specialized Expertise: We focus on large-loss commercial, multifamily, and specialty property claims (fire, hurricane, tornado, etc.).

- Proven Success Without Litigation: We have a 90% settlement success rate without unnecessary lawsuits, saving you time and money.

- Comprehensive Service: We handle everything from damage assessment and policy review to negotiation.

- Broad Geographic Reach: Based in Texas, we are licensed and serve clients in Florida, Georgia, Colorado, and many other states.

- No Upfront Costs: We work on a contingency fee basis. We don’t get paid unless you do.