When Disaster Strikes: Understanding Large Loss Property Insurance Claims

Large loss insurance covers claims with significant property damage—typically over $200,000—where the financial impact and complexity create substantial challenges. These claims often result from major events like fires, hurricanes, tornadoes, floods, and freezes that devastate commercial buildings, multifamily complexes, and other large properties.

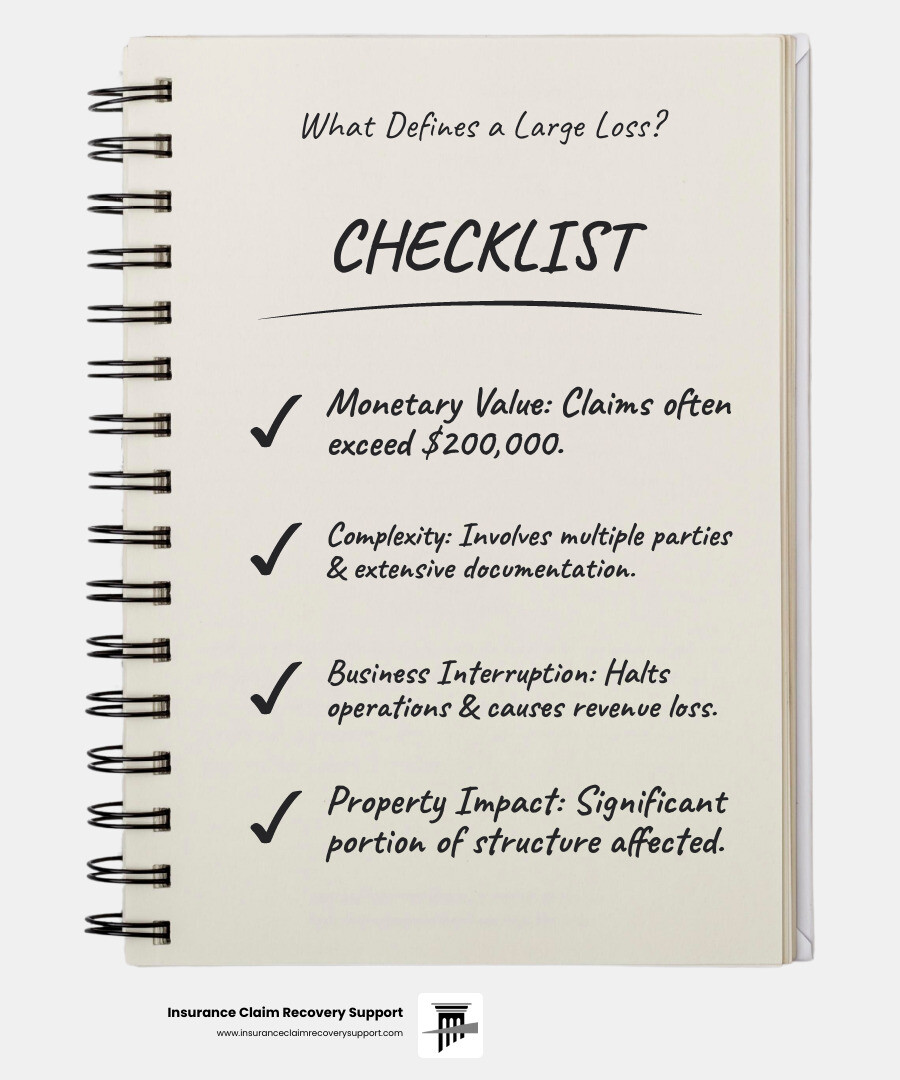

What Defines a Large Loss Insurance Claim:

- Monetary Threshold: Claims usually exceed $200,000, but this varies.

- Extent of Damage: A significant portion of the structure is damaged, requiring complex repairs.

- Business Impact: Operations are halted, cutting off revenue.

- Claims Complexity: Involves multiple parties, extensive documentation, and long resolution timelines.

- Assessment Challenges: Requires experts to evaluate hidden damages, code compliance costs, and business interruption losses.

Why This Matters: Industry data shows 40% of businesses never reopen after a disaster. For commercial property owners, multifamily HOAs, and religious institutions across Texas—from Austin to Houston and Dallas to San Antonio—properly navigating large loss claims is about survival.

I’m Scott Friedson, and for 15 years, I’ve specialized in large loss insurance claims, settling over 500 claims valued at more than $250 million for commercial and multifamily property owners. My expertise in fire, hail, hurricane, tornado, freeze, and other perils has helped clients increase claim recoveries by 30% to over 3,800%.

The Anatomy of a Large Loss Insurance Claim

What is a “Large Loss”? Beyond the Price Tag

A large loss insurance claim is more than just a high dollar amount. While these claims often start around $200,000 and can reach millions for commercial properties in Dallas or Houston, the true definition lies in the total impact.

A large loss disrupts every facet of your operation. When a fire hits a Fort Worth religious institution or a tornado strikes an Austin apartment complex, the damage extends beyond the physical structure. It includes lost revenue, relocation costs, and the complexity of coordinating engineers and contractors. The monetary threshold is subjective; for a small business in Lubbock, a loss that halts operations is “large” regardless of the specific dollar figure. If your business can’t function, your tenants are displaced, or your congregation cannot meet, you are facing a large loss that demands specialized advocacy.

Key Policy Clauses That Make or Break Your Large Loss Insurance Claim

Your insurance policy is your roadmap to recovery. Understanding these key clauses before a disaster in Houston or Waco can prevent costly surprises.

Property damage coverage is the foundation, covering perils like fire, wind, and freeze. However, standard policies often exclude floods, requiring separate coverage.

Business interruption coverage is critical, compensating for lost income and extra expenses during repairs. It can be the difference between reopening and closing for good, as these losses often account for 50-70% of the total insured loss.

Coverage limits are the maximum your insurer will pay. With property values rising, review and update your limits regularly to avoid being underinsured.

Deductibles can be complex. While some insurers waive them for large losses (e.g., over $50,000), this isn’t guaranteed. Furthermore, deductibles often vary by peril. A wind or hurricane deductible might be a percentage of your property’s value (e.g., 2% of a $5 million property is $100,000) rather than a flat amount.

Policy exclusions are the fine print that can derail a claim. Beyond floods, watch for limitations on mold, which often requires a specific endorsement.

“Ordinance or Law” coverage is crucial for older buildings. If a repair in Round Rock triggers a city mandate to upgrade the entire structure to current building codes, this coverage pays for those increased costs, which can be substantial.

The coinsurance clause and underinsurance risk are major pitfalls. This clause requires you to insure your property for a specific percentage of its value (e.g., 80-90%). If you fail to meet this, your insurer can penalize you by reducing your claim payout proportionally, even on a partial loss. If your policy limits haven’t kept pace with property values, you’ll face a significant financial shortfall.

For specific guidance on tornado-related claims, you can find more info about tornado damage claims on our website. Understanding these components now is the key to a successful claim.

Navigating the Claims Process: A Step-by-Step Guide

Filing a large loss claim is daunting, but a clear process makes it manageable.

1. Initial Damage Assessment: As soon as it’s safe, document everything. Take extensive photos and videos of the damage from multiple angles. This initial record is invaluable.

2. Notify Your Insurer Immediately: Prompt notification is required by most policies and starts the claims process. Don’t wait to have all the details.

3. Mitigate Further Damage: Your policy requires you to prevent additional harm. Board up windows, tarp roofs, and dry wet areas. Keep all receipts for these temporary repairs, as they are typically reimbursable. Do not make permanent repairs until the adjuster has inspected the property.

4. Documentation is Key: This is where claims are won or lost. Create a comprehensive file containing:

- Photos and videos of all damage.

- A detailed inventory of damaged property with costs and purchase dates.

- Financial records (P&L statements, tax returns) to prove business interruption losses.

- Written repair estimates from licensed contractors.

- A log of all communications with your insurer.

- A complete copy of your insurance policy and endorsements.

- Receipts for all mitigation and temporary relocation expenses.

5. Work with the Insurer’s Adjuster: Be prepared for the adjuster’s visit. Walk them through the damage and provide your documentation. Their role is to represent the insurance company’s interests, not yours.

6. Review the Settlement Offer: Never accept the first offer without a thorough review. Compare it against your documentation and contractor estimates. If it’s insufficient, you have the right to negotiate. This is where professional representation often proves most critical.

Public Adjuster: Your Advocate for a Fair Settlement

When you file a large loss claim, the insurance company’s adjuster works for them. Their job is to minimize the payout. A public adjuster works exclusively for you, the policyholder. Our sole function is to document your claim, assess the full scope of damages—including hidden issues—and negotiate to secure the maximum settlement you are owed.

The financial difference is substantial. A study showed that claims handled by public adjusters can result in settlements up to 747% higher. We level the playing field.

Public Adjuster vs. Lawsuit

Many policyholders think a lawsuit is the only option after a lowball offer, but litigation is slow, expensive, and uncertain. A public adjuster provides a more direct path to a fair settlement.

- Timeline: A public adjuster can often resolve a claim in months. A lawsuit can take years.

- Upfront Costs: Public adjusters work on a contingency fee (a percentage of the settlement), so you pay nothing upfront. Litigation requires retainers and hourly fees that can cost tens of thousands before you see any recovery.

- Control: With a public adjuster, you remain in control of negotiations. In court, you are subject to schedules and rulings beyond your influence.

- Outcome: We focus on negotiating the full value of your claim. A lawsuit carries the risk of losing entirely, on top of the time and money already spent.

For commercial property owners in San Antonio, multifamily complexes in Lubbock, or religious institutions in Waco, the public adjuster path is a faster, more certain route to recovery. Commercial claims are far more complex than residential ones, involving extensive documentation and high-stakes negotiations. This is where our specialized expertise in large loss insurance makes the difference. We have settled over 500 large loss claims valued at over $250 million, increasing initial offers by 30% to more than 3,800%.

Common Pitfalls in Large Loss Insurance Claims and How to Avoid Them

Navigating a large loss claim is fraught with potential missteps. Here are common myths and the facts you need to know to avoid costly errors.

Myth: My policy covers the full replacement cost automatically.

Fact: Underinsurance is a common and costly mistake. If your coverage doesn’t meet your policy’s coinsurance requirement (typically 80-90% of property value), your insurer can proportionally reduce your payout, even for a partial loss. Solution: Review and update your coverage annually to reflect current property values.

Myth: Debris removal is fully included.

Fact: Debris removal often has a low cap (e.g., $25,000), which is insufficient for a large commercial site where costs can exceed $200,000. Solution: Check your policy’s sub-limits and consider purchasing additional coverage.

Myth: If I can’t see the damage, it doesn’t exist.

Fact: Hidden damage like water infiltration behind walls, smoke in HVAC systems, or structural stress from wind is frequently missed by insurance adjusters but can lead to catastrophic future costs. Solution: Hire independent engineers and specialists to conduct a thorough assessment.

Myth: My deductible is the same for every type of damage.

Fact: Deductibles vary by peril. A fire deductible might be a flat $5,000, but a wind or hurricane deductible could be a percentage of your property’s insured value (e.g., 2% on a $5 million building is $100,000). Solution: Read your policy’s declarations page carefully to understand your out-of-pocket costs for different perils like freeze or tornado damage.

Myth: The insurance company has to treat me fairly.

Fact: Insurers often use delays, excessive documentation requests, and disputes to minimize payouts. This is a business tactic. Solution: Protect yourself with meticulous documentation and professional representation to hold them accountable.

Myth: I should accept the first settlement offer to speed things up.

Fact: Initial offers are almost always low. The insurer is counting on your desire to move on quickly. We’ve seen first offers cover as little as 30% of the actual loss. Solution: Never accept an offer without a detailed review against your own estimates and documentation.

Proactive planning is critical. As FEMA’s scientific research on disaster recovery planning shows, preparation dramatically improves outcomes. Being prepared is the best way to avoid turning a manageable claim into a financial disaster.