Navigating Property Damage Claims in Lakeway, TX

When property damage strikes your commercial building or multifamily complex in Lakeway, a Lakeway public adjuster can be the key to a fair settlement. Navigating the insurance claim process for fire, storm, or flood damage can be overwhelming, with the odds often stacked against the policyholder.

Quick Answer: What You Need to Know About Lakeway Public Adjusters

- What they do: Licensed professionals who work exclusively for policyholders to maximize insurance claim settlements

- How they’re paid: Contingency fee basis (capped at 10% in Texas) – no recovery, no fee

- When to hire: For new claims, denied claims, or underpaid settlements, especially for large losses over $250,000

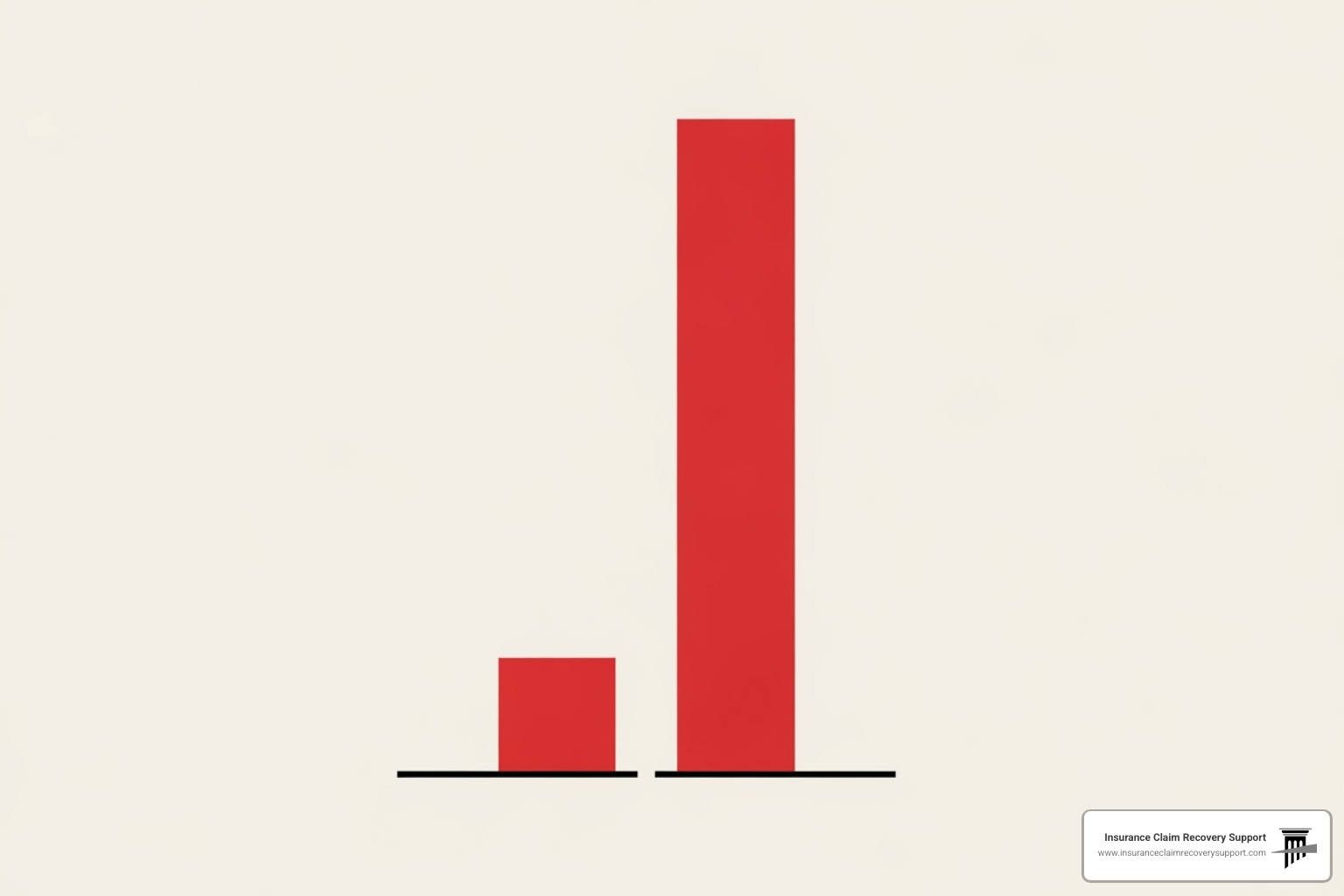

- Key benefit: Studies show claims handled by public adjusters result in 547% higher payments on average

- Local advantage: Understanding of Lakeway building codes, Travis County regulations, and regional weather patterns

The stakes are high when you’re managing commercial properties or apartment complexes. Insurance companies have teams of adjusters working to minimize payouts. A skilled public adjuster levels the playing field and can help you avoid the costly, time-consuming route of litigation.

As Scott Friedson, CEO of Insurance Claim Recovery Support, I’ve settled over 500 large-loss claims valued at more than $250 million. My experience as a Lakeway public adjuster shows that proper representation can dramatically increase settlements and help property owners avoid costly legal battles.

Common Lakeway public adjuster vocab:

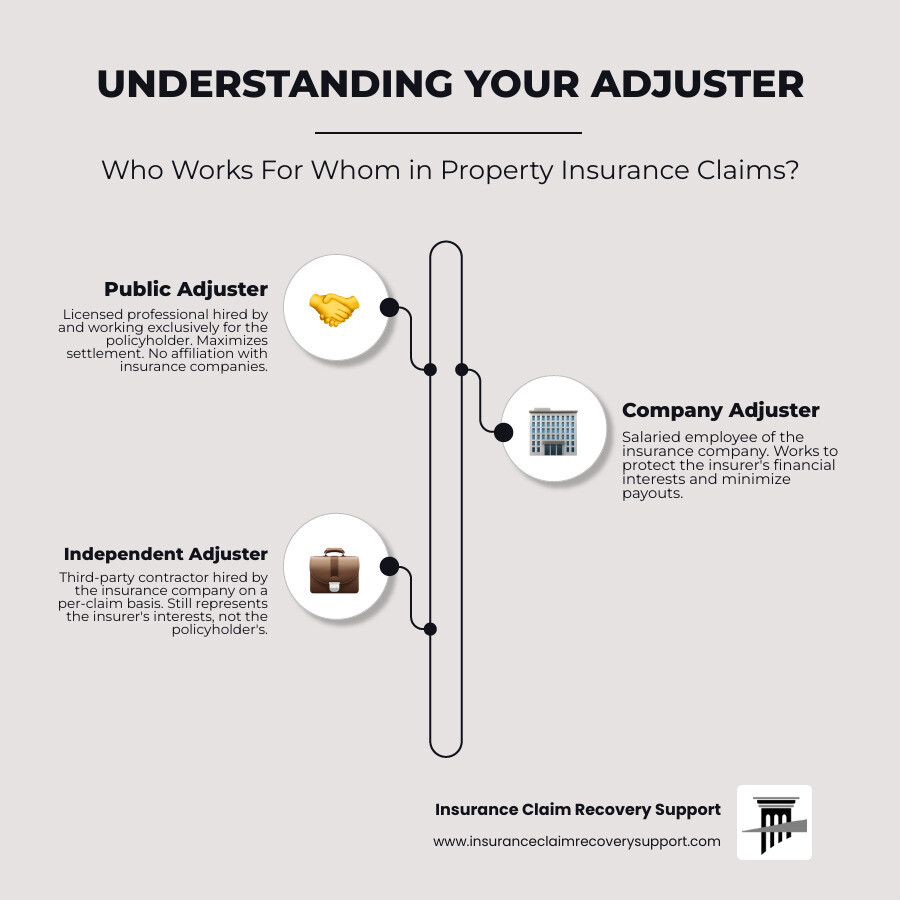

The Critical Difference: Your Advocate vs. The Insurance Company’s Employee

After your Lakeway commercial property is damaged, an adjuster will arrive to assess the loss. But whose interests do they represent? Understanding the difference between adjusters is crucial for protecting your financial future, especially when managing high-value commercial or multifamily properties.

What is a Public Adjuster?

A Public Insurance Adjuster Texas USA is a licensed professional who works exclusively for you, the policyholder. We are your advocate, with no affiliation to insurance companies. Our sole purpose is to maximize your settlement by managing the entire claim process: inspecting damage, interpreting your policy, documenting losses, and negotiating on your behalf. As a Lakeway public adjuster, we understand local codes and challenges in Travis County and have a fiduciary duty to act in your best interest.

How Do They Differ from the Insurer’s Adjuster?

The adjuster sent by your insurance company—whether a staff or independent adjuster—works for the insurer. Their goal is to protect the insurer’s bottom line by minimizing the payout. This creates an inherent conflict of interest. Just as you wouldn’t face a legal team without your own lawyer, you shouldn’t steer a complex claim without your own expert advocate.

| Feature | Public Adjuster | Company Adjuster | Independent Adjuster |

|---|---|---|---|

| Allegiance | Exclusively to You | To the Insurance Company | To the Insurance Company |

| Goal | Maximize Your Settlement | Minimize Company Payout | Minimize Company Payout |

| Compensation | Percentage of Your Settlement | Salary from Insurance Company | Fee from Insurance Company |

| Conflict of Interest | None | Yes | Yes |

This difference explains why policyholders with public adjusters often receive significantly higher settlements. We find damages company adjusters miss, interpret policy language in your favor, and negotiate for every dollar you deserve. Relying on the insurer’s adjuster creates a high risk of underpayment from missed damages or unfavorable policy interpretations. A Lakeway public adjuster provides the independent expertise needed to secure a fair settlement and avoid costly litigation. If you’re asking Should I Hire a Public Adjuster?, the answer lies in having an expert dedicated solely to your financial recovery.

Why Lakeway Commercial & Multifamily Properties Need an Expert on Their Side

Owning commercial property in Lakeway means facing unpredictable Texas weather. Your property in Travis County, Texas is vulnerable to severe thunderstorms, damaging winds, and hail that can devastate commercial roofs and structures. When disaster strikes, a Lakeway public adjuster with local expertise is essential. The Texas fire and storm damage news is a constant reminder of these risks.

Statistics show that claims handled by public adjusters result in 547% higher payments on average. This isn’t an anomaly; it’s the result of expert advocacy that prevents the underpaid claims and denials common in the industry.

The Advantage of a Local Lakeway Public Adjuster

A local public adjuster brings invaluable knowledge. We are familiar with local contractors, regional material costs, and common Lakeway claim types, like damage related to shifting clay soil. We also steer municipal requirements and local building codes, which can significantly impact the scope and cost of repairs, ensuring these factors are included in your claim.

When is the Best Time to Hire a Public Adjuster?

The best time to hire a public adjuster is immediately after a loss to ensure proper documentation from the start. However, it’s never too late. We frequently help with underpaid settlements and denied insurance claims, often uncovering grounds to challenge the insurer’s decision. For complex damage or significant financial loss, professional representation is critical to a successful outcome. We help you [How to Expedite Property Damage Insurance Claim Settlement] and avoid leaving money on the table. Our goal is to secure a fair settlement through negotiation, helping you avoid the time and expense of litigation.

The Path to Fair Recovery: Public Adjuster vs. Lawsuit

After a major loss to your Lakeway property, you face a choice: handle the claim alone, hire a Lakeway public adjuster, or pursue a lawsuit. A public adjuster offers a strategic path that often secures a fair settlement while avoiding the high costs and delays of litigation. By focusing on detailed claim documentation and strategic negotiation, we prevent the bad faith disputes that often escalate into legal battles.

How a Lakeway Public Adjuster Helps You Avoid the Courtroom

Our mission is to get you a maximum settlement without the stress and expense of a lawsuit. We achieve this through:

- Expert Claim Preparation: We carefully document all damage, including hidden issues company adjusters often miss, creating an indisputable case for your loss.

- Thorough Damage Valuation: Using local cost data and expert contractors, we develop accurate repair estimates that reflect the true cost of restoration in the Lakeway area.

- Strategic Negotiation: We know the insurance company’s tactics and counter them with facts, expert policy interpretation, and unwavering advocacy.

- Early Dispute Resolution: By presenting a comprehensive claim upfront, we resolve most disagreements through negotiation, preventing them from escalating into legal battles.

The Lawsuit Process for Property Damage

Litigation is a long, expensive, and uncertain alternative. The process involves filing a lawsuit, a lengthy findy phase, and costly expert witnesses. Attorney fees and court costs can be staggering, and the outcome is never guaranteed. This lengthy process can take years, leaving your property unrepaired and causing further financial loss from business interruption. Even a successful verdict is often diminished by legal fees. A public adjuster provides a better way, achieving fair compensation through negotiation, saving you the time, cost, and stress of a courtroom battle.

Maximizing Your Settlement: Comprehensive Services & Claim Types

A fair settlement requires expert handling of your claim. As your Lakeway public adjuster, we provide comprehensive services to ensure every aspect of your loss is documented and valued correctly. Our process includes: Policy Review to maximize your coverage, Damage Assessment to find all damage, Claim Documentation to build an airtight case, Negotiation to counter the insurer’s tactics, and Settlement Finalization to secure every dollar you’re owed.

What Specific Services Do Public Adjusters Offer?

We manage the entire claim process for you:

- On-site damage inspection: We find hidden damage that company adjusters often miss.

- Detailed cost estimates: We create accurate estimates based on local material and labor costs.

- Insurance policy analysis: We decipher your policy to find all applicable coverages.

- Filing all claim paperwork: We handle all submissions and deadlines to prevent errors.

- Communicating with the insurer: We act as your single point of contact, managing all communication.

- Negotiating the final settlement: We fight to close the gap between the insurer’s low offer and the true cost of your damages.

Property Damage Claims We Specialize In

We specialize in complex commercial claims across Texas:

- [Fire Damage Claims]: Involving fire, smoke, and water damage, plus business interruption.

- [Water Damage Insurance Claims]: Addressing hidden mold, structural, and electrical issues.

- Wind and Storm Damage: Identifying subtle but significant structural problems from Texas storms.

- Business Interruption: Calculating lost rental income and ongoing expenses to ensure they are part of your claim.

- Building Collapse: Working with engineers to assess catastrophic structural failures.

Our goal is always to secure the maximum recovery for your [Commercial Property Damage] through expert negotiation, avoiding the need for costly litigation.

Understanding the Investment: Fees and Financial Outcomes

We operate on a contingency fee basis, meaning there are no upfront costs. Our success is tied to yours—we only get paid if we recover a settlement for you. This is our “No Recovery, No Fee” promise.

In Texas, our fee is capped by law at a maximum of 10% of the total settlement amount. The return on investment is significant. Studies show claims handled by public adjusters result in 547% higher payments on average, with some settlements increasing by over 3,000% compared to initial offers.

For example, if an insurer offers $100,000 and we secure $500,000, our $50,000 fee leaves you with $450,000—a net gain of $350,000. This makes hiring a Lakeway public adjuster one of the smartest investments for your property’s recovery.

For more information on [Public Adjuster Fees] or services in areas like [Public Adjuster Georgetown Texas], we can provide a clear breakdown for your situation.

Frequently Asked Questions About Hiring a Lakeway Public Adjuster

When property owners in Lakeway consider hiring a public adjuster, they naturally have questions about the process, costs, and benefits. Here are answers to some common questions.

How are public adjusters compensated in Texas?

Public adjusters in Texas work on a contingency fee basis. There are no upfront costs, and we only get paid if we successfully recover money for you. Our fee is a small percentage of the settlement, legally capped at 10% of the total amount. This “no recovery, no fee” model ensures our interests are perfectly aligned with yours.

What are the benefits of using a public adjuster for a commercial property claim?

For complex commercial claims, a Lakeway public adjuster provides several key benefits:

- Expert Damage Valuation: We accurately assess damage to intricate commercial systems and ensure code compliance costs are included.

- Business Interruption Calculations: We calculate and claim losses from lost rent and other business-related expenses.

- Time Management: We manage the entire claim process, saving you dozens of hours and allowing you to run your business.

- Leveling the Playing Field: We provide the expert advocacy you need to counter the insurance company’s team of professionals.

Can I reopen a claim that has already been settled?

Yes, it’s often possible. In Texas, you generally have time after a claim is settled to reopen it. This is common if additional damage is found during repairs, if the initial settlement was inadequate, or if repair costs escalate unexpectedly. A Lakeway public adjuster can review your settled claim to find opportunities for additional recovery. Acting promptly is key, so don’t assume the first check is the final word on what you are owed.

Secure Your Maximum Recovery in Lakeway

When your Lakeway commercial property is damaged, you don’t have to face the insurance battle alone. A dedicated Lakeway public adjuster from Insurance Claim Recovery Support is your partner in recovery. We provide the expert advocacy needed to level the playing field against the insurer’s team, ensuring you receive the financial security you deserve.

Our team handles the complex negotiations and paperwork, allowing you to focus on your business. With a track record of securing settlements 547% higher on average, we turn disaster into recovery.

Whether you have a new, underpaid, or denied claim, don’t let the insurer’s first offer be the last word. For a comprehensive review of your claim, contact our team of experts today. We’re ready to fight for every dollar you’re owed.