Why Having Your Own Expert Matters More Than You Think

When you search for “insurance companies have experts working for them, you should too,” you’re likely facing a property damage claim and wondering why the process feels so one-sided. Here’s the quick answer:

What You Need to Know:

- ✅ Insurance companies employ teams of adjusters, lawyers, and actuaries whose primary job is to minimize payouts.

- ✅ These experts use tactics including delay strategies, excessive documentation requests, and lowball settlement offers.

- ✅ Policyholders have the burden of proving their claim, which requires specialized expertise in policy interpretation, damage valuation, and negotiation.

- ✅ Public adjusters work exclusively for you, not the insurance company, and typically increase settlements significantly.

- ✅ In Texas, public adjuster fees are capped at 10% of the settlement, and most work on contingency (no recovery = no fee).

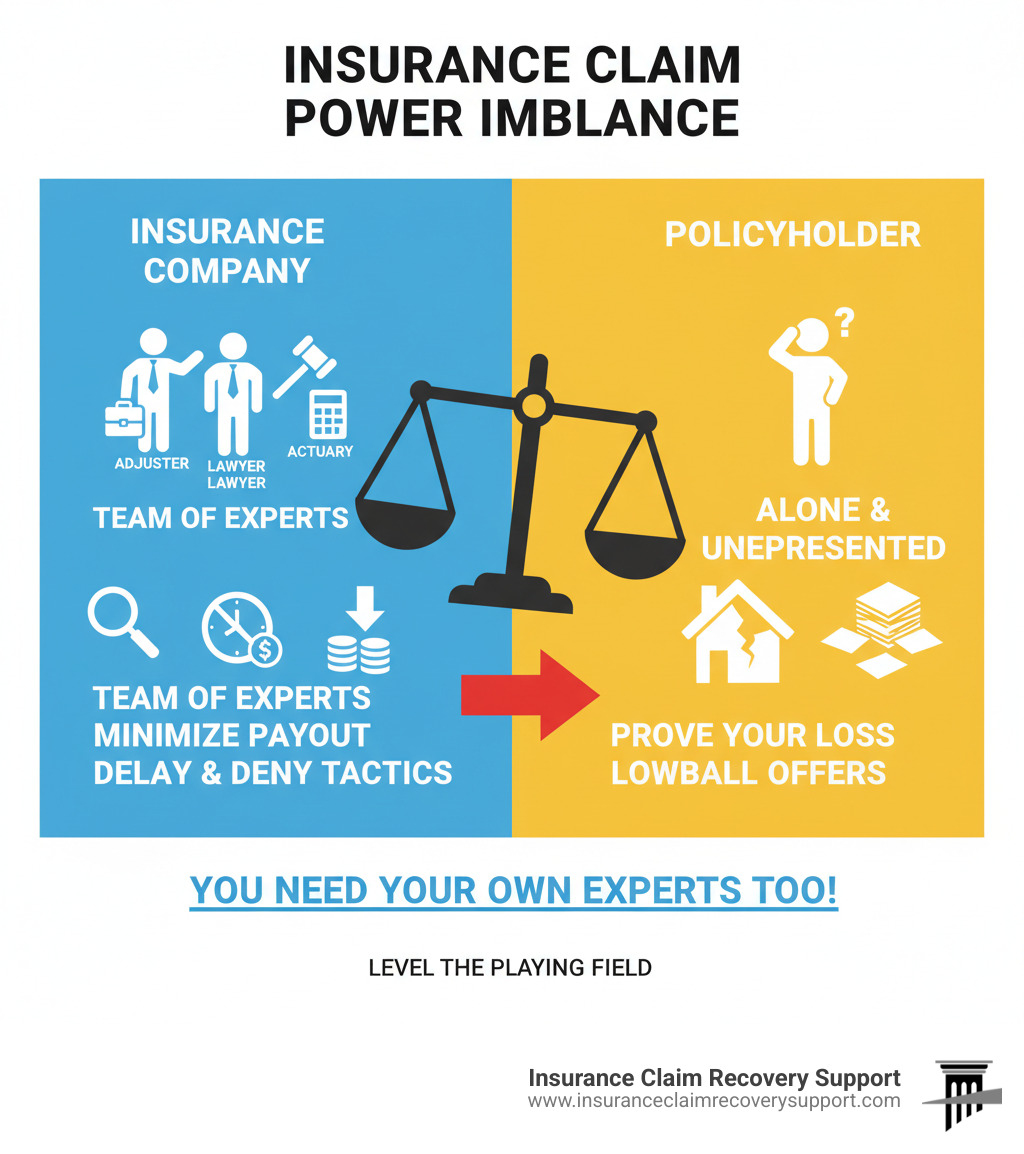

When disaster strikes your commercial property, the insurance claim process begins. Many property owners quickly find they’re facing a well-trained team of insurance company experts—adjusters, lawyers, and actuaries—whose primary mandate is to protect the insurer’s bottom line by paying as little as possible.

This isn’t paranoia; it’s their business model. Insurers benefit from delaying claims and using tactics like excessive documentation requests and lowball offers, hoping you’ll accept less out of exhaustion. Statistics show that settlements are significantly higher when a policyholder has their own expert representation. These professionals level the playing field by understanding complex policy language, properly documenting losses, and effectively countering the insurance company’s tactics.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve seen how applying the principle that insurance companies have experts working for them, you should too has increased claim recoveries by 30% to over 3,800% for commercial and multifamily property owners. This guide will show you why having your own expert is critical to receiving the full compensation you’re owed.

Insurance companies have experts working for them, you should too vocab explained:

- should i hire a public adjuster

- what does a claims adjuster do

- Commercial Insurance Claims – Commercial Property Claims What You Need To Know About The Commercial Property Damage Insurance Claims Process We adjust property claims for churches, schools, warehouses, retail buildings. We can help. We handle all the negotiations with your insurance company so you don’t have to.

Because Insurance Companies Have Experts Working for Them, You Should Too

While you focus on recovering from a fire, hurricane, or freeze in Houston, Dallas-Fort Worth, or Austin, your insurance company activates its team. Their priority isn’t your recovery; it’s protecting their bottom line. This is why insurance companies have experts working for them, you should too.

This team includes:

- Company Adjusters: Employees trained to assess damage through the lens of the insurer’s financial interests, looking for ways to limit your claim.

- Legal Teams: In-house and external lawyers who are masters of interpreting complex policy language to favor the insurer and defend against claims.

- Actuaries and Risk Managers: Professionals who analyze data to set financial limits on claims and develop strategies to reduce the company’s exposure to large payouts.

This team uses a proven playbook of tactics designed to wear you down and pay you less. They make lowball initial offers, hoping you’ll accept out of desperation. They delay the process with excessive and confusing documentation requests. They use the dense, technical language in your policy to deny or limit coverage. A casual remark you make can even be twisted and used to devalue your claim. Facing this coordinated effort alone puts your financial recovery at significant risk.

| Adjuster Type | Employer/Loyalty | Primary Role | Payment Structure |

|---|---|---|---|

| Company Adjuster | Insurance Company | Investigates, assesses damage, determines coverage for the insurer | Salary/Benefits from insurer |

| Independent Adjuster | Insurance Company (contracted) | Investigates, assesses damage for the insurer, often for specific expertise or during high demand | Paid by insurer on a per-claim or hourly basis |

| Public Adjuster | Policyholder | Investigates, assesses damage, interprets policy, negotiates for the policyholder | Percentage of final settlement (contingency fee) |

For an independent overview of the duties and loyalties of adjusters, see the U.S. Department of Labor CareerOneStop resource: Claims Adjusters, Examiners, and Investigators.

Your Countermove: Assembling Your Own Expert Team

The most effective response is to assemble your own team, led by a public adjuster. Unlike the company adjuster, a public adjuster works exclusively for you. At Insurance Claim Recovery Support, we specialize in large commercial and multifamily property damage claims from fire, hurricane, tornado, and freeze events across Texas.

Heres how we level the playing field:

- Expert Policy Interpretation: We dissect your complex commercial policy to identify all areas of coverage, ensuring nothing is overlooked.

- Thorough Damage Valuation: We conduct our own detailed assessment of the damage, using construction expertise and sophisticated software to document the full cost of repairs, including hidden damage and code-required upgrades.

- Comprehensive Claim Preparation: The burden of proof is on you. We build an airtight claim with compelling evidence, including detailed estimates and documentation, leaving little room for dispute. For complex claims, we bring in forensic accountants to calculate business interruption losses or building engineers to assess structural damage.

- Skilled Negotiation: We handle all communications and negotiations with the insurer, countering their tactics to secure the maximum settlement you’re entitled to.

We work on a contingency fee basis, capped at 10% in Texas, so you pay nothing upfront. Our fee comes from the settlement we recover for you. If you don’t get paid, we don’t get paid.

Fact vs. Myth: Common Questions About Public Adjusters

Myth: “The insurance companys adjuster is on my side.”

Fact: The company adjuster works for the insurance company. Their primary loyalty and financial incentive are to protect their employer’s interests, which means minimizing your payout.

Myth: “Hiring a public adjuster will slow down my claim.”

Fact: The opposite is often true. By submitting a thorough, professionally prepared claim from the start, we prevent the common back-and-forth and documentation requests that cause delays. Our goal is to get you a fair settlement efficiently and help you avoid lengthy litigation.

Myth: “Ill get less money if I pay a public adjuster.”

Fact: Statistics show that policyholders who hire public adjusters receive significantly higher settlements. Even after our contingency fee, our clients typically walk away with a much larger net settlement than they would have on their own.

FAQ: What types of claims do you handle?

We specialize in large-scale property damage claims for commercial buildings, apartment complexes, multifamily HOAs, and religious institutions resulting from fire, hurricane, flood, tornado, and freeze events. We do not handle health or renter’s insurance claims.

FAQ: How does a public adjuster help avoid lawsuits?

By building a comprehensive, evidence-backed claim, we leave little room for the insurer to dispute the facts. This professional approach forces the insurance company to negotiate fairly and often results in a settlement without the need for costly and time-consuming litigation. We provide the leverage needed to get you paid without going to court. For more information, check out our explanation of what does a claims adjuster do.

The Two Paths: Public Adjuster vs. Insurance Claim Lawsuit

When you file a major property damage claim, you face a choice. The path you take will dramatically impact your timeline, settlement, and stress level.

Path 1: Hiring a Public Adjuster (The Proactive Approach)

- Maximize Your Settlement: Leverage expert knowledge to get the full amount you’re owed.

- Accelerate Your Claim: Avoid bureaucratic delays with a professionally managed process.

- Avoid Litigation: Compel a fair settlement through expert negotiation, not a lengthy court battle.

- Reduce Your Stress: Offload the work and worry to a professional advocate so you can focus on your business.

Path 2: Going It Alone (The Reactive Path)

- Risk Underpayment: Accept a lowball offer without knowing the true value of your claim.

- Face Wrongful Denials: Struggle to counter the insurer’s complex arguments for denying coverage.

- Endure Prolonged Lawsuits: Get dragged into years of costly and stressful litigation if you dispute the outcome.

- Suffer Business Disruption: Lose valuable time and focus fighting the insurer instead of running your property.

The choice is clear. To protect your investment, having your own expert isn’t just an optionit’s a necessity. For more insights, visit our guide on Commercial Insurance Claims.

Conclusion: Secure Your Recovery with a Professional Advocate

The core message is simple: insurance companies have experts working for them, you should too. Facing their team of adjusters, lawyers, and risk managers alone is a battle you are not equipped to win. They are professionals at minimizing claims, and it’s their full-time job.

At Insurance Claim Recovery Support, we level the playing field. As your public adjuster, we work exclusively for you. We bring the expertise in policy interpretation, damage valuation, and negotiation needed to counter the insurer’s tactics and secure the full settlement you deserve. Our clients consistently see significantly higher recoveries—often enough to avoid costly litigation and get back to business faster.

We’ve helped commercial and multifamily property owners across Texas—from Houston and San Antonio to Austin and Dallas-Fort Worth—recover from devastating fires, hurricanes, freezes, and tornadoes. We handle the entire claims process on a contingency basis, so you can focus on your recovery with peace of mind.

Don’t let the insurance company dictate the value of your loss. Let us be your professional advocate and secure the fair settlement you are rightfully owed.