Why Underpaid Insurance Claims Cost Commercial Property Owners Millions

If your insurance claim was underpaid for property damage, you’re facing a common and fixable problem. If you searched for insurance claim underpaid, you’re not alone. Here’s what you need to know:

Quick Answer: Steps to Dispute an Underpaid Insurance Claim

- Review your policy and the settlement offer – Compare what you received versus what your policy covers.

- Document the full scope of damage – Get independent contractor estimates and take detailed photos/videos.

- Request a written explanation from your insurer explaining how they calculated the settlement.

- File an internal appeal with your insurance company, providing additional evidence.

- Hire a public adjuster who works on your behalf to negotiate a fair settlement.

- Consider legal action only if other options fail (a public adjuster can often help you avoid this).

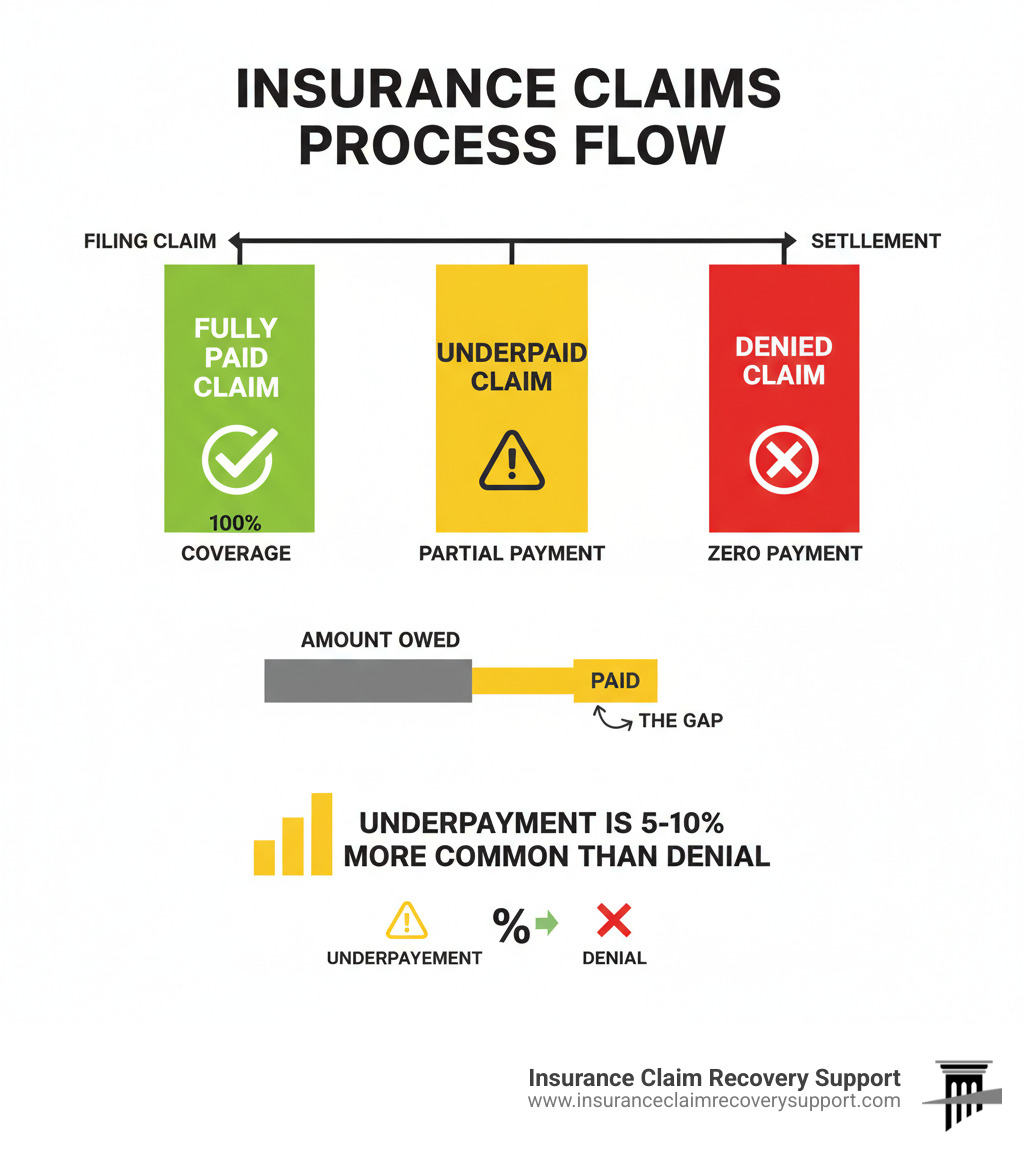

Industry data shows that underpaid claims are 5-10% more common than a wrongful denial. Yet many commercial property owners, HOA managers, and religious institutions accept the first offer, leaving significant money behind. The dispute process can seem intimidating, but accepting a lowball offer is not your only option.

The financial impact is significant. For commercial properties hit by major events like fires, hurricanes, or freezes in Texas, an underpaid claim can mean devastating losses. An unfair settlement for your Houston office building or Dallas apartment complex compromises your ability to fully restore your property and serve your community.

The good news is you can fight back successfully without prior experience or going to court. Whether you manage a multifamily complex, office building, or house of worship, you have options. With over 15 years of experience, we’ve helped commercial property owners successfully dispute underpaid insurance claim settlements, increasing recoveries from 30% to over 3,800%. The process is more straightforward than you might think, especially with professional advocates on your side.

Why Your Commercial Property Has an Underpaid Insurance Claim and How to Spot It

After a disaster strikes your Dallas apartment complex or Houston office building, you file a claim, only to receive a settlement offer that falls far short of your contractor’s quote. You’re left wondering if your insurance claim was underpaid. This scenario is common, and an unfair settlement forces impossible choices: compromise on repairs, delay work, or dip into critical reserves. For multifamily HOAs and commercial properties, this can lead to unsafe conditions, lost income, and liability concerns.

Key Signs Your Commercial Claim is Underpaid

Here’s what should immediately raise red flags that your claim didn’t cover what you’re owed:

- Suspiciously low estimates: If your trusted contractor quotes $500,000 for a roof replacement in Amarillo and the insurer offers $200,000, that’s a major red flag.

- Insufficient funds for repairs: The settlement doesn’t cover real-world costs for materials, labor, and code compliance, often because the adjuster missed damage or used outdated pricing.

- Unexplained deductions: Your statement has large deductions without clear, policy-based justification. These often have no legitimate basis.

- Adjuster rushed the inspection: A quick inspection of a large commercial property almost guarantees missed damage. Thorough assessments take time.

- Ignoring your evidence: The insurer dismisses your detailed photos, contractor estimates, and other documentation. This is often a tactic to frustrate you into accepting less.

- Inadequate business interruption coverage: Your settlement fails to properly account for lost income and extra expenses during the restoration period.

Common Reasons Insurers Underpay Claims

Understanding why insurers underpay helps you fight back. While some are honest errors, many stem from practices designed to protect the insurer’s bottom line.

- Depreciation calculations: Insurers often inflate depreciation on items like roofs and HVAC systems to reduce payouts, even on Replacement Cost Value (RCV) policies where it may not fully apply.

- Actual Cash Value (ACV) vs. Replacement Cost Value (RCV): Insurers may deliberately misapply ACV (depreciated value) vs. RCV (cost to replace new) standards to justify lower payouts.

- Complex policy language: Insurers exploit complex, ambiguous policy language, betting you won’t have the expertise to challenge their self-serving interpretations.

- Policy exclusions: Damage is sometimes unfairly blamed on an excluded cause (like ‘wear and tear’) when it was clearly caused by a covered event like a tornado or freeze.

- Undervaluing costs: Insurers use proprietary software with outdated pricing that doesn’t reflect current market rates in competitive Texas markets like Fort Worth or Austin.

- Scope of damage disputes: The insurer’s adjuster may claim damage is pre-existing or less severe than it is to strategically minimize the payout.

Underpaid vs. Denied Claims: What’s the Difference?

It’s crucial to know the difference between an underpaid and a denied claim. An underpaid claim is a partial payment that’s insufficient to cover all damages. A denied claim is a complete rejection of liability, with zero payment.

Underpaid claims are a unique trap; receiving some money can lead to acceptance, even if it’s far too little. Shockingly, underpaid claims are 5-10% more common than denials. It’s often a deliberate strategy: insurers know busy property owners are more likely to accept a partial payment than fight a total denial. This saves them millions by lowballing settlements, counting on policyholders not to challenge the offer. Disputing an underpaid claim focuses on proving the full damage and costs, while fighting a denial means proving coverage exists for the loss.

Your Options for Disputing an Underpaid Claim

Finding that your insurance claim was underpaid compared to the true restoration cost is frustrating, but it’s not the end of the road. You have options to dispute the settlement for your Fort Worth, Austin, or Lubbock property. The path forward requires documentation, persistence, and knowing when to get professional help.

The Internal Appeal Process: Your First Step

Your first step is the insurer’s internal appeal process. It requires organization and assertiveness.

- Request a Written Explanation: Demand a detailed breakdown of how your settlement was calculated, including all deductions.

- Review Your Policy: Compare their explanation to your policy’s language on coverage limits, exclusions, and definitions.

- Submit New Evidence: Gather detailed, line-item estimates from multiple licensed contractors. Supplement these with photos, videos, and receipts for emergency repairs. For complex issues, an independent expert report can be invaluable.

- Document Everything: Keep a log of all calls, emails, and letters. A clear paper trail is crucial if the dispute escalates.

- Follow Up Consistently: Don’t let your appeal languish. Politely but firmly follow up and know your rights under Texas law regarding insurer response times. You can learn more at the Texas Department of Insurance consumer resources.

This process can be frustrating, but staying organized and persistent significantly increases your chances of success.

How a Public Adjuster Can Help You Dispute an Underpaid Insurance Claim

If the internal appeal fails or seems overwhelming, a public adjuster can be your most powerful ally. Unlike the insurer’s adjuster, a public adjuster works exclusively for you, the policyholder.

- Expert Assessment: We conduct our own thorough damage inspection, often uncovering issues the insurance adjuster missed or downplayed.

- Claim Management: We organize all evidence into a compelling claim package and handle all communication with the insurer, freeing you to run your business.

- Negotiation Power: We are expert negotiators who understand policy language and insurer tactics. We know how to challenge lowball offers and unfair depreciation to maximize your settlement.

- No Upfront Cost: Public adjusters, including Insurance Claim Recovery Support, work on a contingency fee. We only get paid if we recover more money for you, aligning our interests directly with yours.

- Faster, Litigation-Free Resolution: Our expertise often leads to a faster resolution and a fair settlement without the time, stress, and expense of a lawsuit. If your commercial property has an underpaid claim (often searched as insurance claim underpaid), we can help. Learn more at our public adjuster services page.

Public Adjuster vs. Insurance Claim Lawsuit: What’s Best for Property Damage Disputes?

When your insurance claim is underpaid, you have two main paths: hiring a public adjuster or filing a lawsuit.

- The Public Adjuster Route: This path focuses on negotiation. It’s faster (months, not years), less adversarial, and involves no upfront costs due to the contingency fee model. The goal is to achieve a fair settlement through expert assessment and direct negotiation. It’s a low-risk, high-reward first step.

- The Lawsuit Route: This is a formal legal battle that can be lengthy, expensive, and stressful. It’s typically necessary only when an insurer acts in ‘bad faith’ – intentionally delaying, denying, or underpaying a claim without a reasonable basis. While a lawsuit can result in significant damages, it’s a high-risk final resort.

Our recommendation is to start with a public adjuster. We can often secure a fair settlement without litigation. If the insurer still refuses to be fair or has acted in bad faith, the comprehensive claim file we build becomes powerful evidence for your legal team.

FAQs & Myths: Disputing an Underpaid Insurance Claim

Misconceptions about the claims process prevent many property owners from getting the settlement they deserve. Let’s debunk some common myths.

- Myth: The insurer’s first offer is final.

- Fact: The initial offer is a starting point for negotiation. You have the right to dispute it.

- Myth: Disputing my claim will cause my policy to be canceled.

- Fact: Insurers cannot legally retaliate against you for exercising your contractual right to dispute a claim.

- Myth: I can’t afford professional help.

- Fact: Public adjusters work on a contingency fee, meaning there’s no upfront cost. We only get paid if we win you more money.

- Myth: It’s too much hassle to fight.

- Fact: A public adjuster handles the heavy lifting, making the process far less burdensome for you. The potential return—often hundreds of thousands of dollars—is well worth it.

- Myth: The insurance company is on my side.

- Fact: Insurers are for-profit businesses focused on minimizing payouts. A public adjuster is the only adjuster who works for you.

Don’t let these myths stop you from recovering the full amount you’re owed. If your insurance claim underpaid your commercial property damage, get help from a professional public adjuster today.