An insurance claim helper can be invaluable for policyholders navigating the complex world of insurance claims. Whether it’s dealing with property damage from natural disasters or disputes over coverage, these professionals offer vital support to ensure you get the full benefits you’re entitled to. Here’s how they can help:

- Expert Navigation: Insurance claim helpers understand policy details and the claims process intimately.

- Time Savings: They handle communication and paperwork, letting you focus on recovery.

- Fair Settlements: With a helper, overcoming underpayments and wrongful denials is more achievable.

Pro Tip: Before diving into a claim, always review your insurance policy and gather comprehensive evidence. This foundational step is key to a successful process. If needed, seek professional help for complex disputes or significant damages to ensure a fair resolution.

My name is Scott Friedson, and I’ve settled hundreds of millions in property damage insurance claims. As a multi-state licensed public adjuster, my team and I specialize in complex claims to provide clarity and achieve fair settlements, leveraging the strength of an insurance claim helper effectively.

Understanding the Insurance Claim Process

Navigating the insurance claim process can feel like decoding a secret language. But with the right knowledge and tools, it becomes much simpler.

The Claim Process

The journey begins when you file a claim. Timing is crucial—reporting damage promptly can make a big difference in how smoothly your claim progresses. Delays can complicate the process and might even jeopardize your claim’s validity. So, check your policy for specific deadlines and act swiftly.

Paperwork: The Backbone of Your Claim

Paperwork is your best friend in the claim process. Start by gathering all necessary documentation and evidence. This includes photos, videos, receipts, and any records of the damaged property. The more detailed your evidence, the stronger your claim will be. Think of it as telling a story with facts and figures.

Once you’ve compiled your documentation, submit your claim following your insurance company’s specific procedures. This often involves filling out forms and providing the required documentation. If your insurer has an online portal or app, use it to streamline the process.

Clear Communication is Key

Communication is another critical element. Keep detailed records of all interactions with your insurance company. Document every phone call, email, and letter. This record will be invaluable if there are disputes or delays in your claim.

If you’re feeling overwhelmed, an insurance claim helper can step in. They handle communication with insurers, freeing up your time and ensuring nothing falls through the cracks. This professional support can be especially beneficial when dealing with complex claims or when the stakes are high.

Moving Forward

Understanding the claim process, gathering detailed documentation, and maintaining clear communication are your allies in this journey. With these steps, you’re better prepared to handle whatever comes your way.

If at any point the process seems daunting, professional help is available. Insurance Claim Recovery Support is here to guide you every step of the way, ensuring you get the settlement you deserve.

Next, we’ll explore the role of an insurance claim helper and how they can streamline your claim experience.

The Role of an Insurance Claim Helper

When facing an insurance claim, especially one that’s complex or involves significant losses, an insurance claim helper can be a game-changer. These professionals handle the nitty-gritty details that can bog you down, allowing you to focus on getting your life back to normal.

Administrative Tasks Made Simple

Insurance claim helpers are experts at managing the administrative side of claims. They ensure all paperwork is accurate and submitted on time. This includes gathering and organizing documents like photos, receipts, and repair estimates. Their meticulous approach can prevent errors that might delay your claim.

Imagine trying to juggle all these tasks on your own while dealing with the aftermath of a disaster. An insurance claim helper takes that burden off your shoulders, making the process much more manageable.

Data Entry: Accuracy Matters

Data entry might seem trivial, but it’s a crucial part of the claims process. Insurance claim helpers make sure that all information is entered correctly into the system. This accuracy is vital because even a small mistake can lead to delays or reduced settlements.

Here’s a quick look at what they handle:

- Inputting claim details: Ensuring every piece of information is correct and up-to-date.

- Tracking communication: Keeping a record of all interactions with the insurance company.

- Monitoring progress: Regularly checking the status of your claim and following up as needed.

By handling these tasks, insurance claim helpers reduce the risk of errors and ensure a smoother journey through the claims process.

Streamlining Your Experience

The goal of an insurance claim helper is to streamline the entire experience for you. They act as a bridge between you and your insurer, ensuring clear and effective communication. This can be especially helpful if your claim is denied, as they can guide you through the appeal process and help you understand your options.

In short, an insurance claim helper is your advocate, working tirelessly to ensure you receive the settlement you deserve. By handling the administrative load, they allow you to focus on what truly matters: recovering and rebuilding.

Maximizing Your Insurance Settlement

When it comes to insurance claims, achieving a full settlement is the ultimate goal. Yet, this can be a daunting task without the right guidance. This is where public adjusters and expert advice come into play.

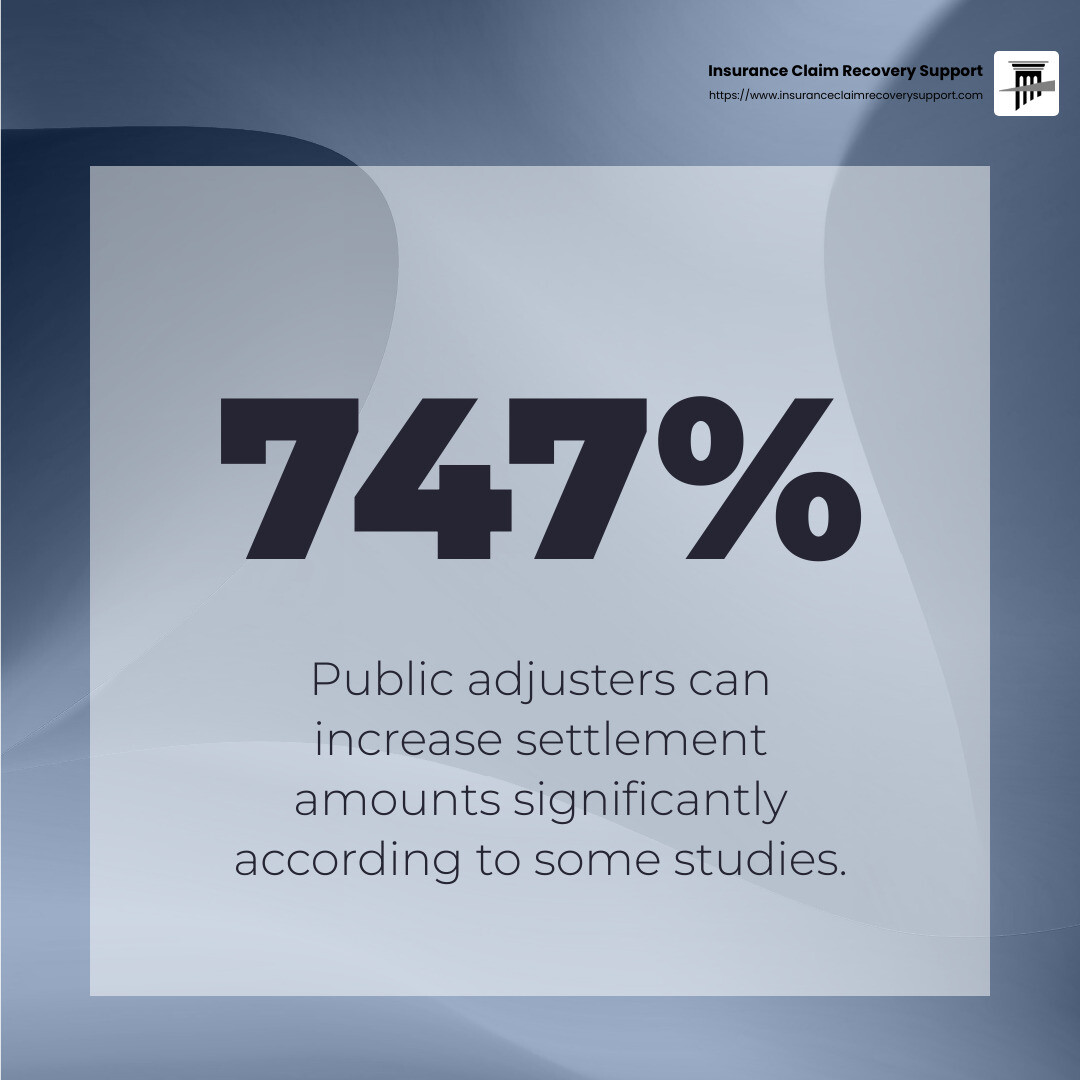

The Power of a Public Adjuster

A public adjuster is a licensed professional who works exclusively for you, the policyholder—not the insurance company. Their job is to ensure you receive the maximum settlement possible. They do this by:

-

Evaluating your claim thoroughly: Public adjusters assess the damage to your property and calculate the true cost of repairs and replacements.

-

Negotiating with your insurer: They have the expertise to communicate effectively with insurance companies, often securing better settlements than you might achieve alone.

-

Handling complex claims: If your claim involves extensive damage or complicated circumstances, a public adjuster can manage these complexities with ease.

Expert Advice: A Game-Changer

Expert advice can significantly impact your settlement outcome. Here’s how:

-

Knowledge of policy details: Experts understand the fine print of insurance policies, ensuring you claim everything you’re entitled to.

-

Strategic documentation: They guide you in documenting your losses comprehensively, which is crucial for a successful claim.

-

Appeal support: If your claim is denied, experts can help you steer the appeal process, increasing your chances of a favorable outcome.

Steps to Maximize Your Settlement

-

Hire a Public Adjuster: They bring specialized knowledge and negotiation skills that can benefit your settlement.

-

Gather Comprehensive Documentation: Include photos, receipts, and estimates to support your claim.

-

Stay Informed: Understand your policy and the claims process to make educated decisions.

-

Be Patient but Persistent: Settlements can take time. Follow up regularly and stand firm on your claim.

By leveraging the expertise of a public adjuster and seeking professional advice, you can confidently steer the insurance claim process and work towards securing the settlement you deserve. Whether you’re dealing with a denied claim or pursuing a full settlement, having the right support makes all the difference.

Now, let’s explore the challenges of navigating denied claims and how to effectively appeal them.

Navigating Denied Claims

Facing a denied insurance claim can be frustrating and confusing. But knowing how to steer this situation can turn things around.

Understanding Denied Claims

Insurance companies deny claims for various reasons, often citing policy exclusions or lack of sufficient documentation. But don’t lose hope—many denials can be overturned with the right approach.

The Importance of a Claim File

A claim file contains all the information your insurer used to deny your claim. This includes internal notes, phone call recordings, and correspondence. Requesting your claim file is crucial because it holds the key to understanding the denial.

Tip: Use ProPublica’s Claim File Helper to customize a request letter. This tool helps you get the documents you need to support your appeal.

The Appeal Process

Once you have your claim file, you can begin the appeal process. Here’s how:

-

Review the Denial Letter: Understand the specific reasons for the denial. This helps you address those points directly in your appeal.

-

Gather Additional Evidence: Collect more documentation, such as photos, expert opinions, or repair estimates. This strengthens your case.

-

Submit a Formal Appeal: Write a detailed letter to your insurer explaining why the denial is incorrect, supported by your gathered evidence.

-

Seek External Review: If the internal appeal fails, request an independent third-party review. This step can be crucial in achieving a favorable outcome.

Seeking Professional Help

If the process becomes overwhelming, consider hiring an insurance claim helper or a public adjuster. They can:

- Analyze your claim file: Identify errors or gaps in the insurer’s decision.

- Guide you through the appeal: Ensure all necessary information is included.

- Negotiate on your behalf: Increase your chances of success.

By understanding the appeal process and utilizing the tools and professionals available, you can effectively contest a denied claim and work towards a successful resolution.

Next, we’ll tackle some frequently asked questions about insurance claims to further clarify this complex process.

Frequently Asked Questions about Insurance Claims

What does an insurance claims assistant do?

An insurance claims assistant plays a vital role in helping both policyholders and claims adjusters. They handle administrative tasks and clerical duties that keep the claims process running smoothly. This includes:

- Data Entry: Inputting claim details and updates into the system.

- Scheduling: Coordinating appointments and follow-ups with adjusters and policyholders.

- Documentation: Organizing and managing the paperwork required for claims.

- Communication: Acting as a liaison between the insurer, policyholder, and other parties involved.

Their work ensures that all necessary information is available and accurate, which helps in processing claims efficiently.

How much do insurance adjusters make per claim?

Insurance adjusters are compensated in various ways, and their earnings can depend on several factors, such as the complexity of the claim and their role (staff adjuster vs. independent adjuster). Typically, adjusters are paid through:

- Flat Fees: A fixed amount for each claim they handle.

- Hourly Rates: Payment based on the hours worked on a claim.

- Settlement Percentage: A percentage of the claim settlement amount, often seen with public adjusters.

For example, public adjusters might charge between 5% to 15% of the final settlement amount. This fee structure incentivizes adjusters to maximize the settlement for the policyholder.

Do insurance agents help with claims?

Yes, insurance agents can provide valuable assistance during the claims process. While they don’t directly handle claims, they offer policyholder assistance by:

- Clarifying Coverage: Helping policyholders understand their policy details and what is covered.

- Guidance: Advising on the steps to take when filing a claim.

- Advocacy: Acting as an intermediary to facilitate communication with the insurance company.

Although agents are primarily focused on selling and managing policies, their support can be crucial in ensuring the claims process is as smooth as possible for the policyholder.

Understanding these roles and processes can explain the insurance claim journey and empower policyholders to steer it more effectively.

Conclusion

At Insurance Claim Recovery Support, we pride ourselves on being more than just a public adjustment firm. We are your dedicated partner in navigating the often complex world of insurance claims. Our mission is simple: to advocate for policyholders and ensure that you receive the maximum settlement you deserve.

Advocating for Policyholders

Insurance claims can be daunting, especially when dealing with significant property damage from events like fire, hurricanes, or floods. Our team is committed to standing by your side, providing the support and expertise needed to steer these challenging times. We understand the tactics insurance companies might use to minimize payouts, and we’re here to ensure you get what’s rightfully yours.

Why Choose Professional Help?

When it comes to securing a fair settlement, having a professional insurance claim helper can make all the difference. Our experts carefully document claims, negotiate with insurance companies, and leverage their deep understanding of insurance policies to maximize your settlement. This approach not only saves you time but also helps avoid unnecessary litigation.

Your Partner Across Texas and Beyond

Whether you’re in Austin, Dallas, San Antonio, or any other part of Texas, our team is ready to assist you. Our track record speaks for itself, with countless policyholders across the state and nationwide benefiting from our relentless advocacy and unwavering support.

Don’t let the complexities of insurance claims overwhelm you. With Insurance Claim Recovery Support, you have a trusted partner ready to help you rebuild and move forward with confidence. Learn more about how our public adjusters can assist you in achieving the settlement you deserve.

Together, we can open up the secrets to a successful insurance claim and ensure your peace of mind.