When Your Property Damage Claim Feels Impossible to Steer

An insurance claim advocate is a licensed professional, also known as a public adjuster, who represents policyholders—not insurance companies—in negotiating property damage claims. They manage the entire claim process on your behalf, from damage assessment to final settlement, to secure the maximum recovery you’re entitled to under your policy.

Key Facts About Insurance Claim Advocates:

- Who They Represent: Exclusively policyholders, never insurance companies.

- What They Do: Assess damage, document losses, interpret policy, and negotiate settlements.

- When to Hire: Immediately after major property damage (fire, hurricane, tornado, freeze, flood).

- How They’re Paid: On a contingency fee (a percentage of the settlement), so they are only paid after you receive payment.

- Types of Claims: Commercial properties, multifamily complexes, apartments, hotels, and religious institutions.

- Key Benefit: Can significantly increase settlements compared to handling claims alone.

If you manage a commercial building, apartment complex, or religious institution that’s suffered property damage, you face a daunting choice: handle a complex claim alone, hire an expensive attorney for litigation, or bring in a public adjuster to advocate for your interests without going to court.

The reality is that insurance company adjusters work for the insurer, not you. Their goal is to protect their employer’s bottom line, which often leads to lowball offers, confusing requests, and wrongful denials. For example, one Florida condo complex settled for just $500,000 after a year of going it alone; after hiring a public adjuster, they recovered an additional $1 million.

A skilled insurance claim advocate can resolve most disputes through expert negotiation, securing fair settlements faster and with far less expense than a lawsuit. As a multi-state licensed public adjuster with over 15 years of experience, my role is to ensure commercial and multifamily property owners receive every dollar they deserve—without the stress, delays, or litigation that too often derail the recovery process.

What is an Insurance Claim Advocate and Who Do They Represent?

When disaster strikes your commercial property, you need an expert in your corner fighting exclusively for you. That’s where an insurance claim advocate comes in.

An insurance claim advocate, or public adjuster, is a licensed professional who represents only policyholders through every step of the claims process. While insurance companies have their own adjusters, those individuals work to protect the insurer’s financial interests. Our allegiance is 100% to you, the property owner. We specialize in representing owners of commercial buildings, multifamily HOAs, apartment complexes, and religious institutions—properties that involve complex policies and significant losses.

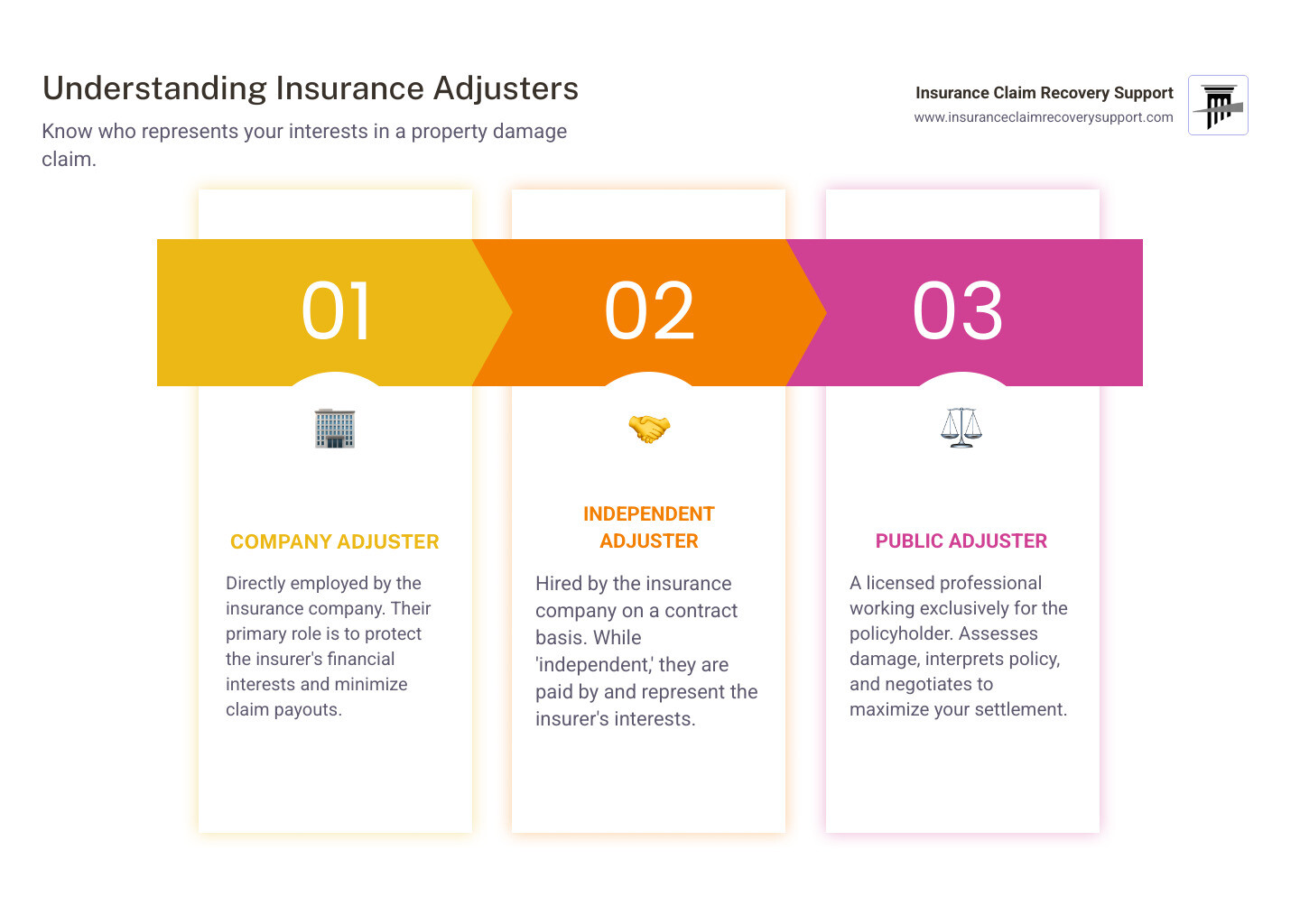

Understanding who is on your side is critical. There are three types of adjusters:

| Adjuster Type | Who They Work For | Primary Goal |

|---|---|---|

| Company Adjuster | The insurance company (your insurer) | Protect the insurer’s bottom line, minimize payout |

| Independent Adjuster | Hired by the insurance company on a contract basis | Still represents the insurer’s interests, often handles overflow claims |

| Public Adjuster | The policyholder (you) | Maximize the policyholder’s settlement, advocate for your best interests |

Only a public adjuster—your insurance claim advocate—works exclusively for you. For a more detailed explanation of these roles, visit What is a Public Insurance Adjuster?

The Role of a Public Adjuster as Your Insurance Claim Advocate

A public adjuster levels the playing field against large insurance companies. Our role as your insurance claim advocate is to maximize your settlement, reduce your stress, and provide expert guidance.

After a disaster, property managers face overwhelming challenges. Trying to steer a complex claim while dealing with displaced tenants, business interruptions, and financial pressure is nearly impossible. An insurance claim advocate takes this burden off your shoulders. We handle the documentation, communication, and negotiation so you can focus on your property and operations. Our expertise often leads to dramatically higher settlements. For example, research from Florida’s OPPAGA found that policyholders who hired public adjusters for hurricane claims received payments 747% higher than those who didn’t.

Many of our public adjusters previously worked for insurance companies, giving us insider knowledge of their tactics. This allows us to build ironclad claims that stand up to scrutiny. Importantly, hiring an advocate helps you avoid unnecessary litigation. While attorneys are needed in some cases, most disputes can be resolved through expert negotiation and formal appeals—our specialty. We secure fair settlements faster and with less expense than going to court. To learn more about timing, read When Should a Policyholder Hire a Public Insurance Adjuster?

Types of Claims an Advocate Manages

As insurance claim advocates for commercial and multifamily properties, we handle a wide range of large-scale property damage claims. We understand these claims involve not just structural repairs but also business interruption and loss of rental income.

Fire Damage: These complex claims require meticulous assessment of smoke, heat, and water damage. As a Fire Claim Adjuster, we ensure all hidden damage is accounted for.

Hurricane Damage: Involving wind, water, and structural issues, these claims often face coverage disputes. We steer these intricacies to ensure proper documentation and payment. Learn more at Hurricane Damage Claims.

Wind Damage: Common in Texas, wind can tear off roofing and siding. We counter insurer claims that damage is cosmetic or pre-existing. See our Texas Wind Damage page for more.

Tornado Damage: We provide comprehensive assessment and documentation to capture the full scope of loss from these destructive events.

Flood Damage: Often contentious, we work to ensure your flood claim is properly valued and processed for maximum recovery.

Freeze Damage: A critical concern in Texas, we document burst pipes and extensive water damage to counter insurer attempts to undervalue secondary damage.

Lightning Damage: We use expert assessment to identify all affected electrical and structural systems to ensure a full recovery.

For any of these Commercial Property Claims, our goal is to secure every dollar you’re entitled to without the delays and disputes that derail recovery.

The Advocate’s Playbook: Navigating the Full Claim Lifecycle

When disaster strikes your commercial property, you don’t have to choose between handling the claim yourself or hiring an attorney for a lengthy lawsuit. An insurance claim advocate offers a better path.

We follow a proven, step-by-step process to secure your maximum settlement without the time and expense of litigation. Most disputes can be resolved through expert negotiation, not courtroom battles. While a lawsuit can drag on for years and cost tens of thousands, our advocacy approach typically reaches a fair resolution in months. For a complete overview, see our Insurance Claim Process Complete Guide.

Step 1: Initial Consultation and Policy Review

It all starts with a free, no-obligation consultation. We listen to understand what happened and what your biggest concerns are. Then, we conduct a thorough policy analysis. Commercial policies are complex, but we comb through every page to identify all applicable coverages, exclusions, and conditions. This deep dive often reveals coverage property owners didn’t know they had. By identifying potential issues early, we build a stronger claim from the start and anticipate challenges before they become roadblocks. For more tips, see our guide on the Dos and Don’ts of Commercial Property Insurance Claims.

Step 2: Comprehensive Damage Assessment and Documentation

Next, we roll up our sleeves to document your loss. This is where our role as your insurance claim advocate becomes tangible. We conduct an exhaustive on-site inspection, acting as your expert Home Insurance Assessor for commercial properties. Using professional-grade equipment, we document every aspect of the damage, including hidden issues that are often missed.

We develop comprehensive, defensible estimates for repair and replacement costs, bringing in engineers or other specialists as needed. For commercial properties, we also carefully assess and document business interruption losses, including lost rental income and other financial impacts. This thorough documentation ensures nothing is undervalued and provides powerful evidence during negotiations, making it much harder for insurers to justify lowball offers.

Step 3: Claim Submission and Negotiation

With a clear strategy and detailed documentation, we manage the entire claim submission process. We handle all paperwork, deadlines, and communications with your insurance company, freeing you from the burden.

We submit a comprehensive claim package that makes a compelling case for the full value of your loss. When the insurer’s adjuster inevitably returns with a low offer, our work begins. This is where many property owners hit a wall, but we level the playing field. We communicate directly with the insurer, presenting our evidence and citing specific policy language to counter their position. Our Insurance Adjustment Services are designed to overcome obstacles and reach a fair settlement through firm, professional negotiation. In the vast majority of cases, our advocacy resolves the dispute without ever needing to file a lawsuit, saving you time, stress, and money.

Leveling the Playing Field: How an Advocate Counters Insurer Tactics

When you file an insurance claim, you’re often stepping into an adversarial relationship. Your insurance company is a for-profit business focused on its bottom line. As your insurance claim advocate, we know every play in their playbook and how to counter each one. Our insider knowledge is your advantage.

Understanding these tactics is the first step to protecting your interests. For property managers dealing with denied or underpaid claims, our advocacy can be the difference between a partial repair and a full recovery. Learn more about Why Hail and Wind Property Damage Insurance Claims Get Denied or Underpaid and What to Do.

Common Insurer Tactics and Advocate Responses

Insurers use predictable strategies to minimize payouts. We neutralize them.

- The Lowball Offer: Insurers often propose cheap repairs for items that need full replacement. We counter with our own detailed, expert-backed estimates that prove the true cost of restoration.

- Misinterpreting Policy Language: Insurers may use ambiguous language to deny coverage. Our deep policy knowledge allows us to challenge these interpretations and ensure your policy is read fairly.

- Delay Tactics and Documentation Requests: Some insurers drag their feet or overwhelm you with requests, hoping you’ll give up. We manage all communications, meet every deadline, and escalate when insurers stall unreasonably.

- Pressure to Use Preferred Vendors: These contractors may be incentivized to keep costs low, compromising quality. We advocate for your right to choose qualified contractors who will restore your property correctly.

- Wrongful Denials: A denial is not the final word. We review the insurer’s reasoning, build a robust counter-argument, and work to overturn the decision. When facing a Claims Dispute, expert representation is key.

The Advocate’s Role in Appeals and Avoiding Litigation

Our primary goal is to resolve your claim efficiently and without costly litigation. For commercial property owners, a lengthy lawsuit is an unbearable burden.

When a claim is denied or underpaid, our first step is a comprehensive appeals process, not a lawsuit. We re-examine evidence, gather expert opinions, and formally challenge the insurer’s decision. We can even reopen underpaid claims to recover the funds you should have received. If you have a Denied Fire Insurance Claim, we can help.

The difference between using an insurance claim advocate and filing an insurance claim lawsuit is stark:

- Public Advocate Approach: Involves negotiation, appeals, and mediation. You pay nothing upfront, only a contingency fee after we recover your settlement. The timeline is typically months, not years, and we handle the stress of dealing with the insurer.

- Litigation Approach: Involves formal legal proceedings, depositions, and court hearings. Legal fees can be immense, and the process can drag on for years, creating prolonged uncertainty. While there’s potential for a large payout, the risk, cost, and emotional toll are significant.

We specialize in policy negotiation to secure maximum settlements without ever setting foot in a courtroom. Before you hire a Lawyer for Damage to Property, speak with us. We can often resolve your claim more effectively, reserving litigation as a true last resort.

Hiring Your Insurance Claim Advocate: What Property Managers Must Know

After property damage, you must decide who will represent your interests. Choosing the right insurance claim advocate is about finding a partner with the expertise to deliver results for your commercial property, multifamily complex, or religious institution. For property managers in Texas and nationwide, this decision can mean the difference between a partial fix and a full recovery. Start by searching for Public Adjusters Near Me to find qualified professionals.

What to Look For in a Top-Tier Advocate

When evaluating advocates, look for these key qualifications:

- State Licensing: Public adjusters are regulated professionals. Verify their license is current and in good standing to ensure they meet strict educational and ethical standards.

- Commercial Claim Experience: Handling a multifamily building is different from a single-family home. You need a Business Public Adjuster who understands complex commercial policies and business interruption.

- A Proven Track Record: Look for concrete case results showing significant settlement increases. Our team has recovered hundreds of millions for property owners, demonstrating our expertise and tenacity.

- Specialization in Your Loss Type: An advocate experienced with your specific damage type offers a distinct advantage. If your Houston property suffered hurricane damage, a Houston Public Adjuster with local storm experience is invaluable. We serve all major Texas cities, including Austin, Dallas, Fort Worth, and San Antonio, with deep knowledge of regional damage types.

- Clear Communication: Your advocate should explain complex terms in plain English and keep you informed. You should feel like a valued partner, not a file number.

Understanding the Cost: How an Insurance Claim Advocate is Paid

The financial arrangement is designed to remove your risk. We work on a contingency fee basis, meaning you pay nothing upfront—no retainers or hourly fees. This is fundamentally different from hiring an attorney, which can involve significant upfront costs.

Our fee is a percentage of the settlement we secure for you, and we only get paid after you get paid. This aligns our interests perfectly with yours: the better we do for you, the better we do. If we don’t increase your settlement, we don’t earn a fee.

This structure also helps you avoid the costly litigation path. Our advocacy resolves most disputes through negotiation, achieving excellent results in a fraction of the time and at a fraction of the cost of a lawsuit. Before signing any contract, ensure the fee percentage and services are clearly stated.

Questions you should ask before signing a contract:

- What is your exact contingency fee percentage, and does it change based on when the claim settles?

- Are there any additional costs or fees beyond the contingency percentage?

- What specific services are included—from initial assessment through final settlement?

- How long does our contract last, and what are the terms if I need to terminate it?

- What happens if you can’t increase my settlement or if the claim is denied?

- How often will I receive updates, and who will be my main point of contact?

- Can you provide references from other commercial or multifamily property managers in similar situations?

- Do you have experience with my specific type of property and damage in my area?

Conclusion: Secure Your Recovery and Rebuild with Confidence

When your commercial property, multifamily complex, or religious institution suffers damage, the path forward can be overwhelming. You’re facing complex insurance policies and an insurer whose interests don’t align with yours. The weight of securing a fair settlement while managing your property is immense.

This is why an insurance claim advocate exists—to stand beside you and fight for your interests. You don’t have to face this alone.

Partnering with a skilled advocate gives you a maximized settlement, reduced stress, and an expert on your side who knows how to counter insurer tactics. Most importantly, it allows you to avoid costly, time-consuming litigation. While lawsuits drag on for years, a public adjuster resolves most disputes through expert negotiation, securing fair settlements faster and with far less expense.

At Insurance Claim Recovery Support, this is our mission. Whether your property in Austin, Dallas-Fort Worth, San Antonio, Houston, or elsewhere in Texas has been damaged by fire, hurricane, tornado, or freeze, we are your dedicated insurance claim advocate. We are public adjusters who work exclusively for you. Our commitment is to ensure you receive every dollar you’re entitled to, allowing you to rebuild with confidence.

To learn more, visit About Insurance Claim Recovery Support Public Insurance Adjusters. Ready to discuss your claim? Explore the types of property damage claims we handle and contact us for a free consultation.