The Critical First Step After a Hurricane

Hurricane damage assessment is the systematic process of evaluating and documenting property damage following a hurricane to support insurance claims, disaster aid applications, and recovery planning.

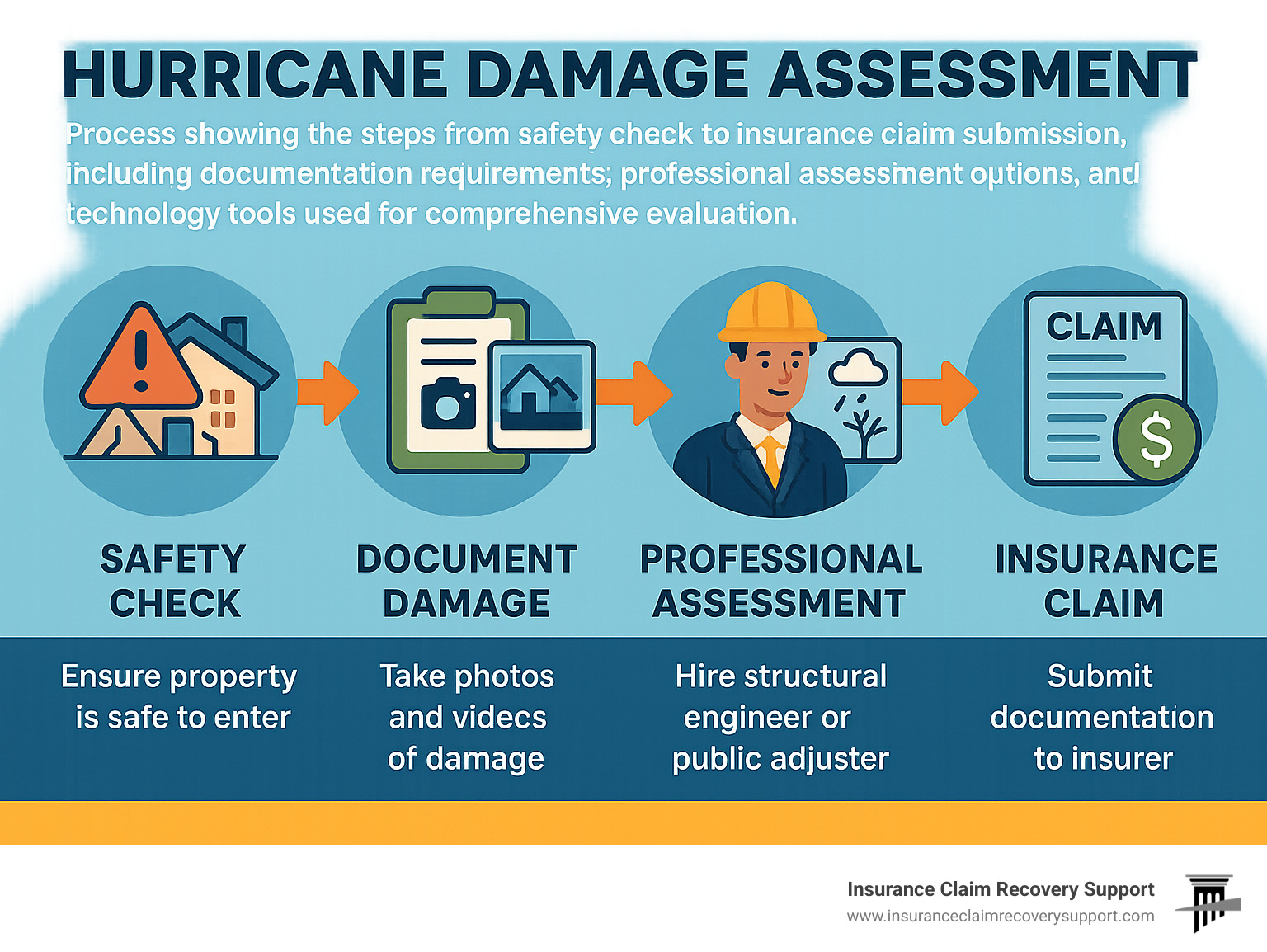

Quick Guide to Hurricane Damage Assessment:

- Safety First: Ensure the property is safe to enter before assessment

- Document Everything: Take dated photos and videos of all damage

- Categorize Damage: Separate wind damage from flood/water damage

- Detailed Inventory: List all damaged items with replacement costs

- Professional Evaluation: Consider hiring structural engineers or public adjusters for complex damage

Hurricanes cause an estimated $10 billion in property damage in the United States each year, leaving devastation that requires thorough assessment before recovery can begin. When a hurricane strikes, the first critical step is conducting a comprehensive damage assessment – the foundation upon which all recovery efforts, insurance claims, and disaster assistance will be built.

Proper hurricane damage assessment combines several approaches:

- Visual inspections to identify obvious structural damage

- Detailed property evaluations to document specific damages and costs

- Geospatial analysis using satellite imagery or drones for comprehensive views

- Integrated assessment combining all methods for the most accurate results

The most reliable way to collect damage estimates is still to send trained professionals to survey the aftermath of the disaster. This process must be methodical, thorough, and well-documented to ensure nothing is overlooked.

I’m Scott Friedson, a multi-state licensed public adjuster who has conducted hurricane damage assessments throughout Texas and the Gulf Coast, helping policyholders recover hundreds of millions in hurricane damage claims by ensuring accurate and comprehensive damage documentation. My experience has shown that proper hurricane damage assessment is the critical difference between fair compensation and significant underpayment.

Similar topics to hurricane damage assessment:

– assessing damage to your property after a hurricane

– damage assessment hurricane katrina

– damage assessment hurricane laura

Understanding Hurricane Damage Assessment

Hurricane damage assessment isn’t just a casual walk-through of your property after the winds die down. It’s a methodical, evidence-based process that documents and quantifies the full extent of storm damage to support your insurance claims and disaster aid applications. This can range from quick “windshield surveys” conducted by local officials immediately after a storm to comprehensive Preliminary Damage Assessments (PDAs) performed jointly by FEMA and state representatives.

The financial stakes couldn’t be higher. Take Hurricane Harvey in 2017—it caused a staggering $125 billion in damage and destroyed nearly 12,700 homes across Texas. Without proper assessment, recovery efforts would be disorganized at best, and insurance settlements would likely fall far short of actual losses.

When we work with homeowners in Houston, Austin, Dallas, and other Texas communities, we emphasize that thorough assessment serves several critical purposes. It determines whether your home is safe to occupy, creates the documentation backbone for your insurance claim, establishes eligibility for federal disaster assistance, helps quantify community-wide impacts needed for disaster declarations, and informs smart rebuilding priorities.

Why Accurate Hurricane Damage Assessment Matters for Homeowners & Businesses

For Texas property owners, the quality of your hurricane damage assessment directly impacts your financial recovery and peace of mind.

Insurance claim approval and value hinges on thorough documentation. We’ve seen countless cases where homeowners who documented everything—from obvious roof damage to subtle water intrusion patterns—received settlements 30-50% higher than initial offers.

Disaster aid eligibility requires detailed proof of damage. FEMA and other agencies won’t simply take your word for it—they need comprehensive documentation to process your application.

Preventing secondary damage is another crucial benefit. A good assessment identifies hidden issues like water seepage into wall cavities that could lead to dangerous mold growth or structural weakening if left unaddressed.

Prioritizing repairs becomes clearer when you have a complete damage inventory. You’ll know which fixes are urgent for safety and which can wait, helping you allocate limited funds wisely.

Building resilience for future storms becomes possible when you understand exactly how your property was compromised. This knowledge helps guide smarter rebuilding decisions.

As FEMA’s own guidance states, “The most reliable way to collect damage estimates is still to send people out to survey the wake of the disaster.” This hands-on, detailed approach ensures nothing important gets overlooked.

Key Terminology You’ll Encounter

When navigating the post-hurricane landscape, you’ll hear specialists using specific terms that are helpful to understand:

Preliminary Damage Assessment (PDA) refers to the official process used by FEMA, state, and local officials to determine the magnitude and impact of a disaster. This is the formal assessment that helps determine if federal assistance will be available.

Initial Damage Assessment (IDA) is the first evaluation conducted by local authorities, typically within days of the hurricane, before state verification takes place.

Individual Assistance (IA) is the FEMA program designed to help homeowners and renters with disaster-related expenses, while Public Assistance (PA) focuses on public infrastructure and certain non-profit organizations.

The distinction between wind damage and flood damage is critically important, as these may be covered under entirely different insurance policies—with standard homeowners insurance typically covering wind but excluding flood damage.

Storm surge refers to the abnormal rise in seawater level during a hurricane, causing coastal flooding that can extend miles inland.

The WF Damage Scale is a combined wind and flood scale ranging from WF-0 (no damage) to WF-6 (complete destruction), helping standardize how damage is classified.

Understanding these terms helps you communicate effectively with insurance adjusters, contractors, and government officials—putting you in a stronger position to advocate for your rightful recovery assistance.

Spotting & Classifying Hurricane Damage

Hurricane damage assessment involves more than just a casual glance around your property. It requires a trained eye to identify the various ways a hurricane can wreak havoc on your home or business. Hurricanes are multi-threat events, with each component causing distinct types of damage:

Wind can tear off roofing and siding, while rain finds its way through these newly created openings. Rising floodwaters from storm surge can saturate everything from your foundation to your furniture. And let’s not forget the flying debris that turns ordinary objects into dangerous projectiles during a storm.

Understanding how to spot each type of damage is crucial because your insurance coverage might treat them differently. For instance, standard homeowners policies typically cover wind damage but exclude flooding, which requires separate coverage through the National Flood Insurance Program.

Exterior Components Checklist

When you step outside to assess hurricane damage, approach your inspection methodically, working from the top down:

Start with your roof system, where the most common hurricane damage occurs. Look for missing or damaged shingles, lifted sections where wind got underneath, and damaged flashing around vents and chimneys. Don’t forget to check gutters and downspouts, which often get clogged or dented during storms.

Next, examine all windows and doors for broken glass, damaged frames, and signs of water intrusion around the seals. After a hurricane, you might notice doors that suddenly won’t close properly – a potential sign of structural shifting.

Your home’s exterior walls tell an important story too. Fresh cracks in brick or stucco, missing siding panels, and water stains can all indicate hurricane damage. Pay special attention to corners and seams where different materials meet, as these are vulnerable points.

Don’t overlook your foundation and structural elements. New cracks, shifting, or water pooling around the foundation can signal serious problems that might get worse over time if not addressed.

Finally, document damage to outdoor structures like fences, decks, and pool equipment. While taking photos, include wider shots to show the context of the damage and close-ups to capture the details. Whenever possible, measure and note the dimensions of damaged areas.

Interior & Hidden Damage Indicators

Some of the most costly hurricane damage lurks inside your walls or beneath your floors. During your hurricane damage assessment, be alert for these telltale signs:

Water is sneaky – it can enter through tiny wind-created openings and travel far from its entry point. Water stains on ceilings or walls, bubbling paint, and warped flooring all suggest moisture intrusion. That musty smell? It could be the early stages of mold, which can begin growing just 24-48 hours after water exposure.

Pay attention to how your home “feels” after a hurricane. Doors that suddenly stick or won’t close properly might indicate structural movement. New cracks in drywall, especially around windows and doors, can signal shifting. And if your floors seem uneven where they once were level, that’s cause for concern.

Modern technology has given us valuable tools for detecting hidden damage. Moisture meters can identify dampness inside walls and under floors before visible damage appears. Infrared cameras reveal temperature differences that often indicate moisture, and borescopes allow inspection inside wall cavities without major demolition.

Your electrical system deserves special attention after a hurricane. Flickering lights, frequently tripping circuit breakers, or non-working outlets might indicate water damage to your electrical system – a serious safety hazard that requires immediate professional attention.

In my years as a public adjuster at Insurance Claim Recovery Support, I’ve seen countless cases where water intrusion damage was initially missed, only to cause major problems weeks or months later. This hidden damage is often the most challenging to document but critical for a fair insurance settlement.

Damage Severity Scales & Codes

When professionals conduct a hurricane damage assessment, they use standardized scales to consistently categorize damage severity. Understanding these scales helps you communicate effectively with insurance adjusters and disaster officials:

The Wind and Flood (WF) Damage Scale provides a framework for classifying hurricane damage severity. It ranges from WF-0 (no visible damage) to WF-6 (complete destruction with only the foundation remaining). Most residential hurricane damage falls between WF-1 (minor roof damage) and WF-4 (complete roof structural failure).

Water damage has its own classification system based on contamination levels. Category 1 is clean water from rain or broken water lines. Category 2 (gray water) contains some contaminants, like washing machine overflow. Category 3 (black water) includes highly contaminated sources like storm surge or sewage – requiring specialized remediation techniques and safety precautions.

Building codes add another layer to your hurricane damage assessment. In many Texas communities, if repairs exceed 50% of your building’s value, you’ll need to bring the entire structure up to current building codes. These code-required upgrades – which might include elevation, stronger roof attachments, or impact-resistant windows – should be documented as part of your claim, as they may be covered under your policy’s ordinance or law provision.

Thorough documentation is your strongest ally in ensuring fair compensation for all hurricane damage, whether it’s immediately visible or hidden beneath the surface.

The Step-by-Step Assessment Workflow

After a hurricane sweeps through, approaching your hurricane damage assessment systematically ensures nothing falls through the cracks. Think of it as detective work – you’re gathering evidence to build a complete picture of what happened to your property.

Start with safety first – never rush into a potentially unstable structure. Once you’ve confirmed it’s safe to enter, begin with a quick visual survey to identify major problem areas. This initial walkthrough helps you prioritize and plan your detailed inspection.

Next comes the heart of your assessment: a methodical, component-by-component examination. This isn’t the time to rush. Take your time examining each room, each structural element, each system in your home or business. Document everything carefully – those details will become invaluable when filing your claim.

“The difference between a fair settlement and a disappointing one often comes down to how thoroughly you document your damage,” explains Scott Friedson, our lead public adjuster at Insurance Claim Recovery Support.

Don’t stop at visible damage. Water intrusion and structural issues can hide behind walls or under floors, causing problems that might not become apparent for weeks. These hidden damages often represent the most costly repairs.

After your inspection, organize your documentation – photos, notes, measurements – into a coherent report. Include repair and replacement cost estimates to strengthen your case when filing with your insurance company.

Preparing for a Safe Inspection

Before you take a single step into your hurricane-damaged property, safety must be your absolute priority. The aftermath of a storm can create numerous hazards that might not be immediately obvious.

Wait for the all-clear from local authorities before returning to your property. When you arrive, approach with caution. Turn off utilities at the main switches or valves if you can safely reach them – this simple step can prevent gas leaks, electrical fires, or water damage.

Look carefully for downed power lines around your property. If you spot any, stay well away and report them immediately to your utility company. Floodwater can conduct electricity, making even standing water potentially dangerous.

Before entering any structure, check for structural stability. Look for warning signs like sagging roofs, leaning walls, or unusual noises that might indicate imminent collapse. Trust your instincts – if something doesn’t feel safe, don’t risk it.

Proper protective gear is non-negotiable. At minimum, wear:

- A hard hat to protect from falling debris

- Sturdy, waterproof boots with puncture-resistant soles

- Heavy work gloves to protect your hands

- An N95 respirator mask to filter mold spores and dust

- Safety glasses to shield your eyes

- Waterproof clothing if you’ll be working in wet areas

Bring a good flashlight with extra batteries, a first aid kit, your fully-charged cell phone, clean drinking water, and hand sanitizer. These basics can make your inspection safer and more effective.

Conducting a Local & State Preliminary Assessment

Local emergency management teams swing into action almost immediately after a hurricane passes, beginning what’s often called a “windshield survey” – a quick drive-through assessment to identify the hardest-hit areas. As a property owner, understanding this official process helps you align your personal assessment efforts with the larger recovery picture.

Within the first 24-72 hours, local officials will be completing Initial Damage Assessment (IDA) forms throughout affected neighborhoods. These preliminary assessments provide the first snapshot of disaster impact and help determine if state or federal assistance might be needed.

In Texas, these local assessments must be submitted to the state emergency management division within 30 days of the disaster. State officials then verify the information, often conducting their own site visits to confirm the extent of damages.

As a property owner, you can support this process by reporting your damage promptly to your local emergency management office. This not only helps officials gauge the full scope of the disaster but can also connect you with available resources.

While official assessments are underway, focus on your own thorough documentation. Take dated photos and videos of all damage before you begin cleanup or temporary repairs. Keep every receipt related to your recovery efforts – from tarps and plywood to hotel stays if you’re displaced.

If a disaster declaration is issued, register with FEMA as soon as possible, even if you have insurance. This preserves your eligibility for assistance that might not be covered by your policy.

Joint FEMA Preliminary Damage Assessment Process

When hurricane damage overwhelms local and state resources, the formal hurricane damage assessment process escalates to include federal partners. This Joint Preliminary Damage Assessment (PDA) follows a specific protocol designed to determine if federal disaster assistance is warranted.

The process begins when your state’s governor requests FEMA’s involvement. FEMA regional staff then coordinate with state officials to organize assessment teams and plan their deployment to affected areas. These teams include representatives from federal, state, and local agencies working together to document the full extent of the disaster.

These joint assessment teams use standardized forms and digital tools to capture consistent data across the affected region. They’re looking at both individual homes and public infrastructure damage, collecting information that will determine if the disaster meets federal thresholds for assistance.

For a Presidential Disaster Declaration, damage typically must exceed $1 million in public infrastructure damage per county and meet per-capita thresholds that vary by state. The teams document everything from destroyed homes to damaged roads, bridges, water systems, and public buildings.

After completing their assessment, FEMA compiles the findings into comprehensive reports that support the governor’s request for a Presidential Disaster Declaration. Since 2008, FEMA has published reports for more than 1,300 major disaster declaration requests, creating a valuable historical record of disaster impacts across the country.

Documenting Findings for Claims & Aid

The most critical element of your hurricane damage assessment is thorough documentation. Your photos, videos, and notes become the evidence that supports your insurance claim and disaster aid applications.

Date and time-stamped photographs serve as your primary evidence. Capture multiple angles of each damaged area – wide shots to show context and close-ups to show detail. If possible, include a measuring tape or familiar object in photos to provide scale.

“Documentation isn’t just about quantity – it’s about quality and organization,” notes our claims team. “A methodical approach now saves countless headaches later in the claims process.”

Video walkthroughs with narration add another powerful layer of documentation. As you record, describe what you’re seeing, noting when and how you believe the damage occurred. These narrated tours help adjusters understand the full context of your situation.

Create a detailed written inventory of damaged items, including age, condition, model numbers, and replacement costs. For significant losses, gather any documentation you have – receipts, owner’s manuals, or credit card statements showing purchases.

Take measurements of damaged areas – dimensions of roof damage, water line heights on walls, size of broken windows. These specifics help contractors provide accurate repair estimates.

Digital tools can streamline this process tremendously. Apps like Survey123 allow you to capture photos with embedded GPS coordinates and integrate them directly into your documentation. These tools help organize your evidence logically and create professional reports that strengthen your claim.

When to Seek Professional Help for Hurricane Damage Assessment

While many homeowners can handle basic hurricane damage assessment, certain situations call for professional expertise. Recognizing when to bring in specialists can save you money and headaches in the long run.

Structural damage is a key indicator that you need professional help. If you see cracked foundations, shifted walls, or sagging rooflines, contact a licensed structural engineer immediately. These experts can determine if your home remains safe to occupy and document exactly what repairs are needed to restore structural integrity.

Extensive roof damage warrants assessment by a licensed roofing contractor. They can identify issues that might not be visible from the ground and provide detailed documentation of damage patterns that help prove storm causation to insurance companies.

When water has penetrated multiple areas of your home, consider bringing in restoration specialists. Water damage can spread quickly, leading to mold growth within days. Professionals use moisture meters and infrared cameras to detect hidden moisture that might otherwise go unnoticed until it causes serious problems.

If your insurance adjuster’s estimate seems low compared to contractor quotes or doesn’t address all visible damage, it’s time to consider hiring a public adjuster. As licensed insurance professionals working exclusively for policyholders, public adjusters like our team at Insurance Claim Recovery Support advocate for your interests throughout the claims process.

For high-value or complex claims, professional representation often pays for itself many times over. Public adjusters typically identify 30-50% more compensable damage than policyholders document on their own, resulting in significantly higher settlements despite their contingency fee.

In Texas, public adjusters must be licensed by the Texas Department of Insurance and typically charge a percentage of the claim settlement – meaning they only get paid when you do. This alignment of interests ensures they’re motivated to identify every dollar of legitimate damage.

Technology & Data Integration

In today’s recovery landscape, hurricane damage assessment has evolved far beyond clipboard checklists and handwritten notes. Modern technology now plays a crucial role in documenting and analyzing hurricane aftermath, making the process more thorough and efficient than ever before.

When we work with clients across Texas, we’re increasingly relying on these digital tools to capture the full scope of hurricane damage. The days of potentially missing critical evidence are fading as technology helps us see the complete picture.

Hurricane damage assessment now harnesses several game-changing technologies:

Drones hover above damaged properties, capturing detailed roof imagery that would be dangerous or impossible to document on foot. Satellite imagery provides powerful before-and-after comparisons, clearly showing the hurricane’s impact. LiDAR scanning creates precise 3D models of damaged structures, revealing subtle deformations invisible to the naked eye.

Mobile apps have replaced paper forms, allowing for consistent data collection right in the field. GIS mapping helps analyze damage patterns across neighborhoods, while AI and machine learning assist in identifying specific damage types from thousands of images.

These technologies shine especially bright when assessing widespread hurricane damage across entire communities. They help prioritize resources where they’re needed most and identify troubling patterns that might otherwise go unnoticed.

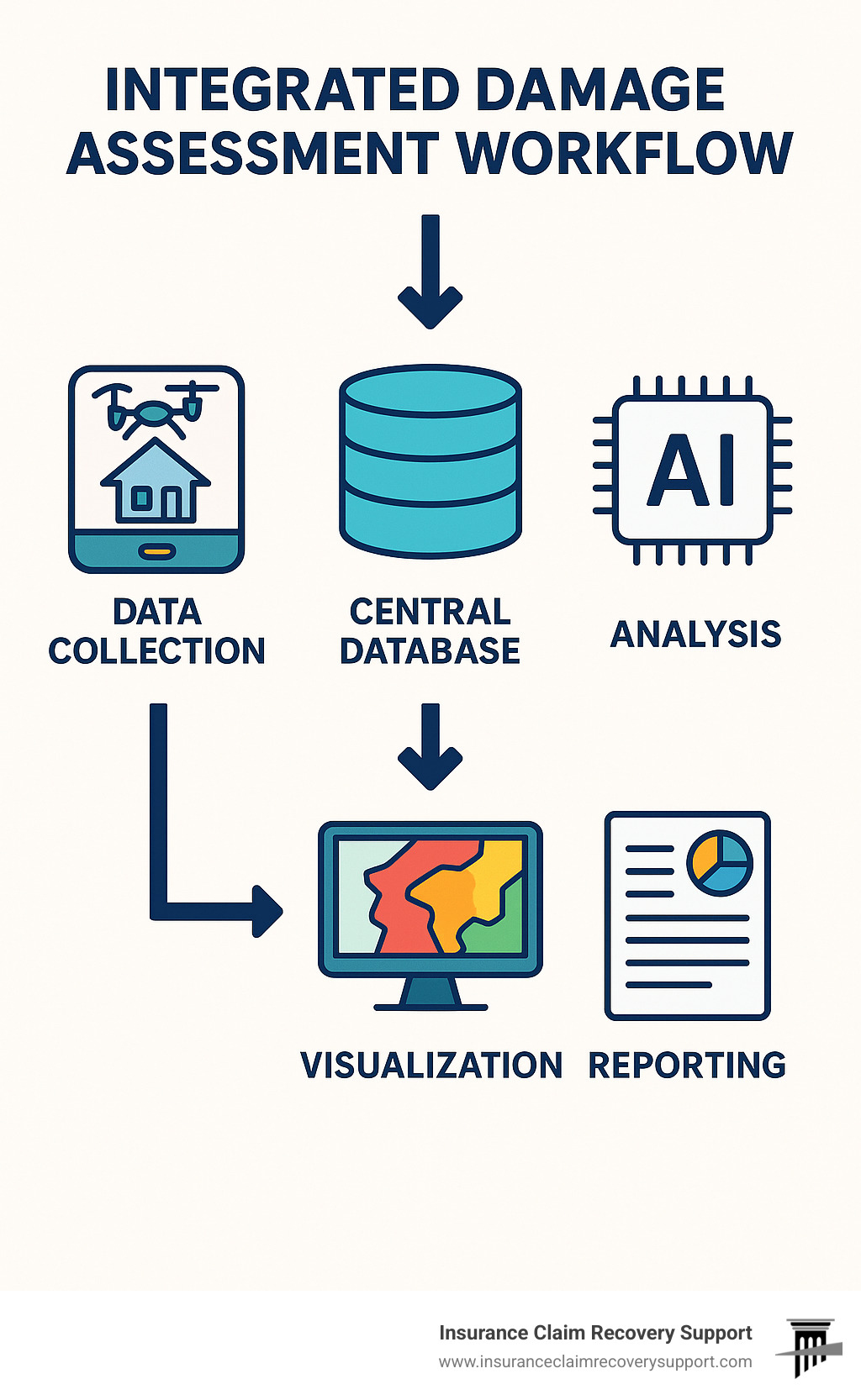

Building an Integrated Assessment System

For communities or organizations managing multiple properties, creating a comprehensive hurricane damage assessment system makes perfect sense. Rather than using disconnected tools, an integrated approach brings everything together for a more complete evaluation.

A well-designed system typically combines five essential elements working in harmony. First, mobile data collection tools like Survey123 or QuickCapture gather standardized information from the field. This feeds into a central database (often using ArcGIS or similar platforms) that securely stores and organizes all assessment data. Analysis tools then process this information, identifying patterns and priority areas.

Clear visualization tools display the findings through intuitive dashboards, showing real-time assessment progress. Finally, reporting systems automatically generate standardized documentation that satisfies insurance requirements and disaster aid applications.

Setting up such a system follows a logical progression. The process starts by configuring feature layers from damage assessment templates, then creating protected view layers to maintain data integrity. Mobile collection forms are built for field teams, web maps designed for visualization, and dashboards created to keep all stakeholders informed.

This approach allows multiple assessment teams to coordinate seamlessly while providing emergency managers and recovery officials with real-time awareness of the situation as it unfolds.

Benefits of Digital Tools

The shift to digital hurricane damage assessment tools brings remarkable improvements that benefit everyone involved in the recovery process.

Speed is perhaps the most obvious advantage – digital forms eliminate the tedious paper handling and manual data entry that once delayed assessments for days or weeks. Standardization ensures everyone collects the same critical information, making comparisons more meaningful. Real-time coordination allows multiple teams to work simultaneously while staying in sync, and automated analysis quickly identifies patterns that would take humans days to spot.

Perhaps most importantly, digital dashboards provide all stakeholders – from homeowners to community leaders – with current, accurate information about the recovery process.

These technological advantages translate into real-world benefits. Insurance adjusters can be strategically deployed to the hardest-hit areas first, reducing wait times for those most affected. Emergency managers allocate resources more effectively based on damage concentration data. Homeowners experience faster claim processing with comprehensive digital documentation. And community recovery officials gain the ability to track progress and identify unmet needs before they become crises.

Even for individual homeowners, simple smartphone apps designed for damage documentation can dramatically improve the quality of your hurricane damage assessment. These user-friendly tools help organize photos, notes, and measurements in ways that strengthen your insurance claim.

At Insurance Claim Recovery Support, we’ve acceptd these technologies across our Texas operations. Our digital documentation system creates thorough, indisputable damage reports that insurance companies find difficult to minimize or deny – which means better outcomes for the homeowners and businesses we serve.

Scientific research on GIS-enabled assessments confirms what we’ve seen firsthand: technology-improved assessment leads to faster, more equitable recovery for hurricane-affected communities.

Conclusion & Next Steps

Mastering hurricane damage assessment is more than just a checklist—it’s an essential skill that can make or break your recovery process after a storm hits. For Texas property owners, understanding how to properly document and evaluate damage can mean the difference between a fair settlement and financial hardship.

Throughout this guide, we’ve walked through the critical aspects of assessing hurricane damage. Let’s take a moment to reflect on the most important takeaways:

Safety must always come first. No property is worth risking your life—wait until authorities confirm it’s safe to return, and be cautious about structural instability, electrical hazards, and contaminated water.

Documentation creates the foundation for recovery. Those photos, videos, and detailed notes aren’t just for your records—they’re the evidence that will support your insurance claim and any disaster assistance applications. The more thorough your documentation, the stronger your position.

A systematic approach prevents overlooked damage. When emotions run high after a disaster, it’s easy to miss things. Using a methodical, room-by-room assessment helps ensure nothing falls through the cracks.

Understanding different damage types matters. Wind damage, water intrusion, and flood damage may be covered differently in your policy. Being able to distinguish between them in your documentation can significantly impact your claim.

Professional help often pays for itself. Sometimes damage isn’t obvious to the untrained eye. Structural engineers, specialized contractors, and public adjusters bring expertise that can identify hidden issues and advocate for proper compensation.

Technology improves assessment accuracy. From smartphone apps to drones, digital tools can improve documentation quality and help create more compelling evidence for your claim.

Balancing speed and thoroughness is crucial. While you need to act quickly to prevent secondary damage like mold, rushing through your assessment can lead to missed items that won’t be covered later.

After completing your hurricane damage assessment, the next step is prioritizing repairs. Focus first on addressing safety concerns and preventing further damage, then move on to restoring essential services before tackling long-term repairs and improvements.

For complex or significant claims, consider reaching out to a public adjuster. At Insurance Claim Recovery Support, our team has helped countless property owners throughout Texas document hurricane damage comprehensively and secure the maximum settlements they deserve. We proudly serve Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, Lakeway, and surrounding areas.

Proper hurricane damage assessment is an investment in your recovery. The hours spent documenting damage thoroughly will ultimately save you time, money, and stress when dealing with your insurance company.

Frequently Asked Questions about Hurricane Damage Assessment

Q: How soon after a hurricane should I conduct a damage assessment?

A: Begin your assessment as soon as authorities declare it safe to return to your property. Document everything immediately, as evidence of damage can change rapidly, especially with water intrusion.

Q: What if I can’t access my property immediately after the hurricane?

A: Document the date when access was restricted and the date when you gained access. Take photos of any official barriers or notices preventing entry. Insurance policies typically account for delayed access in disaster situations.

Q: How do I handle debris for assessment purposes?

A: Document all debris before moving it. Take photos from multiple angles, estimate quantities, and note the type of debris (building materials, vegetation, personal property). If possible, separate debris by type for documentation purposes.

Q: What if I don’t have pre-storm photos of my property?

A: Use any available documentation such as real estate listings, appraisal photos, renovation records, or even Google Street View images. Neighbors’ photos might also show your property in the background. Tax records and building permits can provide information about your property’s pre-storm condition.

Q: How do I document damage to expensive or specialty items?

A: Take detailed photos, gather original purchase receipts, owner’s manuals, and professional appraisals if available. For specialty items like artwork or collectibles, consider getting a post-damage appraisal from a qualified expert.

Post-Assessment Repair Prioritization Tips

After completing your hurricane damage assessment, it’s crucial to tackle repairs in the right order. Start with immediate stabilization within the first 24-48 hours—tarp damaged roofs, board up broken windows, extract standing water, and address any hazardous conditions. These quick actions prevent further damage and secure your property.

Next, focus on moisture mitigation within 3-7 days. Set up dehumidifiers, remove wet materials like drywall and carpeting, and apply antimicrobial treatments. This step is critical for preventing mold growth, which can begin within days after water exposure.

Structural stabilization should follow within 1-2 weeks. Address any compromised support elements, secure loose components, and consult with structural engineers if you have significant damage. Don’t skip this step—even minor structural issues can worsen over time.

Once your property is stable and dry, move on to system repairs (electrical, plumbing, HVAC) within 2-4 weeks, followed by interior finish work like drywall, flooring, and cabinetry over the next 1-3 months. Save exterior and cosmetic repairs for last, typically 3-6 months after the storm.

When getting contractor bids, ensure they specifically address all documented damage and use materials that match your pre-storm property. This is also an excellent time to consider upgrades that improve hurricane resistance, especially if your policy includes code upgrade coverage.

At Insurance Claim Recovery Support, we’ve guided countless Texas property owners through this prioritization process while ensuring their insurance claims cover all necessary repairs. Our experience with hurricane claims throughout coastal communities has taught us that strategic repair planning leads to more complete recovery and fewer headaches down the road.