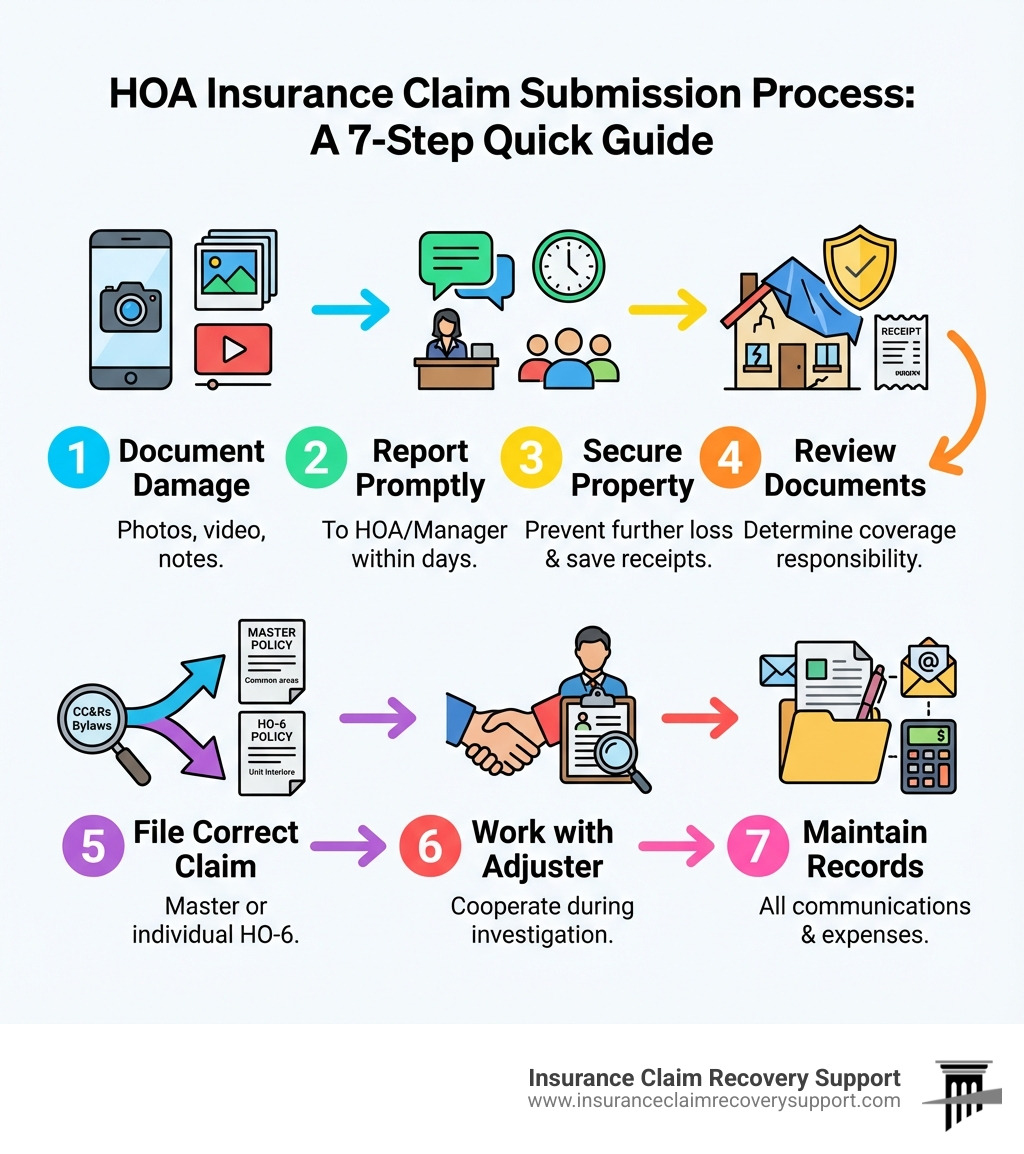

Quick Guide: How to Submit a Claim to HOA Insurance

How to submit claim to hoa insurance involves coordinating between your HOA board, property manager, and insurance provider while understanding the difference between your master policy and individual unit coverage. Here’s the essential process:

- Document the damage immediately with photos, videos, and detailed notes

- Report promptly to your HOA board or property manager (within days, not months)

- Secure the property to prevent further damage and save all receipts

- Review your governing documents (CC&Rs and bylaws) to determine coverage responsibility

- File with the appropriate policy – master policy for common areas, HO-6 for unit interiors

- Cooperate fully with the insurance adjuster’s investigation

- Keep meticulous records of all communications, invoices, and payments

When damage strikes your multifamily property or condominium association, the claims process can be overwhelming. With over 15 years of experience as a large-loss public adjuster, I’m Scott Friedson. I’ve seen how knowing how to submit claim to hoa insurance properly can be the difference between a fair settlement and losing millions. I’ve successfully steerd complex HOA claims involving fire, hurricanes, and business interruption for commercial and multifamily property owners. This guide will walk you through the essential steps to protect your property and maximize your claim.

The stakes are high for HOAs. With insurance rates at an all-time high in 2024, understanding your coverage is critical. Whether it’s storm damage, fire, or water damage, knowing the proper claims process—and when to get professional help—can prevent financial devastation for your association.

Understanding Your HOA Insurance Before You File

As an HOA board member, property manager, or owner, grasping your HOA’s insurance policy is the foundational step before filing a claim. The HOA insurance, or “master policy,” is a safety net designed to protect association members from liability and cover damages in shared community spaces like clubhouses, pools, roofs, and exterior walls.

However, HOA insurance is complex. Understanding what it covers, what it doesn’t, and how it interacts with individual unit owner policies is essential for knowing how to submit claim to hoa insurance effectively.

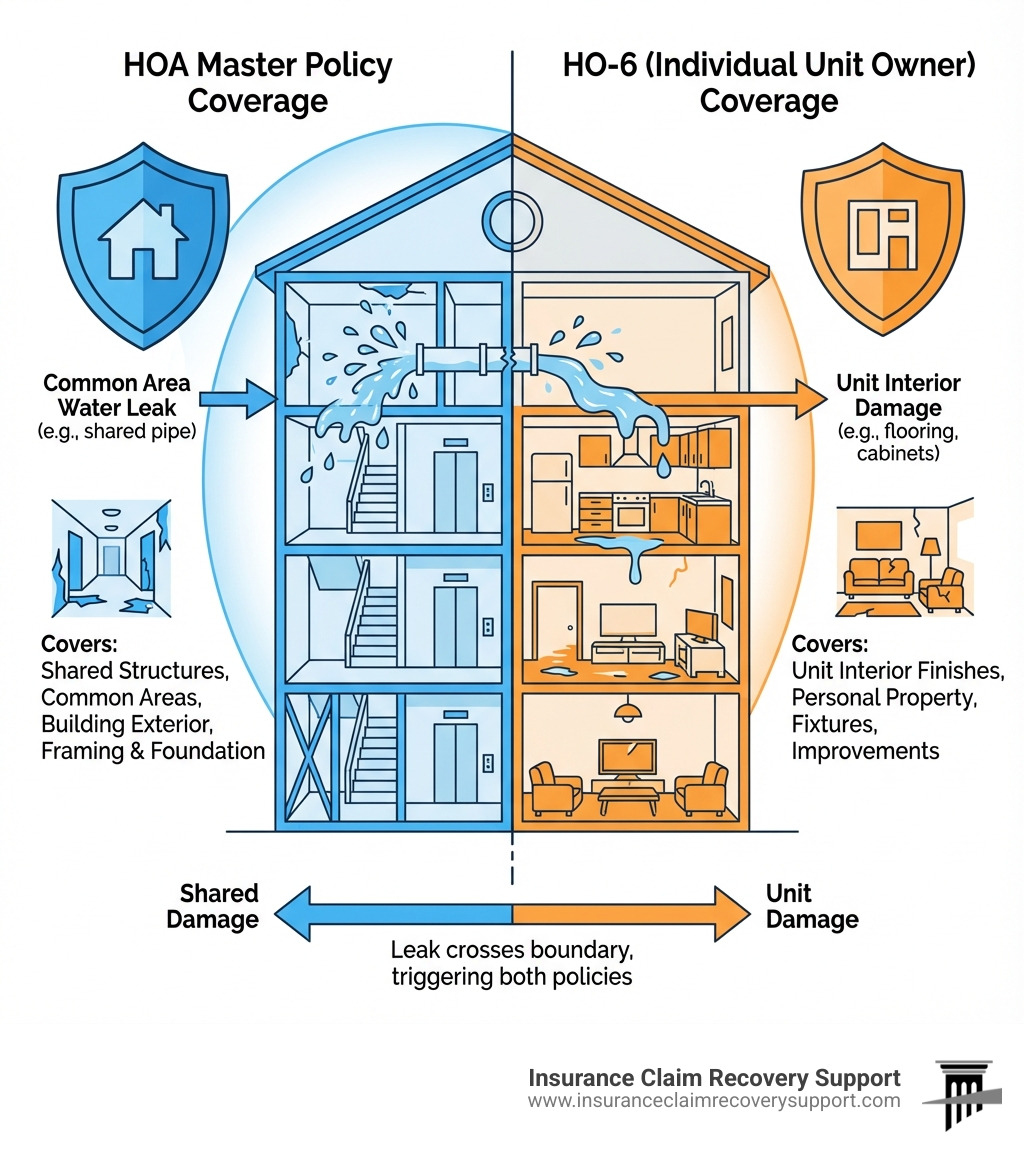

HOA Master Policy vs. Individual (HO-6) Policy: Who Covers What?

Distinguishing between the HOA’s master policy and an individual’s HO-6 insurance is a common point of confusion. They serve separate but complementary roles.

-

HOA Master Policy: This policy protects the association. It covers property damage to common areas (clubhouses, shared roofs, hallways) and provides general liability coverage. For example, if a fire damages a shared building’s roof, the master policy is the primary coverage. The extent of interior coverage depends on the policy type.

- “Bare Walls-in” Policies: These cover the building’s structure (exterior framing, shared walls, roof) but not interior finishes within units. Owners are responsible for items like paint, flooring, and cabinets.

- “All-in” Policies: These are more comprehensive, covering the structure, common areas, and often fixtures and improvements within units. They typically exclude personal belongings and the owner’s personal liability.

-

Individual (HO-6) Policy: This is the unit owner’s personal insurance, designed to cover what the master policy doesn’t. This typically includes:

- Personal Property: Belongings inside your unit (furniture, electronics).

- Interior Damage: Finishes and fixtures within your unit not covered by the master policy.

- Loss Assessment Coverage: Covers your share of a master policy deductible or a special assessment.

- Personal Liability: Coverage if someone is injured inside your unit.

Understanding this is vital. If a common area pipe bursts, the master policy would likely cover the pipe and structural damage, while individual HO-6 policies would cover the owners’ personal property and interior finishes.

Here’s a simplified comparison:

| Damage Type | HOA Master Policy (Typically Covers) | Individual HO-6 Policy (Typically Covers) |

|---|---|---|

| Fire | Shared building structure, common areas, exterior walls. | Personal belongings, interior finishes, improvements within the unit. |

| Water Damage | Common area pipes, structural damage from common source, shared building elements (e.g., roof leaks). | Personal belongings, interior finishes, damage from sources within the unit, loss assessment for master deductible. |

| Wind Damage | Roofs, exterior walls, common structures (e.g., clubhouse, fences). | Personal belongings, interior finishes if wind penetrates unit, loss assessment for master deductible. |

The Critical Role of Governing Documents and Deductibles

Before you submit claim to hoa insurance, you must consult your association’s governing documents (CC&Rs, Bylaws, Declarations). These documents define maintenance and insurance responsibilities for both the association and unit owners.

For instance, Florida Statutes Chapter 718 (for Condominiums) and Chapter 720 (for HOAs) mandate specific insurance and maintenance obligations. These state laws are crucial and directly impact how claims are handled in Florida. Other states we serve, like Texas, Georgia, and Colorado, have their own regulations. Always refer to your state’s laws and your association’s documents.

Deductibles and Policy Limits: These are critical financial considerations.

- Deductibles: The out-of-pocket amount your association pays before coverage begins. If repair costs are less than the deductible, filing a claim may not be worthwhile as it won’t result in a payout and could affect your claims history.

- Policy Limits: The maximum amount the insurer will pay for a covered loss. If damages exceed this limit, the association is responsible for the difference, potentially through special assessments to unit owners.

- Loss Assessment Coverage: This coverage, part of an HO-6 policy, protects unit owners from special assessments levied by the HOA to cover the master policy’s deductible or costs exceeding its limits.

How to Submit a Claim to HOA Insurance: A Step-by-Step Guide

When disaster strikes, knowing how to submit claim to hoa insurance correctly is paramount to a fair and timely settlement. It’s a strategic process requiring prompt action and attention to detail.

Step 1: Immediate Actions and Essential Documentation

Your initial response can significantly impact your claim’s outcome.

-

Document Everything Immediately: As soon as you find damage, document it thoroughly.

- Photos and Videos: Take detailed photos and videos of all damage, including wide and close-up shots. Date and time stamps are helpful. This visual evidence is crucial.

- Witness Statements: If there were witnesses, gather their contact information and brief statements.

- Police Reports: For criminal acts like vandalism or theft, file a police report immediately and get a copy.

- Damage Assessment: Make detailed notes of what happened, when, and what was damaged. Don’t discard damaged items until an adjuster has inspected them.

-

Mitigate Further Damage: You have a duty to protect the property from more damage. Failure to do so can lead to claim denial.

- Temporary Repairs: Take reasonable steps to prevent damage from worsening, like tarping a roof or shutting off water.

- Keep Receipts: Save all receipts for temporary repairs. These costs are often reimbursable.

Here’s a list of essential documents to gather before filing:

- Your HOA Master Policy

- HOA Governing Documents (CC&Rs, Bylaws)

- Detailed photos and videos of the damage

- Date and time of the incident

- Description of what happened

- Contact information for witnesses

- Police report (if applicable)

- Receipts for temporary repairs

- Property inventory or maintenance records

Step 2: Navigating the Investigation and Common Pitfalls

After taking immediate action, the next steps involve official reporting and working with the insurer.

-

Report Promptly: Most policies require reporting a claim “as soon as reasonably possible.” Delays can lead to denial.

-

Contact the Right Parties:

- Notify Your HOA Board or Property Manager: This is the first official step. The board or manager is typically responsible for initiating claims under the master policy.

- Contact the Insurance Provider: The property manager or a board member reports the claim to the insurance broker or agent. Provide your name, policy number, date of the incident, and a description of the damage. Always report in writing to create a paper trail.

-

Cooperate with the Insurance Adjuster: The insurance company assigns an adjuster to investigate the claim. This person works for the insurance company.

- Inspection: The adjuster will inspect the damage. Have your documentation ready. It’s wise to have a representative like a public adjuster present to ensure all damage is noted.

- Proof of Loss Form: You will likely need to complete a sworn “Proof of Loss” form. Ensure all information is accurate.

- Communication Log: Keep a detailed log of all communications with the insurance company, including dates, times, names, and discussion summaries.

-

Understand Policy Exclusions: Be aware of policy exclusions. Damage from floods or hurricanes may require separate coverage. In states like Texas and Florida, windstorm deductibles can be much higher than standard ones.

-

Best Practices for HOAs: To ensure a smoother process, HOAs should:

- Regularly review insurance coverage to match current property values.

- Keep clear bylaws and CC&Rs defining damage responsibilities.

- Educate owners on master vs. HO-6 policies.

- Maintain accessible records of policies, documents, and claims.

What to Do When Your HOA Claim is Delayed, Denied, or Underpaid

Even with careful preparation, HOA insurance claims can be challenging. It’s not uncommon for associations to face delays, underpayments, or denials, especially with large-loss claims where millions are at stake.

Why Claims Go Wrong and How to Submit a Claim to HOA Insurance for a Fair Settlement

Several factors can complicate an HOA insurance claim:

- Complex Policies: Intricate policies with ambiguous language or coverage misunderstandings can cause disputes.

- Valuation Disputes: Insurers may undervalue the cost of repairs, leading to underpayment.

- Insufficient Documentation: A lack of comprehensive photos, receipts, or damage assessments can weaken a claim.

- Failure to Report Promptly: Delays in reporting can be grounds for denial.

- Insurers Intentionally Delaying: Some insurers may drag out the process to pressure policyholders into accepting lower settlements.

Fact vs. Myth: Addressing Common Fears About Claim Denials

Myth: If my claim is denied or underpaid, there’s nothing I can do.

Fact: Not true! As a policyholder, you have rights. You can appeal the decision, gather more evidence, and seek professional help to challenge the insurer’s determination.

Myth: The insurance company’s adjuster works for me.

Fact: The company adjuster works for the insurance company. Their goal is to protect the insurer’s bottom line, not to maximize your settlement.

Myth: Hiring a public adjuster or lawyer means I’m going to court.

Fact: Not necessarily. A public adjuster’s role is to negotiate a fair settlement outside of litigation. Legal action is often a last resort. Our firm, Insurance Claim Recovery Support, has a 90% settlement success rate without unnecessary lawsuits.

If your HOA believes its claim is unfairly denied or underpaid, it’s crucial to act. For complex or high-value claims, professional assistance is often the most effective path.

Learn more about the claims process

Getting Help: How a Public Adjuster Can Maximize Your HOA Insurance Claim

Navigating large-loss HOA claims—especially for fire, hurricane, or water loss—is where a licensed public adjusting firm like Insurance Claim Recovery Support (ICRS) becomes an invaluable asset. We represent policyholders only, never insurance companies. Our expertise is in maximizing settlements and reducing delays.

What a Public Adjuster Does:

A public adjuster is an independent claims professional who works exclusively for you. They handle every aspect of the claim:

- Comprehensive Damage Assessment: We conduct a thorough inspection, finding damage the insurer’s adjuster may miss.

- Detailed Documentation: We carefully document all losses and prepare a comprehensive “Proof of Loss” statement.

- Policy Interpretation: We interpret your complex HOA master policy to ensure all coverages are invoked.

- Negotiation: We handle all communications and negotiations with the insurer, advocating for the maximum possible settlement. Proven public adjusters often obtain settlements 3 to 4 times higher than the initial offer.

- Reducing Delays: We actively manage the claim to ensure prompt communication and push the insurer to meet deadlines.

- Avoiding Unnecessary Litigation: Our goal is to resolve claims through expert negotiation, not costly lawsuits. We specialize in resolving claims with a 90% settlement success rate without unnecessary litigation.

Lawsuit vs. Public Adjuster Process for Property Damage Claims

| Feature | Lawsuit Process (Without Public Adjuster) | Public Adjuster Process (With ICRS) |

|---|---|---|

| Initiation | Dispute insurer’s offer in court. | Negotiate with insurer on your behalf. |

| Cost | High legal fees, court costs, lengthy process. | Contingency fee (percentage of settlement), no upfront costs. |

| Timeline | Can take years to resolve. | Aims for faster resolution, typically months. |

| Control | Less direct control; attorney manages legal strategy. | You are informed; public adjuster manages claim strategy. |

| Complexity | Extremely complex legal procedures. | Complex insurance procedures handled by an expert. |

| Outcome | Court judgment or settlement; can be unpredictable. | Negotiated settlement focused on maximizing recovery. |

For commercial building owners, apartment investors, and HOA & condominium associations in Texas (including Austin, Dallas, Fort Worth, San Antonio, Houston), Florida, Georgia, Colorado, and other states we serve, partnering with ICRS provides an advocate for your financial recovery. We handle complex large-loss claims from fire, hurricanes, water damage, and business interruption.

When considering how to submit claim to hoa insurance and facing potential disputes, you don’t have to go it alone. We are here to help you steer the process and secure the maximum settlement you deserve.