Why the Timeline for Insurance Claims Matters for Your Property and Business

The timeline for insurance claims varies based on claim type, damage severity, and state regulations. Understanding the process can save you months of delays and thousands of dollars in lost revenue.

Quick Answer: Typical Insurance Claim Timelines

| Claim Type | Typical Timeline | Key Variables |

|---|---|---|

| Simple Property Claims | 2-6 weeks | Minor damage, clear liability, complete documentation |

| Complex Commercial Claims | 2-6 months | Major damage, business interruption, code upgrades |

| Large-Loss Claims | 6-18 months | Fire, hurricane, disputed coverage, appraisal needed |

| State-Mandated Deadlines | Varies by state | TX: 15 days to acknowledge; GA: 30 days to decide; NY: 15 days to respond |

When disaster strikes your commercial property, waiting for an insurance payout can feel like an eternity. For multifamily operators and hospitality managers, every day of delay means lost revenue and mounting business disruption. The claims process involves adjusters, contractors, and lenders, and can stretch from weeks to over a year.

Most insurers have legal deadlines to acknowledge, investigate, and pay claims, but these vary by state. For example, in Texas, they must acknowledge your claim within 15 business days and pay within 5 business days after approval. In Georgia, they have 30 days to decide after receiving proof of loss.

Even with these rules, claims often face delays from missing documentation, scope disagreements, or insurer stalling. Knowing whether a delay is legitimate or a potential bad faith practice is crucial to protecting your recovery.

- Myth: All insurance claims take the same amount of time.

-

Fact: A simple roof repair claim might settle in weeks, while a major fire with business interruption can take 18-24 months or longer.

-

Myth: The insurance company controls the entire timeline.

- Fact: Policyholders can significantly speed up a claim with prompt documentation, professional representation, and a clear understanding of their rights.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve helped commercial and multifamily property owners manage the timeline for insurance claims to secure fair settlements without unnecessary delays. My firm has settled hundreds of millions in property damage claims by leveraging state-specific deadlines, identifying bad faith tactics, and expediting the process through strategic public adjuster representation.

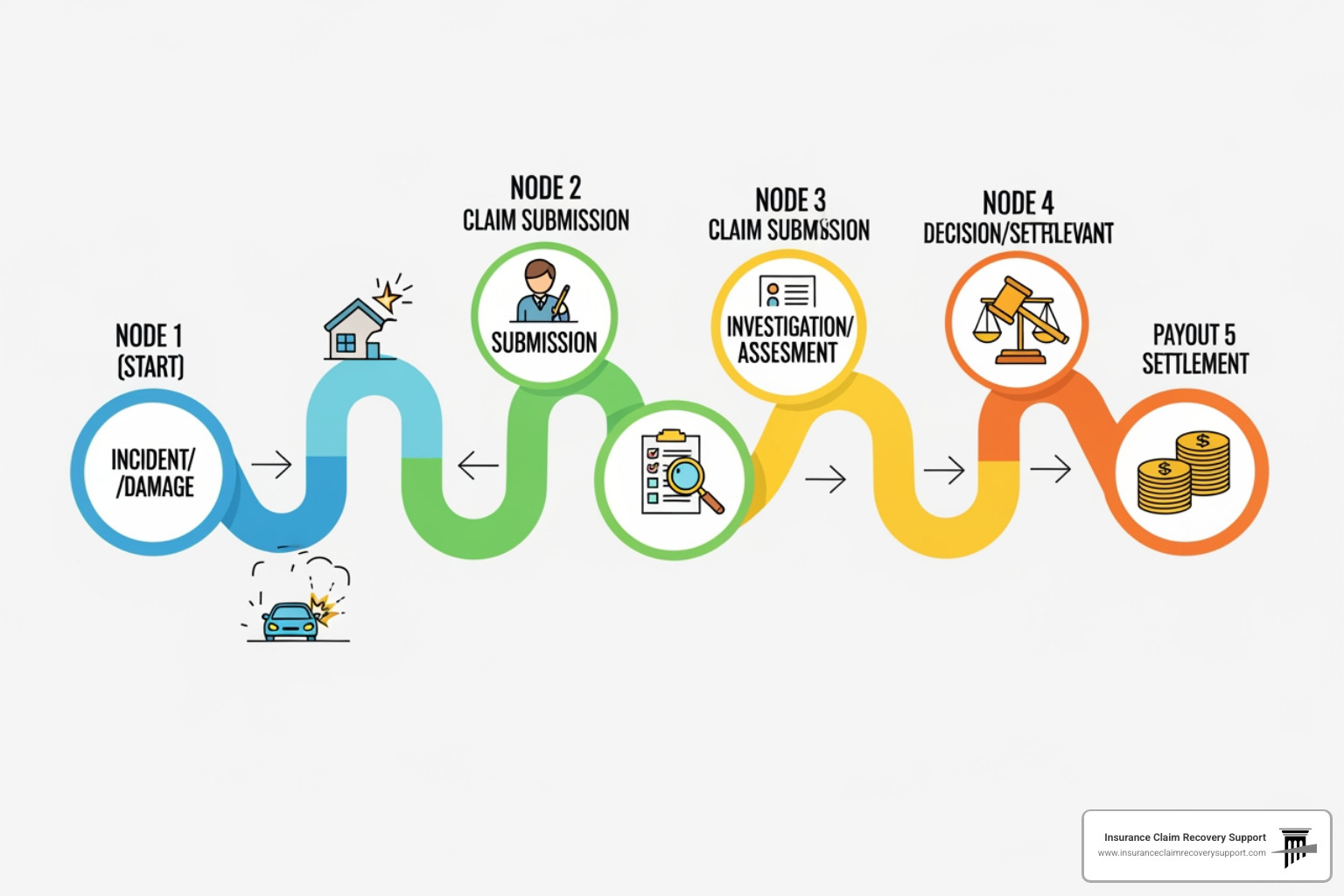

The Standard Timeline for Insurance Claims: A 4-Phase Breakdown

Understanding the typical phases of an insurance claim empowers you to manage the process. While each claim is unique, most follow a general four-phase structure.

Phase 1: Initial Loss & Claim Filing (The First 72 Hours)

The actions you take in the first 72 hours can significantly influence the entire timeline for insurance claims.

- Mitigate Damage & Make Temporary Repairs: Your policy requires you to take reasonable steps to prevent further damage, such as tarping a damaged roof. Make necessary temporary repairs like boarding up windows and save all receipts. These costs should be reimbursable. Avoid permanent repairs until an adjuster has inspected the property.

- Notify Your Insurer: Contact your insurance company as soon as possible to start the official claim timeline. Have your policy information and a preliminary list of damages ready.

- Document Everything: Before any cleanup, take extensive photos and videos of all damage. Create a detailed list of damaged property and do not discard anything until the adjuster has seen it. A pre-existing inventory of your property and contents is invaluable.

- Review Your Policy: Understand your coverage, deductible, and claim filing requirements. This knowledge is your first line of defense.

Phase 2: Investigation & Documentation (Weeks 1-4)

Once filed, the investigation phase begins, setting the pace for the timeline for insurance claims. The insurer gathers information to determine coverage and loss amount.

- The Adjuster’s Role: The insurer assigns an adjuster to inspect the damage and estimate repair costs. The adjuster works for the insurance company. We recommend having a public adjuster represent you during inspections to ensure all damages are identified.

- Proof of Loss: You will likely need to complete a “Proof of Loss” form, a formal statement detailing your claim. Accuracy is critical.

- Scope of Loss & Independent Estimates: The adjuster creates a “scope of loss” detailing the proposed repairs, which forms the basis of the settlement offer. Always get your own independent estimates from licensed contractors to compare against the insurer’s scope.

- State-Specific Deadlines: Insurers must follow state-mandated timelines. For our clients, we monitor these closely:

- Texas: Insurers have 15 business days to acknowledge a claim and another 15 business days to approve or deny it after receiving all information. They can request a 45-day extension for a valid reason.

- Georgia: Insurers must acknowledge a claim within 15 calendar days and decide on it within 30 days of receiving your proof of loss.

- Kansas: Insurers are expected to complete investigations within 30 days and must provide updates every 45 days if more time is needed.

Phase 3: Negotiation & Settlement (Weeks 4-12+)

This phase involves back-and-forth to agree on a final settlement. Understanding Actual Cash Value (ACV) and Replacement Cost Value (RCV) is vital.

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | Cost to replace damaged property minus depreciation. | Cost to replace damaged property with new, similar items (no depreciation). |

| Payout | Initial payment based on depreciated value. | Initial payment based on ACV, with recoverable depreciation paid upon replacement. |

| Impact on Claim | Lower initial payout, may not cover full replacement cost. | Higher overall payout, covers actual cost to restore property. |

| Best for | Older properties, items with significant wear and tear. | Newer properties, ensuring full restoration without out-of-pocket expenses for depreciation. |

With an RCV policy, the difference between ACV and RCV is called recoverable depreciation, which is paid after you complete repairs. The insurer’s initial offer is often negotiable. If you receive a lowball offer, you can dispute it by providing your own contractor estimates and documentation. This can lead to formal dispute resolution processes like appraisal or mediation.

Phase 4: Payment & Post-Settlement (The Final Stretch)

The final phase involves receiving payment and completing repairs.

- Payment Deadlines: Once a settlement is reached, states have payment deadlines. Texas requires payment within five business days, while Georgia requires it within 10 days.

- Multiple Payments & Mortgage Companies: For large commercial claims, you may receive multiple payments (e.g., an initial ACV payment, then recoverable depreciation). If you have a mortgage, the check for structural damage will likely be co-payable to you and your lender, who will then release funds for repairs.

- Supplemental Claims: If you find additional damage after the claim is settled, it is often possible to reopen the claim. Document the new damage immediately and notify your representative. This can extend the timeline for insurance claims but is necessary for a full recovery.

Navigating Delays and Disputes: Your Rights and Options

Even with clear regulations, the timeline for insurance claims can be unpredictable. Knowing what causes delays and how to respond is key to a successful recovery.

What Factors Influence the Timeline for Insurance Claims?

Several elements can extend the duration of a claim:

- Claim Complexity: A simple water leak claim is resolved faster than a major fire affecting a large multifamily complex, which has a naturally longer timeline for insurance claims.

- Severity and Type of Damage: A fire claim involving structural work and code upgrades takes longer than a claim for minor storm damage.

- Liability Disputes: If there are questions about whether your policy covers the loss, the investigation will be prolonged.

- Policyholder Cooperation: Your promptness in providing documentation and access to the property significantly impacts the timeline. Delays on your end can legitimately slow the process.

Experiencing a property loss is incredibly stressful, and managing a complex claim adds to that burden. For more information on coping with the psychological impact, you can visit the Scientific research on the psychological impact of disaster recovery.

Bad Faith vs. Legitimate Delays: Knowing the Difference

It’s crucial to distinguish between a legitimate delay and an insurer’s bad faith practices. One is an acceptable part of a complex process; the other is a violation of your rights.

An insurer acts in “bad faith” when they unreasonably refuse to pay a valid claim or use stalling tactics to avoid their obligations. Red flags for bad faith include:

- Ignoring clear evidence of damage.

- Repeatedly requesting irrelevant or unnecessary documentation.

- Offering a settlement far below repair costs without justification.

- Failing to respond within legal timeframes (e.g., in Texas or Georgia).

- Using stalling tactics like unreturned calls or missed appointments.

Insurers found to be acting in bad faith can face significant penalties. In Georgia, a policyholder may recover the full claim amount, attorney’s fees, and an additional penalty of up to 50% of the claim.

Improving Your Timeline for Insurance Claims: Public Adjuster vs. Lawsuit

When your timeline for insurance claims becomes unreasonable, you have options. For commercial property owners, the choice between hiring a public adjuster and filing a lawsuit has major financial implications.

The Public Adjuster Advantage: A public adjuster is a licensed professional who works exclusively for you, the policyholder. Their expertise is in interpreting complex policies, documenting damage, and negotiating with the insurer. At Insurance Claim Recovery Support, our primary goal is to resolve claims efficiently and fairly, avoiding the need for costly and lengthy litigation. Our process often leads to settlements 3 to 4 times higher than initial offers and helps prevent the claim from ending up in appraisal or a lawsuit.

The Lawsuit Process: In contrast, an insurance claim lawsuit is a long and expensive process. It involves filing a complaint, a lengthy “findy” phase of exchanging documents, depositions, mediation attempts, and potentially a public trial. The entire process can take years and add significant stress and cost, further delaying your recovery.

By engaging a public adjuster early, you leverage expert negotiation to achieve a favorable settlement without going to court. Our 90% settlement success rate without unnecessary lawsuits highlights the effectiveness of this proactive approach. We specialize in large-loss commercial, multifamily, and specialty property claims involving fire, hail, hurricane, tornado, freeze, lightning, flood, and business interruption.

We advocate for commercial building owners, apartment investors, HOAs, hotels, religious institutions, schools, and more. Insurance Claim Recovery Support is licensed and serves clients in Texas, Florida, Georgia, Colorado, North Carolina, South Carolina, Oklahoma, and many other states, with a strong local presence in Texas cities like Austin, Dallas, Houston, and San Antonio.

For more detailed guidance on navigating the entire insurance claims process, you can explore our complete guide here: More info about the insurance claim process.