Why Filing a Hotel Insurance Claim Feels Like a Full-Time Job You Didn’t Sign Up For

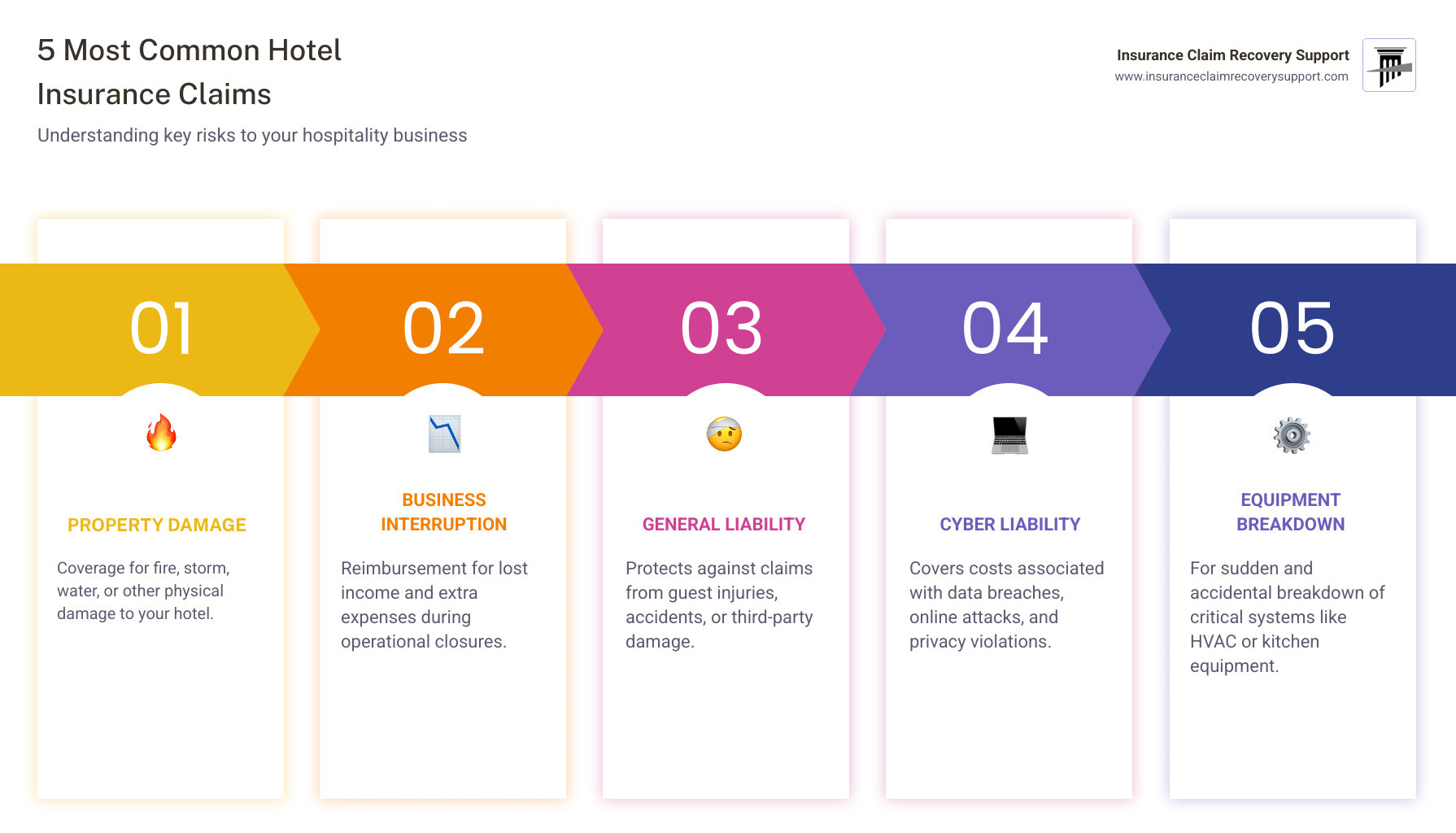

A Hotel Insurance Claim is a formal request to your insurance company for compensation after property damage, guest injury, or business interruption. The process involves notifying your insurer, documenting the loss, working with an adjuster, and negotiating a settlement. Common claims include property damage from fire or storms, business interruption, general liability, and equipment breakdown.

Running a hotel is demanding enough without adding “insurance expert” to your job description. Yet, when a disaster like a fire or hurricane strikes, that’s the reality. The hospitality industry faces unique challenges: 24/7 operations, displaced guests, lost bookings, and complex systems. Missing a seasonal rush can mean devastating income loss on top of physical damage.

Many hotel owners find too late that their claim involves disputed coverage, undervalued damages, and a mountain of unexpected paperwork. The process can become a full-time job, pulling you away from getting your property back online.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve helped hospitality owners steer complex Hotel Insurance Claims from fire, hurricane, and flood damage, significantly increasing their recoveries. This guide will show you what to expect, what to avoid, and when to call for expert help so you can focus on running your hotel.

Navigating Your Hotel Insurance Claim: A Step-by-Step Guide

This section walks you through the critical steps of the claims process, from the moment damage occurs to negotiating your settlement.

Immediate Actions: What to Do in the First 24 Hours

When disaster strikes, swift action in the first 24 hours is crucial for your property, guests, and your Hotel Insurance Claim.

- Mitigate Further Damage: Your first priority is to protect the property. Make temporary repairs like tarping a roof or shutting off water mains. Your policy requires you to take reasonable steps to prevent more damage. Keep all receipts for these repairs, as they are often reimbursable.

- Ensure Safety: Secure the area and ensure the safety of guests and staff, providing alternative accommodations if necessary.

- Notify Your Insurer: Call your insurance agent or company representative immediately. Delays can negatively impact your claim.

- Document Everything: Take extensive photos and videos of all damage. Create a detailed list of every damaged item and area. This initial documentation is the foundation of your claim.

For more comprehensive guidance, refer to this guide to emergency preparedness for businesses.

Documenting Everything: Building a Rock-Solid Claim File

Meticulous documentation is non-negotiable for a successful Hotel Insurance Claim. You must prove the full extent of your loss.

- Visual Evidence: Take high-resolution photos and videos of all damaged areas, equipment, and contents.

- Damaged Item Inventory: List every item with its brand, model, age, and estimated value.

- Repair Estimates: Obtain multiple, detailed bids from licensed contractors.

-

Financial Records: For a business interruption claim, you must prove what you would have earned. Gather the following:

-

Income statements (last 2 years)

- Projected income analyses

- Payroll records (pre- and post-loss)

- Tax and sales tax returns (last 2 years)

- Operating expenses and utility bills

- Occupancy records and average daily rates (last 2 years)

- Estimated lost revenues (rooms, restaurant, events, etc.)

Understand if your policy pays Actual Cash Value (ACV)—the depreciated value—or Replacement Cost (RC)—the cost to replace with a new item. This distinction is vital for accurate valuation.

Understanding the Players: Your Role vs. The Insurance Adjuster’s

When you file a Hotel Insurance Claim, you must understand the roles of each party. As the policyholder, your job is to prove your loss by providing prompt notice and thorough documentation.

The insurance company’s adjuster works for the insurer. Their objective is to evaluate the damage and determine a payout based on your policy. While they aim for a fair settlement, their primary loyalty is to their employer. They will conduct a “scope of loss” inspection to form the basis of the insurer’s offer.

During settlement negotiations, your detailed documentation is your greatest asset. Be prepared to negotiate assertively and keep a log of all communications with the insurance company.

Common Pitfalls in a Hotel Insurance Claim and How to Avoid Them

One misstep can lead to significant financial loss. Avoid these common pitfalls:

- Undervalued Damages: Don’t accept a quick payout that doesn’t cover the true cost of repairs and business interruption. Scrutinize the first offer.

- Incomplete Documentation & Missed Deadlines: Lack of evidence or late submissions can lead to claim denial. Be meticulous and prompt.

- Overlooked Code Upgrades: After a major loss, repairs may need to meet current building codes. This is often not covered unless you have a specific “ordinance or law” endorsement in your policy.

- Unlicensed Contractors: In the chaos after a disaster, be wary of unethical contractors. Always vet professionals and get written bids.

When to Call for Backup: Professional Help for Complex Claims

When your hotel faces extensive damage, the claim’s complexity can become overwhelming. This is when to consider bringing in professional help to protect your financial interests and avoid delays.

How a Public Adjuster Can Help Maximize Your Hotel Insurance Claim

A public adjuster is an insurance professional who advocates exclusively for you, the policyholder. While your insurer has its own team of experts, a public adjuster levels the playing field.

ICRS is a licensed public adjusting firm that represents policyholders only. We handle every aspect of your Hotel Insurance Claim, from conducting a thorough damage assessment to negotiating the final settlement. Our expertise in policy language, construction costs, and business interruption analysis helps uncover costs the insurer’s adjuster might miss.

Our goal is to maximize your settlement and avoid unnecessary litigation. ICRS has a 90% success rate in settling claims without lawsuits, saving you time and stress. We specialize in large-loss commercial claims from fire, hurricane, and water damage, allowing you to focus on recovery.

Insurance Claim Lawsuit vs. Public Adjuster: What Hotel Owners Need to Know

If your Hotel Insurance Claim is undervalued or denied, you might consider a lawsuit. However, it’s important to understand the difference between litigation and working with a public adjuster. A lawsuit may be necessary for bad faith denials but is often a long and expensive process. A public adjuster aims to resolve the claim through negotiation first.

Differences in Process, Cost, and Timeline:

| Feature | Working with a Public Adjuster | Pursuing an Insurance Claim Lawsuit |

|---|---|---|

| Primary Goal | Maximize settlement, avoid litigation, expedite recovery. | Compel insurer to pay, potentially seek bad faith damages. |

| Process | Damage assessment, documentation, negotiation. | Formal legal proceedings, findy, depositions, trial. |

| Cost Structure | Contingency fee (percentage of settlement), no upfront costs. | Hourly fees or higher contingency fee, plus court costs. |

| Timeline | Aims for faster resolution (weeks to months). | Can be lengthy (months to years). |

| Focus | Property damage, business interruption, and related costs. | Broader legal issues, including contractual disputes. |

A public adjuster like ICRS offers a streamlined, cost-effective path to maximizing your claim without the protracted nature of litigation.

Fact vs. Myth: Common Questions About Hotel Insurance Claims

Let’s separate fact from fiction for your Hotel Insurance Claim.

- Myth: My insurance company will always pay fairly.

-

Fact: The insurer’s adjuster represents their interests. They may undervalue costs or interpret policy language in their favor. An advocate on your side is crucial.

-

Myth: It’s faster to handle the claim myself.

-

Fact: The claim process can become a full-time job, delaying your recovery. A public adjuster handles the complexities, often leading to a faster, more favorable settlement.

-

Myth: Hiring a public adjuster will hurt my relationship with my insurer.

-

Fact: Public adjusters are licensed professionals. Their involvement ensures a fair process, which can reduce disputes and foster transparency.

-

Myth: Code upgrade costs are always covered.

- Fact: This is a common misconception. Coverage for bringing a building up to current code typically requires a specific “ordinance or law” endorsement in your policy.

Proactive Risk Management and Final Steps

A successful Hotel Insurance Claim starts before a disaster.

- Be Prepared: Develop emergency action plans and train staff on how to respond to incidents and document facts.

- Maintain Your Property: Regular maintenance of your building and grounds can prevent many common liability and property claims.

- Review Your Policy Annually: Work with your broker to ensure your coverage limits and endorsements are adequate for evolving risks like inflation and supply chain issues.

When a loss occurs, remember to maintain communication, be persistent, and don’t settle for less than you are owed. For large or complex claims, the expertise of a public adjuster is invaluable.

This is where Insurance Claim Recovery Support comes in. We specialize in maximizing settlements for Hotel Insurance Claims across Texas, Florida, Georgia, Colorado, and many other states. We represent policyholders only, ensuring your interests are always prioritized.

Don’t let a disaster derail your business. With proactive risk management and the right support, you can steer your claim successfully.