Navigating Your Home Insurance Claim: A Step-by-Step Guide

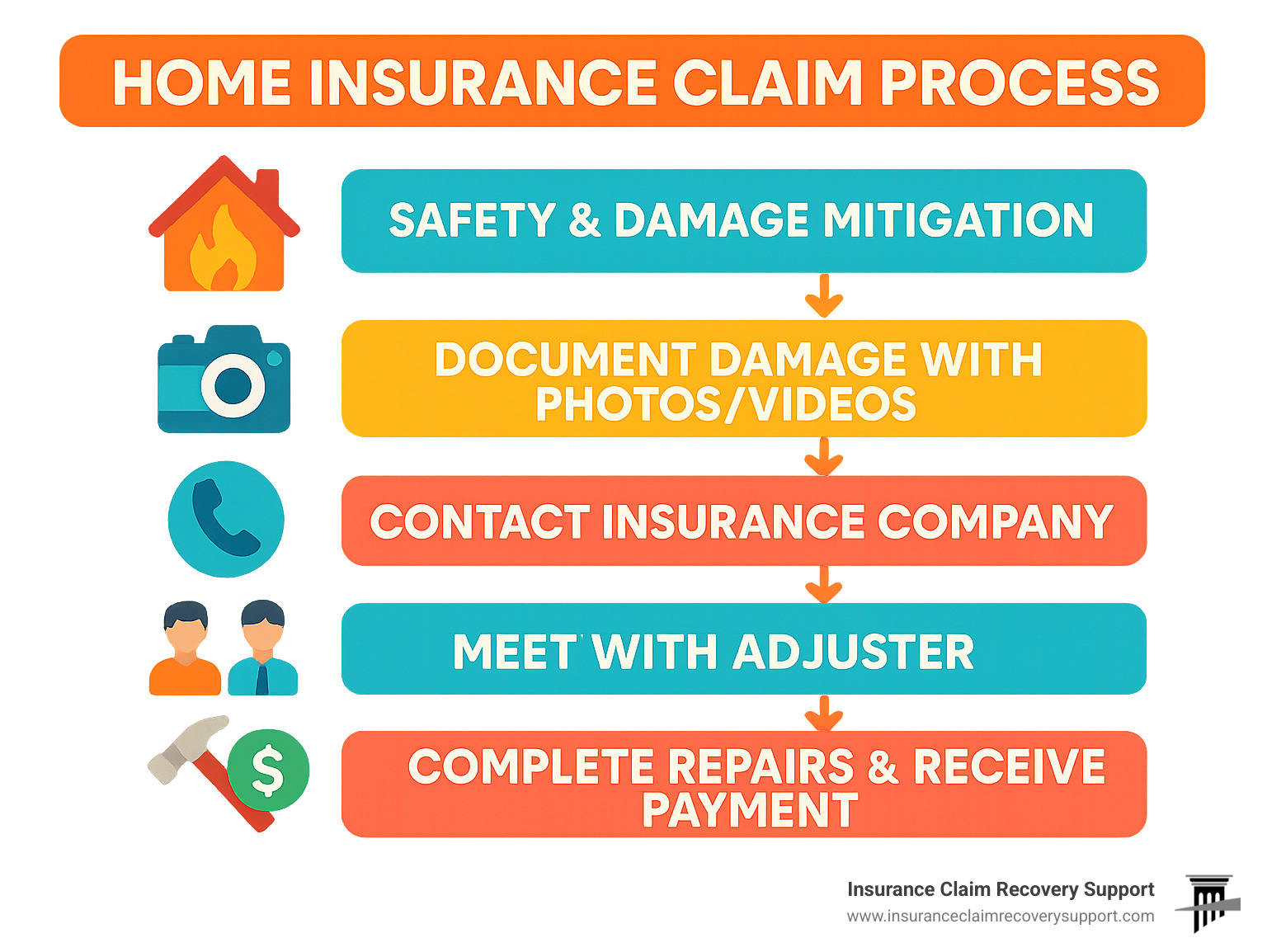

The home insurance claim process follows these key steps:

- Safety & Mitigation – Ensure safety and prevent further damage

- Documentation – Take photos/videos and inventory all damage

- Notification – Contact your insurer promptly (usually within 24-48 hours)

- Adjuster Inspection – Meet with the insurance adjuster

- Settlement Offer – Review and negotiate if needed

- Repairs & Payment – Complete repairs and receive final payment

Maybe it’s a tree crashing through your roof during a Texas thunderstorm. Perhaps it’s water gushing from a burst pipe. Or maybe it’s the aftermath of a kitchen fire. Whatever the disaster, facing property damage is stressful enough without having to steer the complexities of an insurance claim.

The home insurance claim process can feel overwhelming, especially when you’re already dealing with the emotional and practical fallout of property damage. Most homeowners file a claim only once every 10-20 years, making the process unfamiliar territory precisely when you’re most vulnerable.

Understanding how claims work isn’t just about paperwork—it’s about protecting your most valuable asset and ensuring you receive the settlement you deserve. Insurance companies operate on specific timelines and procedures that, when understood, can work in your favor rather than against you.

I’m Scott Friedson, a multi-state licensed Public Adjuster who has settled hundreds of millions in property damage insurance claims throughout my career of handling over 500 large loss claims valued at more than $250,000,000, giving me unparalleled expertise in the home insurance claim process across Texas and beyond.

Simple guide to home insurance claim process terms:

Step 1: Safety First & Immediate Actions After Damage

When disaster strikes your home in Austin, Dallas, Houston, or anywhere across Texas, your first priority must always be safety. About 1 in 20 insured homes has a claim each year, and knowing what to do in those critical first hours can make all the difference.

Immediate Safety Measures

-

Ensure everyone’s safety: Evacuate if necessary, especially in cases of fire, major structural damage, or flooding.

-

Contact emergency services: For fires, gas leaks, or dangerous structural damage, call 911 immediately.

-

Shut off utilities if safe: If you suspect gas leaks, water breaks, or electrical issues, turn off the appropriate utilities—but only if it’s safe to do so.

-

Get official clearance: After severe damage, don’t re-enter your home until emergency personnel or local authorities have confirmed it’s safe.

Preventing Further Damage

Your insurance policy actually requires you to take reasonable steps to prevent additional damage—what insurers call “mitigating damages.” This doesn’t mean making permanent repairs, but rather taking temporary measures to protect your property.

Common mitigation steps include:

- Boarding up broken windows or doors

- Placing tarps over roof damage

- Removing water with pumps or wet vacuums

- Moving undamaged furniture away from affected areas

“We see many cases where initial damage from a storm was compounded because homeowners didn’t take basic mitigation steps,” explains our lead adjuster in San Antonio. “For example, if a broken window isn’t boarded up and theft occurs, the insurer may deny that portion of the claim.”

Important: Keep all receipts for materials and services used for these temporary repairs. These expenses are typically reimbursable as part of your claim.

When to File a Police Report

For certain types of damage, a police report is essential:

- Theft or burglary

- Vandalism

- Hit-and-run damage (such as a vehicle striking your home)

- Any criminal activity resulting in property damage

The police report serves as official documentation of the incident and is often required by insurance companies for these types of claims.

More info about tips for filing claims

When NOT to File a Claim

While it might seem counterintuitive, there are situations where filing a claim may not be in your best interest:

-

When damage costs less than your deductible: If repair costs are $1,000 and your deductible is $1,500, you’ll pay out of pocket anyway.

-

For very minor damage: Filing a claim for small damages may not be worth the potential premium increase.

-

If you’ve filed multiple recent claims: Filing a homeowners insurance claim can increase your premium by an average of 7% to 10%. Multiple claims in a short period could lead to even higher rates or non-renewal.

-

When damage isn’t covered: Standard policies exclude certain perils like floods and earthquakes. Review your policy before filing.

As our Houston office manager notes, “Insurance is best used for significant, unexpected losses—not as a maintenance plan. We recommend doing the deductible math before filing.”

Step 2: Documenting Losses Like a Pro

You know that saying about pictures being worth a thousand words? When it comes to the home insurance claim process, they might be worth thousands of dollars instead. Nearly half of all homeowners insurance claims involve wind and hail damage, and your settlement amount often boils down to one thing: how well you’ve documented what happened.

Creating a Thorough Documentation Package

Think of yourself as a detective at a crime scene—nothing should go unnoticed or unrecorded. Start by photographing absolutely everything. I’m talking wide-angle shots that show the full extent of damage, followed by close-ups that capture every telling detail. That water stain might look minor today, but could reveal serious structural issues later.

Video walkthroughs are gold in the home insurance claim process. As you record, narrate what you’re seeing: “Here’s where the tree broke through the ceiling… you can see the water damage extending along this wall.” This commentary provides context that static photos sometimes miss.

While it’s tempting to start cleaning immediately (especially when your home is in disarray), try to resist the urge until you’ve documented everything thoroughly. Our Dallas clients often tell us their biggest regret was cleaning up too quickly. “Once the evidence is gone,” as our claims specialist puts it, “proving what happened becomes an uphill battle.”

For damaged appliances and electronics, make sure to capture those serial numbers and model information. These details might seem tedious now, but they’ll prove invaluable when determining replacement costs later.

If you happen to have “before” photos of your property, dig them up! Nothing demonstrates the extent of damage better than a clear before-and-after comparison.

Creating a Home Inventory

After a loss, trying to remember everything you owned can feel overwhelming. That’s why a detailed inventory is crucial to the home insurance claim process. For each damaged item, document its description, when you bought it, what it cost, and any identifying information like brand names or model numbers.

A helpful approach is to work room by room, mentally walking through each space to recall what was there. This methodical approach helps prevent overlooking items in the chaos of post-disaster stress.

“I always tell our Austin clients to imagine they’re explaining their home to someone who’s never seen it before,” shares one of our adjusters. “What would you point out in each room? What items did you value most? This mental exercise often jogs memories of items that might otherwise be forgotten.”

Getting Contractor Estimates

Independent assessments from licensed contractors provide powerful leverage in the home insurance claim process, especially if your insurance adjuster’s estimate seems suspiciously low. Aim to collect 2-3 estimates from reputable professionals who understand insurance repairs.

When choosing contractors, verify their credentials carefully. Check their license status, confirm they carry proper insurance, and read reviews from previous clients. Most importantly, insist on detailed, itemized estimates that break down labor and materials costs. Vague, single-figure estimates won’t help your case.

More info about Glossary of Property Insurance Claim Terms

Tech Tools & Checklists to Speed Up the Home Insurance Claim Process

The days of stuffing receipts in shoeboxes are thankfully behind us. Today’s technology offers much better ways to organize your claim:

Many insurance companies now offer dedicated mobile apps specifically designed for documenting and filing claims. These typically include features for uploading photos directly to your claim file and tracking progress in real-time.

Cloud storage solutions like Google Drive or Dropbox have become indispensable tools in the home insurance claim process. They not only keep your documentation safe from further damage but also make sharing information with adjusters and contractors seamless.

Digital inventory apps such as Sortly or Encircle help catalog your belongings with photos and details in an organized, searchable format. Some even estimate values automatically based on your descriptions.

Our San Angelo clients have found that creating shared digital folders with everyone involved in their claim—insurance representatives, contractors, and our public adjusters—dramatically improves communication and reduces delays.

Simple spreadsheet templates can also work wonders for tracking damaged items, repair costs, and claim progress. You don’t need fancy software to stay organized—sometimes the simplest solutions are the most effective.

These digital tools don’t just speed up the home insurance claim process; they create a clear, accessible record that strengthens your position throughout negotiations. As one Houston homeowner told us after successfully settling their claim, “The difference between getting what I deserved and getting shortchanged came down to how thoroughly I documented everything from day one.”

Step 3: Kicking Off the Home Insurance Claim Process

Now that you’ve ensured everyone’s safety and documented your damage, it’s time to officially launch your home insurance claim process by notifying your insurance company. This is where the rubber meets the road – and where many homeowners feel their anxiety spike.

Reporting Your Claim

Most insurance companies make it fairly easy to start your claim, offering several ways to get the ball rolling:

You can call their 24/7 claims hotline (often the fastest approach), file online through their website, use their mobile app, or contact your insurance agent directly. Whichever method you choose, have these essentials ready:

Your policy number, the date and time when the damage occurred, a clear description of what happened, your documentation photos and videos (if filing electronically), and your police report number if you filed one.

Texas Filing Deadlines: While most Texas policies use somewhat vague language requiring you to report claims “promptly” or “as soon as reasonably possible,” it’s best to file within 24-48 hours. The clock is ticking in another important way too – Texas law requires insurance companies to acknowledge your claim within 15 days after you submit it.

“When major storms hit places like Houston or Austin, being among the first to file can make a huge difference,” our Fort Worth adjuster often tells clients. “If you wait even a few days after a widespread disaster, you might find yourself at the back of a very long line of claimants.”

Scientific research on claim timelines

What to Tell the Claims Representative (and What to Keep to Yourself)

When you’re speaking with the insurance company, remember they’re gathering information that will affect your payout. Be factual about what happened, accurate with your policy information, objective in describing damage, and inquisitive about next steps and timelines.

At the same time, avoid speculating about causes you’re not certain of, accepting blame for any aspect of the damage, providing recorded statements without preparation, or agreeing to settlements before you’ve had a full damage assessment.

“Insurance adjusters work for the insurance company, not for you,” as our Lubbock team regularly reminds clients. “They’re trained to minimize payouts, so while you should always be honest, you need to be careful about what you say and how you say it.”

Be particularly cautious about recorded statements. While sometimes necessary in the home insurance claim process, these recordings can come back to haunt you if you misspeak or don’t yet understand your damage’s full extent. Many of our clients find it helpful to consult with a public adjuster before providing any recorded statement.

Hitting “Submit”: Understanding Confirmation, Next Steps & Your Rights

After submitting your claim, you should receive three important things:

First, a claim number – this becomes your golden ticket for all future communications about your case. Second, an acknowledgment letter (which Texas insurers must provide within 15 days). And third, information about next steps, typically including when an adjuster will be assigned and how the inspection will be scheduled.

Texas law provides important protections during the home insurance claim process. Insurance companies must accept or reject your claim within 15 business days after receiving all required documentation. If approved, they must issue payment within 5 business days. And if your claim is denied, you’re legally entitled to a written explanation detailing why.

Many of our successful clients maintain what we call a “claim journal” – either a notebook or digital folder where they track every conversation. Note the date and time, who you spoke with (name and title), what was discussed, what actions are needed next, and keep copies of all written communications.

“One simple habit that’s saved countless headaches for our Waco clients is sending a brief email after phone conversations to create a paper trail,” says our claims specialist. “Something as simple as ‘Just confirming our discussion about X’ can be invaluable evidence if disputes arise later.”

The home insurance claim process is a marathon, not a sprint. Staying organized from the beginning will help you maintain control as things progress.

Step 4: Working with Adjusters, Contractors & Lenders

The heart of the home insurance claim process involves juggling relationships with several key professionals. Think of it as assembling your recovery team – each person plays a vital role in getting your home back to normal.

Types of Adjusters and Their Roles

When disaster strikes your Texas home, you’ll likely meet two types of insurance professionals with very different priorities.

Insurance Company Adjuster

This is the person your insurance company sends to your property. They work for the insurer – not you – and their job is to inspect your damage, determine coverage under your policy, and calculate what the company should pay. They’re knowledgeable professionals, but remember, they’re trained to protect their employer’s bottom line.

Public Adjuster

This is your personal advocate in the claims process. Unlike the company adjuster, a public adjuster works exclusively for you. They bring independent expertise to assess your damage, handle paperwork, and negotiate with your insurer to maximize your settlement.

“I remember a family in Round Rock whose initial settlement offer was just $24,000 for significant roof and interior water damage,” shares Scott from our team. “After bringing us in, we documented extensive hidden damage the company adjuster missed, ultimately securing over $65,000 – enough to properly restore their home.”

Comparison: Company Adjuster vs. Public Adjuster

| Aspect | Company Adjuster | Public Adjuster |

|---|---|---|

| Who they represent | Insurance company | Policyholder (you) |

| Cost to you | No direct cost | Typically 5-15% of settlement |

| Primary goal | Control costs for insurer | Maximize your settlement |

| Claim expertise | Trained by insurance company | Independent expertise |

| When they’re involved | Automatically assigned | Only when you hire them |

More info about Public Adjuster for Insurance Claims

Meeting the Adjuster: Home Insurance Claim Process Tips

The adjuster’s inspection is a crucial moment in your claim. Being prepared can make all the difference.

Be present and engaged during the inspection. Walk alongside the adjuster, pointing out all damage you’ve noticed. Your knowledge of your property is invaluable – you know what things looked like before the damage occurred.

Have your documentation ready to share, including your photos, videos, inventory list, and any contractor estimates you’ve gathered. This shows you’re organized and serious about your claim.

Focus on comprehensive damage assessment, not just the obvious problems. Water damage often leads to hidden mold growth. Wind damage can loosen roof shingles without immediately detaching them. Fire damage includes smoke residue that can travel throughout your home.

“Many Houston homeowners we work with are surprised to learn that smoke particles can damage electronics and fabrics in rooms far from where the actual fire occurred,” notes our claims specialist. “This is exactly the kind of damage company adjusters sometimes overlook.”

Supplemental Claims and Hidden Damage

Sometimes damage reveals itself weeks after the initial inspection. Perhaps you find wet insulation behind a wall or notice your hardwood floors starting to warp. When this happens:

Document immediately with fresh photos and videos. Contact your insurer promptly to report the additional damage. Most policies allow for supplemental claims when new damage from the same incident is finded.

This is another area where public adjusters shine. They’re trained to spot potential hidden damage during initial inspections and can help you file proper supplemental claims if new issues emerge.

Picking the Right Contractor Without Losing Control

Choosing who repairs your home is perhaps your most important decision. Take your time with this step.

Get multiple bids from different contractors to compare prices and approaches. Verify credentials carefully – ask for license numbers, insurance certificates, and bonding information. Check references by speaking with past clients, especially those who had insurance-related repairs.

Review contracts with extreme care. The scope of work should be detailed and specific, not vague. Understand exactly what materials will be used and what quality standards will be met.

Be cautious with payment terms. Never pay the full amount upfront. Instead, establish a payment schedule tied to completion milestones, with final payment only after you’ve inspected and approved the work.

“One of our San Antonio clients nearly lost $20,000 when a contractor took their initial payment and disappeared,” warns our claims manager. “Always maintain control of your funds by being careful with ‘direction to pay’ forms that allow insurance companies to pay contractors directly.”

These forms can seem convenient, but they remove you from the payment process and reduce your leverage if quality issues arise. Your home is too important to rush these decisions – proper vetting protects both your property and your settlement funds.

Step 5: Payments, Disputes & Protecting Your Wallet

When your claim gets approved, understanding how the money flows is crucial to ensuring you receive every dollar you deserve. This is where many Texas homeowners get caught off guard in the home insurance claim process.

How Claim Payments Work

Ever wondered why insurance companies often send multiple checks instead of one lump sum? There’s method to this madness.

Most policies distinguish between Actual Cash Value (ACV) and Replacement Cost Value (RCV). ACV is what your damaged items are worth today (original cost minus depreciation), while RCV is what it costs to replace them with new items of similar quality.

“I remember a family in Lakeway who was shocked when they only received $4,000 for their damaged 10-year-old roof,” shares our claims specialist. “They didn’t realize that was just the depreciated value. The remaining $7,000 would come after they completed the replacement and submitted receipts.”

This “recoverable depreciation” holdback is standard practice. Insurance companies want proof you’ve actually replaced the items before giving you the full replacement value. Always keep those receipts!

Your mailbox might fill up with several different checks during the home insurance claim process:

- One for dwelling/structural damage (often paid in installments)

- A separate check for personal belongings

- Additional Living Expenses (ALE) payments if you can’t live in your home

- Specific payments for external structures like fences or detached garages

Mortgage Company Involvement

Got a mortgage? Your lender has a financial stake in your property, which means they’ll likely be named on any checks for structural damage. This adds another layer to the home insurance claim process.

In practice, this means you’ll need your mortgage company’s endorsement on claim checks. Many lenders will hold these funds in escrow, releasing the money in installments as repairs progress. Some even send inspectors to verify work completion before releasing final payments.

“The mortgage company involvement catches many Houston homeowners by surprise,” notes our regional manager. “We’ve helped countless clients steer these requirements to ensure they can access funds when contractors need payment.”

Claim Disputes and Bad Faith Practices

Sometimes, insurance companies don’t play fair. If your claim is denied or significantly underpaid, you’re not powerless.

Start by requesting a detailed explanation in writing, specifically asking which policy language supports their decision. Then gather additional evidence—more photos, contractor estimates, expert opinions—and formally appeal the decision.

Most Texas policies include an appraisal clause for resolving disputes about damage amounts. This process allows both sides to select independent appraisers who then choose a neutral umpire to make final determinations.

The Texas Department of Insurance can be your ally too. They handle complaints against insurers and can intervene when companies aren’t following regulations.

More info about Claims Dispute

Bad Faith Insurance Practices

Insurance companies in Texas have legal obligations to handle claims fairly and promptly. When they don’t, it may constitute “bad faith”—a legal concept that can open the door to additional damages.

Bad faith practices might include:

- Dragging their feet on claim processing

- Conducting superficial investigations

- Twisting policy language to avoid payment

- Offering settlements far below actual damage value

- Denying valid claims without reasonable basis

“Texas has some of the strongest consumer protection laws for insurance matters in the country,” explains our legal consultant. “When insurers act in bad faith, they can face penalties beyond just paying your claim.”

More info about Bad Faith Insurance Claim Texas

Claim Denied or Underpaid? Re-Opening & Escalating the Home Insurance Claim Process

If you’re staring at a denial letter or a check that won’t cover half your damages, take a deep breath—you have options.

First, gather more evidence. Get additional contractor estimates, expert opinions, or engineering reports that support your position. Submit this with a formal letter requesting reconsideration.

This is also the perfect time to consider hiring a public adjuster. At Insurance Claim Recovery Support, we typically see settlement increases of 30-40% compared to initial offers. While our fee (usually 5-15% of the settlement) might seem significant, the math often works strongly in your favor.

In Texas, you typically have two years from the date of loss or claim denial to take legal action—but don’t wait until the last minute. Evidence gets harder to gather as time passes.

Frequently Asked Questions about the Home Insurance Claim Process

Does filing a claim always raise my premium?

Not necessarily. While many homeowners worry about rate hikes, the reality is more nuanced than you might think.

Premium increases typically average around 7-10% after a claim, but here in Texas, we have some helpful protections. For instance, insurers cannot raise your rates for weather-related claims like hail or wind damage – which is particularly good news considering our Texas-sized storms!

“I always tell our Austin clients to think about the bigger financial picture,” shares our premium specialist. “For smaller damages, sometimes paying out-of-pocket makes more sense than filing a claim that might affect your rates for years to come.”

Several factors determine whether your premium will increase:

- Your claim history (first-timers usually see minimal impact)

- The size of your claim (larger claims may have greater rate effects)

- The type of claim you’re filing (weather vs. non-weather)

- Texas-specific regulations that protect consumers

The best approach? Consider each situation individually and weigh the immediate benefit against potential long-term costs.

How long does it take to get paid after the adjuster’s visit?

Texas law actually puts some helpful guardrails around this process. Insurance companies must accept or reject your claim within 15 business days after receiving all your documentation. Once approved, they must issue payment within 5 business days.

That said, real-world timing can vary. A straightforward claim might wrap up neatly within those timeframes, while more complex situations take longer. After major disasters – like when hurricanes sweep through Houston or tornadoes tear through Dallas-Fort Worth – the home insurance claim process can stretch out as adjusters handle hundreds of claims simultaneously.

Most standard claims reach settlement within a few weeks. However, for truly devastating losses that require complete rebuilding, the entire process from claim to completion can span 18-24 months.

Can I make temporary repairs before my claim is approved?

Yes – and in fact, your policy likely requires it! Most insurance policies include a “duties after loss” section that specifically obligates you to take reasonable steps to prevent additional damage.

When a pipe bursts or your roof has a hole, waiting for claim approval before addressing it could lead to significantly more damage – which the insurance company might not cover if they determine you neglected your responsibility to mitigate.

“The winter storm of 2021 was a perfect example,” recalls our San Angelo representative. “Homeowners across Texas from Austin to Lubbock needed immediate plumbing repairs to prevent further water damage. Those who properly documented the original damage and kept their receipts were reimbursed for these emergency expenses.”

The key is finding the right balance:

- Document everything thoroughly before touching anything

- Make only temporary repairs to prevent further damage

- Save every receipt for materials and labor

- Keep damaged items until after the adjuster’s inspection

Think of it this way: Insurance companies want you to prevent a $5,000 problem from becoming a $20,000 problem – just make sure you have the evidence to show what happened and what you spent.

Conclusion

Navigating the home insurance claim process can feel like climbing a mountain in a storm. But with the right knowledge and approach, you can transform this overwhelming experience into a manageable journey toward fair compensation.

After helping hundreds of Texas homeowners through their claims, I’ve seen how understanding the process empowers you to secure better outcomes. Let’s recap what truly matters:

Safety must always be your first priority. Whether it’s a lightning strike in Austin or wind damage in Houston, protect yourself and your family before worrying about your property. Then take those critical steps to prevent further damage—your insurance actually requires this, and it protects your home from unnecessary additional harm.

Documentation becomes your most powerful ally in any claim. Those photos, videos, and detailed inventories aren’t just paperwork—they’re the evidence that supports every dollar you’re entitled to receive. The homeowners who document thoroughly consistently receive more complete settlements.

Timing plays a crucial role in Texas claims. While you’re processing the emotional impact of property damage, insurance companies are tracking deadlines. Knowing when to report, when to expect responses, and when to follow up keeps your claim on track and compliant with Texas regulations.

The first offer isn’t your only option. Whether it’s requesting reconsideration, filing an appeal, or bringing in professional help, you have multiple paths to a fair resolution. The settlement process is a negotiation, not a take-it-or-leave-it scenario.

Professional advocacy makes a measurable difference. While most homeowners file a claim only once every decade or two, our public adjusters at Insurance Claim Recovery Support handle hundreds each year. This experience translates to settlements that are typically 30-40% larger than initial offers—well worth the fee for our services.

From fire damage in Fort Worth to flood recovery in San Antonio, our team of licensed public adjusters serves homeowners throughout Texas. We stand exclusively on your side, never representing insurance companies. Your interests are our only priority.

The aftermath of property damage is stressful enough without having to become an overnight expert in insurance procedures. Let our experience guide you through this process, ensuring you receive every dollar you deserve for your recovery.

More info about our adjuster claim support

Don’t face this complex process alone. A single conversation with our team could make the difference between a partial recovery and complete restoration. Reach out today for a free consultation—we’re ready to review your claim and show you what’s possible when you have a dedicated advocate in your corner.