Why Getting Help with Denied Claims Is Critical for Property Owners

Help with denied claim situations can mean the difference between financial recovery and devastating loss for commercial property owners. When your insurance company denies a legitimate claim, you’re not powerless – there are specific steps you can take to fight back and secure the compensation you deserve.

Here’s what to do immediately after your claim is denied:

- Request a detailed explanation from your insurer about the specific reasons for denial

- Review your policy language to understand if the denial is justified

- Gather additional evidence including expert reports, contractor estimates, and detailed damage documentation

- File a formal appeal within the specified timeframe (usually 30-180 days)

- Consider hiring a public adjuster to handle negotiations and maximize your settlement

- Know when litigation might be necessary if the insurer is acting in bad faith

The statistics are sobering: over 13% of all disability claims in Canada are denied within the first two years, and property damage claims face similar rejection rates. However, appeals are successful more than half the time when handled properly. The key is understanding the process and having the right professional support.

Commercial property owners face unique challenges when dealing with denied claims. Unlike individual homeowners, you’re managing significant financial stakes, complex policies, and often time-sensitive business operations. Whether you’re dealing with fire damage at a manufacturing facility, hurricane damage to an apartment complex, or hail damage to a retail center, a denied claim can threaten your entire operation.

I’m Scott Friedson, a multi-state licensed public adjuster who has successfully overturned wrongfully denied claims and increased settlements by 30% to 3,800% while helping clients avoid unnecessary litigation. Through my experience settling over 500 large loss claims valued at more than $250 million, I’ve seen how proper help with denied claim strategies can transform devastating denials into fair settlements.

Why Commercial Property Insurance Claims Are Denied

When disaster strikes your commercial property, the shock of damage is often followed by an even greater shock: a denied insurance claim. If you’re a business owner in Texas dealing with fire damage, or managing an apartment complex hit by a tornado, that denial letter can feel like a second disaster.

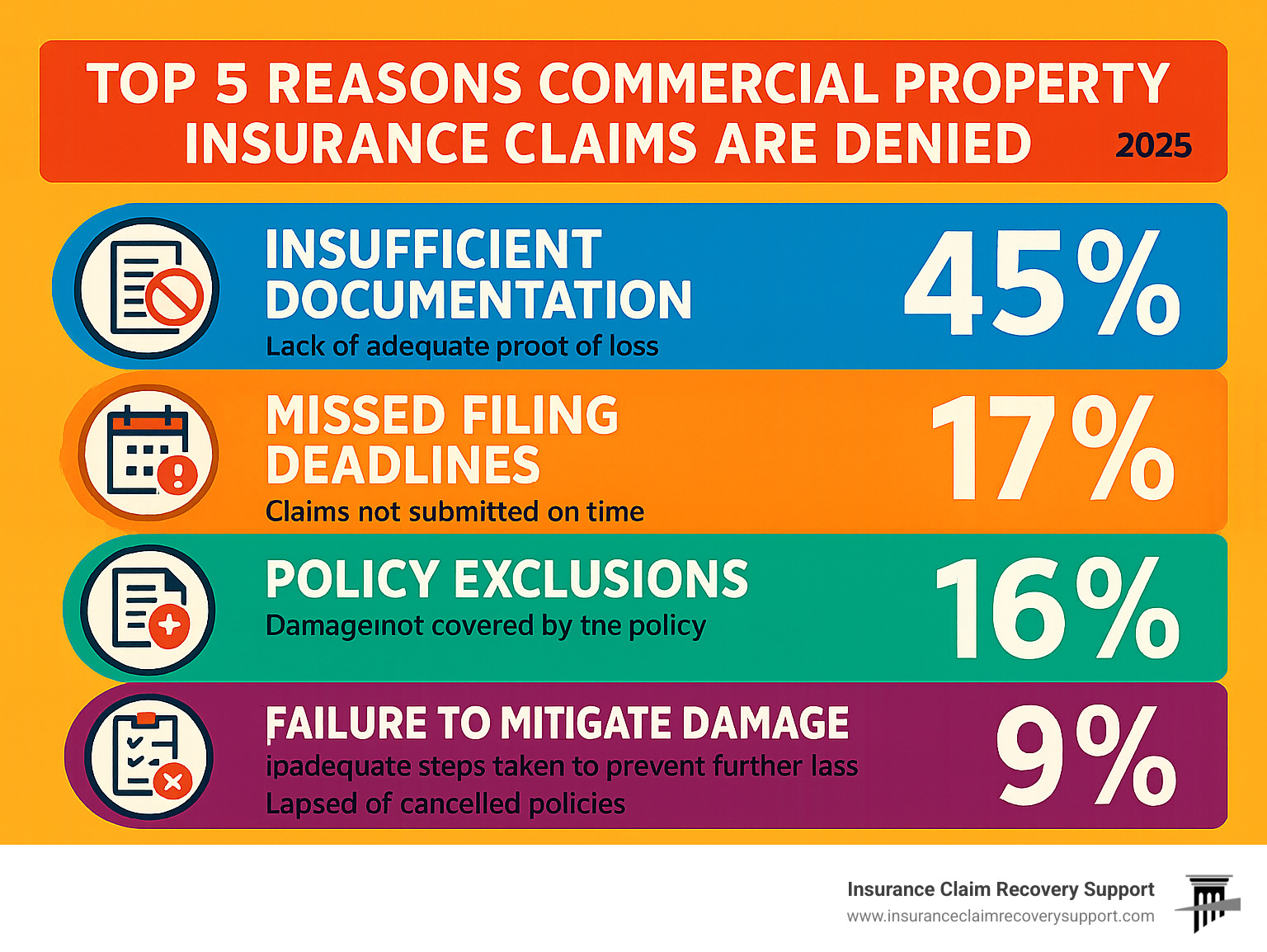

The truth is, help with denied claim situations has become increasingly necessary as insurance companies find more reasons to say “no.” After settling over 500 large loss claims, I’ve seen the same patterns emerge again and again. Understanding why claims get denied is your first step toward getting the compensation you deserve.

Insufficient documentation tops the list of denial reasons. Insurance companies demand proof – lots of it. When your Houston warehouse suffers fire damage or your Dallas office building gets hit by a storm, every detail matters. Without comprehensive photos, detailed estimates, and expert reports, even legitimate claims become easy targets for denial.

Missed filing deadlines create automatic denials, regardless of how valid your claim might be. Texas weather doesn’t wait for convenient timing, and neither do insurance deadlines. Whether it’s the initial notification period or the final claim submission, missing these dates can cost you everything.

Policy exclusions catch many property owners off guard. Your policy is a contract with specific language about what’s covered and what isn’t. That flood damage to your San Antonio retail center might not be covered under your standard property policy, requiring separate flood insurance instead.

Non-payment of premiums seems obvious, but policy lapses happen more often than you’d think. When managing multiple properties or dealing with cash flow issues, a missed premium payment can leave you completely unprotected when disaster strikes.

Failure to mitigate damage becomes a costly mistake. After a storm damages your Fort Worth apartment complex, you’re legally required to prevent further damage. Failing to tarp that damaged roof or extract standing water gives insurers grounds to deny claims for additional damage that could have been prevented.

Underpaid claims represent a different kind of denial – the insurer acknowledges some damage but offers far less than actual repair costs. This partial denial strategy forces property owners to either accept inadequate settlements or fight for fair compensation.

Questionable claims trigger immediate red flags. Any inconsistencies in your documentation or perceived misrepresentations can lead to swift denials and potentially serious consequences. With billions lost to fraud annually, insurers scrutinize every detail.

For Texas properties facing extreme weather – from Lubbock fires to San Antonio storm damage – these denial reasons become particularly relevant. If you’re dealing with a Denied Fire Insurance Claim, identifying the exact reason cited by your insurer becomes crucial for mounting an effective appeal.

Understanding Your Policy’s Fine Print

Insurance policies read like legal documents because they are legal documents. The difference between coverage and denial often comes down to understanding specific language buried in dozens of pages of fine print.

Exclusion clauses spell out exactly what your policy won’t cover. Some policies exclude earth movement damage, specific types of water damage, or even certain weather-related losses unless you’ve purchased additional endorsements. Knowing these exclusions before you need to file a claim prevents devastating surprises later.

Coverage limits and sub-limits create caps on your compensation. Your Austin office building might have $2 million in overall coverage, but only $50,000 for damaged signage or landscaping. When claims exceed these sub-limits, the excess gets automatically denied.

Deductibles for commercial properties can be substantial, often calculated as percentages of property value rather than flat dollar amounts. A 2% wind/hail deductible on a $1 million apartment complex means you’re responsible for the first $20,000 in damage before coverage begins.

Policyholder duties after a loss outline your specific responsibilities following damage. These typically include immediate insurer notification, property protection, detailed documentation, and full cooperation with investigations. Failing any of these duties can void your entire claim.

The complexity of these policies means even experienced property owners get caught off guard. Storm damage claims face particular scrutiny, which is why we’ve detailed common issues in our guide: Why Hail and Wind Property Damage Insurance Claims Get Denied or Underpaid and What to Do.

The Critical Role of Damage Mitigation

Picture this: fire damages your Waco commercial building on a Friday night. By Monday morning, you need to file your claim and start protecting the property from further damage. That second part – damage mitigation – often determines whether your claim gets paid or denied.

Mitigation means taking reasonable steps to prevent additional damage. Tarping damaged roofs stops rain from causing water damage after storm damage. Boarding broken windows and doors secures your property from theft and weather exposure. Water extraction and drying prevents mold growth that can multiply your losses exponentially.

The key word here is “reasonable.” You’re not expected to perform miracles, but you must take steps that any reasonable property owner would take. A public adjuster can guide you through proper mitigation procedures, helping you avoid the litigation that often follows when insurers claim inadequate property protection.

Documenting mitigation efforts proves just as important as the mitigation itself. Keep receipts for materials, photograph damage before and after mitigation, and maintain detailed logs of all protective measures. This documentation proves you fulfilled your policy obligations and can prevent disputes during claim settlement.

For specific guidance on fire damage mitigation, our resource on Mitigation Fire provides detailed steps for protecting your property. Your insurance company investigates claims, but you must prove them and protect your property from further loss.

Your Step-by-Step Guide to Appealing a Denied Claim

Receiving a claim denial can feel like a punch to the gut, especially when your commercial property has suffered significant damage from fire, hurricane, or severe weather. Whether you’re managing an apartment complex in Austin or overseeing a religious institution in San Angelo, that denial letter can seem like the end of the road. But here’s the encouraging truth: a denial is often just the beginning of the battle, not the end.

Our experience shows that appeals are successful more than half the time when handled properly. The key is approaching your appeal strategically and methodically. Many property owners give up too quickly, not realizing that insurance companies sometimes deny valid claims hoping policyholders won’t fight back. Don’t let that be you.

The internal appeal process with your insurance company gives you a chance to present additional evidence and challenge their decision. Many commercial property owners successfully overturn denials by following a structured approach. Getting help with denied claim situations doesn’t have to mean going straight to court – often, a well-prepared internal appeal can resolve the issue.

Step 1: Analyze the Denial Letter

Think of your denial letter as a roadmap to victory. Every denial letter should clearly explain why your claim was rejected, but unfortunately, some insurers send vague explanations hoping you won’t dig deeper. Don’t let them get away with that.

Start by identifying the exact reason for the denial. Was it insufficient documentation? A policy exclusion they’re claiming applies? A missed deadline? Sometimes insurers cite multiple reasons, so address each one systematically. If the letter is unclear or uses confusing language, call your insurer immediately and demand a clearer explanation.

Next, examine the specific policy language cited in their denial. Insurance companies must reference actual policy provisions to justify their decision. Look up these clauses in your policy and read them carefully. Sometimes insurers misinterpret their own policy language or apply exclusions incorrectly.

Pay close attention to appeal deadlines. Most policies give you between 30 to 180 days to file an internal appeal, but this varies. Missing this deadline can permanently close your window for recourse through the internal process. Mark this date on your calendar and work backwards to ensure you submit everything with time to spare.

Finally, note the contact information for submitting your appeal. Some insurers require appeals to go to a specific department or individual. Following their exact procedures shows professionalism and prevents them from rejecting your appeal on technical grounds.

Step 2: Gather Comprehensive Evidence

This is where you build your case and often where the magic happens. The insurance company made their decision based on limited information – now it’s time to show them what they missed or misunderstood.

Start with your original claim documents to understand what information the adjuster had when making their decision. Then, identify gaps in the evidence that may have led to the denial. For commercial properties, this often means going far beyond basic photos and estimates.

New expert reports can be game-changers in commercial property appeals. A structural engineer’s report might prove that damage the insurer attributed to “wear and tear” was actually caused by the covered event. Environmental specialists can document mold or contamination issues. For business interruption claims, forensic accountants can provide detailed loss calculations that insurance adjusters often underestimate.

Detailed contractor estimates from reputable commercial restoration specialists carry significant weight. These should be itemized, professional estimates that clearly outline the scope of work and associated costs. Avoid handwritten estimates or quotes from contractors without proper licensing.

Detailed photo and video evidence remains crucial, but make sure it’s comprehensive. Take high-resolution photos from multiple angles, including wide shots showing the full scope of damage and close-ups highlighting specific issues. Time-stamped and dated evidence is particularly persuasive.

For properties with business interruption claims, gather detailed financial records including tax returns, profit and loss statements, and revenue projections. Document how the damage specifically impacted your operations and for how long.

Don’t forget to document your mitigation efforts. Keep receipts for emergency repairs, tarping, water extraction, and security measures. This proves you fulfilled your policy obligations and prevented additional damage.

Essential documents for your appeal include: the denial letter itself, your complete insurance policy with all endorsements, original claim submission, comprehensive damage photos and videos, professional repair estimates, expert reports, business interruption financial records, mitigation expense receipts, and detailed logs of all communication with your insurer.

Step 3: Craft and Submit a Formal Appeal

Now comes the moment where all your preparation pays off. Your formal appeal isn’t just a complaint letter – it’s a professional legal argument that systematically dismantles their reasons for denial.

Writing a professional appeal letter requires a clear, organized approach. Start by stating your disagreement with the denial and reference your claim number prominently. Then, address each reason they cited for denial, one by one. Be respectful but firm in your language.

Citing policy provisions demonstrates that you understand the contract and aren’t just hoping for sympathy. Reference the specific sections of your policy that support your claim. If they cited an exclusion, explain why that exclusion doesn’t apply to your situation or was misinterpreted.

Presenting new evidence logically is crucial. Don’t just dump a pile of documents on them. Organize your evidence with clear labels, a table of contents, and explanatory notes. Walk them through how each piece of evidence directly refutes their reasons for denial.

Submit via certified mail with return receipt requested. This provides undeniable proof that your appeal was sent and received within the deadline. Keep copies of everything for your records.

Following up shows you’re serious about your appeal. Call to confirm receipt and ask about their review timeline. Keep detailed notes of all conversations, including dates, times, and the names of representatives you spoke with.

The internal appeal process is your opportunity to resolve the matter without involving external parties. Many commercial property owners successfully overturn denials at this stage, saving time and money compared to litigation or filing regulatory complaints with an authority like the Texas Department of Insurance.

Public Adjuster vs. Lawsuit: Choosing the Right Path for Your Appeal

When your commercial property claim gets denied, you’re standing at a crossroads. You can either work with a public adjuster to negotiate your settlement or file a lawsuit against your insurance company. Both paths aim for the same destination – getting you the compensation you deserve – but they take very different routes to get there.

Think of it like choosing between a skilled mediator and a courtroom battle. Help with denied claim situations doesn’t always require the nuclear option of litigation. In fact, we’ve found that working with a public adjuster often achieves better results with far less stress, time, and expense.

| Approach | Public Adjuster | Filing a Lawsuit |

|---|---|---|

| Process | Collaborative negotiation with your insurer | Formal legal proceedings in court |

| Timeline | Typically 3-6 months for resolution | Often 1-3 years before final resolution |

| Cost Structure | Contingency fee (only paid when you win) | Hourly attorney fees plus court costs |

| Stress Level | Lower – professional handles negotiations | Higher – depositions, court appearances, findy |

| Success Rate | Over 95% of claims result in increased settlements | Variable, depends on case strength and legal strategy |

| Relationship with Insurer | Maintains working relationship for future claims | Often damages ongoing relationship permanently |

The beauty of starting with a public adjuster is that you’re not burning any bridges. We can often resolve disputes through professional negotiation and industry expertise, keeping litigation as a last resort rather than the first response.

When to Hire a Public Adjuster

Some situations practically scream for professional help with denied claim advocacy. If you’re managing a large apartment complex in Houston that suffered hurricane damage, or your religious institution in San Antonio experienced fire damage, you’re dealing with complex losses that require specialized knowledge.

Complex commercial claims are where public adjusters truly shine. When your claim involves multiple types of damage – say, fire damage that led to water damage from firefighting efforts, which then caused business interruption – you need someone who understands how all these pieces fit together. Insurance companies often try to minimize these interconnected damages, but an experienced public adjuster knows exactly how to document and present the full scope of your loss.

Large-scale damage scenarios from events like tornadoes in Dallas or freeze damage across multiple properties require detailed damage assessments that most property owners simply don’t have time to handle properly. While you’re focused on getting your business back up and running, we’re carefully documenting every aspect of your loss to ensure nothing gets overlooked.

Disagreements over the scope of damage are incredibly common. Your insurance company’s adjuster might say your roof needs patching, while your contractor insists it needs complete replacement. A public adjuster brings independent expertise to settle these disputes based on industry standards and proper damage assessment techniques.

Undervalued settlement offers are another red flag. When your insurer offers $50,000 for damage you know costs $200,000 to repair, that’s when professional advocacy becomes essential. We’ve seen settlement increases of 30% to 3,800% when claims are properly handled and presented.

For busy property managers and business owners, the lack of time or expertise to fight a complex insurance battle often makes hiring a public adjuster the smart choice. You can focus on running your business while we handle the insurance company. Our Assistance With Insurance Claims page explains exactly how this partnership works.

When a Lawsuit Might Be Necessary

Sometimes, despite our best efforts at negotiation, litigation becomes the only viable path forward. This typically happens when your insurance company crosses the line from simple claim denial into bad faith territory.

When insurers act in bad faith, they’re not just denying your claim – they’re violating their legal obligation to deal fairly with you as their policyholder. This might involve deliberately misrepresenting policy language, conducting sham investigations, or refusing to pay valid claims without any reasonable basis. In Texas, bad faith conduct can result in additional damages beyond just your original claim amount.

Refusal to negotiate fairly is another clear signal that litigation might be necessary. If we present overwhelming evidence supporting your claim and the insurance company won’t even engage in meaningful discussions, sometimes a lawsuit is the only way to get their attention.

Denial based on fraudulent grounds represents the most serious scenario. If an insurance company falsely accuses you of fraud or misrepresentation to avoid paying a legitimate claim, you may need the full power of the legal system to clear your name and recover your damages.

Even then, litigation should come after exhausting other options. We always recommend trying the public adjuster route first because it’s faster, less expensive, and often more effective. If that doesn’t work, then you can escalate to legal action with a stronger foundation of evidence and documentation.

For more detailed information about when bad faith claims become necessary, our resource on Bad Faith Insurance Claim Texas provides comprehensive guidance for Texas property owners.

The key is having an experienced professional evaluate your specific situation and recommend the best path forward. Sometimes that’s negotiation, sometimes it’s litigation, but it’s always based on what will get you the best result in the shortest time with the least stress.

Take Control of Your Denied Claim Today

You don’t have to accept a denied commercial property insurance claim as the final word. Appealing a denial is your right as a policyholder, and with the proper approach, you can transform what feels like a devastating setback into a successful recovery story.

When disaster strikes your commercial building, apartment complex, multifamily HOA, or religious institution – whether from fire, hurricane, tornado, lightning, freeze, or flood damage – the insurance company’s initial denial often represents just the opening move in a larger negotiation. The key is understanding that you have options and taking proactive steps to protect your interests.

Professional representation can make all the difference between a successful appeal and years of costly litigation. As public adjusters who exclusively represent policyholders, we’ve seen how the right strategy can turn denied claims into fair settlements. Our approach focuses on thorough documentation, expert analysis, and strategic negotiation – all designed to avoid the courthouse while maximizing your recovery.

The difference between handling a denial alone and working with experienced professionals is often measured in hundreds of thousands of dollars. We’ve helped property owners across Texas – from Austin’s growing commercial districts to Houston’s sprawling apartment complexes, from Dallas’s religious institutions to San Antonio’s multifamily developments – successfully overturn wrongful denials and secure the compensation they deserved.

Don’t let your insurance company’s initial “no” become your final answer. Whether you’re in Fort Worth, Lubbock, San Angelo, Waco, Round Rock, Georgetown, or Lakeway, professional help with denied claim situations is available. The sooner you act, the stronger your position becomes.

Empowering policyholders means giving you the tools and support needed to stand up to insurance companies that may be acting in bad faith. Your policy is a contract, and you deserve to have it honored fairly and completely.

Find expert help from public adjusters near you and start building your path to recovery today.