Why the Hail Insurance Claim Process Can Make or Break Your Recovery

The hail insurance claim process is your lifeline to rebuilding after a devastating storm, but it’s also where many property owners lose thousands of dollars due to rushed decisions and insurance company tactics. Here’s what you need to know:

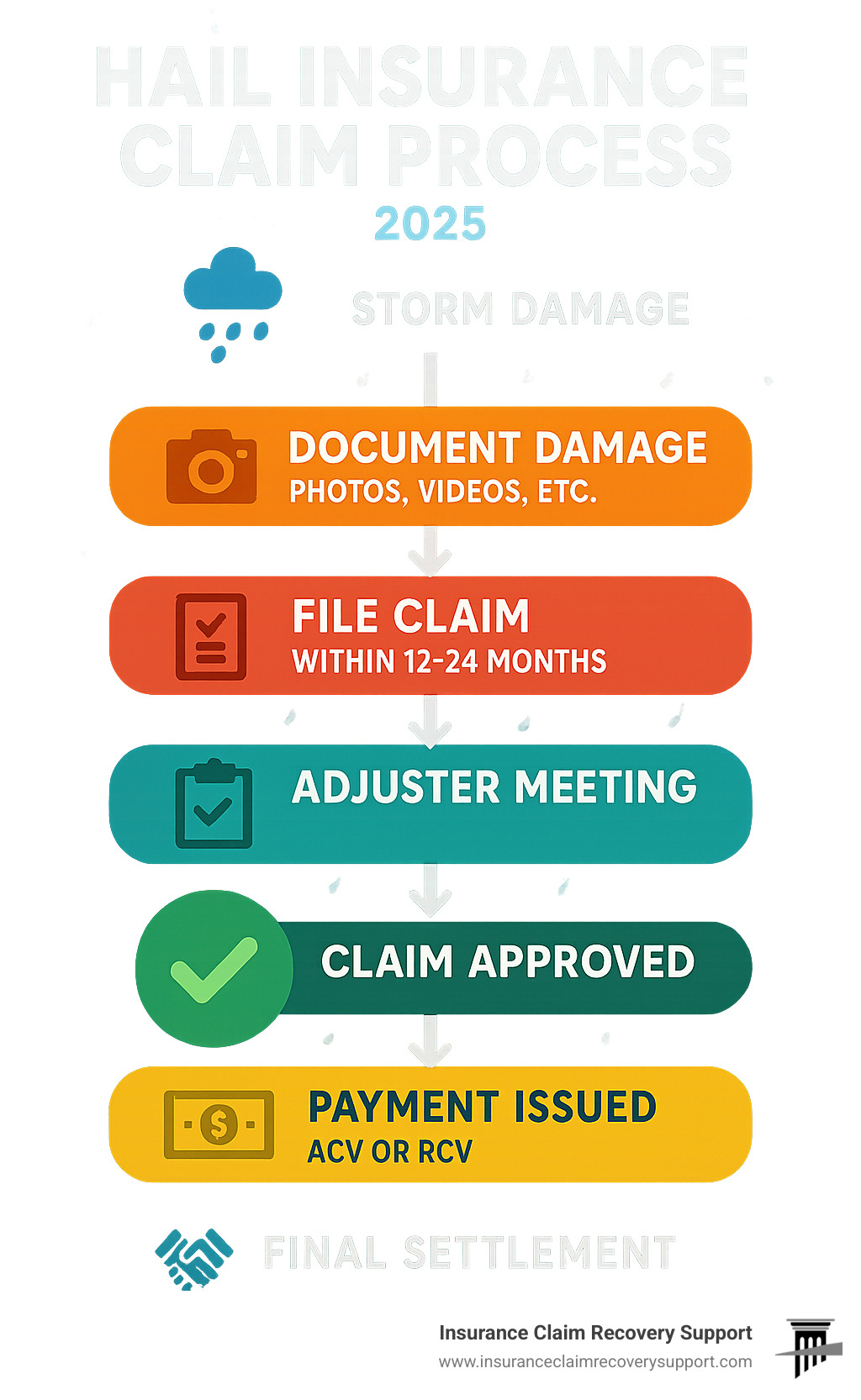

Essential Steps in the Hail Insurance Claim Process:

- Document immediately – Photos, videos, and measurements before cleanup

- File within deadlines – 12-24 months in most states, 2 years in Texas

- Understand your coverage – ACV vs RCV payments, deductibles (1-5% of dwelling)

- Get professional estimates – Don’t rely solely on insurance adjusters

- Know your rights – Appraisal, mediation, and dispute options

Hail causes more than $1 billion in property damage each year across North America. In Texas alone, over 811,000 hail damage claims were filed between 2016-2018, making it the nation’s hail capital. Yet many property owners – from homeowners to commercial building managers – struggle with the complex claims process.

The stakes are enormous. A single hailstorm can destroy roofing systems, dent siding, crack windows, and damage HVAC equipment. Without proper claim handling, you might receive only a fraction of what you’re owed. Insurance companies often deploy out-of-state adjusters after major storms, creating communication gaps and rushed assessments.

“Your insurance representative is your advocate when bad things happen,” notes one industry guide. But the reality is more complex. Insurers have financial incentives to minimize payouts, while you need maximum recovery to fully restore your property.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over 500 large loss claims valued at more than $250 million. Throughout my career helping property owners steer the hail insurance claim process, I’ve seen settlements increase from 30% to 3,800% when handled properly.

Understanding Hail Damage 101

Hailstones form when water droplets are pushed into the cold upper atmosphere by strong thunderstorm updrafts, freeze into ice pellets, and grow by colliding with more droplets before falling when they become too heavy. These frozen projectiles can reach speeds of up to 100 km/h and range in size from peas to baseballs—or even larger.

The damage potential is staggering. Hailstones can:

- Blast apart roof shingles and remove protective granules

- Dent aluminum siding, gutters, and metal flashings

- Crack vinyl siding and wood shakes

- Shatter windows and skylights

- Damage HVAC unit fins and outdoor equipment

- Create holes that allow water intrusion

What makes hail damage particularly dangerous is the secondary damage it causes. Holes and cracks from hail can trap water, leading to mold, mildew, electrical issues, and wood rot if left unrepaired. Even seemingly minor damage like missing shingle granules can significantly reduce your roof’s life expectancy.

Texas sits in the heart of “Hail Alley,” where atmospheric conditions create perfect storms. The state’s vast geography and weather patterns make it ground zero for hail activity, with some areas experiencing multiple severe storms each season. This is why understanding the hail insurance claim process is crucial for Texas property owners.

Immediate Actions After the Storm

Safety must be your first priority. Never go on your roof during or immediately after a hailstorm. Stay away from windows and wait for the storm to pass completely before venturing outside.

Once it’s safe, here’s your immediate action plan:

Document Everything Immediately:

- Note the exact date and time of the storm

- Take photos and videos of all damage from multiple angles

- Photograph any remaining hail on the ground using a common object (like a golf ball or ruler) for size reference

- Don’t wait—hail melts quickly and this evidence disappears

Secure Your Property:

- Cover broken windows, doors, or skylights with tarps or plywood

- Turn off utilities if there’s any risk of electrical or gas line damage

- Remove standing water if safe to do so

- Save all receipts for emergency materials and temporary repairs

Start Your Inventory:

- List all damaged items with brand, price, and age

- Don’t throw away damaged items unless they’re unsafe

- Keep receipts for any cleanup or emergency expenses

- Check your gas lines for leaks and shut off valves if needed

Important Filing Windows:

Most insurance companies in Texas allow 12-24 months to file a claim, but Texas law provides up to two years from the date of loss. However, don’t wait—the sooner you file, the better. Insurers receive thousands of calls during catastrophic events and operate on a first-come, first-served basis.

For comprehensive storm verification, check our Hail Wind Report Verification service to document the meteorological conditions that affected your property.

The Hail Insurance Claim Process: Step-by-Step Roadmap

The hail insurance claim process involves multiple stages, each with specific requirements and deadlines. Understanding this roadmap helps you steer successfully and maximize your settlement.

Step 1: Notify Your Insurer

Contact your insurance company immediately to report the claim. You’ll receive a claim number—write this down and reference it in all communications. Most insurers offer 24-hour claims services and mobile apps for convenient filing.

Step 2: Complete Proof of Loss

You typically have 30 days to submit a sworn proof of loss statement listing all damaged property with values. This document is crucial and must be accurate and complete.

Step 3: Understand Your Payment Structure

Your policy likely includes two payment types:

- Actual Cash Value (ACV): Replacement cost minus depreciation

- Replacement Cost Value (RCV): Full replacement cost without depreciation

Step 4: Steer Deductibles

Windstorm or hail deductibles typically range from 1-5 % of your home’s dwelling limit. For a $300,000 home, this could mean a $3,000-$15,000 deductible.

| Coverage Type | Initial Payment | Final Payment | Your Responsibility |

|---|---|---|---|

| ACV Policy | Depreciated value | None | Deductible + Depreciation |

| RCV Policy | Depreciated value | Remaining RCV after repairs | Deductible only |

For specialized roof damage claims, our Roof Hail Insurance Claim service provides expert guidance through the technical aspects of roofing assessments.

To understand the science behind hail formation and damage patterns, check out the NOAA hail formation resource or the broader overview on Wikipedia – Hail.

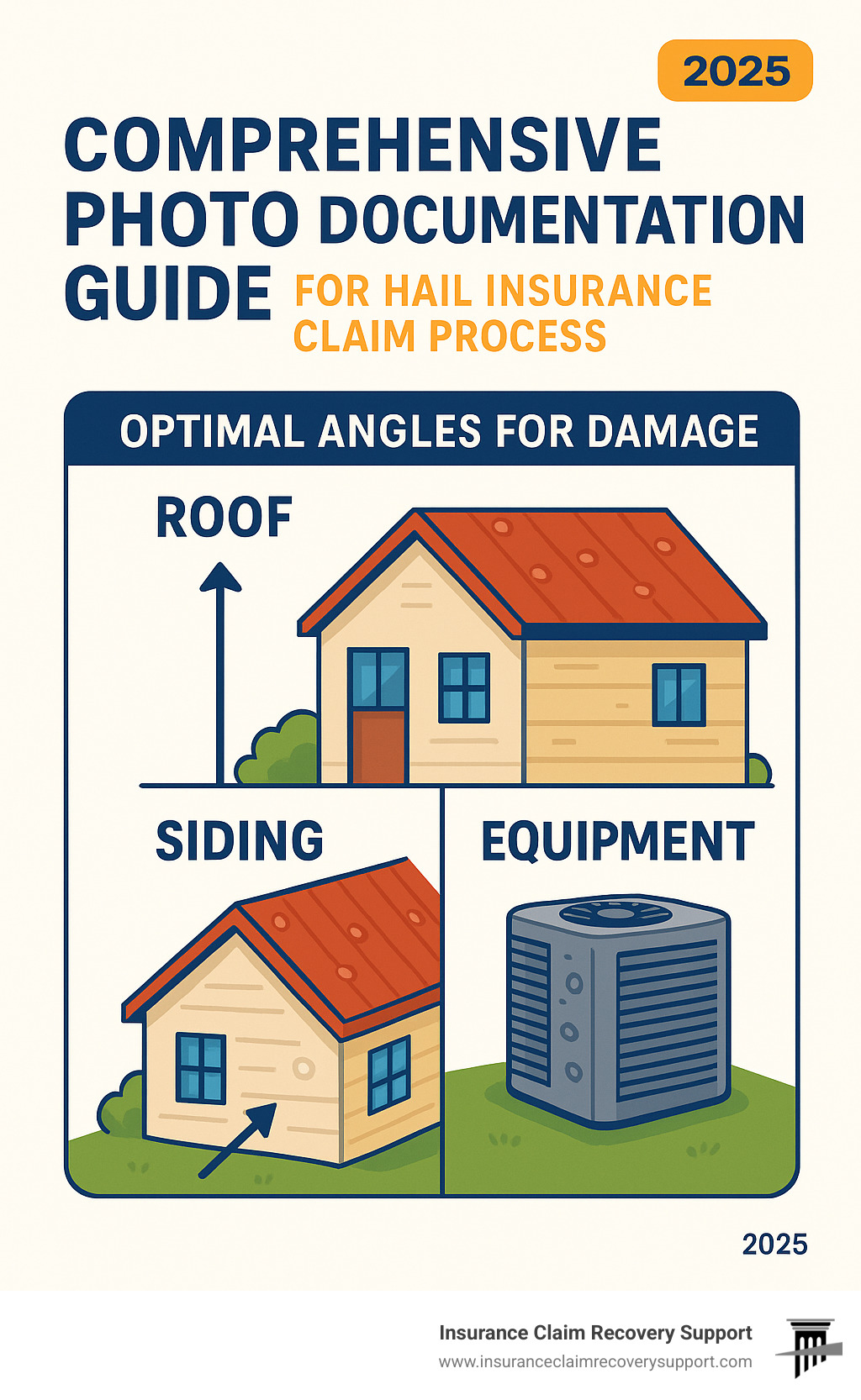

Documenting Damage for Your hail insurance claim process

Proper documentation is the foundation of every successful claim. Poor documentation is one of the leading causes of denied or underpaid claims.

Photo and Video Requirements:

- Take pictures from ground level—never climb on the roof

- Capture wide shots showing overall damage and close-ups of specific issues

- Include timestamps and GPS coordinates if possible

- Use common objects for scale (golf balls, rulers, coins)

- Document both obvious damage and subtle signs like missing granules

Professional Inspection Benefits:

While you can document obvious damage, subtle hail damage requires trained eyes. Professional inspectors certified by organizations like HAAG can identify damage that untrained observers miss. They understand impact patterns, know where to look for hidden damage, and can provide detailed reports that strengthen your claim.

Essential Documentation Checklist:

- Photos of all exterior surfaces (roof, siding, windows, doors)

- HVAC unit damage (dented fins, damaged housings)

- Gutter and downspout dents

- Outdoor equipment damage

- Interior damage from water intrusion

- Receipts for all emergency repairs and expenses

Filing Timelines & Deadlines in the hail insurance claim process

Timing is critical in the hail insurance claim process. Missing deadlines can result in denied claims or reduced settlements.

Immediate Notice Requirements:

Contact your insurer as soon as possible after the storm. While most policies allow “reasonable time” to report claims, immediate notification protects your rights and ensures proper documentation of storm timing.

30-Day Proof of Loss:

Most policies require a signed proof of loss within 30 days of the insurer’s request. This sworn statement must list all damaged property with estimated values. Incomplete or late submissions can void your claim.

Texas-Specific Deadlines:

Texas law provides a two-year statute of limitations for property damage claims. However, your policy may have shorter deadlines, so file as soon as possible.

Late Filing Risks:

Delaying your claim increases the risk of denial. Insurers may argue that subsequent damage resulted from neglect rather than the original storm. Weather exposure, seasonal changes, and normal wear can complicate damage attribution over time.

Temporary Repairs & Mitigation Duties

You have a legal duty to prevent further damage to your property, but you must handle temporary repairs carefully to protect your claim.

Approved Temporary Measures:

- Tarping damaged roofs to prevent water intrusion

- Boarding broken windows and doors

- Turning off utilities if safety requires

- Removing standing water

Documentation Requirements:

- Photograph damage before making temporary repairs

- Save all receipts for materials and labor

- Don’t make permanent repairs without insurer approval

- Keep damaged materials for adjuster inspection

Professional Service Needs:

For electrical or plumbing issues, hire licensed professionals. Keep all receipts—emergency repairs are typically covered under your policy’s additional coverages.

Winning the Adjuster Game & Getting Fair Estimates

The adjuster’s assessment largely determines your settlement amount, making this phase crucial to your recovery. Understanding the different types of adjusters and how to work with them effectively can significantly impact your payout.

Company Adjusters vs. Public Adjusters:

Your insurance company will assign a claims adjuster to inspect your property and estimate repair costs. These adjusters work for the insurer and have incentives to minimize payouts. Public adjusters, like our team at Insurance Claim Recovery Support LLC, work exclusively for you and advocate for maximum settlements.

The HAAG Certification Advantage:

Many Alberta insurance companies require HAAG certification to validate hail damage claims. This specialized training teaches adjusters to identify subtle hail damage patterns that untrained eyes miss. Ensure your adjuster or inspector has proper credentials.

Meeting the Adjuster:

- Be present during the inspection

- Bring all your documentation (photos, videos, receipts)

- Walk the adjuster through every damaged area

- Have your contractor present if possible

- Take notes on what the adjuster documents

Austin-Dallas Contractor Market Dynamics:

The Texas contractor market becomes extremely competitive after major storms. Contractors from across the country converge on affected areas, creating both opportunities and risks. Local contractors often provide better service and warranties, but may be booked solid. Out-of-state contractors may be available immediately but lack local knowledge and long-term accountability.

Negotiation Strategies:

- Present your evidence clearly and completely

- Question any damage the adjuster doesn’t document

- Request explanations for any denials in writing

- Don’t accept the first offer—most initial settlements are low

- Consider hiring a public adjuster if negotiations stall

For comprehensive guidance on wind and hail damage claims, visit our Hail and Wind Damage Insurance Claims resource.

Should You Get Three Bids or One Solid Scope?

Contrary to popular belief, insurance companies cannot require you to obtain three repair estimates. This common misconception often works against policyholders’ interests.

Why Three Estimates Can Hurt You:

- Insurers typically choose the lowest bid

- Competing contractors may lowball to win the job

- Quality varies significantly between estimates

- Time spent gathering multiple bids delays your claim

The Better Approach:

Focus on getting one comprehensive, accurate estimate from a reputable contractor who:

- Has proper licensing and insurance

- Specializes in storm damage restoration

- Provides detailed line-item breakdowns

- Includes necessary building code upgrades

- Offers strong warranties on work

Red Flags in Contractor Estimates:

- Significantly lower prices than market rates

- Vague or incomplete scope descriptions

- Pressure to sign immediately

- Requests for full payment upfront

- Lack of proper licensing or insurance

What to Do if the Settlement Offer Is Too Low

If your insurer’s settlement offer doesn’t cover your actual repair costs, you have several options to pursue additional compensation.

Supplemental Claims:

File a supplemental claim for additional damage or costs not included in the original settlement. This is common when initial estimates prove inadequate or when hidden damage is finded during repairs.

Appraisal Clause:

Most policies include an appraisal clause allowing you to request an independent appraisal when you and your insurer disagree on the amount of loss. Each party selects an appraiser, and if they can’t agree, an umpire makes the final decision.

Mediation Options:

Some policies require mediation before litigation. This process involves a neutral third party helping you and your insurer reach a mutually acceptable settlement.

Public Adjuster Representation:

Public adjusters can reopen negotiations and often secure significantly higher settlements. Our experience shows that properly handled claims can increase settlements by 300-3,800% over initial offers.

State Insurance Department Complaints:

If your insurer acts in bad faith, file a complaint with the Texas Department of Insurance. They can investigate unfair claim practices and order corrective action.

From Payout to Repairs: Turning Checks into a Restored Home

Understanding the payment process helps you plan your restoration and avoid common pitfalls that delay repairs.

The Two-Part Payment System:

Most policies with replacement cost coverage pay claims in two stages:

- Initial ACV Payment: You receive the depreciated value of damaged items minus your deductible

- Depreciation Recovery: After completing repairs, you submit receipts to recover the remaining replacement cost value

Mortgage Company Endorsements:

If you have a mortgage, your insurance checks will likely require your lender’s endorsement. This protects the lender’s interest in your property but can complicate the payment process. Contact your mortgage company immediately to understand their requirements and expedite endorsement processing.

Contractor Selection Strategy:

You’re not required to use your insurer’s preferred contractors. Choose based on:

- Local reputation and references

- Proper licensing and insurance

- Detailed written estimates

- Strong warranties on materials and workmanship

- Financial stability and bonding

Building Code Upgrades:

Modern building codes may require upgrades when repairing storm damage. These improvements—like improved wind-resistant materials or improved flashing—often cost more than original construction but provide better protection. Many policies cover code upgrades, but you must specifically request this coverage.

Additional Living Expenses (ALE):

If your home becomes uninhabitable, your policy’s ALE coverage pays for temporary housing and increased living costs. This includes:

- Hotel or rental housing costs

- Restaurant meals when you can’t cook

- Laundry services if temporary housing lacks facilities

- Storage for belongings during repairs

Key ALE Limitations:

- Only covers increased costs above normal living expenses

- Has specific time and dollar limits

- Requires receipts for all expenses

- May end when repairs are complete, regardless of occupancy

For detailed guidance on maximizing your claim outcome, check our Dos and Don’ts of Filing Hail Claim Damages for Policyholders resource.

Pitfalls to Avoid and How to Storm-Proof Your Property

Learning from common mistakes can save you thousands of dollars and months of frustration during the hail insurance claim process.

Critical Mistakes to Avoid:

Late Filing: Don’t wait months to file your claim. Weather exposure and normal wear can complicate damage attribution, and some policies have specific deadlines shorter than state statutes.

Poor Documentation: Inadequate photos and missing receipts are leading causes of denied claims. Document everything immediately while evidence is fresh.

Storm-Chaser Scams: Be wary of contractors who:

- Knock on doors immediately after storms

- Demand full payment upfront

- Use high-pressure sales tactics

- Lack proper licensing or insurance

- Offer to waive your deductible (this is often insurance fraud)

Signing Blank Contracts: Never sign incomplete contracts or blank forms. Ensure all terms, costs, and timelines are clearly specified before signing.

Ignoring Cosmetic Exclusions: Some policies exclude purely cosmetic damage. Understand your coverage limits and ensure functional damage is properly documented.

Storm-Proofing Your Property:

Impact-Resistant Roofing: Class 4 impact-resistant shingles can withstand larger hailstones and may qualify for insurance discounts. These shingles are typically made from recycled materials, offering both durability and environmental benefits.

Protective Measures:

- Install gutter guards to prevent clogging during storms

- Secure outdoor furniture and equipment

- Trim trees near your home to reduce wind damage

- Consider storm shutters for windows in high-risk areas

- Build or install covered parking for vehicles

Annual Maintenance:

- Schedule professional roof inspections annually

- Clean gutters and downspouts regularly

- Repair minor issues before they become major problems

- Review and update your insurance coverage annually

For comprehensive storm damage claim guidance, visit our Hail Storm Damage Insurance Claim resource.

Frequently Asked Questions about Hail Damage Claims

Does standard homeowners insurance cover hail damage?

Yes, most standard homeowners insurance policies cover hail damage to your dwelling, other structures, and personal property. However, coverage details vary significantly:

- Dwelling Coverage (Coverage A): Covers structural damage to your home

- Other Structures (Coverage B): Covers detached garages, fences, and outbuildings

- Personal Property (Coverage C): Covers belongings damaged by hail

Important Exclusions:

- Pre-existing damage or normal wear and tear

- Damage from lack of maintenance

- Some policies exclude purely cosmetic damage

- Flood damage requires separate flood insurance

Auto Coverage Note: Hail damage to vehicles requires comprehensive coverage, which is optional in most states.

What if my claim is denied or underpaid?

Claim denials and underpayments are unfortunately common, but you have several options:

Immediate Steps:

- Request written explanation of the denial

- Review your policy language carefully

- Gather additional evidence supporting your claim

- Consider hiring a public adjuster for professional representation

Formal Dispute Options:

- File a supplemental claim for missed damage

- Invoke your policy’s appraisal clause

- Request mediation if available

- File a complaint with the Texas Department of Insurance

- Consult with an attorney specializing in insurance law

When to Hire a Public Adjuster:

Public adjusters can be particularly valuable when:

- Your claim is denied or significantly underpaid

- You lack time to manage the complex claims process

- The damage is extensive or technically complex

- You’re uncomfortable negotiating with insurance companies

Will filing a hail claim raise my future premiums?

Generally, hail damage claims should not increase your premiums because they’re considered natural disasters beyond your control. However, several factors affect this:

Factors That Typically Don’t Increase Premiums:

- Single hail claims from verified storms

- Claims where you complete repairs and submit evidence

- Natural disaster claims in designated catastrophe areas

Potential Premium Impacts:

- Multiple claims within a short period

- Claims combined with other types of losses

- Failure to complete repairs may restrict future hail coverage

- Overall market conditions in high-risk areas

Protective Measures:

- Complete all repairs promptly and submit documentation

- Consider higher deductibles to reduce premium costs

- Install impact-resistant materials that may qualify for discounts

- Maintain good overall claims history

Conclusion

The hail insurance claim process doesn’t have to be overwhelming when you understand the system and have proper representation. From immediate post-storm documentation to final settlement negotiations, each step requires careful attention to detail and strategic thinking.

We’ve helped property owners throughout Texas steer complex hail damage claims, securing maximum settlements that fully restore their properties. Our experience with over 500 large loss claims totaling more than $250 million demonstrates the value of professional advocacy in the claims process.

Whether you’re dealing with roof damage in Austin, siding issues in Dallas-Fort Worth, or commercial property damage in Houston, San Antonio, Lubbock, San Angelo, Waco, Round Rock, Georgetown, or Lakeway, we understand the unique challenges Texas property owners face.

Remember these key principles:

- Document everything immediately and thoroughly

- File your claim promptly but don’t rush the process

- Understand your coverage and payment structure

- Get professional estimates and representation

- Know your rights and dispute options

Don’t let insurance companies shortchange your recovery. If you’re facing a hail damage claim, contact Insurance Claim Recovery Support LLC for professional representation that puts your interests first. We’re licensed in multiple states and have the expertise to maximize your settlement.

For additional resources on maximizing your claim outcome, visit our guide on How to maximize your commercial property damage claim.

The next storm may be unpredictable, but your response doesn’t have to be. With proper preparation and professional representation, you can weather any storm and emerge with your property fully restored.