The hail damage roof insurance claim process might seem daunting, but understanding these straightforward steps can help put you on the path to getting your roof repaired smoothly:

- Evaluate the Damage: Look for dents, cracks, or missing shingles.

- Document Everything: Capture detailed photos and videos from various angles.

- Contact a Professional: Get an estimate from a reputable roofing contractor.

- File Your Claim: Submit documentation to your insurer as soon as possible.

- Work with an Adjuster: Meet and provide all requested details.

Heavy storms can strike unexpectedly, leaving behind roofing issues that demand immediate attention. Hail, in particular, can cause severe damage to your property, making it essential to know how to file a roof insurance claim efficiently. Taking quick action and following the right steps ensures you maximize your claim potential and restore your property to its best condition.

I’m Scott Friedson. With over $250 million in claims settlements, I guide policyholders through the complex hail damage roof insurance claim process. This experience reveals that expertise and clear steps are key to a fair and prompt settlement, driving our mission at the Insurance Claim Recovery Support.

Hail damage roof insurance claim process terms you need:

– hail damage insurance claim process

– hail storm damage insurance claim

– roof storm damage insurance claim

Understanding Roof Insurance Claims

Navigating the hail damage roof insurance claim process starts with a solid grasp of your insurance policy. This document is your roadmap for what is covered and what isn’t, so let’s break it down.

Insurance Policies

Your homeowner’s insurance policy outlines the “perils” it covers, including hail damage. However, not all policies are created equal. Some might cover all risks unless specifically excluded, while others only cover named perils. It’s crucial to know which type you have to avoid surprises.

Tip: Always read the fine print of your policy. Understanding what’s included can prevent headaches later.

Coverage Limits

Think of coverage limits like a buffet with a cap on how much you can eat. They define the maximum amount your insurer will pay for a claim. If your roof repair costs exceed these limits, you’ll have to cover the difference.

Example: If your policy limit is $15,000 and repairs cost $20,000, you’ll pay the extra $5,000 out of pocket.

Deductible

The deductible is the amount you pay before your insurance kicks in. It’s an upfront cost that varies by policy. A higher deductible usually means lower premiums, but it also means more out-of-pocket expense when you file a claim.

Quick Math: If your deductible is $1,000 and repairs are $8,000, your insurer pays $7,000.

Key Takeaways

- Know Your Policy: Review it regularly to stay informed.

- Understand Limits: Be aware of your policy’s maximum payout.

- Plan for Deductibles: Set aside funds to cover this initial cost.

Equipped with this knowledge, you’re ready to tackle the next steps in the claim process. Understanding your policy is like having a map before a journey—essential for navigating the road ahead.

Evaluating Hail Damage

Before diving into the hail damage roof insurance claim process, evaluate the extent of the damage. This step helps you understand the severity and prepare for the journey ahead.

Visible Signs

Spotting hail damage can be tricky. Look for dents and dings on metal components like roof vents and gutters. Shingles might show cracks or granule loss, leaving dark spots where the protective layer is missing. These signs indicate potential trouble and need immediate attention.

Quick Tip: Use binoculars to safely inspect your roof from the ground and avoid climbing up unless you’re experienced.

Professional Roofer

Hiring a professional roofer is like having a guide in unfamiliar territory. A reputable roofer will provide a detailed inspection report, highlighting all visible and hidden damages. This document is crucial when dealing with insurance adjusters.

Steps to Hire a Roofer:

- Ask for Recommendations: Word of mouth from friends or neighbors can lead you to reliable contractors.

- Check Credentials: Ensure the roofer is licensed and insured.

- Request a Written Estimate: This should include all potential repair costs.

Repair Costs

Understanding repair costs is vital. A roofer’s estimate will give you a ballpark figure, helping you decide whether to file a claim based on your insurance policy limits and deductible.

Example: If repairs are estimated at $5,000 and your deductible is $1,000, consider if it’s worth filing the claim, especially if your policy covers the full cost.

By evaluating the damage accurately and working with professionals, you’ll be well-prepared to proceed with your insurance claim. This preparation ensures you have a clear picture of what needs to be done and how much it might cost, setting the stage for a smoother claim process.

Hail Damage Roof Insurance Claim Process

When faced with hail damage, starting the insurance claim process might feel overwhelming. But breaking it down into simple steps can make it much more manageable.

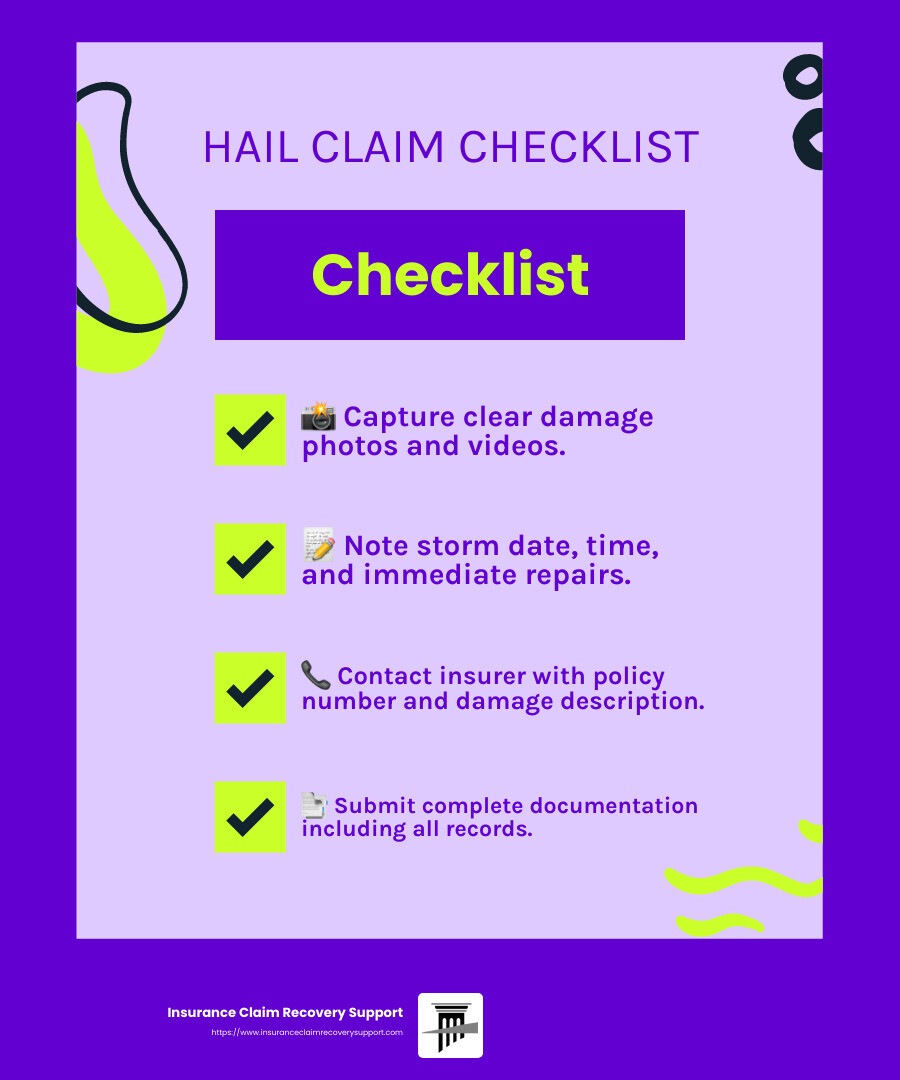

Documenting the Damage

Step 1: Capture Clear Evidence

Begin by thoroughly documenting the damage. This means taking photos and videos from multiple angles. Ensure you capture close-ups of any dents, cracks, or missing shingles. Use a ruler or coin for scale to show the size of the hailstones if possible.

Step 2: Take Detailed Notes

Keep a record of the date and time of the storm, and any immediate repairs you had to make to prevent further damage. This diary of events can be valuable when explaining the situation to your insurer.

Quick Tip: If you’re unsure about what to document, a professional roofer can help you identify and capture all necessary details.

Filing the Claim

Step 1: Contact Your Insurer

Once your documentation is ready, reach out to your insurance company. Most have a dedicated claims hotline. Be ready with your policy number and a brief description of the damage. They’ll provide a claim number—jot this down for future reference.

Step 2: Submit Paperwork

Submit all your documentation, including photos, videos, and any notes, to your insurer. This step is crucial for a smooth process. Missing or incomplete information can delay your claim.

Step 3: Prepare for the Adjuster Visit

An insurance adjuster will be sent to assess the damage. Be present during this visit. Walk through the damage with the adjuster, pointing out everything you’ve documented. This is your chance to ensure nothing is overlooked.

By carefully documenting the damage and organizing your paperwork, you set the stage for a successful claim. This preparation not only helps in getting the necessary funds for repairs but also streamlines the entire claim process, making it less stressful for you.

Next, we’ll dig into negotiating with insurance adjusters to ensure you receive a fair claim amount.

Negotiating with Insurance Adjusters

Once the adjuster has assessed the damage, you might find the initial claim amount offered isn’t enough to cover all repairs. This is where negotiation becomes crucial.

Claim Amount

Insurance companies aim to minimize payouts, so the first offer may be lower than expected. Review the adjuster’s report and compare it with your documentation. Look for discrepancies or overlooked damages. Use your photos, videos, and notes to support your case for a higher settlement.

Documentation

Having thorough documentation is your strongest tool in negotiations. Ensure all evidence is organized and easily accessible. Highlight any differences between your records and the adjuster’s findings. A well-documented claim is harder to dispute and can lead to a better outcome.

Public Adjuster

If negotiations stall, consider hiring a public adjuster. Unlike insurance company adjusters, public adjusters work for you. They can provide an independent assessment and negotiate on your behalf. Public adjusters are experts in maximizing claim settlements, and their fee is typically a percentage of the claim amount. This means they have a vested interest in securing the best possible payout for you.

Key Steps:

- Review the Offer: Compare it with your estimates and documentation.

- Present Evidence: Clearly show any discrepancies.

- Consider Professional Help: A public adjuster can be invaluable if negotiations become challenging.

By being prepared and proactive, you can effectively negotiate with insurance adjusters to ensure you receive a fair settlement for your hail damage roof insurance claim. Next, we’ll explore tips for ensuring a smooth claim process.

Tips for a Smooth Claim Process

Navigating the hail damage roof insurance claim process can be challenging, but with the right approach, you can make it smoother and more effective. Here are some essential tips to keep in mind:

Review Your Policy

Before you file a claim, take a close look at your insurance policy. Understand what’s covered and what’s not. Check if your policy includes wind and hail damage and whether it covers replacement cost or actual cash value. Knowing these details can save you from unnecessary surprises later.

Act Quickly

Time is crucial when dealing with roof damage. The longer you wait, the more difficult it can become to prove the damage was caused by hail.

- Report Promptly: Contact your insurer as soon as you find the damage.

- Prevent Further Damage: Use a tarp or other materials to protect your home from further harm, as this is often required by insurance policies.

Keep Detailed Records

Documentation is your best ally in the claim process. Keep a detailed log of all interactions and communications with your insurance company.

- Photographs and Videos: Capture the damage from various angles. This visual evidence is critical.

- Notes: Write down everything—dates, names, and conversations with insurance reps.

- Correspondence: Save all emails, letters, and other communications related to your claim.

By staying organized and informed, you can streamline the claim process and increase your chances of a successful outcome.

Next, we’ll address some common questions about roof insurance claims to further guide you through this process.

Frequently Asked Questions about Roof Insurance Claims

When navigating the hail damage roof insurance claim process, you might have several questions. Here’s a quick guide to some common queries:

What not to say to a home insurance adjuster?

When speaking with an insurance adjuster, it’s important to communicate carefully:

-

Avoid Guessing: If you’re unsure about something, it’s better to say “I don’t know” rather than speculate. Incorrect information can complicate your claim.

-

Don’t Admit Fault: Even if you think you might share responsibility, let the adjuster determine liability.

-

Stick to the Facts: Only discuss the details relevant to your claim. Avoid sharing unrelated personal information.

-

Be Cautious with Quick Settlements: Don’t rush into accepting the first offer. Ensure it fully covers your damages.

How do insurance companies determine roof damage?

Insurance companies typically follow a structured approach to assess roof damage:

-

Inspection by Adjusters: An adjuster will visit your property to evaluate the damage. They look for signs like dents, missing shingles, and water damage.

-

Review of Documentation: They will review any photos, videos, and notes you provide. This documentation helps them understand the extent of the damage.

-

Policy Review: The adjuster will check your policy to determine what coverage applies. They consider your coverage limits and deductible.

What happens if my hail damage claim is denied?

If your claim is denied, don’t lose hope. You have options:

-

Review the Denial Letter: Understand why your claim was denied. Sometimes it’s due to missing information or documentation.

-

Appeal the Decision: You can appeal the denial. Provide any additional evidence or documentation that supports your claim.

-

Hire a Public Adjuster: If the process becomes overwhelming, consider hiring a public adjuster. They can negotiate with the insurance company on your behalf to seek a fair settlement.

Understanding these aspects can help you manage your insurance claim more effectively. Next, we’ll explore how to negotiate with insurance adjusters to ensure you receive the compensation you deserve.

Conclusion

Dealing with the aftermath of hail damage can be stressful, but you don’t have to steer the hail damage roof insurance claim process alone. At Insurance Claim Recovery Support, we are dedicated to advocating for policyholders like you. Our team of professional public adjusters specializes in maximizing settlements, ensuring you receive the compensation you deserve.

Why Choose Professional Assistance?

Navigating insurance claims can be complex and time-consuming. Our expertise lies in simplifying this process for you. We carefully document your claim, negotiate with insurance companies, and leverage our deep understanding of policies to secure the best possible outcome. Our commitment is to protect your interests and make sure you’re not left short-changed.

Maximize Your Settlement

With our help, you can optimize your financial recovery. We understand the tactics insurance companies use to minimize payouts, and we’re here to counter them. Our approach has consistently resulted in increased settlements for our clients, providing peace of mind and the resources needed to restore your property.

Local Expertise, Nationwide Service

While we’re based in Texas, serving cities like Austin, Dallas, Fort Worth, and Houston, our reach extends nationwide. Whether you’re dealing with hail, fire, or any other property damage, our team is equipped with the knowledge and dedication to support you every step of the way.

Don’t let the complexities of the insurance claim process overwhelm you. Let us be your advocate and partner in recovery. Together, we can ensure you receive the settlement you deserve, allowing you to focus on rebuilding and moving forward with confidence.