When Texan Storms Strike: Your Hail Damage Repair Guide

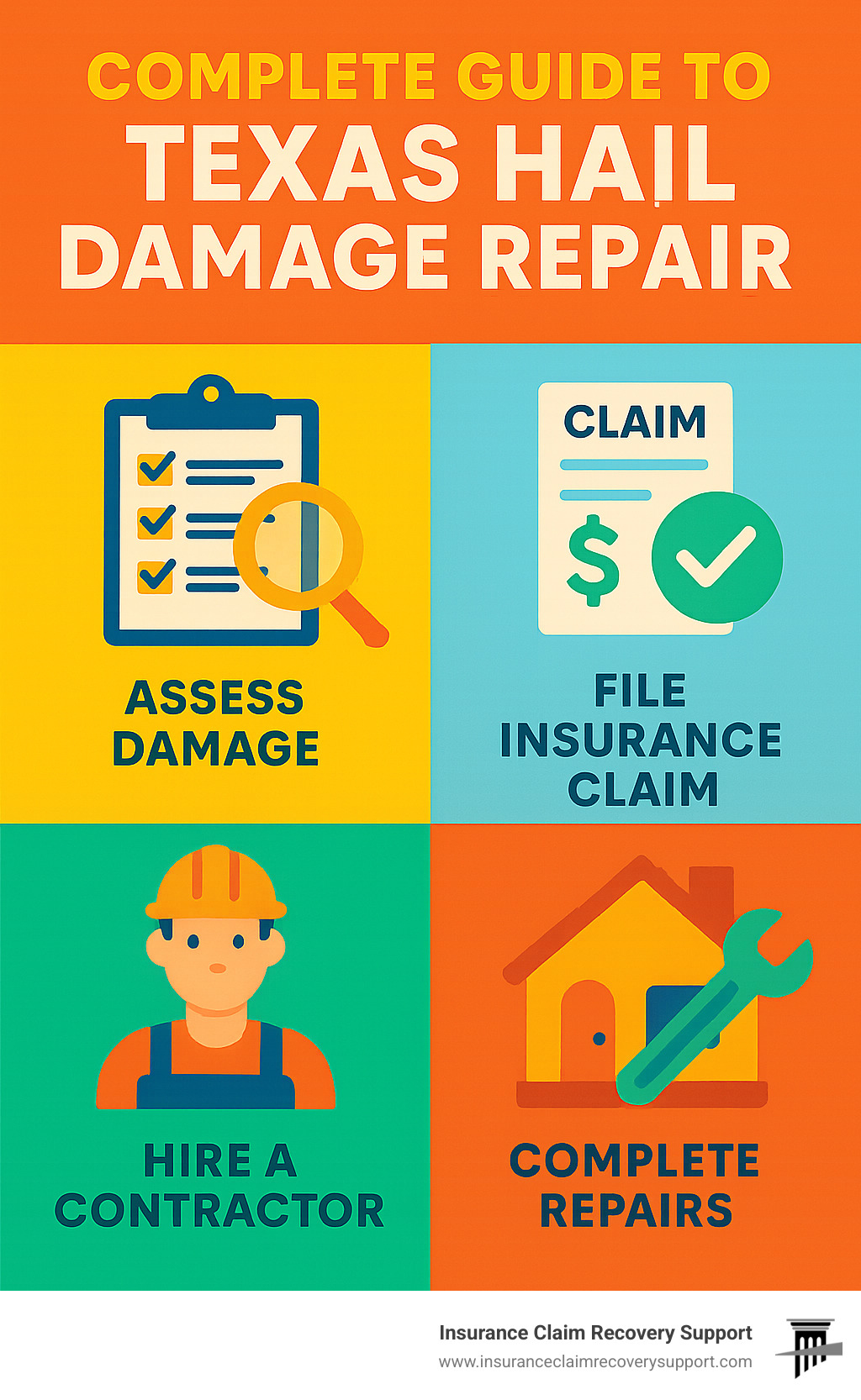

If you need hail damage repair in Texas, here’s what to do immediately:

- Safety first: Wait until the storm passes completely

- Document everything: Take dated photos of all damage

- Contact your insurance: File a claim within 1-2 days

- Get professional assessment: Schedule free inspections for both home and vehicle

- Choose specialists: Use PDR for vehicles and certified contractors for property

Texas ranks #1 in the nation for hail damage claims, with thousands of vehicles and properties affected each year. The Lone Star State’s position in “Tornado Alley” makes it particularly vulnerable to severe hailstorms that can leave devastating damage in their wake.

Hailstorms in Texas are no laughing matter. Golf ball-sized hail (or larger) can pummel your property in minutes, leaving behind a trail of dented cars, damaged roofs, and shattered windows. The average auto hail repair takes about 7 business days to complete, while property repairs can take weeks or months depending on damage severity and contractor availability.

What makes Texas particularly susceptible is the unique weather pattern created by warm Gulf moisture colliding with dry western air. This creates the perfect conditions for supercell thunderstorms that produce damaging hail across Dallas-Fort Worth, Houston, Austin, San Antonio, and smaller communities throughout the state.

I’m Scott Friedson, a multi-state licensed Public Adjuster who has settled hundreds of millions in hail damage claims across Texas, helping property owners steer the complex hail damage repair Texas insurance landscape and overcome wrongfully denied or underpaid claims.

Basic hail damage repair texas vocab: – hail storm texas – texas hail damage lawyer

Understanding Hail Damage in the Lone Star State

When it comes to hail, everything really is bigger in Texas. Our state consistently ranks #1 for hail damage claims nationwide, with a staggering 811,381 claims filed between 2016-2018 alone—more than double the next highest state. It’s no coincidence that four of the top five U.S. cities for hail damage insurance claims are in Texas or neighboring Colorado.

These aren’t your average afternoon showers. Texas hailstorms deliver catastrophic damage across Dallas, Austin, San Antonio, Houston, and Lubbock. What might look like minor damage on the surface can hide serious problems that worsen over time. Hail damage repair Texas specialists see these consequences daily: roof shingles stripped of protective granules that drastically shorten their lifespan, seemingly minor dents in metal panels that eventually rust and deteriorate, vehicle panels that lose resale value even after professional repairs, and hidden structural damage that might not reveal itself until the next heavy rain.

According to National Weather Service data available at the Storm Prediction Center, Texas experiences more severe hail events (hailstones 1″ or larger) than any other state, with the Dallas-Fort Worth metroplex particularly vulnerable to these damaging storms.

Why Texas Gets Slammed So Often

Texas sits in what meteorologists call the perfect “hail alley.” Our unique position creates what’s known as the “dryline”—where dry western air collides with moist Gulf air masses. This collision creates ideal conditions for supercell thunderstorms that produce those golf ball (or larger) sized hailstones that make every Texan wince.

Our peak hail season typically runs from March through June, with a secondary spike in September and October. Interestingly, climate research suggests our future might hold fewer but more severe storms—meaning while hail events may decrease slightly, the hailstones themselves could actually get larger due to changing climate patterns.

“The combination of Texas’s geographical location and its weather patterns creates a perfect storm, quite literally, for hail formation,” explains meteorologist Dr. John Nielsen-Gammon from Texas A&M University. “When you add in urban expansion into previously undeveloped areas, you get more property exposed to these damaging storms.”

Typical Signs of Hail Damage You Might Miss

Many homeowners make a critical mistake after storms pass: assuming no damage occurred because they don’t see obvious holes or leaks. However, hail damage repair Texas professionals know that serious damage often hides in plain sight.

On your roof, watch for granule loss on asphalt shingles (appearing as dark spots), soft spots or bruising when you press on shingles, and small circular impacts that may only be visible up close. Don’t overlook cracked or missing shingles, especially at edges, or damage to roof vents, flashing, and chimney covers.

Your property’s exterior tells its own story: dented gutters and downspouts, cracked siding or chipped paint, damaged window screens, dents on AC units, and splatter marks on decks or fences all signal potential hail damage.

Vehicles often bear the most obvious signs: small dimples on the hood and roof, windshield chips, damaged side mirrors, broken lights, and dents on wheel covers.

“You don’t need visible leaks to have roof hail damage,” notes a roofing expert from Austin. “Insurance covers non-leak damage to shingles and other components. Waiting until you see water inside your home often means the damage has progressed to a much more serious stage.”

The truth is, many Texas homeowners don’t realize their property has sustained significant hail damage until months later when secondary problems emerge. By then, you might be outside your insurance claim window, facing expensive repairs entirely out-of-pocket. This is why prompt, professional assessment after every hail event—regardless of how minor it seemed—is absolutely essential.

Hail Damage Repair Texas: Assessing Your Property and Vehicle After a Storm

When those Texas skies finally clear after a fierce hailstorm, you might be tempted to rush outside immediately to check for damage. But hold your horses! Hail damage repair Texas professionals recommend taking a more methodical approach—both for your safety and to ensure you properly document everything for your insurance claim.

Hail Damage Repair Texas: Roof & Exterior Walk-Through

Before you even think about climbing onto your roof (which we don’t recommend without proper safety equipment), start with a careful ground-level assessment:

Safety should always be your first priority. Make absolutely certain the storm has completely passed—no lingering lightning or high winds—and keep an eye out for potential hazards like downed power lines or unstable structures.

Begin by scanning for the obvious damage that’s visible from ground level. Those fallen shingles in your yard, battered gutters, or cracked windows tell an important story about what might be happening up on your roof.

Grab your smartphone and start documenting everything with clear, dated photos. Here’s a pro tip: place a coin or ruler next to hailstones or dents when taking pictures. This provides valuable scale reference for your insurance adjuster.

Check your soft metal surfaces first—aluminum gutters, downspouts, and roof vents typically show damage more readily than harder materials. These are like the “canaries in the coal mine” for hail damage.

Don’t forget to peek in your gutters and at the bottom of downspouts for asphalt granules that have washed down from your shingles. This granule loss is a telltale sign of roof damage that might not be visible from the ground.

“When inspecting your roof after a hailstorm, pay special attention to ridge caps and areas where the roof changes direction,” shares a seasoned San Antonio roofing contractor. “These areas typically sustain the most damage because they take direct hits from falling hail.”

Most hail damage repair Texas companies offer free professional inspections, which is usually your safest bet. These experts come equipped with specialized tools like core samples to identify internal damage, thermal imaging to detect hidden moisture, and special PDR lights that highlight even the subtlest dents.

Hail Damage Repair Texas: Quick Car Check Before Driving

Your vehicle might have taken quite a beating during the storm, with damage ranging from minor cosmetic dents to serious structural issues. Before you hop in and drive away, take a few minutes for this essential safety check:

Carefully inspect all glass surfaces—windshield, windows, and mirrors—for cracks or chips that could suddenly spread while you’re driving. Even tiny star-shaped chips can quickly become major cracks with the vibration of driving.

Make sure all your lights are intact and working properly. Broken headlights, taillights, or turn signals aren’t just cosmetic issues—they’re serious safety concerns that could lead to accidents.

Run your hand carefully (watch for sharp edges!) over dented areas. Some hail impacts can create jagged metal edges that pose a safety hazard to anyone touching the vehicle.

Pop the hood and check for any signs of fluid leaks. Severe hail can sometimes damage components under the hood, potentially causing coolant, oil, or other fluid leaks that could lead to mechanical failures.

“The hood, roof, and trunk of your vehicle are most vulnerable to hail damage,” explains a Dallas PDR (Paintless Dent Repair) technician. “These flat surfaces provide little resistance to falling hail and can sustain dozens of dents in just minutes.”

| Roof Inspection Checklist | Vehicle Inspection Checklist |

|---|---|

| Shingle granule loss | Hood, roof, and trunk dents |

| Soft/bruised spots | Windshield and window cracks |

| Dented vents/flashing | Headlight/taillight damage |

| Gutter damage | Side panel dents |

| Skylight cracks | Side mirror damage |

| Water stains in attic | Antenna damage |

Thorough documentation is your best friend when it comes to insurance claims. Take your time, be methodical, and don’t hesitate to call in the professionals from Insurance Claim Recovery Support if you’re feeling overwhelmed by the process. After all, that’s what we’re here for—to help fellow Texans steer the sometimes stormy waters of hail damage claims.

The Complete Home Hail Damage Repair & Insurance Process

Let’s face it—dealing with insurance after a hailstorm hits your Texas home can feel like navigating a maze blindfolded. But understanding how the hail damage repair Texas insurance process works can save you thousands of dollars and countless headaches.

Step-by-Step Claim Timeline for Texans

The clock starts ticking the moment those hailstones stop falling. First things first, pull out your insurance policy and give it a good read. Many newer Texas policies now include sneaky cosmetic damage exclusions or surprisingly high wind/hail deductibles that might catch you off guard.

Don’t wait around hoping the damage will fix itself! Most Texas insurers require you to notify them within just 1-2 days of the storm. Make that call, get your claim number, and write it down somewhere safe—you’ll be referencing it constantly in the weeks ahead.

Is your roof letting in water? While waiting for the adjuster, you’re actually expected to make reasonable temporary repairs to prevent further damage. Grab a tarp or some temporary patches, and keep every receipt—these expenses are typically reimbursable.

“When the insurance adjuster schedules their visit, mark your calendar in bold red ink,” advises Scott Friedson, public adjuster at Insurance Claim Recovery Support. “Being present during this inspection is crucial. The insurance company’s adjuster works for them, not for you.”

If your claim starts getting complicated or the settlement offer seems suspiciously low, consider bringing in reinforcements. A licensed public adjuster can be your advocate, often increasing settlements by 40% or more compared to the insurance company’s initial offer.

When that settlement finally arrives, review it with a magnifying glass. Insurance companies are notorious for missing items or undervaluing necessary repairs. Don’t sign anything until you’re satisfied the estimate covers everything.

Finally, hire a reputable, licensed contractor for the actual repairs—preferably one with specific hail damage repair Texas experience. Always verify their credentials, check references, and never pay the full amount upfront.

Special Considerations for Metal, Tile & Flat Roofs

Not all roofs are created equal when it comes to hail damage, and insurance companies know it.

Metal roofs present a unique challenge. Those dents might not affect functionality, but they sure look awful. Unfortunately, many Texas insurers now invoke “cosmetic damage” exclusions to avoid paying for repairs. Aluminum panels show damage much more readily than steel, and some systems require complete panel replacement rather than spot repairs.

Tile roofs are tricky because damage isn’t always obvious. Those terracotta or concrete tiles might have hairline cracks that are nearly invisible until they fail during the next rainstorm. Even more frustrating, the impact may not crack tiles immediately but weaken them for future failure. And if your roof is older, good luck finding matching replacement tiles!

Flat or commercial roofs require specialized inspection techniques. “With commercial roofs, what you can’t see is often more important than what you can,” explains a Houston commercial roofing specialist who works with Insurance Claim Recovery Support. TPO or EPDM membranes might show subtle punctures, while built-up roofs require core samples to verify the extent of damage beneath the surface.

Pay close attention to whether your policy offers Actual Cash Value (ACV) or Replacement Cost Value (RCV) coverage. Many Texas insurers now only offer ACV for roofs over 10 years old, meaning they’ll subtract depreciation from your settlement—sometimes leaving you with just a fraction of the actual repair costs.

The difference between getting fully covered and getting stuck with a massive out-of-pocket bill often comes down to documentation and persistence. That’s why many Texans from Austin to Amarillo are turning to public adjusters to level the playing field with insurance companies after major hailstorms.

Fixing Your Vehicle: From Paintless Dent Repair to Full Panels

When Texas hailstorms turn your car into what looks like a golf ball, there’s good news: modern hail damage repair Texas techniques can make your vehicle look like new again. The star of the show? Paintless Dent Repair (PDR) – a technique that’s changed the game for hail-damaged vehicles across the Lone Star State.

What Is Paintless Dent Repair and Why Insurers Love It

Picture this: instead of filling dents with putty and repainting your car (the old-school way), skilled technicians use specialized tools to gently massage dents from the inside out. It’s almost like magic – the dents disappear without disturbing your factory paint finish.

“PDR is truly an art form,” explains a veteran technician with over 25 years of experience. “We can remove hundreds of dents without leaving any trace they were ever there. Your car maintains its value, and nobody would ever know it survived a Texas hailstorm.”

Your insurance company loves PDR too, and for good reason. It preserves your vehicle’s factory finish, which maintains resale value. Since there’s no repainting involved, PDR doesn’t show up on vehicle history reports like Carfax – another win for your car’s value.

The environmental benefits are substantial too – no chemicals, no paint fumes, no waste. Most hail damage repair Texas specialists can complete PDR work in just 3-7 days, compared to the 2+ weeks traditional body shops might need. And here’s the kicker – it typically costs about a third less than conventional repairs, which makes your insurance company very happy indeed.

Timeline, Cost & “$0 Out of Pocket” Claims—Fact or Fiction?

You’ve probably seen the billboards all over Texas: “Hail damage repair with $0 out of pocket!” Sounds too good to be true, right? Well, it’s actually legitimate in most cases, but understanding how it works helps you avoid any surprises.

The typical hail damage repair Texas timeline goes something like this: 30-60 minutes for the initial inspection, 2-5 business days for insurance approval, 1-7 days for the actual repairs (depending on severity), and a final day for quality control and detailing. All in, you’re looking at about 5-14 days from start to finish.

As for costs, they vary dramatically based on damage severity. Minor damage with just a few dents might run $1,500-$3,000, while moderate damage with dozens of dents typically costs $3,000-$5,000. Severe cases with hundreds of dents can reach $5,000-$8,000 or more. In catastrophic cases, your vehicle might be declared a total loss.

“What many folks don’t realize is that over 90% of auto hail claims require a supplement after in-shop inspection,” notes a Dallas claims specialist. “Insurance adjusters often write initial estimates from photos, but when we get your car in the shop under special PDR lights, we can see and document every single dent.”

So how does the “$0 out of pocket” deal actually work? Many reputable shops cover your deductible (up to $1,000) and provide a free rental car during repairs – even if your policy doesn’t include rental coverage. They accept whatever the insurance pays as payment in full. This works because efficient shops make up the difference through volume and streamlined operations.

Most quality hail damage repair Texas shops sweeten the deal with free loaner vehicles, lifetime warranties on PDR work, convenient pickup and delivery service, and complimentary detailing when your car is finished. It’s a pretty sweet package that makes dealing with hail damage much less painful.

For luxury vehicles or newer models with aluminum panels (like many Ford F-150s), the process requires specialized techniques and tools. These repairs might take longer and cost more, but skilled technicians can still achieve remarkable results that maintain your vehicle’s value and appearance.

Avoid These Costly Texas Hail Repair Mistakes

When the hailstorm passes and you’re eager to get your property back to normal, it’s easy to make snap decisions you might regret later. As a hail damage repair Texas specialist, I’ve seen homeowners make the same costly mistakes time and again—often costing them thousands in unnecessary expenses.

Red Flags When Choosing a Repair Pro

That knock on your door the day after a storm? That’s likely a “storm chaser”—contractors who follow severe weather events looking for quick work. While some are legitimate businesses, many collect deposits and disappear faster than the storm clouds.

For your home, watch out for repair companies without a local physical address. Any legitimate hail damage repair Texas contractor should have roots in your community. If they’re pressuring you to sign immediately or demanding large upfront payments, those are serious warning signs.

“Last year, we helped a family in Lubbock who had paid a $5,000 deposit to a ‘roofing company’ that turned out to be just a guy with a truck and a magnetic sign,” shares a Better Business Bureau representative. “He cashed their check and was never heard from again.”

Texas doesn’t require roofing contractors to be licensed—a fact that surprises many homeowners. This makes checking credentials especially important. Reputable contractors will proudly show their insurance coverage, manufacturer certifications (like GAF Master Elite or CertainTeed Premier), and local references.

Always get everything in writing. A handshake agreement won’t protect you when problems arise six months later. If your contractor seems reluctant to provide detailed written estimates or contracts, that’s your cue to find someone else.

For your vehicle, be equally cautious about pop-up PDR (Paintless Dent Repair) operations. After major hailstorms, temporary shops appear overnight in parking lots and vacant buildings. While some traveling PDR technicians are highly skilled, others are opportunists with minimal training.

Quality PDR work takes time and precision. If someone promises to repair extensive hail damage in just a day or two, they’re likely cutting corners. Reputable hail damage repair Texas auto shops offer lifetime warranties on their PDR work—if the warranty terms seem limited or confusing, that’s another warning sign.

Beyond choosing the right professional, here are other mistakes that can cost you dearly:

Delaying your claim filing can be disastrous. Most Texas insurance policies require prompt notification of damage—typically within 1-2 days. Waiting too long gives insurers grounds to deny your claim entirely.

Signing a “direction to pay” form too early gives contractors direct access to your insurance funds before you’re satisfied with their work. Never sign this until repairs are completed to your satisfaction.

Ignoring subtle damage like minor attic leaks or small shingle cracks can lead to major problems months later. What starts as a tiny water spot can become a ceiling collapse and mold remediation nightmare.

Accepting photo-only estimates is risky business. Proper damage assessment requires hands-on inspection by qualified professionals who know exactly what to look for beyond the obvious dents and cracks.

Skipping permit checks can lead to code violations and complications when selling your home. Reputable contractors handle permitting as part of their service—if they suggest “saving money” by skipping permits, that’s a major red flag.

“The biggest mistake we see is homeowners accepting the first offer from their insurance company,” notes our public adjuster team at Insurance Claim Recovery Support. “Insurance adjusters are trained to minimize payouts. Having a professional assessment often reveals significantly more damage than initially identified.”

The cheapest bid rarely delivers the best value. Quality hail damage repair Texas work isn’t just about fixing today’s problems—it’s about preventing tomorrow’s headaches and protecting your property investment for years to come.

More info about Dos and Don’ts of Commercial Property Insurance Claims

Frequently Asked Questions about Hail Damage Repair Texas

Does filing a hail claim raise my insurance rates in Texas?

The million-dollar question on every Texan’s mind after a hailstorm isn’t just about damage—it’s about what happens to their premiums afterward. The answer has some important nuances worth understanding.

For your vehicle insurance, there’s good news. Hail damage falls under comprehensive coverage, considered a “no-fault” claim. Texas law actually protects you here—insurers cannot raise your rates specifically for comprehensive claims like hail damage because they’re classified as “acts of God.” Nobody controls the weather, after all! That said, if you’re filing multiple comprehensive claims in a short time period, you might notice some impact at renewal time.

When it comes to your property insurance, Texas has your back here too. State law prohibits insurers from singling out your policy for a rate hike based solely on weather-related claims. The reality, though, is a bit more complex—insurers frequently raise rates across entire regions after major storm events. So while your individual hail damage repair Texas claim won’t directly trigger higher premiums, you might still see an increase when you renew simply because your area has been designated higher-risk following widespread storm damage.

“Think of it this way,” explains an Austin-based insurance expert with a warm smile, “Insurance companies can’t legally punish you personally for filing a legitimate hail claim. But they can—and definitely do—adjust their regional rates based on their overall risk assessment, which naturally includes recent storm patterns.”

How long do I have to file a property hail claim?

Time matters when it comes to hail damage repair Texas claims, and understanding the deadlines can make all the difference between a covered repair and an out-of-pocket expense.

Most Texas insurance policies require you to file “promptly” or “as soon as reasonably possible” after finding damage. Two critical timeframes come into play:

First, your policy deadline typically requires notification within 1-2 days of finding damage. This might seem quick, but insurers want to inspect damage before it potentially worsens. Check your specific policy for the exact requirement—it’s usually in the “Duties After Loss” section.

Second, there’s the statute of limitations. Texas law generally gives you up to two years from the date your claim is denied or underpaid to file a lawsuit against your insurer. This legal protection gives you recourse if your claim isn’t handled properly.

Here’s the tricky part—hail damage to your roof isn’t always immediately obvious. You might not see interior leaks until months after a storm. That’s why having a professional inspection after significant hailstorms is so valuable, even if you don’t spot obvious damage yourself.

“I can’t tell you how many times I’ve seen homeowners wait until they notice water stains on their ceiling,” shares a public adjuster from Insurance Claim Recovery Support with a concerned look. “By then, not only is the damage worse, but it’s harder to connect it to a specific storm event. Insurers might argue the damage happened gradually or from something else entirely.”

Can I choose my own contractor or must I use the insurer’s preferred vendor?

Good news, fellow Texans—you have rights when it comes to who repairs your property! Texas law firmly protects your right to choose your own contractor for hail damage repair Texas work. Insurance companies cannot legally force you to use their preferred vendors, though they’ll often strongly suggest you do.

When you choose your own contractor, you gain several advantages. You can select based on reputation and quality rather than who has a special arrangement with your insurer. You maintain control over the repair process from start to finish. Most importantly, you ensure the contractor works for YOU, not your insurance company.

Insurance companies love to recommend their “preferred” contractors, presenting it as a convenience. What they don’t always mention is that these vendors typically have agreements to complete repairs at pre-negotiated (lower) rates. While this arrangement can streamline the process, it sometimes leads to cutting corners to maintain profitability.

“I always remind my clients that their policy is a contract,” says a Dallas construction attorney with a reassuring tone. “The insurance company is obligated to pay for proper repairs regardless of who performs them, as long as the costs are reasonable and necessary. That choice belongs to you, not them.”

If you do decide to hire your own contractor, make sure they’re experienced with insurance work. The best hail damage repair Texas professionals will help document all damage thoroughly and communicate effectively with your insurance company throughout the process.

Conclusion

When Texas skies release their fury, knowing how to handle hail damage repair Texas situations can make all the difference between a smooth recovery and months of headaches. As we’ve seen throughout this guide, taking swift, informed action is your best defense against both the immediate destruction and those sneaky long-term problems that can emerge months after the storm has passed.

The moments after those ice pellets stop pounding your property are critical. Each passing day potentially weakens your position with insurance companies and increases the risk of additional damage to your home or vehicle.

Here’s what successful Texas property owners do after hailstorms. They document everything thoroughly – not just a few quick snapshots, but detailed photos and videos that capture damage from multiple angles with good lighting. They keep written records of all conversations with insurance representatives, noting names, dates, and key points discussed.

They don’t procrastinate. Filing insurance claims promptly shows you’re being responsible and prevents insurers from questioning the timing or source of damage. Making those temporary repairs – like placing a tarp over roof damage – demonstrates you’re taking reasonable steps to prevent further problems.

Texas law is on your side when it comes to choosing repair professionals. You aren’t obligated to use the insurance company’s “preferred vendors.” Your home, your choice – and sometimes that independence makes all the difference in quality.

For many property owners, especially those facing substantial damage or complex claims, professional advocacy becomes invaluable. Public adjusters like our team at Insurance Claim Recovery Support specialize in the art of maximizing settlements, often uncovering damage that insurance adjusters miss or undervalue.

Speaking of hidden damage – don’t be fooled by what appears to be minor hail impact. Those small dents on your roof might seem cosmetic today, but they could compromise your shingles’ ability to protect your home for years to come. The most serious hail damage repair Texas issues often lurk beneath the surface, invisible to untrained eyes.

The financial stakes are significant. The difference between a properly repaired home and one that’s been hastily patched can mean thousands in future repairs and lost property value. Quality matters – both in who inspects your damage and who repairs it.

At Insurance Claim Recovery Support, we’ve walked alongside countless Texas property owners through the aftermath of devastating hailstorms. From busy Austin to sprawling Dallas-Fort Worth, historic San Antonio to dynamic Houston, and from Lubbock to San Angelo, our public adjusters understand the unique challenges Texas property owners face after severe weather strikes.

Going toe-to-toe with insurance companies alone puts you at a disadvantage. Their adjusters handle thousands of claims yearly and know every technique to minimize payouts. Our team levels that playing field, bringing the same expertise to your side of the table.

Don’t face the insurance maze alone after a hailstorm wreaks havoc on your property. Reach out for a free consultation, and let us help guide you toward the full recovery you deserve. Because when those Texas-sized hailstones hit, you deserve Texas-sized support to make things right again.

For more information about the hail damage claims process, visit our Hail Damage Claims resource page.