What Florida Public Adjusters Really Earn: The Complete Salary Guide

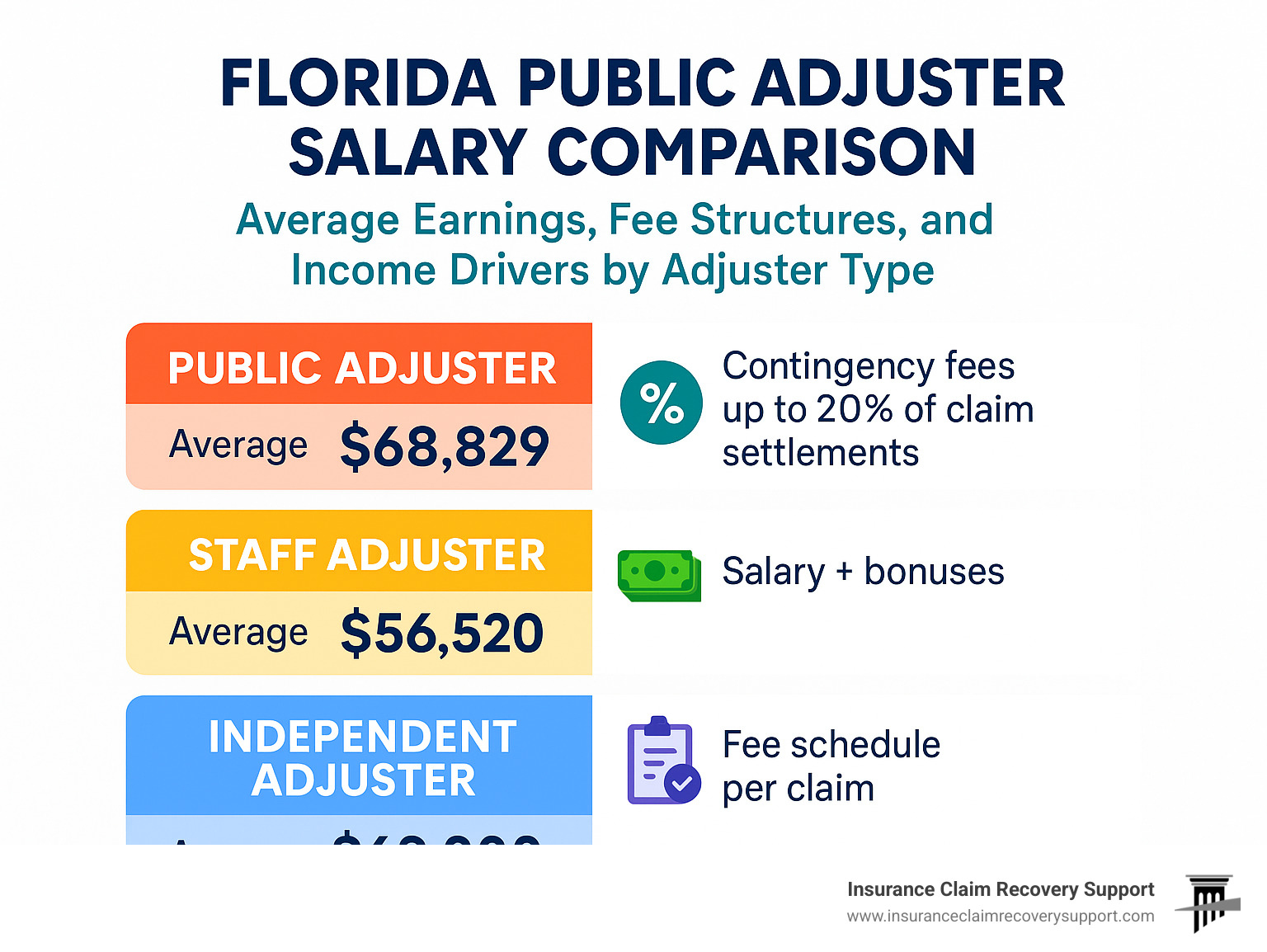

Florida public adjuster salary averages $68,829 per year, with total compensation typically ranging from $61,000 to $104,000 annually, according to the most recent industry data. Public adjusters in Florida earn their income primarily through contingency fees, which are capped at 20% for standard claims and 10% for claims filed during the first year after a declared catastrophe.

| Florida Adjuster Type | Average Annual Salary | Earning Potential | Payment Structure |

|---|---|---|---|

| Public Adjuster | $68,829 | $61,000-$104,000 | Contingency fees (up to 20%) |

| Staff Adjuster | $56,520 | $48,276-$75,733 | Salary + bonuses |

| Independent Adjuster | $60,000 | $39,000-$96,500 | Fee schedule per claim |

Many property owners wonder if the potential income justifies the challenges of becoming a public adjuster in Florida, or whether hiring one is worth the fee. A 2010 Florida OPPAGA report found that policyholders who used public adjusters received settlements averaging $17,187, compared to just $2,029 for those who didn’t—a staggering 747% difference.

Public adjusters earn their fees by representing policyholders in insurance claims, documenting damage, preparing estimates, and negotiating with insurance companies. Unlike staff adjusters who work for insurance carriers, public adjusters work exclusively for policyholders, advocating for maximum claim settlements.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled hundreds of millions in property damage claims throughout Florida and beyond, giving me insight into the Florida public adjuster salary landscape and fee structures that drive income in this profession.

What Does a Public Adjuster Do in the Sunshine State?

When disaster strikes in Floridawhether it’s a hurricane tearing through coastal communities or water damage ruining a family homepublic adjusters become essential advocates in the recovery process. These professionals don’t just fill out paperwork; they stand in your corner when you’re facing what might be one of the most stressful financial situations of your life.

Floridas location makes it particularly vulnerable during the Atlantic hurricane season, which is why the expertise of public adjusters is so critical after major storms.

Florida takes the regulation of public adjusters seriouslyand for good reason. To protect consumers, the Florida Department of Financial Services (DFS) requires public adjusters to:

- Obtain a specialized 3-20 public adjuster license

- Pass a comprehensive state examination

- Complete fingerprinting and background checks

- Maintain professional liability insurance

- Follow a strict code of ethics

- Respect solicitation rules (only Monday-Saturday, 8 a.m. to 8 p.m.)

When you hire a public adjuster in Florida, they become your personal damage detective. They’ll conduct thorough assessments of your property, document every scratch and dent, prepare detailed estimates that insurance companies can’t easily dismiss, interpret the often confusing policy language, and negotiate with insurers to secure the maximum settlement your policy allows.

During hurricane seasonwhen Florida becomes particularly vulnerablepublic adjusters become especially busy. Their expertise with complex claims involving wind, water, and structural damage becomes invaluable when distinguishing between different types of damage that might be covered under different policy provisions.

For more comprehensive information about how these professionals can help with your claim, visit our detailed guide on Insurance Adjustment Services or learn more from the Florida Department of Financial Services.

Public vs. Staff vs. Independent Adjusters

Understanding the different types of adjusters helps explain why their motivationsand paycheckslook so different:

Public Adjusters work exclusively for you, the policyholder. Their Florida public adjuster salary comes entirely from contingency feesa percentage of your settlement. This means their financial success is directly tied to yours. If you don’t get paid, neither do they. This alignment of interests creates a powerful incentive for them to maximize your recovery.

Staff Adjusters receive regular paychecks directly from insurance companies. Their job security depends on accurately assessing claims according to company guidelinesnot necessarily maximizing your payout. Their stable salary and benefits package remain relatively consistent regardless of how your claim turns out.

Independent Adjusters work as contractors for insurance companies, typically getting paid per claim based on fee schedules. During catastrophe seasons, they might handle hundreds of claims in quick succession, with their income potentially spiking dramatically during disaster periods.

The fundamental difference is in whose interests they serve. Public adjusters advocate exclusively for maximizing your settlement, while both staff and independent adjusters represent the insurance company’s interests, even if they’re fair in their assessments.

To learn more about the specific duties of claims adjusters and how they differ from public adjusters, check out our article on What Does a Claims Adjuster Do?

Florida Public Adjuster Salary Snapshot & Industry Comparisons

Curious about what you might earn as a public adjuster in the Sunshine State? Let’s explore the real numbers behind the Florida public adjuster salary landscape – where your income potential can vary dramatically based on your experience, where you work in Florida, and Mother Nature’s unpredictable temperament.

The average public adjuster in Florida brings home about $68,829 annually, with total compensation typically ranging from $61,000 to $104,000 per year. These figures include not just base earnings but also additional compensation from bonuses, commissions, and profit-sharing arrangements that can significantly boost your take-home pay.

When we compare this to other adjuster types working in Florida, the differences become apparent:

- Staff Claims Adjusters: Average $56,520 annually ($48,276 to $75,733 range)

- Independent Adjusters: Average $60,000 annually ($39,000 to $96,500 range)

But here’s where it gets interesting – these averages don’t capture the whole story. During active hurricane seasons, experienced independent adjusters can pocket $65,000 to $100,000 in a single month. Similarly, successful public adjusters handling catastrophe claims might see their bank accounts swell dramatically during disaster periods.

Average Florida Public Adjuster Salary Explained

The Florida public adjuster salary numbers represent a blend of different earning scenarios that paint a complex picture of the profession’s financial reality.

Newcomers to the field typically earn on the lower end while they build their reputation and client base. It’s a profession where experience truly pays off – literally. The longer you’re in the business, the more connections you make and the more efficient you become at handling claims.

Your business model also significantly impacts your earnings. Self-employed adjusters keep 100% of their fees but shoulder all business expenses themselves. If you work for an established firm, you might receive 50-70% of the fees you generate while the company covers overhead costs like office space, marketing, and administrative support.

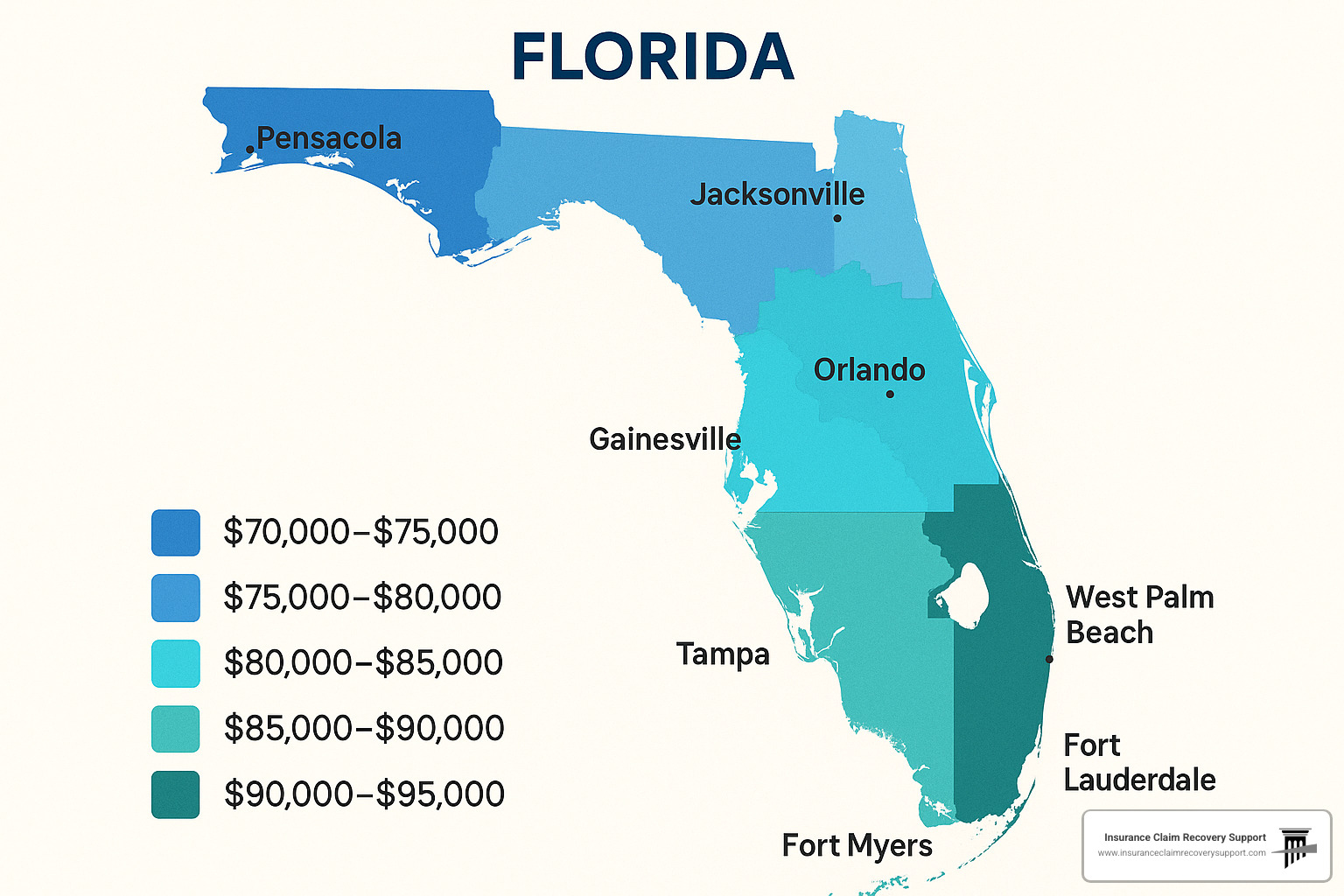

Geography plays a huge role too. Adjusters working in hurricane-prone coastal areas like Miami, Tampa, and the Florida Keys often enjoy higher earning potential due to both the frequency and severity of claims in these regions.

Perhaps most importantly, this profession comes with significant seasonal variations. Your income can be highly cyclical, with substantial earnings during storm seasons followed by quieter periods when the weather cooperates. This feast-or-famine pattern is something every prospective public adjuster should prepare for.

Salary vs. Staff & Independent Counterparts

The Florida public adjuster salary structure differs fundamentally from other adjuster types in ways that directly impact your lifestyle and financial planning.

As a public adjuster, your income is tied directly to claim settlements – there’s no cap on your earnings potential (except for the legal fee percentage limits). This creates both opportunity and uncertainty. You’re responsible for generating your own business and covering your own expenses and benefits, which means your monthly income can fluctuate dramatically.

Staff adjusters, by contrast, enjoy stable bi-weekly or monthly paychecks with benefits packages including health insurance, retirement plans, and paid time off. They might earn limited overtime during catastrophe events and receive annual bonuses based on performance metrics, but their income generally has a ceiling based on company salary bands.

Independent adjusters occupy a middle ground, paid per claim based on fee schedules. They have potential for very high earnings during catastrophes but receive no benefits package. Their work often requires frequent travel for deployment, and their income heavily depends on storm activity.

The most dramatic earning disparities emerge during major catastrophes like hurricanes. While staff adjusters might receive modest overtime pay, independent and public adjusters can see their incomes multiply several times over as claim volumes surge. It’s during these intense periods that the earning potential of a Florida public adjuster salary truly shines – though the workload intensifies accordingly.

How Earnings Are Made: Fees, Caps & Timing

Ever wondered how public adjusters actually make their money in Florida? It’s not quite as simple as a regular paycheck. The backbone of a Florida public adjuster salary comes primarily through contingency fees—they earn a percentage of what they recover for you, the policyholder.

Florida has put thoughtful guardrails around these fees to protect consumers from potential exploitation. Here’s the straightforward breakdown:

For standard everyday claims, public adjusters can charge up to 20% of the settlement amount. However, after a hurricane or major disaster when the Governor declares a state of emergency, that cap drops to 10% for claims filed within the first year. For supplemental claims (when they get additional money on already-settled claims), they can charge up to 20%.

What’s particularly consumer-friendly about Florida’s system is that adjusters can only charge fees on “new money” they obtain. This means if the insurance company initially offered you $10,000 and your public adjuster negotiates it up to $30,000, they can only charge their percentage on that additional $20,000. This ensures they’re truly earning their keep by improving your outcome.

While most public adjusters work on contingency, some offer alternative arrangements. Some charge hourly rates (typically $100-250 per hour), while others might propose a flat fee regardless of claim size, though this is less common in Florida.

Perhaps the most important timing aspect that affects a Florida public adjuster salary is that they cannot collect a penny until you actually receive payment from your insurance company. This creates significant cash flow challenges—imagine working intensively for 3-6 months before seeing any compensation!

Legal Limits & Consumer Protections in Florida

Florida has developed robust consumer protections around public adjusting practices that directly impact how these professionals earn their living:

The fee caps mentioned earlier (20% standard/10% post-catastrophe) represent just one protection. Equally important, policyholders can cancel their contracts within 10 business days without any penalty—or within 30 days after a declared emergency. This cooling-off period gives homeowners time to reconsider.

Public adjusters face strict solicitation restrictions too. They can only knock on doors or call potential clients Monday through Saturday, between 8 a.m. and 8 p.m. They’re completely prohibited from charging advance fees, and must provide clear, transparent fee information while explaining your cancellation rights.

These consumer-friendly regulations significantly shape the Florida public adjuster salary reality by establishing clear boundaries around how and when they can pursue business and collect payment.

Key Income Drivers

What separates the top earners from the rest in this field? Several factors make all the difference:

Experience and reputation stand above all else. Seasoned adjusters with proven track records not only attract more clients but often handle more complex, higher-value claims. Specialization matters too—adjusters who focus on specific claim types like commercial properties, high-value homes, or particular damage categories (fire, flood) typically command better earnings.

Geography plays a huge role in the Florida public adjuster salary equation. Working in Miami-Dade, Broward, and Palm Beach counties generally means higher-value claims than inland areas. The frequency of catastrophes directly impacts earning potential too—years with multiple named storms create waves of claims opportunities.

Networking might be the most underrated income driver. Adjusters who build strong relationships with contractors, attorneys, and satisfied previous clients generate steady referrals without spending a fortune on marketing. The most successful adjusters combine efficient business practices (handling multiple claims simultaneously, leveraging technology) with exceptional negotiation skills that secure substantially higher settlements.

The public adjusters who thrive financially in Florida are those who build sustainable practices that can weather the inherently cyclical nature of this business—creating stable income streams during quiet periods while being positioned to capitalize when storms inevitably arrive.

More info about Public Adjuster Companies

Career Path: Licensing, Pros & Cons, and How to Get Started

Thinking about turning your interest in insurance claims into a career as a Florida public adjuster? Let’s walk through what this journey really looks like – from getting licensed to building a sustainable practice in the Sunshine State.

Step-by-Step to Become a Florida Public Adjuster

The path to becoming a licensed public adjuster in Florida isn’t complicated, but it does require dedication and an investment of both time and money.

First, you’ll need to complete a state-approved 40-hour public adjuster apprentice course. This foundational training covers everything from insurance law to damage assessment techniques. After completing the coursework, you’ll face the state examination, where you’ll need to score at least 70% to move forward.

Next comes the hands-on experience – a minimum 6-month apprenticeship under a licensed public adjuster. During this time, you’ll need to document your involvement in at least 25 claims. This real-world training is invaluable, as you’ll see how to steer complex claims and negotiations.

Once your apprenticeship is complete, the formal licensing process begins. You’ll submit fingerprints for a background check, secure a $50,000 surety bond (which protects your future clients), and pay approximately $300 in licensing fees. All applications are processed through the Department of Financial Services’ MyProfile system.

The investment to launch your career typically ranges from $1,500 to $2,500 – covering courses, exam fees, background checks, and bonding. But remember, this isn’t a one-and-done process. To maintain your license, you’ll need 24 hours of continuing education every two years, plus license renewal and maintaining your surety bond.

Pros and Cons of the Profession

Like any career path, working as a public adjuster in Florida comes with its share of rewards and challenges.

On the bright side, the Florida public adjuster salary potential is genuinely attractive. Successful adjusters can earn six-figure incomes, especially during active hurricane seasons. There’s also the profound satisfaction that comes from helping homeowners recover after devastating losses – you’re literally changing lives during people’s worst moments.

Many adjusters cherish the independence of the profession. You’ll likely have control over which clients you take on and how you structure your business. The work itself stays interesting because no two claims are identical, and outside of catastrophe response, you can often create a flexible schedule that works for your lifestyle.

But it’s not all smooth sailing. The financial reality includes irregular cash flow – you might have months of abundance followed by quiet periods with minimal income. Building a client base takes time, especially for newcomers without established networks. And when disaster strikes, prepare for 80-hour workweeks and potentially weeks away from home responding to catastrophes.

The profession can also be emotionally taxing. You’ll regularly face resistance from insurance companies, and navigating Florida’s strict regulatory environment requires constant attention to compliance details.

Training & Growth Resources

Basic licensing is just the beginning. To truly maximize your Florida public adjuster salary potential, ongoing professional development is essential.

Many successful adjusters pursue advanced certifications like the Certified Property Insurance Specialist (CPIS) or credentials from the Windstorm Insurance Network (WIND). Becoming proficient with Xactimate, the industry-standard estimating software, is practically mandatory for competitive adjusters.

Professional associations offer invaluable networking and educational opportunities. The Florida Association of Public Insurance Adjusters (FAPIA) and National Association of Public Insurance Adjusters (NAPIA) host conferences, webinars, and training events that keep you current on industry trends.

Consider starting your career with an established firm before going solo. The mentorship and training you’ll receive are invaluable, and you’ll build connections that can sustain your business for years to come. Many experienced adjusters are willing to share their knowledge with newcomers, especially during catastrophe response when all hands are needed.

Beyond technical expertise, building a successful public adjusting career requires business acumen. Marketing skills, client acquisition strategies, and networking with attorneys, contractors, and property managers will ultimately determine your long-term success and income potential.

For more comprehensive information about training options, check out our guide to claims adjuster training schools.

Hiring a Public Adjuster: Does It Pay Off for Homeowners?

When your home has been damaged, you’re facing one of life’s most stressful situations. The big question many Florida homeowners ask is: “Is hiring a public adjuster worth the fee?” The data provides a compelling answer.

According to the 2010 Florida Office of Program Policy Analysis & Government Accountability (OPPAGA) report, the difference is striking. Homeowners who worked with public adjusters received average insurance payouts of $17,187, compared to just $2,029 for those who handled claims themselves—a remarkable 747% difference.

Even after paying the public adjuster’s fee (maximum 20% for standard claims), policyholders still came out significantly ahead financially. This impressive return on investment helps explain why the Florida public adjuster salary potential remains strong despite state-mandated fee caps.

The value becomes even clearer when you consider what you’re really getting. Public adjusters bring technical expertise in policy language and coverage details that most homeowners simply don’t have. Their documentation skills ensure nothing is missed when cataloging your damage. They provide negotiation leverage that makes insurance companies take your claim more seriously.

Beyond the dollars and cents, working with a public adjuster saves you countless hours of paperwork and phone calls during an already difficult time. Many clients tell us the stress reduction alone was worth the fee—having a professional advocate in your corner provides genuine peace of mind when you need it most.

Tips for Choosing a Reputable Florida Public Adjuster

Finding the right public adjuster can make all the difference in your claim experience. Here’s how to make a smart choice:

First, verify their license through the Florida Department of Financial Services website—this is non-negotiable. Next, ask about specific experience with your type of damage, whether it’s hurricane, fire, flood, or other loss.

Always review the contract carefully before signing. The fee structure should be crystal clear and comply with Florida law. Don’t hesitate to ask for references from previous clients with similar claims.

Make sure you understand the timeline expectations—how long might your claim take? And watch for red flags like adjusters who promise specific settlement amounts, pressure you to sign immediately, can’t provide license verification, request upfront payments, or solicit door-to-door outside legal hours (8am-8pm Monday through Saturday in Florida).

When & How Adjusters Get Paid

Understanding the payment process helps clarify both the Florida public adjuster salary reality and what you can expect as a homeowner:

When your claim settles, the insurance company typically lists the public adjuster as a co-payee on your settlement check. The adjuster calculates their percentage based on your contract terms—remember, in Florida, they can only charge on the “new money” they help you recover.

The disbursement process varies slightly between firms. Some have you endorse the check, then issue you a new one minus their fee. Others might deposit funds into a trust account before distributing accordingly. In some cases, separate checks are issued to you and your adjuster.

If you have a mortgage, your lender will likely need to endorse the check as well, adding another step to the process. This is standard procedure that your adjuster should help steer.

An important point that affects Florida public adjuster salary reality: final payment to the adjuster occurs only after your claim is settled and paid—which can take months, especially after major hurricanes or disasters. This payment structure is why successful public adjusters must carefully manage their finances to weather periods between settlements.

For homeowners facing the claims process, the data makes a compelling case: the right public adjuster doesn’t cost you money—they help you recover what you’re truly owed under your policy.

Frequently Asked Questions about Florida Public Adjuster Salary & Practice

How soon after a storm can public adjusters solicit clients?

After a major storm hits Florida, many homeowners wonder when they might start hearing from public adjusters. The answer? Pretty much right away—but with some important guardrails in place to protect you.

Florida law allows public adjusters to begin reaching out to potential clients immediately after a storm, but they must follow these specific rules:

Public adjusters can only knock on doors or call you Monday through Saturday, between 8 a.m. and 8 p.m. That late-night doorbell ring from someone offering to handle your claim? That’s actually illegal in Florida.

Perhaps most importantly, adjusters are prohibited from soliciting at the actual scene of a disaster during a declared state of emergency. This prevents opportunistic behavior when homeowners are at their most vulnerable.

These time restrictions strike a balance—giving legitimate professionals the chance to offer their services while protecting storm victims from high-pressure tactics during an already stressful time.

Are contingency fees negotiable below the legal cap?

Absolutely yes! While Florida law sets maximum limits—20% for standard claims and 10% for first-year catastrophe claims—these are ceiling caps, not fixed rates. Think of them as the “sticker price” that you can often negotiate downward.

Many homeowners don’t realize they have room to negotiate, especially in certain situations. If you have a high-value claim (say, over $100,000), even a small percentage reduction can save you thousands. A public adjuster might be willing to work for 15% instead of 20% on a large claim because they’ll still earn a substantial fee while building goodwill.

Similarly, if your claim seems relatively straightforward or you’re a repeat client, you’re in a stronger position to negotiate. I’ve seen many public adjusters offer reduced rates to maintain relationships with existing clients or to secure referrals.

Don’t be shy about having this conversation before signing a contract. Most reputable adjusters understand that Florida public adjuster salary expectations need to be balanced with fair treatment of clients.

Can new adjusters really earn six figures during hurricane season?

The dream of making $100,000+ in your first hurricane season as a public adjuster in Florida is technically possible—but it’s about as likely as hitting a hole-in-one your first time golfing.

The reality check: while experienced adjusters can indeed earn six-figure incomes during active storm seasons, new adjusters face several problems:

First, without an established network, new adjusters struggle to find clients when competition is fierce. Homeowners typically choose adjusters with proven track records, especially for significant claims.

Second, efficiency matters. Seasoned adjusters can handle multiple complex claims simultaneously, while newcomers might spend twice as long on each case while still learning the ropes.

Third, many new adjusters work for established firms, where they might receive only 50-60% of the fee while the firm takes the rest to cover overhead and mentorship.

Perhaps most importantly, even with signed contracts, the Florida public adjuster salary reality includes a significant delay between doing the work and getting paid. Claims can take months to settle, creating cash flow challenges for newcomers.

More realistic first-year earnings fall in the $40,000-$60,000 range, with potential for growth as you build expertise and reputation. The six-figure income typically comes after several years of relationship-building and proving your value in the field.

Conclusion

The Florida public adjuster salary journey offers a fascinating blend of opportunity and challenge. With average earnings of $68,829 annually and top performers breaking into six-figure territory, the financial rewards can be substantial—particularly when hurricane season keeps adjusters busy across the Sunshine State.

But as with any worthwhile profession, these rewards come with trade-offs. The feast-or-famine income cycle can test even the most disciplined financial planners. During active storm seasons, 80-hour workweeks become the norm. You’ll need to steer Florida’s strict regulatory landscape while continuously building your client base in a competitive market.

Success in this field requires a special combination of technical knowledge, business savvy, and genuine compassion for homeowners facing their worst days. It’s not just about understanding insurance policies—it’s about being the advocate policyholders desperately need when facing insurance companies with vastly more resources.

For Florida homeowners wondering if hiring a public adjuster is worth the investment, the evidence speaks volumes. That remarkable 747% increase in average claim payments documented by the OPPAGA report demonstrates why Florida public adjuster salary potential remains strong despite fee caps. Even after the adjuster’s fee, policyholders typically come out significantly ahead.

Looking forward, climate scientists predict increasingly active hurricane seasons affecting Florida’s coastlines. This unfortunate reality suggests growing demand for qualified public adjusters who can help homeowners steer the increasingly complex claims process. For those willing to weather the profession’s challenges, the Florida public adjuster salary outlook remains promising.

At Insurance Claim Recovery Support LLC, we understand the public adjusting profession’s complexities across multiple states. While our primary focus is serving policyholders in Texas and other states where we’re licensed, we’re always happy to provide guidance about finding qualified representation wherever you’re located.

Whether you’re considering becoming a public adjuster or need to hire one for your property claim, we hope this comprehensive guide has helped you understand if the profession’s rewards truly balance its challenges in Florida’s unique insurance landscape.

If you’re interested in learning more about the profession, our resource on claims adjuster training schools provides additional insights into educational pathways for aspiring adjusters.