The Importance of Flood Damage Recovery

Flood damage recovery starts the moment floodwaters recede. Flood damage recovery is crucial for preventing further damage, ensuring safety, and getting back to normal life as soon as possible.

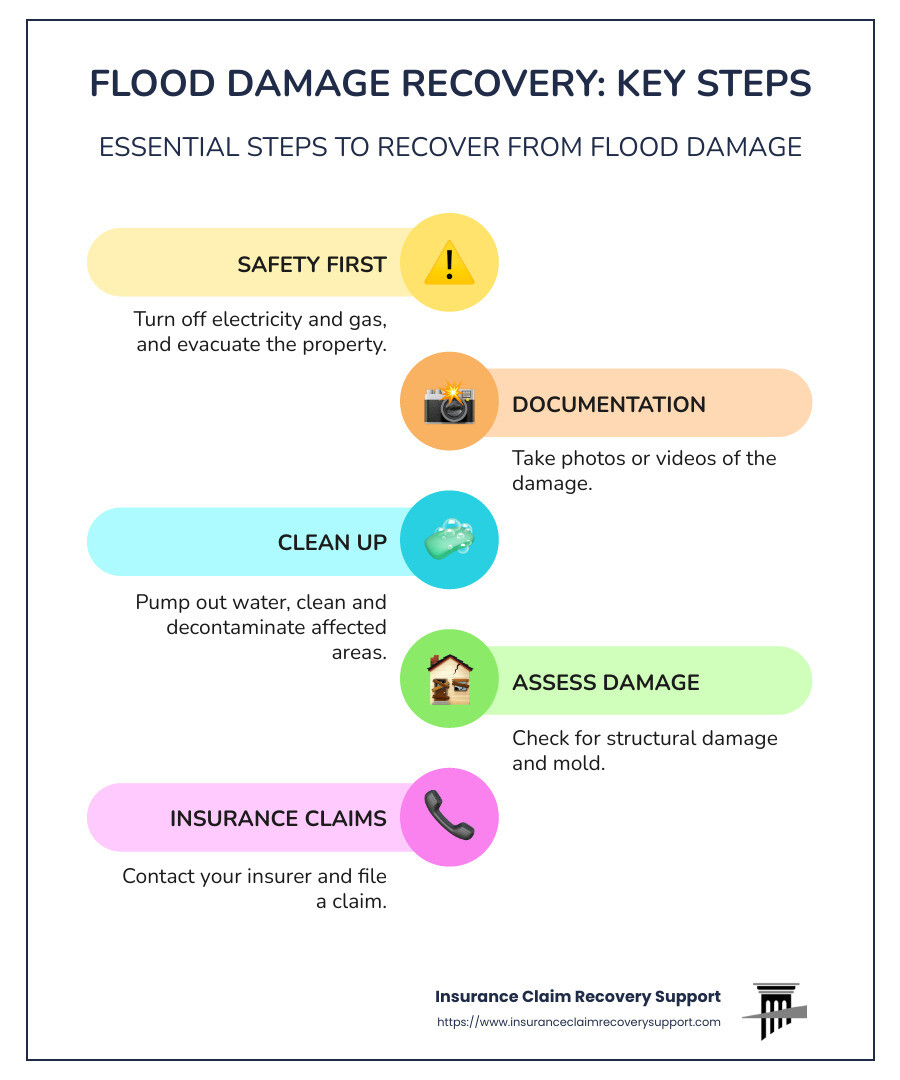

Key steps in flood damage recovery include:

1. Safety First: Turn off electricity and gas, and evacuate the property.

2. Documentation: Take photos or videos of the damage.

3. Clean Up: Pump out water, clean and decontaminate affected areas.

4. Assess Damage: Check for structural damage and mold.

5. Insurance Claims: Contact your insurer and file a claim.

6. Rebuild and Floodproof: Fix your home and take steps to prevent future floods.

7. Seek Financial Assistance: Look into insurance, government programs, and volunteer organizations for help.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. With over 20 years of experience, I’ve helped thousands steer the complex world of flood damage recovery and secure fair settlements. Let’s explore what you need to know to recover quickly and effectively.

Assessing the Damage

Safety First

When you return home after a flood, safety should be your top priority. Floodwaters can create numerous hazards, both visible and hidden. Here’s what you need to do:

- Turn Off Utilities: Electricity: Water and electricity are a dangerous combination. Turn off the main power supply to avoid electrical shocks. Gas: Floodwaters can damage gas lines. Turn off the gas supply to prevent leaks or explosions.

Wear Protective Gear: Gloves and Boots: Wear rubber gloves and waterproof boots to protect yourself from contaminated water and debris. Masks: Use masks to avoid inhaling mold spores and other pollutants.

Check Structural Integrity: Inspect the Foundation: Look for cracks or shifts in the foundation, as these can indicate serious structural damage. Roof and Walls: Examine the roof and walls for any signs of sagging or instability.

Health Hazards: Mold and Mildew: Mold can start growing within 24-48 hours. Use a dehumidifier and fans to dry out the area as quickly as possible. Contaminated Water: Floodwater often contains harmful bacteria and chemicals. Avoid contact and wash thoroughly if exposed.

Documenting the Damage

Proper documentation is crucial for your insurance claims and flood damage recovery. Here’s how to do it effectively:

- Take Photos and Videos:

- Wide Shots: Capture entire rooms to show the overall extent of the damage.

- Close-Ups: Take detailed photos of specific damages, like waterlogged furniture or structural cracks.

- Multiple Angles: Ensure you cover all aspects by taking shots from different angles.

Separate Damaged and Undamaged Items: Create separate piles for damaged and undamaged items to make the inspection process easier for your insurance adjuster.

Keep Receipts and Proof of Purchase: Gather all receipts for damaged items. If you don’t have receipts, bank statements or credit card records can also serve as proof of purchase.

Proof of Loss: Prepare a detailed inventory list, including the item description, date of purchase, and estimated value. This will be crucial for your Proof of Loss statement.

- Documentation: Organize all your photos, videos, and receipts. This will help the adjuster assess the damage accurately.

- List of Damages: Have a comprehensive list of all damaged items and structural issues ready for the adjuster’s visit.

Remember: Thorough documentation not only helps in filing your insurance claim but also speeds up the recovery process. The more detailed your evidence, the stronger your claim will be.

By prioritizing safety and carefully documenting the damage, you set the stage for a smoother and more effective flood damage recovery process. Next, we’ll dive into the drying and cleaning process to ensure your home is safe and habitable again.

Next, we’ll explore the critical steps for drying out and cleaning up your home after a flood.

Drying Out and Cleaning Up

After assessing the damage, the next crucial step in flood damage recovery is to dry out your home and clean up thoroughly. This helps prevent mold growth and ensures a safe living environment.

Drying Out Your Home

Floodwaters can leave your home damp and prone to mold. Here’s how to dry it out effectively:

Dehumidifiers: Use dehumidifiers to remove moisture from the air. These devices are essential for reducing humidity levels and speeding up the drying process.

Fans: Place fans around your home to improve air circulation. This helps to dry out walls, floors, and furniture more quickly.

Ventilation: Open windows and doors to let fresh air in. This can significantly reduce the overall moisture level in your home.

Desiccants: Use desiccants like silica gel or activated charcoal to absorb moisture from small, enclosed spaces such as closets and cabinets.

Cleaning and Disinfecting

Once your home is dry, the next step is to clean and disinfect everything that came into contact with floodwaters. This is crucial to eliminate bacteria, mold, and other contaminants.

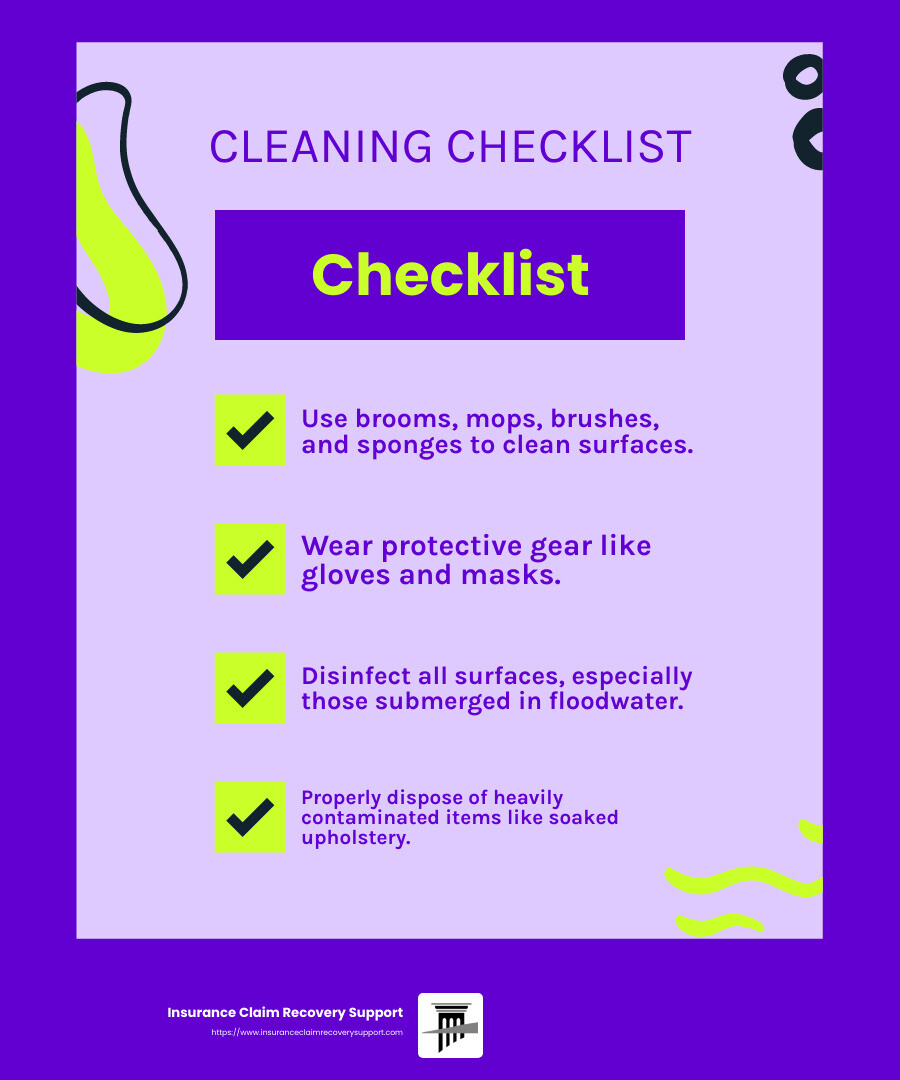

Cleaning Supplies Checklist:

- Brooms, mops, brushes, and sponges

- Buckets and hoses

- Rubber gloves and masks

- Rags and cleaning products

- Disinfectants and lubricating oil

- Trash bags and hair dryer

Cleaning Tips:

Walls and Floors: Floodwaters can leave behind mud, silt, and other contaminants. Use a mixture of water and detergent to clean surfaces. Avoid using bleach unless necessary, as it can produce harmful fumes.

Furniture and Upholstery: For non-porous items like hardwood furniture, clean and disinfect thoroughly. Upholstered furniture that has been soaked should generally be discarded as it can harbor mold and bacteria.

Disinfecting: Use disinfectants to sanitize all surfaces. This is especially important for areas that were submerged in floodwater.

Safety Gear: Always wear protective gear such as gloves, masks, and waterproof boots while cleaning. This protects you from harmful bacteria and chemicals present in floodwater.

By following these steps, you can effectively dry out and clean your home, minimizing long-term damage and health risks. Next, we’ll explore the critical aspects of navigating insurance claims to ensure you get the support you need for your flood damage recovery.

Navigating Insurance Claims

Navigating insurance claims can be a complex part of flood damage recovery. Understanding your coverage and filing your claim correctly can make a big difference.

Understanding Your Coverage

Homeowners Insurance vs. Flood Insurance

Your standard homeowners insurance typically does not cover flood damage. For coverage, you need a separate flood insurance policy. According to the research, water damage insurance covers sudden and accidental water damage, but not flooding.

Policy Details

Review your insurance policy to understand what is covered. Look for sublimits that might cap your water damage coverage. For example, your policy might have $300,000 in property damage coverage but limit water damage to $8,000.

Filing a Claim

Contacting Your Insurer

Start by notifying your insurer immediately. You’ll need the name of your insurance company, your policy number, and your contact information. This gets the ball rolling and helps prevent further damage.

Adjuster Visit

An adjuster will visit to inspect the damage. They work for the insurance company, so be thorough in showing all the damage. Document everything with photos and videos.

Proof of Loss

Your adjuster will help you prepare a Proof of Loss. This is your sworn statement of the amount you’re claiming, including necessary documentation. It’s essential for getting your claim processed and paid.

FEMA Assistance

If you’re in a federal disaster area, FEMA’s Individuals and Households Program can provide additional help. You can apply for assistance at disasterassistance.gov.

SBA Loans

The U.S. Small Business Administration offers low-interest loans for homeowners, renters, and businesses affected by flooding. These loans can help cover damages not fully covered by insurance.

Claim Process

Filing your claim promptly is crucial. Submit all necessary documentation, including photos, videos, and receipts. Keep in touch with your insurance provider to avoid delays.

By understanding your coverage and following these steps, you can steer the insurance claims process more effectively. Next, we’ll explore financial assistance and resources available to support your recovery.

Financial Assistance and Resources

Recovering from flood damage often requires more than just insurance claims. Understanding and accessing various financial assistance programs can help ease the burden.

Federal Assistance Programs

FEMA Assistance

FEMA provides several programs to help flood survivors. The Individuals and Households Program offers money and direct services to those in federal disaster areas. This can help with temporary housing, home repairs, and other critical needs.

To apply, visit disasterassistance.gov or call 1-800-621-FEMA. Remember to have your FEMA registration number handy.

SBA Loans

The U.S. Small Business Administration (SBA) offers low-interest disaster loans. Homeowners can borrow up to $200,000 to repair or replace their primary residence. Renters and homeowners can also get up to $40,000 to replace personal property.

Businesses of all sizes can apply for up to $2 million for physical and economic damage. To learn more, visit the SBA’s disaster loan page.

Grants

In some cases, FEMA and other federal agencies provide grants that do not have to be repaid. These are typically for immediate needs like temporary housing and essential home repairs.

Local and State Resources

Business Recovery Centers

The Louisiana Economic Development and Louisiana Small Business Development Centers (LSBDC) have set up Business Recovery Centers in affected areas. These centers offer a wide range of services, including help with SBA loan applications and business recovery plans.

Tax Relief

The Louisiana Department of Revenue offers tax filing and payment relief for taxpayers in federal disaster areas. This includes extensions on filing deadlines and waivers of penalties and interest. For more details, visit their Flood Recovery Assistance page.

Temporary Monetary Assistance

Temporary monetary assistance is available for businesses and residents whose employment or self-employment was disrupted by flooding. This can help cover immediate expenses and stabilize finances during recovery.

Community Resources

Local organizations and non-profits can also provide crucial support. For example, the Red Cross often offers temporary shelter and emergency assistance. Check local listings for community centers and aid organizations in your area.

By leveraging these federal, state, and local resources, you can access the financial support needed to rebuild and recover.

Next, we’ll dive into the steps for rebuilding and floodproofing your home.

Rebuilding and Floodproofing

Choosing a Contractor

Rebuilding your home after a flood can be overwhelming. Choosing the right contractor is a critical step in ensuring that your home is restored safely and efficiently.

Reputation: Start by asking friends, family, and neighbors for recommendations. Check online reviews and ratings for contractors in your area. A contractor with a solid reputation is more likely to deliver quality work.

Insurance: Always ask for proof of insurance. This includes liability insurance and workers’ settlement. This protects you from being liable for any accidents that might occur on your property.

References: Request references from past clients. Contact them to ask about their experience, the quality of work, and if the project was completed on time and within budget.

Written Estimates: Get written estimates from at least three contractors. This helps you compare costs and understand what each estimate includes. Be wary of estimates that are significantly lower than others—they may cut corners or add hidden costs later.

Contracts: Ensure that everything is in writing. This includes the scope of work, timelines, payment schedules, and any guarantees. Never sign a contract with blank spaces or without understanding all the terms.

Final Payment: Do not make the final payment until the work is completed to your satisfaction. A reputable contractor will agree to this.

Floodproofing Your Home

As you rebuild, consider floodproofing techniques to minimize future damage. Here are some effective strategies:

Elevation: Lift your home or critical utilities (e.g., electrical panels, heating systems) above the base flood elevation level. This can significantly reduce the risk of water damage.

Flood Barriers: Install flood barriers around your home. These can be permanent or temporary and help keep floodwaters at bay. Options include sandbags, flood gates, and levees.

Waterproof Materials: Use waterproof materials for walls, floors, and furniture. Materials like ceramic tiles, concrete, and pressure-treated wood are more resistant to water damage.

Dry Floodproofing: Seal your home to prevent water from entering. This includes applying waterproof coatings to the exterior walls and installing backflow valves to prevent sewage from backing up into your home.

Wet Floodproofing: Allow water to enter but minimize damage. Use flood-resistant materials and lift electrical systems and appliances. This approach can be less costly and easier to implement in some cases.

Local Building Codes: Local building codes often require a permit before you start repairs or alterations. Check with your local building department to ensure compliance.

Professional Help: Consult with floodproofing specialists to determine the best strategies for your home. They can provide custom solutions based on your location and flood risk.

By carefully selecting a contractor and incorporating floodproofing techniques, you can rebuild your home stronger and more resilient against future floods.

Next, we’ll address some frequently asked questions about flood damage recovery.

Frequently Asked Questions about Flood Damage Recovery

How long does it take to recover from a flood?

The time it takes to recover from a flood varies greatly. Factors include the severity of the flood, the extent of damage, and the resources available for recovery.

Minor Flooding: If the flood damage is minimal, such as a few inches of water, recovery might take a few weeks. This includes drying out the home, cleaning, and making minor repairs.

Severe Flooding: For more severe flooding, recovery can take several months. This involves extensive repairs, replacing damaged belongings, and possibly rebuilding parts of the home.

Total Loss: In cases where the home is a total loss, recovery can take a year or more. This includes demolishing the damaged structure and rebuilding from the ground up.

Local resources and support from organizations like FEMA can help speed up the process.

How do people recover after a flood?

Recovering from a flood involves several steps:

Immediate Safety: Ensure that everyone is safe. Evacuate if necessary and avoid contact with floodwaters, which may be contaminated.

Assessing Damage: Once it’s safe, inspect your home for damage. Document everything with photos and videos for insurance claims.

Insurance Claims: Contact your insurance company as soon as possible to start the claim process. An adjuster will be assigned to assess the damage.

Cleaning and Drying: Begin cleaning and drying out your home to prevent mold growth. Use dehumidifiers and fans to speed up the process.

Repairs and Rebuilding: Depending on the damage, you may need to make minor repairs or rebuild entirely. Hiring reputable contractors is crucial for quality work.

Community Support: Take advantage of community resources. Organizations like the American Red Cross and local charities often provide immediate assistance, including food, clothing, and shelter.

Mental Health: Recovering from a flood can be stressful. Seek support from family, friends, and professional counselors if needed.

What does FEMA cover after a flood?

FEMA provides various types of assistance to help flood survivors:

Basic Needs: FEMA can help with temporary housing, essential home repairs, and other critical needs not covered by insurance. This includes rental assistance and grants for repairs.

Eligibility: To qualify, your area must be declared a disaster zone, and you must register with FEMA. You will be assigned a registration number, which you’ll use throughout the process.

Assistance Types:

– Disaster Housing Assistance: Covers temporary housing costs.

– Disaster Loans: Low-interest loans to cover repair costs.

– Individual and Family Grants: For expenses not covered by insurance.

– Income Tax Deductions: Tax relief for disaster-related expenses.

– Floodproofing Assistance: Grants to help floodproof your home for the future.

– Counseling: Mental health support for disaster survivors.

For more detailed information on FEMA assistance, visit FEMA’s website.

Knowing what to expect and having a clear plan can make the flood damage recovery process more manageable. Up next, we’ll dive into the importance of flood insurance and how to develop a flood response plan.

Conclusion

Navigating the flood damage recovery process can be overwhelming, but with the right information and support, you can get your home and life back to normal.

At Insurance Claim Recovery Support LLC, we specialize in representing policyholders in their insurance claims. Our team is dedicated to advocating for you and ensuring you receive the maximum settlement you deserve. We handle property damage claims, including those from floods, and serve clients nationwide from our Texas base. Whether you’re in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, or Lakeway, we are here to help.

Final Tips

Document Everything: Take photos and videos of all damage. Keep receipts and records of any expenses related to the flood.

Stay Safe: Always prioritize safety. Avoid floodwaters and wait for the all-clear from local authorities before returning home.

Seek Assistance: Use federal programs like FEMA and SBA loans for financial aid. Local and state resources can also provide valuable support.

Hire Reputable Contractors: When rebuilding, choose contractors with good reputations. Check for insurance and references.

Floodproof Your Home: Consider floodproofing techniques like elevation and waterproof materials to minimize future risks.

Contact Information

If you’re dealing with flood damage and need expert assistance, don’t hesitate to reach out to us. We offer a free consultation to help you steer your insurance claim.

Visit our website or call us directly for immediate support.

By choosing Insurance Claim Recovery Support LLC, you gain a dedicated partner committed to your recovery. We’re here to help you through the complexities of insurance claims and secure the settlement you need to move forward.

For more detailed information on flood damage recovery, visit our resources page.

Remember: The road to recovery after a flood doesn’t have to be a lonely one. With our support, you can steer the flood damage recovery process with confidence and peace of mind.