Why You Need a Flood Damage Public Adjuster When Water Strikes

A flood damage public adjuster is a state-licensed professional who works only for you, the policyholder, not the insurance carrier. When rising water overwhelms your home or business, the right advocate keeps your claim on track and your stress level down.

What a flood damage public adjuster does for you

- Inspects & documents every inch of flood damage (visible and hidden)

- Reviews your policy to uncover ALL available coverage

- Prepares detailed estimates with Xactimate and industry pricing

- Negotiates directly with the insurer on your behalf

- Handles paperwork & deadlines so you can focus on recovery

- Works on contingency – no recovery, no fee (typically 5-20% of the settlement)

Trying to decipher dense flood policy language while juggling contractors and clean-up crews is overwhelming. Public adjusters level the playing field by translating policy jargon, proving the full scope of loss, and pushing back against low or delayed offers.

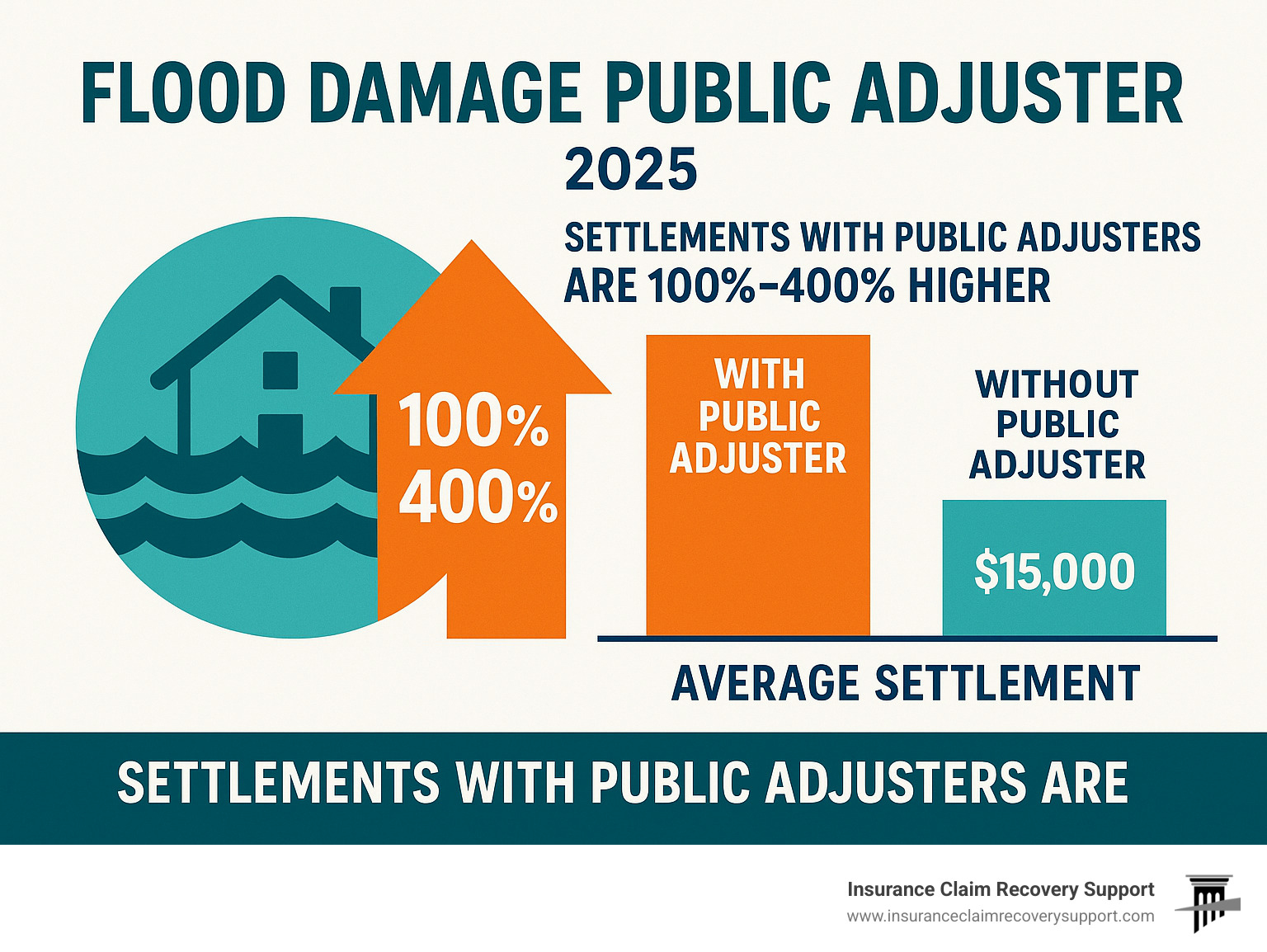

Independent studies show policyholders who hire public adjusters often recover significantly larger settlements than those who go it alone. The difference is simple: adjusters for the insurance company are trained to control costs, while a public adjuster is paid to maximize yours.

As Scott Friedson, CEO of Insurance Claim Recovery Support, my team and I have recovered hundreds of millions for flood-stricken Texans in Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway – without unnecessary litigation.

Find more about flood damage public adjuster:

Understanding the Players: Who Handles Your Flood Claim?

When you report a flood loss, three different adjuster types may show up – but only one works for you.

- Public Adjuster – Licensed advocate hired by the policyholder. Paid a percentage of what they recover for you.

- Company Adjuster – Salaried employee of your insurer. Goal: control claim costs.

- Independent Adjuster – Third-party contractor paid by the insurer. Goal: keep the carrier happy to earn future assignments.

That built-in conflict of interest explains why Insurance Claim Recovery Support acts as policyholder advocates. We inspect, document, and negotiate the entire claim so you don’t have to.

What Does a Public Adjuster Do in Flood Claims?

A flood damage public adjuster becomes your single point of contact. We:

- Inspect the property with moisture meters and thermal cameras.

- Assemble iron-clad documentation.

- Interpret every line of the policy to reveal hidden benefits.

- Submit and defend the claim until a fair settlement is reached.

See our full services at Public Adjusters.

The Value of an Advocate: Why and How to Hire a Flood Damage Public Adjuster

Flood claims are among the most complex in insurance. Water travels everywhere, policies are packed with exclusions, and strict deadlines (often 60-days for Proof of Loss) leave little room for error.

According to the Wall Street Journal, settlements negotiated by public adjusters are routinely double or more than those secured by policyholders alone. Our own files back it up: a recent Texas homeowner saw an $80,000 offer rise to $120,000 after we stepped in.

Step-by-Step Process

- Consultation

- Policy review – identify coverage you paid for but may not know exists

- Damage documentation – photos, drone imagery, thermal scans

- Estimate & claim package – built in Xactimate

- Negotiation – we meet (or Zoom) with the insurer, not you

- Settlement & payment

Learn more about our insurance adjustment services.

Cost to Hire

No upfront fee. We work on contingency, usually 5–20% of new money we recover. Many states, including Florida, cap that fee during declared disasters. Details here: how public adjusters get paid.

Maximizing Your Settlement: Navigating Flood Policy Challenges

Flood insurance – whether through the National Flood Insurance Program (NFIP) or a private carrier – is loaded with fine print. Coverage can hinge on subtle differences such as Actual Cash Value (ACV) vs. Replacement Cost Value (RCV), or whether damage is classified as wind-driven rain (homeowners policy) or over-land flood (flood policy).

Key Factors That Drive Your Payout

- Scope of loss – hidden moisture behind walls is often missed

- Accurate pricing – post-disaster labor & lumber spikes aren’t always reflected in carrier software

- Sub-limits – e.g., $2,500 cap on certain flooring or detached structures

- Documentation quality – photos + measurements + expert narrative = leverage

Common NFIP Limitations We Steer

Basement restrictions, ALE caps, mold allowances, and the unforgiving 60-day Proof of Loss requirement can all gut a claim if mishandled. Our Texas-based team knows local codes and how to separate wind from water to maximize recovery on both policies when a hurricane strikes.

If an insurer drags its feet, we also address bad faith insurance practices to protect your rights.

Finding Your Ally: How to Hire a Legitimate and Qualified Professional

The aftermath of a flood often brings out both legitimate professionals and opportunistic scammers. Knowing how to identify a qualified flood damage public adjuster protects you from fraud while ensuring you get the expert representation you need.

Unfortunately, disasters attract individuals who pose as public adjusters but lack proper licensing, experience, or ethical standards. The key to protecting yourself is understanding what qualifications to look for and how to verify them.

Our public adjuster near me service helps connect you with properly licensed professionals in your area, but it’s important to understand the vetting process yourself.

Requirements and Qualifications for Public Adjusters

Legitimate public adjusters must meet strict state licensing requirements:

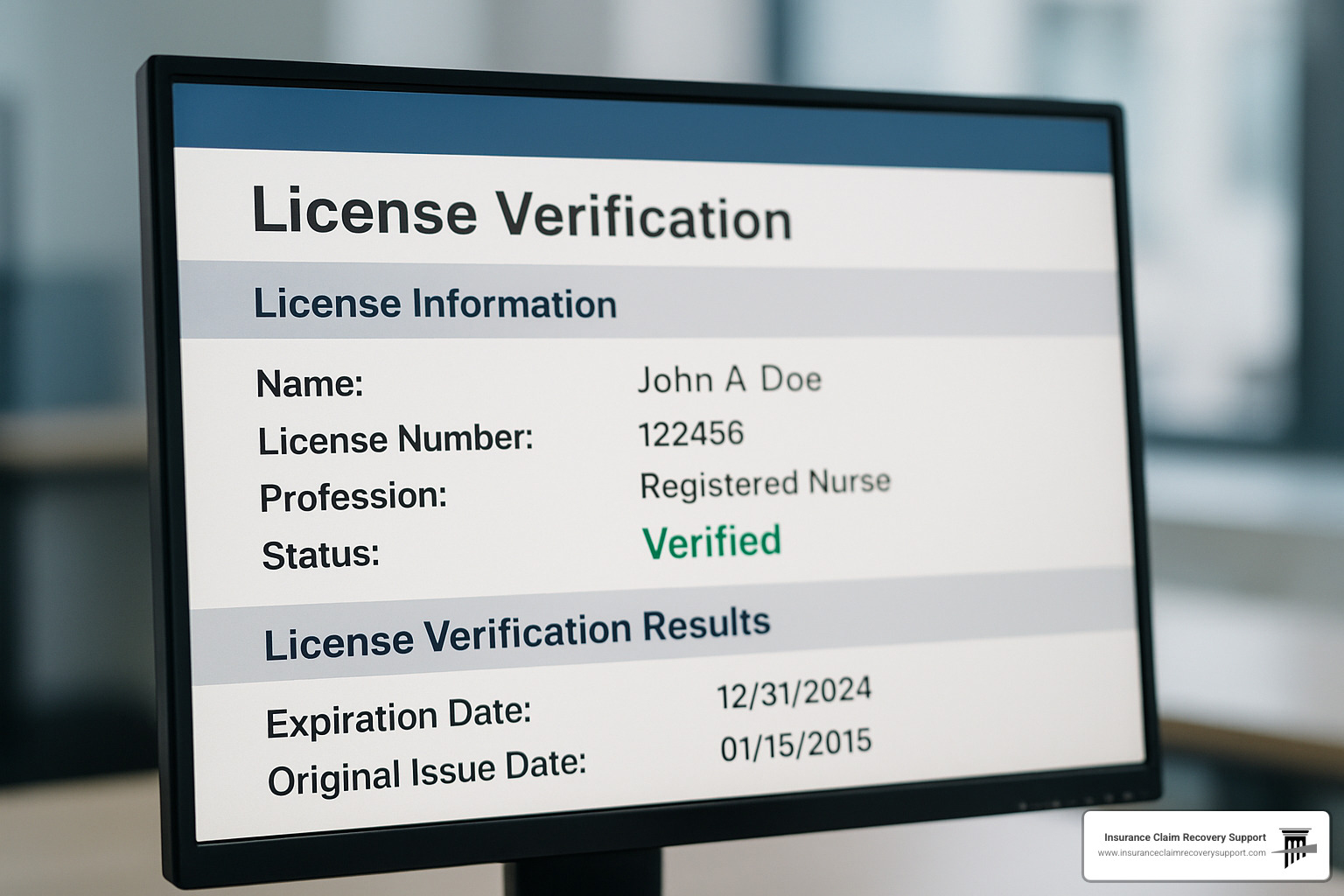

State licensing – Every public adjuster must be licensed in the state where they practice. This requires passing a comprehensive examination and meeting continuing education requirements.

Background checks – Most states require background checks as part of the licensing process, ensuring adjusters have no disqualifying criminal history.

Surety bond – Public adjusters must typically carry a surety bond (often $50,000 or more) to protect consumers from potential misconduct.

Continuing education – Licensed adjusters must complete ongoing education to maintain their licenses and stay current with industry changes.

Professional certifications – Many qualified adjusters hold additional certifications, such as FEMA certification for disaster response or specialized training in water damage assessment.

Experience with flood claims – Look for adjusters with specific experience in flood damage claims, as these require specialized knowledge of NFIP policies and flood damage assessment.

At Insurance Claim Recovery Support, we maintain licenses in multiple states and hold certifications that demonstrate our expertise in complex property damage claims. Our national public adjusters network ensures we can serve clients across the country with qualified, licensed professionals.

Finding a Qualified Flood Damage Public Adjuster in Texas and Beyond

Here’s your step-by-step process for finding a qualified professional:

-

Verify state licensing – Check with your state’s insurance department. In Texas, verify licensing through the Texas Department of Insurance website.

-

Ask for references – Legitimate adjusters will provide references from recent clients. Contact these references to ask about their experience.

-

Review their contract carefully – Understand the fee structure, services provided, and your rights. In Texas, adjusters must use the TDI public insurance adjuster contract form.

-

Check professional associations – Look for membership in the National Association of Public Insurance Adjusters (NAPIA), which maintains professional standards.

-

Verify local expertise – For Texas clients, ensure your adjuster understands local building codes, weather patterns, and insurance practices in cities like Austin, Dallas, Houston, and San Antonio.

-

Avoid red flags – Be wary of adjusters who demand upfront fees, use high-pressure tactics, or show up unsolicited after a disaster.

Red flags to avoid:

- Unsolicited door-to-door solicitation immediately after a disaster

- Demands for upfront payment

- Pressure to sign immediately without time to review the contract

- Lack of proper licensing or inability to provide license numbers

- Promises of specific settlement amounts

- Requests to sign over insurance checks

Our team serves clients throughout Texas, with particular expertise in the unique challenges faced by property owners in Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, San Angelo, and other Texas markets.

Frequently Asked Questions about Flood Damage Public Adjusters

My claim was denied or underpaid. Is it too late to call you?

No. We routinely reopen or supplement claims, dispute low offers, or invoke appraisal. Time limits vary, but you often have years – contact us for specifics or see our insurance claim appraisals guide.

Is a public adjuster worth it for small claims?

If the claim is under ~$5,000 and clearly documented, you might handle it yourself. Anything larger, complex, or disputed usually benefits from professional help. Our free claim evaluation clarifies the math before you decide.

What’s the difference between flood damage and water damage?

Flood damage is rising water from outside (requires separate flood policy). Water damage is internal (burst pipe, roof leak) and falls under homeowners coverage. Mixed events (e.g., hurricanes) may trigger both. Our team sorts it out, whether it’s storm surge or a pipe break.

Conclusion

When flood waters recede and the cleanup begins, the insurance claim process often becomes another overwhelming challenge. But it doesn’t have to be. The evidence consistently shows that having a flood damage public adjuster on your side transforms what could be a frustrating, underpaid claim into a fair recovery that helps you truly rebuild.

The statistics tell a compelling story: policyholders who hire public adjusters receive settlements that are 100% to 400% higher than those who handle claims alone. This isn’t just about money – it’s about getting your life back on track without the financial stress of inadequate settlements.

Throughout this guide, we’ve shown you how insurance companies have teams of experts working to minimize your settlement. The playing field isn’t level, but it becomes level when you have your own expert advocate. A flood damage public adjuster brings the policy knowledge, damage assessment expertise, and negotiation skills that most property owners simply don’t possess.

At Insurance Claim Recovery Support, we’ve built our reputation on empowering policyholders throughout Texas and beyond. Whether you’re dealing with flood damage in Austin, Dallas-Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, or Lakeway, our team brings decades of experience to every claim.

Don’t steer the complex flood claim process alone. The insurance companies have adjusters, attorneys, and specialists working to protect their interests. You deserve the same level of professional representation working to protect yours.

We understand that hiring a public adjuster might feel like another expense during an already difficult time. But remember: we work on contingency, which means you pay nothing unless we increase your settlement. In most cases, our fee is far exceeded by the additional recovery we achieve for our clients.

Your property, your family’s security, and your financial future deserve professional advocacy. After you’ve dealt with the immediate crisis of flood damage, don’t let an inadequate insurance settlement become another crisis.

Take the next step today:

- Contact us for a free consultation to discuss your flood damage claim

- Learn about the steps to take after a property damage insurance claim is settled

- Get the professional help you deserve for your flood damage recovery

You have everything to gain and nothing to lose by getting a professional evaluation of your flood damage claim. Let our experienced team of licensed public adjusters fight for the settlement you deserve, so you can focus on what matters most – getting your life back to normal.