When Fire Strikes: Understanding the Complex Path to Recovery

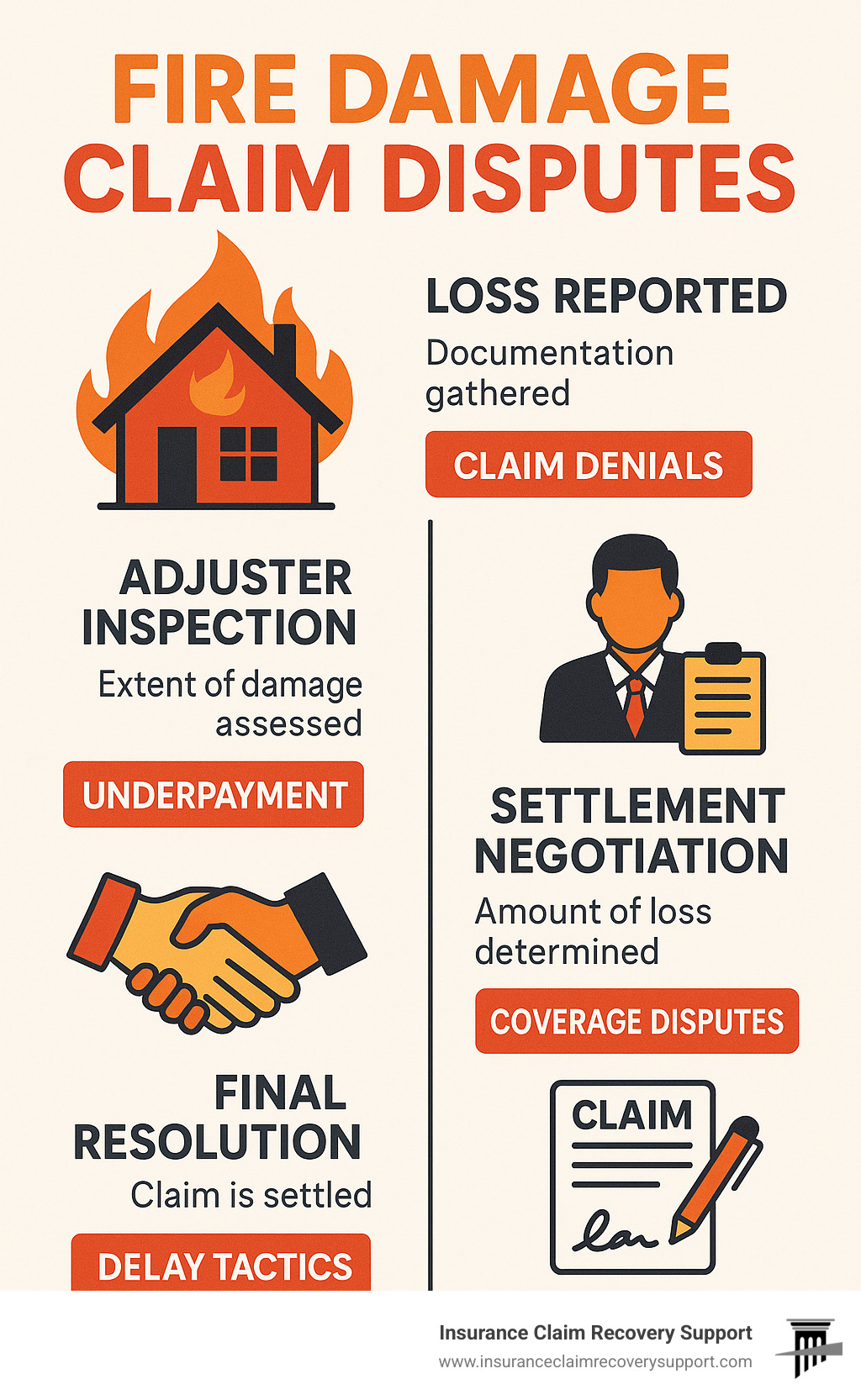

Fire damage claim disputes occur when policyholders and their insurance companies disagree on coverage, settlement amounts, or how a claim is handled after a fire. These conflicts can lead to claim denials, underpayment, and significant delays in recovery.

Common dispute scenarios include:

- Claim denials due to suspected arson, policy exclusions, or lack of documentation.

- Underpayment disputes over repair costs, depreciation, or the scope of damage.

- Coverage disagreements about what the policy covers, such as smoke damage or business interruption.

- Delay tactics by insurers to pressure policyholders into accepting low settlements.

- Bad faith practices, like unreasonable investigation demands or misrepresenting policy terms.

A fire can feel like losing everything twice: first to the flames, and then to the struggle with the insurance company. The statistics are sobering: in 2019, fires caused an estimated $14.8 billion in property damage in the U.S. While the average fire claim payout is high, many policyholders fight for fair compensation.

For commercial and multifamily properties, these disputes are devastating, delaying reconstruction and causing severe financial hardship. The good news is that you have options. Understanding your rights is the first step toward recovering what you’re owed.

I’m Scott Friedson, a public adjuster who has settled over $250 million in fire damage claim disputes for commercial and multifamily property owners. My experience with over 500 large loss claims has helped policyholders avoid litigation while securing fair settlements, often 30% to 3,800% higher than initial offers.

Important fire damage claim disputes terms:

Why Fire Damage Claim Disputes Arise

After a fire devastates your commercial property, you expect your insurance company to provide support. Unfortunately, many property owners in Texas and beyond face fire damage claim disputes instead. The reality is that insurance companies are for-profit businesses, and they may use various tactics to minimize large payouts.

Disputes often begin with an outright claim denial. Insurers might allege policyholder negligence, arson, or cite policy exclusions. A common reason for denial is insufficient documentation, where the insurer claims you failed to provide adequate proof of your loss. If arson is suspected, expect a lengthy investigation that can stall your claim for months.

For more information on navigating these challenges, see our guides on Fires in Texas and what to do about a Denied Fire Insurance Claim.

Common Tactics Leading to Disputes

Even if your claim isn’t denied, insurers may use certain tactics to underpay it:

- Lowball Estimates: The insurer’s adjuster may provide a repair estimate that is far below what local contractors quote, using outdated pricing or ignoring the complexities of fire restoration. This tactic pressures you to accept less than you need to rebuild.

- Unreasonable Delays: Insurers may intentionally drag out the claims process by repeatedly requesting documents or being unresponsive. These delays are designed to wear you down financially and emotionally until you accept a low offer.

- Misinterpreting Policy Language: Insurers use their deep knowledge of complex policy documents to argue that certain damages, like those from an electrical fire or smoke, fall under an exclusion.

- Improper Depreciation: On an Actual Cash Value policy, insurers might apply excessive depreciation to your damaged property, drastically reducing your settlement by undervaluing items like a five-year-old HVAC system.

- Disputing Repair Methods: Insurers may insist on cheaper, inadequate repairs, such as cleaning smoke-damaged drywall instead of replacing it, compromising the quality and safety of the restoration.

Understanding these strategies is the first step to fighting back. For more guidance, visit What You Need to Know About Insurance Claims.

Hidden and Long-Term Damages Insurers Often Overlook

A fire’s destruction extends beyond visible charring. Insurers often minimize or ignore costly hidden damages:

- Smoke and Soot Contamination: Microscopic soot particles can penetrate deep into building materials, furniture, and HVAC systems far from the fire’s origin, leaving behind toxic residues that require specialized, expensive cleaning.

- Water Damage from Firefighting: The water used to extinguish the fire can soak floors, walls, and foundations, compromising structural elements and electrical systems. Insurers may try to claim this damage isn’t covered under a fire policy.

- Structural Integrity Issues: Extreme heat can weaken steel beams, concrete, and wood supports without visible signs of damage, creating serious safety hazards that may only appear later.

- Mold Growth: Water damage creates a breeding ground for mold, which can appear weeks after the fire. Insurers often dispute that this is part of the original loss, leaving you with a large remediation bill.

- Business Interruption: For commercial properties, the lost income from being unable to operate can exceed the physical repair costs. This includes lost rent, revenue, and costs for temporary relocation.

Identifying and documenting these hidden losses is crucial. A public adjuster can ensure every aspect of your loss is accounted for. Learn more in our Commercial Property Damage Claim guide.

Navigating Fire Damage Claim Disputes: Your Options and Rights

When you’re locked in fire damage claim disputes with your insurer, you are not powerless. As a policyholder, you have clear rights and options to secure the compensation you deserve. The key is to take control of your claim instead of assuming your insurance company will act in your best interest.

Essentially, you have two main paths: pursuing legal action or hiring a public adjuster as your advocate. At Insurance Claim Recovery Support, we provide Assistance with Insurance Claims to help commercial property owners choose the right approach to transform a dispute into a fair settlement.

Option 1: The Legal Route – Filing a Lawsuit

When negotiations fail or your insurer engages in bad faith, filing a lawsuit may be necessary. You should consider hiring an attorney if your claim is wrongfully denied, drastically underpaid, or subject to unreasonable delays.

- Breach of Contract: This lawsuit applies when your insurer violates your policy terms by refusing to pay a legitimate claim.

- Bad Faith Practices: If your insurer acts unreasonably—with arbitrary delays, baseless denials, or laughably low offers—you may have grounds for a bad faith lawsuit. These cases can result in compensation beyond your policy limits, including punitive damages.

The litigation process is adversarial, expensive, and time-consuming, often taking months or years to resolve. Legal fees are typically hourly or a high contingency fee (25-40% or more) of your settlement. For more details, see our page on hiring a Lawyer for Damage to Property.

Option 2: The Advocate Route – Hiring a Public Adjuster

Before resorting to a lawsuit, a more effective way to resolve fire damage claim disputes is often to hire a public adjuster. Unlike the insurance company’s adjuster, Claims Adjusters who are public adjusters work exclusively for you, the policyholder.

We level the playing field by bringing expert knowledge of damage valuation, policy interpretation, and negotiation. We manage all communications, prepare comprehensive damage estimates, and counter the insurer’s arguments with facts. Our goal is to maximize your settlement without the cost and stress of litigation.

This approach saves you time and allows you to focus on your business. We work on a contingency fee (typically 5-15%) and only get paid when you do. Learn more about our Public Adjusting Services.

Litigation vs. Hiring a Public Adjuster

| Feature | Property Damage Lawsuit | Hiring a Public Adjuster |

|---|---|---|

| Goal | Win a legal case, often for bad faith | Achieve a fair and full settlement under the policy |

| Timeline | Months to years | Weeks to months |

| Cost | Hourly fees or contingency (25-40%+) | Contingency fee (typically 5-15%) |

| Process | Adversarial, formal, court-based | Collaborative, negotiation-based |

| Expertise | Legal strategy, insurance law | Damage valuation, policy interpretation, claim negotiation |

| Best For | Clear cases of insurer bad faith, after other options fail | Underpaid claims, complex damage, claim management |

Proactively Protecting Your Claim from the Start

Fire damage claim disputes often arise from what happens—or doesn’t happen—in the first few days after a loss. The insurance company begins building its case from your first call, so taking proactive steps can protect your claim and prevent future headaches.

Following the right steps from day one can help you avoid disputes and secure a fair settlement without a fight. For a detailed guide, see our resource on How to File an Insurance Claim for Fire Damage.

Effective Damage Documentation and Evidence Gathering

Thorough documentation is your most powerful tool. Once officials declare the site safe, you must gather comprehensive evidence before it disappears. Here’s what to do:

- Take Photos and Videos: Capture everything. Use wide-angle shots for scope and close-ups for detail. Document not just fire damage but also smoke, soot, and water damage throughout the property.

- Create a Detailed Inventory: For commercial and multifamily properties, list all damaged items, including appliances, furniture, equipment, and building systems. Use previous inventory records, receipts, and maintenance logs to support your list.

- Get the Fire Department Report: This official, third-party document provides crucial details about the fire’s origin and cause. Request a copy as soon as it is available.

- Obtain Independent Repair Estimates: Don’t rely solely on the insurer’s assessment. Get multiple, detailed estimates from licensed contractors specializing in fire restoration.

- Keep Meticulous Records: Log every interaction with your insurer, including names, dates, and conversation summaries. Follow up calls with emails to create a paper trail.

For complex losses, consider consulting experts in Large Loss Claims Handling to ensure nothing is missed.

Understanding Your Commercial Insurance Policy

Commercial insurance policies are complex, but understanding key coverages is vital to avoiding fire damage claim disputes. Key areas include:

- Coverage A (Building Structure): Protects the main structure, including the foundation, walls, and roof.

- Coverage B (Other Structures): Covers detached structures like garages, storage buildings, or fences.

- Coverage C (Business Personal Property): Includes contents like appliances, furniture, office equipment, and inventory.

- Business Interruption Coverage: A financial lifesaver that covers lost income (like rent or revenue) and extra operating costs while your property is being repaired.

A major point of contention is Replacement Cost Value (RCV) vs. Actual Cash Value (ACV). ACV pays what an item was worth right before the fire, factoring in depreciation. RCV pays to replace the item with a new one of similar quality. Insurers often try to apply ACV calculations to reduce payouts, even on RCV policies. Understanding your policy helps you claim everything you’re owed. For specialized assistance, see our Commercial Insurance Claims Help guide.

Alternative Dispute Resolution and State-Specific Laws

When a fire damage claim dispute reaches a stalemate, you don’t have to choose between a lowball offer and an expensive lawsuit. Alternative dispute resolution (ADR) methods can break the deadlock without the stress and cost of litigation.

Think of ADR as bringing in a neutral referee. As Who We Help – Policyholder Advocates, we’ve seen these methods effectively resolve disagreements over repair costs and damage values, often much faster than a court battle.

Appraisal, Mediation, and Other Resolution Methods

- The Appraisal Clause: Most commercial policies contain this provision, which is an escape hatch for valuation disputes. Each side hires an appraiser. If they can’t agree, they select a neutral umpire. A decision by any two of the three is binding. This is highly effective when the dispute is about the amount of loss, not coverage itself.

- Mediation: A neutral mediator facilitates a conversation between you and your insurer to find a mutually acceptable settlement. The mediator doesn’t make decisions but guides the negotiation. Nothing is binding unless both parties agree.

These ADR methods work best for disputes over the scope or cost of damage. For flat-out denials or clear bad faith, other options may be necessary. You can view state-specific insurance regulations to learn more.

Key State Laws Impacting Your Claim

State laws significantly impact your rights and claim timelines. For our clients with properties across Texas—from Dallas and Houston to Austin and San Antonio—understanding local regulations is crucial.

- Texas Statutes of Limitations: Generally, you have four years to sue for breach of contract and two years for bad faith claims. Acting promptly is always the best course of action.

- Texas HB 1774: This 2017 law changed how attorney fees work in property insurance lawsuits, adding complexity to the legal process. While it was intended to curb litigation, policyholders still have strong rights under Texas law. You can read more here: Texas HB 1774 Went Into Law Effective September 1, 2017.

- Prompt Payment Laws: Many states, including Mississippi, require insurers to handle claims within a reasonable timeframe, giving you grounds for action if they cause unjustified delays.

- Unfair Claims Settlement Practices Act: Adopted in most states, this act prohibits insurers from misrepresenting facts, failing to investigate properly, or denying claims without a reasonable basis.

Frequently Asked Questions about Fire Damage Claim Disputes

When your commercial property is damaged by fire, you will have questions about your rights and what to expect from your insurer. Here are answers to common concerns we hear from property owners.

What is ‘bad faith’ in a fire insurance claim?

Bad faith occurs when an insurer fails to uphold its contractual duty by acting unreasonably or unfairly. It goes beyond a simple disagreement over costs and involves deliberate attempts to avoid paying a legitimate claim. Examples include denying a claim without a proper investigation, creating unreasonable delays to pressure you, offering an unjustifiably low settlement, or wrongfully accusing a policyholder of arson. If an insurer acts in bad faith, you may be able to recover damages beyond your policy benefits.

How do public adjusters resolve fire damage claim disputes without a lawsuit?

A Licensed Adjuster working for the policyholder acts as your exclusive advocate. We level the playing field by bringing professional expertise to your side. The process involves three key steps: 1) We conduct a thorough investigation to document all damages, including hidden issues insurers often miss. 2) We interpret your complex policy to ensure all applicable coverages are claimed. 3) We use this evidence to negotiate directly and strategically with the insurer for a full and fair settlement. This expert advocacy often resolves disputes without the time and expense of litigation.

Can I dispute the depreciation my insurance company calculated?

Yes, you can and should dispute excessive depreciation. Insurers often use it to reduce payouts. To fight back, you need to provide evidence of your property’s actual condition before the fire, such as maintenance records and photos. You can also cite current market values for comparable items to show the insurer’s calculation is too low. A public adjuster can perform a detailed analysis to recalculate the true Actual Cash Value (ACV) and present a compelling case to recover the money you are rightfully owed.

Get Expert Help to Settle Your Fire Damage Claim

Dealing with fire damage claim disputes is overwhelming, especially while managing the aftermath of a fire. The insurance process is complex and often designed to minimize what you are paid. For owners of commercial properties, multifamily complexes, and religious institutions, these disputes can halt your recovery for months or years.

You don’t have to face the insurance company alone.

At Insurance Claim Recovery Support, one of the leading Public Adjusting Firms in Texas, we provide proactive advocacy for policyholders. We are your dedicated advocates, committed to securing every dollar you’re entitled to under your policy.

We have helped property owners across Texas—from Dallas and Houston to Austin, San Antonio, Fort Worth, and Waco—secure the compensation they deserve. Our track record includes settling over $250 million in claims, often for amounts far exceeding the insurer’s initial offer.

We handle the entire claims process, from documenting damages to negotiating with the insurer, so you can focus on your recovery. We work on a contingency basis, meaning we only get paid when you do. Don’t let a claim dispute become a second disaster.

Contact ICRS for a free evaluation of your claims dispute and learn how we can help you secure the maximum settlement without unnecessary litigation.