After the Fire: Understanding Your Claim and Your Team

When fire damages your commercial building or multifamily complex, the path to recovery is complex. Beyond the physical devastation, you face a stressful insurance claims process. This guide empowers property owners to work effectively with fire damage adjusters and secure a fair settlement.

Fact: A fire damage adjuster evaluates property loss after a fire to determine the insurance payout.

A fire damage adjuster is a professional who quantifies the extent of damage from flames, smoke, and water. Understanding their role is crucial for your financial recovery.

Myth: All fire damage adjusters work for you.

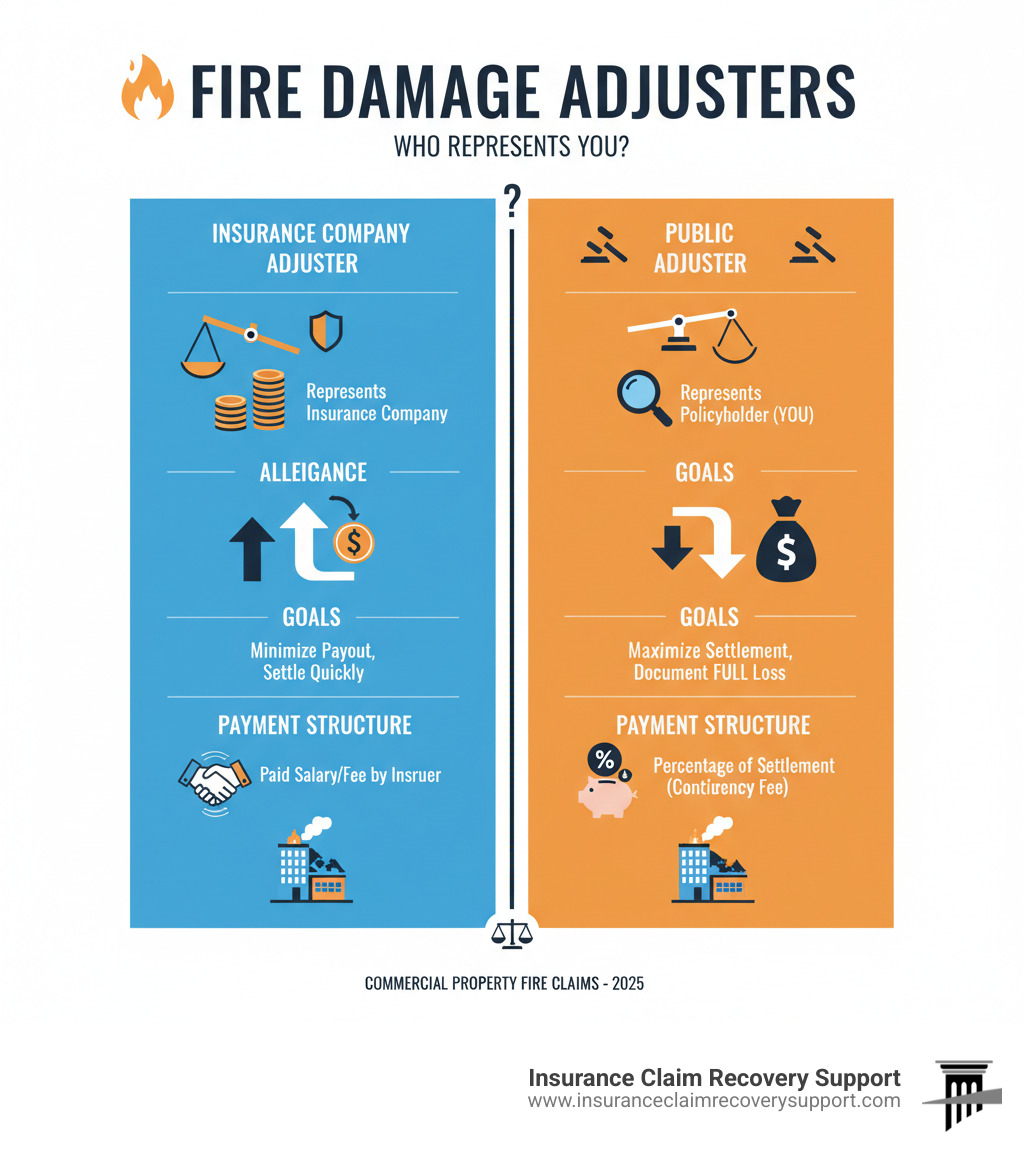

This is untrue. There are two types of adjusters with very different loyalties:

- Insurance Company Adjusters: Employed or hired by your insurer, their goal is to assess damage while protecting the company’s financial interests. Their primary duty is to their employer.

- Public Adjusters: Hired exclusively by you, the policyholder. A public adjuster is your advocate, working to document all losses and negotiate with the insurer to maximize your settlement.

Scott Friedson is a Multi-State Licensed Public Adjuster and CEO of Insurance Claim Recovery Support (ICRS) LLC. With over 15 years of experience, he specializes in helping commercial and multifamily property owners steer complex fire damage claims.

Company Adjuster vs. Public Adjuster: Who Works for You?

Understanding this difference is the first step in protecting your interests. It’s not just semantics; it’s about who represents you.

| Feature | Insurance Company Adjuster | Public Adjuster |

|---|---|---|

| Allegiance | Works for the insurance company | Works exclusively for the policyholder |

| Goal | Assess damage, settle claims, minimize company payout | Assess damage, maximize policyholder’s settlement |

| Payment | Salary or fee from the insurance company | Contingency fee (percentage of the settlement received by policyholder) |

| Expertise | Represents the insurer’s interests | Advocates for you, the policyholder |

While an insurance company adjuster is a skilled professional, they are ultimately looking out for their employer’s bottom line. A public adjuster’s sole allegiance is to you. At Insurance Claim Recovery Support, our goal is to get you the highest possible payout. Statistics show that policyholders who hire a public adjuster may see settlements increase by over 700%. We work on a contingency basis, so we only collect fees after securing your settlement. Learn more about your rights at Fire Damage Public Adjuster.

The First 48 Hours: Critical Steps for Property Owners

The actions you take immediately after a fire can significantly impact your claim. Once authorities clear the scene, a critical phase begins.

- Prioritize Safety and Secure the Property: Prevent further damage by boarding up windows or covering roofs. Document all temporary repairs and keep receipts.

- Document Everything: Use your smartphone to take extensive photos and videos of all damage before any cleanup begins. This includes not just burned areas, but also smoke, soot, and water damage from firefighting efforts. This evidence of Fire Damage is crucial.

- Notify Your Insurance Company: Report the fire to your insurance provider with your policy number and a brief description of the damage.

- Preserve Evidence: Do not discard damaged items. Your adjuster needs to inspect them. Be aware of potential hazards like Asbestos After a Fire in older buildings.

- Start a Communication Log: Keep a detailed record of all interactions with your insurance company, including dates, names, and topics discussed. Save all receipts for fire-related expenses.

The Fire Damage Claims Process: A Step-by-Step Overview

Navigating a fire damage claim can be a maze. Here’s a general overview:

- Initial Report: You formally notify your insurer, who assigns their own adjuster to your claim.

- Damage Assessment: The insurance company’s adjuster inspects the property. A public adjuster conducts their own independent, more thorough assessment to find damages the company adjuster might miss.

- Claim Documentation: The insurer’s adjuster prepares a report and an initial settlement offer. Your public adjuster prepares a comprehensive claim package with detailed estimates and documentation of all losses, including business interruption.

- Negotiation: The insurer’s initial offer is often lower than what you need. Your public adjuster negotiates directly with the insurance company, using expert documentation to advocate for a fair settlement.

- Settlement: Once an amount is agreed upon, you sign a release and funds are disbursed, allowing you to begin restoration.

Simple claims may resolve in weeks, but complex commercial property claims can take many months. Having an expert on your side can streamline the process and lead to a more favorable outcome.

How a Public Fire Damage Adjuster Maximizes Your Settlement

When fire devastates your commercial property, our goal as your public fire damage adjuster is to be your dedicated advocate. We work to ensure you receive the maximum settlement your policy allows. We understand the Texas insurance claim process, whether your property is in Austin, Dallas, Houston, or San Antonio. Our local knowledge and nationwide experience mean we can steer complex situations on your behalf.

At Insurance Claim Recovery Support, we specialize in helping owners of commercial buildings, multifamily HOAs, and apartment complexes. For these properties, expert representation is essential. We focus on maximizing your payout, providing expert representation, interpreting complex policy language, and reducing your stress. This proactive approach leads to higher settlements and a faster recovery. Learn more at Fire Insurance Public Adjuster and Fire Insurance Claim.

Comprehensive Loss Assessment: Documenting Fire, Smoke, and Water Damage

One of the most critical services we provide is a complete and detailed assessment of your losses. Fire damage is more than what the flames touched; it’s a complex mix of destructive forces.

We document structural damage, working with engineers to determine the exact cost to rebuild to current codes. We also carefully document smoke and soot penetration, which can cause discoloration, odors, and contaminate HVAC systems far from the fire’s origin. Finally, we assess water damage from firefighting, which can lead to mold and further structural issues.

We specialize in hidden damage detection, using tools like thermal imaging and 3D scanners to find moisture in walls and create detailed models of the damage, ensuring nothing is overlooked.

For commercial properties, our assessment also covers:

- Business Interruption: We work with forensic accountants to accurately calculate lost income and extra expenses, ensuring these vital losses are part of your claim.

- Detailed Inventory Creation: We create a thorough, itemized list of all contents, equipment, and stock, including replacement values, to ensure you are fairly compensated.

Our comprehensive approach ensures every aspect of the damage is found and properly documented, leading to a more accurate and complete claim.

Strategic Negotiation: The Key to a Fair Payout

After documenting the damage, we begin strategic negotiations with your insurance company. We ensure your claim aligns with your policy’s terms, whether it’s Replacement Cost Value (RCV), which covers the cost to replace items new, or Actual Cash Value (ACV), which is replacement cost minus depreciation. We also fight to include code upgrade coverage, as repairs often require bringing your building up to current building codes at a substantial cost.

We bring professional parity to the table, speaking the same language as the insurance company’s adjusters but with your interests at heart. We prepare a detailed claim package with precise estimates, photos, and expert reports. If the insurer’s offer is too low, we are prepared to defend the claim with strong evidence. This advocacy is especially vital for complex claims, like those for apartment complexes. Learn more about Simplifying Apartment Damage Fire Insurance Claims: Why an Experienced Public Adjuster is Essential.

Avoiding Common Pitfalls and Costly Litigation

Navigating a fire damage claim is full of potential traps that can lead to a lower settlement or lengthy disputes. We help you avoid common pitfalls like accepting the first lowball offer, having your claim undervalued, or suffering from unreasonable delays.

Public Adjuster vs. Lawsuit:

When a claim is undervalued or denied, many property owners consider a lawsuit. However, litigation can be a long, expensive, and emotionally draining process. Our role as your public adjuster is to prevent the need for it. We build a strong, well-documented claim and negotiate aggressively from the start. We aim to resolve disputes through negotiation and the appraisal process—a faster, less confrontational method where neutral parties determine the fair value of the loss. By hiring a public adjuster early, you significantly reduce the chances of needing to pursue costly litigation. We are experts in handling the Fire Claims Adjuster process and protecting your rights.

Your Questions About Hiring a Public Adjuster Answered

After a fire at your commercial property, you likely have questions about the insurance process, the costs, and how quickly you can recover. We’re here to provide clear answers for property owners in Texas cities like Fort Worth, Houston, and San Antonio. For more details, check out our Fire Insurance Claims Webinar.

When should I hire a public adjuster for my commercial property?

Ideally, you should contact a public adjuster immediately after the fire, as soon as it’s safe. Your insurance company sends their own fire damage adjuster right away, and having your own expert from day one ensures you’re on equal footing.

Early involvement allows us to:

- Protect Your Interests: We guide you through the first steps, helping you avoid common mistakes that could harm your claim.

- Ensure Proper Documentation: We conduct a comprehensive assessment immediately, preserving crucial evidence before it’s lost during cleanup.

- Handle Complex Claims: For large properties like an Apartment Fire, early partnership ensures every detail is managed effectively.

If you’ve already started a claim and feel the offer is too low or the process is stalled, it’s not too late. We can step in to review your claim and negotiate for the compensation you deserve.

What are the fees for a public fire damage adjuster?

We operate on a contingency fee basis, so you face no upfront costs.

- No Upfront Fees: You pay nothing out of pocket to retain our services.

- Percentage of the Settlement: Our fee is a small, pre-agreed percentage of the final settlement we secure for you, typically ranging from 10% to 15%.

- Aligned Interests: This structure ensures our success is tied directly to yours. We only get paid when you get paid.

- Complete Transparency: We discuss our fee structure clearly before any agreement is made.

Most property owners find that the significantly higher settlements we achieve far outweigh our fee. Our goal is to ensure you receive a just settlement that covers all your losses. You can learn more at Fire Damage Public Adjuster.

How does a public adjuster help my business recover faster?

After a fire, time is money. A public adjuster not only gets you a better settlement but also accelerates your business’s recovery.

Here’s how we help you get back on your feet faster:

- Accelerated Resolution: Our expertise in presenting a well-supported claim reduces the back-and-forth negotiations and delays.

- Handles All Communication: We take over all communication with your insurer, freeing you to focus on your business and rebuilding.

- Manages Documentation: We handle the extensive paperwork, from detailed inventories to complex repair estimates, preventing errors and ensuring nothing is missed.

- Prevents Costly Mistakes: We act as your safety net, preventing errors that could reduce, delay, or even deny your claim.

- Reduces Stress for Owners: By shouldering the burden of the claims process, we reduce the emotional toll on you, allowing you to focus on running your business.

At Insurance Claim Recovery Support, we are your dedicated advocates. We work to ensure your commercial property, multifamily HOA, or apartment complex receives the full compensation it deserves. Our team serves property owners across Texas, including Austin, Dallas, Fort Worth, San Antonio, Houston, and surrounding areas.

If you’re dealing with fire damage, don’t face the insurance company alone. Contact us for a free consultation in Tarrant County to learn how we can help you recover faster and smarter.

Visit https://www.insuranceclaimrecoverysupport.com/ to learn more about our services.