Introduction

Does insurance cover tornado damage? The short answer is yes, most homeowners insurance policies do cover tornado damage, but the specifics can vary greatly depending on your policy’s terms and conditions. Here’s what you need to know:

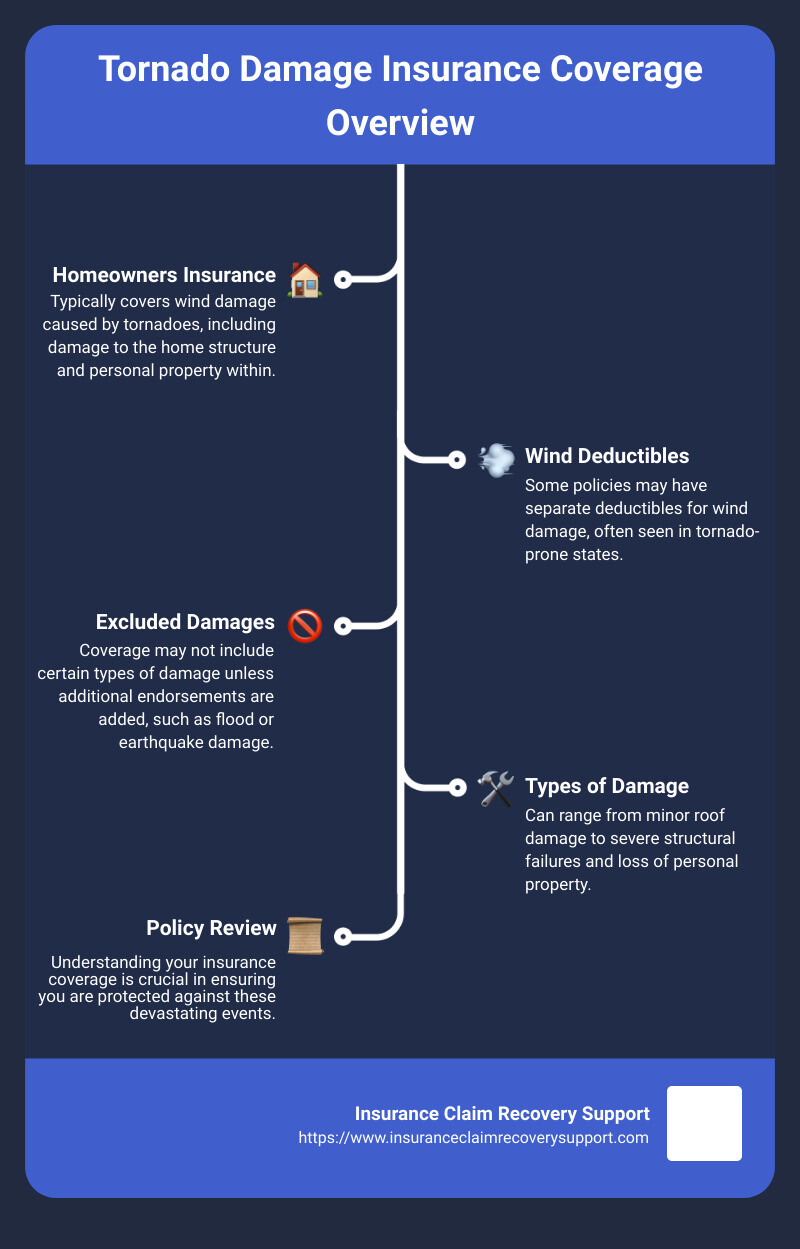

- Homeowners insurance: Typically covers wind damage caused by tornadoes, including damage to the home structure and personal property within.

- Wind deductibles: Some policies may have separate deductibles for wind damage, often seen in tornado-prone states.

- Excluded damages: Coverage may not include certain types of damage unless additional endorsements are added, such as flood or earthquake damage.

When a tornado strikes, it can cause a range of destruction from minor roof damage to severe structural failures and loss of personal property. Understanding your insurance coverage is crucial in ensuring you are protected against these devastating events.

My name is Scott Friedson, a Multi-State Licensed Public Adjuster and CEO of ICRS LLC. With over 500 large loss claims settled, worth more than $250 million, I’ve helped policyholders get fair settlements for tornado, hail, hurricane, and various other property damage claims.

Transitioning into the next paragraph, we will delve deeper into the specifics of homeowners insurance and the kinds of tornado damage it typically covers.

Does Insurance Cover Tornado Damage?

Understanding Homeowners Insurance and Tornado Coverage

Homeowners insurance typically includes coverage for tornado damage, especially damage caused by high winds. Wind is the primary cause of damage during a tornado, and most standard homeowners insurance policies cover wind-related damages. This means that if a tornado damages your home, your policy will likely help pay for repairs or rebuilding.

Dwelling coverage is a key part of homeowners insurance. It covers the structure of your home and any attached structures, like decks or garages. For example, if a tornado rips through your neighborhood, damaging your roof and walls, dwelling coverage would help pay for the repairs.

Personal property coverage is another important component. It covers your belongings if they are damaged or destroyed by a tornado. Some policies might provide the replacement cost of your items, while others might only cover the actual cash value, factoring in depreciation.

While tornado damage is generally covered, every policy is different. Some policies might have exclusions for certain types of wind damage or might require separate windstorm coverage, especially in tornado-prone areas. Always review your policy documents or speak with your insurance agent to understand your specific coverage.

Deductibles and Coverage Limits for Tornado Damage

When it comes to tornado damage, understanding your deductibles and coverage limits is crucial. A deductible is the amount you pay out-of-pocket before your insurance kicks in. For tornado damage, this could be a windstorm deductible, which is often a percentage of your home’s insured value rather than a flat dollar amount.

For example, if your home is insured for $300,000 and you have a 2% windstorm deductible, you would need to pay the first $6,000 of damage out-of-pocket before your insurance covers the rest. This percentage-based deductible can significantly impact your out-of-pocket costs, especially in areas prone to severe tornadoes.

Coverage limits are the maximum amounts your insurance will pay for a covered loss. These limits apply to both your dwelling and personal property coverage. It’s essential to know these limits to ensure you have enough coverage to rebuild your home and replace your belongings if a tornado causes significant damage.

Policy review is an important step in tornado preparedness. Regularly reviewing your policy with your insurance agent can help you understand your deductibles, coverage limits, and any exclusions. This ensures you are adequately covered and can help you avoid surprises during the claims process.

In the next section, we will explore the different types of damages covered by homeowners insurance during a tornado, including roof damage, structural damage, and fallen trees.

Types of Damages Covered by Homeowners Insurance in a Tornado

When a tornado hits, the damage can be extensive. Understanding what your homeowners insurance covers is crucial. Here, we’ll break down the types of damages typically covered, including wind and water damage.

Tornado Damage Caused by Wind

Wind is the primary cause of damage during a tornado. Here are some common types of wind-related damages and how they are covered:

Roof Damage

– Most common and visible damage: Tornadoes can strip off roofing materials or lift entire roofs off the structure.

– Dwelling coverage: This part of your policy helps pay for repairs to the structure of your home, including the roof.

– Repair costs: Depending on your policy, you may be reimbursed for the cost to repair or replace your roof. Some policies cover the replacement cost, while others may only cover the actual cash value, which factors in depreciation.

Structural Damage

– Walls and foundations: Tornadoes can cause walls to buckle and foundations to shift.

– Dwelling coverage: This also covers the cost to repair or rebuild the structural components of your home.

– Professional assessments: It’s essential to get a professional assessment to ensure safety and proper repair.

Fallen Trees

– Tree removal: Most policies cover the removal of trees that fall on your house or other covered structures.

– Blocked driveways: Some policies also cover tree removal if the tree blocks your driveway or handicap access ramp.

– Out-of-pocket costs: If a tree falls without causing damage to a covered structure, you’ll likely have to pay for removal out of pocket.

Tornado Damage Involving Water

While wind is the primary concern, water damage can also be significant during a tornado. Here’s how water-related damages are typically handled:

Rainwater Entry

– Roof and window breaches: Tornadoes can cause roofs and windows to fail, leading to rainwater entering the home.

– Dwelling coverage: This often covers the cost to repair water damage resulting from wind-driven rain entering through a damaged roof or window.

– Policy specifics: It’s crucial to review your policy to understand the specifics of water damage coverage. Some policies may have exclusions or limitations.

Interior Water Damage

– Secondary damage: Once water enters, it can damage ceilings, walls, and personal property.

– Personal property coverage: This part of your policy helps replace or repair items inside your home that are damaged by water.

– Mold prevention: Promptly addressing water damage can prevent mold, which may not be covered by your policy if deemed a result of neglect.

Understanding the nuances of your homeowners insurance can help you navigate the aftermath of a tornado more effectively. In the next section, we’ll discuss additional coverage options for those living in tornado-prone areas, including flood and windstorm insurance.

Additional Coverage Options for Tornado-Prone Areas

Importance of Comprehensive Coverage

Living in a tornado-prone area means you need to be extra prepared. Standard homeowners insurance usually covers wind damage from tornadoes, but you might need additional coverage to fully protect your home and belongings.

Flood Insurance: Tornadoes often bring heavy rain, which can lead to flooding. Standard homeowners insurance typically doesn’t cover flood damage. You may need a separate flood insurance policy, available through the National Flood Insurance Program (NFIP) or private insurers. Flood insurance can cover the cost of repairing your home and replacing damaged belongings.

Windstorm Insurance: While many homeowners policies cover wind damage, some may have exclusions, especially in high-risk areas. Windstorm insurance can fill this gap, ensuring that your home is protected from the high winds and flying debris that tornadoes bring.

National Flood Insurance Program (NFIP): Managed by FEMA, the NFIP offers flood insurance to property owners in participating communities. This program can be crucial for those in areas where tornadoes and flooding often go hand-in-hand. Learn more about NFIP.

Replacement Cost vs. Actual Cash Value: Understanding these terms can make a big difference in your coverage.

-

Replacement Cost Value (RCV): This coverage pays to replace damaged property with new items of similar kind and quality, without deducting for depreciation. For example, if your 10-year-old roof is destroyed, RCV would cover the cost of a new roof.

-

Actual Cash Value (ACV): This coverage pays what your property is worth today, factoring in depreciation. Using the same example, ACV would pay the value of your 10-year-old roof, which is likely much less than the cost of a new one.

Personal Property Protection: Your personal belongings are also at risk during a tornado. Personal property coverage can help replace items like furniture, electronics, and clothing. Some policies offer RCV for personal belongings, while others offer ACV. Make sure you know which one you have.

Table: RCV vs. ACV

| Coverage Type | What It Covers | Example |

|---|---|---|

| RCV | New items of similar kind and quality | New roof for old |

| ACV | Current value, considering depreciation | Value of a 10-year-old roof |

Having the right coverage can make all the difference when a tornado hits. Check your policy and consider additional coverage options to ensure you’re fully protected.

In the next section, we’ll discuss how to prepare for a tornado, including safety and insurance tips.

Preparing for a Tornado: Insurance and Safety Tips

How to File a Tornado Damage Claim Successfully

When a tornado hits, knowing how to navigate the insurance process can make recovery smoother. Here’s a step-by-step guide to help you file your tornado damage claim successfully.

Safety Preparations

- Inspect Your Home: Before entering, check for structural damage. Wait for local authorities to declare it safe.

- Avoid Hazards: Steer clear of downed power lines and be cautious of debris, broken glass, and exposed nails. Wear sturdy shoes, long sleeves, and gloves.

- Shut Off Utilities: If you suspect gas leaks or electrical issues, shut off power, gas, and propane tanks—only if it’s safe to do so.

Insurance Checklist

- Review Your Policy: Understand what your insurance covers, including wind damage and personal property.

- Document Everything: Take detailed photos and videos of the damage from multiple angles. This helps in providing clear evidence for your claim.

- Home Inventory: Use your home inventory to list all damaged items. Include purchase dates and costs if possible.

- Emergency Expenses: Keep receipts for temporary living costs like hotel bills and meals. These might be reimbursed under additional living expenses coverage.

Emergency Contacts

- Local Authorities: Have the contact information for local emergency services.

- Insurance Company: Keep your insurance provider’s contact details handy.

- Utility Companies: Note the numbers for your gas, electric, and water providers to report outages or leaks.

Claim Process

- Secure Your Property: Board up openings and cover exposed areas to prevent further damage and support your claim.

- File Promptly: Contact your insurance provider as soon as possible to initiate the claim. You can file online, via an app, or by phone.

- Professional Assessments: Consider hiring professionals like roof inspectors or structural engineers for detailed damage reports.

- Repair Estimates: Obtain repair estimates from licensed contractors. Multiple estimates can help in negotiations with your insurer.

- Stay in Touch: Maintain regular communication with your claims adjuster. Provide any additional information or documents they request promptly.

Documentation

- Photos and Videos: Capture clear, detailed images of all damaged areas and items.

- Professional Reports: Include assessments from experts to substantiate your claim.

- Detailed Inventory: List all damaged or destroyed items, including their value and any receipts.

- Repair Estimates: Provide detailed estimates from contractors for repairs.

Insurance Claim Recovery Support

Consider hiring a public adjuster if your home has extensive damage. Public adjusters work for you, not the insurance company, and can help maximize your claim settlement. They typically charge 10% to 20% of the insurance settlement but can be invaluable in complex cases.

By following these steps, you can improve your chances of receiving fair compensation for your losses, helping you recover more efficiently after a tornado.

In the next section, we’ll explore the importance of comprehensive coverage and how it can protect you in tornado-prone areas.

Conclusion

Navigating the aftermath of a tornado can be overwhelming. From assessing the damage to filing insurance claims, the process is complex and often stressful. This is where Insurance Claim Recovery Support steps in as your trusted partner.

Maximizing Settlements

One of our primary goals is to maximize your settlement. Tornado damage can be extensive, affecting roofs, windows, structural integrity, and personal property. We understand the intricacies of insurance policies and are adept at documenting and arguing for the fullest possible compensation.

For example, consider a homeowner in Dallas who faced $50,000 worth of tornado damage. By meticulously documenting every aspect of the damage and negotiating with the insurer, we helped them secure a settlement that fully covered their repair costs, minus the deductible.

Policyholder Advocacy

We pride ourselves on advocating for policyholders. Tornadoes can leave you feeling vulnerable, but you don’t have to navigate the insurance maze alone. Our experienced public adjusters work for you, not the insurance company, ensuring that your claim is not undervalued or unfairly denied.

In Texas, cities like Austin, Houston, and San Antonio are particularly prone to severe weather. Our deep understanding of Texas’ unique weather patterns makes us the perfect ally in storm damage claims.

Why Choose Insurance Claim Recovery Support?

- Expertise: We specialize in Texas weather-related claims, with a keen focus on tornadoes.

- Commitment: Our goal is to ensure you receive a fair and prompt settlement.

- Support: We stand with property owners in their journey to recovery, providing exceptional service and uncompromising support.

By following these steps and utilizing professional help, you can navigate the insurance claims process more effectively and ensure a fair settlement.

For more information on how we can assist you with your insurance claim, visit our Tornado Damage Claim Service Page. Let us help you navigate the path to recovery.