When Nature Strikes: Understanding the Recent Central Texas Tornado & Hail Event

A recent article from Temple Daily Telegram reports on a confirmed tornado touchdown near Kempner in Lampasas County and severe weather that impacted Central Texas communities on Thursday. Here’s what property owners need to know:

Key Facts About the Central Texas Severe Weather Event:

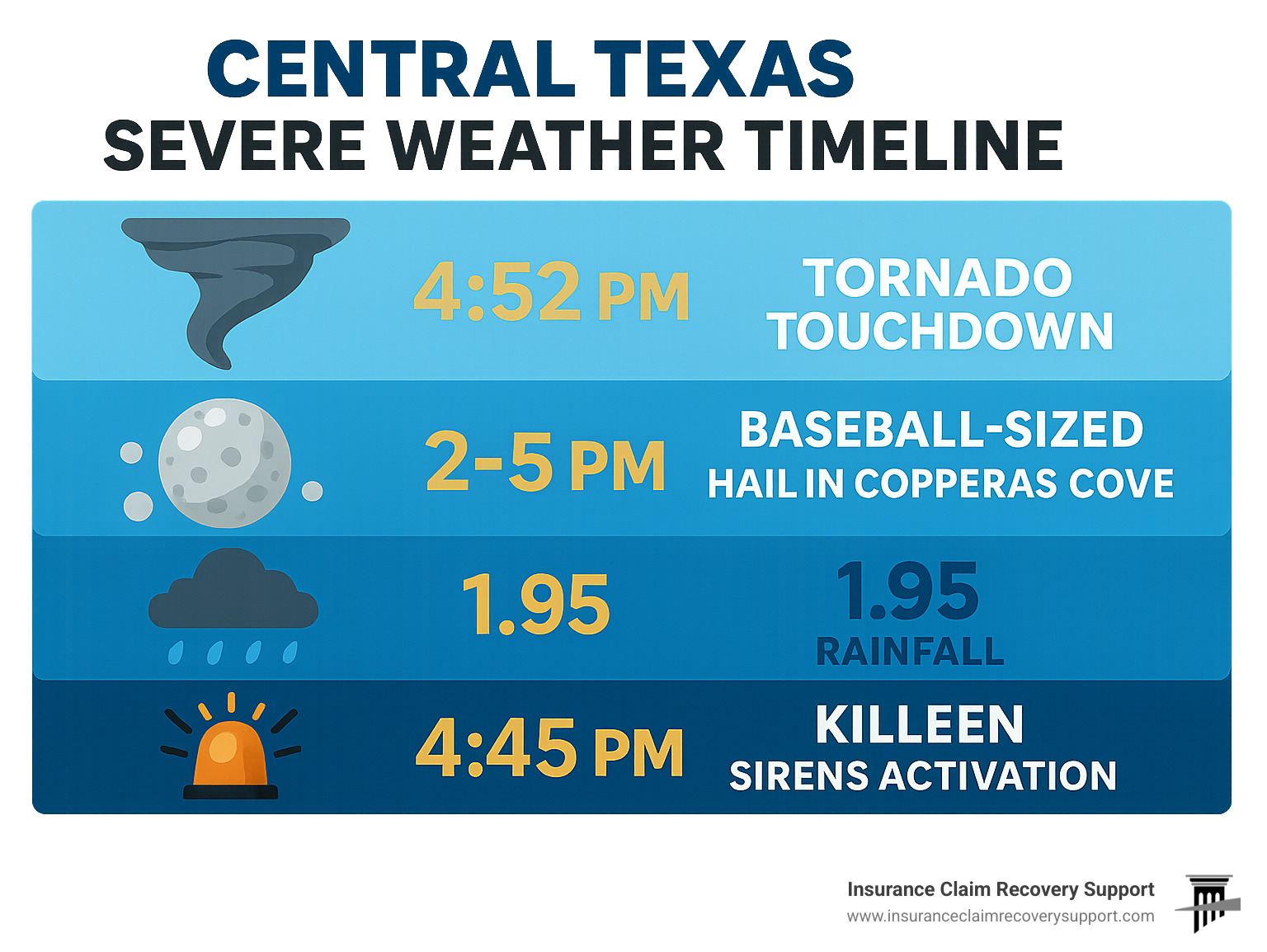

- A tornado touched down near Kempner at approximately 4:52 p.m. Thursday

- Baseball-sized hail pummeled Copperas Cove during the storm

- Copperas Cove received 1.95 inches of rainfall between 2 and 5 p.m.

- Killeen recorded 0.19 inches of rainfall by 5 p.m. with more rain continuing

- Killeen emergency sirens activated around 4:45 p.m. warning of large hail

- The National Weather Service confirmed the tornado was real, not a false alarm

When severe weather strikes like this, property owners face a challenging road to recovery. As Central Texans assess the aftermath of Thursday’s tornado and hailstorm, many will soon be navigating the complex world of insurance claims.

I’m Scott Friedson, a multi-state licensed Public Adjuster and CEO of Insurance Claim Recovery Support LLC, who has handled numerous tornado and hail damage claims similar to those that will arise from the events reported in the Temple Daily Telegram.

Simple word guide for property owners:

- how much does it cost to repair tornado damage

- does insurance cover tornado damage

- window tornado damage insurance claim

Timeline of Thursday’s Severe Weather Near Kempner, Copperas Cove, and Killeen

Central Texas residents experienced a dramatic weather event on Thursday when powerful storms swept through the region. According to the National Weather Service, a tornado touched down near Kempner in Lampasas County at exactly 4:52 p.m., marking the most intense moment in an afternoon filled with severe weather.

“This was a confirmed tornado, not just a warning,” explained meteorologist Hunter Reeves of the National Weather Service. “We had visual confirmation and radar signatures that showed rotation consistent with tornadic activity.”

While experts are still working to determine the official EF-rating (Improved Fujita scale), the storm system delivered much more than just spinning winds. Copperas Cove took an especially hard hit, with a drenching 1.95 inches of rainfall between 2 and 5 p.m. Even more dramatic, baseball-sized hail pounded homes, vehicles, and businesses throughout the area.

In Killeen, the situation developed more gradually but still prompted action from emergency officials. By 5 p.m., the city had recorded a more modest 0.19 inches of rainfall, though heavy precipitation continued well after this measurement. Most notably for residents, emergency sirens blared to life around 4:45 p.m. not for the tornado itself, but specifically to warn about the approaching large-hail threat.

Storm Chronology & Size Details

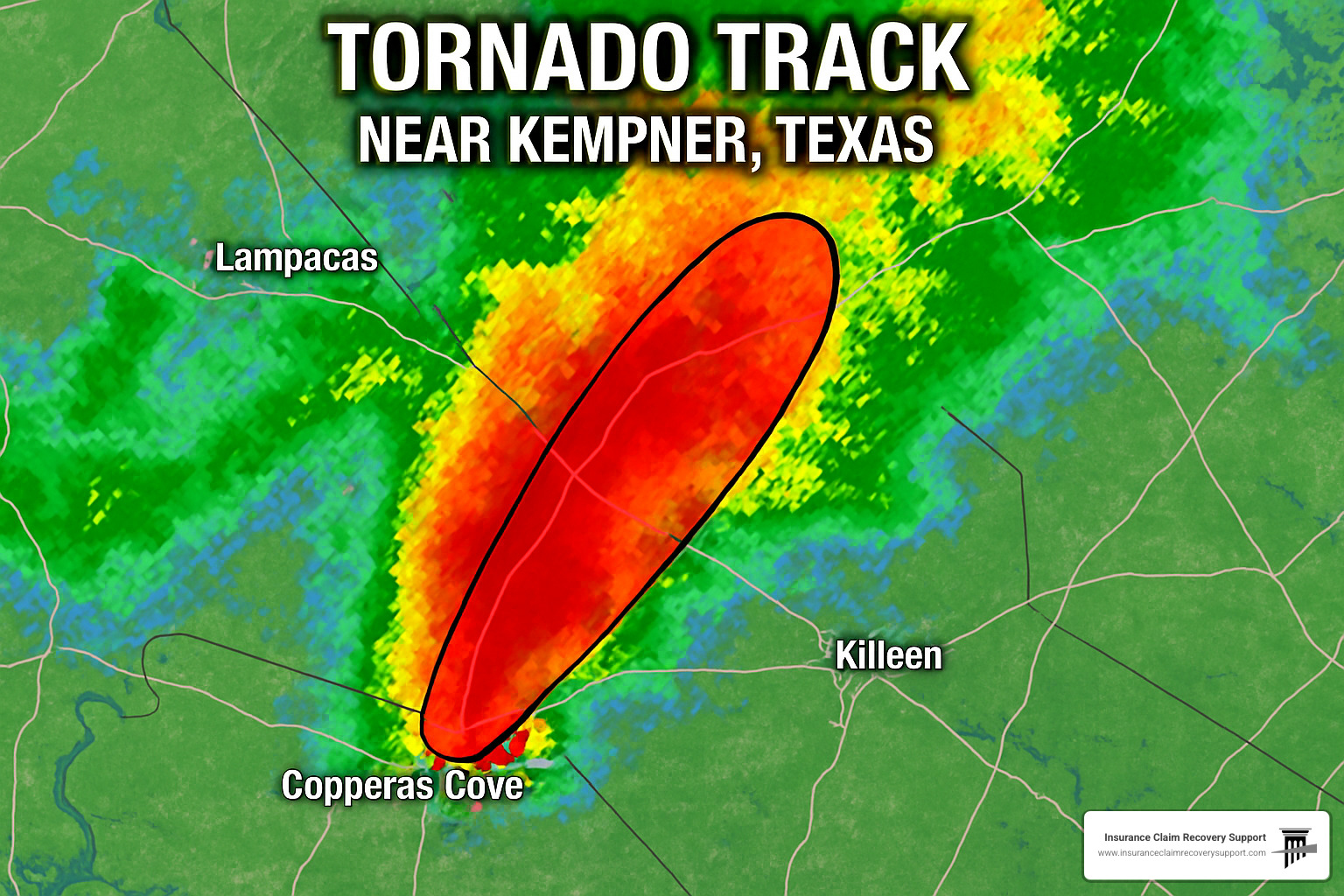

The Kempner tornado was part of a larger weather system that meteorologists had been monitoring throughout the day. While the complete assessment is still underway, early reports suggest the tornado was on the ground for approximately 3-5 minutes.

“We’re still gathering data on the exact path width and length,” Reeves noted. “Our survey teams are using both ground assessment and aerial imagery to map the precise track and intensity.”

What we do know is that the storm system developed with alarming speed, with conditions worsening from concerning to dangerous in less than an hour. The NWS had placed the region under tornado watches earlier in the day, upgrading to warnings when rotation became evident on radar.

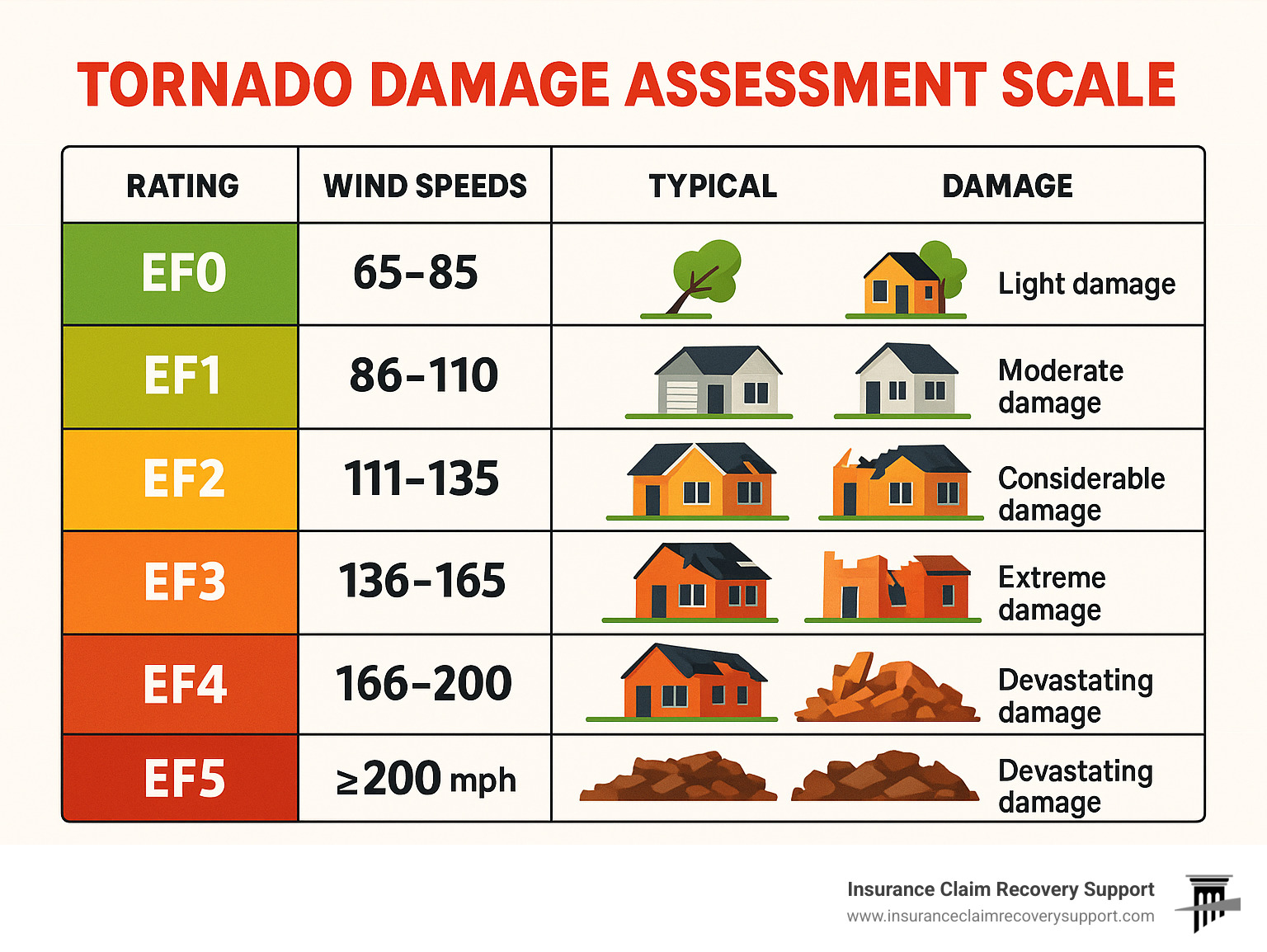

The NWS survey plan includes a thorough ground assessment examining structural damage, vegetation patterns, and debris distribution all crucial factors in determining the final EF-rating. This careful process typically requires 24-48 hours to complete, with verified findings released to the public afterward.

Hail & Rain Totals by Community

The severe weather affected different communities in varying ways across the region, with some areas primarily experiencing heavy rainfall while others faced both drenching precipitation and damaging hail.

| Community | Rainfall Total | Hail Size | Time Period |

|---|---|---|---|

| Copperas Cove | 1.95 inches | Baseball-sized (2.75″) | 2-5 p.m. |

| Killeen | 0.19+ inches | Warning for large hail | Measurement at 5 p.m. |

| Kempner | Not specified | Not specified | Tornado at 4:52 p.m. |

Copperas Cove clearly received the heaviest rainfall, with nearly two inches pouring down in just three hours. This rapid deluge created significant flash flooding concerns, especially in areas with poor drainage or near creek beds.

The hail reported in Copperas Cove reached baseball size approximately 2.75 inches in diameter. Hail this large can cause devastating damage to roofing materials, break windows, severely dent vehicles, and destroy outdoor furniture. For perspective, the National Weather Service considers hail “severe” when it reaches just one inch in diameter, making the Copperas Cove hail nearly three times that threshold.

In Killeen, rainfall measurements were lighter when recorded, but emergency officials were concerned enough about the approaching hail threat to activate the city’s warning sirens at 4:45 p.m. This quick action gave residents approximately 7-10 minutes to seek shelter before the most intense portion of the storm arrived.

Key Facts You Need to Know About the Central Texas Tornado

The recent tornado that touched down near Kempner wasn’t just a warning or a close call – it was the real deal. Weather officials have confirmed this wasn’t a false alarm, which is crucial information for both emergency management credibility and property owners who may need to file insurance claims.

According to reports, the National Weather Service verified a tornado touched down in Lampasas County near Kempner at approximately 4:52 p.m. on Thursday. This official confirmation matters tremendously for insurance purposes, since many policies treat tornado damage differently than general wind damage.

The hail that fell during this storm was truly massive. To put it in perspective, the baseball-sized hail reported in Copperas Cove (approximately 2.75 inches in diameter) can do serious damage. This isn’t your typical “pinging on the roof” kind of hail – we’re talking about ice chunks capable of:

- Punching through roof shingles

- Damaging the underlying roof decking

- Breaking windows

- Causing significant damage to both homes and businesses

This recent outbreak isn’t isolated – it follows a pattern of increasingly severe weather events in Central Texas. In 2021, the Salado area experienced a devastating EF-3 tornado that damaged or destroyed dozens of homes. Earlier in 2024, parts of Bell County saw significant hailstorms that resulted in millions of dollars in insurance claims. These recurring events highlight why understanding your insurance coverage before disaster strikes is so important.

Scientific research from the National Severe Storms Laboratory continues to improve our understanding of tornado intensity and formation, helping communities better prepare for these destructive events.

What Happened According to Reports?

The National Weather Service meteorologist Hunter Reeves confirmed the tornado touchdown near Kempner, validating the emergency alerts issued for the area. The tornado was part of a severe weather system that brought not only spinning winds but also significant rainfall and large hail to communities across Central Texas.

In Copperas Cove, between 2 and 5 p.m., the city received a drenching 1.95 inches of rainfall along with those baseball-sized hail stones. This one-two punch of heavy rain and large hail creates multiple pathways for property damage – from water getting into your home to impact damage on roofs, siding, and windows.

Killeen residents heard emergency sirens activated around 4:45 p.m., but interestingly, these were specifically to warn of the approaching large-hail threat, not the tornado itself. By 5 p.m., Killeen had recorded 0.19 inches of rainfall, though heavy rain continued falling after this measurement.

The silver lining in all this? No injuries or fatalities were reported from the severe weather, which is truly fortunate given the potential for harm from both tornadic winds and large hail. However, property damage assessments were still ongoing when this information was released.

How Does This Compare to Past Storms?

While Thursday’s weather event was significant, placing this storm in historical context helps property owners understand the potential scope of damage and recovery they might face.

The tornado that touched down near Kempner appears less widespread than the April 2021 Salado tornado, which was rated as an EF-3 with winds up to 165 mph. That powerful storm carved a path 13 miles long and up to half a mile wide, damaging or destroying more than 60 homes and structures. The aftermath resulted in insurance claims totaling tens of millions of dollars.

However, the hail reported in Copperas Cove rivals some of the largest seen in Central Texas in recent years. The baseball-sized hail (approximately 2.75 inches) approaches the size of the softball-sized hail (4+ inches) that struck parts of Bell County in March 2024, which resulted in widespread roof damage and thousands of insurance claims.

What makes Thursday’s event particularly notable is the combination of threats – tornado, heavy rainfall, and large hail – all affecting the region within a compressed timeframe. This multi-hazard scenario creates complex damage patterns that can complicate insurance claims, as adjusters must determine which specific peril caused each type of damage.

When storms like this hit, having experienced help with the claims process can make all the difference between a fair settlement and one that leaves you struggling to fully repair your property.

Assessing the Damage: What the National Weather Service and Local Authorities Are Doing

In the aftermath of Thursday’s severe weather, teams are now fanning out across Central Texas communities to measure the storm’s impact. The National Weather Service has boots on the ground near Kempner, where skilled meteorologists are carefully piecing together the tornado’s story.

“Our survey teams blend old-school detective work with modern technology,” explained a NWS representative. “We’re looking at telling clues like twisted trees, damaged buildings, and debris scatter patterns to determine just how strong this tornado was.”

The response hasn’t been limited to weather experts. Lampasas County Sheriff’s deputies have increased their presence in hard-hit neighborhoods, offering a reassuring presence while protecting vulnerable properties. Over in Copperas Cove, the city’s emergency management team is orchestrating a complex dance with utility companies to restore power and water where Thursday’s fury knocked out essential services.

Road crews are tackling the maze of fallen branches and scattered debris, clearing paths for both emergency responders and returning residents. This coordinated effort shows the remarkable resilience of Central Texas communities when nature strikes.

Next Steps in Official Damage Surveys

The NWS investigation isn’t just about satisfying scientific curiosity—it’s creating an official record that matters for everyone affected. Their teams are using photogrammetry (a fancy word for measuring things in photographs) to calculate just how fast those devastating winds were whipping.

On the ground, surveyors are getting their boots muddy to verify what satellite images and radar suggested. They’re also mapping “hail scars”—distinctive patterns where large hailstones shredded vegetation, leaving behind evidence of the storm’s path and intensity.

Within the next few days, we can expect the complete assessment report, including the official EF-rating that classifies exactly how powerful this tornado was. This isn’t just for the weather history books—it’s documentation that can make a real difference for homeowners navigating their insurance claims.

Local Relief & Safety Resources

As the initial shock wears off, Central Texas communities are rallying to help those hit hardest by Thursday’s weather. A network of support is already taking shape:

Lampasas County Emergency Management has opened its doors to displaced residents while connecting homeowners with organizations that can provide immediate relief. In Copperas Cove, a dedicated cleanup hotline is helping officials track dangerous debris and damaged infrastructure that needs urgent attention. Meanwhile, the Central Texas Volunteer Center is matching willing hands with those who need help most—particularly elderly and disabled residents who need assistance with emergency roof tarping and clearing debris.

For those needing immediate assistance, here are the essential county emergency contacts:

- Lampasas County Emergency Management: (512) 556-8271

- Copperas Cove Emergency Management: (254) 547-2514

- Killeen Emergency Management: (254) 501-7706

While these resources address immediate needs, property owners should simultaneously begin documenting damage and contacting insurance providers. Safety must come first during this process—avoid entering unstable buildings, stay well clear of any downed power lines, and use proper protective equipment when handling debris.

Thorough documentation now can save tremendous headaches later when it’s time to file your insurance claim. Your smartphone camera may be the most valuable tool you own in these first critical days after the storm.

From Sirens to Settlements: Navigating Tornado & Wind Insurance in Texas

If you heard those emergency sirens on Thursday, you probably weren’t thinking about insurance policies. But now that the immediate danger has passed, understanding your coverage becomes crucial for recovery.

Most Texas homeowners are surprised to learn their policies have some tricky details when it comes to tornado and hail damage. While standard policies typically cover tornado damage, important gaps often exist. Those beautiful oak trees, your garden shed, or that custom fence might have limited coverage or none at all.

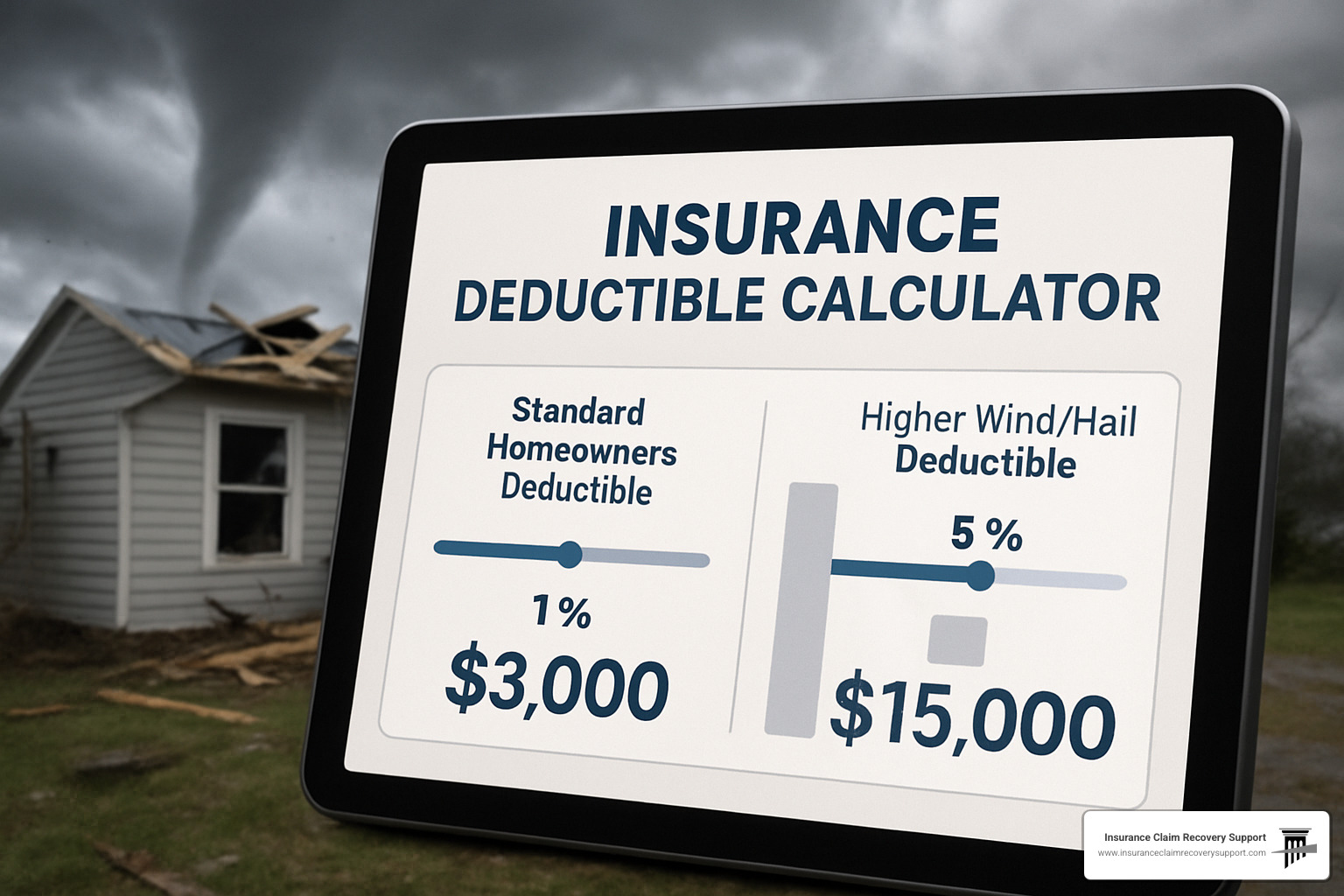

Perhaps the biggest shock for many property owners comes when they find their wind and hail deductible. Unlike the standard $1,000 deductible you might expect, wind and hail claims typically trigger a percentage-based deductible ranging from 1-5% of your home’s insured value. For a $300,000 home, that means you could be responsible for the first $3,000 to $15,000 in damages before your insurance kicks in!

“When people see that percentage deductible after a storm, it’s often the first time they realize what they actually signed up for,” explains Scott Friedson, CEO of Insurance Claim Recovery Support. “That 2% might not have seemed significant when you bought the policy, but it feels very different when you’re facing thousands in out-of-pocket costs.”

Timing matters too. Most Texas policies require you to file claims promptly – typically within 30-60 days of the damage. The challenge? Some tornado and hail damage isn’t immediately obvious. A roof might look fine from the ground but have significant structural damage that only becomes apparent months later when leaks develop.

Documentation is your best friend after storm damage. Take clear photos of everything before making repairs, save all receipts for emergency work, and keep detailed notes of every conversation with your insurance company. These records create a vital paper trail if disputes arise later.

Filing a Strong Claim After Tornado or Hail

The moments after finding storm damage can feel overwhelming, but taking the right steps now can make a huge difference in your final settlement.

Start by thoroughly documenting everything with photos and videos before touching anything. Capture multiple angles in good lighting to show the full extent of damage. This visual evidence becomes invaluable if questions arise about what was damaged and how severely.

Next, focus on preventing further damage with temporary measures only. Use tarps, boards, or other short-term solutions to protect your property, but avoid permanent repairs until your insurer has inspected everything. Insurance companies can deny claims if you make permanent changes before their assessment.

Keep every receipt related to your emergency repairs or temporary living arrangements. Many policies include Additional Living Expenses coverage that can reimburse these costs – but only with proper documentation.

When the insurance adjuster visits, be present during the inspection. Walk with them, point out all damage areas, and ask questions about their assessment. This engagement ensures nothing gets overlooked and gives you insight into how they’re evaluating your claim.

Many property owners find value in professional representation through a public adjuster – someone who works exclusively for you, not the insurance company. These licensed professionals understand construction costs, damage assessment techniques, and policy language that can level the playing field in complex claims.

“Insurance companies often send adjusters who specialize in minimizing payouts,” notes Friedson. “Having your own expert who knows exactly what to look for can make a significant difference in your final settlement.”

Understanding Wind & Hail Deductibles

Wind and hail deductibles work differently than what you might expect, and they vary significantly based on your location in Texas. Instead of a flat dollar amount, most policies now feature percentage-based deductibles calculated against your home’s insured value.

For example, if your home is insured for $350,000 with a 2% wind/hail deductible, you’ll be responsible for the first $7,000 in damages before insurance coverage begins. That’s substantially higher than typical $1,000 or $2,500 flat deductibles that apply to other types of claims like fire or theft.

The percentages vary by region:

- Coastal areas: Typically 2-5% of insured value

- Central Texas (including Austin): Usually 1-2%

- North Texas (Dallas-Fort Worth): Commonly 1-3%

Some policies also make distinctions between named storms (like hurricanes) and other wind events (like tornadoes), with higher deductibles for named storms. While this distinction is more common along the coast, it’s increasingly appearing in policies throughout Texas.

Understanding your specific deductible before damage occurs helps you budget appropriately and avoid unwelcome surprises during the claims process. Take a moment to review your declarations page, and if anything seems unclear, contact your agent for clarification.

The complexities of storm damage claims highlight why many property owners seek professional guidance. Having someone who understands the fine print can make all the difference between a denied claim and a fair settlement that truly covers your losses.

Frequently Asked Questions About Thursday’s Tornado, Hail, and Insurance

Did anyone report injuries or fatalities?

Thankfully, the Temple Daily Telegram article indicates there were no reported injuries or fatalities from Thursday’s severe weather event. Despite the frightening combination of tornadic activity and baseball-sized hail, Central Texas communities appear to have escaped without human casualties. This positive news stands in stark contrast to the property damage left in the storm’s wake. Local emergency management teams continue their assessment work, maintaining vigilance as they complete their surveys of affected areas.

What warnings were issued in Killeen and why did the sirens sound?

If you were in Killeen on Thursday afternoon and heard the emergency sirens, you might have wondered about their specific purpose. According to the Temple Daily Telegram report, city officials activated the sirens around 4:45 p.m. – but interestingly, they weren’t warning about the tornado that touched down near Kempner. Instead, the sirens specifically alerted residents to the imminent threat of large hail approaching the city.

This distinction highlights how emergency management officials must often make quick decisions about which specific threats warrant public alerts. In this case, the approaching hail presented a more direct danger to Killeen residents than the tornado, which was tracking through a different area. The sirens gave people precious minutes to move vehicles under cover and ensure they were safely indoors before the hail arrived.

How soon should I contact my insurer after a tornado?

When it comes to tornado or hail damage, time is truly of the essence. You should contact your insurance company within 24-48 hours of the event. This prompt notification isn’t just good practice – it’s often a requirement buried in the fine print of your policy.

Most Texas insurance policies contain specific language requiring “prompt notification” when damage occurs. Waiting too long can potentially give your insurer grounds to question or even deny your claim. Even if you’re unsure about the full extent of your damage, it’s better to start the claim process early rather than delay.

When making that initial call, be prepared with:

- Your policy number and contact information

- The date and approximate time when the damage occurred

- A basic description of what you’ve observed so far

- Any preliminary photos you’ve been able to safely take

- Alternative contact details if you’ve been displaced from your home

Filing a claim starts the official timeline for your insurer’s obligations under Texas insurance regulations. Their clock doesn’t start ticking until you notify them, so prompt action protects your rights and gets the recovery process moving. If you’re overwhelmed by the process, a public adjuster can help guide you through these critical first steps.

Conclusion

The severe weather that swept through Central Texas on Thursday serves as a powerful reminder of nature’s unpredictable force. The confirmed tornado near Kempner, baseball-sized hail pummeling Copperas Cove, and heavy rainfall across the region created a perfect storm of potential property damage, as detailed in the https://www.tdtnews.com/article_1f151d18-4468-5a96-b3a5-daf1d7c05043.html article. Even with sophisticated warning systems in place, these weather events can develop with startling speed and intensity.

If your property was affected by this recent severe weather outbreak, the path to recovery starts with careful documentation. Take clear photos of all damage before making temporary repairs, save receipts for any emergency expenses, and notify your insurance company promptly. The specific details of your policy regarding tornado and hail damage – particularly those sometimes-hidden percentage deductibles, coverage limitations, and strict filing deadlines – will significantly impact your claim outcome.

Central Texas communities have weathered many storms before, both literally and figuratively. Each severe weather event teaches valuable lessons about preparation, response, and recovery. From the emergency management teams who activated warning sirens to property owners documenting damage in its aftermath, everyone plays a crucial role in building community resilience.

For those feeling overwhelmed by the claims process ahead, you don’t have to steer these choppy waters alone. Insurance Claim Recovery Support LLC stands ready to help property owners from Austin to Waco secure fair settlements for tornado damage. Our licensed public adjusters understand the nuances of Texas insurance policies and the particular challenges that arise with wind and hail claims. By advocating exclusively for you, the policyholder, we ensure your interests remain protected throughout the entire claims journey.

With proper documentation, timely action, and professional guidance when needed, Central Texas property owners can recover from these destructive weather events and rebuild stronger than before. The road to recovery may seem daunting now, but with the right approach and support, fair settlements are within reach.