Introduction

Commercial wind insurance claims can be tricky, especially for Policyholders who expect to be fairly and promptly indemnified by their insurance company following the strong wind storm that rocked Houston May 16, 2024, which was the equivalent force of Hurricane Ike.

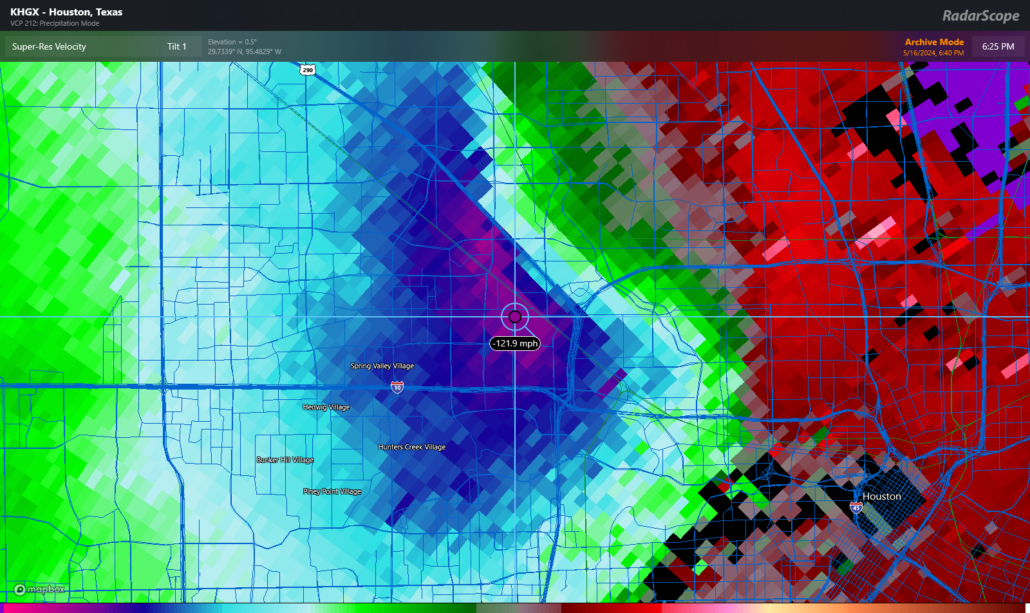

Estimated damage from Houston 100+ MPH wind event are $5 billion-$7 billion. The Storm was ruled to be a derecho. A derecho deh-REY-cho”) is a widespread, long-lived wind storm that is associated with a band of rapidly moving showers or thunderstorms that has to produce wind damage along a path length of at least 240 miles. Damages resulted similar to the impact of strong winds from hurricanes Ike and Alicia, according to AccuWeather.

The damaging wind event significantly impacted the Houston Metro and surrounding areas as a very strong thunderstorm moved through the area. This storm produced a 62-mile-long swath of +60 mph winds. The downtown area in particular fell victim to the “wind tunnel effect” where wind tunneling through skyscrapers likely resulted in locally higher gusts of 80 to possibly 100 mph gusts, especially on the middle and upper floors of buildings greater than 10 stories high.

The damaging wind event significantly impacted the Houston Metro and surrounding areas as a very strong thunderstorm moved through the area. This storm produced a 62-mile-long swath of +60 mph winds. The downtown area in particular fell victim to the “wind tunnel effect” where wind tunneling through skyscrapers likely resulted in locally higher gusts of 80 to possibly 100 mph gusts, especially on the middle and upper floors of buildings greater than 10 stories high.

While the majority of the hail occurred to the Northwest of the downtown area, significant winds of 70-80 mph were responsible for blowing large hail across the metro as well as other debris like tree branches into buildings and structures destroying windows and damaging sides of buildings and skyscrapers across the area.

Flat and pitched roof systems were damaged in several buildings, apartments, religious organizations, and multifamily properties. Dozens of windows were blown out of Houston skyscrapers by +100 mph winds exposing the interiors to moisture intrusion. At least four fatalities, schools closed, a million customers lost power

https://www.bbc.com/news/world-us-canada-69025566

Here’s a quick overview of the wind insurance claim process for Policyholders interested in managing risk for their claim.

- What Is It?: Commercial wind insurance covers damage caused by high winds, such as the Houston May 16, 2024 occurrence, hurricanes, tornadoes, and gusty storms, protecting buildings and their contents. Windstorm insurance pays to repair or rebuild your property.

- Who Needs It?: Any business owner, religious organization, or homeowner association with property at risk from wind damage, especially those in high-risk areas like the coast.

- Why Is It Important?: Wind damage can be costly. Insurance helps cover repair costs, reduces financial strain, and allows for quicker recovery.

- Steps to File a Claim: Report the loss, document the damage, make sure your damages exceed your deductible, thoroughly review your policy, and work with your insurance adjuster efficiently to ensure a fair settlement.

Running a business is demanding, and the added stress of dealing with property damage from windstorms can be overwhelming. Unfortunately, many standard commercial property insurance policies don’t automatically cover wind damage for certain regions.

Understanding how to navigate the claims process can mean the difference between swift recovery and prolonged business interruption. For example, industrial operations may face delays without proper insurance coverage, causing extended income loss and disrupted services.

Business owners must not just prepare but also know how to act quickly when wind damage strikes. Proper knowledge ensures you can manage risk, safeguard your property, minimize financial losses, and get back to business as quickly as possible.

Understanding Commercial Wind Insurance

When it comes to protecting your business from wind damage, understanding commercial wind insurance is essential. This type of insurance ensures that your property, inventory, and equipment are covered when a windstorm hits. Let’s break down the key components.

Coverage

Commercial wind insurance covers a variety of damages caused by high winds, including:

- Physical damage to buildings and structures

- Damage to inventory and equipment inside the property

- Costs for temporary repairs to prevent further damage

- Note: Policyholders must mitigate damages and prevent the property from getting worse.

For example, if a windstorm peels off your warehouse roof, exposing your inventory to rain and debris, your commercial wind insurance should cover both the roof repairs and any damage to the inventory.

Commercial Property Insurance

Commercial property insurance is a broader policy that includes coverage for various perils, including wind damage. However, not all policies automatically cover wind damage, so it’s crucial to review your policy details.

Typical coverages under commercial property insurance include:

- Fire Damage: Costs for repairs or rebuilding if a fire occurs.

- Theft: Coverage for stolen equipment or inventory.

- Weather Damage: Includes wind, hail, and lightning damage.

- Vandalism: Covers cleanup and repairs if your property is vandalized.

Windstorm Insurance

Windstorm insurance is a specialized type of coverage that focuses specifically on damage caused by high winds, such as those from tornadoes, hurricanes, and gales. This insurance is often added as a rider to a standard commercial property insurance policy.

Key points about windstorm insurance:

- Covers physical damage to the property and personal belongings.

- Often includes coverage for detached structures like garages and sheds.

- Does not typically cover flood damage; separate flood insurance is required.

Perils and Exclusions

Understanding what your policy covers—and what it doesn’t—is critical. Here are some common perils covered and exclusions in commercial wind insurance:

Covered Perils:

– Wind damage to buildings and structures

– Damage to inventory and specialized machinery

– Costs of temporary repairs to mitigate further damage

Common Exclusions:

– Flood Damage: Separate flood insurance is needed.

– Commercial Vehicles: Requires a separate auto policy.

– Customer Property: Covered by general liability insurance.

– Business Interruption: Needs business interruption insurance.

– Equipment Breakdown: Requires specific equipment breakdown insurance.

Real-World Example

Insurance Claim Recovery Support public adjusters in Texas recently adjusted a wind claim for a church which resulted in an increase of 170% higher than the insurer’s initial offer. This happy client was able to properly restore their wind-damaged building without compromising the historical integrity of the structure.

By understanding the specifics of commercial wind insurance, you can ensure your business is protected against the unpredictable forces of nature. Proper coverage can mean the difference between a quick recovery and prolonged business interruption.

Next, we’ll explore the steps to file a commercial wind insurance claim, ensuring you know exactly what to do when wind damage strikes.

Steps to File a Commercial Wind Insurance Claim

When wind damage hits your commercial property, knowing the right steps to take can make all the difference. Let’s break down the process into simple, actionable steps.

Contacting Your Insurance Company

First, contact your insurance company or agent to report the loss in writing. Whether you have a comprehensive policy or a separate wind policy, your primary insurer will handle the initial investigation and adjustment of the claim.

Key Questions to Ask:

- What documents are needed to complete your claim?

- Is there a deadline for filing the claim?

- How long will it take to process your claim?

- Should you start cleaning up?

- Can or should you make any repairs?

- What is your deductible?

- Do you need to acquire estimates for repairs?

- How can the insurer assist you?

Documenting the Damage

Before making any repairs, document the damage thoroughly.

Steps to Take:

– List all damages: Write down every damaged item and area.

– Take clear photos and videos: Capture each damaged item, the type of damage, and its estimated value.

– Keep receipts: Save receipts for any expenses related to temporary repairs or protective measures.

Pro Tip: If you had to make immediate repairs to prevent further damage, keep those receipts. They might be reimbursable.

Working with a Claim Adjuster

After reporting the damage and documenting everything, an insurance adjuster will visit to inspect the damage.

Preparation:

– Organize your documentation: Have all photos, videos, and notes ready.

– Temporary repairs: Make only those necessary to prevent further damage. Do not proceed with permanent repairs until the adjuster has inspected the damage and you’ve agreed on the repair costs.

During the Inspection:

– Show your work: Present all evidence of damage to the adjuster.

– Discuss costs: Ensure you and the adjuster agree on the cost of repairs.

– Ask questions: Inquire if additional information is needed to process your claim promptly.

By following these steps, you’ll be well-prepared to navigate the commercial wind insurance claims process effectively. Next, we’ll discuss common challenges you might face and how to overcome them.

Common Challenges in Commercial Wind Insurance Claims

When filing commercial wind insurance claims, business owners often face several obstacles. Understanding these challenges can help you navigate the process more effectively.

Underpayment

One of the most common issues is underpayment. Insurance companies may offer less than what you believe is necessary for repairs. This can happen due to:

- Excessive depreciation: Insurers might reduce the payout based on the age and condition of the damaged property.

- Outdated price lists: Using old pricing information to estimate repair costs can lead to lower payouts.

- Roof repairs vs. replacement disputes are common, and insurers often look for exclusions like wear and tear or improper installation.

- Moreover, damaged windows, siding, and interior moisture intrusion often become a battleground for arguments as ensuing latent damages arise.

To combat underpayment, get detailed repair estimates from licensed contractors. This documentation can help you argue for a fair settlement.

Detailed Estimates

Insurance companies often require detailed estimates for repairs. These estimates must be thorough and accurate. Most insurers use a software program called Xactimate for these estimates. This program helps standardize repair costs and ensures consistency.

- Pro Tip: Hire a contractor who is certified in Xactimate. They can provide the detailed estimates your insurer will accept.

Scrutiny of Older Buildings

Older buildings often face more scrutiny during the claims process. Insurers may argue that damage was due to pre-existing conditions or poor maintenance rather than the windstorm.

- Example: If your roof was already in poor condition before the storm, the insurer might deny your claim for roof damage.

To avoid this, maintain your property regularly and document its condition. Keep records of any repairs and updates. This can help prove that any damage was indeed caused by the windstorm.

By being aware of these common challenges, you can better prepare yourself to handle them. Next, we’ll share some tips for maximizing your claim and ensuring you get the compensation you deserve.

Tips for Maximizing Your Claim

Prevent Further Damage

After a windstorm, it’s crucial to prevent any additional damage to your property. For example, if your roof has been damaged, place a tarp over it to stop water from entering. Keep all receipts for these temporary repairs. Your insurance company may reimburse these expenses.

Understand Your Deductibles

Wind deductibles typically range from one to five percent of your total insured value (TIV). Deductibles are the amount you pay out of pocket before your insurance kicks in. They can vary based on the type of damage. For windstorm and hail damage, deductibles are often a percentage of your Coverage A (Dwelling) or Coverage C (Personal Property) amounts. For example, a 2% deductible on a $3,000,000 policy means you’ll pay $60,000 out of pocket.

Named Storm Deductibles

Named storm deductibles come into play when a storm with an official name (like a hurricane) causes damage. These deductibles are triggered by advisories or warnings from the National Weather Service. They can be higher than standard deductibles, so be sure to understand how they apply to your policy.

Policy Review

Reviewing your insurance policy is essential. Know what is covered and what isn’t. Look for details about:

- Dwelling Coverage: Repairs or replaces your damaged buildings.

- Other Structures Coverage: Covers structures not attached to your property, like garages and sheds.

- Personal Property Coverage: Reimburses for damaged items inside your business.

- Business interruption (BI) insurance, also called business income insurance, helps businesses protect against monetary losses for loss of use due to periods of suspended operations when a covered event, such as a tornado, hurricane, or fire, occurs and causes physical property damage.

Other considerations:

- Water damage brings a distinct set of challenges, including the risk of mold growth and water trapped within walls, which can extend the restoration timeline.

- Recoverable Depreciation: Policyholders can claim the depreciated amount once repairs are completed. The concern is the time it takes to complete these repairs and submit proof to the insurer to receive the remaining funds.

- Detailed Records: Policyholders must provide detailed documentation of the repairs, including invoices and receipts, to claim recoverable depreciation. This can be time-consuming and may delay reimbursement.

- Inspection Delays: Insurers may require an inspection to verify that repairs meet standards before releasing the recoverable depreciation, potentially causing further delays.

- Claim Processing Time in Texas: Sec. 542.055. RECEIPT OF NOTICE OF CLAIM. (a) Not later than the 15th day or, if the insurer is an eligible surplus lines insurer, the 30th business day after the date an insurer receives notice of a claim, the insurer shall:

(1) acknowledge receipt of the claim;

(2) commence any investigation of the claim; and

(3) request from the claimant all items, statements, and forms that the insurer reasonably believes, at that time, will be required from the claimant. - Adjustment Delays: The time it takes for insurers to process and adjust claims can vary, impacting when funds are received and when repairs can commence. Unreasonably delaying a settlement offer may violate the unfair settlement practices of Texas statute 541.060.

- Disputes and Negotiations: Disagreements over the claim amount or covered damages can prolong the process, delaying settlement and restoration efforts. In Texas, a public insurance adjuster holds the authority to investigate, settle, adjust, advise, or assist an insured policyholder with a claim and negotiate a settlement on your behalf. Public adjusters are a valuable non-litigious option for settling claims, are licensed by the Department of Insurance, work on contingency, and understand the claims process.

Having a clear understanding of your policy and statutes can help you know what to expect when filing a claim.

By following these tips, you can maximize your commercial wind insurance claim and ensure you get the settlement you deserve to recover from a windstorm.

Next, we’ll address some frequently asked questions about commercial wind insurance claims.

Frequently Asked Questions about Commercial Wind Insurance Claims

What is a Named Storm Deductible?

A named storm deductible is a specific deductible applied when damage is caused by a weather event that has been formally named by recognized meteorological authorities like the National Hurricane Center. This includes hurricanes, tropical storms, and other significant weather events.

The deductible is usually a percentage of your Coverage A (Dwelling) amount. For example, if your property is insured for $3,000,000 and you have a 5% named storm deductible, you would pay $150,000 out of pocket before your insurance coverage kicks in.

Understanding your named storm deductible can help you prepare financially for potential out-of-pocket expenses after a storm.

How Can I Prevent Further Damage Before the Adjuster Arrives?

After a windstorm, it’s crucial to prevent further damage to your property. Here’s what you should do:

- Make Temporary Repairs: Cover broken windows with plywood or place a tarp over a damaged roof. These actions can stop water from entering and causing more damage.

- Document Everything: Take clear photos and videos of the damage before making any repairs. This documentation will be essential for your claim.

- Keep Receipts: Save all receipts for materials and labor used in temporary repairs. Your insurance company may reimburse these expenses.

Temporary repairs can prevent additional damage and help speed up the claims process.

What Should I Do If My Claim is Underpaid?

If you believe your claim has been underpaid, don’t panic. Here are steps you can take:

- Understand the Reason: Your insurer should provide a reason for the underpayment. Knowing why can help you address the issue.

- Gather More Evidence: Collect additional documentation or evidence to support your claim. This can include more detailed estimates from contractors.

- Negotiate: Contact your insurance company to discuss the underpayment. Provide the additional evidence you’ve gathered.

- Seek Professional Help: If negotiations don’t resolve the issue, consider hiring a public adjuster or legal professional. They can advocate on your behalf to ensure you receive a fair settlement.

By being proactive and prepared, you can challenge an underpaid claim and work towards getting the compensation you deserve.

Conclusion

Navigating the complexities of commercial wind insurance claims can be daunting, but you don’t have to do it alone. At Insurance Claim Recovery Support, we specialize in advocating for policyholders dealing with large loss property damage insurance claims to ensure they receive the maximum settlement in the minimum time.

As public adjusters, our mission is to stand firmly on your side, guiding you through every step of the insurance claim process. We understand the unique challenges posed by wind damage, especially in Texas, where storms can wreak havoc on commercial properties.

Our team is dedicated to helping you secure the settlement you deserve. From meticulous documentation to expert negotiation, we strive to make the claim process as smooth and stress-free as possible. We believe in fair indemnification to help restore and rebuild without undue financial strain.

By choosing Insurance Claim Recovery Support, you gain a partner committed to your cause. We believe in building relationships, not just settling claims. Our focus on customer service, combined with our technical expertise, makes us a leading advocate for policyholders across Texas and beyond.

Whether you’re dealing with the aftermath of a storm or the complexities of an underpaid claim, we’re here to help. Visit our Texas service page for more information on how we can assist you with your insurance claim. Let us be your guide and advocate in securing the settlement you need to move forward.

#HoustonWindDamage #HoustonStorm #HoustonWeather #HoustonStrong #InsuranceClaims #PropertyDamage #WindDamageClaims #InsuranceRecovery #CommercialClaims #MultifamilyClaims #InsuranceExperts #PublicAdjuster