Why Understanding Commercial Property Insurance Appraisal Can Save Your Business Thousands

Commercial Property Insurance Appraisal is a structured, non-judicial process designed to resolve valuation disputes between a policyholder and their insurer without going to court. When you disagree on the amount of loss after a claim, this contractual process allows each side to select an independent appraiser. These appraisers (or a neutral umpire) determine a binding settlement amount, offering a powerful alternative to costly, time-consuming litigation.

Why This Matters for Commercial Property Owners

For commercial property owners, this process is more critical than ever. With replacement costs soaring 40% since 2019, many policies are dangerously outdated. This underinsurance gap—often as high as 19%—can lead to financial disaster after a major loss from a fire, hurricane, or freeze. Understanding property valuation and the appraisal process is your best defense against underpaid claims and crippling coinsurance penalties.

About the Author: I’m Scott Friedson, CEO of Insurance Claim Recovery Support (ICRS) and a Multi-State Licensed Public Adjuster with over 15 years of experience settling hundreds of millions of dollars in large-loss claims for commercial and multifamily property owners. Throughout my career, I’ve guided clients through countless Commercial Property Insurance Appraisal processes, often increasing recoveries by 30% to over 3,800% and helping them avoid unnecessary litigation. My goal is to ensure you understand your rights, your policy, and the tools at your disposal to secure the maximum settlement you’re entitled to.

Your Complete Guide to the Commercial Property Insurance Appraisal Process

When your commercial property faces damage, understanding its true value is paramount. This isn’t just about what you could sell it for; it’s about what it takes to rebuild, repair, and get back to business. This is where a Commercial Property Insurance Appraisal becomes your financial compass.

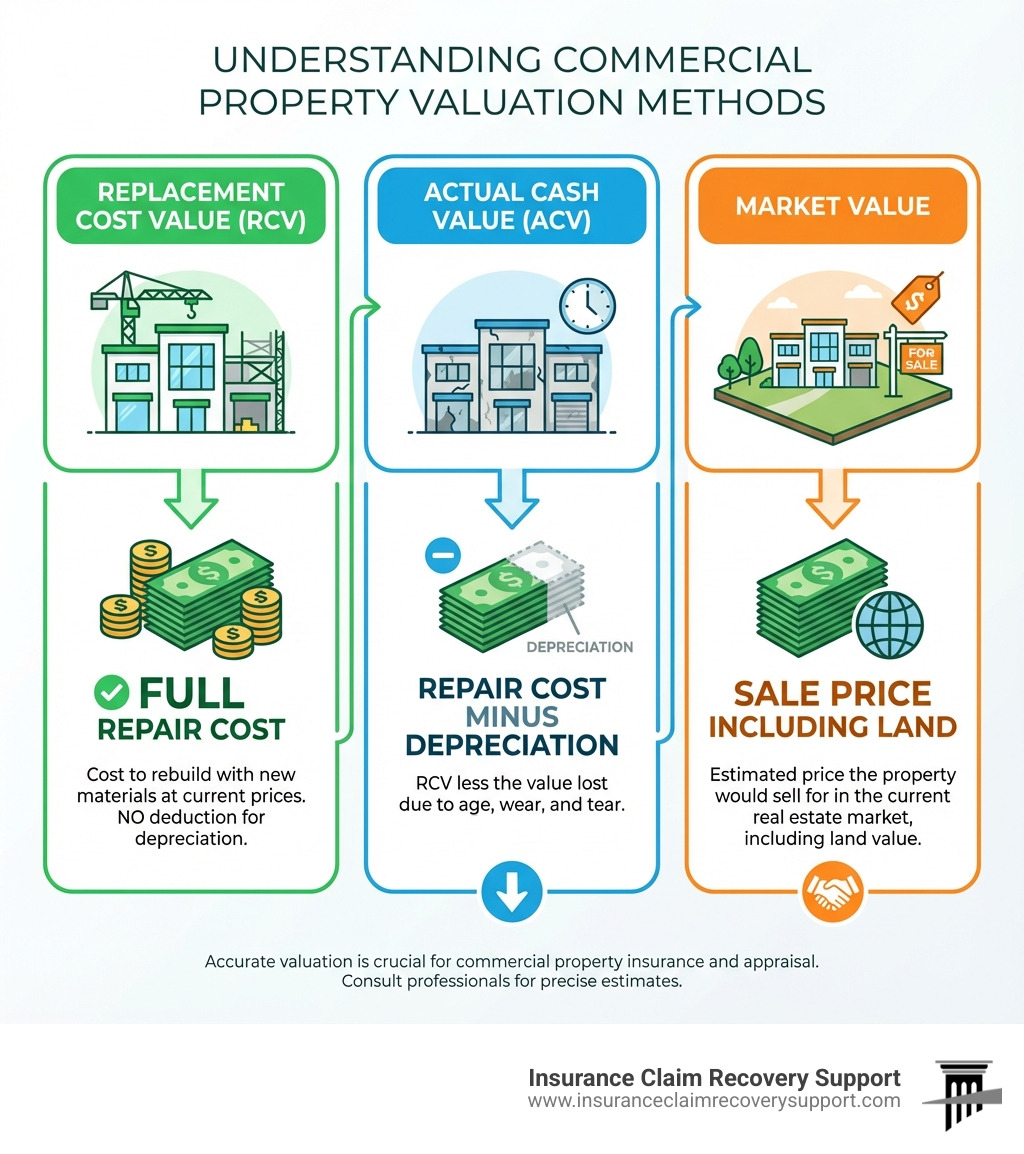

Understanding Valuation: RCV, ACV, and Other Key Methods

The primary purpose of an insurance appraisal is to determine a property’s value in the context of a loss. This value dictates how much your insurer will pay. Here are the key valuation methods:

1. Replacement Cost Value (RCV)

This represents the cost to rebuild or repair your property to its pre-loss condition with similar materials, without deducting for depreciation. This is the gold standard for full recovery, focusing only on the structure, not the land.

2. Actual Cash Value (ACV)

This starts with the replacement cost but then deducts for depreciation (wear and tear). While ACV policies have lower premiums, they can leave you with significant out-of-pocket expenses, as payouts can be up to 30% lower than RCV.

3. Functional Replacement Cost

A practical option for older buildings, this method pays to restore function using modern, less expensive (but equivalent) materials. It gets your building operational but may not replicate original aesthetics like ornate plasterwork.

4. Market Value

This is the price your property would sell for on the open market, including land. It’s crucial for real estate transactions but is not used for calculating insurance payouts, as rebuilding costs and market prices often differ significantly. Learn more about the definition of market value.

How Economic Factors Impact Valuation

Recent inflation, labor shortages, and supply chain issues have caused replacement costs to skyrocket—up 40% since 2019. An outdated policy can leave you severely underinsured and exposed to massive financial risk.

| Valuation Method | Description | Payout Example (for a $1M new roof) | Potential Impact on You |

|---|---|---|---|

| Replacement Cost (RCV) | Cost to rebuild/repair with new materials of like kind/quality, no depreciation deduction. | $1,000,000 | Full cost to replace, minimizes out-of-pocket. |

| Actual Cash Value (ACV) | Replacement cost minus depreciation (wear and tear). | $700,000 (if 30% depreciated) | Significant out-of-pocket expense due to depreciation. ACV settlements can be up to 30% lower than RCV. |

| Functional Replacement Cost | Cost to replace with functionally equivalent, but not identical, modern materials. | $800,000 (e.g., modern, cheaper materials) | Restores functionality at lower cost, but may alter aesthetics. |

| Market Value | What the property would sell for on the open market (includes land). | Not used for insurance payout. | Relevant for property transactions, not typically for insurance reconstruction. |

Understanding these methods is your first step towards ensuring adequate coverage. For more comprehensive information, explore our resources on More info on commercial property claims.

The Coinsurance Penalty: A Costly Consequence of Undervaluation

Most commercial policies include a coinsurance clause, which requires you to insure your property for a minimum percentage (usually 80%) of its total replacement value. If you’re underinsured, you become a “co-insurer” and must pay a portion of the loss.

How the Penalty Works:

If your property’s replacement cost is $5 million and your policy has an 80% coinsurance clause, you must insure it for at least $4 million. If you only insure it for $3 million, you are underinsured. For a $1 million loss, the formula is applied:

(Amount of Insurance Carried / Amount of Insurance Required) x Amount of Loss = Payout

($3,000,000 / $4,000,000) x $1,000,000 = $750,000

You would be responsible for the $250,000 shortfall, plus your deductible. This penalty can even apply to business interruption coverage, making accurate valuation essential for avoiding a What is a Large Loss Claim?.

Appraisal vs. Insurance Claim Lawsuit: Resolving Claim Disputes

When you and your insurer agree a loss is covered but dispute the amount of damage, the appraisal clause in your policy provides a powerful alternative to a lawsuit. It’s a contractual process designed to resolve valuation disagreements efficiently.

Appraisal vs. Insurance Claim Lawsuit: A Clear Choice

| Feature | Commercial Property Insurance Appraisal | Insurance Claim Lawsuit for Property Damage |

|---|---|---|

| Nature | Non-judicial, contractual process | Formal legal proceeding |

| Scope | Determines amount of loss (value of damage/repair costs), not coverage or liability. | Can determine all aspects of a claim: coverage, liability, amount of loss, bad faith, etc. |

| Binding? | Yes, typically a binding decision on the amount of loss (unless fraud or mistake is proven). | Yes, a court judgment or settlement agreement is binding. |

| Speed | Generally faster, often resolved in weeks to months. | Can take months to years to resolve. |

| Cost | Lower, primarily appraiser fees (each party pays their own), umpire fees (shared). | Significantly higher, involving attorney fees, court costs, findy expenses, expert witness fees, etc. |

| Complexity | Focused on valuation expertise. | Involves legal arguments, rules of evidence, court procedures. |

| Publicity | Private process. | Public record. |

| Dispute Type | Valuation disagreement. | Any dispute, including denial of coverage, bad faith, fraud, or valuation. |

| Role of ICRS | We can act as your appraiser or guide you through the process, ensuring your interests are protected. | We help you avoid needing one by maximizing your settlement through the appraisal process, or by advocating for you throughout the claim, potentially preventing the need for a lawsuit entirely. Our goal is a 90% settlement success rate without unnecessary lawsuits. |

Unlike arbitration, which can address broader issues like liability, appraisal is strictly focused on the amount of loss. A public adjuster can provide Learn about insurance claims dispute assistance to help you steer this process, providing robust documentation and expert negotiation to secure a fair settlement and often avoid litigation altogether.

The Step-by-Step Commercial Property Insurance Appraisal Process

The Commercial Property Insurance Appraisal process is a structured path to resolving valuation disagreements. Here’s how it unfolds:

1. Dispute and Demand: Either the policyholder or insurer makes a formal written demand to invoke the policy’s appraisal clause when a dispute over the loss amount arises.

2. Selecting Appraisers: Each side selects a competent and impartial appraiser. It is critical to choose an expert who understands the complexities of commercial property valuation.

3. Choosing an Umpire: The two appraisers select a neutral umpire to act as a tie-breaker. If they cannot agree, a court may be petitioned to appoint one.

4. Property Inspection and Assessment: The appraisers independently inspect the property, assess the damage, and calculate the amount of loss according to the policy’s valuation method (RCV, ACV, etc.).

5. Negotiations and Agreement: Appraisers present their findings to each other and negotiate to reach an agreement on the value of the loss.

6. Umpire’s Role (If Needed): If the appraisers disagree, they submit their differences to the umpire. An agreement by any two of the three (the two appraisers and the umpire) sets the final award amount.

7. Binding Award: The final, signed award is binding on both parties for the amount of loss, resolving the valuation dispute without litigation.

A What is a Public Adjuster? represents your interests throughout this process, ensuring a fair and accurate outcome.

How to Prepare for a Favorable Appraisal Outcome

A successful appraisal requires meticulous preparation. The more organized your claim is, the better your chances of a favorable outcome.

- Policy Documents: Have your complete policy ready and understand its key terms, like valuation methods and coinsurance.

- Pre-Loss Condition: Provide blueprints, maintenance records, and pre-loss photos/videos to establish the property’s prior condition.

- Inventory Lists: Create detailed lists of damaged contents and equipment with purchase dates and costs.

- Damage Documentation: Take thorough photos and videos of all damage from multiple angles. Our guide on How to Assess the Damages can provide further detail.

- Contractor Estimates: Get multiple repair estimates from licensed contractors to substantiate your claim’s value.

- Business Interruption Records: Compile financial records (P&L statements, tax returns) to prove the financial impact of the shutdown.

By providing a comprehensive package of information, you empower your appraiser to present the strongest possible case for your loss.

Benefits of Professional Valuations and Regular Policy Reviews

Regularly reviewing your policy and obtaining professional valuations are essential practices for safeguarding your commercial assets. This ensures you have accurate coverage that reflects true replacement costs, helps you avoid costly coinsurance penalties, and positions you for fairer settlements when a loss occurs. Given today’s volatile construction costs, you should review your coverage at least annually and after any significant property renovations. Don’t wait for a disaster to find you’re underinsured, especially with complex assets like those in Learn about navigating multi-family property claims.

Fact vs. Myth: Common Questions About Commercial Property Insurance Appraisal

Let’s clear up some common misconceptions about the Commercial Property Insurance Appraisal process.

Myth 1: Appraisal is the same as a lawsuit.

Fact: No. Appraisal is a contractual process to avoid a lawsuit by resolving disputes over the amount of loss. It is faster, cheaper, and narrower in scope than litigation, which addresses coverage and liability.

Myth 2: I can’t use a public adjuster if I go to appraisal.

Fact: A public adjuster can be your greatest asset in an appraisal. They help prepare your claim, select a qualified appraiser, and advocate for your interests to maximize your settlement and avoid unnecessary litigation.

Myth 3: Appraisal guarantees a higher settlement.

Fact: It doesn’t guarantee a higher payout, but it often leads to a fairer one than the insurer’s initial offer. The outcome depends on the evidence presented. A well-prepared case significantly increases your chances of a favorable award. Note: The insurer can still deny the claim based on coverage issues.

Myth 4: The insurer can refuse my demand for appraisal.

Fact: If your policy includes an appraisal clause, the insurer generally cannot refuse a valid demand for appraisal when there is a legitimate dispute over the value of the loss. Refusal without a valid reason may be grounds for legal action.

Myth 5: The appraisal process takes forever.

Fact: Appraisal is significantly faster than a lawsuit, typically resolving in weeks or months rather than years. This allows you to get your recovery funds and rebuild much sooner.

Myth 6: I don’t need to provide much information; the appraisers will figure it out.

Fact: Poor documentation leads to poor outcomes. Providing your appraiser with comprehensive records—blueprints, pre-loss photos, contractor estimates, and inventories—is crucial for building a strong case and achieving a favorable award.

Partnering for Success: Navigating Claims with an Advocate

Navigating Commercial Property Insurance Appraisal is your shield against underinsurance and prolonged disputes, but you don’t have to do it alone. Insurance Claim Recovery Support (ICRS) is a licensed public adjusting firm that works only for policyholders—never for insurance companies.

Our specialty is maximizing settlements for large-loss commercial and multifamily property claims while avoiding unnecessary litigation, boasting a 90% success rate in settling claims without lawsuits. We advocate for property managers, building owners, apartment investors, HOAs, and a wide range of commercial enterprises across Texas, Florida, and other states we serve. Whether your property is in Austin, Dallas-Fort Worth, or Houston, our team understands the local challenges and is ready to advocate for you.

Don’t let a valuation dispute derail your recovery. Partner with us to ensure your claim is handled professionally and with your best interests at heart.

Get expert help with your insurance claim appraisal today, and let us help you secure the settlement you deserve.