Commercial large loss claim can be daunting for any business or property owner who faces significant damage to their property. Whether it’s destruction caused by a natural disaster like a hurricane or a fire, the financial implications are considerable. A commercial large loss claim steps in when the damage is extensive and starts affecting your business’s financial health.

- Definition: A claim made when there’s major damage causing large financial setbacks.

- Examples: Tornadoes, fires, and floods often lead to these claims.

- Impact: Could disrupt business operations and lead to revenue loss.

When disaster strikes, understanding your insurance policy and effectively maneuvering the claims process becomes critical. Any delay or misstep might mean further financial strain. In these challenging times, having a strategic plan is vital.

I’m Scott Friedson, a multi-state licensed public adjuster with experience in handling commercial large loss claims. Over the years, I’ve helped many policyholders steer this complex terrain, recovering hundreds of millions in claims. Let’s dive deeper into how to secure the best settlement possible.

Learn more about commercial large loss claim:

– large loss claims

– what is a large loss claim

Understanding Commercial Large Loss Claims

When disaster strikes, the damage can be overwhelming. Think about a hurricane tearing through your business or a fire sweeping through your building. These events cause significant damage that can halt operations and strain finances. That’s where a commercial large loss claim comes into play.

What Constitutes a Large Loss?

A large loss is more than just a broken window or a leaky roof. It involves extensive damage that disrupts business and leads to a substantial financial setback. For example, a flood that wrecks your inventory or a fire that destroys your office space. These are not just minor inconveniences; they can threaten the very existence of your business.

Financial Implications

The financial impact of a large loss can be profound. Beyond the immediate costs of repairs, businesses face lost revenue due to downtime. Imagine a bakery that can’t produce bread or a tech firm without its servers. These interruptions can lead to a significant dip in income, making it crucial to leverage your insurance policy effectively.

Insurance Policies: Your Safety Net

Insurance policies are designed to be your safety net in these dire situations. But they are not one-size-fits-all. Understanding your policy is key. Does it cover natural disasters? What about business interruption? Knowing what’s included and excluded can make a huge difference in your claim process.

- Covered Damages: Fire, theft, storms, and more.

- Exclusions: Often, flood damage and consequential losses require separate policies.

Being prepared and informed about your insurance policy can help you steer the claims process more smoothly and secure the best possible settlement.

Navigating a commercial large loss claim is complex, but with the right approach, you can mitigate the financial blow and get back on track. Let’s explore how to take immediate steps after a large loss incident effectively.

Immediate Steps After a Large Loss Incident

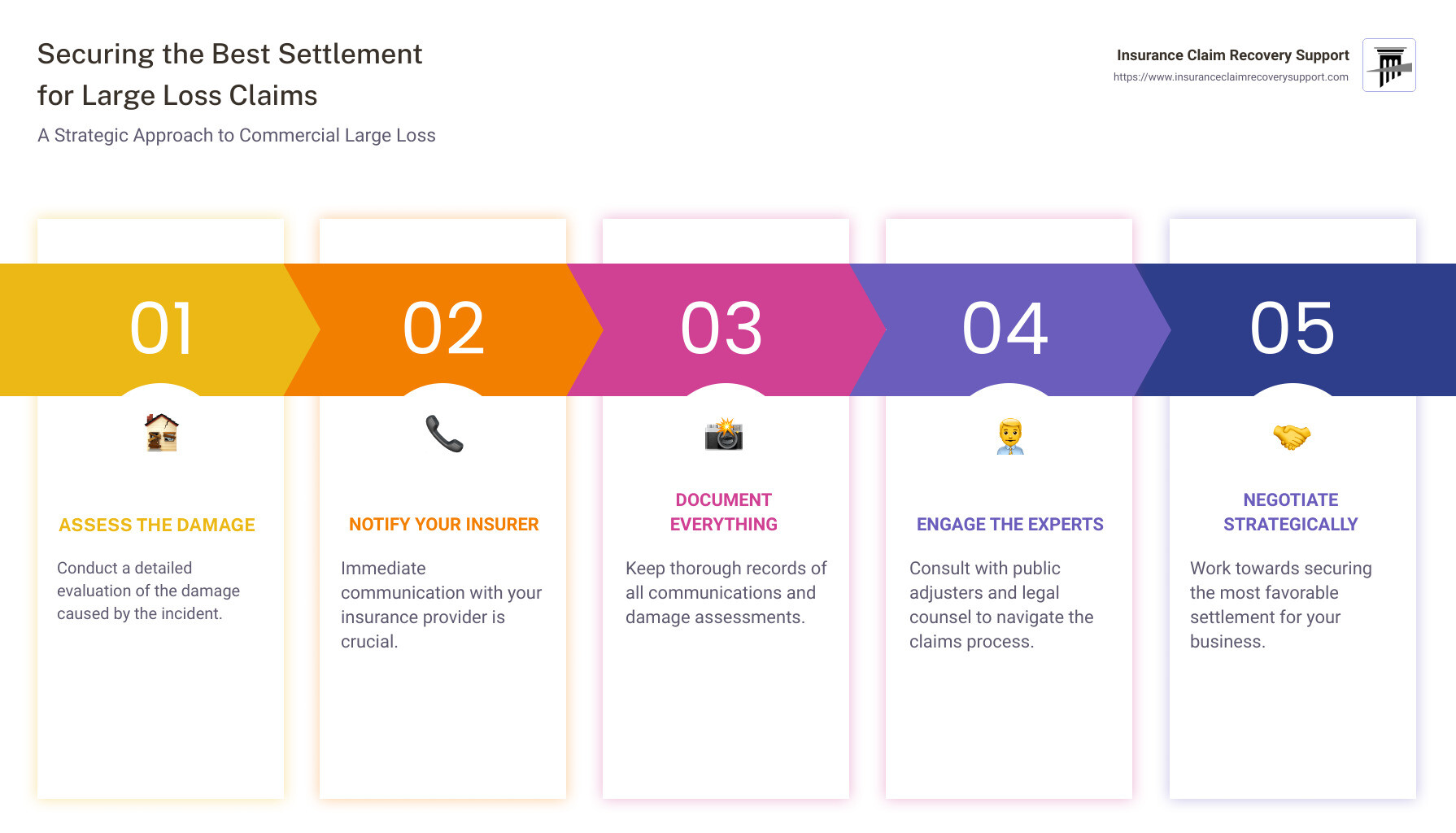

When a large loss incident hits your business, the initial moments are crucial. Taking the right steps quickly can make a significant difference in the outcome of your commercial large loss claim. Here’s what you need to do:

Secure the Property

First and foremost, ensure everyone’s safety. If the property is severely damaged, evacuate all occupants to a safe area. Once everyone is safe, focus on securing the property to prevent further damage or theft. Here’s how:

- Board Up: Cover broken windows and doors to protect against weather and unauthorized entry.

- Remove Water: If there’s flooding, drain standing water to avoid mold and additional water damage.

- Relocate Inventory: Move items at risk to a safer location, either within the building or off-site.

These immediate actions not only safeguard your property but also demonstrate to your insurer that you’re taking proactive steps to minimize further losses.

Document Damage

After securing the premises, document everything. This is a critical step in supporting your insurance claim. Use your smartphone or camera to capture detailed photos and videos of all affected areas. Here’s what to include:

- Visual Evidence: Take clear pictures and videos of structural damage, destroyed inventory, and any other affected areas.

- Detailed Inventory: Create a list of damaged items, noting purchase dates, descriptions, and estimated values. Attach receipts if available.

- Hidden Damages: Note any potential issues like electrical or plumbing problems that might not be visible in photos.

Comprehensive documentation serves as the foundation of your claim, providing irrefutable evidence of the extent of damage.

Notify Your Insurance

Once you’ve documented the damage, contact your insurance provider immediately. Early notification is key to expediting the claims process. Here’s why:

- Prompt Assessment: The sooner you notify them, the quicker they can send an adjuster to assess the damage.

- Clear Communication: Provide an initial overview of the damage and follow their guidance on next steps.

- Avoid Delays: Early contact helps avoid disputes and ensures you’re following the insurer’s specific requirements.

Document all communications with your insurer, including emails, phone calls, and letters. This record will be invaluable if any issues arise during the claim process.

Taking these steps quickly and efficiently can significantly impact the smoothness of your claim process and the speed of your recovery. Next, we’ll discuss how to assemble your commercial large loss claim team to further optimize your settlement.

Assembling Your Commercial Large Loss Claim Team

Navigating a commercial large loss claim can be overwhelming, but assembling the right team can make all the difference. Here’s who you need on your side:

Public Adjusters

Public adjusters are your advocates. Unlike insurance company adjusters, who protect the insurer’s interest, public adjusters work for you. They:

- Evaluate Damage: Thoroughly assess all damages, ensuring nothing is missed.

- Understand Policies: Decode complex insurance policies to identify what’s covered.

- Negotiate Settlements: Use their expertise to negotiate with insurers for maximum compensation.

Hiring a public adjuster can be a game-changer. They speak the insurer’s language and know how to secure the best deal for you.

Restoration Experts

Restoration experts, like United Water Restoration Group, are essential for getting your business back on track. They:

- Assess Damage: Conduct detailed evaluations to support your claim.

- Mitigate Further Damage: Implement immediate measures like water extraction to prevent worsening conditions.

- Oversee Restoration: Manage the entire restoration process, aiming to bring your property back to its original state.

Their quick action not only supports your claim but also speeds up your business recovery.

Legal Counsel

In complex or disputed claims, having legal counsel can be crucial. Lawyers can:

- Interpret Policies: Help you understand your rights and obligations under your policy.

- Handle Disputes: Represent you in negotiations or court if disputes arise.

- Ensure Compliance: Make sure all legal aspects of the claim process are followed.

Not every claim requires a lawyer, but in contentious cases, their expertise can protect your interests.

With a strong team of public adjusters, restoration experts, and legal counsel, you’re better equipped to handle the complexities of a commercial large loss claim. Up next, we’ll share expert tips for navigating the claim process effectively.

Expert Tips for Navigating the Claim Process

Navigating a commercial large loss claim can be daunting. But with the right approach, you can streamline the process and maximize your settlement. Here are some expert tips to guide you:

Stay Organized

Organization is key to a successful claim. With all the paperwork, deadlines, and communication involved, it’s easy to get overwhelmed.

- Create a Central Repository: Use a digital folder or physical binder to store all claim-related documents. This includes receipts, correspondence, and photos.

- Track Deadlines: Keep a calendar of important dates to ensure you don’t miss any critical deadlines.

- Document Everything: From initial damage photos to repair invoices, detailed documentation can support your claim and counter any disputes.

Understand Your Policy

Your insurance policy is more than just a piece of paper; it’s a roadmap for your claim.

- Know Your Coverage: Familiarize yourself with coverage limits, deductibles, and exclusions. This helps set realistic expectations.

- Clarify Ambiguities: If any terms or clauses are unclear, consult your public adjuster or legal counsel for clarification.

- Empower Negotiations: A solid understanding of your policy strengthens your position during negotiations.

Be Patient

Patience is crucial in the claim process. Given the complexity of commercial large loss claims, the process can be lengthy.

- Allow Time for Evaluation: Insurance companies conduct thorough checks to ensure accurate settlements. Rushing can lead to oversights.

- Maintain Regular Follow-ups: Stay in contact with your insurance provider and adjusters to keep the process moving without appearing impatient.

- Stay Persistent: Persistence, paired with patience, often results in a more favorable outcome.

By staying organized, understanding your policy, and being patient, you can steer the claim process with confidence. Up next, we’ll discuss common mistakes to avoid in large loss claims to further bolster your chances of success.

Common Mistakes to Avoid in Large Loss Claims

When dealing with a commercial large loss claim, avoiding common pitfalls can make a big difference in your settlement. Here are the key mistakes you should steer clear of:

Not Documenting Everything

Documentation is your best ally in a large loss claim. Think of it as your evidence in a courtroom. Without it, your case weakens.

- Capture the Scene: Immediately after the incident, take photos and videos of all damage. This provides a clear picture of the situation before any changes occur.

- Keep Detailed Records: Document every interaction, expense, and repair. This includes invoices, emails, and phone call summaries.

- Identify Hidden Costs: Don’t overlook ancillary expenses like temporary storage or relocation costs. These can add up and should be part of your claim.

Failing to document thoroughly can lead to disputes or a reduced settlement. It’s better to have too much documentation than too little.

Accepting the First Offer

The first offer from your insurance company might seem appealing, especially when you’re eager to move forward. But it’s often not the best offer.

- Understand the Motive: Insurance companies aim to minimize their payouts. The initial offer might be lower than what you deserve.

- Negotiate: Don’t hesitate to negotiate. Public adjusters can be invaluable in this process, helping you understand what a fair settlement should look like.

- Get Expert Opinions: Consult with professionals like restoration experts to accurately assess the damage and costs involved.

Accepting the first offer without scrutiny can leave significant money on the table. Take the time to evaluate and negotiate for a better outcome.

Not Reviewing the Final Settlement

Before you sign off on any settlement, ensure it covers all your damages. Overlooking this step can lead to unexpected out-of-pocket expenses.

- Review Thoroughly: Go through the settlement details with a fine-tooth comb. Ensure it includes all damage and associated costs.

- Seek Clarification: If anything is unclear, ask for explanations. Your public adjuster or legal counsel can help interpret complex terms.

- Confirm Coverage: Make sure that the settlement aligns with your policy coverage and expectations.

By avoiding these common mistakes, you can improve your chances of securing the best settlement possible. Next, we’ll tackle frequently asked questions about commercial large loss claims to further equip you with the knowledge you need.

Frequently Asked Questions about Commercial Large Loss Claims

What is considered a large loss claim?

A large loss claim typically involves significant property damage that results in a substantial financial impact. Think of incidents like fires, hurricanes, or floods that cause extensive damage to a business or complex. While there’s no strict dollar amount defining a large loss, it’s often seen as any claim exceeding $200,000. However, the true measure of a large loss is the overall effect on business operations. For example, even smaller businesses can face a large loss if damage halts their operations and revenue.

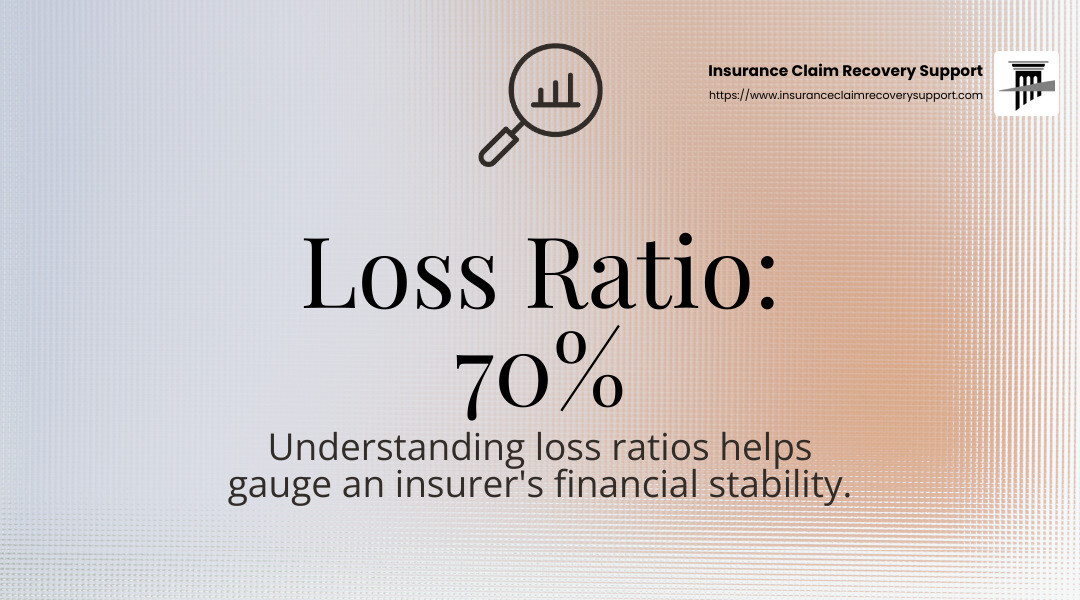

What is the loss ratio for commercial insurance?

The loss ratio is a key metric for insurance companies. It compares the amount of claims paid out to the premiums collected. A high loss ratio means the insurer is paying out a lot in claims compared to what it earns from premiums, which could indicate financial instability. Conversely, a low loss ratio suggests the insurer is retaining more premium dollars. For policyholders, understanding your insurer’s loss ratio can give insights into their financial health and how they might handle your claim.

What are loss runs for commercial insurance?

Loss runs are detailed reports that show the history of claims made on a commercial insurance policy. They provide information on the number of claims, the amounts paid, and the status of each claim. Think of them as a report card for your insurance history. Reviewing your loss runs can help you understand your risk profile and identify any patterns or issues that might affect your insurance rates or coverage options. Insurers use this data to assess risk and set premiums, so keeping an eye on your loss runs is crucial for managing your insurance effectively.

By understanding these aspects of commercial large loss claims, you can steer the process more effectively and make informed decisions. Up next, we’ll dig into how to assemble a team to support your large loss claim.

Conclusion

In commercial large loss claims, having the right support can make all the difference. At Insurance Claim Recovery Support, we specialize in helping policyholders steer the complex claims process to secure the best possible settlement. Our commitment is to stand by you every step of the way, ensuring that you receive the compensation you deserve.

Maximizing Your Settlement

Our expertise lies in understanding the intricacies of insurance policies and leveraging our knowledge to maximize your claim payout. We carefully document every detail and negotiate fiercely on your behalf. Whether you’re dealing with fire, flood, or storm damage, our goal is to relieve your stress and get you the settlement that reflects the true value of your losses.

Serving Texas and Beyond

Our team is deeply familiar with the unique challenges that Texas property owners face, from the hurricane-prone coasts of Houston to the hailstorms in Dallas and beyond. We serve a wide range of locations, including Austin, Fort Worth, San Antonio, Lubbock, and more. Our local expertise, combined with our national reach, ensures that no matter where you are, we have the experience to handle your claim effectively.

In conclusion, navigating a commercial large loss claim doesn’t have to be overwhelming. With the right preparation and support from Insurance Claim Recovery Support, you can tackle the process confidently and secure a fair settlement. Let us be your trusted partner on the path to recovery.