Why Commercial Fire Damage Demands Immediate Expert Attention

Commercial fire damage is a devastating event. In 2021 alone, non-residential fires in the U.S. caused over $3.6 billion in losses. With commercial fires on the rise and approximately 40% of affected businesses never reopening, the stakes are incredibly high.

Quick Overview: What You Need to Know About Commercial Fire Damage

Immediate Impacts:

- Structural damage from flames and intense heat

- Smoke and soot contamination throughout the property

- Water damage from sprinkler systems and firefighting efforts

- Business interruption and revenue loss

- Health risks from toxic byproducts and poor air quality

First Steps After a Fire:

- Wait for fire department clearance before entering

- Contact your insurance company immediately

- Secure the property and prevent further damage

- Document all damage thoroughly

- Engage restoration professionals and consider a public adjuster

Key Challenges:

- Hidden secondary damage that worsens over time

- Complex insurance claim processes

- Risk of underpayment or wrongful denial

- Pressure to reopen quickly vs. need for thorough restoration

The damage extends far beyond visible flames. Smoke penetrates entire properties, leaving corrosive residues. Water used to extinguish the fire can lead to mold within 24 hours. Meanwhile, every day your business is closed means lost revenue.

Navigating the insurance claim process adds another layer of stress. Many business owners mistakenly assume their insurance carrier will manage all the details and protect their best interests. The reality is that the policyholder is responsible for proving their claim.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, my team and I have specialized in helping businesses recover from devastating fires. We advocate for policyholders, document the full extent of damage, and negotiate fair settlements, often avoiding unnecessary litigation.

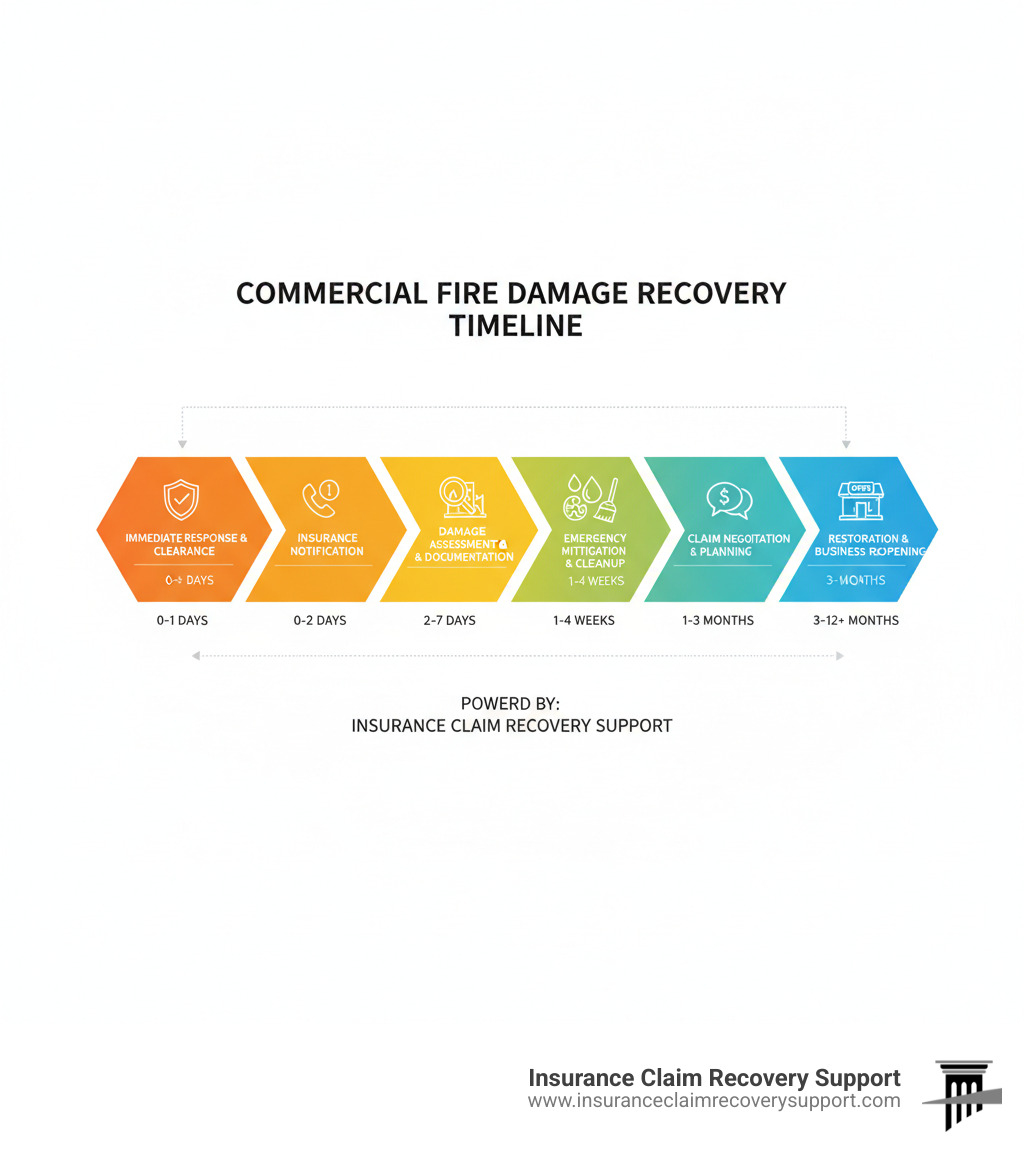

The Aftermath: A Step-by-Step Guide to Recovery from Commercial Fire Damage

The moments after a commercial fire are overwhelming, but taking the right steps in the first critical hours can make all the difference in your recovery. This isn’t just about cleaning up; it’s about protecting what remains and positioning yourself for the strongest possible financial and physical recovery.

Immediate Actions: Securing Your Property and Safety

Safety is the absolute priority. Do not enter the building until the fire department gives you official clearance. Once cleared, take these steps:

- Contact Your Insurance Carrier: Notify them immediately to start the claim process. Request a copy of the fire report.

- Prevent Further Damage (Mitigation): Your policy requires you to secure the property. Arrange for board-up services for broken windows and doors. Tarp a damaged roof to prevent water intrusion. This is crucial in Texas cities like Dallas and Houston, where weather can quickly compound damage.

- Disconnect Utilities: Turn off electricity, gas, and water to prevent further hazards like shorts or leaks.

- Document Everything: Before anything is moved or cleaned, take extensive photos and videos of all damage, both wide shots and close-ups.

- Limit Entry: Soot and smoke residue are hazardous to breathe and can be spread easily. Anyone entering should wear proper protective gear.

For a thorough breakdown, see our guide on how to Assess the Damages.

Understanding the Full Impact of Commercial Fire Damage

The flames are just the beginning. The most extensive and costly damage is often secondary.

- Primary Damage: The visible destruction from fire and heat to the structure, equipment, and inventory.

- Secondary Damage: This is where costs escalate. Corrosive smoke and soot travel through HVAC systems, staining and damaging surfaces within minutes. Water from firefighting efforts can cause mold growth in 24-48 hours if not professionally dried.

- Structural Damage: Intense heat can weaken steel, concrete, and wood, compromising the building’s integrity in ways that aren’t always visible.

- Business Interruption: This is often the most devastating financial blow. While your doors are closed, revenue stops but expenses like rent, payroll, and loan payments continue. This is why so many businesses fail to reopen after a disaster.

- Health Risks: Smoke contains toxic chemicals, and mold poses serious respiratory risks. The EPA details the health risks of smoke inhalation.

Learn more about different types of property damage in our guide on Commercial Property Damage.

The Restoration Process: What to Expect

Professional restoration is a science that requires a rapid response to prevent further damage. The process typically includes:

- Water Extraction and Drying: Using industrial-grade equipment to remove water and dry the structure to prevent mold.

- Soot and Smoke Removal: Employing specialized techniques and cleaning agents to remove corrosive soot from all surfaces.

- Odor Neutralization: Using advanced methods like thermal fogging and ozone treatments to eliminate smoke odors at a molecular level.

- Contents and Document Cleaning: Salvaging items like furniture, electronics, and important records through specialized restoration processes.

- Structural Repairs and HVAC Cleaning: Repairing or rebuilding damaged parts of the building and thoroughly cleaning the ductwork to ensure safe air quality.

This process is complex and occurs while you’re managing your business and insurance claim. A public adjuster handles the insurance side so you can focus on recovery. For more details, see our page on Fire Damage.

Maximizing Your Recovery: The Insurance Claim Process

After the fire, the insurance claim process begins—a battle where many business owners feel overwhelmed. As public adjusters, we level the playing field. While your insurer has its own adjusters and interests, we work exclusively for you, the policyholder, to ensure you get a fair settlement.

Navigating Your Policy: Key Concepts and Common Pitfalls

Your commercial policy is a complex contract. Understanding these key terms is vital:

- Actual Cash Value (ACV) vs. Replacement Cost Value (RCV): ACV pays for the depreciated value of your damaged property, leaving you with out-of-pocket costs to replace it with new items. RCV pays the full cost to replace items with new ones of similar quality. The difference in payout is substantial.

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | Replacement cost less depreciation | Cost to replace with new, like kind & quality, no depreciation |

| Payout Timing | Initial payment | Initial ACV, then remainder upon replacement/repair |

| Out-of-Pocket Costs | Higher, as you cover depreciation difference | Lower, as depreciation is eventually covered |

| Policy Cost | Generally lower premiums | Generally higher premiums |

| Benefit for Recovery | Less comprehensive, may not fully cover replacement | More comprehensive, aims to restore to pre-loss condition |

- Coinsurance Penalties: If your property is underinsured (e.g., insured for less than 80% of its value), your insurer can penalize you by paying only a fraction of your claim.

- Business Income Coverage: Replaces lost income and covers ongoing expenses like payroll and rent while your business is closed.

- Extra Expense Coverage: Covers additional costs to resume operations quickly, such as renting a temporary location or equipment.

For a deeper dive, see our guide on Commercial Property Insurance Claims and general information on what you need to know about insurance claims.

Your Path to a Fair Settlement: Public Adjuster vs. Insurance Claim Lawsuit

Do you need to sue your insurance company? Often, there’s a better first step. A lawsuit is a costly, time-consuming last resort.

A Public Adjuster is your proactive first line of defense. We are licensed professionals who work for you, not the insurer. We step in early to:

- Independently assess and document all damages, including hidden ones.

- Handle all communication and negotiations with the insurance company.

- Build a comprehensive claim package to support a fair settlement.

Our goal is to resolve your claim through negotiation, avoiding the stress and expense of litigation. This allows business owners in Texas cities like San Antonio, Austin, and Fort Worth to focus on rebuilding. Learn more about our Claim Adjustment Services.

An insurance claim lawsuit is a reactive, adversarial process for when an insurer denies, underpays, or acts in bad faith. While sometimes necessary, it should be a last resort after negotiation fails. For disputes, see our Insurance Claim Dispute Guide.

Fact vs. Myth: Common Questions About Commercial Fire Damage Claims

- Myth: “The adjuster my insurance company sends works for me.”

Fact: They work for the insurance company. Their job is to protect the insurer’s interests, not yours. - Myth: “I can handle this claim myself.”

Fact: Commercial fire claims are incredibly complex. Without expertise, you risk leaving significant money on the table. - Myth: “If my claim is denied, there’s nothing I can do.”

Fact: A denial is not the end. We specialize in reviewing and often successfully appealing denied claims. See our guide on a Denied Insurance Claim for Fire Damage to Commercial Property. - Myth: “I have to accept the first offer.”

Fact: The first offer is a starting point for negotiation. We negotiate to ensure you receive full compensation.

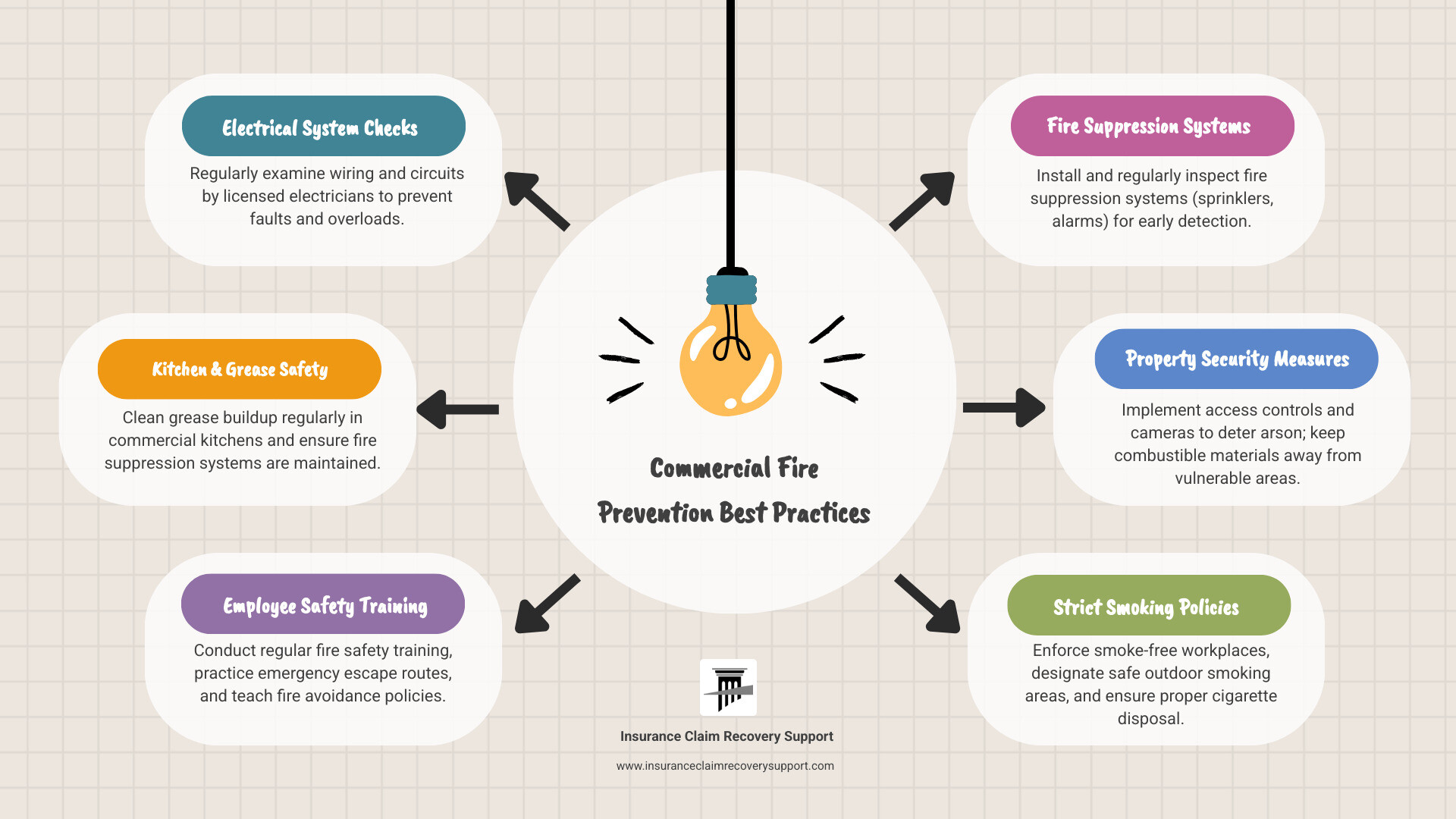

How Can Businesses Prepare for and Prevent Commercial Fires?

Prevention is the best strategy. Key steps include:

- Regular Maintenance: Have licensed professionals inspect electrical systems and clean commercial kitchen grease traps.

- Employee Training: Conduct regular fire safety training and practice emergency plans.

- Fire Suppression Systems: Install and regularly inspect sprinklers and alarms.

- Security Measures: Use access controls and cameras to deter arson.

- Smoke-Free Policies: Enforce strict rules for designated smoking areas.

At Insurance Claim Recovery Support, we guide commercial property owners through every step of a fire damage claim. We serve businesses throughout Texas—from Austin to Houston, Dallas to San Angelo—and are dedicated to helping you rebuild. For more on our expertise, see Public Adjuster Fire Claims.

For personalized assistance and to ensure you receive the maximum settlement you deserve, contact us for a complimentary claim review today.