Understanding the Key Players in Your Commercial Claim

A commercial claims adjuster is an insurance professional who investigates business property damage claims and determines settlement amounts. However, who they work for makes all the difference in whether you receive a fair payout or face delays, underpayment, or denial.

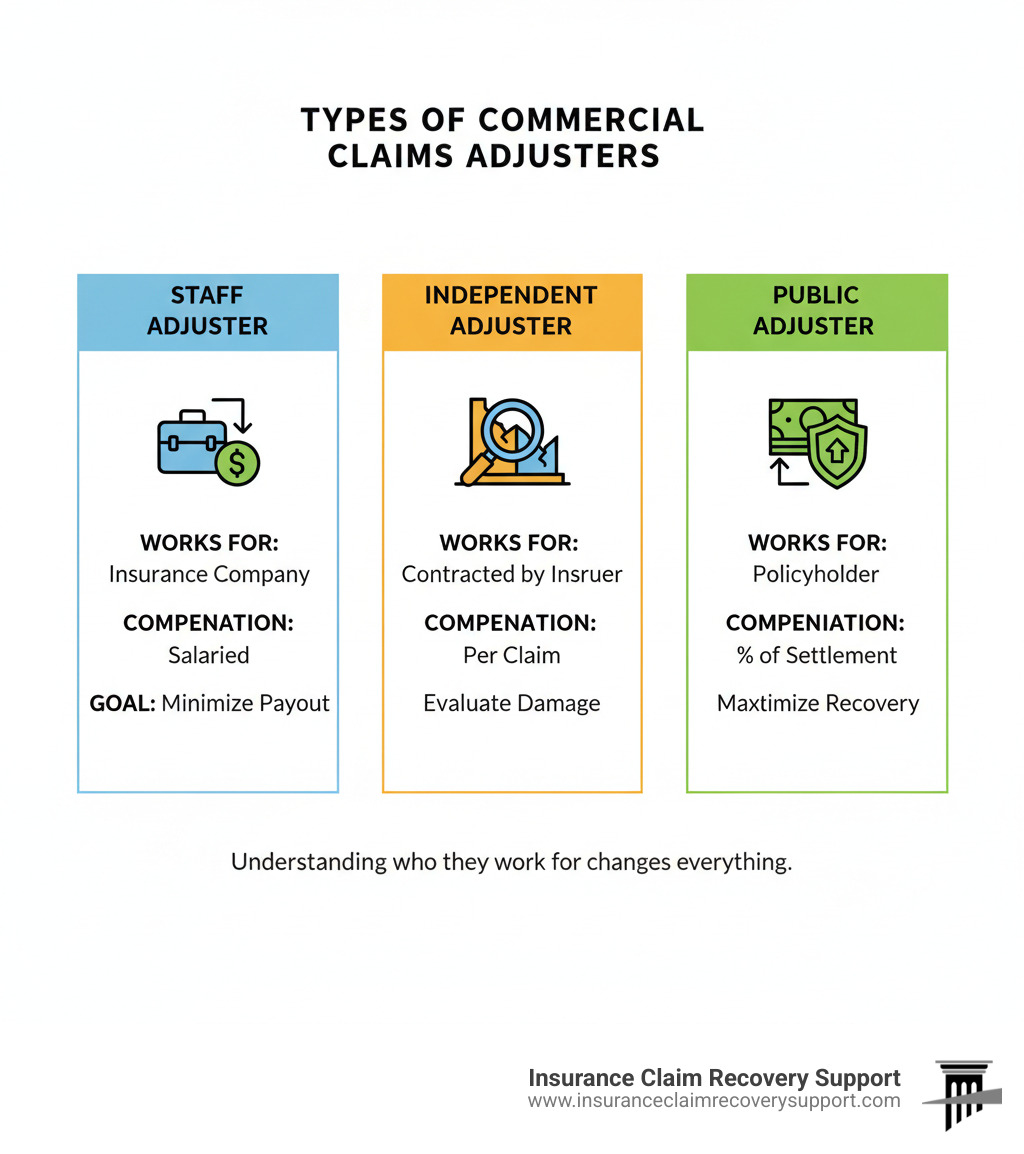

Quick Answer: Types of Commercial Claims Adjusters

- Staff Adjuster: Salaried employee of your insurance company; works to limit the insurer’s financial exposure

- Independent Adjuster: Contractor hired by your insurance company; paid per claim to evaluate damage and determine payouts

- Public Adjuster: Licensed professional hired by YOU, the policyholder; works exclusively to maximize your settlement and steer the claims process on your behalf

When your commercial building, multifamily complex, or industrial facility suffers fire, hail, hurricane, or other damage, the commercial claims adjuster sent by your insurance company is a trained negotiator. Their primary responsibility is to investigate your claim, assess the damage, and determine how much—if anything—the insurance company will pay. While they may seem helpful, their ultimate goal is to protect their employer’s bottom line.

The reality is that insurance companies are not on your side when it comes to claim payouts. The adjuster’s job performance is often measured by how much money they save the company, creating an inherent conflict of interest. Many commercial property owners find themselves overwhelmed as the adjuster may downplay damage, dispute policy coverage, or pressure them into accepting a low settlement offer.

This is where understanding your options becomes essential. While you might assume hiring an attorney is your only recourse, a public adjuster works exclusively for you. A skilled public adjuster can help you avoid unnecessary litigation, secure a fair settlement, and return to business faster—often recovering 30% to more than 3,800% more than initial offers.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support. With over 15 years of experience settling hundreds of millions of dollars in commercial property damage claims, I’ve worked extensively with insurance company commercial claims adjusters while advocating for policyholders to ensure they receive every dollar they’re entitled to.

The Insurance Company’s Commercial Claims Adjuster: Role and Process

When your commercial property suffers damage—whether in Dallas, Houston, or Austin—the insurance company sends a commercial claims adjuster to evaluate your loss. This person works for the insurer, not you. Their job is to assess the damage and determine the payout while keeping that amount as low as defensibly possible. Recognizing this conflict of interest is the first step to protecting your business from an inadequate settlement that can hinder your recovery.

For more context on the unique challenges commercial property owners face, especially in Texas, read our guide on Commercial Property Insurance Claims.

What is a Commercial Claims Adjuster and What Are Their Primary Responsibilities?

A commercial claims adjuster is the insurer’s investigator, accountant, and negotiator. Their primary responsibilities are to:

- Investigate the Claim: They visit your property, gather evidence like photos and reports, and interview relevant parties.

- Assess Damage: The adjuster examines the loss, including hidden damage, and uses industry-standard software like Xactimate to estimate repair costs.

- Interpret the Policy: They review your policy to find coverage limits, deductibles, and exclusions that can reduce your payout.

- Calculate the Settlement: Finally, they determine the settlement amount after applying depreciation and other factors, always with the goal of protecting the insurer’s bottom line.

No matter how professional an adjuster seems, their loyalty is to their employer. For foundational knowledge on navigating these complexities, explore our Commercial Claims 101 resources.

The Commercial Claims Process: A Step-by-Step Look

Understanding the claims process helps you prepare for what’s ahead. Here are the typical steps:

- First Notice of Loss (FNOL): You report the damage to your insurance company as soon as possible.

- Adjuster Assignment: The insurer assigns a commercial claims adjuster to your case.

- Site Inspection: The adjuster schedules a visit to inspect the damage. You or a representative should always be present.

- Evidence Collection and Valuation: The adjuster gathers documents and uses software to estimate repair costs. This is where depreciation is often applied, significantly reducing the claim’s value.

- Settlement Offer: You receive an initial offer. This is a starting point for negotiation, not the final word.

- Negotiation: If you disagree with the offer, negotiations begin. The adjuster is a trained negotiator, putting an unrepresented policyholder at a distinct disadvantage.

This is where many property owners realize they need an advocate. For detailed insights, read our guide on Commercial Claims Adjustment.

Staff vs. Independent Adjusters: Understanding Who Represents the Insurer

Insurance companies use two types of adjusters, but both represent the insurer’s interests.

- Staff Adjusters are salaried employees of one insurance company. Their performance is judged on how efficiently they close claims and control costs.

- Independent Adjusters are contractors hired on a per-claim basis, often after catastrophes (CAT adjusters) in places like San Antonio or Fort Worth. Though called “independent,” their loyalty is to the insurer that hires them, as they depend on them for future work.

For large, complex losses, an insurer might assign a General Adjuster, a specialist in high-value claims. However, their objective remains the same: to investigate the claim and limit the insurer’s liability. You can learn more about this role in our General Adjuster Definition article. All these adjusters work for the insurance company, which is why many policyholders hire a public adjuster to work exclusively for them.

Empowering Your Claim: Your Rights, Your Allies, and Your Recovery

When a disaster damages your apartment complex in Dallas or your retail center in Austin, you have rights. Understanding them is your first defense against a settlement that leaves your business financially exposed. Many property owners accept low offers simply because they don’t know they have options beyond what the insurance company presents.

Texas claims have unique challenges, from freeze damage to hurricanes. If you’re curious about what makes our state different, read Why Commercial Claims Are Different In Texas. At Insurance Claim Recovery Support, we believe that with the right advocate, you can secure a fair settlement without the stress and expense of litigation.

The Public Adjuster: Your Exclusive Advocate in the Claims Process

The commercial claims adjuster from your insurer works for them. A public adjuster works exclusively for you, the policyholder. Our only goal is to maximize your settlement and protect your financial interests.

| Feature | Company/Independent Adjuster | Public Adjuster |

|---|---|---|

| Who they represent | The insurance company | You, the policyholder |

| Primary goal | Limit the insurer’s financial exposure, process claims efficiently | Maximize your settlement, ensure fair and full recovery |

| How they are paid | Salary (staff) or fee per claim (independent) from the insurer | Percentage of the final settlement from the policyholder |

| Expertise focus | Company guidelines, policy interpretation from insurer’s view | Policyholder rights, maximizing claim value, negotiation |

Our compensation is tied to your recovery, so our interests are perfectly aligned. Public adjusters often recover significantly more than initial offers because we carefully document all damages, find hidden coverage, and negotiate aggressively on your behalf. To learn more, explore our Public Adjuster Definition and What Is A Good Public Adjuster.

Fact vs. Myth: Answering Your Questions About the Commercial Claims Adjuster

Let’s clear up some common misconceptions about the claims process.

Myth: The insurer’s adjuster is there to help me get the most money for my claim.

Fact: The commercial claims adjuster’s primary duty is to protect the insurance company’s finances by minimizing claim payouts. It’s their job.

Myth: I must accept the first settlement offer from my insurance company.

Fact: Absolutely not. The initial offer is a starting point for negotiation. You have the right to dispute it and provide your own evidence for a fair settlement.

Myth: If I don’t like the offer, my only recourse is to hire a lawyer and sue.

Fact: A public adjuster is a powerful alternative to litigation. We are skilled negotiators who can often secure a fair settlement without the time, cost, and stress of a lawsuit. For a detailed comparison, see Public Adjuster Or Plaintiff Insurance Attorney.

Myth: Hiring a public adjuster will make my insurance company angry or delay my claim.

Fact: The opposite is often true. A professionally prepared claim can move more quickly through the system. Insurers are legally obligated to work with your licensed representative.

Myth: My insurance company will cancel my policy if I hire a public adjuster.

Fact: This is illegal. Retaliating against a policyholder for hiring representation violates state insurance regulations.

Your Path to a Fair Settlement and Final Steps

Recovering from major property damage—whether from a fire in Lubbock or a hurricane in Houston—is challenging enough without fighting your insurance company. The insurer’s commercial claims adjuster has one mission: protect their employer’s finances. You need an equally skilled advocate on your side.

At Insurance Claim Recovery Support, we specialize in complex commercial property damage claims across Texas—from Austin to Dallas and San Antonio—and nationwide. Our sole focus is ensuring you receive the maximum settlement you’re entitled to under your policy.

While technology like AI is making claims processing more efficient for insurers, it can’t replace the strategic negotiation and policy expertise needed to maximize your recovery. Public adjusters are licensed professionals who meet state standards, like those set by the Texas Department of Insurance, to advocate on your behalf. We use our expertise to level the playing field.

The path forward is clear. You have a right to full and fair compensation. The insurance company has professional adjusters protecting their interests; you deserve the same. We’re here to guide you through every step, secure the maximum settlement, and let you focus on rebuilding your business.

For expert help navigating your business’s property damage claim, explore our Commercial Property Public Insurance Adjusters services. Let’s get your business back on track.