The Unique Challenge of Commercial Property Damage in Texas

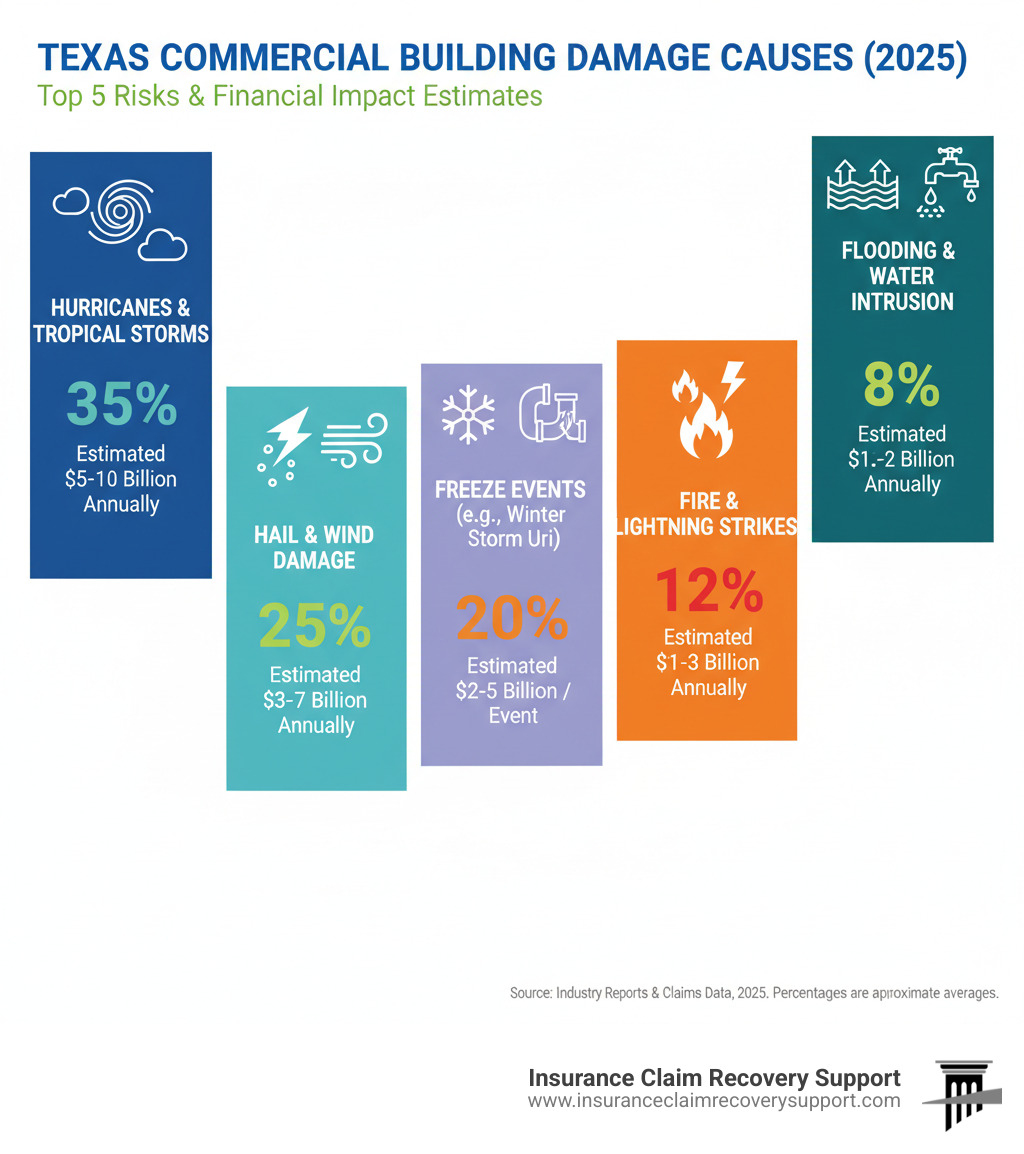

Commercial building damage can strike without warning, leaving property owners facing massive repair costs and complicated insurance claims. From hurricane destruction on the Gulf Coast to hail in Dallas-Fort Worth and freeze damage from events like Winter Storm Uri, understanding the recovery process is critical to protecting your Texas investment.

Key Facts About Commercial Building Damage:

- Common Causes: Water, fire, hail, wind, and freeze damage are frequent culprits.

- Urgency: Mold can grow within 24-48 hours after water intrusion.

- Financial Impact: Winter Storm Uri alone caused an estimated $10-$20 billion in property damage.

- Insurance Reality: Initial insurance offers are often far lower than actual repair costs.

Myth vs. Fact: Understanding Your Claim ✅

Myth: 🚫 Minor damage doesn’t require immediate attention.

Fact: ✅ Small leaks can escalate rapidly, leading to structural failure, mold, and exponentially higher costs.

Myth: 🚫 Your insurance company will automatically offer a fair settlement.

Fact: ✅ Insurers often dispute the cause of damage or offer settlements far below what is owed.

Myth: 🚫 You need a lawyer to get a fair insurance settlement.

Fact: ✅ A public adjuster can negotiate directly with insurers, often avoiding costly litigation while maximizing your claim.

Commercial properties, from office complexes to apartment buildings, have unique vulnerabilities. The scale of the damage requires specialized expertise. In Texas, extreme weather magnifies this challenge, making it difficult to recover fair compensation from insurance carriers.

I’m Scott Friedson, a public adjuster who has specialized in commercial building damage claims for over 15 years. I’ve helped clients overturn wrongful denials and increase their recoveries by negotiating hundreds of millions of dollars in settlements for property owners across Texas.

From Assessment to Action: A Property Owner’s Guide

When commercial building damage occurs, a clear plan starting with a swift, expert assessment can minimize losses and speed up recovery. Unlike homes, commercial properties have complex systems and valuable inventory, making the restoration process more intricate.

Common Types of Commercial Building Damage

Knowing these common damage types is the first step to a successful recovery in Texas.

- Water Damage: From burst pipes, leaky roofs, or storms, water damage is a major threat. Even small leaks can cause structural issues and mold, which can grow in just 24-48 hours, making a fast response crucial.

- Fire Damage: A fire leaves behind physical destruction plus smoke and soot. The cleanup is complex, often requiring specialized cleaning and odor removal. For more on these claims, see our guide on Commercial Fire Claims.

- Structural Damage: This is any harm to the building’s core structure—roof, walls, or foundation. It can result from severe weather, ground shifts, or faulty construction and must be addressed early to prevent catastrophic failure.

- Wind Damage: Common in Texas due to tornadoes and hurricanes, wind can cause anything from missing shingles to structural collapse. Our expertise in these claims is detailed in our resource on Commercial Wind Insurance Claims.

- Mould Growth: A direct result of water damage, mold is a serious health risk and can further degrade building materials. Its rapid growth highlights the need for immediate water removal.

- Water Contamination: Not all water is the same. White water (Category 1) is clean, from a supply line. Gray water (Category 2) is contaminated, from washing machines or toilets (urine only). Black water (Category 3) is highly toxic, from sewage or floodwaters, and poses severe health risks. Cleanup protocols differ drastically; black water often requires removing and disposing of porous materials like drywall and carpet.

Spotting Structural Commercial Building Damage

Knowing the early warning signs of structural failure can prevent a small problem from becoming a disaster. Here are 5 critical signs to look for:

- Foundation Cracks: Look for vertical, horizontal, or diagonal cracks in the foundation, a sign of settling.

- Bowed or Leaning Walls: Any bulging or leaning in walls indicates the building is under structural stress.

- Uneven Floors: Spongy, sagging, or uneven floors often point to foundation or support issues.

- Cracked Concrete: Wide, deep, or spreading cracks in concrete can signal serious deterioration and allow water intrusion.

- Persistent Water Leaks: Ongoing leaks from roofs or plumbing can weaken structural components over time.

Regular inspections are your best defense. For more tips, see our resources on Acing Commercial Property.

The High Cost of Delay: Risks of Postponing Repairs

Putting off repairs after commercial building damage is a costly mistake that creates a domino effect. The risks include:

- Worsening Structural Integrity: Small cracks grow, and minor water intrusion leads to rot, threatening the entire building.

- Mold Proliferation: Delaying water removal creates a perfect breeding ground for mold, leading to health hazards and expensive remediation.

- Increased Repair Costs: The longer you wait, the worse the damage gets, and repair costs grow exponentially.

- Extended Business Interruption: Longer repairs mean more lost income and potential loss of customers. Our expertise in Business Interruption Claims shows how significant this can be.

- Tenant Displacement: For multifamily properties, delays mean lost rental income and unhappy tenants.

- Safety Hazards & Liability: Damaged structures and mold create unsafe conditions, leading to potential accidents and lawsuits.

- Potential Insurance Claim Denial: Most policies require you to mitigate further damage. Delaying can give your insurer a reason to deny or reduce your claim.

Securing Your Financial Recovery: The Commercial Claim Process

Navigating the aftermath of commercial building damage involves a complex financial recovery. Understanding your insurance policy and having the right advocate is key to securing the maximum settlement you deserve.

Decoding Your Policy: What Commercial Insurance Actually Covers

Commercial property policies can be intricate, with varying coverage levels and crucial exclusions. Generally, they cover three areas:

- Structure Coverage: Protects the physical building itself—foundation, walls, roof, and permanent fixtures.

- Contents & Equipment: Covers assets inside the building, like inventory, machinery, and furniture.

- Business Income Loss (Business Interruption): Compensates for lost income and fixed expenses when your operations are halted due to a covered loss.

A key distinction is between ‘Named Perils’ and ‘All-Risk’ policies. Knowing which you have is critical.

| Feature | Named Perils Policy | All-Risk (Open Perils) Policy |

|---|---|---|

| Coverage | Only covers losses specifically listed (e.g., fire, windstorm). | Covers all incidents unless specifically excluded. Broader coverage. |

| Burden of Proof | You must prove the damage was caused by a named peril. | The insurer must prove the damage was caused by an exclusion. |

| Cost | Generally less expensive. | Typically more expensive. |

| Best For | Businesses with specific, identifiable risks. | Most businesses, offering comprehensive protection. |

Even with an ‘All-Risk’ policy, be aware of Common Exclusions. Flood damage, for example, typically requires a separate policy, which is critical in Texas. Other common exclusions include earthquake damage, normal wear and tear, faulty workmanship, and sometimes mold resulting from delayed mitigation. Understanding these nuances is vital for maximizing your claim. For more information, see our guide on how to Maximize Commercial Claim or consult resources from the Texas Department of Insurance.

The Claims Maze: Public Adjuster vs. Property Damage Lawyer

After damage occurs, you’ll encounter different professionals. Knowing who represents your interests is crucial.

- The Insurance Company Adjuster: Works for the insurance company. Their goal is to evaluate the damage and settle the claim for the lowest possible amount on behalf of their employer.

- The Public Adjuster: Works exclusively for you, the policyholder. As your advocate, a public adjuster from a firm like Insurance Claim Recovery Support independently assesses and documents all damage, interprets your policy to find all coverages, and negotiates with the insurer to achieve a maximum settlement. We are your expert representative. Learn more about Commercial Property Public Insurance Adjusters.

- The Property Damage Lawyer: Becomes involved when a claim enters a legal dispute, such as a bad faith denial. Lawyers handle litigation and represent you in court, which can be a lengthy and costly process. More on this role can be found here: Property Damage Lawyer.

Avoiding Litigation: The Public Adjuster Advantage

Engaging a public adjuster early can often help you avoid court entirely. Here’s how:

- Expert Documentation: We build a comprehensive, evidence-based claim that leaves little room for an insurer to dispute the extent of your loss.

- Skilled Negotiation: With deep policy knowledge, we counter lowball offers and aim for a fair resolution through negotiation, not confrontation.

- Faster Settlement: By professionally managing the claim, we streamline the process, often leading to a quicker, more favorable settlement without the delays of litigation. Our goal is to get you back in business faster.

Your Next Steps to a Successful Recovery

When commercial building damage strikes, take these immediate, strategic actions:

- Ensure Safety & Notify: Prioritize occupant safety, secure the property, and promptly report the damage to your insurance company.

- Mitigate Further Loss: Take reasonable steps to prevent more damage, like tarping a roof or boarding windows. Keep all receipts for these expenses, as they are often reimbursable.

- Document Everything: Before any cleanup, take extensive photos and videos of all damage. Create a detailed inventory of lost items. Keep a log of all communications with your insurer. For a helpful checklist, see our Large Loss Claim Documentation Lists.

- Assembling Your Recovery Team:

- Public Adjuster: This is your most critical step. Engaging a public adjuster ensures your interests are represented from day one. We handle the complexities so you can focus on your business.

- Reputable Contractors: Work with licensed contractors experienced in commercial restoration.

- Legal Counsel (if needed): A lawyer may be necessary if your insurer acts in bad faith, but a public adjuster can often resolve the claim without litigation. See our guide on building your Large Loss Team: Right Resources.

At Insurance Claim Recovery Support, we are committed advocates for policyholders in Texas and nationwide. Our expertise in claims for commercial buildings, multifamily HOAs, and apartment complexes—from fire and flood to hurricanes and freeze events—ensures you receive the settlement you deserve. We understand the challenges property owners face in Austin, Dallas, Houston, and across the state.

Don’t face your insurance company alone. Their adjuster works for them; our public adjusters work for you.