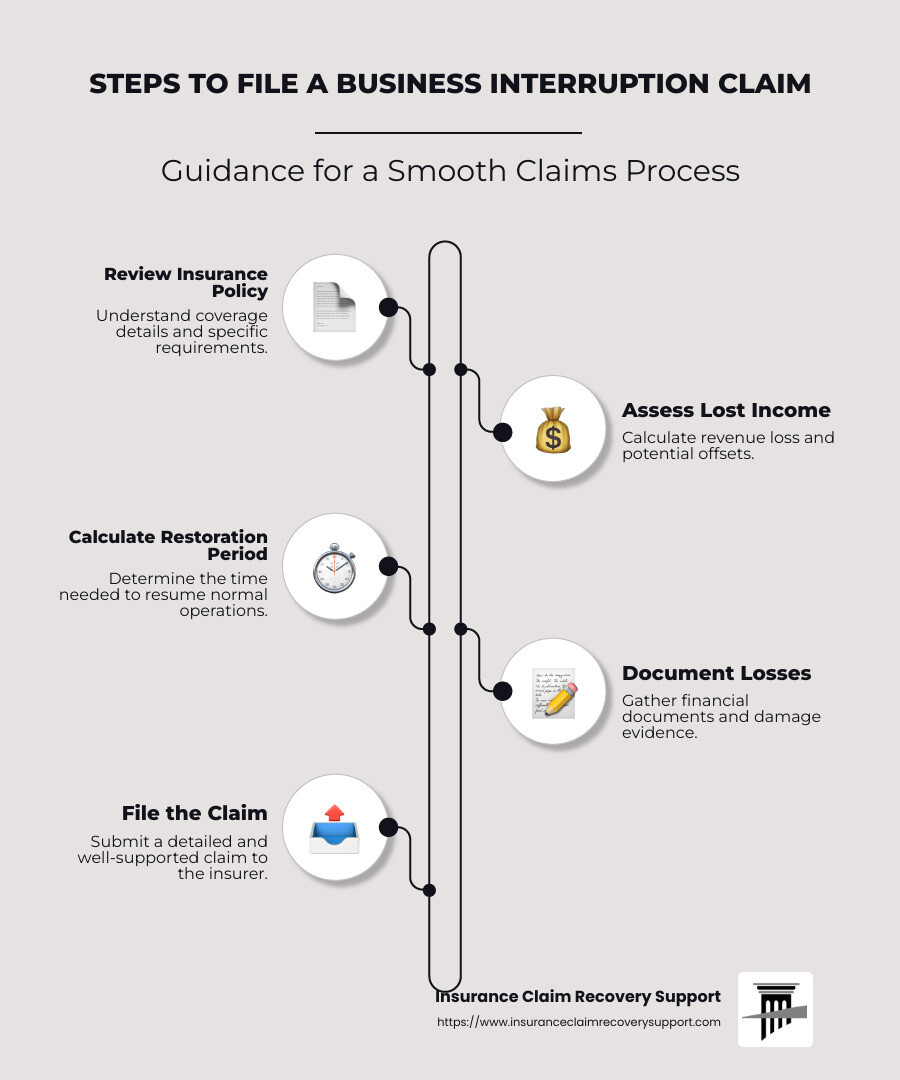

Business interruption claims are a critical tool for businesses that experience unexpected disruptions. When fires, floods, hurricanes, or other disasters strike, companies often face significant income loss. Understanding how to steer the claims process can mean the difference between a swift recovery and financial distress. Here’s a quick overview:

- Review your insurance policy. Understand what is covered and any specific requirements.

- Assess your lost income. Determine how much revenue was lost and if it can be offset in the future.

- Determine the restoration period. Calculate how long it will take to return to normal operations.

- Document your losses. Collect relevant financial documents and evidence of damage.

- File your claim. Present a detailed and well-supported case to your insurer.

Navigating the complex world of business interruption claims can feel overwhelming, but understanding these basic steps can provide a foundation for action. As someone with experience in managing insurance claims for various industries, I have seen how comprehensive preparation can ease the claims process and lead to fair settlements.

Understanding Business Interruption Insurance

Business interruption insurance is a safeguard for businesses facing unexpected disruptions. Let’s break down its key components to better understand how it works.

Coverage

Business interruption insurance covers the loss of income a business suffers after a disaster. It’s not just about repairing physical damage; it’s about keeping the business afloat while operations are on hold. This insurance usually covers:

- Lost Income: Replaces revenue that would have been earned during the closure.

- Operating Expenses: Continues to pay for ongoing costs like rent and utilities.

- Employee Wages: Ensures salaries are covered so staff can be retained.

However, it’s crucial to note that this insurance only kicks in if the loss is due to a covered peril, like fire or a natural disaster.

Physical Loss

For a business interruption claim to be valid, there generally needs to be direct physical loss or damage to the property. For instance, if a hurricane damages a store, causing it to close temporarily, the business can file a claim. However, if the closure is due to a non-physical event, like a pandemic, standard policies usually don’t cover it.

Policy Limits

Each policy has limits, which is the maximum amount the insurer will pay. These limits depend on the coverage amount chosen when the policy is purchased. It’s important to ensure that these limits are adequate for your business’s needs. If they’re too low, you might not receive enough to cover all your losses.

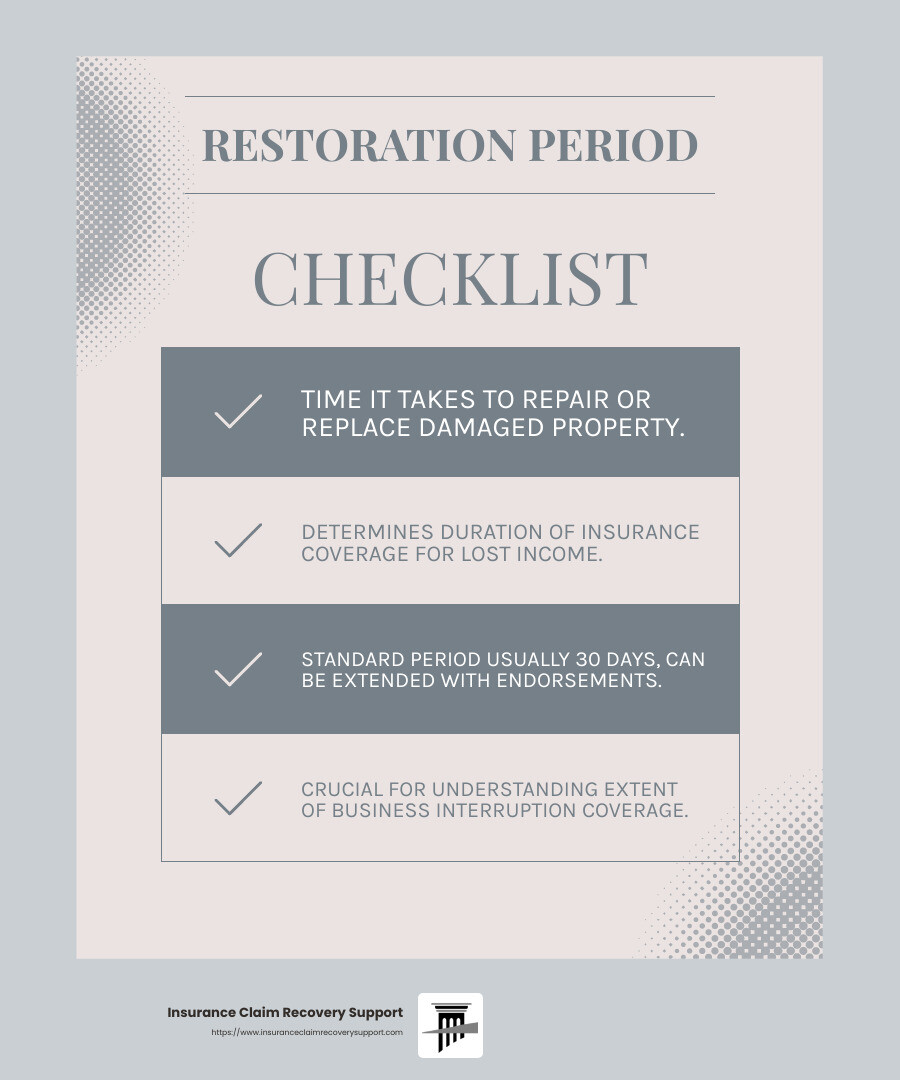

Restoration Period

The restoration period is the time it takes to repair or replace damaged property and return to normal business operations. This period is crucial because it determines how long the insurance will cover lost income and expenses. Most policies specify a standard period, often 30 days, but this can be extended with endorsements.

In conclusion, business interruption insurance is a vital part of risk management for businesses. Understanding its components can help ensure you’re adequately protected and prepared to file a claim if the need arises. Next, we’ll explore the steps to file a business interruption claim, ensuring you have all the information needed to steer the process smoothly.

Steps to File a Business Interruption Claim

Filing a business interruption claim can seem daunting, but breaking it down into clear steps can make the process manageable. Here’s a simple guide to help you through it.

1. Review Your Policy

Before anything else, review your insurance policy. This will clarify what is covered and what isn’t. Policies vary, so check for specifics like covered perils, exclusions, and the restoration period. Look for any endorsements or extensions that might apply, such as coverage for civil authority orders or supply chain interruptions.

2. Assess Income Loss

Next, assess the income loss your business has suffered. This involves calculating the revenue you would have earned if the interruption hadn’t occurred. It’s important to consider whether this loss can be offset by future earnings. If not, document it carefully as part of your claim.

3. Calculate the Restoration Period

The restoration period is the time required to get your business back to its pre-disruption state. It starts on the date of the incident and ends when the property is repaired or could have been repaired with due diligence. Your policy should define this period, but some policies include a waiting period before coverage begins.

4. Document Losses

Thorough documentation is key. Gather evidence of all losses and expenses related to the interruption. This includes financial statements, inventory records, and any extra expenses incurred. Photos of physical damage and records of repair costs will also support your claim. Make sure to provide a clear timeline of events and any actions taken to mitigate losses.

5. Apply the Deductible

Finally, understand and apply your policy’s deductible. This is the amount you must cover out-of-pocket before the insurance kicks in. Deductibles can be a fixed dollar amount or a percentage of the loss. Ensure you account for this in your claim calculations to avoid surprises.

By following these steps, you can streamline the process of filing a business interruption claim and increase your chances of a successful outcome. Next, we’ll dig into common triggers for these claims, helping you identify potential risks to your business.

Common Triggers for Business Interruption Claims

When it comes to business interruption claims, understanding what can trigger them is crucial for any business owner. Here are some common scenarios that might lead to such claims:

Natural Disasters

Natural disasters like hurricanes, tornadoes, and earthquakes are major triggers for business interruptions. These events can cause physical damage to your business property, leading to a halt in operations. For example, a tornado in Iowa caused extensive damage, resulting in businesses being unable to operate until repairs were completed.

It’s essential to check your policy to see if these perils are covered, as some policies might exclude certain types of natural disasters.

Civil Authority

Sometimes, your business might not suffer direct damage, but a government order can still disrupt operations. This is known as a “civil authority” trigger. For instance, if a nearby area is damaged by a covered peril like a fire or flood, authorities might restrict access to your business location for safety reasons. In such cases, business interruption insurance can cover losses due to these mandated closures. This coverage was highlighted when tornadoes led to city-mandated closures, preventing businesses from operating despite not being directly damaged themselves.

Supply Chain Disruptions

Supply chain disruptions can also lead to business interruptions. If your business relies heavily on suppliers, any interruption in their operations can impact your ability to function. For example, if a supplier experiences a fire, your business might face delays in receiving essential goods. Contingent business interruption coverage can help mitigate these losses by compensating for income lost due to disruptions at your supplier’s location.

Understanding these triggers helps you prepare and ensure your policy covers potential risks. Next, we’ll explore key considerations for making a successful business interruption claim.

Business Interruption Claims: Key Considerations

When filing business interruption claims, there are several key considerations to keep in mind. These elements are crucial to ensure your claim is successful and you maximize your recovery.

Actual Loss Sustained

The concept of “actual loss sustained” is fundamental in a business interruption claim. This refers to the real financial loss your business incurs due to an interruption. It’s not just about lost sales; it includes net income that would have been earned and normal operating expenses like payroll that continue even when operations are suspended.

For example, if a fire damages your store and you can’t operate for a month, the insurance would cover the net income you lost during that period, provided it’s within the policy limits. Always document your financials carefully to prove the actual loss.

Extra Expenses

Extra expenses are additional costs you incur to keep your business running during an interruption. These could include renting temporary office space, paying overtime to staff, or even leasing equipment.

Imagine your business is hit by a flood, and you need to set up a temporary location to keep serving customers. Extra expense coverage in your policy can help cover these costs, ensuring your business can continue to operate as smoothly as possible despite the disruption.

Contingent Business Interruption

This is an often-overlooked aspect of business interruption insurance. Contingent business interruption coverage protects you against income loss resulting from disruptions at a supplier or another business you depend on.

For instance, if a fire at a supplier’s warehouse delays your product shipments, causing you to lose sales, this coverage can compensate for those losses. It’s essential to understand whether your policy includes this coverage and how it applies to your specific business relationships.

By keeping these considerations in mind, you can better steer the complexities of business interruption insurance and ensure you’re adequately protected. Next, we’ll address some frequently asked questions about business interruption claims.

Frequently Asked Questions about Business Interruption Claims

What triggers a business interruption claim?

A business interruption claim is typically triggered by physical property loss. This means your business must suffer a direct physical loss or damage to property due to a covered event. Common triggers include:

- Fire: If a fire damages your business premises, it can halt operations, leading to lost income and triggering a claim.

- Flood: Although standard policies often exclude flood damage, if you have specific flood coverage, it can activate a claim when your property is inundated.

Understanding what your policy covers is crucial. Not all disasters, like pandemics, are covered, so review your policy details carefully.

How do you prove a business interruption claim?

Proving a business interruption claim requires solid documentation. Here’s what you need:

- Financial Statements: Provide detailed financial records showing your income before and after the interruption. This helps establish the loss.

- Tax Returns: These documents support your income claims and provide a historical financial overview.

- Restoration Documentation: Keep records of repair costs and timelines to show the restoration period and expenses incurred.

These documents help verify the extent of your loss and ensure your claim is processed smoothly.

What does business interruption insurance typically cover?

Business interruption insurance is designed to cover several critical areas:

- Lost Income: This includes the net income you would have earned if the business had not been interrupted.

- Operating Expenses: These are ongoing costs like rent and payroll that continue despite the interruption.

- Relocation Costs: If you need to move to a temporary location, the insurance can cover these expenses to keep your business running.

The specifics can vary, so always check your policy to understand what’s covered and what’s not. This ensures you’re prepared and can maximize your recovery when a disruption occurs.

Next, we’ll explore how to steer the claims process efficiently and make sure you’re well-prepared for any potential challenges.

Conclusion

Navigating the complex world of business interruption claims can be daunting, but you don’t have to go it alone. At Insurance Claim Recovery Support, we are dedicated to advocating for policyholders like you. Our mission is to ensure you receive the maximum settlement possible, helping you get back on your feet quickly and effectively.

Why Choose Us?

-

Expert Advocacy: We specialize in representing policyholders, not insurance companies. This means we’re always on your side, fighting for your best interests.

-

Texas Focused: With locations in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, and beyond, we understand the unique challenges posed by Texas weather and geography. Whether it’s fire, hurricane, or storm damage, we’re equipped to handle it all.

-

Comprehensive Support: From filing your claim to negotiating settlements, we guide you every step of the way. Our deep understanding of insurance policies and the claims process ensures you’re well-prepared for any challenges.

In the aftermath of a disaster, the road to recovery can seem overwhelming. But with Insurance Claim Recovery Support by your side, you’re not just another number. We believe in building relationships and providing top-notch customer service. Our commitment to policyholder advocacy means we’re here to help you rebuild and restore without undue financial strain.

For more information on how we can assist you with your business interruption claim, reach out. Let us help you steer the path to recovery with confidence and peace of mind.