Why Business Interruption Claims Are Critical to Your Recovery

A business interruption claim can mean the difference between your commercial property surviving a disaster and closing its doors forever. When fire, storms, or other covered perils shut down your operations, you’re not just dealing with property damage—you’re facing lost income, ongoing expenses, and the real possibility of never reopening.

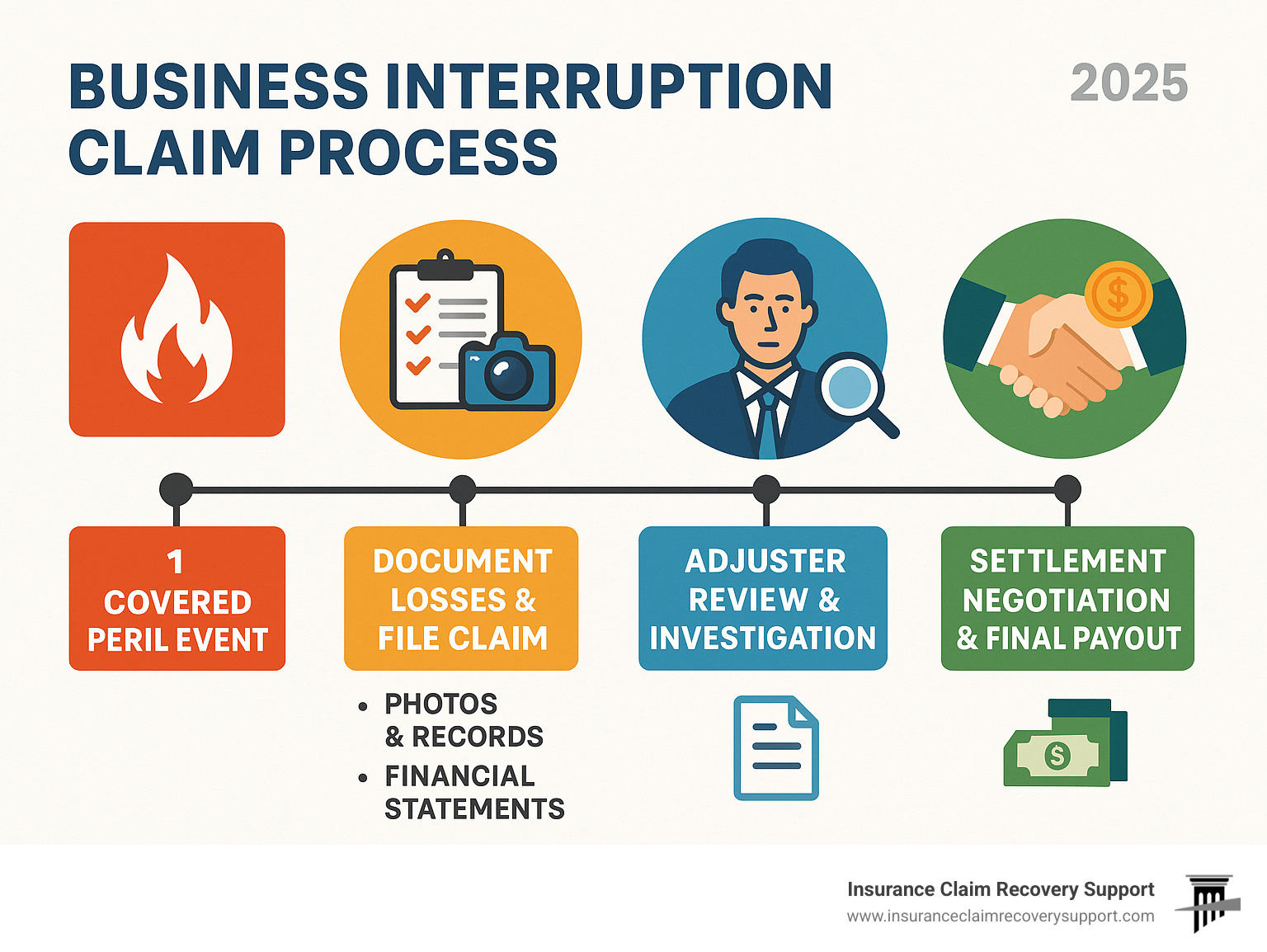

Key Steps to File a Business Interruption Claim:

- Document everything – Take photos, gather financial records, and preserve evidence

- Calculate your losses – Include lost profits, continuing expenses, and extra costs

- Submit promptly – Notify your insurer immediately and file within policy deadlines

- Prove your case – Use historical data to show projected income and actual losses

- Consider professional help – Public adjusters can maximize settlements and avoid litigation

The statistics are sobering: according to FEMA, 25% of small businesses never reopen after a major disaster. For commercial property owners, multifamily complexes, hotels, and manufacturing facilities, having the right coverage and knowing how to claim it properly isn’t just important—it’s essential for survival.

Business interruption insurance covers the income you lose when a covered peril forces you to temporarily shut down or reduce operations. This includes lost profits, continuing expenses like rent and payroll, and additional costs needed to get back up and running. However, getting fair compensation requires understanding complex policy language, calculating losses accurately, and often negotiating with insurance companies who may try to minimize your payout.

I’m Scott Friedson, a public adjuster who has settled over $250 million in commercial property damage claims, including hundreds of business interruption claims across Texas and nationwide. My experience with large loss claims helps property owners avoid unnecessary litigation while maximizing their settlements, often increasing initial offers by 30% to 3,800% or more.

Quick bsuiness interruption claim definitions:

Understanding Your Safety Net: What is Business Interruption Insurance?

When a fire tears through your apartment complex or a tornado rips the roof off your retail center, your income stops, but your expenses don’t. This is where business interruption insurance becomes your financial lifeline.

Unlike a standard commercial policy that covers physical repairs, this add-on business interruption insurance replaces the income you lose while your doors are closed. It’s the partner to your property coverage—one fixes the building, the other keeps your business alive. A business interruption claim covers ongoing expenses like your mortgage, payroll for essential staff, and the extra costs of recovery. When a covered peril like fire, wind, or freeze damage forces a shutdown, your policy replaces the income you would have earned, preventing a temporary setback from becoming a permanent closure for commercial properties across Texas.

What Triggers a Claim?

The golden rule for any business interruption claim is that there must be direct physical damage to your property from a covered peril. Without physical damage, there is no claim. This requirement ensures claims are tied to real, measurable losses.

The most common triggers we see across Texas commercial properties include fire damage—one of the most devastating events that can completely shut down operations. Whether it’s an electrical fire in your office building or kitchen fire in your restaurant, a Fire Claims Public Adjuster can help steer these complex claims.

Wind damage from hurricanes and tornadoes is another major trigger, especially given Texas’s position in tornado alley and along the Gulf Coast. We’ve helped countless property owners with Hurricane damage claims and Tornado Damage Claims that forced temporary or extended closures.

Freeze damage has become increasingly common in Texas, particularly after recent winter storms that caught many property owners off guard. Burst pipes and water damage from freezing temperatures can shut down operations for weeks or months. Our experience with Freeze Damage in Texas claims shows how quickly these events can escalate.

Your policy will specify exactly which perils are covered—whether it’s a named perils policy (listing specific events) or an all-risk policy (covering everything except what’s excluded). Understanding this distinction is crucial for your Commercial Property Damage Claims strategy.

What Costs Are Typically Covered?

When you file a business interruption claim, the coverage is designed to restore you to the financial position you would have been in without the interruption, recognizing that losses go far beyond lost sales.

Lost net income forms the foundation of most claims. This is the profit you would have earned during the shutdown, calculated using historical performance and accounting for seasonal variations. For a hotel, this might mean lost room revenue during peak season. For an apartment complex, it’s the rent you can’t collect from damaged units.

Continuing operating expenses often surprise property owners. Your claim can cover fixed expenses that continue during a shutdown, such as mortgage or lease payments, payroll for key employees, loan payments, and utility costs at your damaged location.

Extra expenses represent one of the most valuable aspects of coverage. These are costs incurred to minimize the shutdown period, such as overtime pay for repairs, expedited shipping for equipment, temporary equipment rentals, or post-reopening advertising.

Temporary relocation costs can be substantial but necessary. If you must move operations to keep serving customers or residents, your policy can cover rent, setup, and moving expenses for a temporary location. This is particularly important for businesses that can’t afford to completely shut down.

The goal is comprehensive financial protection that recognizes the true cost of business interruption. For strategies on maximizing your overall commercial property claim, including business interruption components, check out our guide on How to Maximize Your Commercial Property Damage Claim.

How to File a Business Interruption Claim: A Step-by-Step Guide

Filing a business interruption claim while dealing with property damage can feel overwhelming, but a methodical approach is key. Success depends on acting quickly, documenting carefully, and presenting a clear financial picture of your losses. Following these steps systematically can lead to a significantly better recovery.

Step 1: Immediate Actions and Documentation

The first 48 hours after a disaster are critical for your business interruption claim. What you do now will strengthen your case later.

Secure your property first. Your priority is preventing additional damage, a step typically required by your insurance policy. If a storm tears off part of your roof, get it tarped. If pipes burst, shut off the water and start drying the space. Document these mitigation efforts.

Before touching anything, use your smartphone to photograph and video all damage from multiple angles. Show the big picture and the details, capturing how the damage affects your ability to operate.

Immediately gather your financial records, as your claim’s success depends on this documentation. You’ll need business tax returns for the past three to five years, profit and loss statements, payroll records, and bank statements showing normal cash flow.

Keep all invoices and receipts for extra expenses incurred during recovery. Every dollar spent on emergency repairs or temporary equipment could be recoverable.

The more organized your initial documentation, the smoother your claims process will be. For additional guidance, check out our Tips for Filing Claims.

Step 2: Calculating and Submitting Your Business Interruption Claim

Calculating business interruption losses is challenging because you must prove what your business would have earned had the disaster not occurred.

The calculation is founded on historical performance analysis, digging into your financial records to establish revenue and expense patterns. For a multifamily property, this might mean analyzing occupancy rates, rental income, and operating expenses over several years.

Projecting lost profits requires accounting for factors like seasonality, planned improvements, and market conditions that could have affected performance.

The calculation is complex: lost gross profit, plus continuing fixed expenses and extra expenses, minus any expenses saved during the shutdown.

Working with forensic accountants is invaluable here. They build evidence-based financial projections that withstand insurer scrutiny. Many business interruption claims qualify as Large Loss Claims, meaning they’ll receive extra attention from your insurer.

Submit your claim promptly, as policies have strict deadlines. Include all supporting documentation, organized clearly, and present your loss calculation with professional explanations of your methodology.

Insurers have expert teams reviewing your claim. Professional representation levels the playing field, often leading to higher settlements and avoiding litigation.

Navigating the Fine Print: Coverage Details, Limits, and Exclusions

Understanding your business interruption policy before a disaster is crucial. The difference between a smooth business interruption claim and a frustrating battle often lies in knowing your coverage, exclusions, and limits. Every policy has unique language and limitations that can catch you off guard. If you’re already facing an interruption, understanding these nuances is critical for your claim’s success.

Understanding Your Indemnity Period

The indemnity period is the timeframe during which your insurer pays benefits. It starts when the physical damage occurs and ends when your property is repaired and operations return to normal, or when the policy’s time limit is reached.

Many property owners are caught off guard by the difference between limited and extended coverage. A standard “period of restoration” may only last 12 months or until repairs are complete, but your business may not be back to full strength by then.

For example, an apartment complex needs time to re-lease units, and a retail center must rebuild foot traffic. An extended period of indemnity endorsement is invaluable, providing coverage beyond physical restoration until revenue streams recover.

Underinsurance is a real risk. If your recovery takes 18 months but your policy only covers 12, you face six months of uncompensated losses. This gap can severely damage your financial recovery. We regularly provide Assistance with Insurance Claims to help property owners identify and address these coverage gaps.

Key Endorsements to Consider

Beyond basic coverage, several endorsements can significantly expand your protection.

Extra Expense Coverage covers necessary costs to continue operating or minimize the shutdown period, such as renting temporary space or paying overtime. These expenses can reduce your overall business interruption claim by speeding up your return to business.

Contingent Business Interruption Coverage protects you when a key supplier or customer suffers a disaster. It can compensate for your lost income even if your own property isn’t damaged.

Civil Authority Coverage applies when a government authority denies access to your property due to nearby damage. This endorsement covers that lost income, though it’s often limited to a few weeks.

Service Interruption Coverage covers losses when a direct physical loss to a utility provider (e.g., a power station) cuts service to your property, forcing a shutdown. Understanding What Does a Claims Adjuster Do? can help you steer how insurers evaluate these claims.

Common exclusions can catch property owners by surprise. Pandemic-related closures were a major issue during COVID-19, as most policies require direct physical loss, so government-mandated shutdowns without property damage are typically not covered. Cyber-attacks are also usually excluded unless you have specific cyber insurance. Utility failures from off-premises sources require a specific Service Interruption endorsement. Finally, any undocumented income that cannot be proven with solid financial records will not be covered.

Here’s a straightforward comparison of the two main policy types:

| Feature | Named Perils Policy | Comprehensive All-Risk Policy |

|---|---|---|

| Coverage Scope | Only covers perils specifically listed | Covers all perils unless specifically excluded |

| Burden of Proof | You must prove loss caused by named peril | Insurer must prove loss caused by exclusion |

| Flexibility | Less flexible, requires specific listing | More flexible with broader default coverage |

| Cost | Generally lower premiums | Higher premiums for broader protection |

| Business Interruption | BI applies only if damage from named peril | BI applies if damage from any non-excluded peril |

Understanding these policy details upfront can make the difference between a successful claim and a disappointing settlement.

Maximizing Your Settlement and Avoiding Pitfalls

Filing a business interruption claim can feel like a minefield. Insurers are businesses focused on their bottom line, which can lead to tactics that work against you. They may question your financial data, dispute projections, or argue over policy language. Delays and excessive documentation requests are common strategies designed to pressure you into accepting a low settlement.

These aren’t accidents; they’re calculated moves, as we’ve documented in our guide on 8 Sneaky Tricks Insurance Companies Use to Underpay and Delay Your Claim. Recognizing these tactics is your first defense, but you don’t have to face this alone. An experienced advocate can level the playing field.

The Public Adjuster Advantage vs. Insurance Claim Lawsuits

When your business interruption claim hits a roadblock, you have two main paths: hire a public adjuster or retain an attorney for litigation. They work very differently and lead to different outcomes.

As public adjusters, we are licensed professionals who work exclusively for you, the policyholder, acting as your advocate against the insurance company. We manage the entire claims process—from documentation and loss calculation to negotiation—so you can focus on your business. Crucially, our goal is to avoid litigation. We prepare and negotiate your claim so thoroughly that lawsuits become unnecessary, leading to faster, less expensive resolutions.

Insurance claim lawsuits are a different approach, necessary when negotiations fail or bad faith is involved. However, they come with significant trade-offs:

- Cost: Attorney fees, court costs, and expert witness fees can consume a large part of your settlement.

- Time: Lawsuits can take years, while a public adjuster can often resolve a claim in months. This delay can be devastating for a recovering business.

- Uncertainty: Litigation outcomes are never guaranteed, adding significant stress.

- Focus: Attorneys focus on legal strategy, while public adjusters specialize in the intricate financial calculations and documentation specific to insurance claims.

Comparison: Public Adjuster vs. Lawsuit

The public adjuster process is typically faster, resolving claims in months versus years for lawsuits. Our approach is to build a case so strong that litigation is avoided. Public adjusters work on a contingency fee (a percentage of the settlement), whereas litigation involves attorney fees and court costs that can be substantial. The process is also more collaborative, compared to the adversarial nature of a lawsuit.

For more insight into when litigation might be necessary, see our resource on Disputing Damage Claims in a Lawsuit.

Why You Need an Expert for Your Business Interruption Claim

Business interruption claims are uniquely complex. You must prove hypothetical losses—the income you would have earned—which is much harder than documenting physical damage.

- Complex Calculations: The financial calculations are overwhelming, requiring analysis of historical performance, seasonality, growth projections, and cost structures.

- Policy Interpretation: Policy interpretation is critical. Insurers have experts who interpret ambiguous language in their favor.

- Proving Your Loss: Proving your full loss requires expertise in forensic accounting and market analysis that most business owners lack. Understanding what constitutes a Claims Dispute can help you recognize when professional help is essential.

- Uneven Playing Field: The insurer has a team of experts dedicated to minimizing your payout. Without professional representation, you are at a significant disadvantage.

This is why many commercial property owners ask, Should I Hire a Public Adjuster? For complex business interruption claims, where your business’s survival is at stake, professional advocacy isn’t just helpful—it’s essential.