Why Understanding the Texas Insurance Claim Process Can Save Your Property Investment

The insurance claim process Austin property owners steer is significantly different from residential claims, especially for commercial buildings and multifamily complexes. When property damage strikes your investment, knowing the steps, deadlines, and requirements under Texas law can be the difference between a fair settlement and financial hardship.

Key Steps in the Austin Insurance Claim Process:

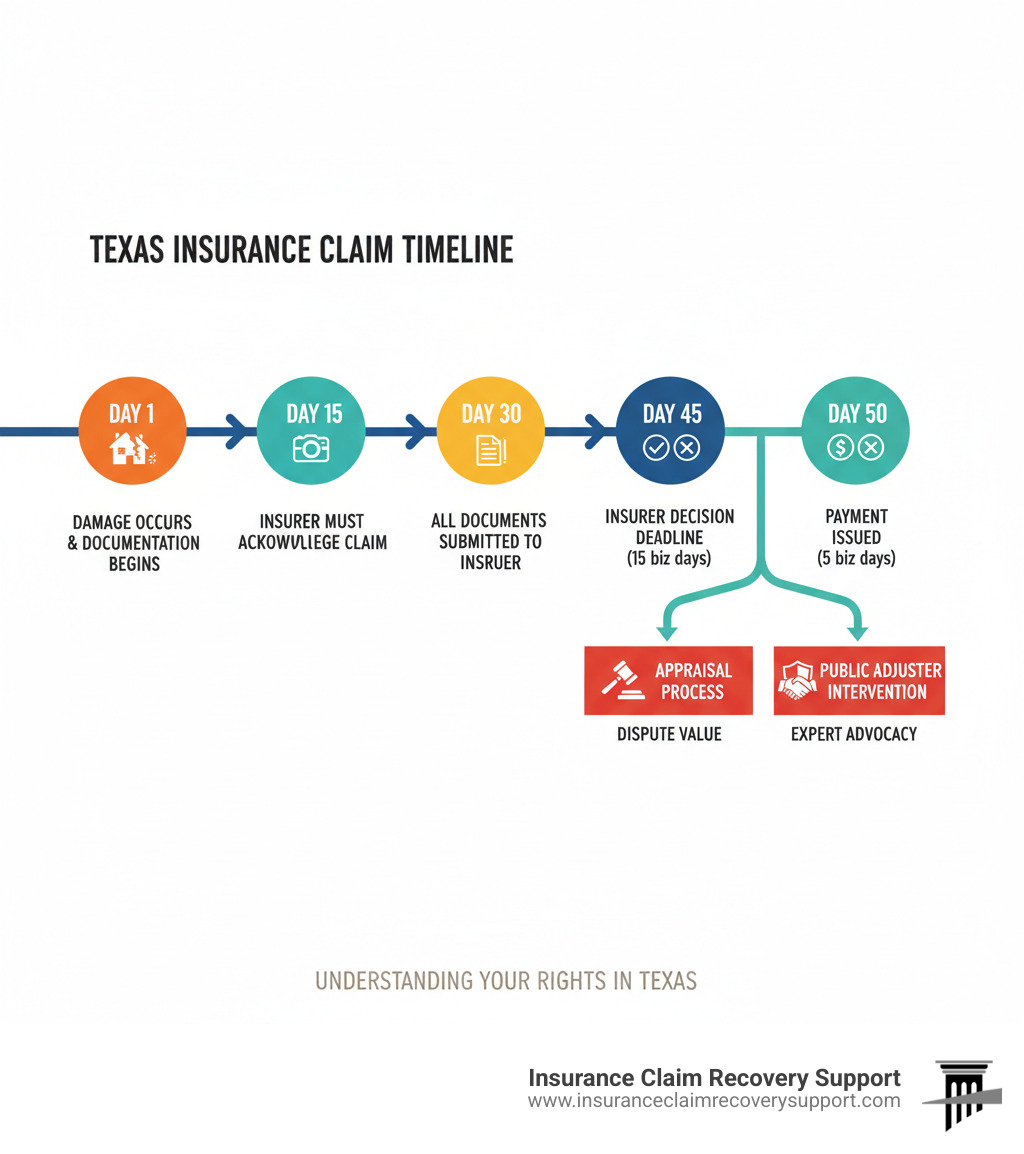

- First 48 Hours: Document damage, secure property, notify insurer

- File Your Claim: Insurers must acknowledge within 15 days

- Adjuster Inspection: The insurance company’s adjuster evaluates the damage

- Settlement Decision: Insurers have 15 business days to approve/deny after receiving all documentation

- Payment: If approved, payment must be issued within 5 business days

- Appeals Process: If denied or undervalued, you can dispute the decision

Many property owners are disappointed by low payouts and denied claims. Texas law provides specific protections, but the stakes for commercial properties—with business interruption losses and complex building systems—are much higher. Understanding the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) alone can impact your recovery by tens of thousands of dollars.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. As a Multi-State Licensed Public Adjuster with over 15 years of experience, I’ve helped property owners steer the insurance claim process Austin and throughout Texas, settling hundreds of millions in claims. Proper advocacy can increase recoveries by 30% to over 3,800% and help you avoid lengthy, unnecessary litigation.

Important insurance claim process Austin terms:

The First 48 Hours: Immediate Steps After Property Damage

When disaster strikes your commercial property in Austin, Houston, or San Antonio, the actions you take in the first 48 hours are critical. The right steps can make or break your insurance claim process Austin experience, while missteps can cost you tens of thousands of dollars. Insurance companies watch your every move, looking for reasons to reduce your settlement. Knowing what to do ensures a successful recovery for your Property Damage Claims in Texas.

Securing Your Commercial Property

Safety comes first. Before anything else, ensure tenant safety, evacuate dangerous areas, and call emergency services if needed. Next, shut off utilities like water, gas, and electricity to prevent secondary damage, which can be catastrophic.

Your insurance policy requires you to take reasonable steps to mitigate further harm. This is a condition of your coverage. Key actions include:

- Boarding up broken windows to protect against weather and theft.

- Tarping damaged roofs to prevent water intrusion.

- Beginning water extraction immediately to prevent mold and structural decay.

These emergency measures are typically covered expenses, so document everything and keep all receipts. Working with professionals who understand Water Damage Restoration is invaluable, as they know what insurers will cover.

Documenting the Damage Like a Pro

Think of documentation as building your case. Every photo, video, and note is evidence to support your claim. Exceptional documentation can increase a settlement by hundreds of thousands of dollars.

- Photos and Videos: Take wide shots to show the overall scope, then detailed close-ups of specific issues from multiple angles. A video walkthrough with narration creates a compelling story that adjusters can’t ignore.

- Written Logs: Keep a detailed record of events. Note when the damage occurred, when you found it, who you spoke with, and what actions you took.

- Inventory and Receipts: For commercial properties, create thorough lists of damaged inventory with descriptions, quantities, and costs. Keep receipts for all emergency expenses, as these are typically reimbursable.

- Pre-Loss Records: Photos or videos of your property’s condition before the damage provide undeniable proof of your loss, which is especially critical for a Fire Damage Insurance Claim.

Solid documentation makes it much harder for insurance companies to challenge your claim and is the foundation for a successful recovery.

Navigating the Commercial Insurance Claim Process Austin

After securing your property and documenting the damage, the formal insurance claim process Austin begins. This phase can be overwhelming, but knowing what to expect makes it manageable.

First, file the claim with your insurer promptly and get a claim number. Your insurer will assign a company adjuster who works for them, not you. Their goal is to evaluate the damage according to the insurer’s interests, which often means minimizing the payout. Be present for the on-site inspection to point out all damage and provide your documentation.

You will need to complete Proof of Loss forms, which are official documents detailing your losses. Accuracy is crucial to avoid delays. Finally, the insurer will make a settlement offer. Be prepared for this initial offer to be lower than you expect. For a complete overview, see our Insurance Claim Process Complete Guide.

Key Deadlines You Must Know

Texas law provides protections for policyholders with strict deadlines for insurers:

- 15-Day Acknowledgment Rule: Insurers must acknowledge your claim within 15 days of receipt.

- 15-Business-Day Decision Window: After receiving all necessary information, they have 15 business days to accept or reject your claim (with some exceptions for extensions).

- 5-Business-Day Payment Rule: If your claim is approved, payment must be issued within five business days.

Also, be aware of the statute of limitations, which is typically two years from the incident date to file a lawsuit if needed. These protections are outlined in the Texas Policyholder Bill of Rights.

Understanding Your Settlement: ACV vs. RCV

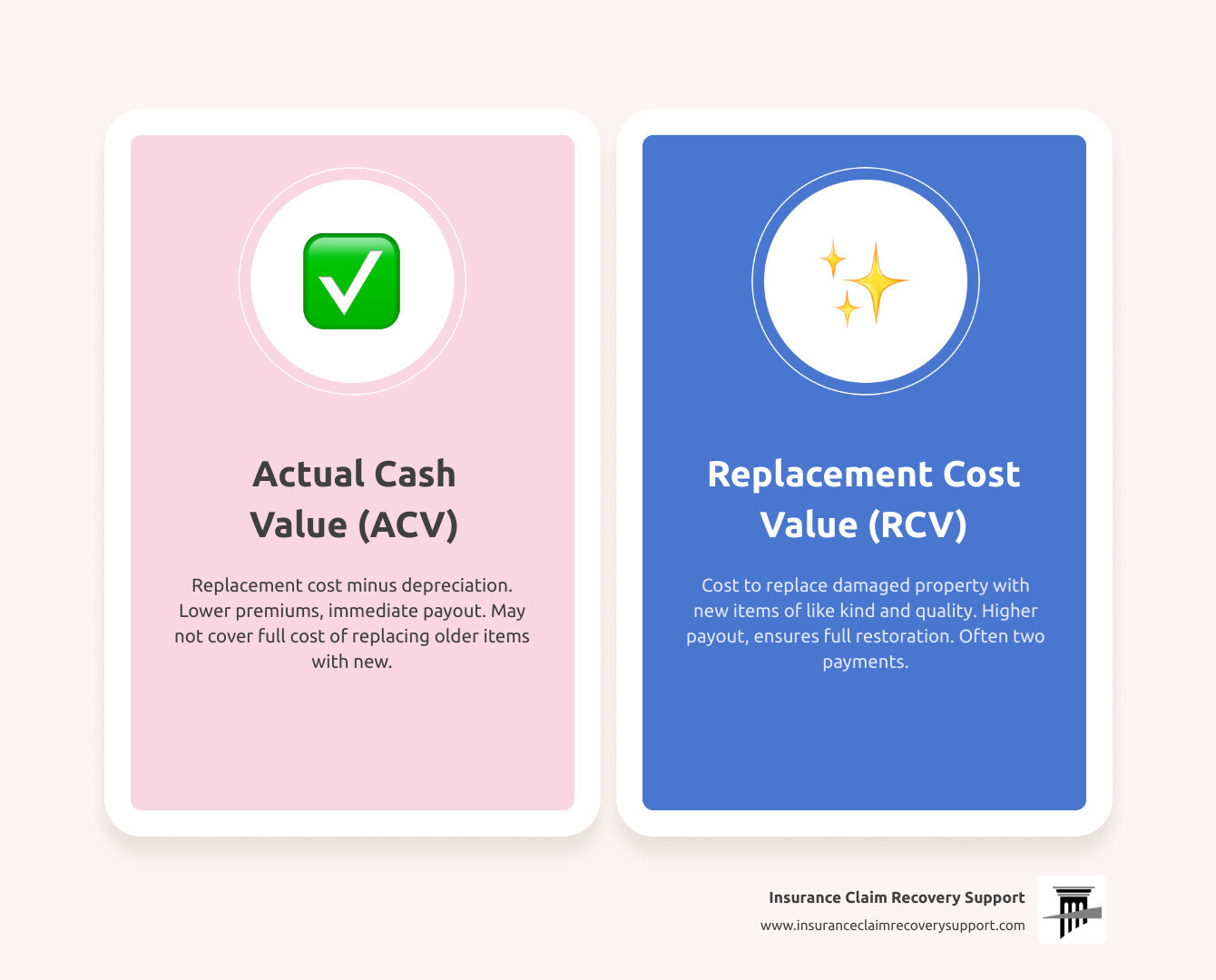

Your settlement amount depends on whether your policy pays Actual Cash Value (ACV) or Replacement Cost Value (RCV). The difference can be enormous.

- ACV pays the replacement cost minus depreciation. You get what your used property was worth.

- RCV pays the full cost to replace damaged property with new items of similar quality.

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | Replacement cost minus depreciation | Cost to replace damaged property with new property of like kind and quality |

| Depreciation | Deducted from the settlement offer | Not deducted (initially, for recoverable depreciation) |

| Payout Timing | Single payment based on current value | Often two payments: ACV first, then the remaining depreciation after repairs are complete |

| Benefit | Lower premiums, immediate payout | Higher payout, covers full cost of new replacement |

| Consideration | May not cover full cost of replacing older items | Ensures property can be restored to its pre-loss condition |

| Best For | Properties where lower premiums are a priority, or older assets | Properties where full restoration is crucial, and higher premiums are acceptable |

With RCV policies, you often get an initial ACV payment, and the remaining recoverable depreciation is paid after you complete repairs and provide receipts. Understanding your policy’s specific terms is crucial.

The Unique Challenges of Commercial Property Claims

Commercial claims are far more complex than residential ones. Key challenges include:

- Business Interruption: Documenting lost rental income and ongoing expenses is critical but requires detailed financial records.

- Scale and Complexity: Damage to large properties with complex HVAC, electrical, and plumbing systems requires specialized assessment. A small issue in a large building can lead to a massive loss.

- Multiple Stakeholders: Claims involve managing displaced tenants, lost income, and communications with lenders and investors.

- Higher Values: With millions of dollars at stake, even small percentage disputes in a settlement can mean a difference of hundreds of thousands of dollars, especially in cases like Wind Damage Insurance Claims.

Your Rights and The Insurer’s Obligations Under Texas Law

As a commercial property owner, understanding your rights under Texas law is crucial for a fair settlement. Policyholders have specific protections, and insurance companies have clear legal obligations throughout the insurance claim process Austin.

Your policyholder rights include prompt payment, a fair investigation, and honest communication. You are entitled to a written explanation if your claim is denied or the offer is inadequate. Your insurance company’s duties include acting in good faith, conducting a reasonable investigation, and not misrepresenting policy terms. Unfortunately, insurers often fall short, leaving owners struggling with Disputing Damage Claims.

What to Do if Your Claim is Denied or Undervalued in Austin

Receiving a denial or a lowball offer is frustrating, but you are not powerless. If your multifamily property in Georgetown suffers storm damage and the offer is too low, take these steps:

- Request a written explanation: Demand a detailed letter outlining the specific policy provisions used to deny or undervalue your claim.

- Review your policy: Compare the insurer’s explanation with your policy language. Adjusters sometimes misinterpret or misapply exclusions.

- Gather new evidence: Obtain independent contractor estimates or hire specialists to provide a professional assessment of the damage.

- Use the appraisal process: Most commercial policies include an appraisal clause to resolve disputes over the amount of loss. Each side hires an appraiser, and if they can’t agree, a neutral umpire makes a binding decision. This is often faster and cheaper than a lawsuit.

- File a complaint: The Texas Department of Insurance (TDI) can investigate whether your insurer acted in good faith and followed proper procedures.

Recognizing and Responding to Insurance Bad Faith

Insurance bad faith occurs when an insurer unfairly puts its financial interests ahead of your legitimate claim. Watch for these red flags:

- Unreasonable delays in acknowledging your claim or conducting an investigation.

- Inadequate investigation, such as a brief inspection of extensive damage or failing to use specialists for complex systems.

- Misrepresenting policy coverage by telling you something isn’t covered when it is.

- Lowball offers that ignore your evidence, use outdated pricing, or are significantly below independent estimates.

- Refusing to pay a valid claim without a reasonable basis.

If you experience these issues, Texas law provides strong protections. Professional advocacy can help you steer these challenges and hold the insurer accountable without resorting to lengthy litigation.

The Public Adjuster Advantage: Maximizing Your Claim Without Unnecessary Litigation

After a storm damages your Austin commercial property, you may receive a settlement offer that covers only a fraction of your losses. This is a common frustration for property owners across Texas.

This is where a public adjuster changes the game. Unlike the company adjuster who works for the insurance company, a public adjuster works exclusively for you, the policyholder. We act as your personal advocate, leveling the playing field against insurers who have teams dedicated to minimizing payouts. The results are clear: property owners who hire public adjusters often see settlements increase by 30% to over 3,800% compared to initial offers. We bring the same expertise to the table as the insurer, but our focus is entirely on your recovery.

For more on how we champion property owners in the insurance claim process Austin, visit our Public Adjuster Services page.

The Role of an Austin Public Adjuster in Your Claim

Hiring an Austin public adjuster means you gain a professional who manages every aspect of your claim. Our process includes:

- Policy Review: We analyze your insurance contract to identify all applicable coverages, ensuring you receive everything you’re entitled to.

- Damage Assessment: We conduct thorough inspections to find hidden damage that company adjusters often miss, which can add thousands to your settlement.

- Documentation and Negotiation: We package your claim professionally and handle all negotiations with the insurer, removing the stress from your shoulders and fighting for the maximum settlement.

Our ultimate goal is to secure the funds you need to fully restore your property and business operations. Learn more about our qualifications here: What is a Public Insurance Adjuster?.

Insurance Claim Lawsuits vs. Public Adjuster Approach

When facing a low offer or denial, many owners consider a lawsuit, but this path is often long and expensive. Litigation involves significant attorney fees, court costs, and extensive findy expenses that can consume a large part of any eventual settlement. The process can take years, during which your property remains damaged and business losses mount. The adversarial nature of a lawsuit often makes reasonable negotiation impossible.

In contrast, the public adjuster approach focuses on advocacy and negotiation within the insurance framework. We aim to achieve settlement maximization in weeks or months, not years. We work on a contingency basis—if we don’t increase your settlement, you don’t pay our fee. This aligns our interests with yours and eliminates the financial risk of hourly legal fees.

While legal action is sometimes necessary for clear cases of bad faith, the vast majority of claims can be resolved successfully through skilled public adjuster advocacy. This saves you time, money, and stress while securing the maximum recovery you deserve.

Frequently Asked Questions about the Texas Insurance Claim Process

Owners and managers of commercial and multifamily properties often have similar questions about the insurance claim process Austin. Here are answers to the most common concerns.

How do mortgage companies get involved in property damage insurance claim payments?

If you have a mortgage, your lender has a financial stake in your property and is typically named on your insurance policy. This means any check for structural damage will likely be made out to both you and your mortgage company. You’ll need to endorse the check and send it to your lender, who will place the funds in an escrow account.

The lender will then release the money in draws as repairs are completed and inspected. This process protects their investment by ensuring the funds are used to restore the property. To avoid delays, communicate with your mortgage company early to understand their specific requirements for releasing funds.

What are the main differences between commercial and residential property claims?

While the basic steps are similar, commercial claims are vastly more complex than residential ones. The key differences are:

- Scale and Complexity: Commercial properties are larger and have intricate systems (HVAC, electrical) that require specialized assessment.

- Business Interruption: Commercial policies often cover lost rental income and ongoing expenses, adding a layer of financial documentation not present in most residential claims.

- Policy Intricacy: Commercial insurance policies are highly detailed, with specialized endorsements and higher limits that require expert interpretation.

- Multiple Stakeholders: A commercial claim can involve owners, managers, multiple tenants, and lenders, each with their own interests.

- Higher Financial Stakes: With potential losses in the millions, the financial impact of a settlement dispute is far greater.

What are my rights if I disagree with the insurance company’s final offer?

A “final offer” is rarely final. You have several powerful options if you believe the offer is inadequate:

- Negotiate: Present your own detailed estimates and documentation to support a higher valuation. Negotiation is an expected part of the process.

- Invoke the Appraisal Clause: Most policies allow you to use the appraisal process to resolve disputes over the amount of loss. This is typically faster and less expensive than a lawsuit.

- File a Complaint: The Texas Department of Insurance (TDI) can investigate your claim to ensure your insurer acted fairly and followed the law.

- Seek Professional Representation: A public adjuster has the expertise to effectively challenge an inadequate offer and negotiate a fair settlement on your behalf, often avoiding the need for litigation.

Don’t settle for less than you deserve. With the right strategy, you can challenge an unfair offer and secure the recovery your investment requires.

Your Partner in Recovery from Dallas to the Gulf Coast

When property damage strikes your commercial investment in Texas, you don’t have to face the complex insurance claim process Austin alone. At Insurance Claim Recovery Support, we are public adjusters who serve as your dedicated advocates, specializing in claims for commercial buildings, multifamily properties, and religious institutions across Texas—from Dallas-Fort Worth to Houston and San Antonio.

Our expertise is in navigating complex fire, storm, and flood damage claims to secure the maximum settlement you deserve, without the need for costly and time-consuming litigation. We challenge lowball offers and unfair denials to ensure you can fully recover. Our approach has increased client recoveries from 30% to over 3,800%.

We work on a contingency basis, which means we only get paid if we increase your settlement. This aligns our success directly with yours and eliminates financial risk. Don’t let an inadequate offer derail your investment.

Contact us today for a free consultation, and let us put our expertise to work for your recovery. We’re ready to be your trusted Austin Public Adjuster and partner in getting your property—and your business—back on track.