The Unforgettable Impact of Winter Storm Uri

Austin freeze damage from Winter Storm Uri in February 2021 left a trail of destruction, causing over $195 billion in statewide damages and widespread infrastructure failures. The storm plunged temperatures to 6°F, and a disrupted polar vortex sent Arctic air deep into a state unprepared for such extreme cold. At its peak, nearly 10 million Texans were without power, leading to catastrophic failures in commercial and multifamily properties.

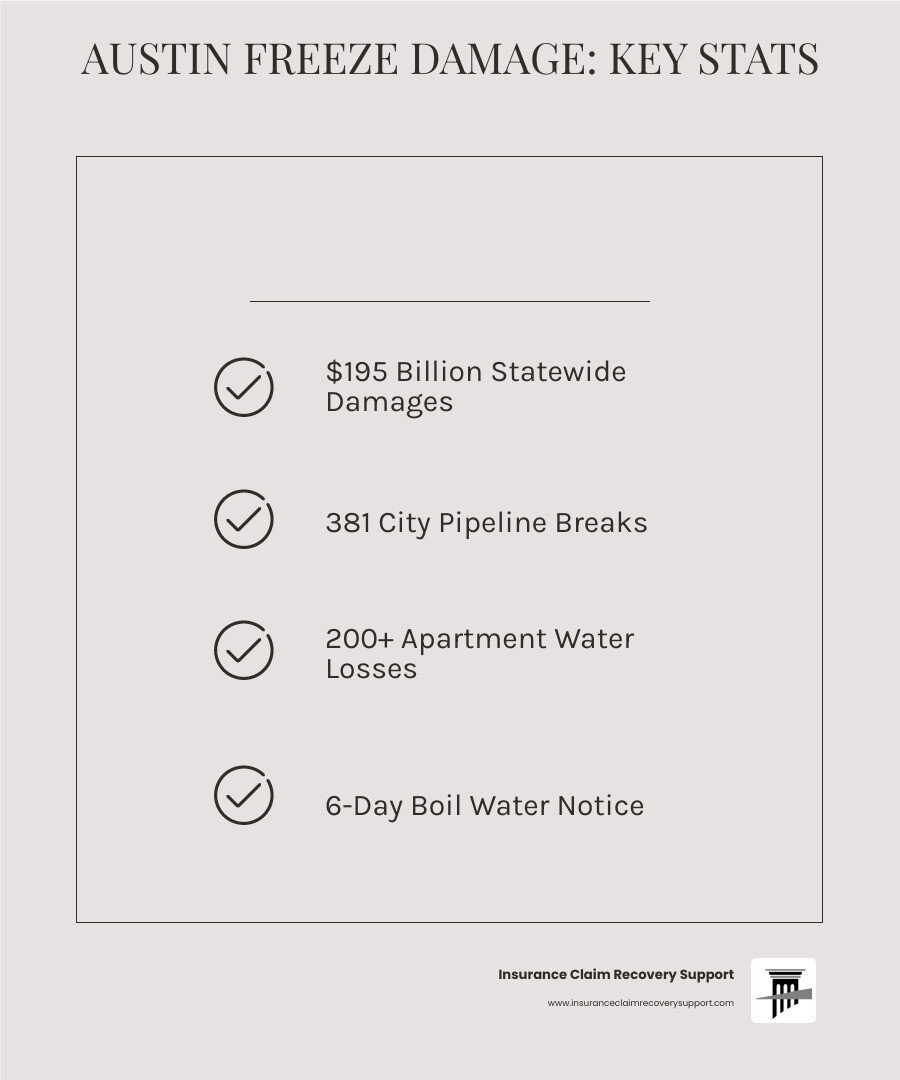

In Austin alone, the city saw 381 water line breaks, over 200 apartment complexes lost water, and a 6-day boil water notice was issued. For property owners, this meant burst pipes, shattered sprinkler systems, flooding, and extended business interruptions. The grid failure compounded the crisis, as failed heating systems caused damage to multiply exponentially. The storm was directly linked to over 200 deaths statewide.

For property owners filing insurance claims, the aftermath was just as challenging. Many faced low payouts, claim denials, or disputes over coverage for freeze-related damage. The complexities of commercial property policies left many struggling to recover.

I’m Scott Friedson, a licensed public adjuster with over 15 years of experience. My firm specializes in helping commercial and multifamily property owners steer complex insurance claims for events like Austin freeze damage. We work to secure the maximum settlement you’re entitled to, avoiding the costly delays and adversarial nature of litigation.

The Cascade of Failure: How the Freeze Crippled Austin’s Infrastructure

Winter Storm Uri created a domino effect of infrastructure failures that left millions of Texans in crisis. The state’s infrastructure, never designed for a deep freeze that lasted six to nine consecutive days, buckled under the strain.

The Electric Reliability Council of Texas (ERCOT) grid failed almost immediately. Power generation facilities weren’t weatherized, triggering forced outages that left nearly 10 million Texans without power. In Austin, some residents and businesses went without electricity for over a week.

The loss of power caused a cascade of secondary failures. Without electricity for pumps and treatment plants, Austin’s water system collapsed. The city reported 381 water line breaks in municipal pipelines, and over 200 apartment complexes lost water due to private plumbing damage. This led to a city-wide boil water notice that lasted for six days. Emergency services were stretched thin, responding to a record number of 911 calls.

Assessing Widespread Commercial Austin Freeze Damage

For commercial and multifamily property owners, the combination of intense cold and prolonged power outages created a perfect storm of destruction. The resulting Austin freeze damage was extensive and costly.

- Burst Pipes and Sprinkler Systems: Uninsulated pipes and fire sprinkler lines froze and ruptured, leading to massive flooding once temperatures rose. This was the most common and destructive form of damage, compromising fire safety systems and causing widespread water damage.

- Extensive Flooding: The failure of plumbing and sprinkler systems led to severe flooding in apartment complexes and commercial buildings, soaking carpets, damaging walls, and creating electrical hazards and the potential for mold.

- Roof and Structural Damage: Ice dams forced water under roofing materials, leading to hidden leaks and long-term structural issues. The expansion and contraction from extreme temperature fluctuations also placed significant stress on building foundations, walls, and roofs.

- HVAC and System Failures: Commercial HVAC systems with exposed piping or water coils froze, resulting in costly repairs and leaving buildings without heat, which only worsened the pipe-freezing problem.

- Business Interruption: Beyond physical damage, the inability to operate due to power outages, water loss, and property damage meant staggering lost revenue and disrupted operations for countless businesses.

The scale of this damage was immense, and for many property owners, the immediate aftermath was just the beginning of a long and challenging recovery process.

Navigating the Complexities of a Commercial Freeze Damage Claim

After experiencing severe Austin freeze damage, the path to recovery for commercial property owners leads into a maze of insurance complexities. Filing a claim for what seems like obvious damage can quickly become overwhelming.

Commercial policies are filled with technical language, specific coverage limits, and potential exclusions. Insurers may require you to prove you fulfilled your duties after loss, such as mitigating further damage. Without comprehensive damage documentation—photos, videos, inventories, and receipts—you risk a lowball offer or denial.

Property owners routinely face underpaid claims or outright claim denials, with insurers blaming damage on “deferred maintenance” or “aging infrastructure” instead of the freeze. These disputes can drag on, costing you lost revenue and delaying critical repairs.

Why a Public Adjuster is Your Best Ally for Recovery

When facing a dispute over Austin freeze damage, many think their only option is to hire an attorney and file a lawsuit. However, there is a better way that avoids a costly, years-long legal battle.

Litigation is expensive, with attorney fees (33-40% contingency or high hourly rates), court costs, and expert witness fees. The process is slow and adversarial, involving depositions and cross-examinations while your property deteriorates. A public adjuster offers a more efficient path.

As public adjusters, we work exclusively for you, the policyholder. We bring expert advocacy to the negotiation table, leveraging our deep knowledge of policy language and damage valuation. Our detailed claim preparation includes documenting hidden damage that company adjusters often miss. Our focus is on negotiation, not litigation, to secure a fair settlement quickly.

| Feature | Insurance Claim Lawsuit (Property Damage) | Using a Public Adjuster (Commercial Freeze Claim) |

|---|---|---|

| Timeline | Can take years to resolve, often dragging through findy and court dates. | Generally much faster; aims for resolution within weeks or months through negotiation. |

| Cost | High legal fees (hourly or contingency, plus court costs, expert witness fees). | Pre-arranged fee (typically 10-15% of the final settlement); no upfront costs. |

| Adversarial Nature | Highly adversarial, often involves depositions, cross-examinations, and intense legal battles. | Collaborative advocacy; public adjuster negotiates on your behalf, aiming for a fair settlement. |

| Control | Limited control over the process once it’s in the hands of attorneys and the court. | You retain control and make final decisions on settlement offers. |

| Focus | Proving liability and fault, often leading to a win/lose outcome. | Proving the full extent of your loss and maximizing your entitled benefits. |

| Outcome | Uncertain, can result in a favorable judgment, a forced settlement, or even a loss. | Significantly increases chances of a higher settlement without court intervention. |

We handle all communications with the insurer, freeing you to manage your property. Our fee is a percentage of the final settlement, so we only get paid when you do. We routinely secure settlements two to three times higher than initial offers, getting you the funds needed to repair your property and resume business in a fraction of the time a lawsuit would take. For commercial property owners, a public adjuster is the best path to a full and fair recovery.

Future-Proofing Your Property Against Austin Freeze Damage

Winter Storm Uri exposed critical weaknesses in Texas commercial properties. While lawmakers passed Senate Bill 3 to mandate power plant weatherization, gaps in the gas supply chain mean property owners cannot rely solely on the grid. Proactive property protection is essential.

Key winterization steps for commercial properties include:

- Insulating Pipes: Protect all pipes in unheated spaces like attics, crawl spaces, and exterior walls. Use heat tape for vulnerable sections.

- Sealing the Building: Seal gaps and cracks around windows, doors, and foundations to prevent cold air infiltration.

- Draining Exterior Systems: Before a freeze, drain irrigation systems, outdoor faucets, and pool lines.

- Maintaining HVAC: Ensure regular HVAC maintenance and consider backup heating for critical areas.

- Knowing Your Shut-Off Valve: Train all staff on the location of the main water shut-off valve to prevent catastrophic flooding from a burst pipe.

- Conducting Risk Assessments: Regularly identify vulnerabilities and consider upgrading infrastructure with cold-resistant materials.

The Winter weather preparedness guide from Ready.gov offers more comprehensive guidance. These measures protect your investment from the next inevitable storm.

How a Public Adjuster Streamlines Your Claim

Even with preparation, damage can occur. A public adjuster streamlines the recovery process. We provide comprehensive claim management, handling all communications and paperwork so you can focus on your business. Our expert damage valuation ensures all losses, including hidden damage like mold or structural issues, are documented. We use our deep policy interpretation expertise to counter unfair denials and negotiate effectively with the insurer, maximizing your settlement and securing a faster resolution without resorting to litigation.

Frequently Asked Questions About Austin Freeze Damage

What made Winter Storm Uri the costliest disaster in Texas history?

Winter Storm Uri caused over $195 billion in damages due to a catastrophic, large-scale infrastructure failure. Texas’s power plants, gas facilities, and water systems were not winterized for the prolonged, deep freeze. This led to a domino effect: the power grid failed, which caused water systems to collapse, which led to burst pipes and widespread flooding in millions of properties. The financial toll included not only the high cost of repairs but also significant business interruption losses across the state.

My commercial property’s sprinkler system burst. Is that covered by insurance?

Usually, yes. Most commercial policies cover sudden and accidental damage from freezing, which includes burst sprinkler pipes. However, insurers may try to deny the claim by citing policy exclusions or blaming the damage on “lack of maintenance” or a “pre-existing condition.”

Proving the damage was a direct result of the freeze is crucial. This requires thorough documentation of the event and your property’s condition. A public adjuster can help interpret your specific policy, gather the necessary evidence, and counter unfair denials to ensure you receive the coverage you’re entitled to.

My initial freeze damage claim was denied. What are my options now?

A denial is not the final word. Your first step is to review the specific denial reason provided by the insurer. Often, denials are based on claims of “insufficient documentation” or vague policy exclusions.

The most effective path forward is to engage a public adjuster to reopen and negotiate the claim. We build an ironclad case by gathering additional evidence, conducting our own thorough inspection for hidden damage, and using our policy expertise to challenge the denial. This approach focuses on negotiation to secure a fair settlement quickly, avoiding the time, cost, and stress of a lawsuit. We have successfully overturned countless denied freeze damage claims, recovering the full settlements our clients deserved.

Conclusion: Building a More Resilient Future

Winter Storm Uri was a stark reminder of how vulnerable Texas infrastructure is to extreme weather, resulting in catastrophic Austin freeze damage. The lessons are clear: preparedness is essential, but even the best plans can be overwhelmed. When disaster strikes, a swift and full recovery depends on having the right expert support.

The insurance claim process for commercial properties is complex and often adversarial. Property owners who faced Austin freeze damage were met with lowball offers and unfair denials. This is where the value of expert assistance becomes critical.

At Insurance Claim Recovery Support, we work exclusively for policyholders. Our public adjusters specialize in complex commercial claims for apartment complexes, office buildings, and other properties. We document the full extent of your loss, interpret your policy, and negotiate with the insurance company to secure the maximum settlement you deserve.

Engaging a public adjuster helps you avoid the costly and lengthy path of litigation. We achieve better results through expert negotiation, getting you a fair settlement faster. Resilience comes from preparing for the next storm and knowing you have an advocate ready to fight for your full recovery.

Don’t face the aftermath of property damage alone. Learn how our public adjusters can help with your commercial property claim. Whether you’re in Austin, Dallas, Houston, San Antonio, or anywhere across Texas, we are ready to ensure your recovery is as complete as possible.