The Real Risk: What Happens After You File a Property Damage Claim

Fact or Myth: Will Your Insurance Company Drop You or Raise Your Premium After You File a Property Damage Claim?

When disaster strikes — whether from hail, wind, fire, or another natural catastrophe — property owners often hesitate to file an insurance claim. One of the biggest reasons? The fear that their insurance company will drop them or raise their rates after they file.

So, let’s separate fact from myth and explain under what circumstances your insurer can increase your premiums or cancel your policy — especially if you hire a licensed public adjuster to represent your interests.

Myth: Filing a Property Claim Automatically Means You’ll Be Dropped

This is one of the most common misconceptions among policyholders — and it’s mostly a myth.

Filing a valid property damage claim for a covered loss under your insurance policy does not automatically trigger a non-renewal or cancellation. Insurance companies are legally required to handle legitimate claims in good faith, and you have every right to use your coverage when you suffer damage.

However, there are some exceptions.

Fact: Certain Circumstances Can Lead to Non-Renewal or Rate Increases

While a single claim typically won’t cause your policy to be dropped, multiple claims or high-risk patterns can. Here are the key distinctions:

1. Type of Claim Matters

Acts of Nature (Wind, Hail, Tornado, Fire, Hurricane):

These are generally considered “no-fault” claims — meaning the damage wasn’t due to your negligence. Most insurance carriers don’t penalize you for these, especially if the event affected a large geographic area.

Preventable or Liability Claims (Water leaks, theft, liability injuries):

Insurers may view repeated or preventable claims as higher risk, potentially affecting your renewal.

- ✅ Premium increases are common after filing a claim, with rates typically rising 5-10% or more depending on claim type and severity.

- ✅ Policy non-renewal is possible, especially after multiple claims within 3-5 years.

- ✅ Mid-policy cancellation is rare but can occur in cases of suspected fraud or extreme risk.

- 🚫 Not all claims are treated equally—weather-related claims may have less impact than liability or repeated water damage claims.

- 📊 Claims stay on your record for 5-7 years via the CLUE (Comprehensive Loss Underwriting Exchange) database.

2. Claim Frequency

Filing multiple claims within a short period — typically within three to five years — can result in premium increases or even a non-renewal notice. Insurers use claim history databases like CLUE (Comprehensive Loss Underwriting Exchange) to assess risk patterns.

Fact: Filing two or more claims within three to five years can raise red flags for home insurance companies and place you in a “high-risk category.”

3. Underwriting Guidelines

Each carrier has its own underwriting rules. If the carrier’s risk tolerance changes (for example, reducing exposure in hurricane-prone regions), they may choose not to renew entire classes of policies — not just yours personally.

The decision to file a property damage claim isn’t just about immediate repairs—it’s a strategic business decision that can impact your insurance coverage and costs for years. For commercial property owners, multifamily housing operators, HOAs, and religious institutions, understanding how insurers evaluate claims is critical to protecting both your property and your policy.

Fact: Hiring a Public Adjuster Will Not Get You Dropped

Another myth that circulates among property owners is that hiring a public adjuster will cause your insurance company to retaliate or cancel your coverage.

That’s completely false.

You have the legal right in all 50 states to be represented by a licensed public insurance adjuster who advocates for you — the policyholder — not the insurance company.

Public adjusters are professionals who:

- Interpret your policy,

- Document and value your loss,

- Negotiate on your behalf to ensure a fair settlement.

Insurers cannot legally cancel or non-renew your policy simply because you exercised your right to representation.

Fact or Myth: Your Premiums Will Automatically Go Up After a Claim

This one’s partly true — but it depends.

Insurers base premiums on overall risk data, not individual punishment. Here’s the reality:

If your area was affected by a widespread natural disaster, premiums may increase across the board due to regional risk adjustments — not because you personally filed a claim.

If you have a history of multiple claims, your personal risk profile may increase, resulting in higher premiums.

If your claim is small or preventable (like repeated water leaks), that can impact your individual rate more directly.

In other words: One legitimate claim for storm or fire damage won’t usually raise your rates — but a pattern of claims might.

Insurance companies view every claim as an indicator of future risk. They use sophisticated models to assess whether a policyholder represents a higher-than-average risk, which directly influences renewal decisions and premium pricing. The type of claim, its severity, and even your property’s location in Texas—from Houston to Dallas or San Antonio—all play a role in the outcome.

I’m Scott Friedson, and over the past 15 years, I’ve helped hundreds of commercial and multifamily property owners steer the complex question of Will Your Insurance Company Drop You or Increase Your Premium After You File a Property Damage Claim by ensuring their claims are properly documented, fairly valued, and strategically presented. As a multi-state licensed public adjuster, I’ve seen how professional claim advocacy can protect both your immediate settlement and your long-term insurability.

Simple guide to Will Your Insurance Company Drop You or Increase Your Premium After You File a Property Damage Claim? terms:

Why Insurers Raise Premiums or Cancel Policies After a Claim

Insurance is a business built on calculated risk. Every time you file a claim, your insurer’s view of your property’s risk changes. This isn’t personal; it’s a data-driven assessment to protect their bottom line.

Once your claim is filed, it enters the Comprehensive Loss Underwriting Exchange, or CLUE report. This industry-wide database, managed by LexisNexis, tracks claims on a property for up to seven years, creating a loss history that follows the address, not just the owner. An active loss history can flag your property as high-risk, triggering premium increases or non-renewal.

External factors also play a major role. If an insurer pays out millions after widespread Texas storms in areas like Houston, Dallas, or Austin, they may raise rates across the board to remain solvent. Rising construction costs and the increasing cost of reinsurance—insurance for insurance companies—also get passed down to policyholders through higher premiums.

Factors That Influence an Insurer’s Decision

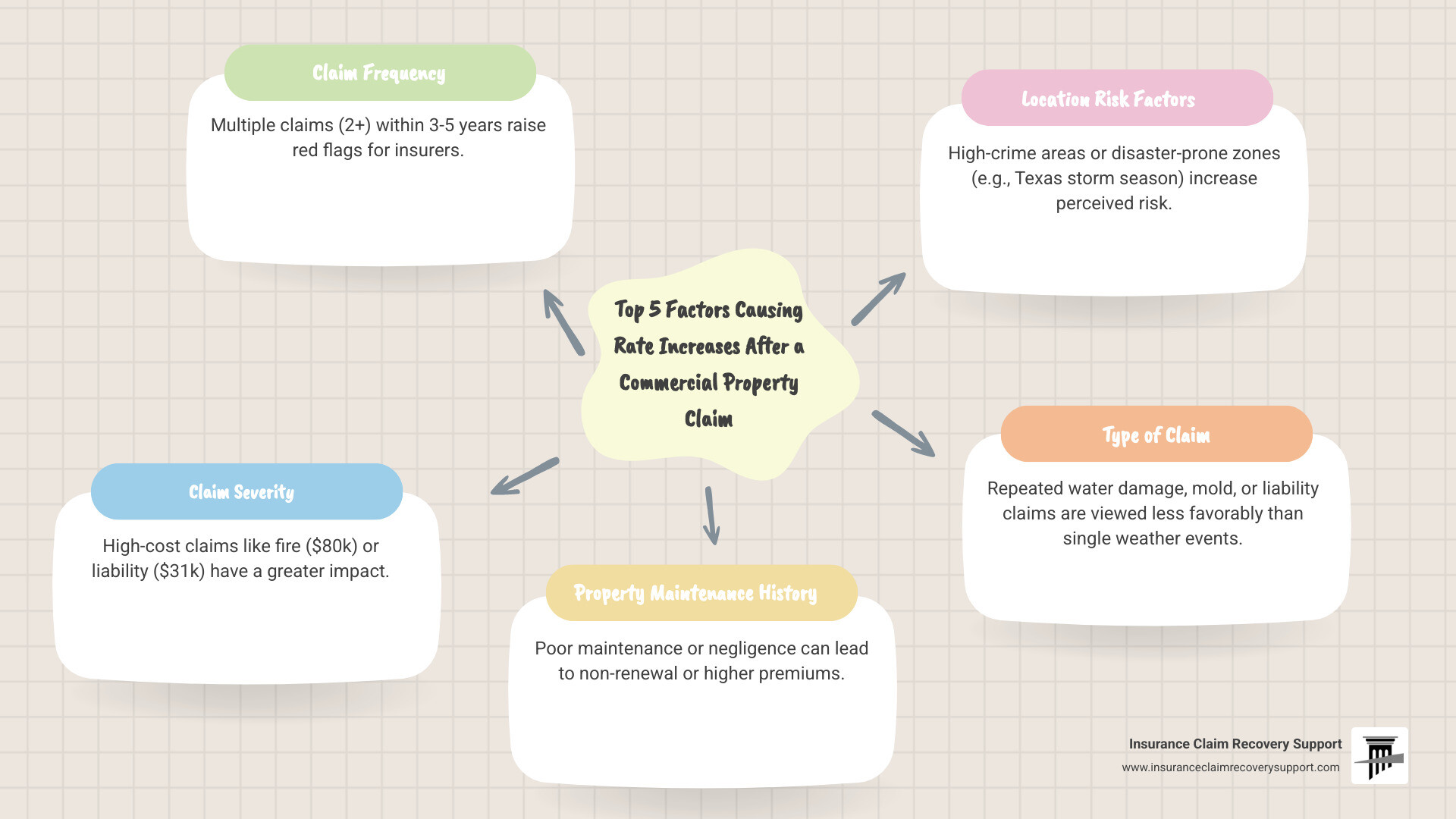

Several critical factors determine whether your rates will rise or your policy will be non-renewed:

- Claim Frequency: This is a top concern for underwriters. Filing two or more claims within a three-to-five-year period is a major red flag, as it suggests a pattern of future losses.

- Claim Severity: The dollar amount of your claim matters. A major fire claim (averaging $80,000) or a liability claim (averaging $31,000) carries far more weight than a minor repair.

- Property Maintenance: Insurers distinguish between unforeseen events and negligence. A claim resulting from a roof leak you ignored for months will be viewed more harshly than damage from a sudden tornado.

- Property Location: You can’t control geographic risk. If your building is in a flood-prone area or a neighborhood with high crime rates, your premiums will reflect that risk, regardless of your personal claim history.

How Long Does a Claim Affect Your Commercial Policy?

Your claim history lives on in the CLUE database for up to seven years. While the full history is stored, most insurers focus on the most recent three to five years when making renewal or pricing decisions. A recent claim can make it significantly harder and more expensive to find new coverage if your current insurer decides not to renew your policy. This long-term impact is why the question “Will Your Insurance Company Drop You or Increase Your Premium After You File a Property Damage Claim?” requires careful strategic consideration.

Will Your Insurance Company Drop You or Increase Your Premium After You File a Property Damage Claim?

Yes, both premium increases and non-renewal are real possibilities. While you pay for coverage, filing a claim permanently alters your property’s risk profile in the eyes of your insurer.

- Premium Surcharges: This is the most common outcome. A single claim can trigger a rate hike that lasts for three to five years, often costing you more in the long run than the initial claim payout.

- Non-Renewal: Insurers generally can’t cancel your policy mid-term for a legitimate claim, but they can choose not to renew it when the term ends. This is common after multiple claims in a short period (e.g., two in three years).

- Mid-Policy Cancellation: This is rare and typically reserved for cases of fraud, material misrepresentation on your application, or a drastic, undisclosed increase in your property’s risk.

State regulations, especially in places like Texas, provide policyholders with protections against unfair practices. However, commercial property policies are complex, and insurers scrutinize claims carefully due to the high financial stakes involved.

What types of claims are most likely to cause your insurance company to drop you or increase your premium after you file a property damage claim?

Not all claims are equal. Insurers categorize them based on perceived risk:

High-Risk Claims:

- Water Damage & Mold: These often signal persistent, underlying issues like aging plumbing or poor maintenance, making them a top concern.

- Liability Claims: A slip-and-fall or other injury on your property opens the door to unpredictable and potentially massive legal and medical costs.

- Theft & Vandalism: A pattern of these claims suggests the property is in a high-crime area or lacks proper security.

- Preventable Fires: A fire caused by faulty wiring or deferred maintenance is viewed as negligence and a significant liability.

Lower-Risk Claims:

- Weather-Related Catastrophes: Damage from a single, widespread event like a hurricane in Houston or a tornado in Dallas is often seen as an uncontrollable act of nature. Many states limit an insurer’s ability to penalize you for a single catastrophic weather claim.

How can you minimize the risk that your insurance company will drop you or increase your premium after you file a property damage claim?

A proactive approach is your best defense:

- Document Proactive Maintenance: Keep detailed records of roof inspections, plumbing evaluations, and other preventive measures to prove you are a responsible property owner.

- Invest in System Upgrades: Modernizing electrical, plumbing, and fire suppression systems reduces the likelihood of a major loss and may qualify you for discounts.

- Improve Security: For properties vulnerable to crime, installing cameras and alarm systems can deter incidents and lower your risk profile.

- Understand Your Policy: Know your coverage limits, exclusions, and deductibles before you need to file a claim.

- Choose a Higher Deductible: If you have adequate financial reserves, a higher deductible can lower your annual premium and discourage you from filing small, non-catastrophic claims.

- Handle Small Repairs Out-of-Pocket: Paying for minor damage yourself helps maintain a claims-free history, which often comes with valuable discounts.

Strategic Claim Management for Commercial Properties

For owners of commercial properties, multifamily HOAs, and apartment complexes, every claim is a business decision with long-term financial consequences. The question Will Your Insurance Company Drop You or Increase Your Premium After You File a Property Damage Claim? requires a careful cost-benefit analysis.

Weigh the immediate relief of a claim payout against the potential for years of increased premiums. This is especially true for commercial properties, where business interruption can mean lost rent and revenue, adding another layer to the financial calculation.

When to File a Claim vs. Paying Out-of-Pocket

Before filing, do the math. If your deductible is $10,000 and the damage is $12,000, the $2,000 payout may not be worth the subsequent premium hikes, which could cost you more over the next 3-5 years. Avoid filing small “nuisance claims” that create a pattern of high frequency.

- Pay Out-of-Pocket For: Minor repairs or damage that is only slightly above your deductible.

- File a Claim For: Catastrophic damage from a fire, tornado, or major flood where repair costs are financially devastating. This is what insurance is for.

- Always File For: Liability claims. If someone is injured on your property, always report it to your insurer. The potential for future legal and medical costs is too great to handle privately.

How a Public Adjuster Helps Mitigate Risk and Avoid Litigation

When facing a significant commercial property claim, you are up against your insurer’s team of adjusters and experts whose goal is to minimize the payout. A public adjuster works exclusively for you, the policyholder, to level the playing field.

We conduct detailed damage assessments, prepare comprehensive documentation, and negotiate directly with the insurer on your behalf. This professional approach not only maximizes your settlement but also dramatically reduces the risk of disputes that lead to costly and time-consuming litigation.

An insurance lawsuit should be a last resort. By presenting a claim professionally from the start, a public adjuster can secure a fair settlement efficiently, saving you time, money, and the stress of a legal battle.

Public Adjuster Process vs. Insurance Lawsuit

| Feature | Public Adjuster Process | Insurance Lawsuit |

|---|---|---|

| Goal | Collaborative resolution & fair settlement | Adversarial victory, proving bad faith |

| Timeline | Months | Years |

| Cost | Contingency fee (% of settlement) | Hourly legal fees, court costs, expert witness fees |

| Relationship | Preserves a working relationship with insurer | Creates a permanently adversarial relationship |

| Focus | Accurate damage valuation and documentation | Legal arguments and depositions |

| Outcome | Faster, fair settlement without litigation stress | Uncertain, lengthy, and stressful process |

Bottom Line

✅ Filing a legitimate property damage claim will not automatically cause your insurance company to drop you.

✅ Natural disaster claims typically do not raise your premiums individually.

✅ Hiring a public adjuster is your right and does not impact your policy status.

🚫 Repeated or preventable claims, however, can lead to non-renewal or higher premiums.

Final Thoughts

Your insurance policy is a contract — and when damage occurs, filing a claim is not a favor you’re asking from your insurer, it’s a right you’ve paid for.

At Insurance Claim Recovery Support, we know how to document and present claims to avoid the disputes that lead to lawsuits. Our expertise means fewer delays and settlements that reflect the full extent of your damages—all while keeping you out of court and focused on your property.