Why Understanding Public Adjusters Can Transform Your Insurance Claim

When property damage strikes your commercial building or apartment complex, hiring an insurance claim public adjuster can be the difference between a fair settlement and financial ruin. A public adjuster is a licensed professional who works exclusively for you, the policyholder. We evaluate damage, interpret your policy, and negotiate with your insurance company to maximize your settlement.

Quick Answer: What is a Public Adjuster?

- Who they work for: You, the policyholder (not the insurance company)

- What they do: Assess damage, document losses, negotiate settlements

- How they’re paid: Contingency fee (typically 10-15% of settlement)

- When to hire: Complex claims, denied claims, or settlements over $10,000

- Key benefit: Studies show settlements can be 2-4 times higher than initial offers

The stakes are high for commercial properties, where a lowball settlement can force a business to close. Insurance companies are for-profit businesses focused on minimizing payouts, but you don’t have to accept their first offer. Unlike the insurer’s adjuster, a public adjuster is your advocate, countering tactics designed to reduce your claim. The earlier you involve a public adjuster, the stronger your position becomes.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled over 500 large loss claims valued at more than $250 million for commercial and multifamily properties. My career handling insurance claim public adjuster cases has involved overturning wrongful denials and increasing settlements by up to 3,800%, helping clients get what they’re owed without unnecessary litigation.

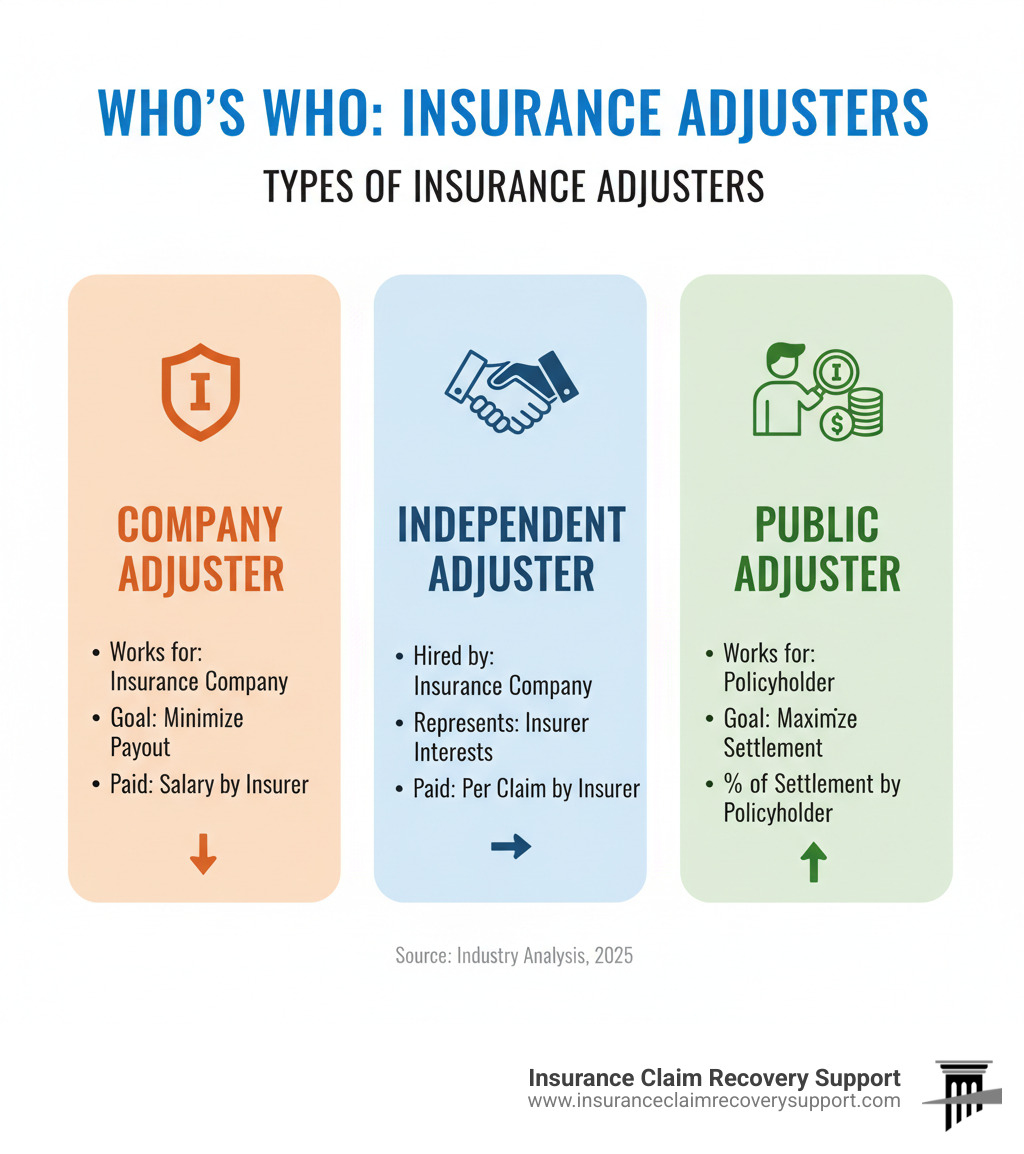

Who’s Who in the Claims Process: Public vs. Company Adjusters

Understanding who works for whom in the claims process is critical. The allegiance of your adjuster directly impacts your final settlement. There are three types of adjusters, each with a different loyalty.

| Adjuster Type | Who They Work For | Primary Goal | How They Are Paid | Cost to Policyholder |

|---|---|---|---|---|

| Company Adjuster | The Insurance Company | Minimize the payout for the insurer | Salary from the insurance company | None |

| Independent Adjuster | The Insurance Company | Assess damage and report to the insurer to minimize payout | Fee per claim from the insurance company | None |

| Public Adjuster | You, the Policyholder | Maximize the settlement for the policyholder | Percentage of the settlement | Contingency fee |

The Company Adjuster’s Role

After you file a claim, your insurer sends a company adjuster. This person is an employee or contractor of the insurance company, and their primary goal is to protect their employer’s bottom line by minimizing the payout. While their services come at no direct cost to you, their assessment is performed through a lens of cost control. They may undervalue damage or interpret policy language in the insurer’s favor. Their loyalty is not with you.

The Public Adjuster’s Advantage

An insurance claim public adjuster works exclusively for you, the policyholder. Our success is tied directly to yours, as we are paid a contingency fee from the settlement we secure for you. We fight for your best interests, using our expert policy interpretation skills to find all available coverage and maximize your settlement. We’ve seen company adjusters overlook business interruption, undervalue contents, or miss other coverages that add tens of thousands to a claim. The difference can be dramatic, turning a lowball offer into a full and fair recovery.

The Scope of an Insurance Claim Public Adjuster’s Services

An insurance claim public adjuster acts as your expert guide, managing the entire claims process so you can focus on your business. We handle everything from the initial damage assessment to the final settlement check.

Our services include:

- Thorough Damage Assessment: We document all obvious and hidden damage, such as water behind walls or structural issues from a fire, to build a comprehensive picture of your loss.

- Policy Review and Analysis: We decode complex insurance policies to identify every applicable coverage, often uncovering benefits you didn’t know you had.

- Detailed Claim Documentation: We prepare ironclad reports with photos, videos, and expert evaluations to substantiate your claim.

- Strategic Negotiation: We manage all communication with the insurer, countering their tactics to secure the maximum settlement you are entitled to. Our goal is to finalize your settlement quickly so you can rebuild.

Types of Property Damage Claims We Handle

At Insurance Claim Recovery Support, we have specialized expertise in all major types of commercial and multifamily property damage.

- Fire and smoke damage: We document structural damage, content loss, and widespread smoke remediation needs.

- Water and flood damage: We assess visible damage and hidden moisture that can lead to mold.

- Hurricane and wind damage: Common in Texas, we evaluate everything from roofing to structural integrity after storms and tornadoes.

- Freeze damage: We manage complex claims from burst pipes and utility failures, ensuring all resulting water damage is covered.

- Vandalism claims: We document the full scope of damage and business interruption from these incidents.

You can find more info about our services for different types of damage.

Special Considerations for Commercial and Multifamily Properties

Commercial claims are more complex than residential ones and require specialized knowledge.

- Business Interruption Claims: A critical component for commercial properties. We calculate and document your lost revenue and extra operational expenses to ensure you are fully compensated for the financial impact of a shutdown.

- Multifamily and HOA Claims: We manage the complex interests of multiple residents and the association, ensuring damages to common areas and individual units are properly assessed.

- Religious Institutions: We understand the unique challenges of these properties, including specialized structures and the urgent need to restore community services.

Our experience across Texas—from Austin and Dallas-Fort Worth to Houston and San Antonio—means we understand local codes and challenges, allowing us to effectively manage claims for all stakeholders.

The Tipping Point: When and Why to Hire a Public Adjuster

When should you hire an insurance claim public adjuster? Often, it’s when the insurance company’s settlement offer won’t even cover half the repairs for your fire-damaged apartment complex or storm-damaged commercial building.

The numbers are eye-opening: studies show policyholders who hire public adjusters receive settlements that are 2-4 times higher, with some reports documenting increases up to 700% over initial offers. We’ve personally turned a $100,000 denial into a $400,000 recovery. Beyond the money, we save you time and stress, handling the complex claim process so you can run your business. Think of it as leveling the playing field; the insurer has a team of experts, and so should you.

Key Scenarios for Hiring an Insurance Claim Public Adjuster

You should strongly consider hiring a public adjuster if:

- Your claim involves substantial or complex damage, such as a major fire or hurricane damage.

- The insurance company has denied your claim.

- The insurer’s settlement offer is too low to cover your losses.

- You lack the time or expertise to manage a complex commercial claim.

- Your claim involves complicated issues like business interruption, which requires detailed calculation of lost revenue and extra expenses.

Can a Public Adjuster Help with Denied or Underpaid Claims?

Absolutely. This is one of our greatest strengths. When a claim is denied or underpaid, we dig into the details to find a path to a fair resolution.

- Re-opening Denied Claims: We scrutinize the denial letter, challenge flawed reasoning, and find policy provisions the insurer may have overlooked.

- Challenging Lowball Offers: We build a comprehensive case with independent assessments to prove the insurer’s valuation is wrong. We find overlooked damage and correct their estimates, which often use outdated pricing or substandard materials.

Our goal is always to negotiate a fair resolution that covers your actual losses and restores your property to its pre-loss condition.

Vetting and Working with Your Public Adjuster

Hiring an insurance claim public adjuster is an investment in your financial recovery. Understanding how to choose the right professional and what the process looks like is key.

Our process is designed to be seamless for you:

- Initial Consultation: A free, no-obligation review of your claim, damage, and policy.

- Damage Inspection & Assessment: A thorough inspection to document all visible and hidden damages.

- Claim Preparation & Submission: We handle all paperwork, preparing detailed estimates and submitting a complete claim package to avoid delays.

- Negotiation with the Insurer: We manage all communications and negotiate aggressively to achieve the maximum settlement.

- Settlement & Payment: Once you approve a fair settlement, we ensure funds are disbursed correctly. Our fee is then paid from the settlement.

How to Choose a Reputable Insurance Claim Public Adjuster

Choosing the right adjuster is paramount, especially for large commercial losses. Here’s what to look for:

- State Licensing: Ensure the adjuster is licensed in the state of the loss. In Texas, you can verify this with the Texas Department of Insurance.

- Credentials and Experience: Look for a proven track record in commercial and multifamily claims.

- Reviews and References: Check testimonials from past clients with similar properties and claims.

- Clear Fee Structure: The contingency fee percentage and terms should be transparent in the contract.

- Reputable Directories: Use resources like the National Association of Public Insurance Adjusters (NAPIA) to find qualified professionals.

- Avoid High-Pressure Tactics: A reputable adjuster will give you time to make an informed decision, not pressure you to sign on the spot.

Understanding Public Adjuster Fees

We operate on a contingency fee model. This means our fee is a pre-agreed percentage of the final insurance settlement, typically 10-15%. There are no upfront costs. We only get paid if we successfully secure a settlement for you. This aligns our interests directly with yours—our success is your success. This risk-free model is almost always the most beneficial option for the large, complex commercial claims we handle.

Navigating Disputes and Avoiding Litigation

Disputes with insurance companies are common, but they don’t have to end in a prolonged legal battle. An insurance claim public adjuster is your best tool for resolving conflicts efficiently.

Insurers use tactics like “reservation of rights” letters or lowball checks, hoping you’ll give up. We don’t. We counter these strategies by escalating the claim, presenting a carefully documented case, and using our deep policy knowledge. When an insurer is presented with an ironclad claim, it becomes much harder for them to justify a denial or low offer. For disagreements on the value of a loss, we can also guide you through the policy’s appraisal clause, a process that often resolves disputes without litigation.

Public Adjuster vs. Lawsuit: A Path to Faster Resolution

Should you hire a public adjuster or a lawyer? For most property damage claims, a public adjuster offers a faster, more efficient path to resolution. We work within your insurance policy to negotiate a settlement, while lawyers work within the court system to compel payment through litigation.

- Process: We focus on negotiation and settlement, a business conversation that typically resolves in months. A lawsuit involves a lengthy legal process that can take years.

- Time and Cost: Our process is faster (typically 3-6 months), and you only pay a contingency fee upon success. Litigation can last 2-3 years with ongoing legal fees, win or lose.

While we are not lawyers, we know when legal expertise is needed. If we encounter a situation like insurance bad faith that requires an attorney, we will advise you accordingly. Our primary goal is to avoid unnecessary litigation by securing the settlement you deserve through expert negotiation.

What Are the Potential Risks?

Being transparent about risks is important.

- Hiring the Wrong Adjuster: The biggest risk is choosing an unlicensed or unethical adjuster. Always verify credentials, check references, and avoid anyone using high-pressure tactics.

- Cost on Small Claims: For minor, straightforward claims, our fee might not be economical. However, for the large commercial losses we handle, the significant increase in settlement size typically makes our fee a wise investment.

- Policy Limitations: We are experts at maximizing what you are owed under your policy, but we cannot create coverage that doesn’t exist.

- Clear Contract: Ensure your contract is clear about the role, fees, and terms before signing. A reputable adjuster will welcome your questions.

Frequently Asked Questions about Public Adjusters

Here are answers to the most common questions we receive from commercial property owners about working with an insurance claim public adjuster.

What qualifications should a public adjuster have?

A public adjuster must be licensed by the Department of Insurance in the state where the loss occurred. For example, we are licensed in Texas and multiple other states. Beyond licensing, look for deep experience with your specific claim type (e.g., fire damage to an apartment complex in Dallas) and strong negotiation skills. A good reputation is also key, so check reviews and ask for references from similar commercial property claims.

How does a public adjuster get paid?

Most public adjusters, including us, work on a contingency fee basis. We are paid a small, pre-agreed percentage of your final settlement, typically 10-15%. You pay nothing upfront. If we don’t secure a settlement for you, you owe us nothing. This model ensures our interests are perfectly aligned with yours: we only succeed when you do.

Can I hire a public adjuster after I’ve already filed a claim?

Yes, and it’s very common. Many clients contact us after a claim has been denied, underpaid, or is dragging on. An insurance claim public adjuster can take over an existing claim at any stage. We will re-evaluate the damage, review your policy for additional coverage, and reopen negotiations with the insurer. Even if you’ve received a “final” offer, it’s not too late to challenge it. The earlier we get involved, the stronger your position, but we can add value at nearly any point in the process.

Get the Expert Advocacy Your Commercial Property Deserves

When your commercial property is damaged, you’re facing more than just repair costs—you’re facing a threat to your business and tenants. You don’t have to battle the insurance company alone.

Insurance Claim Recovery Support empowers policyholders by leveling the playing field. As your insurance claim public adjuster, our role is to ensure you don’t settle for less than you deserve. With experience settling over $250 million in large loss claims, we handle the stress, paperwork, and negotiations so you can focus on recovery. We’ve increased settlements by up to 3,800% over initial offers, helping clients avoid costly litigation.

Our commitment is to maximize your recovery so you can fully restore your property. We serve clients nationwide, with deep expertise in Texas cities like Austin, Dallas-Fort Worth, San Antonio, and Houston. Whether you’re dealing with fire, storm, or freeze damage, we are ready to fight for the settlement you deserve.

Don’t let a lowball offer dictate your future. The earlier you involve a public adjuster, the stronger your claim. Contact us for a free claim review today and let us advocate for you.