Why Colorado Property Owners Need Professional Insurance Claim Advocacy

When disaster strikes your Colorado property, public adjuster Colorado services can mean the difference between a fair settlement and financial devastation. Here’s what you need to know:

Quick Facts About Public Adjusters in Colorado:

- Work exclusively for policyholders – not insurance companies

- Increase settlements by 747% on average according to government studies

- Licensed by Colorado Department of Regulatory Agencies (DORA)

- Fees capped at 10% during declared catastrophic disasters

- 72-hour rescission right – you can cancel contracts within 3 days

- Handle all claim types – fire, hail, wind, water, business interruption

Colorado faces unique insurance challenges that make professional advocacy essential. The state suffers 1,200 to 1,800 wildfires annually and experienced 294 hail events in 2019 alone. With over 60% of homes and 70% of businesses under-insured, property owners often leave millions on the table during the claims process.

Most major mistakes happen within the first few hours or days after disaster strikes. Insurance companies operate on a “delay, deny, defend” model to protect their profits, while policyholders carry the burden of proof for their claims. This creates an uneven playing field where professional representation becomes crucial.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of a large loss public adjusting firm based in Austin, Texas. Having settled over 500 large loss claims valued at more than $250 million, I’ve seen how public adjuster Colorado services can transform denied claims into substantial recoveries and increase settlements from 30% to 3,800% or more.

For more information about Colorado’s wildfire statistics and prevention efforts, property owners can better understand the risks they face and the importance of adequate insurance coverage.

Why & When to Hire a Public Adjuster Colorado

When disaster strikes your Colorado property, understanding who’s truly on your side can make the difference between a fair settlement and financial hardship. The insurance claims world has three main players, and knowing their loyalties is crucial for protecting your interests.

Public adjusters are the only professionals who work exclusively for you, the policyholder. They’re licensed advocates who fight for maximum settlements and handle all the complicated communications with your insurance company. Think of them as your personal champion in what can often feel like an uphill battle.

Carrier adjusters are employees of insurance companies. While they may seem friendly and helpful, their paychecks come from the insurer – not from you. They’re trained to minimize payouts and protect their employer’s bottom line, which directly conflicts with your goal of receiving fair compensation.

Independent adjusters might sound neutral, but they’re actually freelance contractors hired by insurance companies. Even though they’re not direct employees, they depend on insurers for future work, creating pressure to keep settlements low to maintain those business relationships.

| Adjuster Type | Works For | Primary Goal | Loyalty |

|---|---|---|---|

| Public Adjuster | Policyholder | Maximum Settlement | You |

| Carrier Adjuster | Insurance Company | Minimize Payouts | Employer |

| Independent Adjuster | Insurance Company (Contract) | Keep Insurer Happy | Future Business |

Colorado faces a hidden crisis that most property owners don’t find until it’s too late. Recent surveys reveal that over 60% of homes and 70% of businesses lack adequate insurance coverage. This means even if you receive what seems like a “full” settlement, you could still face devastating out-of-pocket expenses.

The state’s unique weather patterns make this under-insurance problem even more dangerous. With 1,200 to 1,800 wildfires annually and frequent severe storms, Colorado properties face constant threats that many policies simply don’t cover adequately.

Fortunately, Colorado law provides important protections when you work with a public adjuster Colorado professional. You have a 72-hour written rescission right after signing any public adjuster contract, giving you time to reconsider without penalty. During declared catastrophic disasters, the state also caps public adjuster fees at 10% of your settlement, ensuring you keep more of your recovery.

Signs You Need a Public Adjuster Colorado

Several red flags should prompt you to seek professional representation immediately.

Denied or underpaid claims are the most obvious warning signs. Insurance companies often issue lowball offers hoping you’ll accept them quickly. We’ve seen cases where insurers initially offered $15,000 for damage that ultimately settled for over $100,000 with proper advocacy.

Large loss situations almost always benefit from professional help. When your claim exceeds $10,000, the potential settlement increase typically far outweighs the adjuster’s fee. Complex damage also increases the chances that important details get overlooked or undervalued.

Commercial business interruption claims involve intricate calculations of lost income, extra expenses, and operational disruptions. Insurance companies frequently undervalue or deny these claims entirely, making professional representation essential for protecting your business’s financial future.

Complex policy language can trip up even the most careful property owners. Modern insurance policies contain dozens of exclusions, endorsements, and technical terms that can dramatically affect your coverage. Professional adjusters know how to interpret these provisions in your favor.

Timing Mistakes Colorado Owners Make

The first few hours and days after a loss are absolutely critical, yet this is when most property owners make their costliest mistakes.

Delayed notice can complicate your entire claim process. While most policies allow reasonable time to report losses, unnecessary delays give insurers ammunition to question your coverage or the extent of damage.

Poor documentation is perhaps the most expensive mistake you can make. Failing to photograph damage thoroughly, preserve evidence, or maintain detailed records gives insurance companies justification for lower payouts. Many property owners don’t realize that the burden of proof falls on them, not the insurer.

Harmful statements to insurance representatives can haunt your claim for months. Simple phrases like “I think” or “maybe” get interpreted as uncertainty about the cause or extent of damage. Everything you say gets documented and can be used to minimize your settlement later.

The key is acting quickly but carefully. Getting professional help early in the process protects you from these common pitfalls while ensuring your claim gets the attention it deserves.

The Public Adjuster Claims Process in Colorado

When you hire a public adjuster Colorado professional, you’re getting a systematic approach that’s designed to uncover every dollar you’re entitled to. The process isn’t just about filling out paperwork—it’s about building an ironclad case that insurance companies can’t ignore.

The foundation starts with inspection. Your adjuster will arrive with specialized equipment like moisture meters and thermal imaging cameras. These tools reveal damage that’s invisible to the naked eye—the kind of damage that insurance company adjusters often miss or conveniently overlook. I’ve seen cases where a basic visual inspection missed thousands of dollars in hidden structural damage.

Policy analysis comes next, and this is where experience really matters. Every insurance policy reads like it was written by lawyers who wanted to make things as confusing as possible. Your adjuster will dissect your specific coverage, endorsements, and exclusions to identify benefits you probably didn’t even know existed. This includes code upgrade costs, debris removal, and additional living expenses that can add substantial value to your claim.

Creating detailed estimates using industry-standard software like Xactimate ensures your claim reflects real-world repair costs. Insurance companies use the same software, but they often input lower-quality materials or skip necessary repairs entirely. A thorough estimate can exceed the insurance company’s initial offer by 30% to 300% or more.

Proof of loss documentation transforms your claim from a simple request into a professional presentation. This includes detailed inventories, photographs, receipts, and expert reports when needed. Think of it as building a legal case—because that’s essentially what you’re doing.

The negotiation phase is where professional representation truly shines. Armed with comprehensive documentation and policy analysis, your adjuster negotiates directly with insurance companies. This often involves multiple rounds of discussions and supplemental claims as additional damage is finded or initially overlooked items are addressed.

More info about Claim Adjustment Specialists

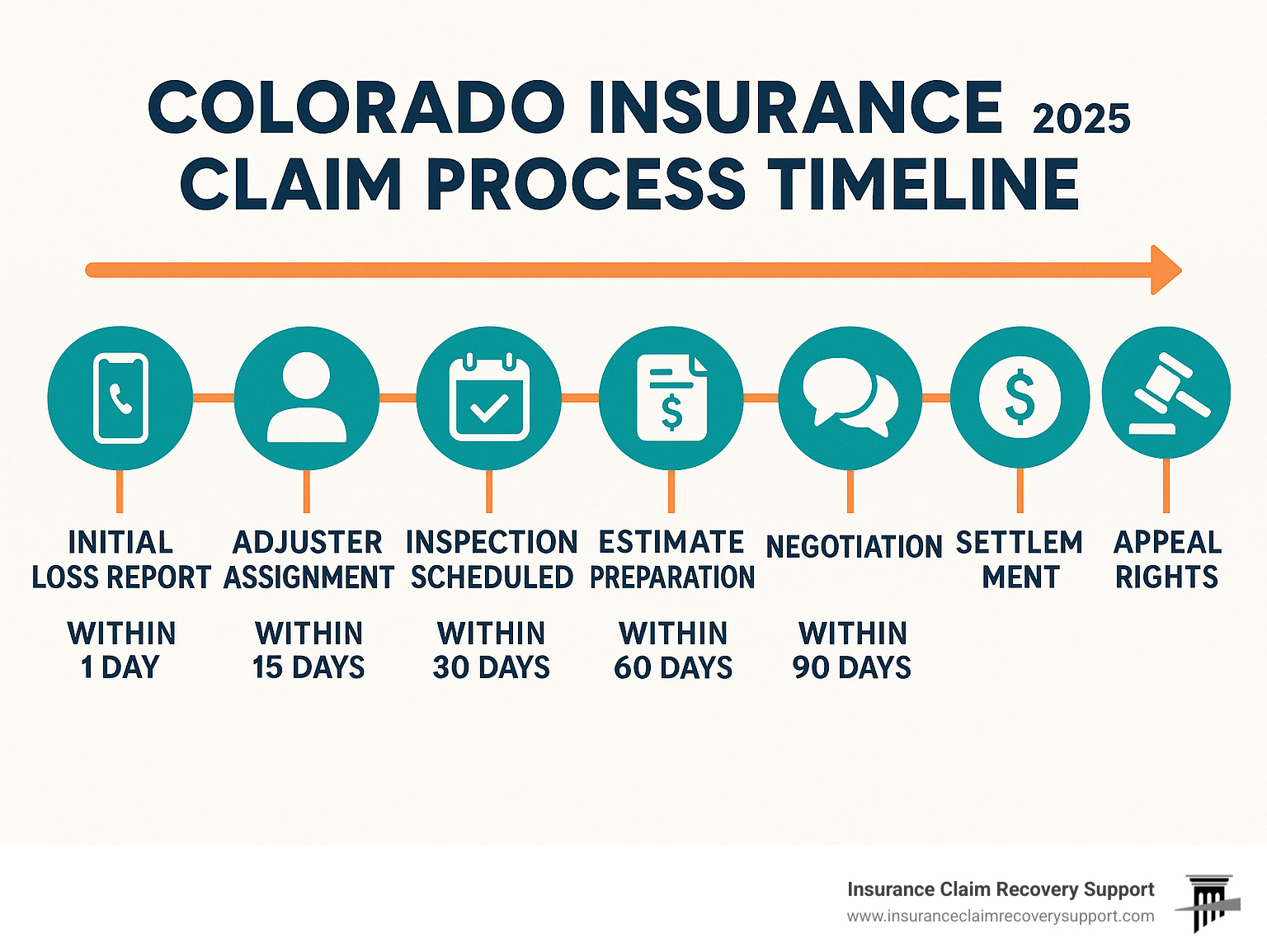

Step-by-Step Road Map

Step 1: Report the Loss immediately to your insurance company. Don’t delay this step, even if you’re not sure about the full extent of damage. Take basic steps to prevent further damage, but document everything before making temporary repairs.

Step 2: Engage a Public Adjuster before having extensive conversations with insurance representatives. What you say in those early conversations can impact your claim for months to come. Having professional representation from the start protects your interests.

Step 3: Detailed Scope Development happens when your adjuster documents all damage and prepares comprehensive repair estimates. This process can take several days for complex claims, but thoroughness pays off in the final settlement.

Step 4: Settlement Review and Negotiation ensures you understand exactly what you’re accepting before signing anything. Never accept the first offer without professional review—insurance companies routinely start with lowball settlements, expecting negotiation.

Reopening or Appealing Prior Decisions

Don’t assume a denied or closed claim is the end of the story. Colorado law provides several powerful tools for challenging insurance company decisions, and professional adjusters know how to use them effectively.

Statute of limitations rules vary depending on your specific policy and the type of damage involved. While most property damage claims must be filed within specific timeframes, these periods can be extended under certain circumstances. An experienced adjuster can determine if you still have viable options.

The appraisal clause becomes your ace in the hole when there’s disagreement about the amount of loss. Either you or the insurance company can invoke this process, which involves independent appraisers determining the actual cash value and amount of loss. This process has turned many inadequate settlements into fair recoveries.

Denied claim turnaround happens more often than you might think. Professional adjusters frequently identify coverage that insurance companies overlooked, misinterpreted, or deliberately ignored. We’ve seen completely denied claims result in five-figure settlements once proper advocacy was applied.

The key is acting quickly once you realize your claim wasn’t handled properly. Time limits exist, but experienced public adjuster Colorado professionals know how to work within these constraints to maximize your recovery options.

Types of Property Claims Handled by Colorado Public Adjusters

Colorado’s dramatic landscape brings both beauty and risk to property owners. From the Front Range to the Western Slope, our state faces some of the most challenging weather conditions in the country. A public adjuster Colorado understands these unique risks and knows how to steer the complex claims that result.

Fire and smoke damage represents one of our most serious ongoing threats. With Colorado experiencing between 1,200 and 1,800 wildfires annually, these claims have become unfortunately routine. But there’s nothing routine about the complexity involved. Smoke can travel through HVAC systems, infiltrating areas that appear untouched. Contents may need specialized cleaning or complete replacement. And don’t forget about code compliance upgrades – when you rebuild, you often must meet current building standards, not the ones from when your home was first constructed.

Wind and tornado damage can cause tens of thousands of dollars in destruction to roofs, siding, and windows. Colorado’s high winds don’t always leave obvious damage, but they can compromise structural integrity in ways that aren’t immediately apparent. Insurance companies frequently minimize wind damage or try to attribute it to excluded causes like wear and tear. Understanding Colorado’s severe weather patterns helps property owners recognize when professional claim assistance is needed.

Hail damage dominates Colorado’s claim landscape, with the state recording 294 hail events in 2019 alone. These storms can devastate entire neighborhoods in minutes, leaving behind damaged roofs, siding, windows, and vehicles. Insurance companies often try to minimize hail damage or claim it’s cosmetic rather than functional. A professional adjuster knows how to document the full extent of impact damage and ensure proper repairs.

Water and mold damage requires immediate attention in Colorado’s variable climate. Water intrusion can lead to extensive mold growth, creating both property damage and health hazards. These claims often involve complex coverage questions about what caused the water damage and whether resulting mold is covered.

Vandalism and theft claims can result in both direct property damage and indirect losses. When commercial properties are targeted, the resulting business interruption can exceed the direct property damage costs. These claims require careful documentation of both physical damage and financial losses.

Business interruption coverage becomes crucial when commercial properties suffer any type of damage. The resulting loss of income, extra expenses, and operational disruptions often exceed the direct property damage costs. These claims require detailed financial analysis and documentation that many business owners aren’t prepared to provide.

Residential vs Commercial Considerations

Residential claims present their own unique challenges. Personal property inventories can be overwhelming – trying to remember and document every item you’ve lost is emotionally draining and practically difficult. Additional living expenses coverage helps pay for temporary housing and meals while your home is being repaired, but insurance companies often try to limit these payments. Code upgrade requirements can add significant costs to repairs, and landscaping and outdoor structures are frequently overlooked in initial estimates.

Commercial claims involve entirely different complexities. Business interruption calculations require detailed financial analysis to determine actual lost income versus normal fluctuations. Equipment breakdown coverage may apply when specialized machinery is damaged. Tenant displacement costs can be substantial for rental properties, and professional liability considerations may come into play depending on the type of business affected.

The key difference is that residential claims focus on getting families back to normal life, while commercial claims must address both property restoration and business continuity. Both require specialized expertise to ensure full recovery.

Real-life Success Snapshots

The numbers tell the story of why professional representation matters. In one recent case, a Colorado family faced an initial insurance estimate of $15,000 for what appeared to be minor damage. After professional evaluation, the claim ultimately settled for over $100,000 when hidden damage was properly documented and code upgrade costs were included.

Another family dealing with fire loss received an initial insurance company estimate of $20,213. Through proper advocacy and thorough documentation, their final settlement reached $192,104. The difference covered not just repairs, but proper smoke remediation and content replacement they didn’t know they were entitled to.

Commercial claims show even more dramatic results. One business owner received an initial insurance company offer of $180,743 for property damage and business interruption. After professional representation, the final settlement reached $4,156,380 – a difference that literally saved the business from bankruptcy.

Perhaps most importantly, we’ve seen numerous cases where insurance companies initially denied claims entirely, offering zero dollars. Through professional advocacy and proper documentation, these “worthless” claims have resulted in settlements ranging from $50,000 to over $300,000.

These success stories reflect the 747% average increase in settlements when policyholders use professional representation, according to government studies. The difference isn’t just in the money – it’s in getting your life or business back on track after disaster strikes.

Licensing, Fees & How to Choose the Right Advocate

Public adjuster Colorado services are regulated by the Colorado Department of Regulatory Agencies (DORA). All public adjusters must maintain current licenses and meet continuing education requirements. The Rocky Mountain Association of Public Insurance Adjusters (RMAPIA) provides additional ethical standards and professional development for regional adjusters.

Fee Structure: Public adjusters typically charge between 5% and 15% of the final settlement amount. During declared catastrophic disasters, Colorado law caps fees at 10% of the insurance proceeds. Legitimate public adjusters work on contingency – you pay nothing unless they increase your settlement.

Bonding and Insurance: Licensed public adjusters carry professional liability insurance and surety bonds to protect clients from potential losses.

File a Complaint Against Your Insurance Company

Due-diligence Checklist for Hiring a Public Adjuster Colorado

Before hiring any public adjuster, verify:

License Status: Check the Colorado Division of Insurance website to confirm current licensing and review any disciplinary actions.

Local References: Ask for references from recent clients with similar claim types. Contact these references directly to discuss their experience.

Clear Contract Terms: Ensure all fee structures, payment schedules, and cancellation policies are clearly documented in writing.

No Upfront Fees: Legitimate public adjusters don’t require upfront payments or deposits. Be wary of anyone demanding money before work begins.

Red Flags & Fraud Prevention

Watch for these warning signs:

Kickback Arrangements: Avoid adjusters who insist on specific contractors or seem to receive compensation from repair companies.

Excessive Fees: Be suspicious of fee structures significantly above market rates or contracts with unusual penalty clauses.

Pressure Tactics: Legitimate adjusters don’t use high-pressure sales tactics or demand immediate contract signing.

Identity Theft Risk: Never provide Social Security numbers or financial account information until you’ve verified the adjuster’s credentials.

Frequently Asked Questions about Public Adjuster Colorado Services

Let me address the most common questions I hear from Colorado property owners who are considering professional claim representation. These answers come from real experience handling hundreds of claims across the state.

What protections do Colorado policyholders have when signing with a public adjuster Colorado?

Colorado has some of the strongest consumer protections in the country when it comes to public adjuster Colorado services. The state understands that property owners are often in vulnerable situations after disasters, so they’ve built in meaningful safeguards.

Your most important protection is the 72-hour written rescission right. This means you can cancel any public adjuster contract within three days of signing, no questions asked. I always tell clients to take advantage of this cooling-off period to review the contract carefully and make sure they’re comfortable with the arrangement.

During declared catastrophic disasters like the Boulder County fires, Colorado law caps fees at 10% of the settlement amount. This prevents price gouging when communities are most vulnerable. All public adjusters must be licensed by the Colorado Department of Regulatory Agencies (DORA) and carry professional liability insurance to protect clients.

If you ever feel you’ve been treated unfairly by an adjuster, you have recourse. You can file complaints with Stop Fraud Colorado or the Colorado Division of Insurance. These agencies take consumer protection seriously and investigate all complaints thoroughly.

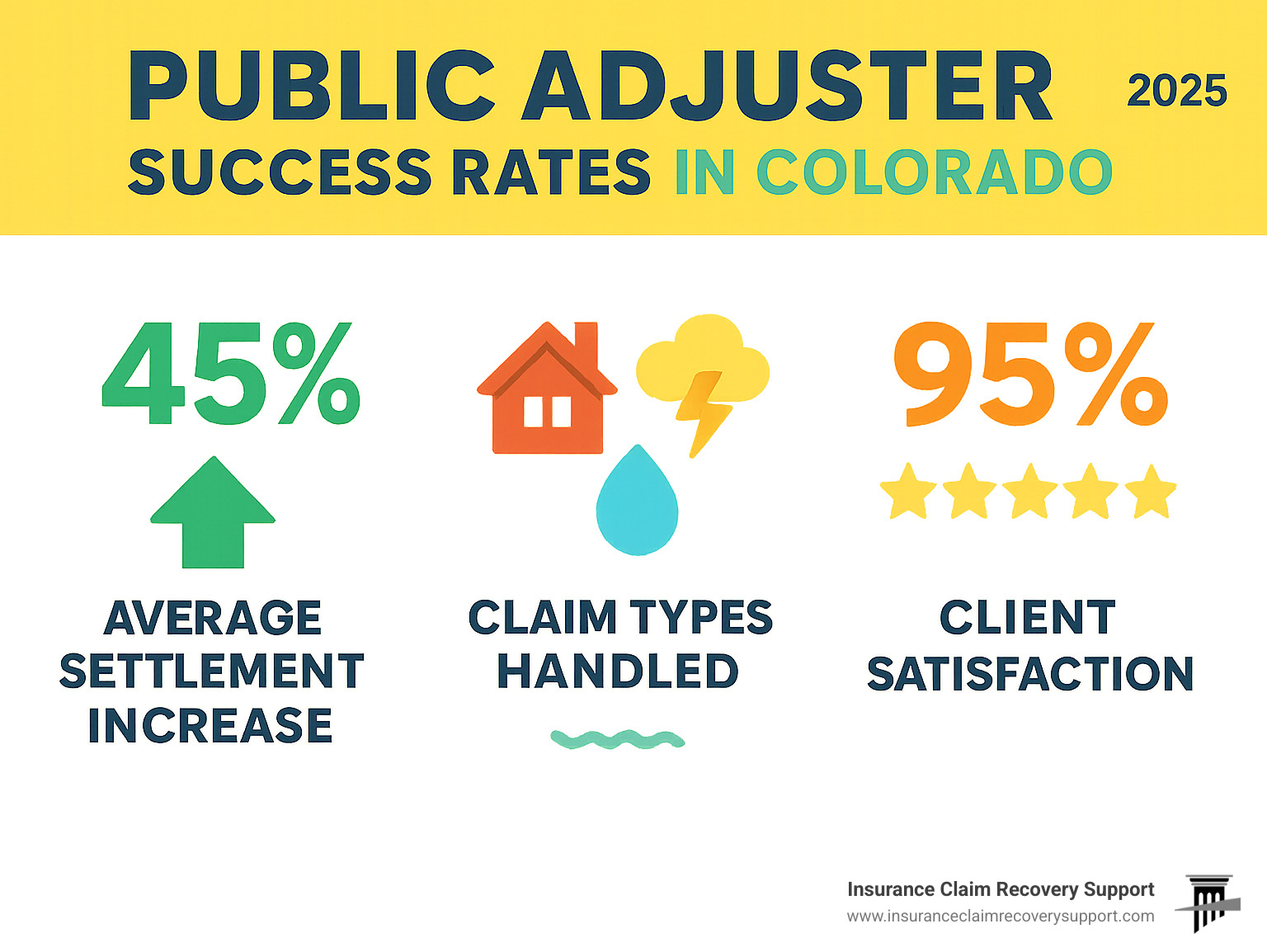

Can a public adjuster Colorado really increase my settlement by 747%?

The 747% figure comes from government studies comparing settlements with and without professional representation, and yes, it’s real. However, I always caution clients that every claim is unique, and results vary significantly based on several factors.

The increases I’ve seen range from 30% to over 3,800% in extreme cases. The higher percentages typically occur when insurance companies initially deny claims or offer unreasonably low settlements. For example, we’ve turned zero-dollar offers into six-figure settlements through proper documentation and policy interpretation.

What drives these dramatic increases? Thorough documentation is crucial – insurance companies often miss damage that trained adjusters catch. Proper policy interpretation also matters enormously, as many beneficial coverages get overlooked. Finally, skilled negotiation can make the difference between accepting the first offer and fighting for what you truly deserve.

The beauty of working with a public adjuster Colorado professional is that you only pay if we increase your settlement. There’s literally no risk in getting a professional evaluation of your claim.

Are public adjuster Colorado fees capped after a declared catastrophe?

Yes, and this is one of Colorado’s most important consumer protections. When the Governor declares a catastrophic disaster, public adjuster fees are automatically capped at 10% of insurance proceeds or settlement amounts. This law was specifically designed to protect vulnerable communities during their most difficult times.

We saw this protection in action during the Boulder County fires, where legitimate adjusters could not charge more than the statutory maximum regardless of the claim complexity or settlement amount. This ensures that disaster victims keep more of their settlement money when they need it most.

Outside of declared disasters, fees typically range from 5% to 15% of the settlement amount. The exact percentage depends on factors like claim complexity, damage extent, and the amount of work required. However, all fees should always be clearly disclosed in your contract before you sign anything.

Legitimate public adjusters work on contingency, meaning you pay nothing unless we successfully increase your settlement. If an adjuster asks for upfront fees or deposits, that’s a major red flag to walk away immediately.

Conclusion

When disaster strikes your Colorado property, you’re not just dealing with physical damage – you’re facing an insurance system designed to protect company profits, not your interests. The statistics paint a sobering picture: with Colorado’s 1,200 to 1,800 annual wildfires and 294 hail events recorded in 2019 alone, property damage claims are unfortunately common. Yet over 60% of homes and 70% of businesses remain under-insured, leaving property owners vulnerable even after receiving their “full” settlement.

The 747% average increase in settlements when using professional representation isn’t just a number on a page. It represents real Colorado families who can afford to rebuild after wildfire devastation, small business owners who can reopen after hail damage, and homeowners who don’t have to drain their savings to repair storm damage. These results come from understanding policy language, documenting damage properly, and negotiating from a position of strength.

Colorado’s consumer protections make hiring a public adjuster Colorado service virtually risk-free. The 72-hour rescission right gives you time to reconsider your decision, while the 10% fee cap during declared disasters ensures fair pricing when you need help most. Since public adjusters work on contingency, you pay nothing unless they increase your settlement.

The complexity of modern insurance policies, combined with the adversarial nature of the claims process, makes professional representation essential. Most critical mistakes happen within the first few days after a loss, when emotions run high and insurance companies begin their “delay, deny, defend” strategy. Having an experienced advocate in your corner levels the playing field.

Whether you’re dealing with fire damage from Colorado’s wildfire season, wind destruction from severe storms, water intrusion from burst pipes, or business interruption from any covered peril, the path to fair recovery doesn’t have to be traveled alone. Insurance Claim Recovery Support LLC advocates nationwide for policyholders facing property damage claims, bringing decades of experience and a track record of settling over 500 large loss claims valued at more than $250 million.

Don’t let insurance companies minimize your claim or delay your recovery. You deserve an advocate who fights exclusively for your interests, not theirs.