Why Finding the Right Public Insurance Adjuster Could Save You Thousands

Public Insurance Adjusters near me is one of the most important searches you’ll make after property damage strikes your building. Here’s what you need to know:

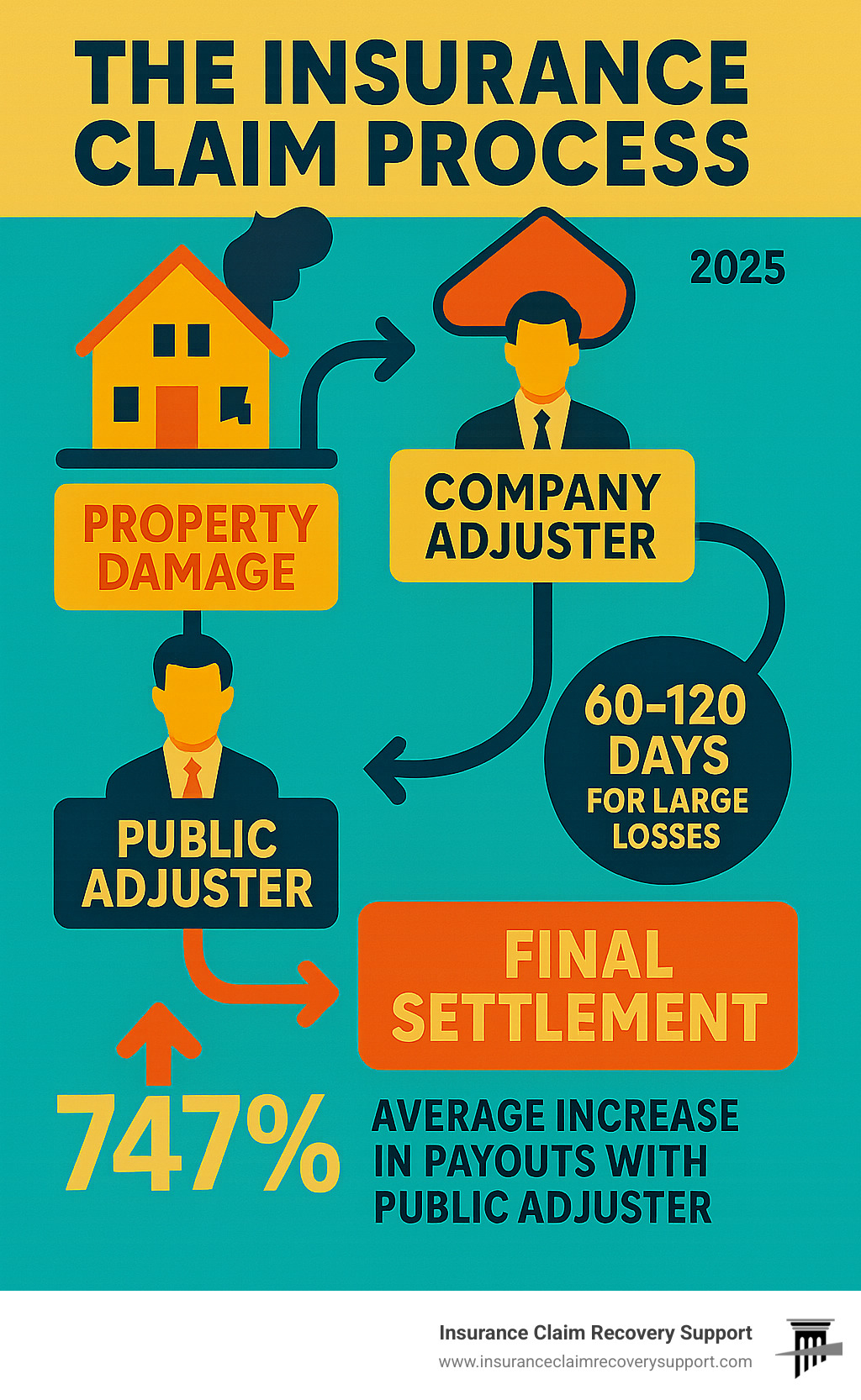

Types of Claim Adjusters:

– Company Adjusters – Work for your insurance company (not for you)

– Independent Adjusters – Hired by insurance companies to handle claims

– Public Adjusters – Work exclusively for YOU, the policyholder

Key Fact: Using a public adjuster increases insurance claim payouts by 747% on average, according to a government study. Public adjusters typically charge 10-30% of your settlement on a contingency basis – meaning no recovery, no fee.

When your commercial property, multifamily complex, or facility suffers damage from fire, hurricane, tornado, freeze, or flood, the insurance company sends their adjuster to minimize what they pay you. But you have the right to hire your own adjuster to fight for maximum recovery.

The difference is massive. As one hotel owner put it: “If you have an insurance claim and don’t use a reputable public adjuster, then you are wasting your time and losing thousands of dollars… without even knowing it.”

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support LLC. Over my career settling 500+ large loss claims valued at over $250 million, I’ve seen countless policyholders searching for public adjusters near me after finding their insurance company’s initial offer was woefully inadequate. The best advice I can give you is even if you’re dealing with an initial claim, don’t wait! Especially if your damages exceed $250,000.

Why This Guide Matters

Every year, thousands of policyholders struggle with underpaid, delayed, and wrongfully denied claims when they allow the insurance company to handle their claim alone. Most insurance company adjusters are well-intentioned but trained to see claims from the insurer’s perspective, not yours.

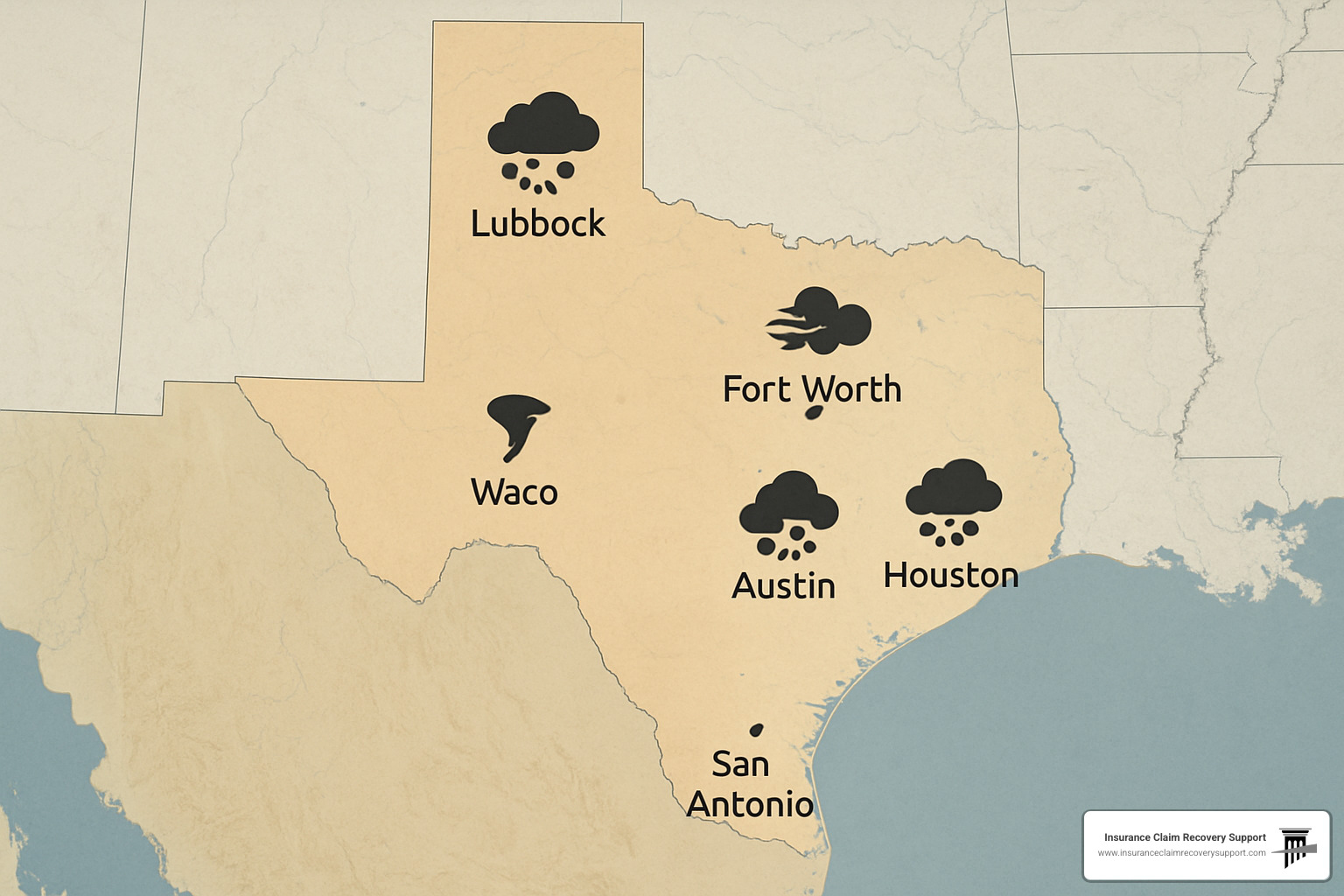

Local expertise matters tremendously. A public adjuster who understands Texas building codes, knows how Austin’s freeze events affect plumbing, or recognizes Houston’s flood zones will build a stronger case for your claim. They know local contractors, permitting requirements, and Texas weather patterns.

The faster you get proper representation, the faster your recovery begins. While you’re dealing with property damage, business interruption, and displaced operations, we handle the complex insurance paperwork, policy interpretation, and aggressive negotiation needed to maximize your settlement.

Understanding the Different Types of Claim Adjusters

When you search for “public adjusters near me” after property damage strikes, you’ll find three very different types of professionals who handle insurance claims. Understanding who works for whom can make the difference between a fair settlement and leaving thousands of dollars on the table.

Company adjusters (also called staff adjusters) are full-time employees of your insurance company. They seem helpful and professional – and most genuinely are – but they work for the insurance company, not for you. Their performance reviews depend on how quickly they close claims and how much money they save their employer.

Independent adjusters are hired by insurance companies as contractors, especially when storms create more claims than their staff can handle. While they’re not direct employees, they’re still paid by the insurance company and represent the insurer’s interests. They often juggle dozens of claims at once and may lack deep knowledge of local building codes or weather patterns.

Public adjusters are completely different – by state law, we can only work for policyholders like you. We cannot represent insurance companies, period. We’re your advocate, fighting to maximize your settlement rather than minimize it.

| Adjuster Type | Works For | Paid By | Goal | Licensing |

|---|---|---|---|---|

| Company/Staff | Insurance Company | Insurance Company | Minimize payouts | Varies by state |

| Independent | Insurance Company | Insurance Company | Process claims efficiently | State licensed |

| Public | Policyholder | Policyholder (contingency) | Maximize settlements | State licensed |

The conflicts of interest are obvious when you see it laid out like this. When the insurance company controls the adjuster’s paycheck, whose interests do you think they’re really protecting?

How Public Adjusters Stand Out

The numbers don’t lie. Scientific research on increased payouts with public adjusters shows that public adjusters secure settlements that are 747% higher on average than what policyholders receive when they go it alone with the insurance company.

Why such a dramatic difference? Policy interpretation is like reading a foreign language for most people. Insurance policies are packed with industry jargon, hidden exclusions, and conditions that can dramatically impact your claim. We spend our careers learning to decode these documents and identify coverage you might not even know you have.

The contingency fee structure changes everything. We only get paid when you get paid, and our fee is a percentage of your settlement (typically 10-30% depending on complexity). This means we’re motivated to fight for every dollar you deserve, not to close your claim as quickly as possible.

The insurance company has teams of adjusters, attorneys, and experts working to minimize what they pay you. Shouldn’t you have a professional advocate fighting just as hard for your interests? That’s exactly what a public adjuster provides – someone who knows the insurance game inside and out, but plays it on your team.

“Public Insurance Adjusters Near Me”: When & Why to Hire One

The moment you realize you need to search for “public insurance adjusters near me” usually comes when you’re staring at overwhelming property damage. Maybe your Austin business suffered freeze damage that burst pipes throughout the building. Perhaps your Houston warehouse took a direct hit from hurricane winds. Or your Dallas office building has extensive damage that the insurance company is calling “normal wear and tear.”

Complex losses are the most obvious trigger for hiring professional help. When your property damage involves multiple building systems, requires extensive documentation across several floors, or includes business interruption calculations, you’re dealing with complexity that can easily cost you thousands if handled incorrectly.

Denied or underpaid claims represent another critical moment to seek professional representation. Insurance companies routinely offer settlements that sound reasonable but fall far short of actual repair costs. A Public Adjuster Near Me can reopen your claim, challenge the denial, and fight for the coverage you’re paying for.

Large-loss thresholds change everything. While there’s no magic number, claims over $250,000 almost always benefit from professional representation. The stakes are higher, the documentation requirements are more complex, and the potential for underpayment grows dramatically.

Claim deadlines add urgency to your decision. Most policies require you to file claims within a specific timeframe after the loss occurs, but you typically have much longer – sometimes up to two years – to dispute an unsatisfactory settlement.

Supplemental claims become necessary when additional damage surfaces during repairs or when initial estimates prove woefully inadequate. We regularly reopen files months after the original settlement to pursue additional compensation for newly finded damage.

Top Reasons to Search “public adjusters near me” Today

Severe weather events across Texas create some of the most complex property damage scenarios in the country. When wind events strike cities like Fort Worth or San Antonio, the damage often affects roofing systems, HVAC units, and exterior components that aren’t immediately visible. What looks like minor damage from the ground can represent tens of thousands in repairs when properly assessed.

Fire rebuild situations present unique challenges that go far beyond obvious structural damage. Smoke penetrates building materials requiring specialized cleaning or replacement. Water damage from firefighting efforts compounds the problem. Building code upgrades triggered by the fire can significantly increase reconstruction costs – coverage that’s often overlooked without professional representation.

Hurricane recovery along the Texas coast involves wind damage, rain infiltration, and potential flooding from storm surge creating overlapping damage that requires careful analysis. Determining which damage came from which peril affects how your various insurance policies respond.

Freeze damage has become increasingly common across Texas, from Georgetown to Lubbock. When temperatures plummet and pipes burst, the resulting water damage often affects multiple floors and building systems in ways that aren’t immediately obvious.

Business interruption claims require specialized expertise combining insurance knowledge with business financial analysis. When property damage forces you to close, relocate, or operate at reduced capacity, calculating your actual losses requires understanding both your policy language and your business operations.

Whether you’re in Waco dealing with tornado damage, Round Rock facing storm damage, or Lakeway handling freeze-related losses, the complexity of modern insurance claims makes professional representation essential for protecting your financial recovery.

Working With a Public Adjuster Step-by-Step

When you’re ready to work with a public adjuster, the process unfolds in a carefully orchestrated way that takes the burden off your shoulders while building the strongest possible case for your claim.

Everything starts with damage documentation – and this isn’t just taking a few photos with your phone. We bring professional-grade equipment including thermal imaging cameras, moisture meters, and drone photography to uncover damage that’s invisible to the naked eye. That water stain on the ceiling might seem minor, but our thermal camera reveals extensive moisture damage behind the walls that could cost thousands to repair.

Policy review is where many policyholders find they’ve been leaving money on the table for years. We analyze your insurance policy word by word, examining not just your primary property coverage but also business interruption, ordinance and law coverage, debris removal, and any umbrella policies you might have.

You’d be amazed how often we find coverage that policyholders didn’t even know they had. That code upgrade requirement adding $50,000 to your rebuild? There might be coverage for that. The income you’re losing while your business is closed? That’s likely covered too.

Estimate preparation requires intimate knowledge of construction costs, local building codes, and current material prices. We work with trusted contractors who understand the quality of materials and workmanship your policy requires. When insurance companies see a detailed, professional estimate that accounts for every aspect of your loss, they take your claim seriously.

The negotiation phase is where our expertise really pays dividends. We present your claim with compelling documentation, expert estimates, and solid legal arguments for maximum compensation.

The Process From First Call to Final Check

Your journey begins with a consultation where we honestly evaluate whether hiring a public adjuster makes sense for your situation. Not every claim needs professional representation, and we’ll tell you straight up if you can handle things on your own.

If we determine that you’d benefit from our help, we prepare a letter of representation that formally notifies your insurance company that we’re now handling your claim. This is actually a relief for most clients – suddenly, all those phone calls, emails, and requests for documentation flow through us instead of interrupting your day.

The heart of the process involves meetings with your insurer where we present your case. These are strategic presentations where we lay out the evidence, explain the coverage, and advocate for every dollar you deserve.

Everything wraps up with closing papers that finalize your settlement. We carefully review every document before you sign to make sure the terms are correct and complete.

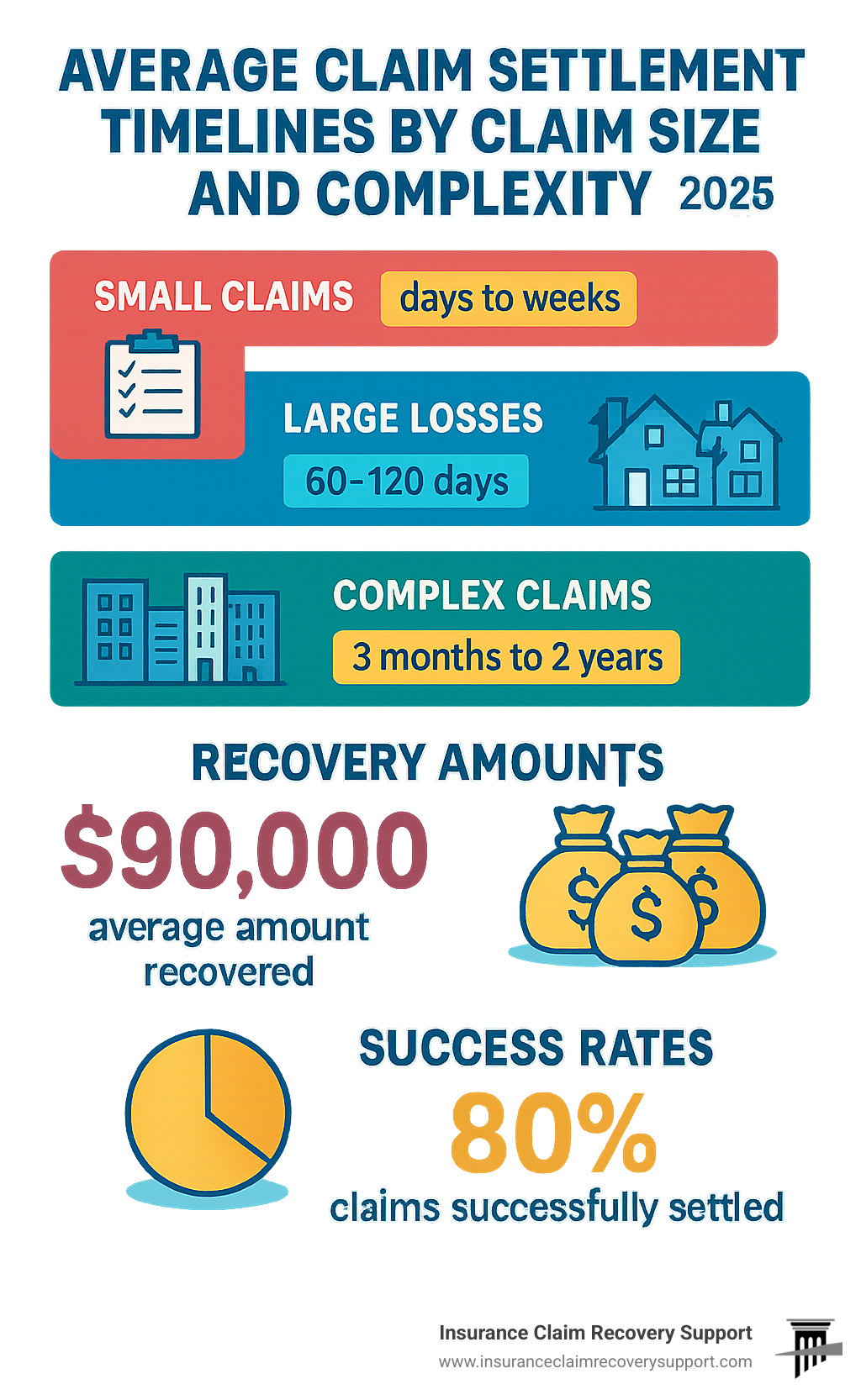

For most large losses, you’re looking at a typical timeline of 60-120 days from our initial documentation to your final settlement check. Complex claims can take longer, but we keep you informed every step of the way.

How Fees & Compensation Work

Here’s the beauty of working with a public adjuster: we work on contingency fees ranging from 10-30% of your settlement. That means if we don’t increase your payout, you don’t pay us a dime.

Most states cap public adjuster fees to protect consumers. Many states limit fees to 10% for newer claims, with higher percentages allowed for older or reopened claims. We’re always transparent about our fee structure upfront.

The no recovery, no fee arrangement means you can afford expert representation even when money is tight after a major loss. We’re betting our time and expertise on our ability to increase your settlement enough to more than cover our fee.

Think about it this way: if your insurance company offers you $200,000 and we negotiate that up to $350,000 with a 15% fee, you still walk away with $297,500 – nearly $100,000 more than the original offer.

When you’re weighing whether professional representation makes sense for your claim, our guide Should I Hire a Public Adjuster? walks through the key factors to consider.

Choosing a Reputable Local Adjuster & Red Flags to Avoid

When you type “public adjusters near me,” you’re really looking for a licensed public adjuster who works for you—not for the insurer. A few quick checks will keep your claim in safe hands.

1. Verify licenses. Every state requires public adjusters to hold an active license. Look the number up on your state department of insurance site instead of taking anyone’s word for it.

2. Check certifications. Roof inspection certifications, water and fire certifications, and OSHA are examples.

3. Favor local knowledge. An adjuster who understands local building codes,

4. Read real reviews. Search Google, the BBB, or ask for recent client references—ideally from claims like yours. How the public adjuster handles negative feedback tells you as much as five-star praise.

5. Confirm insurance & bonding. Reputable firms carry errors-and-omissions coverage to protect you if something goes wrong.

For a deeper dive, see our guide What is a Good Public Adjuster?

Quick Verification Checklist

- Active state license with no disciplinary actions

- Written contract spelling out scope, contingency fee, and cancellation rights

- Clear fee cap (in Texas, usually 10 % on new storm claims)

- Local office address and phone number

- At least two recent references you can call

Red Flags

- Up-front fees (legitimate public adjusters work on “no recovery, no fee”)

- Insurance fraud that overstates your damages or a scheme where you make money from your claim.

- High-pressure sales tactics or “today-only” offers

- Vague promises or guaranteed dollar amounts

- Out-of-state P.O. boxes with no local presence

- Suspended or expired licenses

- Contractors offering to “handle your claim”—they legally cannot negotiate insurance settlements in most states

Trust your gut: a good public adjuster leaves you informed and comfortable, not rushed or confused.

Frequently Asked Questions About Public Adjusters Near Me

When you’re searching for “Public adjusters near me,” you probably have plenty of questions about how the process works and whether hiring a public adjuster makes sense for your situation. Let me address the most common concerns I hear from property owners across Texas.

What types of claims can a public adjuster handle?

Public adjusters handle the full spectrum of property insurance claims that affect commercial buildings, multifamily properties, apartment complexes, churches, industrial parks, historical buildings, custom homes, and other real estate investments.

Storm damage claims are probably what we see most often. Whether it’s wind damage in Dallas-Fort Worth, tornado damage in central Texas, or hurricane destruction along the coast, severe weather creates complex damage patterns that require expert documentation and negotiation.

Fire and smoke damage claims present some of the most challenging scenarios we handle. Beyond obvious structural damage, fire creates smoke contamination throughout buildings, potential health hazards, and often triggers expensive building code upgrades during reconstruction.

Freeze damage claims have become increasingly common as Texas experiences more extreme weather events. When pipes burst or HVAC systems fail during freeze events, the resulting water damage can affect multiple floors and building systems in ways that aren’t immediately obvious.

We also handle business interruption claims when property damage forces you to close or relocate operations. These claims require detailed financial analysis to document lost income and continuing expenses during the repair period.

Lightning damage claims often affect electrical systems, HVAC equipment, and sensitive electronics in ways that take time to fully understand. Flood damage claims can be particularly complex because they often involve separate flood insurance policies that interact with your primary property coverage.

Our expertise spans across the United States but since we’re headquartered in Texas cities including Austin, Dallas, Fort Worth, Houston, San Antonio, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway are near and dear to us. We handle everything from smaller commercial losses to multi-million dollar catastrophic events.

Can a public adjuster help after my claim was denied or underpaid?

Absolutely yes – and it’s often where we do our best work. Many of our most successful cases involve claims that were initially denied or severely underpaid.

Here’s something most policyholders don’t realize: you typically have up to two years in most states to dispute a claim settlement. That means even if you accepted what seemed like a reasonable offer months ago, it’s not necessarily too late to get additional compensation if new damage is finded or if you realize the settlement was inadequate.

Supplemental claims are incredibly common in our business. Additional damage often shows up during repairs when contractors start opening walls or removing damaged materials. Initial estimates frequently prove inadequate once the full scope of work becomes clear.

We’ve successfully reopened claims and secured substantial additional compensation even months after initial settlements. Insurance companies are much more likely to pay additional amounts when the request comes from a licensed public adjuster with proper documentation than when it comes from a frustrated policyholder.

How long does it take to settle with a public adjuster?

Settlement timelines vary dramatically based on your specific situation, but I can give you realistic expectations based on thousands of claims we’ve handled.

Small claims under $50,000 often settle relatively quickly – sometimes within days or weeks if the damage is straightforward and well-documented.

Large losses between $100,000 and $1,000,000 typically take 60-120 days from start to finish. This timeline allows for thorough damage documentation, detailed estimate preparation, policy analysis, and negotiation with the insurance company.

Complex claims involving multiple buildings, extensive business interruption calculations, or coverage disputes can take anywhere from 3 months to 2 years. These might involve engineering reports, expert opinions, or even litigation if the insurance company refuses to negotiate fairly.

While we work diligently to settle claims as quickly as possible, we never rush to accept inadequate settlements just to close files faster. Our job is to maximize your recovery, and sometimes that takes patience and persistence.

The good news is that once we take over your claim, you can focus on running your business or managing your property while we handle all the insurance company communications, paperwork, and negotiations.

Conclusion

When disaster strikes your property, that frantic search for “public insurance adjusters near me” becomes one of the most important actions you’ll take. The difference between professional representation and going it alone often means the difference between a settlement that truly covers your losses and one that leaves you scrambling to make up the shortfall.

Here’s the reality: your insurance company has teams of experienced professionals working to minimize what they pay you. Shouldn’t you have someone equally skilled fighting for your maximum recovery?

Local advocacy makes all the difference. A public adjuster who knows that Austin’s clay soil shifts and causes foundation issues, who understands Houston’s flooding patterns, or who’s familiar with Dallas building codes will spot coverage opportunities that an out-of-town adjuster might miss. When you’re dealing with Texas weather damage – whether it’s freeze-related pipe bursts, tornado destruction, or fire reconstruction – local expertise accelerates your path to recovery.

The numbers don’t lie. Public adjusters secure settlements that are 747% higher on average than what policyholders receive when handling claims alone. When you factor in that we work on contingency – meaning you pay nothing unless we increase your settlement – the choice becomes crystal clear.

But this isn’t just about the money. It’s about getting your life and business back on track as quickly as possible. While you’re juggling contractors, dealing with displaced tenants, or trying to keep your business running from a temporary location, we’re handling the insurance maze that can consume weeks of your time.

The stress reduction alone is worth it. One client recently told me, “I finally slept through the night for the first time in months after hiring you. Just knowing someone competent was handling my claim lifted this huge weight off my shoulders.”

Insurance Claim Recovery Support LLC has spent years mastering the art and science of large-loss property damage insurance claims. We’ve settled over 500 large loss claims worth more than $250 million, and we understand exactly how weather, building codes, and construction costs impact your claim. Whether you’re in one of the 16 states where we’re licensed, near us in Austin, Dallas-Fort Worth, Houston, San Antonio, or anywhere across Texas, we bring that local knowledge to every case we handle.

Your insurance policy is a contract, and you deserve every dollar you’re entitled to under that contract. Don’t let the insurance company’s first offer be your final settlement.

Contact ICRS today for your claim review. We’ll evaluate your situation honestly, explain your options clearly, and show you exactly what professional representation can mean for your claim. Remember our promise: no recovery, no fee. You literally have nothing to lose and potentially tens of thousands to gain.

Your property damage claim is too important to leave in the hands of the insurance company alone. Get the professional advocacy you deserve and the maximum settlement your policy allows.