When Business Income Loss Strikes, Time Is Money (And Your Survival May Depend on It)

A certified public adjuster for business income loss is a licensed professional who exclusively represents policyholders in negotiating business interruption insurance claims. These specialists combine insurance expertise with forensic accounting skills to maximize settlements when your business operations are disrupted by covered disasters.

Quick Answer for Business Owners:

– What they do: Document lost income, calculate continuing expenses, and negotiate with insurers

– When to hire: Immediately after major property damage that stops operations

– How they’re paid: Typically 10-20% contingency fee (often covered by policy’s claims preparation clause)

– Why it matters: Can increase settlements by 30% to 747% compared to self-representation

– Certification: Must hold state public adjuster license and often specialized business interruption credentials

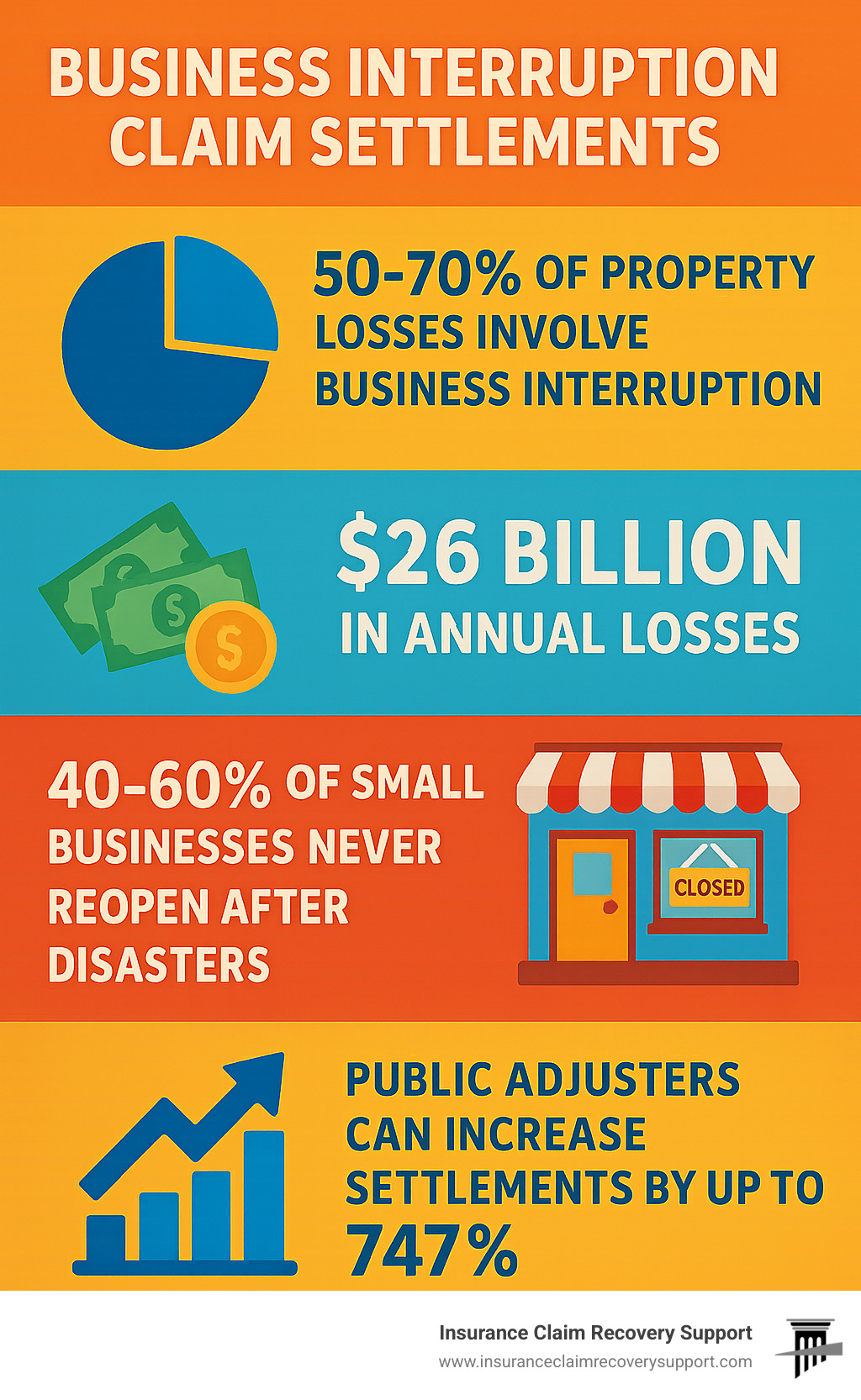

The stakes couldn’t be higher. Small Business Administration data shows that 40-60% of small businesses never reopen after a disaster. With business interruption losses accounting for 50-70% of all insured property claims – roughly $26 billion annually – getting your claim right the first time isn’t just about money. It’s about survival.

“Nothing but good to say! We received everything we were hoping for from our insurance company thanks to these guys!” says one business owner whose initial $846,833 offer became a $2.75 million settlement with professional help.

As Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support, I’ve settled over 500 large loss claims valued at more than $250 million, including countless certified public adjuster for business income loss cases across Texas and beyond. My team has increased business interruption settlements from 30% to 3,800% by properly documenting lost revenues, continuing expenses, and period of restoration calculations that overwhelmed business owners often miss.

Business Income Loss 101: Reading the Fine Print

When disaster strikes your business, business interruption insurance doesn’t simply replace your lost income dollar for dollar. Instead, it calculates what you would have earned (your net income) plus your continuing normal operating expenses, then subtracts any expenses you actually saved during the shutdown. This three-part calculation is where many claims go wrong without proper representation from a certified public adjuster for business income loss.

The coverage triggers when direct physical loss or damage to your insured property forces you to suspend operations. But the devil truly lives in those policy definitions that determine whether you collect thousands or millions in your settlement.

Key Policy Definitions Every Owner Must Know

The period of restoration might be the most important phrase in your entire policy. This period starts 72 hours after the physical damage occurs and continues until your property should be repaired with reasonable speed – or until you resume operations at a new location, whichever happens first.

That 72-hour deductible can be particularly brutal. Picture a popular restaurant in Austin that suffers kitchen fire damage on a Thursday night before a big University of Texas home game weekend. Those 72 hours wipe out their busiest revenue period, but they receive zero compensation because it falls within the deductible period.

Extended business income coverage becomes crucial when you consider what happens after you reopen. Standard policies stop paying the moment your doors reopen, even though it often takes weeks or months to rebuild your customer base.

The coinsurance clause can devastate your claim if you’re underinsured. Let’s say your policy requires 80% coinsurance, but you only carried coverage equal to 60% of your actual business income exposure. Your insurer will reduce your entire claim payment proportionally.

What Typically Triggers Coverage?

Business income coverage responds to the same covered perils that trigger your property insurance. Across Texas, we regularly handle business insurance claims triggered by various disasters.

Fire and smoke damage remains one of the most common triggers. Wind and tornado damage particularly devastates businesses in the Dallas-Fort Worth corridor and around Lubbock. Hurricane damage affects coastal businesses with wind and storm surge, while freeze events like the February 2021 Texas winter storm created thousands of business interruption claims from burst pipes and power outages.

Supply chain disruptions can trigger coverage when damage to your suppliers’ or customers’ properties affects your operations – but only if you have dependent property coverage. Civil authority orders provide coverage when government officials prevent access to your business due to damage in the surrounding area.

One critical gap catches many Texas business owners off-guard: standard business income policies exclude flood damage, and the National Flood Insurance Program doesn’t provide business interruption coverage.

What Does a Certified Public Adjuster for Business Income Loss Do?

When disaster strikes your business, you need someone who truly understands the maze of insurance policies and knows how to fight for every dollar you deserve. That’s exactly what a certified public adjuster for business income loss does – we become your champion in what can feel like an unfair fight.

While insurance company adjusters work to protect their employer’s bottom line, we work exclusively for you. Our job is to maximize your settlement, not minimize it.

We handle every piece of your Business Insurance Claims puzzle. We inspect your damaged property, document every loss, gather the financial records that matter, review your policy with a fine-tooth comb, calculate what it will really cost to get you back on your feet, and then negotiate relentlessly with your insurance company.

Why a Certified Public Adjuster for Business Income Loss Beats Going It Alone

The numbers don’t lie. A Florida state report found that public adjusters can boost insurance settlements by as much as 747% compared to business owners who go it alone. Even modest increases of 30-50% are common in business interruption claims.

Why such dramatic differences? Business interruption claims are incredibly complex. Calculating net income, separating continuing expenses from saved expenses, projecting future revenues based on historical trends – these tasks require specialized expertise that most business owners simply don’t have.

Then there’s the time factor. Filing a proper business interruption claim is a full-time job when done right. While you’re scrambling to keep your business alive, manage displaced employees, and reassure worried customers, we’re building the strongest possible case for your claim.

Small Business Administration research shows that businesses with professional advocacy recover faster and more completely. When 40-60% of small businesses never reopen after a disaster, having expert help isn’t just about money – it’s about survival.

How Certified Public Adjusters for Business Income Loss Work with CPAs & Forensic Accountants

We believe in teamwork, especially when millions of dollars are on the line. The most successful business interruption claims combine our insurance expertise with the financial analysis skills of CPAs and forensic accountants.

This collaboration becomes crucial during trend analysis – where we dig into up to five years of your financial history to establish sales patterns and project what your business would have earned during the shutdown period.

Our forensic accounting partners create the detailed audit trail that insurance companies demand. They identify seasonal variations in your business, account for growth trends, and carefully separate continuing expenses like rent and key employee salaries from saved expenses like utilities for a closed facility.

Step-By-Step Claim Process: From Disaster to Dollars

When disaster strikes your business, every hour counts. The business interruption claims process isn’t just paperwork – it’s a race against time where missing steps or deadlines can literally cost you thousands of dollars.

The first 24-48 hours are critical. You’ll need to notify your insurance company immediately, but keep that initial report focused on the basics – what happened, when it occurred, and the general scope of damage.

Your mitigation duties kick in right away. You must take reasonable steps to minimize further damage and document everything you do. This means securing the property, protecting undamaged assets, and beginning emergency repairs if necessary.

Next comes the loss site inspection, where we conduct a thorough examination to document all direct physical damage and assess how it impacts your operations. We’re looking for hidden damage that might extend your restoration period – water damage behind walls, smoke contamination in HVAC systems, or structural issues that weren’t immediately apparent.

The data gathering phase is where most business owners who go it alone hit a wall. The paperwork requirements are overwhelming: tax returns for the past 3-5 years, monthly profit and loss statements, payroll records, accounts payable and receivable, contracts with suppliers and customers, and any other financial documents that support your claim.

Revenue projections require sophisticated analysis that combines your historical data with industry trends and market conditions. This isn’t just about averaging your past three years – we account for seasonality, growth trends, and external factors that would have affected your earnings during the restoration period.

The proof of loss submission is your formal claim presentation. This document must be comprehensive, accurate, and professionally prepared.

Finally, settlement negotiation is where our expertise really pays off. Armed with comprehensive documentation and thorough policy analysis, we negotiate with the insurance company to secure the maximum settlement your policy allows.

Documenting & Calculating Your Loss Like a Pro

The foundation of any successful business interruption claim starts with rock-solid financial documentation. Tax returns from the past 3-5 years establish your baseline income patterns. Monthly profit and loss statements reveal seasonal fluctuations that could dramatically affect your claim value.

Payroll records are crucial because they document continuing employee costs. Customer contracts showing committed future revenue strengthen your projections, while supplier agreements might trigger dependent property coverage.

There are three main approaches to calculating your loss. The bottom-up method adds your net income to continuing expenses. The top-down approach starts with gross revenue and subtracts saved expenses. Hindsight calculations use actual post-loss data to refine projections.

Growth trend analysis can significantly boost your settlement. If your business was experiencing 15% annual growth, we project that trend through the restoration period rather than using flat historical averages.

Extra Expense & Continuing Operations

Extra expense coverage pays for unusual costs you wouldn’t normally incur but are necessary to keep operating or reduce your business income loss.

Temporary location rental and setup costs are common examples. Equipment rental allows manufacturers to maintain production schedules. Overtime labor costs often qualify when you need to work extended hours to make up for lost production time.

The key principle is proving these expenses actually reduced your business income loss.

Top Challenges, Mistakes, and Myths That Kill Claims

After handling hundreds of business interruption claims across Texas, I’ve noticed the same costly mistakes appearing over and over. The good news? Every single one of these claim-killers is completely preventable when you know what to watch for.

Missed deadlines top the list of avoidable disasters. Most policies require your proof of loss within 60 days, and while extensions are usually possible for complex business interruption cases, you must request them properly and in writing.

The under-insured limits problem breaks my heart every time. A restaurant owner in Round Rock recently found his $500,000 business income coverage wouldn’t even cover three months of closure after a kitchen fire. His annual revenue was $2.8 million, but he’d never calculated what six months of lost income plus continuing expenses would actually cost him.

Speculative profits claims rarely succeed unless you have rock-solid documentation. That expansion you were “planning to start next month” won’t be covered without signed leases, construction contracts, and bank loan approvals already in place.

Here’s where many Texas businesses get blindsided: flood exclusions. Standard property policies exclude flood damage, and the National Flood Insurance Program doesn’t provide business interruption coverage at all. During Hurricane Harvey, countless Houston businesses found this gap the hard way.

Insurance companies love to inflate saved expenses to shrink your claim. Just because your manufacturing facility was empty for three months doesn’t mean you saved all your utility costs. You still needed security systems, minimal climate control to prevent equipment damage, and basic maintenance.

The insurer accountant bias issue surprises many business owners. The forensic accountant hired by your insurance company works for them, not you. Their job is finding reasons to reduce your claim payment. Having your own Property Insurance Attorney or public adjuster levels the playing field.

Myth-Busting: “My Broker Will Handle It”

This myth has cost Texas business owners millions in underpaid claims. While insurance brokers are fantastic for purchasing coverage, they face serious conflicts of interest during claims. Their ongoing relationship with the insurance company creates pressure to accept lower settlements.

More importantly, most brokers lack the specialized knowledge required for complex business interruption calculations. Your broker might know insurance products inside and out, but forensic accounting? That’s a different skill entirely.

Common Texas Pitfalls After Storm & Fire Events

Texas weather creates unique challenges that catch business owners off-guard. In the Austin area, severe storms and tornadoes frequently damage the tech corridor, creating complex dependent property claims. Dallas-Fort Worth businesses face tornado alley risks that create tricky coverage questions. Houston presents complex scenarios with hurricane and freeze events. The February 2021 freeze caught thousands of businesses unprepared when burst pipes shut down operations for weeks.

Understanding Why Commercial Claims Are Different in Texas helps explain the regulatory nuances that affect business interruption claims throughout our state.

Real-World Wins & When to Call for Help

Sometimes the best way to understand the value of a certified public adjuster for business income loss is to see the real numbers. These aren’t theoretical examples – they’re actual cases from our Texas practice.

Take the Fort Worth manufacturing company that suffered a devastating fire in their main production facility. The insurance company’s adjuster presented a check for $180,743. Our team spent weeks documenting the ripple effects that the insurance company missed. We traced how the fire disrupted supplier relationships, identified seasonal demand patterns, and calculated the true cost of keeping key employees on payroll. The final settlement? $4,156,380 – more than 20 times the original offer.

Down on the Gulf Coast, a resort management company faced a different challenge after hurricane damage. Their insurance company wanted to pay only for the rooms they directly owned, ignoring the managed properties that generated substantial management fees. This often-overlooked dependent property coverage added hundreds of thousands to their settlement.

The February 2021 Texas freeze created a perfect storm of business interruption claims. One restaurant chain initially focused only on their burst pipe damage, but we helped them see the bigger picture. Supply chain disruptions meant they couldn’t get fresh ingredients even after repairs. What started as a property damage claim became a comprehensive business recovery settlement worth three times the original estimate.

Signs It’s Time to Hire a Public Adjuster

You don’t need to wait until problems develop to bring in professional help. The earlier you engage a certified public adjuster for business income loss, the better your outcome typically becomes.

Expensive repairs are an obvious red flag – anything over $50,000 usually involves enough complexity to benefit from professional advocacy. A prolonged shutdown lasting more than a week can create business interruption losses that dwarf the property damage itself.

Insurer lowball offers are unfortunately common, especially in business interruption claims where the calculations are complex. Staff overload is a reality most business owners face after a disaster. Disputed coverage interpretations should always trigger professional consultation.

Complex operations with multiple revenue streams, seasonal variations, or dependent relationships almost always benefit from professional claim handling. The more moving parts your business has, the more opportunities exist for coverage that you might not recognize.

Our Public Adjusting Services are designed to handle every aspect of your claim while you focus on what you do best – running your business.

Success Stories from Texas Storm Corridors

The San Antonio hotel story perfectly illustrates how business interruption claims extend far beyond obvious losses. After severe weather damaged their roof and flooded multiple floors, this 200-room property faced a six-month closure. The insurance company’s adjuster calculated lost room revenue and called it a day.

But hotels don’t just rent rooms. We documented lost conference bookings that had been planned months in advance, restaurant revenue from both hotel guests and local diners, and the extended period needed to rebuild their reputation after reopening. The final settlement was 400% higher than the initial offer.

Up in Lubbock, a manufacturing plant found that sometimes disasters come in clusters. High winds destroyed their main production building, but the same storm system also damaged their primary supplier’s facility 50 miles away, creating supply chain disruptions that extended their business interruption period. Dependent property coverage added $500,000 to their settlement.

Sometimes the most valuable claims come from the smallest incidents. A kitchen fire in a business adjacent to a Round Rock medical clinic triggered civil authority orders that prevented patient access for two weeks. The property damage was minimal, but the business interruption was significant. For this medical practice, civil authority coverage meant the difference between absorbing two weeks of lost revenue and receiving full compensation for the forced closure.

Frequently Asked Questions about Certified Public Adjusters & Business Income Loss

How soon after a disaster should I involve a certified public adjuster for business income loss?

The short answer? Immediately. The sooner you get professional help, the better your chances of a fair settlement.

Critical evidence disappears fast. That water damage you’re looking at today might dry up and become invisible in a week, but it could affect your business operations for months. Initial conversations with insurance adjusters can accidentally hurt your claim if you’re not prepared.

We recommend calling within 24-48 hours of any significant loss. Early engagement allows us to help document your mitigation efforts properly. Many business owners don’t realize that those emergency repairs and protective measures are typically covered expenses.

Are public adjuster fees covered by my policy’s claims preparation clause?

Many commercial property policies include claims preparation coverage that can pay for our services without reducing your settlement one penny. This coverage typically pays for reasonable professional fees you incur to prepare and present your claim.

Even when policies don’t include this specific coverage, our contingency fee structure means you only pay when we successfully recover money for you. Given that we typically increase settlements by 30% to 747%, our fee essentially pays for itself many times over.

What documents should I gather before the adjuster’s first visit?

Financial records are the foundation of any business interruption claim. Start with your tax returns for the past 3-5 years and monthly profit and loss statements. Payroll records and employee information help us document continuing expenses during your shutdown.

Customer contracts and supplier agreements can open up additional coverage you might not know you have. Business plans or growth projections with solid documentation can add substantial value to your claim. Don’t forget photos of the damage – take lots of them from multiple angles.

Here’s the thing though: don’t stress if you can’t locate everything immediately. We’ve worked with businesses whose records were destroyed in the same disaster that triggered their claim. We’ll help you identify what’s truly needed and work with your accountant to reconstruct missing information.

The most important thing is to call us quickly. We can guide you through the documentation process while ensuring you don’t miss any critical deadlines.

Conclusion

When disaster strikes your Texas business, you’re facing more than just property damage – you’re staring down a fight for your company’s very survival. The statistics are sobering: 40-60% of small businesses never reopen after a disaster. But it doesn’t have to be that way.

A certified public adjuster for business income loss isn’t just another expense during tough times. We’re your lifeline, your advocate, and your best shot at turning what feels like a business-ending catastrophe into a manageable setback with fair compensation.

While you’re juggling displaced employees, worried customers, and the overwhelming task of rebuilding, we’re fighting your insurance company for every dollar your policy owes you. It’s not just about the money (though settlements increasing by 30-747% certainly helps). It’s about giving you the breathing room to focus on what you do best – running your business.

At Insurance Claim Recovery Support LLC, we’ve walked alongside hundreds of Texas business owners through their darkest hours. From Austin tech companies hit by severe storms to Houston manufacturers dealing with freeze damage, from Dallas retailers facing tornado destruction to San Antonio hotels recovering from hurricane impacts – we’ve seen it all. Our work extends beyond Texas too, helping businesses from Round Rock to Lakeway, and across the nation when disaster strikes.

What sets us apart isn’t just our expertise (though settling over 500 large loss claims valued at more than $250 million speaks for itself). It’s our proactive advocacy approach. We don’t just file paperwork and hope for the best. We build bulletproof cases, negotiate aggressively, and never forget that behind every claim is a business owner who’s counting on us to get it right.

The insurance companies have armies of adjusters, accountants, and lawyers working to minimize your claim. Shouldn’t you have someone equally qualified fighting for you? When you’re dealing with complex business interruption calculations, policy interpretation disputes, and the maze of documentation requirements, going it alone isn’t brave – it’s risky.

Don’t let your business become another casualty statistic. When business income loss threatens everything you’ve built, professional help isn’t a luxury – it’s essential.

Ready to turn your disaster into a comeback story? Visit our Public Adjusting Services page to learn more about how we can help, or contact us directly. Because when your business’s future is on the line, you shouldn’t have to face the insurance company alone.