Navigating the Storm: Understanding the Hail Damage Insurance Process

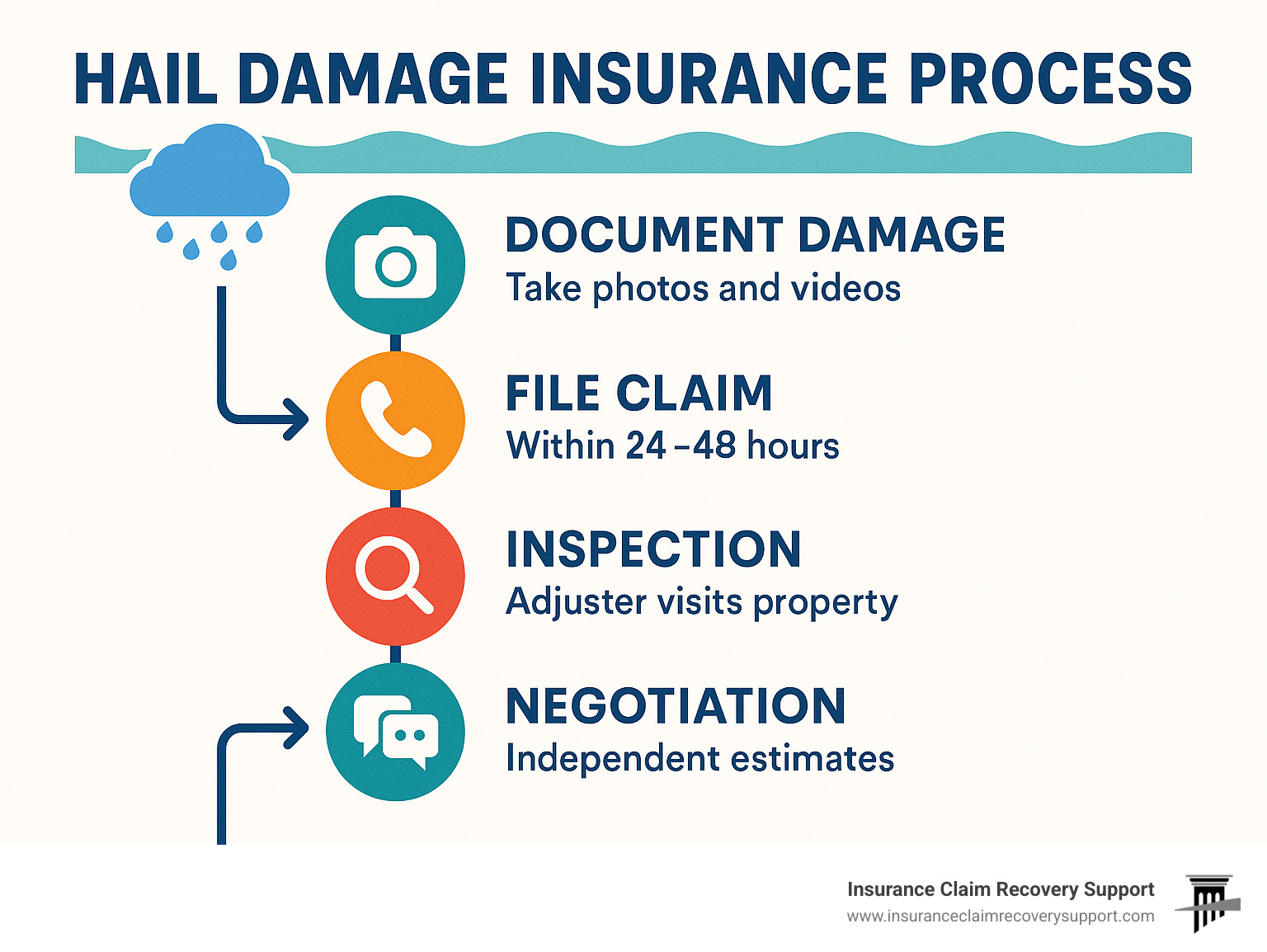

The hail damage insurance process typically follows these key steps:

- Document damage immediately with photos and videos

- Contact your insurance company within 24-48 hours

- Schedule an adjuster inspection of your property

- Obtain independent estimates from qualified contractors

- Review the settlement offer carefully before accepting

- Complete repairs and submit proof for any recoverable depreciation

When those golf ball-sized hailstones pound your roof and property, few things are more stressful than wondering if your insurance will cover the damage. A severe hailstorm can cause thousands of dollars in damage in just 5-6 minutes, leaving you with damaged shingles, dented siding, broken windows, and potentially compromised structural integrity.

The good news? Most standard homeowners and commercial property policies cover hail damage. The challenge lies in navigating the claims process effectively to ensure you receive the full settlement you deserve.

Texas and Colorado lead the nation in hail damage insurance claims, with Texas alone experiencing over $5 billion in hail losses in recent years. This isn’t surprising considering the frequency and severity of storms in these regions, where property owners often face multiple hail events in a single season.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled hundreds of millions in hail damage claims throughout my career managing the hail damage insurance process for commercial and multifamily properties across Texas and beyond. My experience has shown that understanding the proper steps in the claim process can mean the difference between a fair settlement and a frustrating underpayment.

Understanding Hail Damage & Insurance Basics

When those ice pellets start hammering your roof, understanding what you’re dealing with makes all the difference in the hail damage insurance process.

Hail severity depends largely on size—pea-sized hail (¼ inch) rarely causes problems, but once those frozen projectiles reach quarter-size (1 inch), your shingles start taking a beating. When golf ball-sized hail (1¾ inches) or larger strikes, the damage can be devastating to your roof, siding, windows, and other property elements.

On asphalt shingle roofs, hail damage has a distinctive appearance. Look for random damage patterns with no consistent direction, dark spots where granules have been knocked away, and exposed shiny asphalt underneath. You might also notice soft “bruised” areas when you press on the shingles, or circular cracks where hailstones made impact.

“Most homeowners are shocked when they learn what their policy actually covers—and what it doesn’t,” says our team of public adjusters who’ve seen thousands of Texas hail claims.

Your standard homeowners policy typically includes hail damage coverage, but several critical factors affect your protection:

Deductibles have changed dramatically in recent years. Many Texas policies now feature separate wind/hail deductibles ranging from 1-5% of your dwelling coverage. For perspective, if you have a $300,000 policy with a 2% wind/hail deductible, you’ll pay $6,000 out-of-pocket before your insurance kicks in.

Cosmetic exclusion clauses might leave you with dented metal roofing or siding that insurers won’t cover if they determine the damage is “merely cosmetic” and doesn’t affect functionality. This distinction can be highly subjective and often requires professional advocacy.

Matching limitations can result in a patchwork roof or siding if your insurer only pays to replace the specifically damaged sections. Imagine having half your roof in one shade and half in another—not exactly what you had in mind!

Actual Cash Value vs. Replacement Cost represents perhaps the biggest potential gap in your settlement. ACV policies only pay the depreciated value of damaged items, while Replacement Cost policies cover what it actually costs to replace the damage with new materials.

Texas remains the nation’s hail damage capital, with over 800 significant hail events in 2022 alone. The “hail alley” regions around Dallas-Fort Worth, San Antonio, Houston, and the Panhandle are particularly vulnerable, making understanding your coverage essential for Texas property owners.

For comprehensive information about how to steer these complex claims, visit our detailed guide on Hail Damage Claims where we break down everything from documentation requirements to settlement negotiations.

The Hail Damage Insurance Process: Step-by-Step Roadmap

The hail damage insurance process isn’t just paperwork—it’s your path to recovery after Mother Nature’s icy bombardment. Let me walk you through exactly what to do when those frozen projectiles target your property.

When to start the hail damage insurance process

That first moment you spot missing shingles or dented siding is when your clock starts ticking. Most insurance policies use language requiring “prompt notice” of damage, which typically means within 24-48 hours of findy. This doesn’t mean you need a complete claim filed immediately—just that you’ve alerted your insurer to potential damage.

Your timing matters tremendously here. Your policy likely has specific reporting requirements that, if missed, could give your insurer grounds to deny your claim entirely. In Texas, while you legally have two years from a claim denial to file a lawsuit, most insurers expect actual damage reports within one year of the storm event. Wait longer, and you’ll face the uphill battle of proving which specific storm caused your damage.

For leaking roofs or broken windows, don’t wait to make temporary repairs! Your policy likely covers reasonable emergency mitigation costs, so save every receipt. The ideal approach is simple: notify your insurer within 1-2 days of finding damage, even if you’re still assessing the full extent. This creates your paper trail while you gather more evidence.

Evidence that fuels a successful hail damage insurance process

Your documentation is your strongest ally throughout the hail damage insurance process. Think of it as building your case before a jury—the more compelling your evidence, the better your outcome.

Start with thorough visual documentation. Capture close-up photos of damaged shingles, dented gutters, and affected siding, along with wider shots showing the overall context. If you can safely photograph your roof (using a drone or from the ground with zoom), do so from multiple angles to show damage patterns.

Weather verification becomes your scientific backup. If possible, photograph actual hailstones next to coins or rulers for size comparison. Services like Hail/Wind Report Verification can provide official documentation of the storm event at your specific address—invaluable if your insurer questions whether hail actually struck your property.

Professional assessments add credibility to your claim. Have licensed roofing contractors who specialize in hail damage inspect your property and provide written reports. Their expert opinions carry significant weight during the adjustment process.

Organization becomes your secret weapon. Create a dedicated claim folder containing your policy documents, claim number, adjuster contact information, damage photos, weather reports, contractor estimates, communication logs, and receipts for emergency repairs. This systematic approach not only strengthens your position but helps you maintain control when the process feels overwhelming.

According to the latest hail statistics from the Insurance Information Institute, hail causes billions in damage annually, with Texas consistently leading the nation in claims. The hail damage insurance process might seem daunting, but with proper documentation and timely action, you can steer it successfully. For a deeper understanding of the entire claims journey, visit our detailed guide on the Hail Damage Insurance Claim Process.

Negotiation, Adjusters & Payout Math

Once you’ve filed your claim, your insurance company will assign an adjuster to inspect the damage. Understanding the roles and the math behind settlements is crucial to navigating the hail damage insurance process successfully.

Insurance Adjuster vs. Public Adjuster

When that insurance company adjuster shows up at your property, remember they work for the insurer—not you. While many try to be fair, their primary loyalty lies with their employer.

Insurance adjusters verify your coverage, assess damage, estimate repairs, and recommend settlement amounts. But they might miss hidden damage, apply excessive depreciation, underestimate replacement costs, or misclassify functional damage as merely cosmetic.

That’s where public adjusters like our team at Insurance Claim Recovery Support come in. We work exclusively for you, the policyholder. We thoroughly document all damage, apply our expertise in construction costs and policy language, and negotiate directly with insurance companies to maximize your settlement.

In Texas, public adjusters typically charge around 10% of the claim settlement—but only on amounts recovered above what the insurance company initially offered. This means our services often pay for themselves by securing significantly higher settlements.

Understanding Payout Calculations

When it comes to insurance settlements for hail damage, the math matters. Here’s what you need to know:

Actual Cash Value (ACV) is what your damaged property is worth today after depreciation is factored in. Replacement Cost Value (RCV) is the full cost to replace damaged items with new ones. The difference between these two figures is called recoverable depreciation, which is typically paid after repairs are completed and documented.

Your deductible is your out-of-pocket responsibility before insurance pays a dime.

Here’s how this plays out in real life:

| Scenario | Replacement Cost | Depreciation | Actual Cash Value | Deductible | Initial Payment | Final Payment |

|---|---|---|---|---|---|---|

| RCV Policy | $20,000 | $5,000 | $15,000 | $2,500 | $12,500 (ACV minus deductible) | $5,000 (recoverable depreciation) |

| ACV Policy | $20,000 | $5,000 | $15,000 | $2,500 | $12,500 (ACV minus deductible) | $0 (no recoverable depreciation) |

With an RCV policy, you’ll eventually receive the full replacement cost (minus your deductible) after completing repairs. With an ACV policy, you only receive the depreciated value minus your deductible—potentially leaving you thousands short for full repairs.

Avoiding claim denials & disputes

Insurance companies deny hail claims for various reasons, but knowing these pitfalls helps you avoid them. Late reporting is a common reason—insurers may deny claims if you wait too long to report damage. They might also attribute damage to pre-existing conditions or normal wear and tear rather than hail impact.

Another common dispute arises when insurers classify damage as merely cosmetic when it may actually affect functionality. Some policies also deny claims based on improper maintenance, suggesting your negligence contributed to the damage.

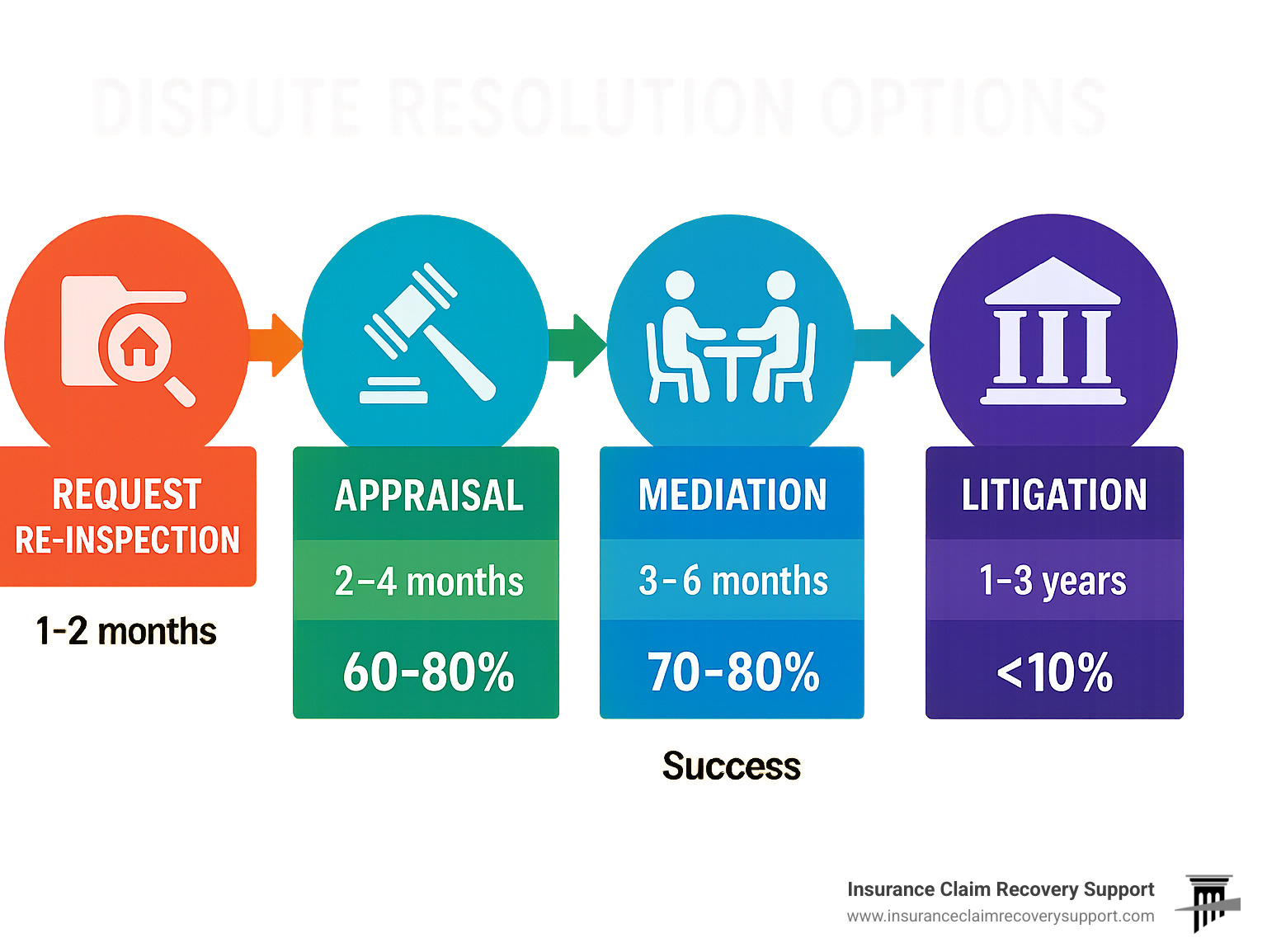

If your claim is denied or underpaid, don’t give up! You have several options:

Request a re-inspection with a different adjuster. Invoke your policy’s appraisal clause for formal dispute resolution. File a complaint with the Texas Department of Insurance. Hire a public adjuster to represent your interests. For severely underpaid claims, legal action might be necessary.

Contractor selection & fraud prevention tips

After a major hailstorm, your neighborhood might suddenly fill with trucks and contractors knocking on doors. Some are legitimate, but others… not so much.

Choose established local companies with physical offices and verifiable references. Be wary of those out-of-state “storm chasers” who appear immediately after storms—they might disappear just as quickly once they’ve collected payment.

Always verify credentials—check licensing, insurance coverage, and Better Business Bureau ratings before signing anything. Getting multiple estimates helps you understand fair market value for your repairs and spot outliers.

Never pay the full amount upfront! A reasonable deposit (10-30%) is standard, but full payment should only happen after satisfactory completion. And remember: in Texas, it’s actually illegal for contractors to waive or absorb your deductible. Any contractor offering to “cover” or “pay” your deductible is breaking the law.

Make sure your contract spells out all work specifications, materials, costs, and timelines. Request lien waivers to protect yourself from supplier or subcontractor claims if the contractor fails to pay them.

The hail damage insurance process can feel overwhelming, but understanding how adjustments and settlements work puts you in a stronger position. With the right knowledge and support, you can steer this process successfully and ensure your property is properly restored.

Rebuilding & Future-Proofing Your Roof

After successfully navigating the hail damage insurance process and securing your settlement, it’s time to rebuild with an eye toward the future. Think of this as your opportunity to not just repair, but upgrade your property’s defenses against Texas’s notorious hail seasons.

Impact-Resistant Roofing Materials

Feeling of dread during the last hailstorm? You can significantly reduce that anxiety by upgrading to impact-resistant roofing materials. These materials are rated on a scale of 1-4, with Class 4 offering the highest resistance against those golf ball-sized hailstones that plague Dallas-Fort Worth and San Antonio properties.

Impact-resistant roofing isn’t just about peace of mind—it makes financial sense too. Many Texas insurers offer premium discounts between 5-35% when you install these materials. While you’ll pay about 15-30% more upfront compared to standard materials, the combination of insurance savings, reduced maintenance costs, and extended roof lifespan often makes this a smart investment, especially in our hail-prone Texas regions.

Your best options include modified asphalt shingles with SBS polymers that flex rather than crack when struck, metal roofing with specialized impact-resistant coatings, concrete or clay tiles, and synthetic slate products. Each offers distinct aesthetic and performance benefits worth discussing with your contractor.

For commercial property owners managing multiple buildings in Houston or Austin, these upgrades can translate to significant long-term savings across your portfolio while maintaining property values and reducing maintenance headaches.

Building Code Upgrades

When replacing your roof, don’t miss the opportunity to incorporate both required and optional upgrades that can dramatically improve performance:

Improved Underlayment: Think of synthetic underlayments as your roof’s backup plan—they provide superior water resistance compared to traditional felt if your primary roofing materials are compromised.

Proper Ventilation: Good ventilation isn’t just about comfort—it extends roof life by preventing heat and moisture buildup that can prematurely age your new materials.

Ice and Water Shield: This self-adhering membrane provides extra protection in vulnerable areas like valleys and eaves where water tends to collect.

Drip Edge and Flashing: These simple metal components direct water away from fascia and prevent seepage into your building envelope—small details that make a big difference in performance.

If your policy includes “ordinance or law” coverage (worth checking!), it may pay for required code upgrades even beyond your basic dwelling coverage limit. This can help offset the costs of bringing your property up to current building standards, which is particularly valuable for older properties in Waco, San Angelo, or Lubbock.

For comprehensive information about maximizing your claim for a full roof replacement, visit our detailed guide on Roofing Insurance Claims for Storm Damage. You might also find value in reviewing the latest research on hail-resistant building materials from the NOAA severe storm data resource center.

Fortifying against the next storm

Let’s face it—if you’ve experienced one Texas hailstorm, you’ll almost certainly face another. Beyond roofing improvements, consider these practical strategies to protect your property:

Annual professional inspections can catch minor issues before they become major problems. Schedule these in early spring before storm season hits, and again after any significant weather event. A small investment in prevention can save thousands in future damage.

Gutter protection systems prevent debris buildup and ensure proper water drainage. When gutters function properly, they direct water away from your foundation and prevent erosion that can compromise your property’s structural integrity.

Regular tree maintenance isn’t just about aesthetics—those overhanging branches can become projectiles or fall on your property during severe storms. Keep them trimmed back, especially near rooflines and power lines.

Emergency preparedness means having tarps, plastic sheeting, and basic tools readily accessible. When that midnight storm hits in Round Rock or Georgetown, you’ll be ready to make temporary repairs before professional help arrives.

Current documentation of your property in good condition provides invaluable comparison points for future claims. Take photos seasonally, especially after completing any improvements or repairs.

For commercial property owners in Lakeway or elsewhere in Texas, we recommend developing comprehensive hail mitigation plans that include staff training for emergency response and established relationships with restoration contractors before damage occurs. Being prepared isn’t just smart—it’s profitable when disaster strikes.

Frequently Asked Questions about Hail Damage Insurance

Will a hail claim raise my premiums?

Let’s talk about the question on every homeowner’s mind after a hailstorm. While hail claims are technically considered “no-fault” events (Mother Nature doesn’t pay premiums, after all), the reality isn’t quite so simple.

In theory, you shouldn’t be penalized for something completely beyond your control. However, insurance companies do look at patterns:

A single hail claim typically won’t trigger an individual rate increase. You can usually file one claim without seeing your personal premium jump. That said, after major storms, many Texans notice regional rate increases as insurers adjust to widespread losses.

Multiple weather claims within a 3-5 year window? That’s where things get tricky. If your property seems to be a frequent target for damage, insurers may view you as higher risk, potentially leading to rate increases or even non-renewal when your policy term ends.

The good news is that Texas regulations do offer some protection against arbitrary cancellations. My advice as someone who’s guided hundreds of property owners through this process: don’t avoid legitimate claims out of fear, but understand that your claims history does matter in the long run.

Can I keep the payout instead of repairing?

This question comes up frequently, especially for property owners considering selling or making different improvements. Whether you can pocket insurance proceeds depends on several important factors:

If you have a mortgage, your lender likely appears as a “loss payee” on your policy and must endorse any insurance checks. Most lenders won’t release funds without proof that repairs have been completed—they’re protecting their investment in your property.

Replacement cost policies typically pay in two stages: first the actual cash value (depreciated amount), then the remaining “recoverable depreciation” only after you’ve completed repairs and provided documentation. No repairs usually means no second check.

For property owners in Austin, Dallas-Fort Worth, San Antonio, and Houston who own their properties outright, it’s technically possible to keep insurance proceeds without making repairs. However, I strongly caution against this approach. Unrepaired damage tends to worsen over time, potentially leading to more severe problems, complications with future claims, and disclosure headaches when selling your property.

What if the adjuster says there’s no hail damage?

I’ve seen this scenario countless times: you know your roof was pummeled by hail, but the insurance adjuster claims there’s no damage. Don’t worry—you have options.

First, request the denial in writing with a detailed explanation. This documentation is crucial for any appeal process.

Next, get a qualified second opinion. Have a reputable roofing contractor or structural engineer inspect your property and provide a written assessment of the damage. Their expertise can reveal impacts that an adjuster might have missed or misclassified.

Don’t hesitate to request a re-inspection from your insurance company, preferably with a different adjuster. Sometimes a fresh set of eyes makes all the difference.

If you’re still hitting a wall, this might be the perfect time to hire a public adjuster like our team at Insurance Claim Recovery Support. We specialize in documenting damage that insurance adjusters overlook and negotiating directly with insurers to reverse claim denials.

For more significant disagreements, you can invoke the appraisal clause in your policy—a formal dispute resolution process that can resolve differences about damage extent or value.

As a last resort, filing a complaint with the Texas Department of Insurance can prompt a review of potential bad faith practices by your insurer.

Over the years, our team has successfully reversed countless initial claim denials by providing thorough documentation and expert assessment of hail damage that insurance adjusters overlooked. Sometimes it’s simply a matter of knowing what to look for and speaking the insurance company’s language.

Conclusion

Navigating the hail damage insurance process doesn’t have to leave you out in the cold. With proper documentation, timely reporting, and expert guidance, you can secure the settlement you deserve to restore your property to pre-storm condition—or even better.

Key takeaways for property owners in Austin, Dallas-Fort Worth, San Antonio, Houston, and other hail-prone regions of Texas:

-

Act Quickly: Document damage and notify your insurer promptly after a hailstorm.

-

Document Thoroughly: Photos, videos, and professional assessments create a strong foundation for your claim.

-

Understand Your Policy: Know your deductible, coverage limits, and whether you have actual cash value or replacement cost coverage.

-

Consider Professional Representation: Public adjusters can level the playing field with insurance companies and often secure significantly higher settlements.

-

Rebuild Stronger: Use your claim as an opportunity to upgrade to more resilient materials that may qualify for insurance discounts.

At Insurance Claim Recovery Support, we’ve helped countless property owners throughout Texas steer the complexities of hail damage claims. Our team of licensed public adjusters works exclusively for policyholders—never insurance companies—ensuring your interests are protected throughout the hail damage insurance process.

Whether you’re dealing with a recent hailstorm or concerned about future events, we’re here to help you understand your coverage, document damage properly, and maximize your settlement. Contact us today to learn how our expertise can make the difference in your hail damage claim.

Remember: The right approach to the hail damage insurance process not only helps you recover from the current storm but also better prepares you for whatever weather Texas throws your way next.