Why Understanding Your Homeowners Insurance Claims Adjuster Matters

A homeowners insurance claims adjuster is a professional who investigates property damage, evaluates your loss, and determines how much your insurance company should pay for your claim. When disaster strikes your home, this person becomes one of the most important figures in your recovery process.

Quick Answer: Types of Homeowners Insurance Claims Adjusters

• Company Adjusters – Work directly for your insurance company (free to you)

• Independent Adjusters – Contracted by insurers during busy periods (free to you)

• Public Adjusters – Work exclusively for you, the policyholder (typically 10-15% fee)

What They Do:

1. Inspect your property damage

2. Document losses with photos and notes

3. Calculate repair/replacement costs

4. Recommend settlement amounts to the insurer

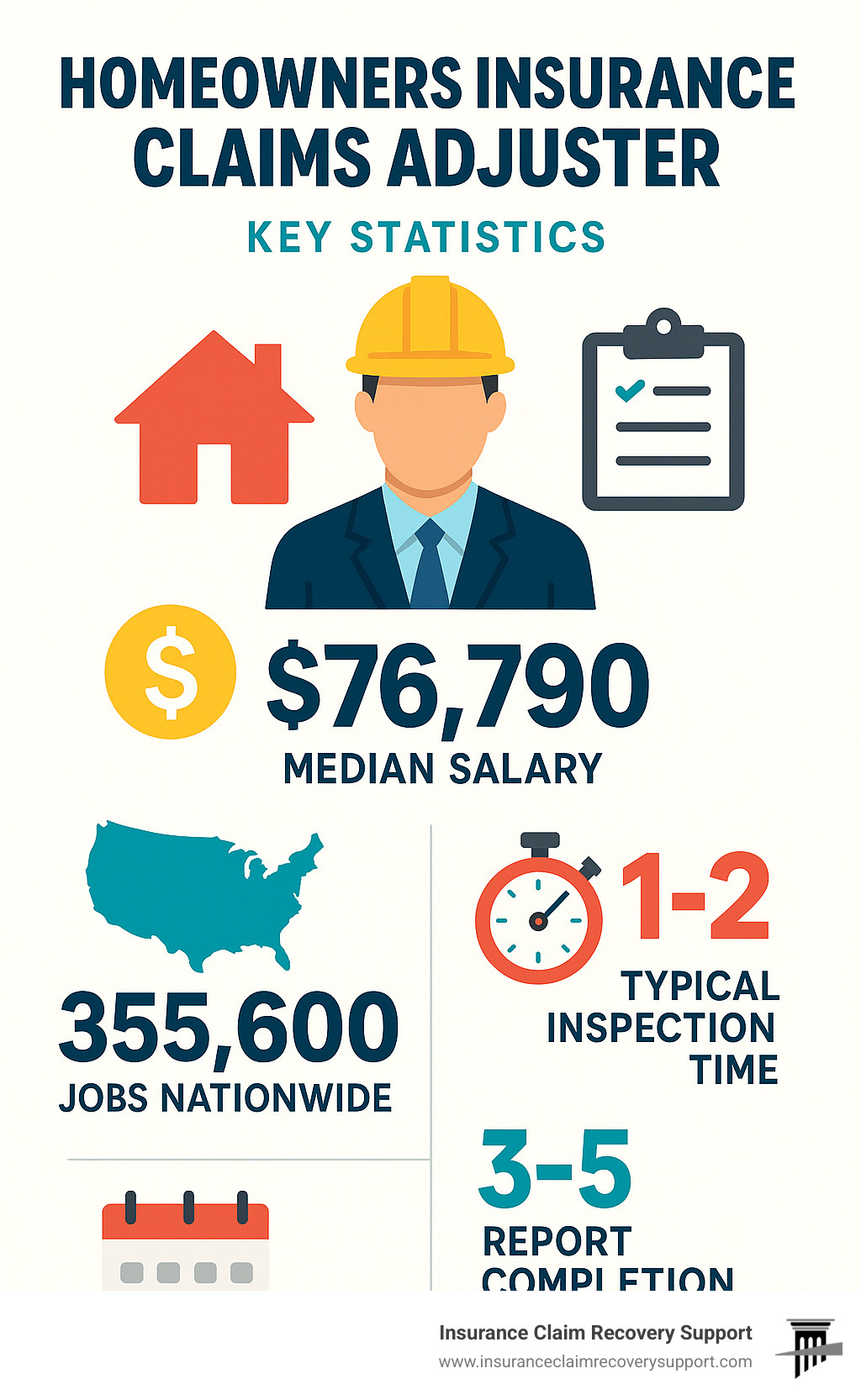

Most adjuster visits last 1-2 hours, and you can expect their report within 3-5 days. The median salary for claims adjusters is $76,790 annually, with about 355,600 professionals working in this field nationwide.

Whether you’re dealing with fire damage in Austin, hail damage in Dallas, or hurricane damage along the Texas coast, understanding how adjusters work can mean the difference between a fair settlement and leaving money on the table. Many homeowners don’t realize that company adjusters work for the insurance company – not for you.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of ICRS LLC, headquartered in Austin, Texas, where I’ve settled over $250 million in property damage claims on behalf of policyholders. Throughout my career handling 500+ large loss claims, I’ve seen how understanding the homeowners insurance claims adjuster process can help property owners secure fair settlements and avoid unnecessary disputes.

What a Homeowners Insurance Claims Adjuster Is & The Players

When your home suffers damage, a homeowners insurance claims adjuster becomes the key person who determines your financial recovery. But here’s what many homeowners don’t realize: not all adjusters work for you.

The National Association of Insurance Commissioners defines an adjuster as someone who investigates claims, inspects damage, and determines coverage. While this sounds straightforward, the reality is more complex. Who pays the adjuster matters tremendously because it shapes their priorities and loyalty.

In Texas, all adjusters must hold licenses from the Texas Department of Insurance. However, their allegiances couldn’t be more different. Company adjusters receive salaries and performance reviews that often include metrics on how quickly they close claims and how much they pay out. Independent adjusters get paid per claim by insurance companies. Public adjusters work exclusively for homeowners and earn a percentage of whatever settlement they secure.

This creates a fundamental conflict of interest that affects homeowners from Austin’s wildfire zones to Houston’s hurricane-prone areas. Company adjusters aren’t bad people – they’re simply working within a system that rewards minimizing payouts rather than maximizing your recovery.

| Adjuster Type | Works For | Payment Source | Average Fee | Typical Caseload |

|---|---|---|---|---|

| Company (Staff) | Insurance Company | Salary from insurer | $0 to homeowner | 50+ active claims |

| Independent | Insurance Company | Per-claim fee from insurer | $0 to homeowner | Varies by season |

| Public | Homeowner | % of settlement (10-15%) | 10-15% of settlement | 15-25 active claims |

Who Exactly Is a Homeowners Insurance Claims Adjuster?

A homeowners insurance claims adjuster performs crucial regulatory duties that directly impact your claim’s outcome. They conduct field inspections of your damaged property, interview you and any witnesses, and document their findings with photographs and detailed reports.

According to the Bureau of Labor Statistics, claims adjusters held about 345,200 jobs in 2023, earning a median annual wage of $76,790. However, the profession faces significant challenges – employment is projected to decline 5% from 2023 to 2033 as automation handles more routine evaluations.

The job involves reviewing policy coverage and exclusions, calculating settlement amounts using specialized software, and negotiating with contractors. Adjusters split their time between office work and field inspections, often working irregular hours during storm seasons across Texas cities like Dallas, San Antonio, and Fort Worth.

The work environment can be particularly stressful during catastrophe seasons. Adjusters frequently work away from home for weeks, handling dozens of claims simultaneously. While they’re managing their heavy caseload, you’re dealing with your single, often life-changing loss – a dynamic that can create tension and misunderstandings.

In Texas, adjusters must pass licensing exams and complete continuing education requirements. The state also maintains reciprocity agreements with other states, allowing experienced adjusters to work across state lines during major disasters.

Insurance Company vs. Independent vs. Public Adjusters

Understanding the three types of adjusters can save you thousands of dollars and weeks of frustration. Each type operates with different objectives, fee structures, and timelines that significantly impact your claim’s outcome.

Company adjusters are salaried employees who work exclusively for insurance companies. While there’s no direct cost to you, their performance reviews often emphasize claim closure speed and settlement amounts. During busy periods following storms in cities like Lubbock or Waco, a single adjuster might juggle 50 or more active claims.

Independent adjusters work as contractors hired by insurance companies, especially during catastrophe seasons. They’re paid per claim or daily rates by insurers – not by you. While they may have more specialized experience with specific damage types like hail or fire, they still represent the insurance company’s interests.

Public adjusters work exclusively for policyholders like you. Licensed professionals in this field advocate solely for homeowner interests, handling everything from initial filing to final settlement. In Texas, they typically charge 10-15% of the settlement amount, with some states like New York capping fees at 12.5%.

The difference in outcomes can be substantial. Through our work with Insurance Claim Recovery Support, we’ve seen countless cases where homeowners initially worked with company adjusters, received inadequate settlements, then hired public adjusters to reopen and renegotiate their claims. The additional recovery often amounts to tens of thousands of dollars for major losses.

Timeline impact varies significantly between adjuster types. Company adjusters may rush through inspections to meet closure targets, while public adjusters typically spend more time documenting damage and researching coverage to maximize your settlement.

Inside the Homeowners Insurance Claim Adjustment Process

When you file a homeowners insurance claim, you’re entering a structured process that can feel overwhelming – especially when you’re already dealing with property damage. The good news? The homeowners insurance claims adjuster process follows a predictable path, and knowing what to expect can help you steer it more confidently.

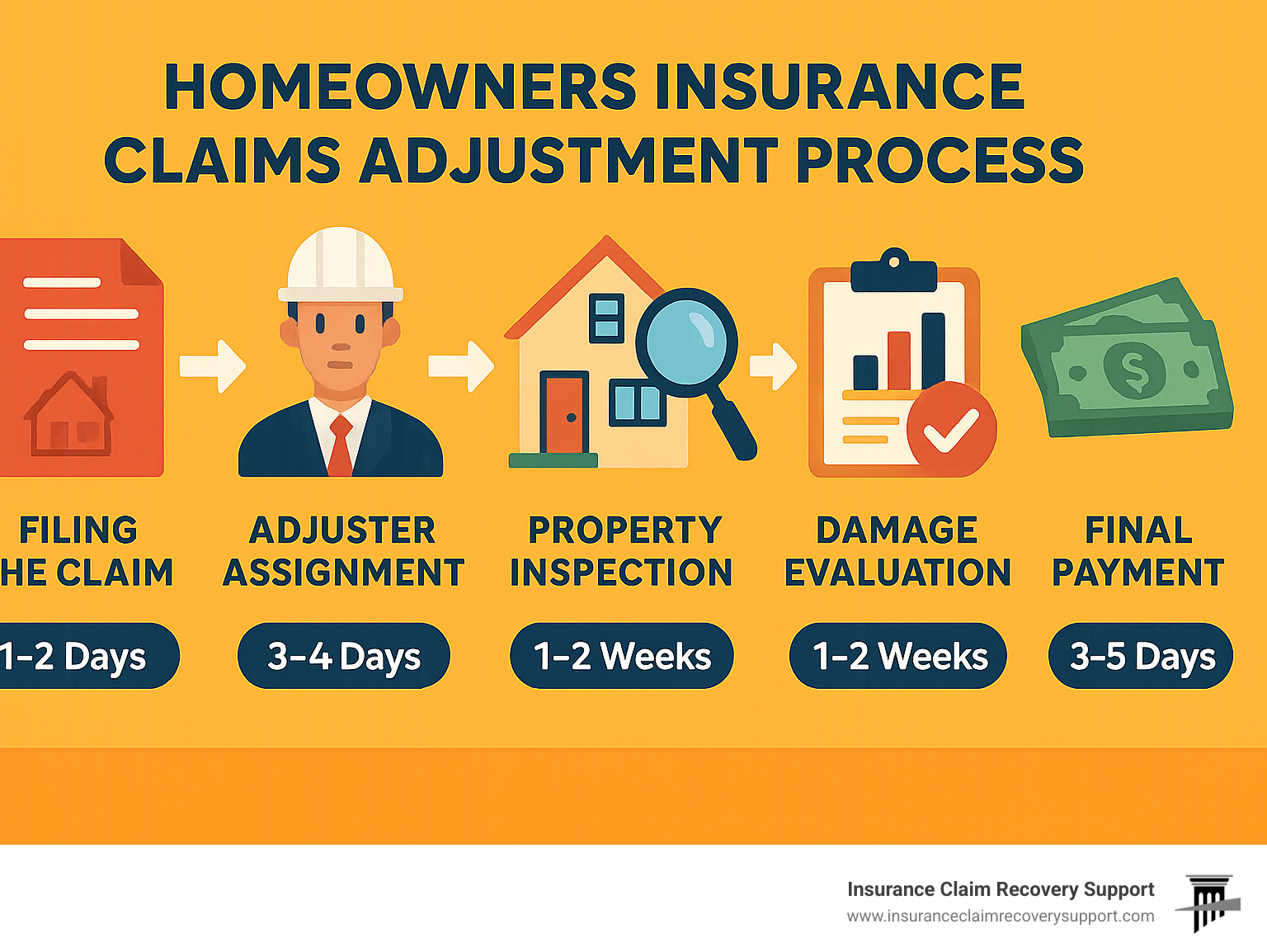

Think of it like a recipe that insurance companies follow every time. First comes the first notice of loss when you report your claim. Within hours, the insurer assigns an adjuster based on your damage type and location. If you have fire damage in Austin, they’ll likely assign someone experienced with fire claims. Hail damage in Dallas? You’ll get an adjuster familiar with storm damage patterns.

The adjuster should contact you within 24-48 hours to schedule an inspection. This isn’t just courtesy – it’s often required by state law. In Texas, prompt-payment deadlines are taken seriously, with insurers required to acknowledge claims within 15 days and begin investigation immediately.

During the inspection phase, your adjuster will spend 1-2 hours documenting everything. They’ll photograph damage, take measurements, and create detailed sketches. This documentation becomes the foundation for your settlement, so it’s crucial they capture everything accurately.

After the inspection comes the behind-the-scenes work. The adjuster reviews your policy coverage, prepares estimates using specialized software, and sets reserves – the money your insurance company puts aside for your claim. They then submit their settlement recommendation to the insurance company for approval.

For homeowners with mortgages, there’s an extra step. Mortgagee check stages mean your claim payment will likely include your mortgage company’s name, requiring their endorsement before you can access funds. This protects the lender’s investment but can slow down your repair process.

The entire journey from first call to final check typically takes 3-6 weeks for straightforward claims. Complex losses involving structural damage or multiple experts can extend this timeline significantly. Understanding this helps you know when delays become unreasonable and when you might need additional advocacy.

Key Duties of a Homeowners Insurance Claims Adjuster

Your homeowners insurance claims adjuster wears many hats during the claim process, and understanding their responsibilities helps you work with them more effectively. Their primary job is investigating your loss and recommending a settlement amount to the insurance company.

The inspection scope covers everything from obvious damage to hidden issues that might not be immediately visible. They’ll examine your roof, siding, windows, and interior spaces, looking for both primary damage and secondary effects. For example, a roof leak might cause obvious ceiling damage but also hidden mold growth or structural weakening.

Photos and sketches form the visual record of your claim. Experienced adjusters take hundreds of photos from multiple angles, capturing not just the damage but also the surrounding context. They create detailed sketches showing room dimensions, damaged areas, and repair requirements. This documentation becomes crucial if disputes arise later.

Software estimating is where things get technical. Most adjusters use programs like Xactimate to calculate repair costs, but these systems often lag behind current market prices. In rapidly growing Texas markets like Round Rock and Georgetown, we frequently see estimates that undervalue actual repair costs by 10-20%.

Fraud screening is an unfortunate reality of the process. Adjusters are trained to spot potential red flags, from inconsistent damage patterns to suspicious timing. While legitimate claims shouldn’t worry about this, understanding that it’s part of their job helps explain some of their detailed questions.

The adjuster’s reserve adjustments and settlement recommendation ultimately determine your initial offer. They balance policy coverage, damage extent, and company guidelines to arrive at a number. This is their recommendation to the insurance company – the final decision often involves multiple people.

Timeline From First Call to Final Check

Let’s walk through what actually happens during your claim, week by week. This timeline helps you understand when things are progressing normally and when you might need to speak up about delays.

Emergency mitigation happens immediately after your loss. Don’t wait for the adjuster to start protecting your property. Cover holes with tarps, extract standing water, and secure openings. Document everything with photos before and after your emergency repairs. Your insurance company expects you to prevent further damage, and these immediate actions are typically covered.

The adjuster visit usually occurs within the first week. Plan on them spending 1-2 hours at your property, though complex losses might require multiple visits. Be prepared to walk through the damage with them, explaining what happened and pointing out all affected areas. This is your chance to ensure nothing gets missed.

Within 3-5 days after the inspection, the adjuster should complete their report. This document includes their findings, photos, estimates, and settlement recommendation. Some adjusters share preliminary findings during their visit, while others prefer to complete their investigation first.

Initial payment often comes within 2-3 weeks for straightforward claims. However, don’t expect this to cover everything. Initial payments typically address obvious damage, with additional funds released as contractors find hidden issues during repairs.

Supplements are additional payments for damage or costs not included in the original estimate. Experienced contractors often find problems that weren’t visible during the initial inspection. This is normal, not a sign that your adjuster missed something important.

Claim closure happens when all repairs are complete and all payments have been made. Some claims close quickly, while others involving extensive damage or complications can remain open for months.

During busy seasons – like after major storms hit Houston or San Antonio – these timelines can stretch significantly. Patience helps, but don’t hesitate to follow up if communication stops completely. Your claim deserves attention, even during hectic periods.

Preparing for and Meeting the Adjuster

The way you prepare for your homeowners insurance claims adjuster visit can make or break your settlement outcome. I’ve seen well-prepared homeowners in Austin receive settlements that were 20-30% higher than those who winged it. The difference? They treated the adjuster meeting like the important business appointment it actually is.

Think of it this way: you wouldn’t go to a job interview without preparing, right? The same principle applies here, except the stakes might be even higher – we’re talking about your home and potentially tens of thousands of dollars.

Your preparation should start the moment you find damage. Take comprehensive photos before touching anything. Gather those receipts from your recent kitchen renovation or the new roof you installed last year. Get contractor estimates from licensed professionals who understand current market rates. In rapidly growing Texas markets like Round Rock and Georgetown, construction costs have skyrocketed, and your adjuster needs to understand these local realities.

Being present during the inspection is absolutely crucial. You know your home better than anyone. You’ll remember that the ceiling stain wasn’t there before the storm, or that the hardwood floors were pristine until the pipe burst. Your adjuster might be handling 50+ claims and won’t catch every detail unless you point it out.

Safety comes first, always. After fires in areas like San Angelo or Waco, never allow inspections until structural engineers have cleared the property. For storm damage, check for downed power lines and unstable structures. In flood-prone areas like Houston, be aware that mold can start developing within 24-48 hours – time is critical.

Review your insurance policy before the meeting. You don’t need to become an expert, but understanding your coverage limits, deductibles, and any special provisions helps you ask better questions. Know whether you have replacement cost or actual cash value coverage – it makes a huge difference in your settlement.

Documentation & Evidence Homeowners Should Provide

The quality of your documentation directly impacts your settlement amount. Period. I’ve seen homeowners lose thousands simply because they couldn’t prove what their property looked like before the damage occurred.

Pre-loss photos are gold. They establish your property’s condition before the incident. Even casual photos from social media posts or real estate listings can be valuable. If you don’t have recent photos, gather any you can find – holiday pictures, family gatherings, anything that shows your home’s condition.

Document the damage thoroughly from multiple angles. Take wide shots to show the scope, then zoom in for details. Photograph every room, even those that seem undamaged – sometimes problems appear later. For water damage claims, document not just the obvious flooding but also staining, warping, and any areas where moisture might have penetrated.

Contractor estimates provide crucial leverage. Get estimates from licensed contractors who understand current local pricing. In markets like Dallas and Fort Worth, labor shortages have driven costs up significantly. Your adjuster’s software might not reflect these realities, but a contractor’s estimate will.

Keep detailed records of everything. Receipts for recent improvements, building permits for additions, invoices for maintenance work – it all matters. These documents help establish the true value of what was damaged and can significantly impact your settlement calculation.

Create both digital and physical copies of everything. Email documentation to yourself to create timestamped records. This practice has saved our clients in disputed claims where timing became an issue. For valuable personal property, having photos and receipts makes the difference between getting replacement cost or settling for far less.

For more detailed guidance on documentation, check out these tips for filing claims that can help maximize your settlement.

Common Mistakes to Avoid During the Visit

After handling hundreds of claims across Texas, I’ve seen the same mistakes cost homeowners thousands of dollars. The good news? They’re all completely avoidable with a little awareness.

Never speculate about what caused the damage. Stick to facts you actually observed. Saying “I think the wind blew off some shingles and then the rain got in” when you didn’t actually see it happen can hurt your claim. Instead, say “I noticed water damage in the bedroom after the storm passed.”

Avoid admitting fault or making apologetic statements. Comments like “I should have cleaned those gutters” or “I knew that roof was getting old” can be used against you. Your homeowners insurance claims adjuster is documenting everything, and these statements might end up in their report.

Don’t rush through the inspection. Take your time. Point out every area of damage, even minor issues. What seems small now might indicate larger problems that develop over time. Water damage, in particular, often reveals itself gradually.

Never sign documents on the spot without reading them thoroughly. It’s perfectly acceptable to ask for time to review anything the adjuster wants you to sign. If you don’t understand something, ask for clarification or seek advice before signing.

Be cautious about recorded statements. While you’re required to cooperate with your insurer’s investigation, you have the right to understand what’s being recorded and why. Ask about the purpose and scope of any recorded conversation.

Don’t make permanent repairs before getting approval. Emergency mitigation to prevent further damage is fine – actually, it’s required. But permanent repairs should wait until the adjuster has documented everything. We’ve seen cases where homeowners repaired damage quickly, only to have the adjuster question whether it was really as extensive as claimed.

Take your own notes during the visit. Write down what the adjuster says about coverage, next steps, and timelines. Ask for copies of their photos and measurements. Request explanations for any items they’re excluding from coverage.

Adjusters are often overworked professionals juggling dozens of claims, especially after major storms hit areas like Lubbock or San Antonio. Patience and professionalism go a long way, but don’t let courtesy prevent you from advocating for your interests. Your home is likely your largest investment – treat its protection accordingly.

Settlement Calculations, Disputes & Your Options

When your homeowners insurance claims adjuster hands you that settlement offer, you might feel relieved that the process is finally moving forward. But here’s the thing – that first number isn’t necessarily your final answer. Understanding how settlements work gives you the power to evaluate whether you’re getting a fair deal or leaving money on the table.

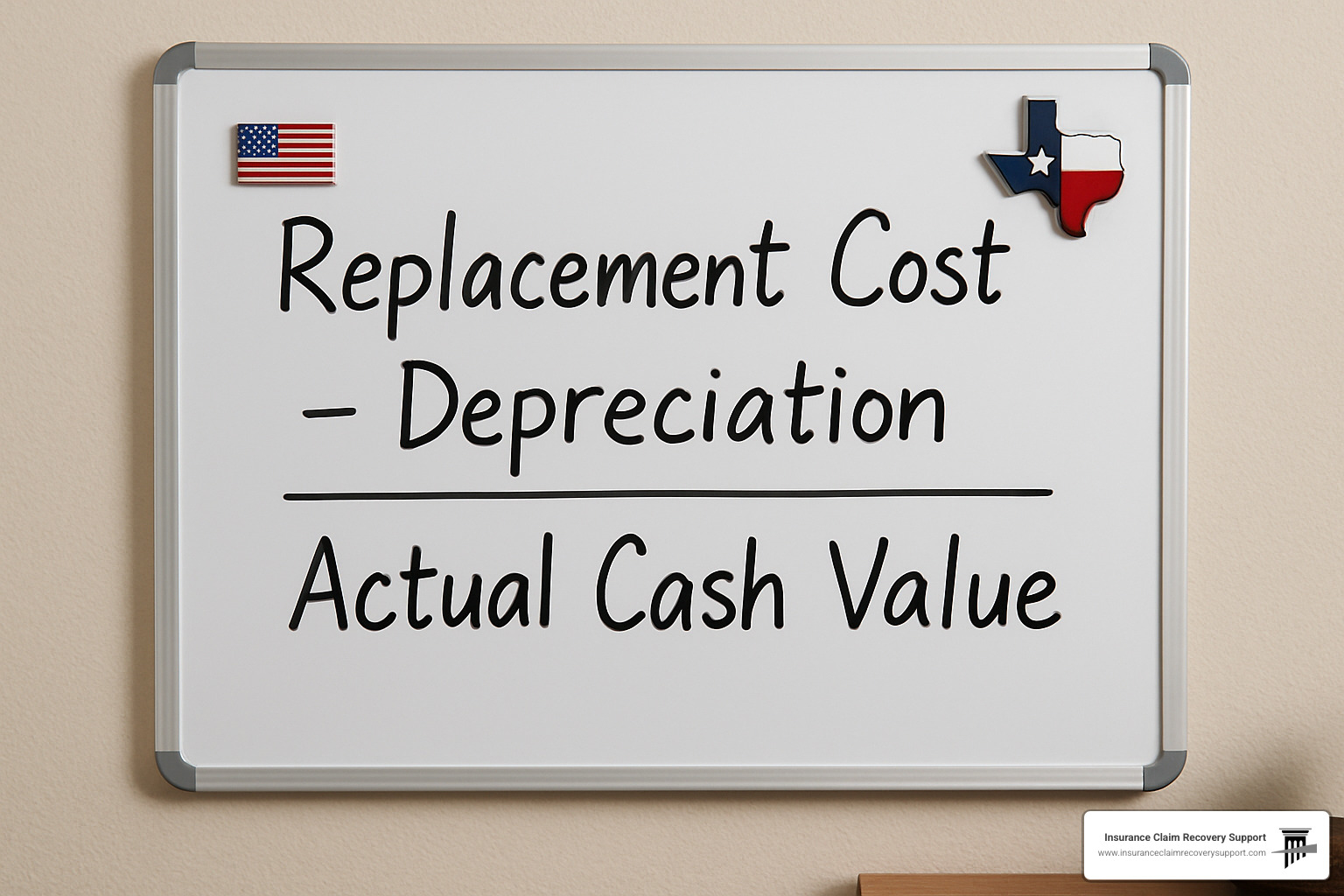

The math behind insurance settlements can feel confusing, but it boils down to a few key concepts. Replacement cost represents what it would actually cost to rebuild or repair your home with similar materials today. Actual cash value takes that replacement cost and subtracts depreciation – essentially what your damaged property was “worth” considering its age and condition.

Here’s where it gets interesting: if you have replacement cost coverage (and most homeowners do), you’re entitled to that recoverable depreciation once you complete the repairs. Many homeowners don’t realize they’re only getting partial payment upfront.

Deductibles come off the top of your settlement, and code upgrades can add significant costs when your repairs must meet current building standards. In older neighborhoods throughout Austin, Dallas, and Houston, these upgrade requirements can easily add $10,000 or more to a claim.

We’ve seen countless cases where initial settlements dramatically undervalue claims. Sometimes it’s outdated pricing in the adjuster’s software. Other times, damage gets missed during the inspection. The booming construction markets in cities like Round Rock and Georgetown often see labor costs running 15-20% above what estimating software assumes.

What Happens if You Disagree with the Adjuster?

Disagreeing with your adjuster’s assessment doesn’t mean you’re stuck with their number. You have options, and knowing them can make a substantial difference in your final settlement.

Start by requesting a written explanation of how they calculated your settlement. Ask for the detailed breakdown – you’re entitled to see their work. Get independent contractor estimates from licensed professionals who can point out damage or costs the adjuster might have missed.

If significant gaps remain, you can file supplemental claims with additional evidence. Sometimes adjusters simply miss things during their inspection. A qualified contractor walking through after the adjuster might spot structural damage that wasn’t obvious during the initial visit.

When these informal approaches don’t resolve the dispute, Texas law provides more formal options. The appraisal process built into your policy allows both sides to select neutral appraisers who can settle amount disputes. If your appraiser and the insurance company’s appraiser disagree, they choose an umpire whose decision becomes binding.

You can also file a complaint with the Texas Department of Insurance. While their decisions aren’t binding, insurance companies often reconsider settlements when state regulators get involved. The process is free and can be done online at tdi.texas.gov.

For more serious disputes involving coverage denials or bad faith, claims dispute resolution may require legal intervention. Texas law protects homeowners from insurance company overreach, but you need to know your rights.

When to Bring in a Public Adjuster or Attorney

Some situations practically demand professional help. Large losses exceeding $50,000 involve complex calculations and substantial money at stake. Fire damage claims require expertise in smoke and heat damage assessment that most homeowners simply don’t possess.

Complex damage involving multiple perils – like a storm that causes both wind and water damage – often creates coverage disputes that benefit from professional navigation. We’ve handled cases in San Antonio and Lubbock where homeowners initially received denials, only to recover substantial settlements once we got involved.

Mold claims present unique challenges involving health implications and specialized remediation costs. Business interruption coverage for home-based businesses requires detailed income calculations that adjusters often undervalue.

The math on professional representation often works in homeowners’ favor. Public adjusters in Texas typically charge 10-15% of the settlement, but we frequently recover 25-50% more than initial offers. For a claim that grows from $60,000 to $100,000, the additional $40,000 recovery easily justifies the fee.

Attorney involvement becomes necessary when insurance companies act in bad faith, create unreasonable delays, or dispute coverage inappropriately. Texas law allows attorney fee recovery in successful bad faith cases, making legal representation accessible for legitimate disputes.

Consider professional help from a public insurance adjuster when you’re dealing with denied claims you believe should be covered, settlements significantly below contractor estimates, or processing delays that stretch beyond reasonable timeframes.

The key is recognizing when you’re in over your head. Insurance companies have teams of professionals working on their side. Sometimes leveling the playing field makes all the difference in getting the settlement you deserve.

Becoming & Being an Effective Claims Adjuster

The world of claims adjusting is changing rapidly, and understanding these shifts helps homeowners work more effectively with these professionals. If you’ve ever wondered what it takes to become a homeowners insurance claims adjuster or why some adjusters seem more knowledgeable than others, the answer often lies in their background and training.

The numbers tell an interesting story. Nationwide, about 355,600 people work as claims adjusters, earning a median salary of $76,790 annually. But here’s the surprising part – the Bureau of Labor Statistics projects a 5% decline in adjuster jobs through 2033. Why? Technology is taking over routine claims, leaving human adjusters to handle the complex cases that require real expertise.

This shift actually benefits homeowners dealing with significant losses. The adjusters who remain in the field tend to be more experienced and skilled at handling complicated damage scenarios. When your Austin home suffers fire damage or your Dallas property gets hit by a severe storm, you’re more likely to work with someone who really knows their stuff.

Artificial intelligence and automated systems now handle many simple claims – like minor fender benders or small water leaks. But when it comes to assessing whether your roof damage extends beyond what’s visible, or determining if smoke damage has affected your HVAC system, you still need a human expert. This trend pushes the profession toward exactly the types of claims where homeowner advocacy matters most.

The industry sees about 21,500 annual job openings, primarily from retirements rather than growth. Many veteran adjusters who’ve handled catastrophic events across Texas – from Hurricane Harvey in Houston to the devastating wildfires near Austin – are leaving the profession. Their replacement often comes from younger adjusters who may lack experience with the specific challenges Texas weather presents.

Qualifications & Licensing Requirements

Every homeowners insurance claims adjuster working in Texas must meet specific state requirements, but the standards vary more than you might expect. The basic requirements include a high school diploma and completion of pre-licensing education, though the hours required depend on the type of adjuster license.

Texas licensing involves several steps: passing a state examination, submitting to a background check, and maintaining continuing education credits. The good news for homeowners is that Texas takes licensing seriously – your adjuster has demonstrated at least basic competency in insurance law and claim handling procedures.

Reciprocity agreements allow adjusters from other states to work in Texas during emergencies. After major storms hit areas like Houston, San Antonio, or the Panhandle around Lubbock, you might encounter adjusters from other states. While these professionals are licensed and competent, they may not understand local building codes, construction costs, or weather patterns that affect damage assessment.

Continuing education requirements ensure adjusters stay current with regulations and industry practices. In Texas, this typically means 10-24 hours of education every two years. However, the quality and relevance of this training varies significantly. Some adjusters pursue specialized certifications in areas like fire investigation, water damage assessment, or construction estimating – expertise that can make a real difference in your claim outcome.

Many experienced adjusters working in markets from Austin to Fort Worth have developed specializations over years of handling specific damage types. When your adjuster mentions their background with wind damage from Lubbock storms or experience with foundation issues common in Central Texas clay soils, that expertise can translate into more accurate damage assessment.

How Filing a Claim Affects Future Premiums

One question we hear constantly from homeowners across Texas is whether filing a claim will hurt them down the road. The honest answer is that it might, but understanding how insurance companies evaluate risk helps you make better decisions.

Claim frequency matters more than severity to most insurers. Filing three small claims over five years typically impacts your rates more than one large claim. Insurance companies view frequent claimants as higher risk, regardless of whether the claims were your fault.

The type of loss makes a difference too. Weather-related claims – common in Texas with our severe storms, tornadoes, and occasional hurricanes – generally have less impact on your rates than claims involving negligence or maintenance issues. When Georgetown gets hit by golf ball-sized hail or Round Rock experiences straight-line winds, insurers expect claims and price accordingly.

CLUE reports track your claim history for seven years through the Comprehensive Loss Underwriting Exchange. Future insurance companies access this information when you apply for coverage. Multiple claims can lead to non-renewal, coverage restrictions, or higher premiums with new insurers.

Mitigation credits offer some relief from rate increases. Texas insurers often provide discounts for impact-resistant roofing (especially valuable in hail-prone areas like Waco), storm shutters, security systems, and fire suppression systems. Newer construction typically receives better rates due to improved building codes and materials.

The strategic decision about whether to file smaller claims near your deductible amount requires careful consideration. For minor damage that costs $2,000 to repair with a $1,500 deductible, paying out of pocket might make sense to protect your claim history. But for major losses – the kind that can devastate your finances – always file claims. That’s exactly why you pay for insurance coverage in the first place.

Communication, Rights & Common Pitfalls

Navigating the insurance claims process in Texas means understanding both your rights and responsibilities as a policyholder. The good news is that Texas has strong consumer protection laws, but knowing how to use them effectively can make all the difference in your claim outcome.

Good faith obligations form the foundation of Texas insurance law. Your insurance company must investigate claims promptly and thoroughly, communicate regularly with you throughout the process, and pay valid claims without unnecessary delays. They’re also required to provide reasonable explanations if they deny your claim – not just a form letter saying “claim denied.”

Texas prompt payment laws set specific timelines that insurers must follow. They have 15 days to acknowledge your claim after you report it, must begin their investigation immediately, and need to accept or reject claims within a reasonable timeframe. Once they agree to pay, they have 60 days to cut you a check. These aren’t suggestions – they’re legal requirements.

Of course, you have responsibilities too. You must report claims promptly after damage occurs, cooperate fully with their investigation, take reasonable steps to prevent further damage, and provide any documentation they request. If they ask for an examination under oath (which happens rarely, usually in complex cases), you’re required to participate.

Insurance fraud carries serious consequences in Texas, including claim denial, policy cancellation, criminal charges, and civil penalties. It can also make it nearly impossible to get coverage elsewhere. The key is being honest and accurate – if you’re not sure about something, say so rather than guessing.

Tips for Effective Communication with a Homeowners Insurance Claims Adjuster

Building a productive relationship with your homeowners insurance claims adjuster starts with understanding their world. During busy storm seasons in Texas – think hail in Dallas or hurricanes along the coast – adjusters often juggle 50+ claims while working 12-hour days away from home. A little patience and professionalism go a long way.

Organization is your best friend. Keep all your documentation in one place, provide complete information upfront, and follow up phone conversations with email summaries. This creates a paper trail and shows you’re serious about your claim. We’ve seen countless cases where well-organized homeowners received faster, more thorough claim handling.

Ask questions to understand their process and timeline. When will they complete their report? What happens next? Who makes the final settlement decision? Good adjusters appreciate homeowners who want to understand the process rather than just complain about delays.

Document everything – dates, times, who you spoke with, and what was discussed. If an adjuster promises to call you back by Friday, note it. If they miss the deadline, you have grounds for escalation. Keep copies of every document you submit and request written explanations for any decisions you don’t understand.

When communication breaks down, follow the escalation path: start with the adjuster’s supervisor, then contact the insurance company’s customer service department, and finally file a complaint with the Texas Department of Insurance. For serious disputes, consider hiring a public adjuster who can handle communications and negotiations on your behalf.

Most Common Reasons for Delays or Denials

Claim delays often stem from circumstances beyond the adjuster’s control. Catastrophe overload hits Texas regularly – when a major storm sweeps through Austin to Houston, there simply aren’t enough adjusters to handle thousands of claims simultaneously. Complex investigations requiring engineers, contractors, or other experts naturally take longer than straightforward roof damage assessments.

Documentation issues cause unnecessary delays. Missing photos, incomplete damage lists, or failure to provide requested information can stall your claim for weeks. Coverage questions arise when damage involves multiple perils or policy interpretation disputes. Fraud concerns trigger additional investigation when circumstances seem suspicious or inconsistent.

Common denial reasons include excluded perils like floods (which require separate flood insurance), earthquakes, or other specifically excluded causes. Maintenance issues become problematic when damage results from years of neglect rather than a covered event. Policy lapses due to non-payment leave you without coverage, while late reporting can void claims filed beyond policy time limits.

Pre-existing damage is another frequent issue. If your roof was already damaged before the storm, insurers won’t pay to fix the old damage. This is why we always recommend documenting your home’s condition with photos before storm season.

Prevention strategies include reviewing your policy annually to understand what’s covered, maintaining adequate coverage limits as your home’s value increases, documenting your home’s condition regularly with photos, reporting claims immediately after finding damage, and keeping detailed maintenance records that prove you’ve properly cared for your property.

The Insurance Dispute Resolution process becomes important when standard communication fails. Understanding these common pitfalls helps you avoid them and positions you for a smoother claims experience when disaster strikes your Texas home.

Frequently Asked Questions about Home Insurance Adjusters

How long does it usually take to settle a homeowners claim?

The timeline for settling your homeowners insurance claim depends heavily on the complexity of your damage and how busy your homeowners insurance claims adjuster is during the season. Simple claims like a broken window or minor water damage often wrap up within 30-45 days. However, if you’re dealing with major storm damage in Austin or fire damage in Houston, expect the process to take 3-6 months or longer.

Damage complexity plays the biggest role in timing. A straightforward roof repair from hail damage in Dallas moves much faster than structural damage requiring engineers and multiple contractors. During Texas storm seasons – particularly after hurricanes along the coast or severe hail in the Dallas-Fort Worth area – adjusters become overwhelmed with claims, creating significant backlogs.

Your preparation makes a huge difference too. Homeowners who have organized documentation, quality photos, and contractor estimates ready often see their claims process 2-3 weeks faster than those scrambling to gather information after the adjuster’s visit.

Coverage disputes represent the biggest timeline killer. When there’s disagreement about whether damage is covered or how much should be paid, settlements can drag on for months. In Texas, prompt payment laws encourage faster processing, but insurers still get reasonable time for thorough investigations.

If your claim hits the 60-day mark without clear progress or explanation, it’s time to take action. File a complaint with the Texas Department of Insurance or consider whether you need professional help navigating the process.

Will my mortgage company be on the claim check?

Yes, if you have a mortgage, expect your lender’s name on any claim check over a certain amount – typically $1,000 to $5,000 depending on your loan agreement. This isn’t the insurance company being difficult; it’s protecting your lender’s financial interest in the property.

Here’s how the check endorsement process works: Your insurance company issues the check made out to both you and your mortgage company. You’ll sign it first, then submit the entire check to your lender. Your mortgage company reviews the scope of work, verifies you’re using licensed contractors, and ensures proper permits are obtained when required.

Most lenders release funds in stages as work progresses rather than handing over the full amount upfront. They want to see actual progress and often require lien waivers from contractors before final payment. This protects everyone involved but adds 1-2 weeks to your timeline.

Some mortgage companies offer expedited processing for smaller claims or longtime customers with good payment histories. If you’re dealing with emergency repairs after storm damage in San Antonio or fire damage in Round Rock, ask your lender about their emergency procedures – many have faster tracks for urgent situations.

Plan ahead for this extra step. The last thing you want is contractors ready to start work while you’re waiting for your mortgage company to process paperwork.

Can I reopen my claim after it’s been closed?

Absolutely, and this happens more often than you might think. Claims can be reopened when hidden damage surfaces during repairs, when the original settlement proves inadequate, or when damage was missed during the initial inspection.

Valid reasons for reopening include finding structural damage behind walls during fire restoration, finding additional storm damage when contractors remove damaged materials, or realizing the initial estimate didn’t account for current material costs in rapidly growing markets like Austin or Georgetown.

Texas law typically allows claim reopening within one year for additional damage from the same loss event. For coverage disputes or missed items, you generally have until the statute of limitations expires – usually 2-4 years depending on the specific issue.

The key to successfully reopening a claim is clear documentation showing the additional damage stems from the original loss event and wasn’t included in the initial settlement. Professional assessments from contractors or engineers significantly improve your chances of success.

We’ve seen this scenario countless times: A homeowner accepts an initial settlement, starts repairs, then finds the damage was far more extensive than anyone realized. Don’t panic if this happens to you. Insurance policies are designed to cover the full extent of covered damage, even if it’s not all apparent immediately.

Required documentation includes proof the damage relates to the original loss, evidence it wasn’t included in the initial settlement, and professional assessments supporting the additional costs. The stronger your documentation, the smoother the reopening process.

Your homeowners insurance claims adjuster may have missed damage during their initial inspection – they’re human, and some damage only becomes apparent when repairs begin. A legitimate reopened claim shouldn’t be controversial if you can clearly connect the additional damage to the original loss event.

Conclusion

Understanding how homeowners insurance claims adjusters work gives you the knowledge to steer what can be a stressful and confusing process. Company adjusters are professionals doing their job, but they work for the insurance company – not for you. This fundamental fact shapes every interaction and decision in your claim.

The claims process doesn’t have to be mysterious or intimidating. When you know what to expect from that first phone call through the final settlement check, you’re better equipped to advocate for yourself. Whether it’s preparing detailed documentation before the adjuster arrives, understanding why your mortgage company needs to endorse your check, or knowing when a settlement offer seems too low, knowledge is your best tool.

Your rights as a Texas homeowner are real and enforceable. The state’s prompt payment laws exist to protect you from unnecessary delays. The appraisal process gives you recourse when you disagree with damage assessments. And professional help is available when claims become too complex or contentious to handle alone.

We’ve seen too many homeowners accept inadequate settlements simply because they didn’t understand their options. A homeowners insurance claims adjuster might miss damage, underestimate repair costs, or apply outdated pricing – but these issues can be addressed if you know how the system works.

From storm damage in Dallas to fire losses in Austin, from hurricane impacts in Houston to hail damage in San Antonio, Texas homeowners face unique challenges. Our local markets move fast, construction costs fluctuate rapidly, and weather events can overwhelm even experienced adjusters.

The difference between a fair settlement and leaving money on the table often comes down to preparation, persistence, and knowing when to seek professional help. Don’t let the complexity of insurance policies or the pressure to settle quickly prevent you from getting what you deserve.

At Insurance Claim Recovery Support, we’ve spent years helping Texas homeowners steer these exact challenges. Our team understands the local construction markets from Austin to Lubbock, and we know how to work within the system to secure fair settlements for property damage claims.

If your claim feels overwhelming, if the settlement offer seems inadequate, or if you’re facing delays without explanation, you have options. Learn more about our public adjuster services to understand how professional representation can level the playing field and protect your interests throughout the claims process.