Navigating the Complex World of Industrial Property Claims

Industrial property claims involve the process of seeking compensation from insurance companies for damage to manufacturing facilities, warehouses, distribution centers, and other industrial buildings. Here’s what you need to know:

| Key Aspects of Industrial Property Claims | What to Know |

|---|---|

| Common Causes | Fire, hail, windstorms, equipment failure, flood |

| Timeline | Typically 30-90 days for settlement (can extend in complex cases) |

| Documentation Needed | Damage photos, inventory lists, maintenance records, financial statements |

| Initial Steps | Secure property, document damage, notify insurer within policy timeframe |

| Professional Help | Consider a public adjuster for claims exceeding $100,000 |

When disaster strikes your industrial facility, the path to recovery can feel overwhelming. Whether it’s a catastrophic fire that’s halted production, extensive hail damage to your warehouse roof, or equipment failure that’s disrupted your entire operation, industrial property claims are notably more complex than residential or simple commercial claims.

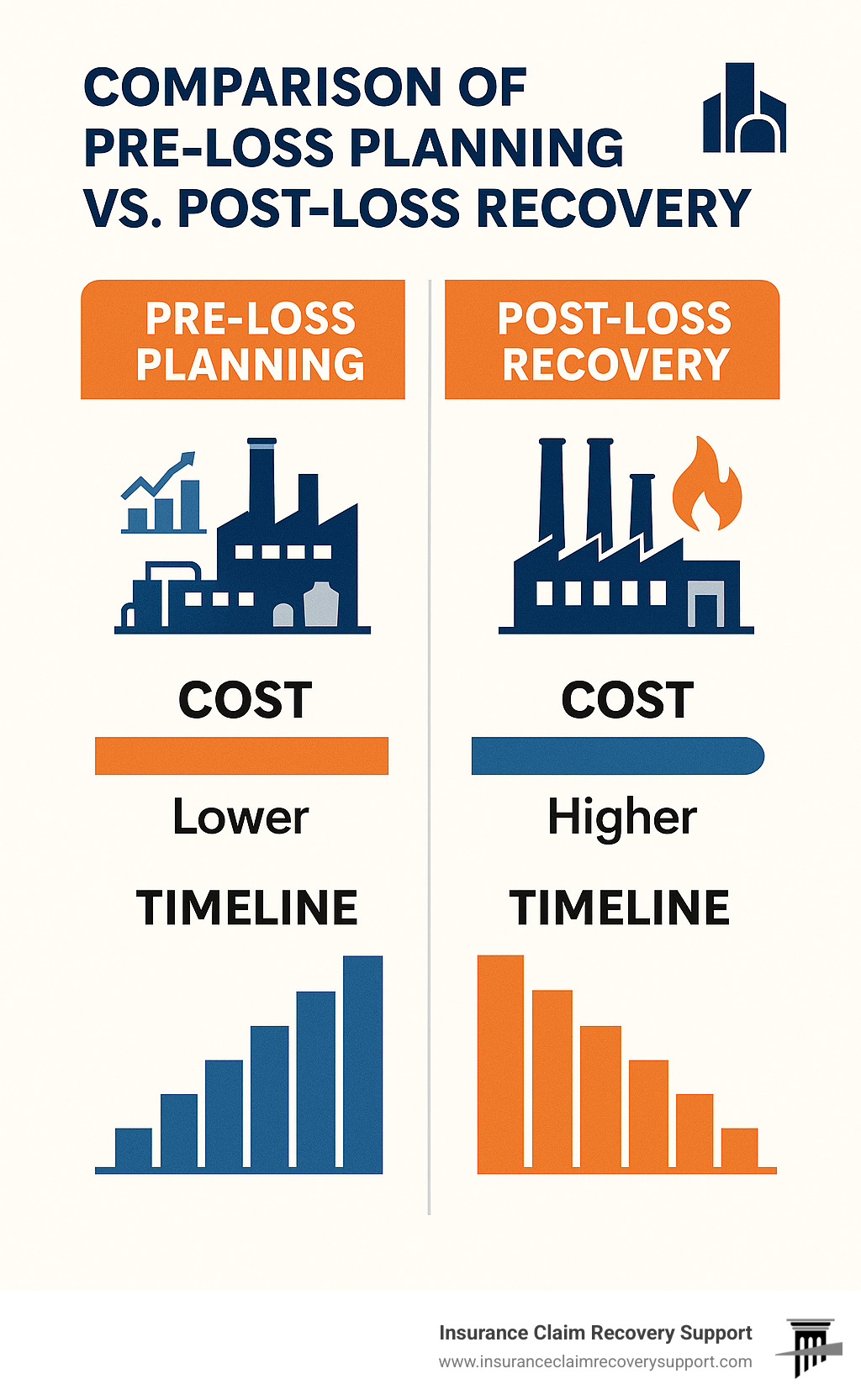

The stakes are higher with industrial facilities – not only are you dealing with valuable specialized equipment and structures, but every day of downtime means lost production and revenue. Insurance companies understand this and often deploy their most experienced adjusters to minimize payouts on these high-value claims.

Business interruption losses often exceed direct property damage in industrial claims, yet these complex calculations are frequently undervalued by insurers. According to industry data, industrial property owners file thousands of insurance claims each year due to severe weather events alone, with many claims being significantly undervalued or denied.

I’m Scott Friedson, a multi-state licensed public adjuster who has settled hundreds of millions in industrial property claims for manufacturing facilities, warehouses, and distribution centers throughout Texas and beyond. Having successfully increased claim settlements from 30% to over 3,800% and overturned wrongfully denied claims for industrial property owners, I’ve developed a streamlined approach to mastering the industrial claims process in just 30 days.

Industrial property claims vocab to learn:

– property damage insurance claims in the insurance industry

– public adjusters Austin Texas

Understanding Industrial Property Claims

When disaster strikes your manufacturing facility or warehouse, you’re not just dealing with a damaged building – you’re facing potential production shutdowns, equipment losses, and a complex insurance maze that looks nothing like a standard commercial claim.

Industrial property claims involve specialized facilities like manufacturing plants, distribution centers, warehouses, and processing facilities that have unique operational needs and equipment. These properties aren’t just bigger versions of office buildings – they’re designed with specific requirements in mind, from reinforced floors supporting multi-ton machinery to specialized electrical systems and safety features that ordinary commercial buildings simply don’t have.

“I remember walking through a damaged injection molding facility in Houston after a major storm,” says Scott Friedson, our lead adjuster. “The building itself wasn’t severely damaged, but the water that entered affected precision equipment worth millions. The insurance company wanted to treat it like a simple roof leak, but we were looking at a complete production shutdown for months.”

Key Differences Between Industrial Property Claims and Other Commercial Claims

Industrial property claims stand apart from typical commercial claims in several crucial ways that can make or break your recovery:

Machinery and equipment complexity is perhaps the biggest difference. While a retail store might worry about inventory and fixtures, your industrial facility likely contains specialized equipment that can’t be quickly replaced. When a custom manufacturing line gets damaged, you can’t just order a new one from Amazon – it might take months to rebuild or replace.

High-value assets are standard in industrial settings. A single CNC machine or industrial oven can cost more than an entire small commercial building. This means your coverage needs are different, and the stakes are much higher when these assets are damaged.

Business interruption impacts hit harder and faster. When a restaurant closes temporarily, they lose that day’s sales. When your production line stops, you might lose contracts, disappoint major clients, and face penalties for missed deadlines. The downstream effects can be devastating.

Specialized coverage requirements often include equipment breakdown insurance, contingent business interruption, and extra expense provisions that don’t typically appear in standard commercial policies.

Zoning and environmental regulations add another layer of complexity. Industrial facilities often operate under strict permits and compliance requirements that must be addressed during repairs and rebuilding.

One manufacturing client in San Antonio experienced a fire that damaged only 10% of their facility but disrupted 100% of their operations due to smoke contamination and electrical system damage. Their insurer initially offered to cover only the visible fire damage, which would have left them with a non-operational facility. After we intervened, the settlement increased by over 400% to account for all aspects of the loss.

The complexity of industrial property claims means that having an experienced advocate on your side isn’t just helpful – it’s essential for your business’s survival and recovery. An experienced public adjuster who understands the intricacies of industrial operations can be the difference between getting back to production quickly or facing months of unnecessary delays and inadequate settlements.

Common Causes of Industrial Property Damage

Let’s face it – Texas weather can be downright hostile to industrial facilities. From blistering heat to sudden floods, your manufacturing plant or warehouse faces unique challenges that residential properties simply don’t encounter. Understanding these threats isn’t just about being prepared – it’s essential for handling your claim properly when disaster strikes.

Fire and Smoke Damage

Fire remains one of the most devastating threats to industrial properties across the Lone Star State. But here’s what many facility managers find too late: the smoke often causes more financial damage than the flames themselves.

“The flames only touched our storage area, but the smoke went everywhere,” one of our Houston electronics clients told me after a fire. Their relatively small fire infiltrated their clean room with microscopic smoke particles, requiring a decontamination process that cost substantially more than repairing the actual burn damage.

Even a small fire can shut down your entire operation due to smoke contamination, electrical system damage, and safety concerns. The restoration process requires specialized knowledge that many adjusters simply don’t have.

Learn more about Fire and Smoke Damage Insurance Claims

Windstorms and Severe Weather

If you operate an industrial facility in Texas, you’re no stranger to our extreme weather. The Dallas-Fort Worth area alone sees numerous severe thunderstorms every year that can tear up roofs, force water into your building, and knock out power when you least expect it.

“A single hailstorm can cause millions of dollars in damages to industrial properties,” our Dallas claims manager often reminds clients. “We’ve worked with facilities that reported eligible capital expenditure deductions exceeding $4.8 million for repairs after severe hail events.”

These weather events don’t just damage buildings – they interrupt operations, compromise inventory, and can create cascading failures throughout your facility.

Get help with Storm Damage Insurance Claims

Flood and Water Damage

Water doesn’t play favorites, but it certainly plays dirty with industrial facilities. From Gulf Coast hurricanes pushing storm surge inland to Central Texas flash floods, water intrusion represents one of the most common threats to your operation.

Water damage goes beyond the obvious soaked inventory and equipment. It undermines foundations, corrodes electrical systems, and creates perfect conditions for mold growth – which can be particularly devastating in food processing or pharmaceutical facilities where contamination concerns can halt operations indefinitely.

Equipment Failure

When critical equipment breaks down – whether from mechanical failure, power surges, or operator error – the resulting claims can be particularly complex. These events often trigger both property damage and business interruption components.

The challenge? Insurance companies frequently try to attribute equipment failures to maintenance issues (which may not be covered) rather than covered perils. Having documentation of your maintenance schedules and professional analysis of the failure cause can make all the difference.

Hidden vs. Obvious Losses in Industrial Property Claims

The trickiest part of industrial property claims is often what you can’t see with the naked eye. While collapsed roofs and charred walls announce themselves clearly, the hidden damages can be far more costly.

When your adjuster walks through your facility, they’ll easily spot the obvious damages – the collapsed sections, visible fire damage, standing water, and broken windows. But what about the hidden damages that can cripple your operation?

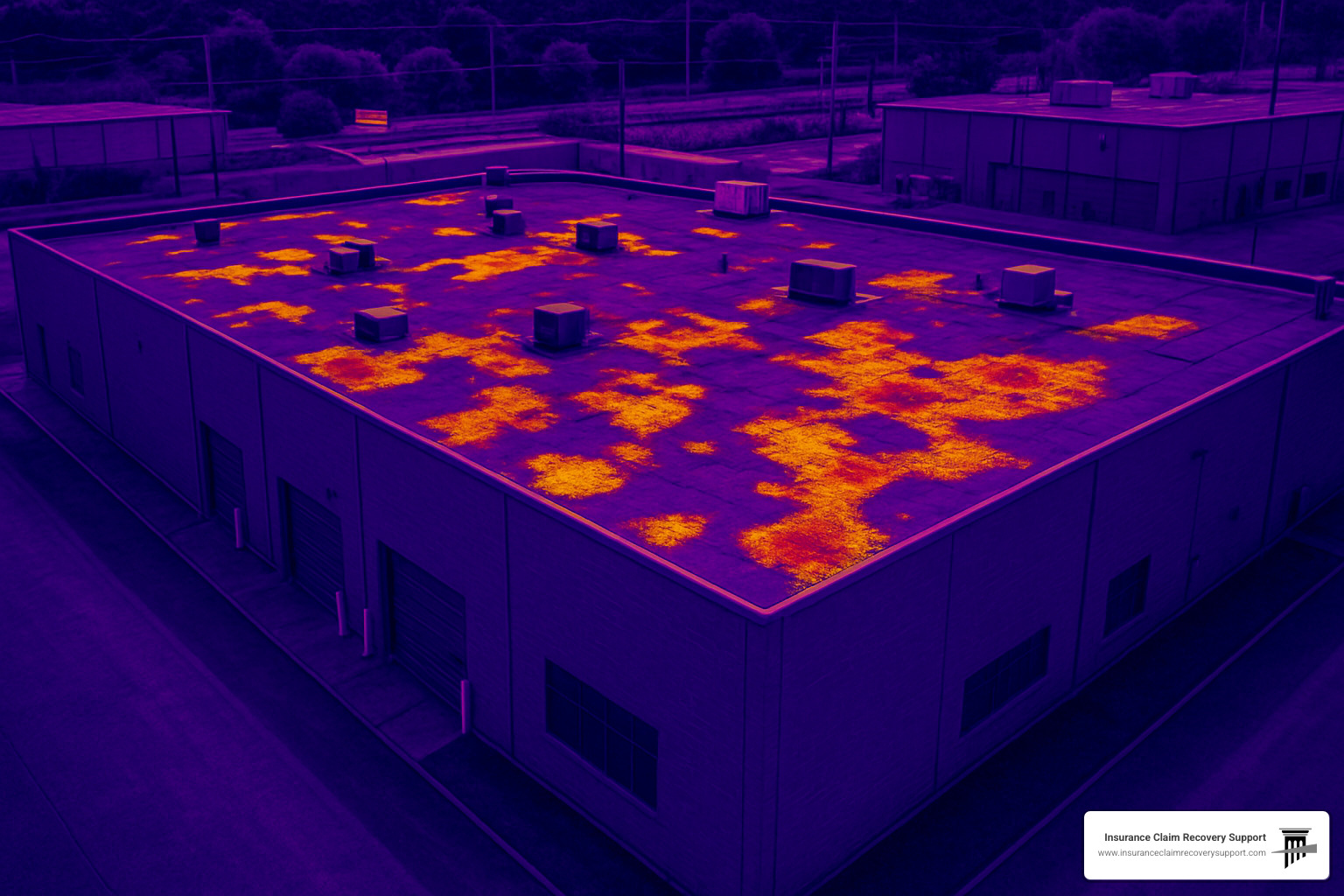

These hidden issues often include microscopic contamination in clean manufacturing areas, moisture trapped within roof systems, electrical components that look fine but are degraded, structural weakening invisible to the naked eye, and tiny fractures in precision equipment that affect calibration.

I remember visiting a Lubbock manufacturing facility after what seemed like “minor” storm damage. The insurance company’s adjuster had already been through and offered a small settlement. When we conducted infrared scanning of their roof system, we finded extensive trapped moisture that wasn’t visible during the initial inspection. This finding increased their settlement by over $2.3 million – money they would have left on the table without proper assessment.

The difference between a fair settlement and an inadequate one often comes down to finding these hidden damages before you sign any release forms. That’s why we bring specialized equipment and industrial experts to every facility inspection.

For more information about storm impacts on industrial facilities, check out the National Institute of Standards and Technology’s research on disaster resilience.

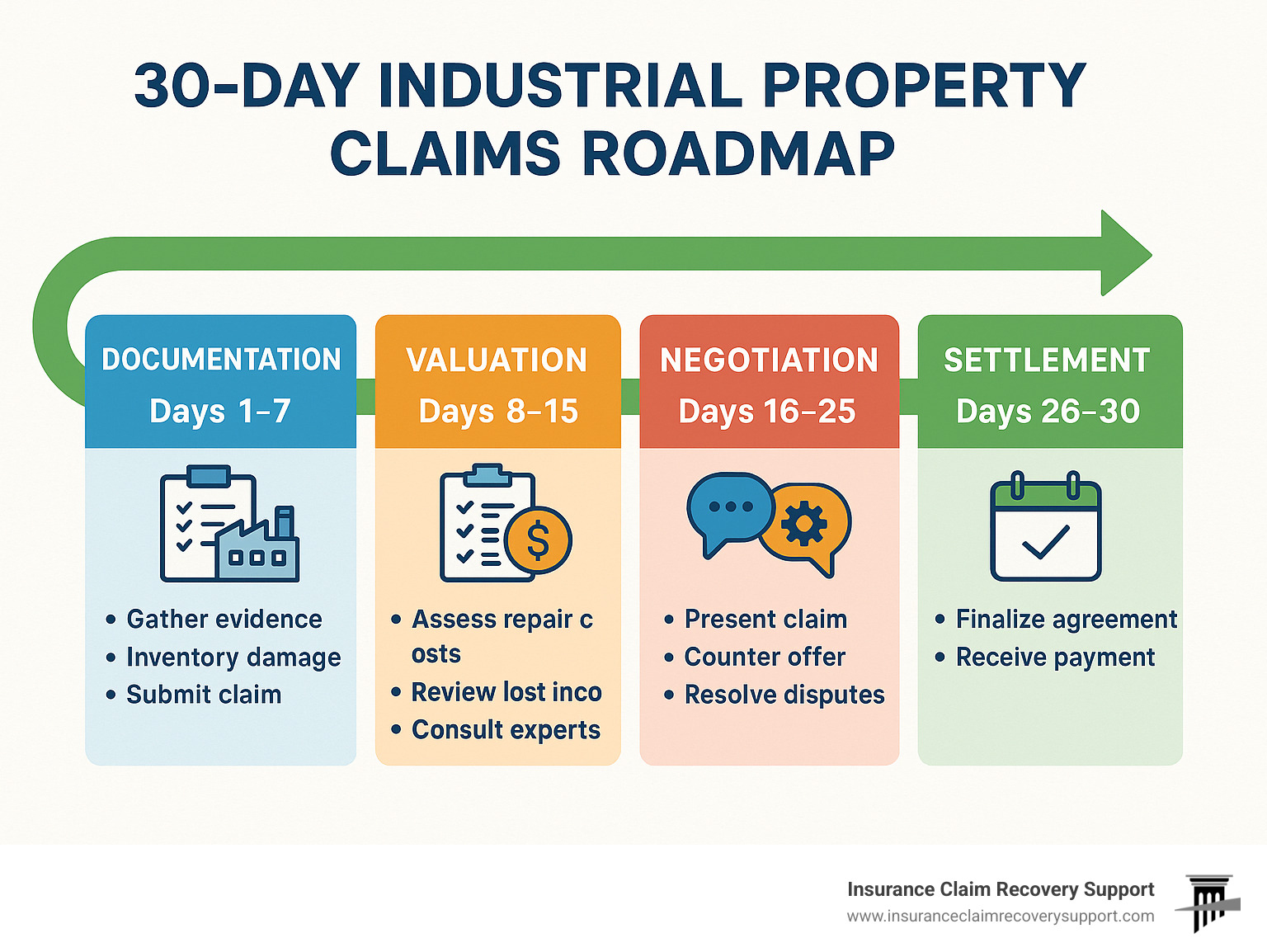

30-Day Action Plan: From Finding to Settlement

When disaster strikes your industrial facility, every minute counts. With extreme weather events becoming more common across Texas and insurers struggling with high claim volumes and staff shortages, having a clear roadmap is essential for getting the settlement you deserve.

Days 1-7: Secure, Mitigate, Notify

The first week after damage is finded is absolutely critical. What you do in these early days can make or break your claim.

Day 1: Emergency Response

Safety comes first. Make sure all employees are accounted for before addressing property concerns. Once safety is established, secure your facility against further damage and unauthorized access. Before any cleanup begins, grab your camera or phone and document everything thoroughly. Those initial photos and videos are pure gold when it comes to proving your claim later.

“I can’t stress enough how important those first photos are,” says our Austin claims manager. “During the 2021 Texas freeze, clients who thoroughly documented before cleanup received settlements averaging 40% higher than those who didn’t.”

If you’re dealing with water intrusion, fire damage, or structural concerns, contact emergency mitigation vendors immediately. Then notify your insurance broker or carrier—this officially starts your claim clock ticking.

Days 2-3: Initial Documentation

Continue building your evidence file with photos and videos from every angle. Start listing damaged equipment, inventory, and building components. Save every receipt for emergency expenses—these are typically reimbursable under your policy. If cash flow is a concern, don’t hesitate to request an emergency advance from your insurer.

Days 4-7: Assemble Your Team

When the insurance adjuster arrives, have someone take notes during this meeting. For industrial property claims exceeding $100,000 (which is most of them), consider bringing in a public adjuster who specializes in your type of facility. Begin reaching out to restoration contractors for preliminary estimates and start planning how to maintain operations during repairs.

Learn about Fire and Smoke Damage Insurance Claims

Days 8-15: Assemble Your Industrial Property Claims File

Week two is all about building a comprehensive claim package that will serve as your negotiation foundation.

During days 8-10, focus on developing detailed inventories. For industrial property claims, this means documenting every piece of damaged equipment with make, model, and serial numbers. Include original purchase documentation, replacement cost estimates, and assessments of age and condition. Don’t forget to organize building damage details by area and system.

By days 11-13, turn your attention to business impact documentation. Calculate ongoing interruption costs, document production losses, track extra expenses for temporary operations, and gather pre-loss financial statements that show what normal operations looked like.

“For a San Antonio distribution center client, our room-by-room, system-by-system inventory identified 37% more damaged items than the insurer initially found,” shares our documentation specialist. “This thorough approach added over $1.2 million to their settlement.”

Wrap up this phase on days 14-15 by bringing in specialized experts. Schedule engineering evaluations for structural concerns, arrange equipment assessments by qualified technicians, and consider environmental testing if contamination might be an issue.

Download Large Loss Claim Documentation Lists

Days 16-23: Valuation & Negotiation Prep

This is where most industrial property claims are won or lost. Understanding how your property and equipment will be valued is critical to a fair settlement.

Start days 16-18 with a valuation analysis. Review your policy to confirm whether damaged items will be valued at replacement cost (RCV) or actual cash value (ACV). Analyze depreciation schedules for equipment, identify any coinsurance requirements, and calculate business interruption values based on historical financial data.

During days 19-21, review expert reports carefully. Engineering assessments should clearly outline necessary repairs, while equipment reports should provide solid recommendations on whether to repair or replace. Compile all vendor and contractor estimates to support your valuation position.

Use days 22-23 to develop your negotiation strategy. Identify areas where the insurer is likely to push back, prepare counterarguments for valuation challenges, and organize your documentation for maximum impact.

| Insurance Company Adjuster | Public Adjuster |

|---|---|

| Works for the insurance company | Works exclusively for you, the policyholder |

| Paid by the insurer regardless of claim outcome | Paid percentage of what they recover for you |

| Focused on policy limitations and exclusions | Focused on policy coverage and maximizing your recovery |

| Handles dozens of claims simultaneously | Handles fewer claims with more personalized attention |

| Often lacks specialized industrial knowledge | Can bring in industry-specific experts as needed |

Days 24-30: Settlement, Advance Payments & Disbursement

The final week focuses on turning your preparation into actual payment.

During days 24-26, meet with the insurance adjuster to review their proposed settlement. Present your documented claim package and be prepared to negotiate specific line items where discrepancies exist. Don’t wait for the final settlement to request partial payments for undisputed portions—this can help maintain cash flow during extended negotiations.

“For a Round Rock manufacturing client, we secured a $750,000 advance payment within 30 days while negotiations continued,” explains our claims director. “This allowed them to begin critical repairs immediately while we worked toward their full $3.2 million settlement.”

On days 27-28, carefully review all settlement documents before signing. Watch for problematic release language that might waive future rights, ensure proper allocation between building, contents, and business interruption, and verify any requirements your lender might have for disbursement.

Finish on days 29-30 by either finalizing documentation for an acceptable settlement or initiating formal dispute resolution if significant differences remain. Consider appraisal or mediation options, and document any practices by the insurer that might constitute bad faith.

Learn about Texas Bad Faith claims

Documentation, Valuation & Negotiation Strategies

When it comes to industrial property claims, your success depends on three pillars: meticulous documentation, precise valuation, and strategic negotiation. Think of these as the foundation, walls, and roof of your claim’s structure – miss one, and the whole thing might collapse.

How Industrial Property Claims Are Assessed

Insurance adjusters don’t just pull numbers out of thin air when evaluating your industrial property claim. They follow specific methodologies that you need to understand if you want a fair settlement.

For your building itself, adjusters typically use one of three approaches. Replacement Cost calculates what it would take to rebuild with materials of similar quality. Actual Cash Value takes that replacement cost and subtracts depreciation based on age and condition. Some policies offer Functional Replacement Cost, which covers replacing with functionally similar but potentially less expensive materials.

When it comes to equipment and contents, the approach varies. Standard equipment might be valued at market or depreciated value, while specialized machinery often requires replacement cost calculations based on similar capacity and capabilities. Your inventory will typically be assessed at actual cash value or selling price minus expenses you haven’t yet incurred.

Business interruption calculations get even more complex. Adjusters analyze your historical financial performance, project what you would have earned during restoration, factor in ongoing expenses, and consider extra costs for temporary operations.

I recently worked with a metal fabrication facility in Georgetown that highlights the importance of understanding these valuation methods. Their specialized equipment suffered extensive storm damage, and the insurer initially offered just 30% of replacement cost, citing the equipment’s age. By providing detailed maintenance records, operational capacity documentation, and replacement cost research, we increased their equipment settlement by over 200%.

Commercial Property Public Insurance Adjusters

Evidence That Wins Industrial Property Claims

The strength of your evidence directly impacts your settlement amount. Think of your claim as a court case – the side with the most compelling evidence usually wins.

High-quality visual documentation forms the cornerstone of winning claims. 4K video walkthroughs with narration provide context that still photos can’t capture. Drone footage offers perspectives adjusters can’t safely access. Thermal imaging can reveal hidden moisture or heat anomalies that might otherwise go undetected until they cause major problems.

Expert assessments carry tremendous weight in negotiations. Structural engineering reports from qualified professionals are difficult for insurers to dismiss. Equipment manufacturer evaluations provide authoritative opinions on repair versus replacement decisions. Environmental testing results can document contamination that might not be visible to the naked eye.

Financial documentation proves the monetary impact of your loss. Certified financial statements establish your baseline performance. Production records demonstrate your facility’s capabilities before the damage. Sales forecasts compared against actual losses quantify your business interruption claim.

Maintenance records often become the deciding factor in disputed claims. Proof of regular maintenance counters arguments about pre-existing conditions. Recent inspections or upgrades demonstrate your commitment to property preservation. Service contracts show you were properly caring for specialized equipment.

“One of our Waco clients faced a complete claim denial until we deployed drone footage with thermal imaging,” shares our technical documentation specialist. “The aerial perspective revealed extensive roof damage invisible from ground level, completely reversing the insurer’s position and resulting in a $1.7 million settlement.”

The difference between a denied claim and a seven-figure settlement often comes down to the quality of your evidence. When insurers know you’re armed with irrefutable documentation, they’re far more likely to offer fair value from the start.

Business Interruption & Depreciation Tactics

When disaster strikes your industrial facility, the visible damage is just the beginning. The financial impact of downtime and depreciation considerations can often eclipse the physical repair costs. Yet these critical aspects of industrial property claims are frequently undervalued by insurance companies.

Maximizing Business Interruption in Industrial Property Claims

“The machine isn’t just broken—it’s costing us $30,000 every day it sits idle.”

This was how one of our Dallas manufacturing clients described their situation after a major equipment failure. Business interruption losses represent the financial heartbeat of your industrial claim, yet they’re often the most challenging to document and recover.

Industrial property claims involving business interruption require a deep dive into your operation’s financial health. Your pre-loss performance creates the baseline for calculating what you’ve lost. We’ve seen countless cases where insurers use simplified formulas that dramatically undervalue these losses.

For example, a Houston chemical processing facility experienced a devastating fire that halted production for three months. The insurer initially calculated their business interruption at $1.2 million. After our detailed analysis of seasonal trends, contracted sales, and production forecasts, we increased their settlement to $4.7 million—nearly four times the original offer!

When calculating business interruption, don’t overlook lost profits based on historical performance and growth trends. Remember to document continuing expenses like essential employee payroll and mortgage payments that don’t stop just because production has. Extra expenses for temporary operations—like expedited shipping or overtime pay—also deserve compensation. Many policies include an extended period of indemnity that covers the ramp-up time needed to return to pre-loss revenue levels.

“Most industrial operators don’t realize their policy covers the slow return to normal after repairs are complete,” explains our business interruption specialist. “That recovery period can add 30-60% to your claim value.”

Depreciation & Tax Deduction Opportunities

When disaster forces you to replace equipment or rebuild structures, a silver lining emerges in the form of potential tax advantages. Understanding depreciation is crucial both for maximizing your insurance recovery and optimizing your tax position.

“We’re not just rebuilding—we’re resetting the depreciation clock,” is how our Lakeway manufacturing client described their perspective after working with us. We coordinated with their tax advisors to implement a cost segregation study alongside their insurance claim. This approach not only maximized their insurance recovery but also created tax benefits exceeding $230,000 in the first year after rebuilding.

Industrial property claims intersect with several key tax considerations. For capital works (building structures), commercial properties typically depreciate over 39 years, but qualified improvements may be eligible for accelerated depreciation. Your plant & equipment follows different depreciation schedules based on asset class, with potential for bonus depreciation in the replacement year.

The tax advantages after a loss can be substantial. Casualty loss deductions, involuntary conversion provisions, and cost segregation studies can all work in your favor. Our tax specialist notes, “Depreciation schedules for industrial properties can enable owners to claim millions in deductions over the facility’s lifetime. We’ve seen first-year claims sometimes exceeding $19,600 for a single facility after proper cost segregation analysis.”

This intersection of insurance recovery and tax planning represents a tremendous opportunity that most industrial property owners never fully realize. While your insurer focuses narrowly on the claim, we take a holistic approach that considers both your immediate recovery needs and long-term financial position.

By approaching your industrial property claim with both insurance recovery and tax strategy in mind, you transform a disaster into an opportunity for financial optimization that can benefit your operation for years to come.

For more detailed information on cost segregation studies and their tax implications, review the IRS guidelines on cost segregation.

Risk Mitigation & Future-Proofing Your Facility

After experiencing an industrial property claim, you’ve got the perfect opportunity to implement smart risk mitigation strategies. Not only can these reduce the likelihood of future claims, but they might also lower your insurance premiums – a win-win situation for your facility.

I’ve seen how proper planning can dramatically reduce both damage severity and recovery time. Think of risk mitigation as an investment rather than an expense – one that typically pays substantial dividends when the next disaster strikes.

Let’s talk about what works. Structural improvements like impact-resistant roofing systems can withstand severe weather that would destroy standard materials. A client in Dallas invested $175,000 in roof upgrades after a claim and ended up preventing an estimated $1.2 million in damage during a hailstorm the following year. That’s quite a return on investment!

Fire protection upgrades are another critical area where small investments make big differences. Custom sprinkler systems designed specifically for your facility’s unique hazards provide dramatically better protection than one-size-fits-all solutions. Early detection systems can alert you to problems before they become catastrophes, and proper compartmentalization limits fire spread.

Don’t overlook equipment protection measures. Surge protection systems, backup power generators, and redundant critical systems might seem expensive until you calculate the cost of a total production shutdown. One Austin manufacturer told me their $30,000 investment in backup power systems saved them over $400,000 in potential losses during a recent outage.

Finally, operational safeguards like updated emergency response plans and regular staff training cost very little but pay enormous dividends when disaster strikes. Having vendor agreements in place for emergency response means you’re not scrambling to find help when everyone else is too.

Post-Claim Improvements That Lower Premiums

Insurance companies notice when you take risk seriously, and they’ll often reward these efforts with better rates and coverage terms.

Improved monitoring systems represent some of the best premium-reducing investments you can make. Water leak detection systems with automatic shutoffs can prevent catastrophic water damage from a simple pipe break. Temperature monitoring in critical areas gives early warning of potential problems, and remote security monitoring deters theft and vandalism while providing valuable documentation if incidents do occur.

Redundancy planning is another area where insurers take notice. A San Antonio client implemented backup data systems and alternative production capabilities that not only reduced their premium by 17% but also allowed them to maintain partial operations during a recent claim event – keeping key customers happy and preventing permanent business loss.

Documentation systems might not prevent physical damage, but they absolutely improve claim outcomes. Digital inventory management, automated maintenance records, and regular property valuation updates ensure you can prove what you had and its condition when disaster strikes.

A client in San Angelo followed our recommended improvements after a significant claim, installing a comprehensive water detection system and reinforced roofing. The result? A remarkable 23% reduction in their annual premium alongside substantially better protection.

Smart mitigation isn’t just about preventing the next disaster – it’s about being ready when it happens. As we like to say, “An ounce of prevention is worth a pound of claim settlement.”

When you’re ready to disaster-proof your facility, our team can help identify the highest-impact improvements for your specific operation. We’ve seen what works across hundreds of industrial property claims throughout Texas, from Houston’s hurricane zones to Dallas’s hail alley and San Antonio’s flash flood areas.

Frequently Asked Questions about Industrial Property Claims

What documentation is mandatory for an industrial claim?

When it comes to industrial property claims, documentation is your best friend. Think of it as building your case – the more evidence you have, the stronger your position.

The essential paperwork falls into several categories. First, you’ll need your initial notification materials – this includes your proof of loss forms, any incident reports you’ve filed, and official reports from police or fire departments if they were involved. These establish the basic facts of what happened.

Next comes the property documentation, which is really the heart of your claim. This means detailed inventories of everything damaged, plenty of photos and videos (the clearer the better), estimates for repairs or replacements, and original purchase records when you can find them.

“The most successful claims we’ve handled for industrial facilities in Austin, San Antonio, and across Texas have one thing in common: exceptional documentation,” notes our claims director. “It’s impossible to over-document a claim.”

For business interruption aspects, you’ll need to gather financial statements (typically from the past 2-3 years), your production records, sales forecasts, contracts, and payroll information. These help establish what you’ve lost beyond just physical damage.

Don’t forget to include maintenance records, inspection reports, expert assessments, and receipts for any emergency expenses you’ve incurred. These additional documents help paint the complete picture of your facility’s condition before and after the incident.

How long does an insurer have to pay once liability is accepted?

In Texas, the insurance claim timeline is actually governed by specific regulations. Once your insurer receives your claim, they must acknowledge it within 15 days. After they have all the necessary documentation, they have another 15 days to accept or reject the claim. If accepted, payment should follow within 5 business days.

That said, reality often looks different for complex industrial property claims. During major disasters, the Texas Department of Insurance may grant extensions to these deadlines, recognizing the overwhelming volume of claims being processed.

For larger industrial claims, you’ll typically receive your settlement in stages rather than one lump sum:

– Emergency advances to begin immediate repairs

– Partial payments as certain aspects of your claim are approved

– Final settlement once all components are resolved

“For our clients in Houston and Dallas-Fort Worth, we’ve secured initial advance payments within days of a loss, even while the full claim investigation was ongoing,” shares our claims expeditor. “These advances are crucial for beginning emergency repairs and maintaining business continuity.”

The key is staying on top of these timelines and knowing when to push back if your insurer is dragging their feet without explanation.

When should I hire a public adjuster or attorney?

Knowing when to bring in professional help for your industrial property claim can make all the difference in your settlement outcome. While you can certainly handle smaller claims yourself, consider reaching out to a public adjuster when the stakes get higher.

If your damage exceeds $100,000, that’s usually a good indicator that professional help would be valuable. The same goes for claims involving complex components like business interruption calculations or specialized industrial equipment that’s difficult to value.

Have you received a surprisingly low offer or an outright denial from your insurer? That’s another red flag that suggests expert assistance might be needed. Many of our clients come to us after being shocked by an initial settlement offer that wouldn’t begin to cover their actual losses.

Time and expertise are also important factors. Managing an industrial claim properly can feel like a full-time job – at exactly the moment when you’re already dealing with the stress of getting your business back up and running.

“The timing of hiring a public adjuster is critical,” advises our founder. “The earlier we get involved, the more we can do to properly document, present, and negotiate your claim. We’ve seen the most dramatic improvements in settlements when we’re engaged within the first week after a loss.”

At Insurance Claim Recovery Support, we work on a contingency fee basis, which means we only get paid when you receive a settlement. Our fee comes as a percentage of what we recover for you – so our interests are perfectly aligned with yours: maximizing your settlement.

Conclusion

Navigating industrial property claims is a bit like steering a ship through stormy waters—you need the right tools, expertise, and a steady hand at the helm. For industrial property owners across the Lone Star State, from the tech corridors of Austin to the energy hubs of Houston, the manufacturing centers of Dallas-Fort Worth to the distribution facilities of San Antonio, these claims represent far more than just paperwork—they’re the lifeline to recovery for your business.

After helping industrial property owners recover hundreds of millions in settlements that were initially undervalued or flatly denied, we’ve seen how the right approach can mean the difference between barely surviving and fully thriving after a loss. Our team at Insurance Claim Recovery Support understands the unique challenges industrial facilities face, where every day of downtime translates to significant revenue loss and potential customer relationships damaged.

The 30-day roadmap we’ve outlined isn’t just theory—it’s battle-tested strategy that has helped warehouse operators in Waco, manufacturers in Lubbock, and distribution centers in Round Rock get back to business faster while maximizing their insurance recovery.

Remember these five critical keys to success with your industrial property claim:

Document everything thoroughly from day one—those initial photos and videos before cleanup begins are worth their weight in gold when negotiating your settlement. Understand your full coverage, especially the often-misunderstood business interruption provisions that can mean the difference between financial stability and hardship. Never overlook hidden damages—what you can’t see often costs more than what you can. Prepare comprehensive valuation support that accounts for the true replacement cost of specialized equipment and systems. And perhaps most importantly, consider professional representation for claims exceeding $100,000—the return on investment is typically substantial.

Whether your Georgetown manufacturing facility suffered fire damage, your Lakeway warehouse experienced water intrusion, or your San Angelo distribution center sustained storm damage, don’t steer these complex waters alone. The insurance company has professionals working to minimize their payout—shouldn’t you have an expert in your corner too?

Don’t settle for less than what your policy promises. Your business deserves to recover fully, and our team of public adjusters is ready to help make that happen. Reach out for a free, no-obligation claim review—it might be the most valuable 30 minutes you invest in your recovery process.