Navigating the Tornado Aftermath: Insurance Claim Challenges

When a tornado tears through your community, the devastation can be overwhelming. But for many property owners, the real struggle begins when they face tornado damage claim problems with their insurance company.

Each year, approximately 1,200 tornadoes rip across the United States, causing around $10 billion in property damage. These powerful storms leave behind not just physical destruction, but also a maze of insurance challenges that can feel just as devastating as the tornado itself.

| Common Tornado Claim Problems | Quick Solutions |

|---|---|

| Denied claims due to “pre-existing damage” | Document with before/after photos and professional inspections |

| Wind vs. flood damage disputes | Prove water entered through wind-damaged structures |

| Inadequate settlement offers | Get independent repair estimates from licensed contractors |

| Delayed claim processing | Maintain weekly contact with your adjuster and document all communications |

| Coverage exclusions | Review policy for anti-concurrent causation clauses and windstorm deductibles |

I’ve seen how tornado damage claim problems can turn a natural disaster into a financial nightmare. Property owners are often shocked when their claims are denied or significantly underpaid due to policy exclusions they didn’t know existed, documentation gaps, or disagreements about what caused the damage.

The unique nature of tornado damage creates specific challenges. Unlike some disasters, tornadoes often cause multiple types of damage simultaneously – wind tears off roofing, rain pours in, structures become compromised, and businesses can’t operate. When your adjuster starts picking apart which damage was caused by what peril, things get complicated fast.

Commercial properties face particular vulnerability in tornado-prone regions. Many people don’t realize that building codes typically only require warehouse-style retail stores to withstand winds of about 90 mph. When a tornado with 200+ mph winds hits, catastrophic failure is almost inevitable – leading to complicated insurance battles over whether the building met code requirements.

As a multi-state licensed public adjuster who has settled over 500 large-loss claims worth more than $250 million, I’ve helped countless property owners overcome tornado damage claim problems throughout Texas and beyond. From Austin to Dallas, Houston to San Antonio, the challenges are similar – but solutions exist when you understand your policy and properly document your damage.

The anti-concurrent causation clause is one policy provision that frequently creates headaches. This clause allows insurance companies to deny coverage if an excluded peril (like flooding) contributes to the damage, even if a covered peril (wind) was the primary cause. Understanding these nuances before disaster strikes can make all the difference in your claim outcome.

Documentation becomes your most powerful tool when fighting tornado damage claim problems. Before-and-after photos, detailed inventories, professional inspections, and proper maintenance records can mean the difference between a denied claim and a fair settlement. Scientific research from the Insurance Information Institute confirms that well-documented claims are settled faster and more favorably.

When you’re picking up the pieces after a tornado, the last thing you need is a battle with your insurance company. But with proper knowledge and assistance, you can overcome these challenges and rebuild what matters most.

Understanding Tornado Insurance Coverage

When a tornado tears through your property, your insurance policy becomes your financial lifeline. Most standard homeowners and commercial policies do cover tornado damage as a windstorm peril, but the devil is in the details – and those details can make or break your recovery.

“Does insurance cover tornado damage? The short answer is yes, most homeowners insurance policies do cover tornado damage, but the specifics can vary greatly depending on your policy’s terms and conditions,” explains our team at Insurance Claim Recovery Support.

Residential Coverage Basics

If you’re a homeowner in Round Rock or Georgetown where tornadoes have left devastating paths in recent years, your policy typically includes three critical protections:

Your dwelling coverage shields the actual structure of your home from wind damage. Your personal property coverage takes care of your belongings that get damaged or destroyed. And if your home becomes uninhabitable, Loss of Use/Additional Living Expenses (ALE) coverage helps pay for temporary housing while repairs are underway.

But here’s where many homeowners get caught off guard – the windstorm deductible. Unlike your standard deductible with a fixed dollar amount, windstorm deductibles are typically calculated as a percentage of your home’s insured value. Imagine you’ve insured your home for $300,000 with a 2% windstorm deductible. That means you’ll need to pay $6,000 out-of-pocket before your insurance kicks in – a significant sum when you’re already dealing with disaster.

Another crucial distinction that can dramatically affect your recovery is whether you have Actual Cash Value (ACV) or Replacement Cost Value (RCV) coverage:

| Coverage Type | Definition | Example |

|---|---|---|

| Actual Cash Value | Original cost minus depreciation | A 5-year-old $1,500 laptop might be valued at only $400 |

| Replacement Cost Value | Cost to replace with new equivalent item | Full $1,500 for a new equivalent laptop |

If you live in the tornado-prone Austin to Dallas corridor, you’ll want to verify whether your policy includes coverage for wind-driven rain. Many homeowners face tornado damage claim problems when water intrudes through tornado-damaged roofs or windows, only to find this damage isn’t fully covered.

Commercial Policy Nuances

For business owners in San Antonio, Lubbock, and other Texas commercial centers, tornado coverage becomes even more complex:

Your building structure coverage typically includes specialized components like HVAC systems that residential policies might not address. Business personal property coverage protects your inventory, equipment, and furnishings, while business interruption insurance helps replace income lost during repairs – often the difference between reopening or closing permanently after a disaster.

Many commercial properties also benefit from code upgrade coverage, which pays for bringing repairs up to current building codes – a significant expense that standard policies might exclude.

Commercial buildings face unique vulnerability to tornadoes. Most big-box retail stores and warehouses are only built to withstand winds around 90 mph, while tornadoes can exceed 200 mph. Their large, flat roofs essentially act like sails in high winds, often leading to catastrophic failures.

Be prepared for higher deductibles too. Commercial policies typically have percentage-based deductibles that can reach 5% of the building’s insured value. For a $2 million commercial property, that’s a $100,000 deductible before coverage begins – a sobering reality when facing tornado damage claim problems.

Tornado Damage Claim Problems: Pitfalls & Fixes

The period following a tornado is chaotic and stressful. Understanding the most common tornado damage claim problems can help you avoid pitfalls that could cost you thousands.

Common Tornado Damage Claim Problems Homeowners Face

- Wind vs. Flood Disputes

One of the most prevalent tornado damage claim problems involves insurers attributing water damage to flooding (typically excluded) rather than wind damage (typically covered).

“When two disasters occur simultaneously and the homeowner is only covered for one, the insurer will not cover any of the damages,” warns our claims team, referring to anti-concurrent causation clauses that appear in many policies.

Solution: Document evidence showing water entered through wind-damaged openings in the roof, windows, or walls. Photos of water stains on ceilings and walls can help establish the water’s path from above (wind damage) rather than below (flooding).

- Pre-existing Damage Claims

Insurers frequently deny claims by attributing damage to pre-existing conditions or poor maintenance rather than the tornado.

Solution: Maintain regular home maintenance records and, if possible, have recent photos or inspection reports from before the tornado. This documentation can disprove allegations of pre-existing damage.

- Fallen Tree Disputes

When trees fall during a tornado, insurers may attempt to deny coverage by claiming the tree was unhealthy or improperly maintained.

Solution: Document the condition of trees on your property with regular photos. After a tornado, photograph the fallen tree from multiple angles, showing how the wind uprooted or snapped even healthy specimens.

- Matching Issues

When replacing damaged siding, roofing, or other materials, insurers often only pay to replace the damaged sections, leading to mismatched appearances that reduce property value.

Solution: Invoke the “Loss to a Pair or Set” clause present in many policies, which can provide coverage for matching undamaged materials to maintain your home’s appearance and value.

Tornado Damage Claim Problems for Commercial Properties

Commercial property owners face additional challenges when dealing with tornado damage claim problems:

- Big-Box Roof Collapse

Large commercial buildings with flat roofs are particularly vulnerable to wind uplift and collapse during tornadoes.

Solution: Document all structural damage thoroughly and hire a structural engineer to provide an independent assessment of the damage and necessary repairs.

- Business Income Loss Calculations

Quantifying business interruption losses is complex and often disputed by insurers.

Solution: Work with a forensic accountant to properly document lost income, continuing expenses, and extra expenses incurred due to the tornado.

- Supply Chain and Material Cost Spikes

Following major tornado events, construction material costs often surge due to high demand, but insurers may base settlements on pre-disaster prices.

Solution: Obtain multiple contractor estimates reflecting current market conditions and material availability in your area.

- Multiple Peril Confusion

Commercial tornado claims often involve multiple perils (wind, water, fire from electrical damage), and insurers may attempt to classify damage under less favorable coverage terms.

Solution: Have experts document the precise cause of each type of damage to ensure proper coverage application.

Post-Tornado Action Plan & Documentation

What you do in the hours and days after a tornado strikes can make or break your insurance claim. Let’s walk through the essential steps to protect both your property and your financial recovery.

Building a Bulletproof Claim File

When facing tornado damage claim problems, documentation becomes your most powerful ally. Think of your claim file as telling the complete story of your loss—with you as the author.

First and foremost, prioritize safety. Never enter structures that appear unstable or damaged until emergency officials have declared them safe. Your life is worth more than any property.

Once safety is established, you have a duty to mitigate further damage. Insurance policies actually require this—and may deny coverage for additional damage if you don’t take reasonable protective measures. This means covering broken windows with plywood, placing tarps over roof openings, or removing fallen trees from structures when safe to do so.

“Many policyholders don’t realize they have a contractual obligation to prevent additional damage,” our claims team often explains. “Your insurer expects you to act reasonably to protect what remains.”

Be sure to notify your insurance company promptly—ideally within 72 hours of the tornado. Most policies have strict notification requirements, and delays can give insurers grounds to deny or reduce your claim.

The heart of your claim file should include:

- Detailed, date-stamped photos and videos showing damage from multiple angles

- A comprehensive inventory of damaged personal property with estimated values

- All receipts for emergency repairs, temporary housing, and replacement items

- Notes from every conversation with insurance representatives (including names, dates, and what was discussed)

- Independent assessments from qualified contractors and specialists

For homeowners along the tornado-prone Austin to Waco corridor, we strongly recommend creating a pre-loss inventory before disaster strikes. A simple walkthrough video of your home, focusing on valuable items, can prove invaluable when tornado damage claim problems arise later.

Avoiding Contractor & Scam Pitfalls

Unfortunately, disasters bring out both the best and worst in people. After tornadoes tear through communities, the area often becomes a magnet for what we call “storm chasers”—opportunistic contractors who follow severe weather events looking for quick work.

While some traveling contractors are legitimate, many others prey on vulnerable homeowners during their time of need. They might offer quick repairs, waived deductibles, or promises to “handle everything” with your insurance company—all red flags that should make you pause.

Work with established local professionals who understand Texas building codes and will still be around months later if issues arise. These contractors have reputations to protect in your community and typically provide more reliable service.

Always verify credentials before signing anything. Check their license status with the Texas Department of Licensing and Regulation, confirm they carry adequate insurance (including workers’ compensation), and ask for local references you can contact.

Get detailed written estimates from at least three different contractors. This not only helps ensure fair pricing but also provides documentation that can strengthen your claim if your insurer’s settlement offer seems low.

The American Property Casualty Insurance Association offers this advice: “Be careful about unscrupulous contractors following a natural disaster. Contact your insurer, agent or local business bureau for references on potential contractors… Ask for certificates of liability and workers compensation before signing contracts.”

Never pay large amounts upfront. Legitimate contractors typically require reasonable deposits, not full payment before work begins. Structure payments to align with completed work milestones.

The recovery process is a marathon, not a sprint. Taking time to find trustworthy professionals will save you significant headaches down the road. If you’re feeling overwhelmed by the process, consider consulting with a public adjuster who can guide you through these critical decisions while advocating for your interests.

More info about Tips for Filing Claims

Negotiating & Resolving Disputes

When the dust settles after a tornado, you might find yourself facing an uphill battle with your insurance company. Even with meticulous documentation, many tornado victims find their claims aren’t what they expected. But don’t worry—you’ve got options.

“The initial offer is rarely the final offer,” explains Scott Friedson, our lead public adjuster. “Insurance companies start with conservative estimates, expecting you to negotiate.”

Start by comparing your contractor’s estimates with the adjuster’s report. Notice how they differ in scope, pricing, or damage assessment? These differences aren’t accidents—they’re negotiation starting points.

If your claim was denied or underpaid, don’t take it lying down. Gather additional evidence that supports your position. Maybe it’s a structural engineer’s report showing the roof damage was indeed from wind uplift, not pre-existing issues. Or perhaps it’s moisture readings proving water entered through tornado-damaged areas.

Most policies include an appraisal clause—a powerful but underused tool. This provision allows you to resolve disputes over damage amounts without expensive litigation. You select an appraiser, the insurance company selects theirs, and together they choose an umpire to make final decisions on disputed items.

Tornado damage claim problems often continue weeks after the initial settlement when you find additional damage. In these cases, file a supplemental claim. In Texas, you typically have two years from the date of loss to submit these claims, though it’s best to act quickly.

If your insurer acts in bad faith—denying valid claims, unreasonable delays, or deceptive practices—consider filing a complaint with the Texas Department of Insurance. This regulatory pressure often motivates insurance companies to reconsider their position.

How a Public Adjuster Maximizes Your Settlement

When facing serious tornado damage claim problems, having a licensed public adjuster in your corner can be a game-changer. Think of us as your personal insurance claim experts—we work exclusively for you, not the insurance company.

We begin with a thorough policy analysis, uncovering coverage provisions you might not even know exist. Many tornado victims don’t realize their policy includes ordinance and law coverage or that they’re entitled to recoverable depreciation on certain items.

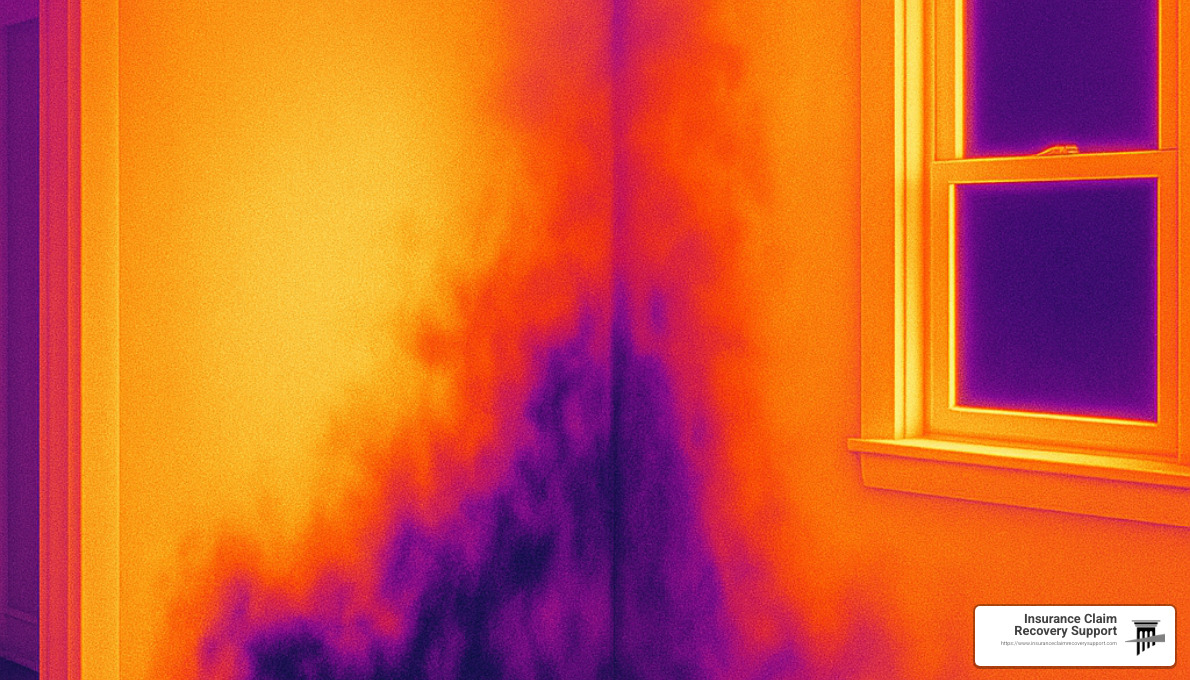

Our team conducts comprehensive damage inspections using professional-grade equipment. The thermal imaging camera doesn’t lie—it reveals hidden water damage behind walls that insurance adjusters often miss during their quick 30-minute inspections.

“Insurance company adjusters are trained to find the minimum damage possible,” notes our senior adjuster. “We’re trained to find every bit of legitimate damage your policy covers.”

We prepare detailed, line-by-line estimates reflecting true replacement costs based on current market conditions—not the outdated pricing software insurance companies often use. After major tornado events, construction costs typically surge 20-30% due to demand, but insurance estimates rarely account for this reality.

Best of all, public adjusters typically work on contingency. We only get paid if you get paid, and our fee comes from the increased settlement amount—money you likely wouldn’t have received without our help.

Research from the Office of Program Policy Analysis and Government Accountability found policyholders who used public adjusters received settlements 747% higher on average than those who handled claims themselves. That’s not a typo—seven hundred forty-seven percent!

FAQs About Tornado Claim Disputes

Q: What documents does my insurer need after a tornado?

Your insurance company will require solid documentation to process your claim efficiently. Prepare a complete inventory of damaged items—don’t forget those in drawers and closets. Take extensive photographs and videos showing all damage from multiple angles. Keep every receipt for emergency repairs and temporary living expenses. Finally, obtain detailed contractor estimates for permanent repairs, making sure they specify materials, quantities, and labor costs.

Q: How do windstorm deductibles work?

Unlike your standard fixed-dollar deductible, windstorm deductibles work as a percentage of your property’s insured value. If your home is insured for $300,000 with a 2% windstorm deductible, you’ll pay $6,000 out-of-pocket before insurance kicks in. These percentage deductibles became common after insurance companies faced massive losses from hurricane and tornado events in the early 2000s.

Q: Can I reopen an underpaid tornado claim?

Absolutely! Most policies allow you to reopen a claim if you find additional damage or if repair costs exceed the original settlement. In Texas, you generally have two years from the date of loss to file a supplemental claim or lawsuit. Document the newly finded damage thoroughly and submit a formal request to your insurance company as soon as possible.

Q: What if my insurer denies my claim citing “normal wear and tear”?

This is unfortunately one of the most common tornado damage claim problems we see. Insurance companies love to blame damage on age or maintenance issues rather than the tornado. Fight back with an independent engineering report that specifically identifies tornado-related damage versus normal aging. Before-and-after photographs are gold in these situations—they show your property was fine until the tornado hit.

Q: Does my policy cover the cost of upgrading to current building codes?

Not automatically. Many standard policies exclude code upgrade costs unless you’ve purchased specific ordinance or law coverage. This becomes particularly important with older buildings that may need significant electrical, plumbing, or structural upgrades to meet current codes during repairs. Check your policy or ask your public adjuster to identify if you have this protection.

Conclusion

Navigating tornado damage claim problems isn’t just challenging—it can feel like you’re battling the storm all over again. But with the right approach, documentation, and sometimes professional help, you can secure the settlement you deserve to rebuild your life.

At Insurance Claim Recovery Support LLC, we’ve walked hundreds of property owners through the aftermath of tornado disasters across Austin, Dallas, Fort Worth, Houston, San Angelo, and throughout Texas. Our commitment is exclusively to policyholders—never insurance companies—ensuring our goals are perfectly aligned with yours.

The difference between a denied claim and an approved one often comes down to how well you understand your policy and document your loss. When a tornado tears through your community, the chaos it leaves behind can be overwhelming. That’s why having a clear strategy makes all the difference.

Remember these essential points as you move forward:

Document everything thoroughly before and after damage occurs. Those photos of your home in better days aren’t just memories—they’re evidence.

Understand your policy’s specific coverage and exclusions. That fine print matters when you’re fighting for what you’re owed.

Take immediate steps to prevent further damage. Something as simple as covering a broken window can protect your claim from denial.

Obtain independent assessments from qualified professionals who can counter the insurance company’s potentially lowball estimates.

Consider professional representation for significant losses. The data speaks for itself—policyholders with public adjusters receive settlements many times higher than those going it alone.

The emotional toll of losing your home or business to a tornado is devastating enough without adding financial stress. By applying the strategies we’ve outlined and seeking expert help when needed, you can overcome common tornado damage claim problems and focus on what really matters—rebuilding your life.

If you’re struggling with a tornado damage claim anywhere in Texas or our other service areas, reach out for a free consultation. As licensed public adjusters who’ve recovered over $250 million for our clients, we know exactly how to steer the complexities of your policy and secure the maximum settlement you’re entitled to receive.

Life after a tornado is challenging enough. Let us handle the insurance company while you focus on moving forward.