Property damage insurance claims in the insurance industry are more than just a bureaucratic hurdle—they’re a crucial lifeline for property owners looking to rebuild after unwanted disasters. Whether it’s a fire, severe storm, or acts of vandalism that have caused damage, understanding these claims can determine whether you quickly recover or grapple with prolonged setbacks.

Here’s what you need to know right away:

- Types of Coverage: Your policy might cover fires, storms, explosions, burst pipes, theft, and vandalism but not flood damage unless you have separate coverage.

- Claims Process: Always evaluate safety first, document the damage thoroughly with photos and detailed notes, make temporary repairs if necessary, and notify your insurer immediately.

- Getting a Fair Settlement: Organize professional repair estimates and don’t settle for less than you deserve; negotiation is key.

Navigating property damage insurance claims in the insurance industry can be overwhelming, especially if your insurer offers a low initial payout or wrongfully denies your claim. You’re not alone in this—we’re here to guide you every step of the way.

As Scott Friedson, a multi-state licensed public adjuster and CEO of a leading public adjusting firm, I have extensive experience handling property damage insurance claims in the insurance industry. My journey includes successfully settling numerous high-value claims, overturning wrongful denials, and advocating for policyholders like you. Let’s move forward to explore how to effectively manage this process.

Understanding Property Damage Insurance Claims

When your property faces unexpected damage, navigating through a property damage insurance claim can feel daunting. But understanding the basics can make a significant difference in how smoothly the process goes and how much you recover.

What is a Property Damage Insurance Claim?

A property damage insurance claim is your formal request to an insurance company for compensation. This claim is essential when events like fire, storms, vandalism, or theft damage your property. The process starts with notifying your insurer about the damage. Then, you provide evidence, like photos and videos, to support your claim.

Why is this important? A well-documented claim helps ensure you get the compensation you deserve. It’s not just about financial recovery; it’s about getting back to normalcy without unnecessary delays.

Types of Property Damage Covered

Your insurance policy typically outlines what types of damage are covered. Here are some common types:

-

Fire: Fires can cause extensive damage. They’re often covered, including related smoke and water damage from firefighting efforts.

-

Storm: Storms can bring wind, hail, and lightning, all of which can be destructive. Coverage often includes these elements, but remember, flood damage usually requires separate insurance.

-

Vandalism: If someone intentionally damages your property, like graffiti or broken windows, this is usually covered.

-

Theft: Stolen items, whether equipment or inventory, are generally covered under your policy.

Claim Process and Compensation

Claim Process: After documenting the damage, you notify your insurer. An adjuster will inspect the property to assess the damage and determine the compensation amount. It’s crucial to be present during this inspection to ensure all damage is noted.

Compensation: You may receive compensation based on replacement cost (what it would cost to replace or repair using current prices) or actual cash value (the value of the item considering depreciation).

Policyholder Rights: As a policyholder, you have the right to a fair evaluation and settlement. If you feel the initial offer is low, you can negotiate or seek professional help to ensure a fair payout.

Understanding these elements is the first step in managing property damage insurance claims effectively. Next, we’ll dig into the detailed steps you need to take when filing a claim.

The Property Damage Insurance Claims Process

Navigating the property damage insurance claims process can be complex, but breaking it down into manageable steps can make it more straightforward. Below, we outline the essential steps to file a claim and the role of the insurance adjuster in this process.

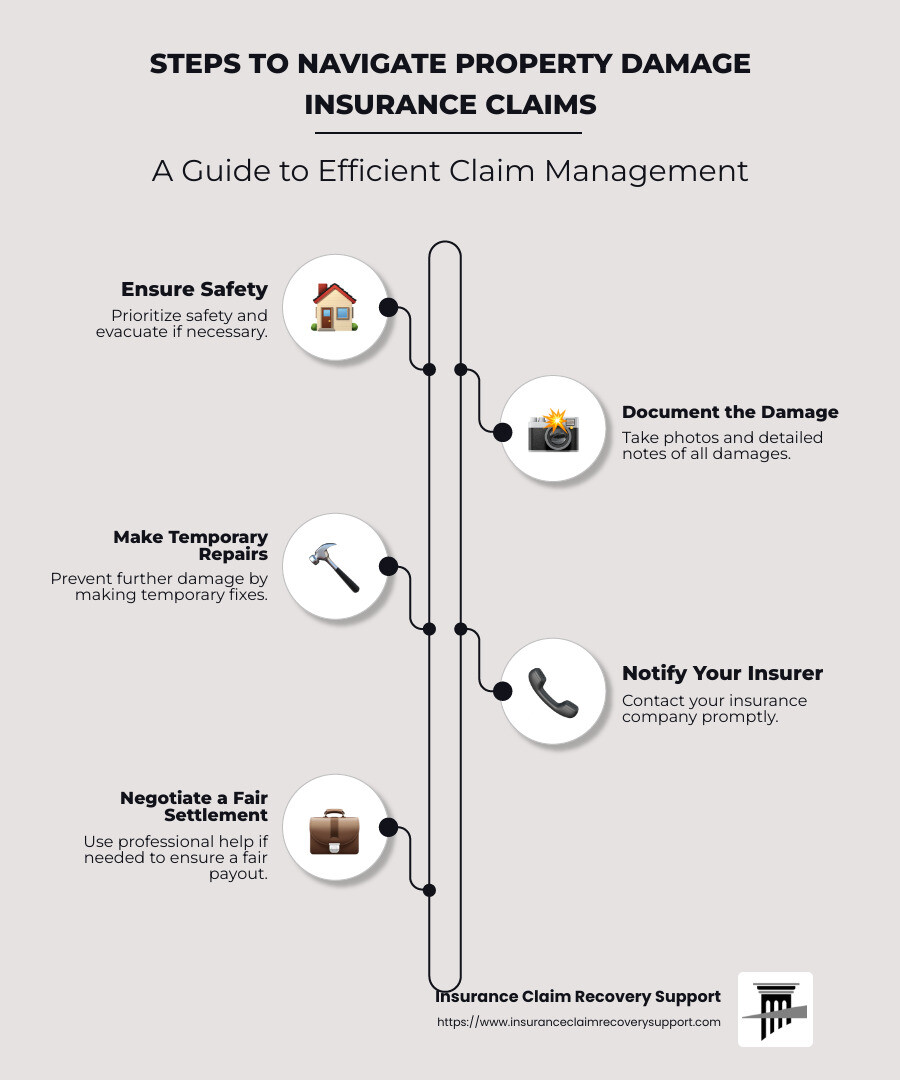

Steps to File a Claim

1. Ensure Safety First

Before anything else, ensure the safety of everyone involved. If your property has suffered damage, check for immediate hazards like broken glass or electrical risks. Evacuate if necessary. Safety is your top priority.

2. Document the Damage

Once safety is secured, document the damage thoroughly. Take clear photos and videos from multiple angles. Write detailed notes about what happened, when, and any potential causes. This evidence is crucial for your claim.

3. Notify Your Insurer Promptly

Contact your insurance company as soon as possible to report the damage. Provide them with all the documentation you have gathered. Quick notification helps expedite the claims process and prevents any denial due to delays.

4. Make Temporary Repairs if Necessary

If you need to make emergency repairs to prevent further damage, consult your insurer first. Some policies have specific rules about unauthorized repairs. Keep receipts and document any work done.

Role of the Insurance Adjuster

Once your claim is filed, an insurance adjuster will be assigned to your case. Their role is pivotal in determining the outcome of your claim.

1. Inspection

The adjuster will visit your property to inspect the damage. Be present during this inspection to ensure all damage is noted and discussed. Your presence helps clarify any discrepancies and ensures nothing is overlooked.

2. Assessment

Based on the inspection, the adjuster will assess the extent of the damage and calculate the compensation amount. They consider factors like the replacement cost and actual cash value of the damaged items.

3. Settlement

After the assessment, the adjuster will propose a settlement offer. This is the amount your insurance company is willing to pay for the damages. If the offer seems low, you have the right to negotiate or seek professional assistance to ensure a fair settlement.

Understanding these steps and the role of the adjuster can help you steer the claims process more effectively. The goal is to ensure you receive the compensation you deserve to restore your property to its pre-loss condition.

Next, we’ll explore the challenges policyholders often face in the insurance industry.

Challenges in the Insurance Industry

Navigating property damage insurance claims in the insurance industry is often fraught with challenges. Here, we dig into some common issues and offer tips to help you secure a fair settlement.

Common Issues Faced by Policyholders

1. Underinsurance

Imagine losing your home to a fire, only to find your insurance doesn’t cover the full cost of rebuilding. This is underinsurance, a prevalent issue where coverage limits fall short of actual repair costs. It’s crucial to regularly review your policy to ensure it matches current rebuilding costs.

2. Delays

Insurance claims can drag on, leaving you in limbo. Delays often stem from complex procedures or incomplete documentation. Be proactive by submitting all required documents promptly and following up regularly with your insurer.

3. Lowball Offers

Insurance companies might offer settlements lower than expected, known as “lowball” offers. These can be tempting if you’re eager to resolve your claim, but accepting too quickly can leave you undercompensated. Always evaluate offers carefully.

4. Coverage Limits

Each policy has limits on what it will pay. These limits can be problematic if costs exceed expectations. Understanding your policy’s coverage limits upfront can prevent unpleasant surprises.

5. Depreciation

Items lose value over time, a concept known as depreciation. Insurers often factor this into settlements, reducing the amount you receive. Knowing the difference between replacement cost value and actual cash value can help you better estimate your potential payout.

6. Matching Issues

Sometimes, repairs involve matching materials that are no longer available. This can lead to disputes over what the insurer will cover. Documenting your property thoroughly before damage occurs can help resolve these issues.

Tips for a Fair Settlement

1. Negotiation

Don’t accept the first offer if it doesn’t meet your needs. Negotiation is a critical part of the claims process. Use your documentation to support your case and consider enlisting professional help if needed.

2. Professional Help

Sometimes, hiring a public adjuster or attorney is the best way to ensure a fair settlement. These professionals understand the intricacies of insurance claims and can advocate on your behalf.

3. Documentation

Thorough documentation is your best ally. Keep detailed records of all communications, agreements, and receipts. Photos and videos of the damage, as well as any repairs, provide solid evidence to support your claim.

By understanding these challenges and following these tips, you can better steer the claims process and work towards a settlement that reflects the true value of your losses.

Next, we’ll tackle some frequently asked questions about property damage insurance claims to further clarify the process.

Frequently Asked Questions about Property Damage Insurance Claims in the Insurance Industry

What are the major classifications of property damage?

Property damage is often classified into several major categories, each with distinct characteristics:

-

Fire Damage: This includes damage caused by flames, smoke, and soot. Fires can result in significant structural damage and loss of personal items.

-

Storm Damage: Typically includes damage from wind, hail, and lightning. Storms can affect roofs, windows, and other structural components.

-

Vandalism and Theft: Damage or loss caused by intentional acts of destruction or theft of property.

-

Water Damage: Often results from burst pipes or leaks. However, keep in mind that flood damage usually requires separate coverage.

Understanding these categories helps in identifying what your policy might cover and aids in filing accurate claims.

How do insurance companies pay out claims?

Insurance companies typically follow a structured process to pay out claims:

-

Assessment: An insurance adjuster inspects the damage to determine the extent and cost of repairs.

-

Estimation: Based on the assessment, the insurer estimates the compensation amount, considering factors like depreciation and policy limits.

-

Payment: Once an agreement is reached, the insurer issues a payment. This can be a lump sum or multiple payments, depending on the situation and policy terms.

-

Final Settlement: After all repairs are completed and documented, the final settlement is processed to ensure all covered expenses are reimbursed.

Can I make repairs before the insurance company approves?

It’s crucial to approach this carefully:

-

Emergency Repairs: You can make emergency repairs to prevent further damage, like covering a leaking roof. Document these repairs with photos and receipts.

-

Approval for Major Repairs: For significant repairs, it’s best to wait for the insurance company’s approval to avoid complications or denial of coverage.

-

Consult Your Insurer: Always inform your insurer about any repairs and seek guidance on their policy regarding unauthorized repairs.

By understanding these FAQs, you can steer property damage insurance claims in the insurance industry with greater confidence and clarity.

Next, we’ll explore the role of the insurance adjuster in the claims process.

Conclusion

At Insurance Claim Recovery Support, our mission is simple but powerful: to stand firmly by policyholders and ensure they receive the maximum settlement they deserve. We know that navigating property damage insurance claims in the insurance industry can be daunting, especially in the wake of devastating events like Texas fires and storms.

Why Choose Us?

Our expertise in Texas fire and storm damage is best. We understand the unique challenges posed by Texas’s climate and geography, enabling us to provide unparalleled support to property owners affected by these disasters. Our focus is not just on settling claims but on advocating for our clients every step of the way.

Advocating for Policyholders

We are not just another public adjustment firm. We are your partners in recovery. Our commitment to policyholder advocacy means that we prioritize your needs and rights. We carefully document your claim, negotiate expertly, and leverage our comprehensive understanding of insurance policies to secure the best possible outcome for you.

Securing Maximum Settlements

Achieving a fair settlement is about more than just numbers. It’s about ensuring you have the financial resources to rebuild and recover without undue strain. With our guidance, you can steer the complexities of the claims process with confidence, knowing that we are working tirelessly to secure the maximum settlement you deserve.

For more information on how we can assist you with your insurance claim, visit our Texas Fire Damage service page. Let us be your guide and advocate in securing the settlement you need to move forward.

In the challenging landscape of property damage claims, having a dedicated and knowledgeable partner makes all the difference. Whether you’re dealing with the aftermath of a fire, a storm, or another disaster, you’re not alone. We’re here to help you every step of the way.