How to become a licensed public adjuster is a common question asked by those interested in advocating for policyholders during their insurance claims process. If you want to start on this rewarding path, here are the key steps to follow:

- Understand the Role: A public adjuster acts as a trusted advocate for policyholders, helping them steer insurance claims and ensuring they receive fair settlements.

- Educational Requirements: Complete a pre-licensing course to gain necessary skills and knowledge.

- Pass Licensing Exam: Prepare through resources like Pearson VUE to get exam outlines and guidelines.

- Meet State Requirements: Each state has specific standards, check requirements for your location.

- Apply for License: Submit your application online and complete a background check.

Public adjusters are vital in the insurance process, helping people recover from unexpected property damage events like fires and floods by securing fair settlements. Their expertise prevents unnecessary litigation, shortens delays, and resolves underpayments or wrongful denials.

My name is Scott Friedson, and I am passionate about guiding others on how to become a licensed public adjuster. Over the course of my career, I’ve settled hundreds of millions in property damage claims. My experience in navigating complex claims allows me to share essential insights in this field.

Understanding the Role of a Public Adjuster

Public adjusters are the unsung heroes in insurance claims. They step in when policyholders feel overwhelmed by the insurance claim process or believe they aren’t getting a fair settlement. But what exactly do they do, and what skills are needed to succeed in this role?

Job Duties

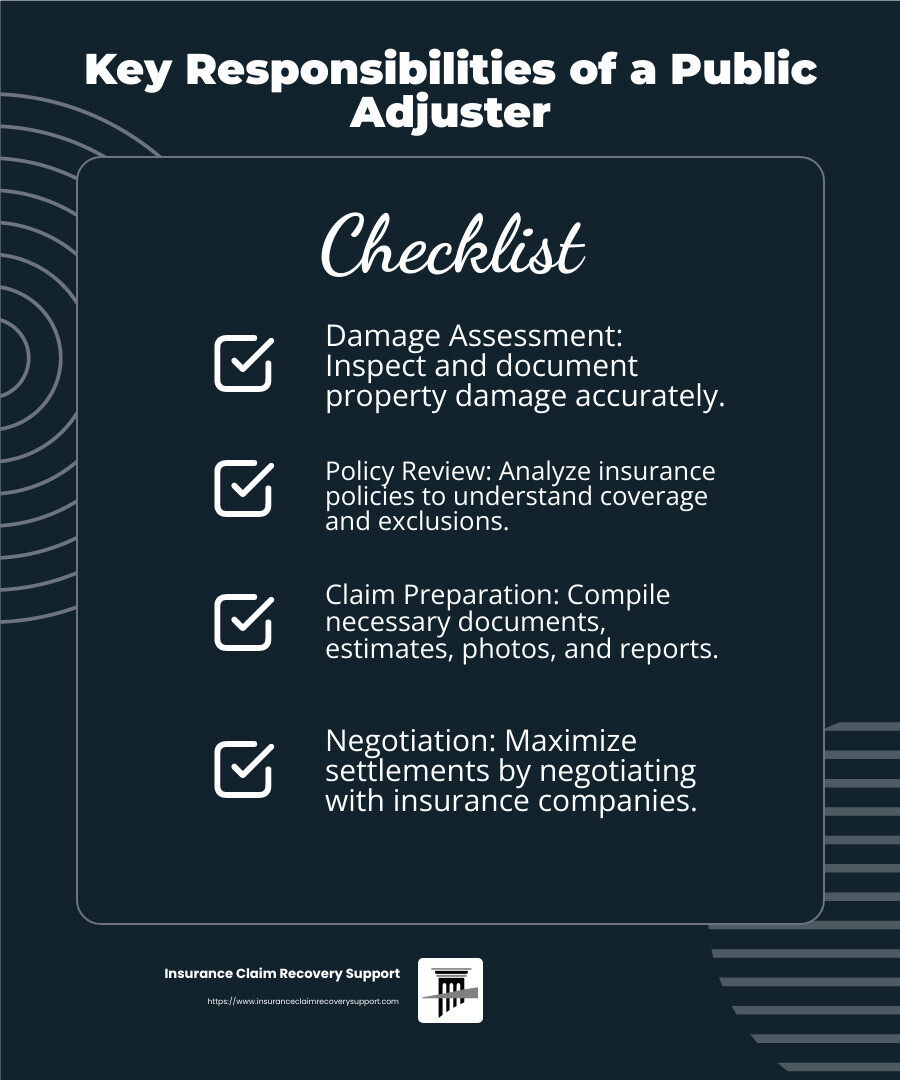

At the core, a public adjuster is an advocate for the policyholder. They take on several key responsibilities:

-

Damage Assessment: Public adjusters inspect and document property damage to ensure nothing is missed. This is crucial for building a strong case for the claim.

-

Policy Review: They analyze insurance policies to understand coverage and exclusions. This helps in determining what the policyholder is entitled to.

-

Claim Preparation: Compiling necessary documents, such as estimates, photos, and reports, is part of their job. These documents support the claim and ensure all bases are covered.

-

Negotiation: Perhaps one of the most critical roles, adjusters negotiate with insurance companies to maximize the settlement for the policyholder.

-

Settlement Guidance: They help policyholders understand settlement offers and ensure they meet the policyholder’s needs.

Skill Standards

Becoming a successful public adjuster requires a unique set of skills:

-

Attention to Detail: Meticulous documentation and thorough analysis of policies are essential.

-

Communication Skills: They must clearly communicate complex information to policyholders and negotiate effectively with insurance companies.

-

Problem-Solving: Public adjusters need to think critically and creatively to resolve disputes and secure fair settlements.

-

Empathy and Advocacy: Representing the policyholder means understanding their needs and advocating fiercely on their behalf.

Professional Organization

Joining a professional organization can be a valuable step in a public adjuster’s career. Membership in associations like the National Association of Public Insurance Adjusters (NAPIA) can indicate a commitment to the profession. Members often adhere to higher ethical standards and participate in ongoing education. This not only improves credibility but also provides networking opportunities and resources for continuous learning.

By understanding these aspects of the role, aspiring public adjusters can better prepare for a successful career in this field, ensuring they provide the best possible service to their clients.

Next, we’ll explore the licensing requirements by state, focusing on how different states like Illinois and Texas set their standards for public adjusters.

How to Become a Licensed Public Adjuster

Licensing Requirements by State

Navigating the path to becoming a licensed public adjuster involves understanding the specific licensing requirements of your state. These requirements can vary significantly, so it’s crucial to know what’s expected in your area. Let’s dive into the standards for Illinois and Texas, two states with distinct processes.

Illinois:

In Illinois, aspiring public adjusters must first complete a pre-licensing course approved by the state. This course covers essential topics like policy interpretation and claims negotiation, providing a solid foundation for your career. After completing the course, candidates must pass the Illinois Public Adjuster Licensing Exam. The state also requires a background check to ensure all applicants have a clean record.

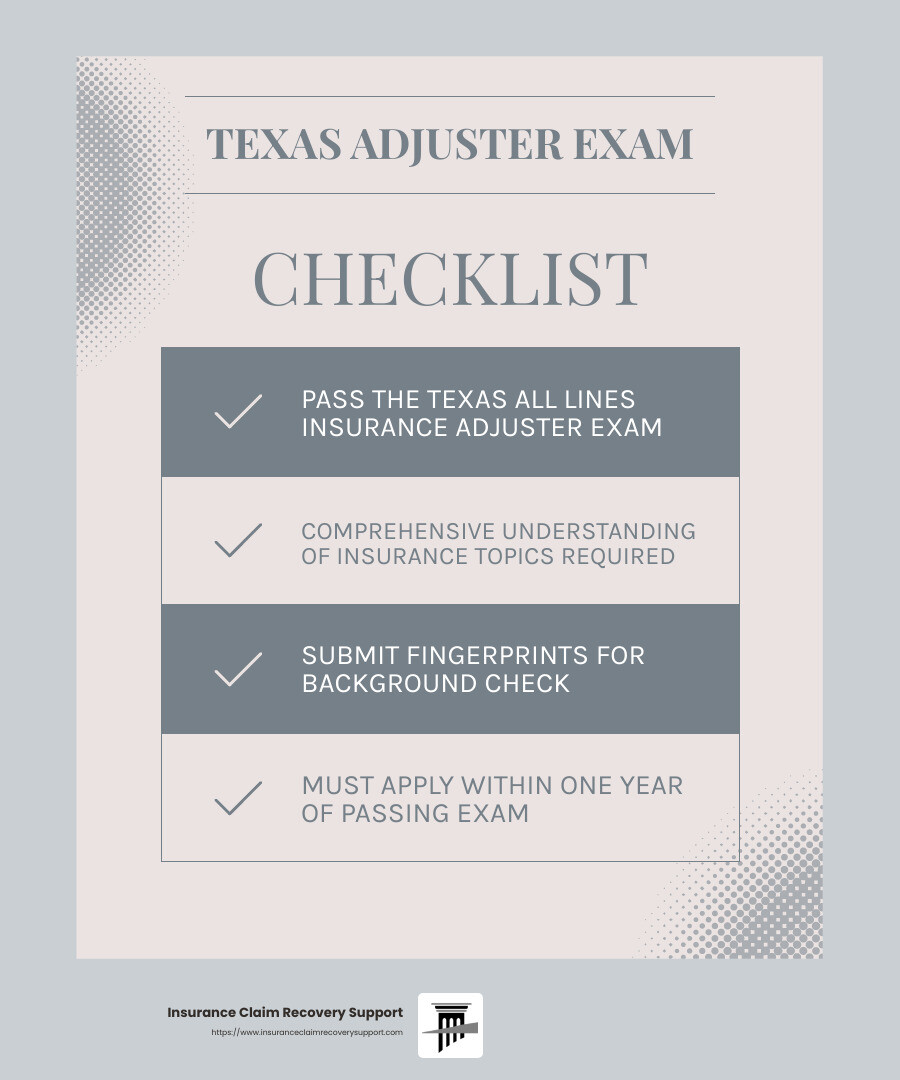

Texas:

Texas, known for its rigorous standards, requires candidates to pass the Texas All Lines Insurance Adjuster exam. This exam tests a wide range of insurance-related topics, ensuring that adjusters have a comprehensive understanding of the field. Once you pass the exam, you need to submit your fingerprints for a background check. Importantly, if you don’t complete the application process within one year of passing the exam, you’ll need to retake it.

Exam Preparation and Resources

Preparing for the licensing exam is a critical step in becoming a public adjuster. Thankfully, there are several resources available to help you succeed.

Pearson VUE and Candidate Handbook:

Pearson VUE is a prominent provider of testing services for public adjusters. They offer a candidate handbook that outlines everything you need to know about the exam process, from scheduling to what to expect on test day. The handbook is an invaluable resource, providing insights into the structure and content of the exam.

Exam Outlines:

To ensure you’re studying the right material, Pearson VUE also provides exam outlines. These outlines detail the subjects covered on the exam, helping you focus your study efforts on the most relevant topics. Whether you’re tackling questions on policy interpretation or claims negotiation, these outlines will guide your preparation.

Pre-Licensing Courses:

Many states, including Illinois, require a pre-licensing course. These courses are designed to prepare you for the licensing exam and your future career as a public adjuster. They cover a range of topics, from understanding insurance policies to effective negotiation techniques. Completing one of these courses not only fulfills a requirement but also equips you with the knowledge needed to excel in the field.

By understanding the licensing requirements by state and utilizing available resources, you can confidently prepare for the journey to becoming a licensed public adjuster. Next, we’ll explore the financial and legal responsibilities that come with this role, ensuring you’re fully prepared for success.

Financial and Legal Responsibilities

Becoming a licensed public adjuster is not just about passing exams and understanding policies. It also involves meeting certain financial and legal responsibilities. Let’s explore these crucial aspects.

Surety Bond

A surety bond is a key requirement for public adjusters in many states. This bond acts as a financial guarantee that you will adhere to state laws and ethical standards. For example, Florida requires adjusters to secure a $50,000 surety bond. This bond protects clients from any potential misconduct or errors on your part. It’s a way to ensure that you have a financial safety net in place, providing peace of mind for both you and your clients.

Financial Responsibility

Being financially responsible is essential in this profession. As a public adjuster, you may handle large sums of money on behalf of your clients. This means you need to manage funds with utmost care. Maintaining accurate records, being transparent with clients, and adhering to financial regulations are all part of your fiduciary duty. This financial diligence not only protects your clients but also improves your reputation as a trustworthy professional.

Contract Approval

Before you can officially start working as a public adjuster, you need to have your contracts approved. In Texas, for instance, you must either use the contract developed by the state (Form FIN535) or submit your own contract for approval. This step ensures that the agreements you make with clients are clear, fair, and compliant with state regulations. Having a proper contract in place is crucial, as it outlines the scope of your services and the fees involved, protecting both you and your clients.

By understanding and fulfilling these financial and legal responsibilities, you can build a solid foundation for your career as a public adjuster. Next, we’ll address some frequently asked questions about becoming a public adjuster, shedding light on common concerns and misconceptions.

Frequently Asked Questions about Becoming a Public Adjuster

Is it hard to be a public adjuster?

Becoming a public adjuster requires dedication and a commitment to learning. You need to develop a solid understanding of insurance policies, claims processes, and state regulations. This means you’ll need to invest time in training and gaining knowledge.

Public adjusters must meet specific skill standards, including excellent communication and negotiation skills. These skills are critical when dealing with insurance companies and advocating for fair settlements on behalf of policyholders.

How long does it take to get an adjuster license?

The timeline for obtaining a public adjuster license can vary by state. Generally, the process involves completing a pre-licensing course, passing a licensure exam, and undergoing a background check.

-

Pre-Licensing Course: Some states require you to complete a pre-licensing course, which covers the basics of insurance and claims adjusting. This course can take a few weeks to complete, depending on your schedule and the state’s requirements.

-

Licensure Exam: After completing the course, you’ll need to pass a state-administered exam. Resources like the Pearson VUE candidate handbook can help you prepare by providing exam outlines and practice questions.

-

Background Check: A background check is typically required to ensure you have a clean record. This step can take a few days to a couple of weeks, depending on the state’s processing time.

In total, you could expect the entire licensing process to take anywhere from a few weeks to a few months, depending on your state and how quickly you complete each step.

Is a public adjuster worth it?

Hiring a public adjuster can be highly beneficial, especially if you’re dealing with a complex insurance claim. Public adjusters specialize in navigating the insurance claim process and advocating for policyholders to ensure they receive a fair settlement.

-

Insurance Claim Process: Public adjusters handle all the paperwork and negotiations, reducing the stress and time commitment for policyholders.

-

Fair Settlement: They work to maximize your settlement by identifying all possible areas of compensation, ensuring you receive what you’re entitled to under your policy.

-

Policyholder Advocacy: Public adjusters represent only the interests of the policyholder, not the insurance company. This means their primary goal is to achieve the best possible outcome for you.

Overall, while there may be costs involved in hiring a public adjuster, the potential for a higher settlement and less stress often makes it a worthwhile investment.

With these insights into becoming a public adjuster, you can make informed decisions as you steer your career path in this field.

Conclusion

At Insurance Claim Recovery Support, we dedicate ourselves to being your trusted partner in navigating the complex world of insurance claims. As a public insurance adjuster, our primary focus is on advocating for policyholders like you, ensuring that you receive the maximum settlement you deserve.

Our team specializes in settling property damage claims, including those caused by fire, hurricanes, tornadoes, and other disasters. We understand the stress and complexity that come with these situations, and we are here to alleviate that burden by handling the claims process for you.

Why choose us?

-

Expert Advocacy: We work exclusively for policyholders, not insurance companies. This means our sole focus is on achieving the best possible outcome for you.

-

Maximized Settlements: Statistics show that policyholders who hire public adjusters often receive significantly higher settlements than those who handle claims on their own. Our experienced team knows how to spot hidden damages and negotiate assertively with insurance companies.

-

Peace of Mind: By partnering with us, you can focus on restoring your property and life, while we handle the intricacies of the insurance claim process.

Whether you’re in Austin, Dallas-Fort Worth, San Antonio, Houston, or anywhere else in Texas, our team is ready to assist you. We are committed to protecting your rights and ensuring you receive the full benefits of your insurance policy.

Ready to maximize your settlement? Contact us today for a complimentary assessment and let us help you get the settlement you deserve.