Multi-family property claims can be a daunting, multifaceted maze that challenges property owners dealing with instances like fire, hurricane, or flood damage. Quickly addressing these claims while grasping the complex insurance process is pivotal for owners of apartments, condos, or large residential buildings to safeguard their investments efficiently.

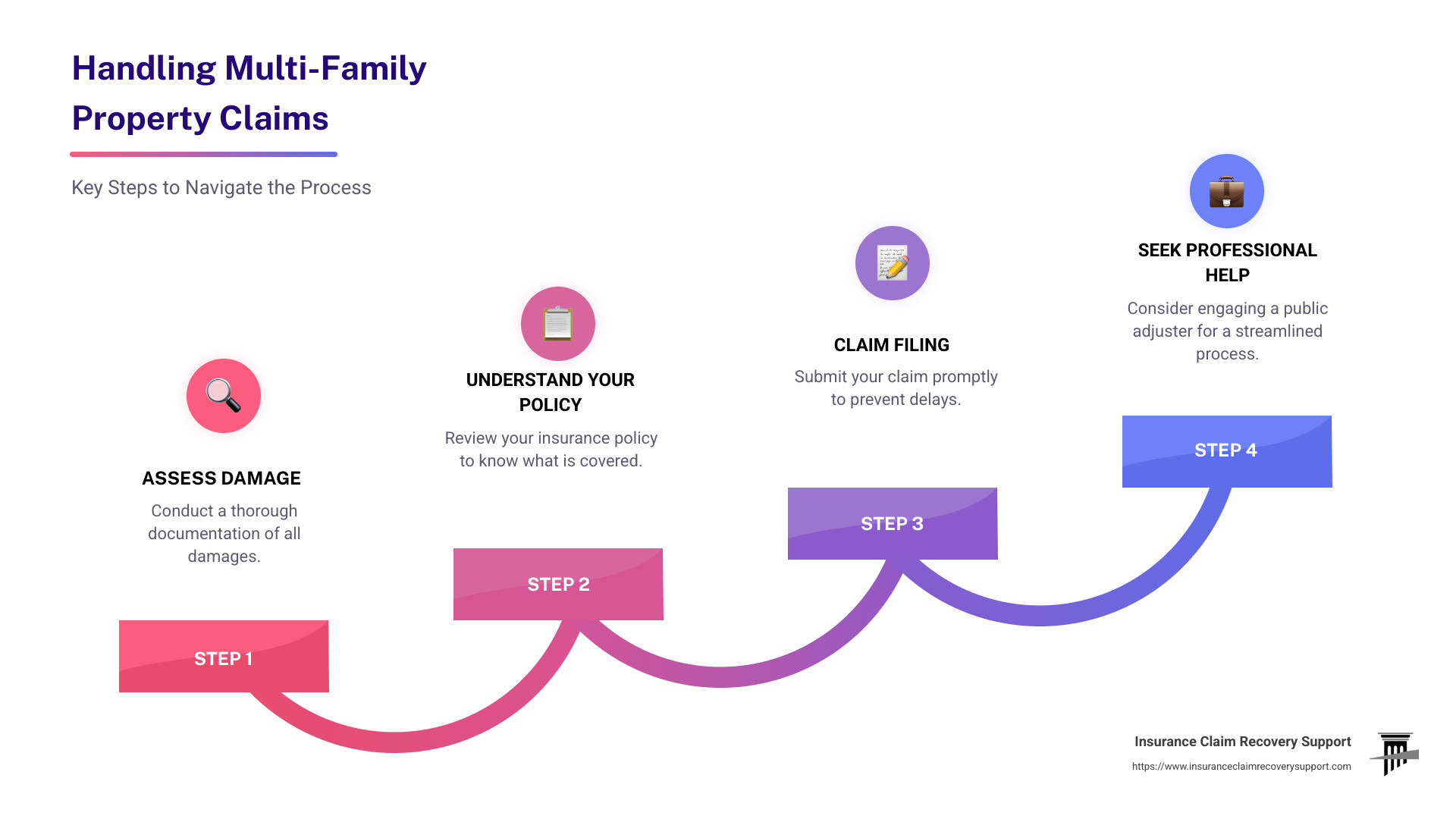

Key Steps in Handling Multi-Family Property Claims:

1. Assess Damage: Begin with a thorough documentation of all damages.

2. Understand Your Policy: Review your insurance policy to know precisely what is covered.

3. Claim Filing: Submit your claim promptly to prevent delays.

4. Seek Professional Help: Consider engaging a public adjuster for a streamlined process.

I’m Scott Friedson, a multi-state licensed public adjuster with experience in resolving large-loss multi-family property claims. Over my career, I’ve helped many owners steer the intricate insurance claim landscape, securing fair settlements and avoiding unnecessary complications. Whether your property has suffered from a natural calamity or another loss, it’s crucial to understand the steps involved to safeguard your investment and ensure a fair outcome.

Multi-family property claims vocab to learn:

– Fire damage claims Austin

– Flood damage claims Houston

– Public adjuster Houston

Understanding Multi-Family Property Insurance

Navigating multi-family property insurance can seem complex, but understanding the basics can make all the difference. This type of insurance is essential for landlords and property owners, providing a safety net against a variety of risks. Let’s break down the key components of multi-family property insurance: coverage types, liability protection, and loss of income.

Coverage Types

Comprehensive Property Insurance is the cornerstone of your policy. It covers damage to the physical structure of your property, including landlord-owned furnishings and equipment. This is crucial for protecting against common threats like fire, storms, or vandalism. For instance, water damage is the most reported claim, affecting over 70% of respondents in a recent survey.

Liability Protection

Imagine a tenant slipping on an icy walkway. Without liability protection, you could face hefty legal fees and damages. Liability insurance covers these costs, protecting you from lawsuits if someone is injured on your property. It’s an essential part of your multi-family insurance policy, offering peace of mind and financial security.

Loss of Income

What happens if a storm renders your property uninhabitable? This is where loss of income insurance comes into play. Also known as business interruption insurance, it compensates for lost rental income during periods when tenants can’t live in their units due to a covered event. This ensures you can meet your financial obligations even when your property isn’t generating revenue.

Understanding these components will help you choose the right insurance policy for your multi-family property, ensuring comprehensive protection against unexpected events.

Next, we’ll explore the steps to file a multi-family property claim, a critical process for safeguarding your investment.

Steps to File a Multi-Family Property Claim

Filing a multi-family property claim can seem daunting, but breaking it down into clear steps makes it manageable. Here’s how to steer the process effectively:

1. Damage Assessment

After an incident, the first step is to assess the damage. Safety is your top priority. Ensure the area is secure before inspecting the property. Document everything you see. Use your smartphone to take clear photos and videos from various angles. Capture both close-ups and wide shots to provide a complete picture of the damage. This visual evidence is crucial for your claim.

2. Documentation

Proper documentation is the backbone of a successful claim. Here’s what you need:

- Accident Report: If applicable, file a police report. This serves as an official record of the incident.

- Photos and Videos: As mentioned, these are critical. Ensure they are clear and comprehensive.

- Repair Estimates: Get multiple repair estimates to support your claim’s value. This helps validate the amount you’re requesting.

- Witness Statements: If there are witnesses, gather their contact information and statements. Their accounts can strengthen your claim.

Keep all documents organized and easily accessible. This will streamline the process and reduce delays.

3. Claim Filing

With your documentation ready, it’s time to file your claim. Contact your insurance provider as soon as possible to report the incident. Provide them with all the necessary information and documentation. This includes your policy number, details of the damage, and any supporting documents.

Be clear and concise in your communication. Prompt reporting and thorough documentation help ensure a smooth claims process.

4. Work with a Public Adjuster

Consider hiring a public adjuster to represent your interests. They can help:

- Evaluate the Damage: Public adjusters have the expertise to accurately assess the extent of the damage.

- Prepare Detailed Reports: They create comprehensive reports that support your claim.

- Negotiate with Insurers: Public adjusters negotiate with the insurance company on your behalf to secure a fair settlement.

Involving a professional can make a significant difference, especially if you’re facing challenges with your claim.

By following these steps, you can steer the multi-family property claim process more effectively and increase your chances of a fair settlement.

Next, we’ll discuss common challenges you might face when dealing with multi-family property claims and how to overcome them.

Common Challenges in Multi-Family Property Claims

Dealing with multi-family property claims can be tricky. Here are some common challenges you might face and how to handle them.

Multiple Stakeholders

In multi-family properties, you have more than just one person involved. There are property owners, managers, residents, and the insurance company. Each has different interests. For example, a property owner wants a quick fix, while a resident might be more concerned about safety and comfort.

To manage this, communication is key. Set up regular meetings or updates to keep everyone informed. Make sure all parties know what’s happening and what’s expected of them. This helps prevent misunderstandings and keeps everyone on the same page.

Policy Interpretation

Insurance policies can be confusing. They are packed with legal terms and complex language. Understanding what is covered and what is not can be difficult. Sometimes, policyholders find out too late that they are not covered for certain damages, like mold or flood damage.

To avoid surprises, review your policy regularly. Know your coverage limits, deductibles, and exclusions. If you’re unsure about anything, ask your insurance agent for clarification. This helps you understand your policy better and ensures you are adequately covered.

Underinsurance

Being underinsured is a common issue. This means your insurance coverage is not enough to cover the full cost of a loss. For instance, if severe weather causes extensive damage to your property, underinsurance can leave you with hefty out-of-pocket expenses.

To prevent this, evaluate your insurance needs regularly. Consider factors like property value, location risks, and recent improvements or expansions. Make adjustments to your policy as needed to ensure you have sufficient coverage.

In the next section, we’ll share tips on how to make your claim successful and secure a fair settlement.

Tips for a Successful Multi-Family Property Claim

Filing a multi-family property claim can be overwhelming, but with the right approach, you can steer the process smoothly and secure a fair settlement. Here are some essential tips to guide you:

Seek Professional Help

Navigating insurance claims can be complex, especially if it’s your first time. Don’t hesitate to seek professional help. Engaging a public adjuster can be a game-changer. These professionals are experts in insurance claims and work exclusively for you, not the insurance company. They help you understand your policy and ensure you don’t miss out on the compensation you’re entitled to.

Case Study: R. Holland, a Board President from Jacksonville, FL, shared, “Dealing with Stone Claims Group was one of the most rewarding experiences I’ve had as a board member. Not only did they deliver monetarily in a huge volume for our association, but they also brought best expertise and professionalism.”

Use a Public Adjuster

A public adjuster can handle the tedious details of your claim, from documentation to negotiation. They ensure all damages are accounted for and valued correctly. This is crucial because insurance companies might offer lowball estimates that don’t cover the actual repair costs.

Fact: According to Insurance Claim Recovery Support, public adjusters are skilled in understanding complex insurance policies and advocating for policyholders to get maximum payouts.

Aim for a Fair Settlement

Getting a fair settlement is your ultimate goal. This means receiving enough compensation to cover all repair costs without dipping into your own pockets. To achieve this, provide comprehensive documentation of the damage. Include photos, receipts, and any relevant reports. If the initial offer from your insurer seems low, don’t hesitate to negotiate.

Tip: Many clients are unaware that depreciation amounts are negotiable. A claim consultant can assist with interim submissions and requests for partial payments or advances along the way.

By following these tips, you can improve your chances of a successful claim process and ensure that your property is restored efficiently.

In the next section, we’ll address some frequently asked questions about multi-family property claims to further assist you in navigating the process.

Frequently Asked Questions about Multi-Family Property Claims

How do you determine the value of a multi-family property?

Determining the value of a multi-family property involves looking at both financial data and market conditions. Key factors include rental income, operating expenses, and occupancy rates. An appraiser might use the income approach, which calculates property value based on its ability to generate revenue.

Fact: According to industry experts, understanding your property’s financial health is crucial for accurate valuation, especially when filing a multi-family property claim.

Can you file an insurance claim on private property?

Yes, you can file an insurance claim on private property, but it’s important to distinguish between private and common areas in multi-family properties. Private property usually refers to areas exclusively used by a tenant or owner, like an individual apartment unit. If damage occurs in these areas, the property owner or tenant can file a claim, depending on the insurance policy.

Tip: Personal injury claims on private property can also be filed if someone gets hurt due to negligence. Make sure your policy includes liability coverage to protect against these claims.

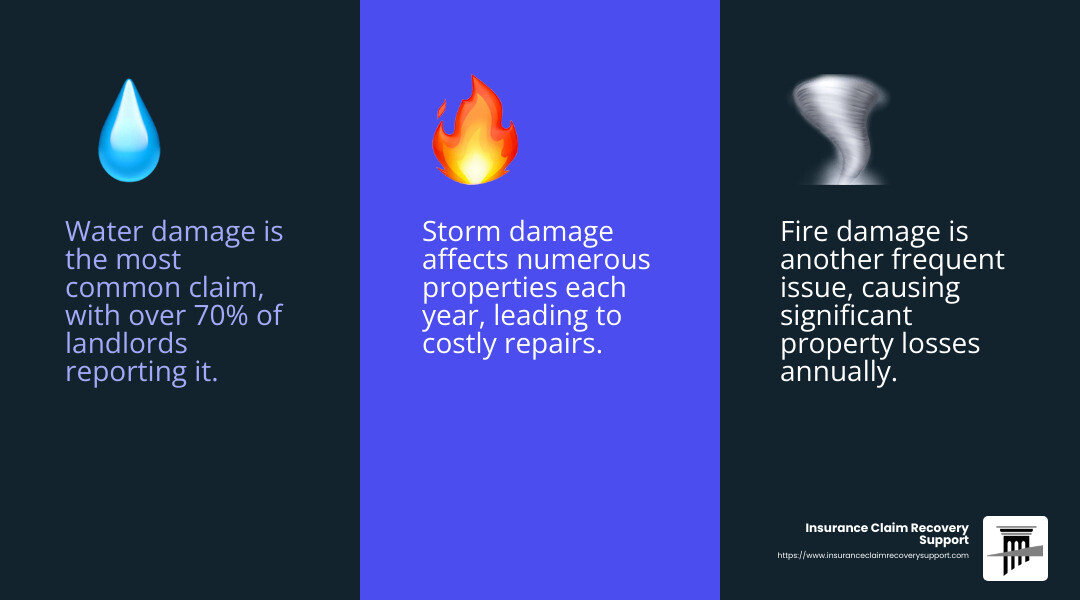

What is the most common type of property damage?

The most common types of property damage in multi-family properties are water damage and fire damage.

Water Damage: It’s the leading cause of claims, affecting 70.2% of properties, often due to plumbing issues or severe weather. It’s crucial to regularly inspect and maintain plumbing systems to prevent such damage.

Fire Damage: This affects over 52% of properties and can result from electrical faults or cooking accidents. Ensuring that fire safety measures are in place, like smoke detectors and fire extinguishers, is essential for reducing risk.

Understanding these common issues can help you prepare better and ensure you have the right coverage in place.

In the next section, we’ll dig into the conclusion and how Insurance Claim Recovery Support can assist you throughout the claims process.

Conclusion

Navigating multi-family property claims can be daunting, but you don’t have to do it alone. At Insurance Claim Recovery Support, we specialize in guiding you through every step of the claims process. Our team is dedicated to advocating for policyholders to ensure you receive the maximum settlement you deserve.

Our expertise spans across various types of property damage, including fire, water, hurricane, and tornado damage. We understand the unique challenges faced by property owners in Texas, where weather-related events like hail storms, hurricanes, and tornadoes are common. With locations in Austin, Dallas-Fort Worth, San Antonio, and Houston, we’re well-positioned to serve clients throughout Texas and beyond.

Our approach is simple: we work exclusively for you, the policyholder. This means our success is tied to yours. We handle the documentation, negotiations, and everything in between to make the claims process as smooth as possible. Our goal is not just to help you steer the process, but to emerge with the settlement you rightfully deserve.

If you’re dealing with a multi-family property claim, reach out to us for expert assistance. We’re here to help you protect your investment and ensure a quick recovery. For more information on how we can assist you, visit our website or contact us today.