Understanding Inside Property Claims Adjusters: The Professionals Behind Your Claim

An inside property claims adjuster is a desk-based insurance professional who handles property damage claims remotely from an office or call center. Unlike field adjusters, they do not physically inspect the damage. Instead, they serve as the policyholder’s primary contact, reviewing reports and photos, estimating repair costs with software like Xactimate, and determining settlement amounts based on policy terms. They typically handle smaller, simpler claims like minor theft, vandalism, or small water leaks.

When you file a claim for your commercial building, apartment complex, or religious institution, an inside adjuster will likely be your first point of contact. They rely on information provided by others to evaluate your loss and decide what the insurance company will pay. For property owners in Texas cities like Austin, Dallas, or Houston, it’s crucial to understand that this adjuster works for the insurance company—not for you. Their performance is often measured by how quickly they close claims and how little they pay out, creating a conflict of interest when you need full compensation.

I’m Scott Friedson, a Multi-State Licensed Public Adjuster with over 15 years of experience. I’ve helped commercial and multifamily property owners recover hundreds of millions in property damage claims. I know that understanding the inside adjuster’s role and limitations is key to avoiding an underpaid settlement and achieving a full recovery.

What is an Inside Property Claims Adjuster and How Do They Differ from Field Adjusters?

When your commercial property in Houston or Austin suffers damage, you’ll deal with an insurance adjuster. However, not all adjusters are the same. Understanding what is an inside property claims adjuster versus a field adjuster is key to managing your claim effectively.

The Core Definition of an Inside Property Claims Adjuster

An inside property claims adjuster (also called a “desk adjuster”) handles your claim remotely from an office. They never visit your property. Instead, they manage the process through phone, email, and software like Xactimate. As employees of the insurance carrier, they work for the company, not for you. They review documents, interpret your policy, and decide how much the insurer will pay. This remote relationship can be challenging for commercial property owners, as the decision-maker never sees the damage firsthand.

Key Distinctions from a Field Adjuster

The main difference is physical presence. Field adjusters visit your property to inspect damage, while inside adjusters work entirely from their desks. This defines their roles and the types of claims they handle.

| Aspect | Inside Adjuster | Field Adjuster |

|---|---|---|

| Work Location | Office, call center, or remote | On-site at the damaged property |

| Claim Types Handled | Typically smaller, simpler claims with clear causation | Larger, more complex claims requiring physical inspection |

| Inspection Method | Reviews photos, videos, reports from others, virtual tools | Physical, on-site inspection of damages, climbing roofs, etc. |

| Policyholder Interaction | Primarily via phone, email, and digital communication | Face-to-face meetings and on-site discussions |

| Primary Goal | Efficient processing, applying policy terms for the insurer | Documenting physical damage to determine scope for the insurer |

A field adjuster might inspect a storm-damaged roof on a Dallas multifamily property for hours. The inside property claims adjuster then reviews that report from their desk. This allows inside adjusters to handle a high volume of smaller claims, often under $3,000, such as minor water damage, theft, or vandalism.

For commercial property owners, this distinction is critical. When facing major storm damage in Round Rock or fire damage in San Antonio, a desk-based adjuster may miss hidden damage or underestimate repair costs. This disconnect between the decision-maker and the reality on the ground is why many owners hire a public adjuster to ensure their claim is fully and accurately represented.

More info about Independent Adjuster Meaning

The Daily Operations and Responsibilities of an Inside Adjuster

The daily life of an inside property claims adjuster is a balancing act of managing multiple claims simultaneously. They serve as the central communication hub for policyholders, contractors, and field staff, juggling phone calls about Austin properties, reviewing photos of Dallas water damage, and creating estimates—all from their desk.

What Types of Claims Do Inside Adjusters Handle?

Inside property claims adjusters focus on smaller, straightforward claims where the cause is clear and the damage is easily documented. For commercial properties, this often includes:

- Minor theft or vandalism: A broken window at a Georgetown office or graffiti on a Round Rock retail center.

- Minor water damage: A small pipe leak in a single apartment unit or a malfunctioning water heater.

- Small fire incidents: A contained kitchen fire or minor electrical damage.

These claims are typically valued at $3,000 or less. Insurers assign them to inside adjusters for efficiency, but this can be problematic if hidden damage is missed in photos.

How Technology Shapes the Inside Adjuster’s Role

Technology is essential for an inside property claims adjuster. Their work relies entirely on digital tools to manage claims remotely.

- Claims Management Systems: These platforms are the command center, tracking every detail of a claim, from the initial report on a San Antonio property to the final payment.

- Xactimate: This is the industry-standard software for creating repair estimates. Adjusters use it to price materials and labor for properties anywhere, like a Houston apartment complex. However, estimates are only as accurate as the data entered, and incomplete information leads to lowball offers.

- Virtual Inspection Tools: Video walkthroughs and specialized apps allow for real-time documentation. While convenient, they can miss critical details an in-person inspection would catch.

- Artificial Intelligence (AI): AI is increasingly used to analyze photos and generate preliminary estimates, but it struggles with the complexities of commercial property damage.

This reliance on technology means you’re dealing with someone making decisions based solely on a computer screen. A public adjuster can bridge this gap, ensuring your documentation effectively communicates the full extent of your damage through these digital channels.

The Inside Adjuster’s Role in Your Commercial Property Claim

When your Dallas commercial building has fire damage or your Houston apartment complex floods, the inside property claims adjuster is a pivotal figure. Understanding their role is essential for commercial property owners, Multifamily HOA managers, and religious institutions.

How an Inside Adjuster Interacts with Other Professionals

The inside property claims adjuster acts as a central hub, coordinating information from multiple sources. They review field adjuster reports, compare them to your contractor’s estimates, and interpret everything through the lens of your insurance policy. For complex issues, like structural fire damage to a San Antonio religious institution or freeze damage in Lubbock, they may consult engineers or architects. They synthesize all this data to determine what the insurance company will pay, giving them significant power over your claim’s outcome without ever visiting your property.

The Impact on Your Claim in Texas

Texas’s unique environment affects how inside property claims adjusters handle claims. Our state’s severe weather, from hurricanes to tornadoes in Fort Worth, creates high claim volumes. During a catastrophe, an inside adjuster may juggle 50+ claims, leading to potential delays for your file.

Furthermore, construction costs in booming markets like Round Rock and Georgetown can be 15-20% higher than the pricing in estimating software. An out-of-state adjuster may mistake a fair local estimate for inflated pricing. Texas does have strong prompt payment laws requiring insurers to act within specific timelines, which your adjuster must follow.

Because the adjuster never sees the damage, thorough documentation is critical to prevent undervaluation. The decisions made by your inside property claims adjuster directly impact your recovery. They work for the insurer, which is why many commercial property owners hire their own representation to level the playing field.

More info about Texas Insurance Claims

Career Path, Skills, and Compensation

For a commercial property owner, understanding the qualifications of the inside property claims adjuster handling your claim provides valuable context.

Essential Skills and Qualifications for Success

An effective inside property claims adjuster needs a blend of technical and soft skills. They must be excellent remote communicators, highly organized to juggle dozens of claims, and empathetic when dealing with distressed policyholders. Strong analytical skills are crucial for interpreting policy language and using estimating software like Xactimate.

Most positions require a high school diploma, though degrees are preferred. Critically, adjusters in Texas must be licensed by the Texas Department of Insurance, which requires passing an exam, a background check, and ongoing education to stay current on regulations.

Compensation and Career Outlook

According to the Bureau of Labor Statistics, the median annual wage for claims adjusters was $76,790 in May 2024. While entry-level salaries are lower, experienced adjusters earn more. Some receive bonuses tied to claim efficiency, which can create a conflict of interest for policyholders seeking a full settlement.

While automation may cause a slight decline in overall adjuster jobs, thousands of openings are projected annually due to retirement and career transitions. The role serves as a strong entry point to the insurance industry and is an attractive option for experienced field adjusters seeking a desk-based position without the physical demands of site inspections.

Understanding this career context helps explain the capabilities and limitations of the person handling your claim. They are trained professionals, but they operate within constraints set by their employer—the insurance company.

Occupational Outlook Handbook for Claims Adjusters

Navigating Your Claim: Inside Adjuster vs. Public Adjuster

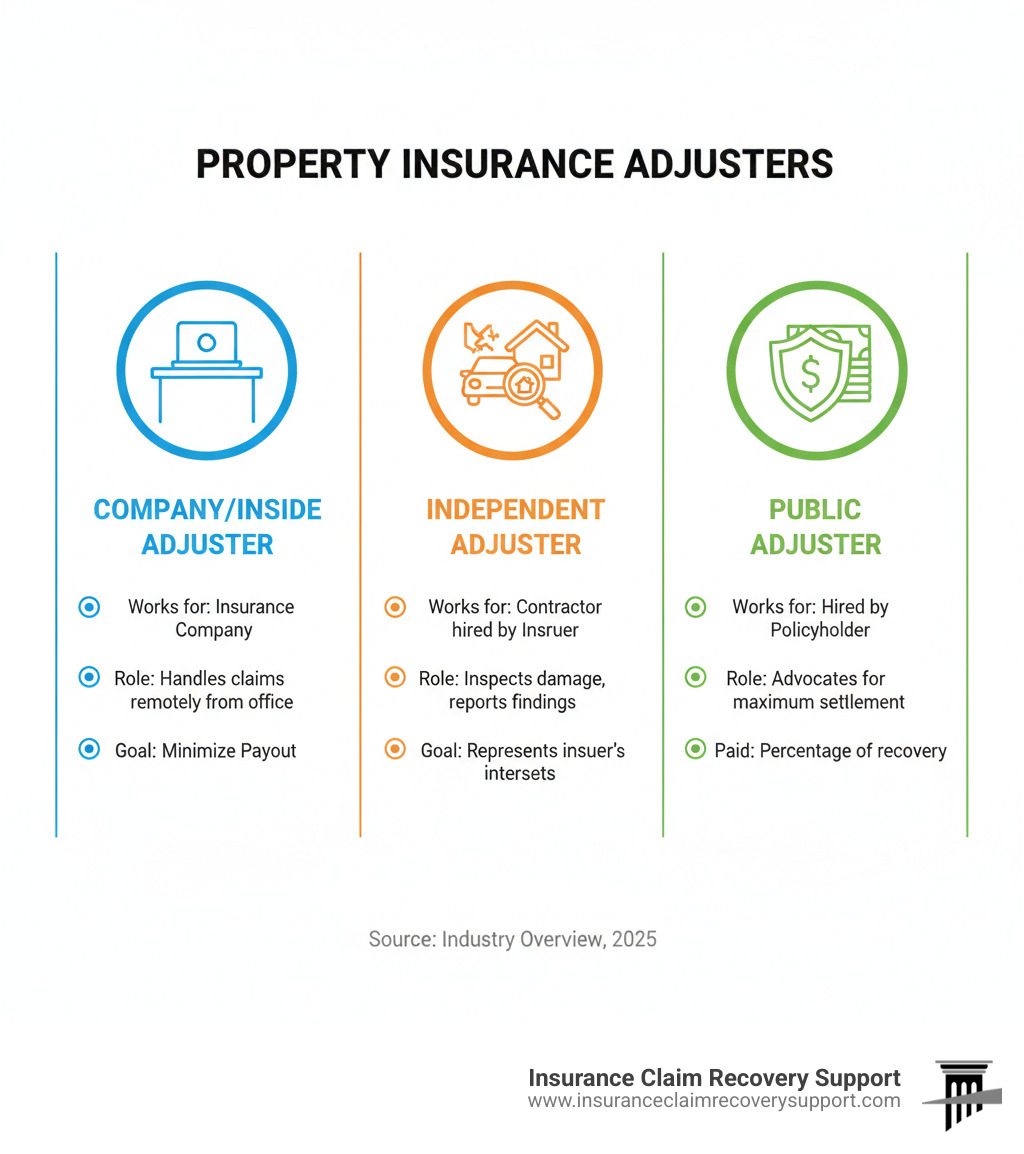

After a disaster, understanding who is on your side is critical. The difference between an inside property claims adjuster and a public adjuster is simple: one works for the insurance company, and the other works exclusively for you.

Understanding the Difference in Allegiance

Inside property claims adjusters work for the insurance company. Their loyalty is to their employer’s bottom line, and their performance is often judged on minimizing payouts. This creates an inherent conflict of interest, as the insurer’s goal to pay less directly opposes your goal to be fully compensated.

Public adjusters, like us at Insurance Claim Recovery Support, exist to balance the scales. We work only for you, the policyholder, with a fiduciary duty to your financial interests. Our fee is a percentage of your recovery, so our success is directly tied to yours. When you’re facing a complex commercial claim in Dallas or Houston, the insurer has a team of experts; a public adjuster is your expert.

More info about Public Adjuster vs. Insurance Company for Property Damage Claim

More info about What Makes ICRS Public Insurance Adjusters P.I.A.s Different

How a Public Adjuster Levels the Playing Field

For complex commercial claims, a public adjuster is your most valuable advocate. We level the playing field by:

- Challenging Low Estimates: Inside adjusters rely on software that often underestimates costs in Texas markets like Round Rock by 15-20%. We create detailed counter-estimates based on real-world pricing, often recovering 25-50% more than initial offers.

- Documenting Complex Losses: We use experts to find and document hidden damage—like structural issues or water behind walls—that a remote adjuster will never see.

- Negotiating on Your Behalf: We manage all communication with the inside property claims adjuster, using our deep policy knowledge to dispute denials and secure a fair settlement. You focus on your business while we handle the bureaucracy.

- Avoiding Unnecessary Litigation: An insurance lawsuit for property damage is a long, expensive, and stressful process. By carefully documenting your claim and negotiating from a position of strength, we resolve most disputes without going to court. We make a fair settlement more appealing to the insurer than a costly legal battle, getting you paid faster so you can rebuild.

For commercial properties, Multifamily HOAs, and religious institutions across Texas facing fire, storm, or freeze damage, a public adjuster transforms the claims process from adversarial to achievable.

More info about Public Adjuster Fees for Property Damage Claims

Conclusion

An inside property claims adjuster is a skilled professional who processes claims efficiently for the insurance company. However, their loyalty is to their employer, not to your full recovery. This systemic conflict of interest is a major challenge for commercial property owners seeking fair compensation.

For significant losses from fire in Austin, hurricanes in Houston, or freeze damage in Lubbock, this distinction is critical. Your commercial building, apartment complex, or religious institution is a major investment. You need an advocate who fights exclusively for your interests.

That’s our role at Insurance Claim Recovery Support. As public adjusters, we work only for you, the policyholder. We carefully document your loss, value all damages, and negotiate with the insurance company’s inside property claims adjuster to secure the maximum settlement you deserve. We handle the entire claims process so you can focus on your business.

The difference professional representation makes can be hundreds of thousands of dollars—the difference between a temporary patch and a full recovery. Don’t steer complex commercial property claims alone. Let us level the playing field and ensure you receive every penny you’re entitled to.