Navigating Property Damage Claims in Waco

When property damage strikes your Waco public adjuster becomes your most powerful advocate in securing fair compensation from insurance companies. Here’s what you need to know:

Quick Answer for Waco Property Owners:

- What they do: Licensed professionals who represent YOU (not the insurance company) in property damage claims

- Cost: Contingency fee basis – no recovery, no fee (capped at 10% in Texas)

- When to hire: For claims over $10,000, denied claims, or complex commercial property damage

- Types handled: Fire, hail, hurricane, tornado, freeze, lightning, flood, and business interruption

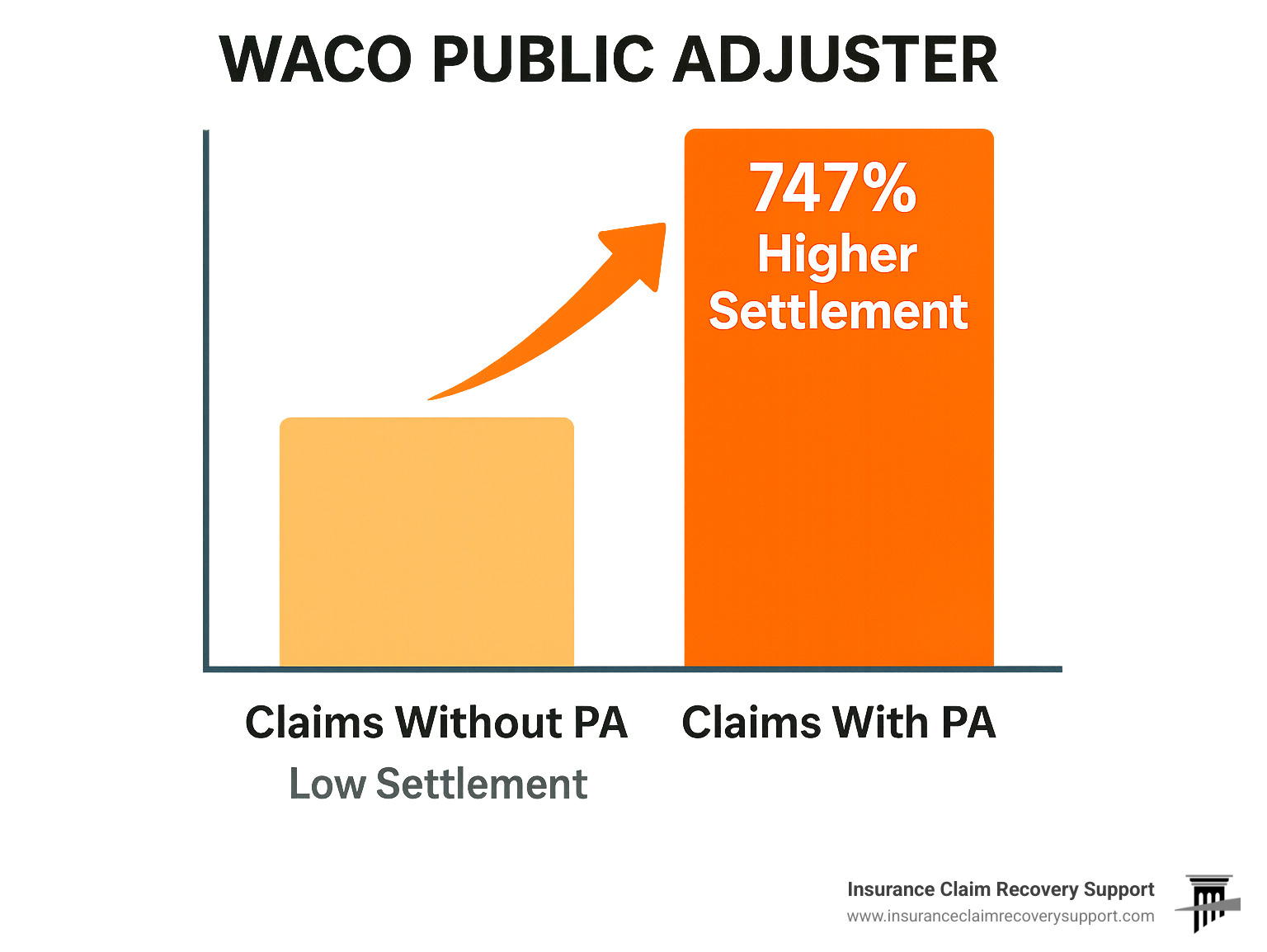

- Key benefit: Average claim settlements are 747% higher with public adjuster representation

Property damage from Texas storms, fires, or floods can devastate your business operations. But dealing with insurance companies afterward often becomes a second disaster. Insurance adjusters work for the carrier – not for you. They’re trained to minimize payouts, not maximize your recovery.

Many Waco property owners accept settlements that are far below what they’re entitled to under their policy. Others get trapped in lengthy disputes or costly litigation that drags on for months or years.

The reality is stark: Insurance companies have teams of experts working against you. Shouldn’t you have an expert working for you?

As Scott Friedson, a multi-state licensed public adjuster and CEO of a large loss adjusting firm, I’ve settled over $250 million in commercial and multifamily claims throughout Texas. My experience as a Waco public adjuster has shown me how proper representation can transform denied claims into six-figure recoveries while avoiding unnecessary litigation entirely.

Waco public adjuster terms made easy:

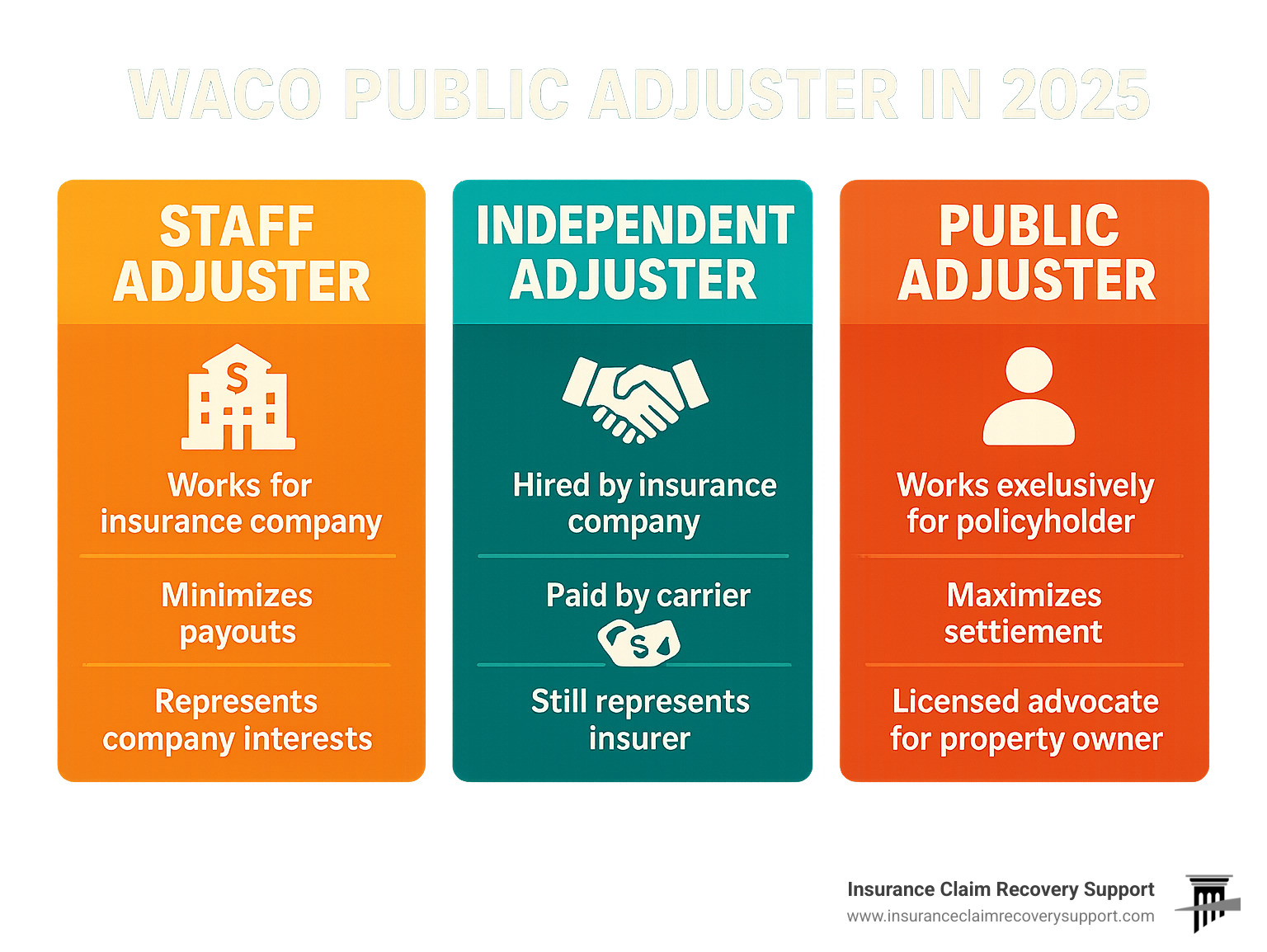

What is a Public Adjuster and How Do They Serve Waco?

When disaster strikes your commercial property in Waco – whether it’s your apartment complex, religious institution, or multifamily building – your first instinct might be to call your insurance company. But here’s something many property owners don’t realize: the adjuster your insurer sends works for them, not for you.

A Waco public adjuster changes this dynamic completely. We’re licensed professionals who work exclusively for you – the policyholder. Unlike staff adjusters who are employees of insurance companies, or independent adjusters who are contracted by insurers, we have zero conflict of interest. Our mission is simple: get you the maximum settlement you deserve under your policy.

Think of us as your advocate in what can feel like an unfair fight. Insurance companies have teams of experts working to minimize what they pay out. Shouldn’t you have an expert working to maximize what you receive?

Our comprehensive services take the burden off your shoulders during an already stressful time. We start with a thorough policy review, carefully examining your coverage, endorsements, and those tricky exclusions that insurers love to hide in fine print. Insurance policies can be maze-like documents filled with confusing language – we translate them into plain English and identify every possible avenue for recovery.

Damage documentation is where our expertise really shows. We conduct detailed inspections of your property, using high-quality photos, videos, and precise measurements to document every bit of damage. For larger commercial properties, we often use advanced tools like Matterport 3D imaging to create an immersive, accurate record of your loss. This technology helps us uncover both obvious damage and hidden issues that insurance company adjusters might conveniently overlook.

When it comes to claim preparation, we handle all the paperwork and technical details. Using industry-standard Xactimate software, we create detailed repair estimates that reflect current market rates and include all necessary costs – from structural repairs to debris removal. We then submit a comprehensive claim package on your behalf.

Expert negotiation is where we truly earn our fee. We handle all communication with your insurance company, challenging lowball offers and fighting for fair settlements. If negotiations stall, we can invoke the appraisal process in your policy – an alternative to costly litigation that often resolves disputes faster and more efficiently.

Waco’s unpredictable weather creates specific challenges for property owners. We regularly handle storm damage claims from severe weather events including tornadoes, hurricanes, and wind damage that can devastate roofs and building facades. Water damage from burst pipes during sudden freezes or flooding from heavy rains requires immediate attention to prevent costly mold growth.

Fire damage claims are particularly complex because they involve not just flame damage, but smoke, soot, and water damage from firefighting efforts. Freeze damage has become increasingly common after severe winter storms that have caused widespread pipe bursts throughout Texas commercial properties.

The Financial Impact of Expert Representation

Here’s a statistic that might surprise you: claims handled with a public adjuster average 747% higher payouts than those handled without one. For claims over $10,000, this difference can mean tens of thousands of additional dollars in your pocket.

Why such a dramatic difference? Insurance companies often take advantage of property owners who don’t understand their rights or the true extent of their coverage. They count on you accepting their first offer or giving up when they deny your claim.

We maximize settlements by uncovering hidden damage that company adjusters miss – like water behind walls or structural issues that aren’t immediately visible. Our accurate cost estimation using professional software ensures every repair cost is accounted for at current market rates.

Our firm specializes in commercial properties – the complex world of multifamily HOAs, apartment complexes, and religious institutions. These properties involve intricate claims due to their size, specialized systems, and potential for business interruption losses. We ensure every aspect of your recovery is addressed, from structural repairs to lost rental income.

Most importantly, working with a Waco public adjuster helps you avoid unnecessary litigation. While some property damage disputes end up in court, the majority can be resolved through proper representation and negotiation – saving you time, stress, and legal fees while still achieving excellent results.

The Public Adjuster Process vs. Going to Court

When property damage hits your Waco commercial building, apartment complex, or religious institution, you face a critical decision. You can tackle the insurance claim yourself, hire a Waco public adjuster, or eventually end up in court fighting your insurance company. Here’s the reality: litigation should be your last resort, not your first choice.

As your Waco public adjuster, our entire process is designed to get you maximum compensation without the headache, expense, and uncertainty of a lawsuit. Think of us as your pre-litigation powerhouse – we resolve disputes before they spiral into costly court battles.

Our streamlined process starts with a free consultation where we review your situation with no strings attached. You’ll understand exactly what your policy covers and what your claim could be worth. No legal jargon, no pressure – just honest answers.

Next comes our comprehensive inspection using cutting-edge tools like Matterport 3D imaging. We don’t just look for obvious damage; we hunt for hidden issues that insurance company adjusters often “miss” (sometimes conveniently). Every crack, every water stain, every structural concern gets documented with bulletproof evidence.

Then we prepare your detailed claim package using industry-standard Xactimate software. This isn’t a back-of-the-napkin estimate. We create a carefully documented case that insurance companies can’t easily dismiss or lowball. Think of it as building a fortress of facts around your claim.

The expert negotiation phase is where our experience really pays off. We handle all communication with your insurance company, speaking their language while fighting for your interests. No more frustrating phone calls or confusing paperwork – we become your professional voice in these discussions.

Our goal is always a final settlement that fully covers your damages. Since we work on contingency, we don’t get paid until you do. This aligns our interests perfectly with yours.

This approach helps you avoid unnecessary litigation entirely. Many property owners end up in court simply because they didn’t have proper representation from the start. By the time they realize they need help, positions have hardened and relationships have soured.

The appraisal process offers another powerful alternative to lawsuits. If negotiations stall, we can invoke your policy’s appraisal clause – a much faster, cheaper way to resolve disputes than going to court.

Comparing the Claim Process: Handling it Alone vs. Hiring a Public Adjuster vs. Filing a Lawsuit

| Feature | Handling it Alone | Hiring a Public Adjuster | Filing a Lawsuit (Property Damage) |

|---|---|---|---|

| Advocate | You (against the insurance company) | Licensed expert working for you | Attorney (often expensive, lengthy process) |

| Expertise | Limited, based on personal experience | Deep knowledge of policies, damage, and negotiation | Legal expertise, but may lack claims-specific knowledge |

| Time Commitment | High (research, documentation, negotiation) | Low (we handle everything) | High (depositions, court appearances, findy) |

| Cost | Your time, potential for underpaid claim | Contingency fee (percentage of settlement, no upfront) | Hourly attorney fees or higher contingency fees |

| Outcome Likelihood | Often underpaid or denied | Significantly higher payouts (747% average increase) | Variable, can be lengthy and uncertain |

| Stress Level | Very High | Low (we manage the process) | Extremely High |

| Relationship with Insurer | Adversarial, often frustrating | Professional, negotiation-focused | Highly adversarial |

| Public Record | No | No | Yes (court filings are public) |

| Speed of Resolution | Slow (due to inexperience, insurer tactics) | Expedited (due to expertise, proper documentation) | Very Slow (court dockets, appeals) |

We prevent the common mistakes that often force property owners into litigation. Incomplete documentation is the biggest claim killer – missing hidden damage or failing to provide proper evidence gives insurance companies easy excuses to deny or underpay your claim.

Accepting lowball offers happens more often than you’d think. Insurance companies count on your desperation or lack of knowledge to settle for pennies on the dollar. Misunderstanding policy language can be equally devastating – one wrong statement can jeopardize your entire claim.

Missed deadlines are another lawsuit creator. Insurance claims have strict timelines, and missing them can lead to automatic denials. We manage every deadline and keep your claim moving forward smoothly.

The bottom line? A Waco public adjuster gives you professional representation that levels the playing field before disputes escalate into expensive court battles. We turn potential lawsuits into successful settlements.

Why Hiring a Waco Public Adjuster is a Strategic Business Decision

For commercial property owners and managers in Waco, hiring a Waco public adjuster isn’t just about getting a fair payout—it’s a strategic business decision that protects your assets, minimizes disruption, and ensures your operations can continue smoothly.

Think about it this way: when property damage strikes your apartment complex, commercial building, or religious institution, you’re suddenly juggling two full-time jobs. You still need to manage your regular responsibilities while also becoming an insurance claims expert overnight. That’s where the real value of a Waco public adjuster becomes clear.

We save you precious time and stress by handling every aspect of your claim. Your primary focus should be on running your business, managing your property, or serving your congregation—not wrestling with insurance paperwork and phone calls. Dealing with an insurance claim properly requires extensive documentation, constant communication, and skilled negotiation. We take all of this off your plate, freeing up your valuable time and eliminating the overwhelming stress that comes with fighting for what you deserve.

We level the playing field in a way that many property owners don’t fully appreciate until they need it. Insurance companies have vast resources and trained professionals working around the clock to protect their bottom line. They have teams of adjusters, attorneys, and engineers—all focused on minimizing what they pay you. When you hire us, you get equally skilled and experienced representation ensuring you’re not outmatched or outmaneuvered. It’s like having your own specialized legal counsel dedicated exclusively to your insurance claim.

Our contingency fee model eliminates your financial risk entirely. You pay us a percentage of the final settlement only after your claim is successfully resolved and you receive payment. If we don’t recover anything for you, you owe us nothing. This approach aligns our incentives directly with maximizing your recovery—we only succeed when you do.

Our local expertise in Waco’s specific challenges makes a significant difference in claim outcomes. We understand the regional building codes, current repair costs, and the unique weather patterns that affect properties throughout Texas. This local insight proves invaluable when assessing damage and negotiating with insurers who may not fully grasp the local market conditions.

When should you consider hiring a Waco public adjuster? Large losses where repair costs are substantial always benefit from professional representation. Complex claims involving extensive damage, multiple types of perils (like fire followed by water damage), or business interruption components require specialized expertise. If your claim was denied, we can review the denial, identify its weaknesses, and work to overturn it. When you receive underpaid settlement offers that clearly won’t cover your actual losses and restoration costs, we step in to fight for what you’re truly owed. Finally, when insurers create delays by dragging their feet, avoiding communication, or requesting excessive documentation, we cut through these tactics to move your claim forward.

What to Look for in a Reputable Waco Public Adjuster

Choosing the right Waco public adjuster can make or break your claim outcome. Here’s what separates the professionals from the rest:

Texas Department of Insurance (TDI) licensing is your first checkpoint. Always verify that any public adjuster is currently licensed by the TDI, ensuring they meet the state’s regulatory requirements. You can easily verify their license on the TDI website.

Commercial claim experience matters enormously. Make sure they have specific, proven experience handling claims for commercial buildings, multifamily properties, apartment complexes, or religious institutions—especially for the type of damage you’ve sustained. Residential experience doesn’t automatically translate to commercial expertise.

Positive references from other commercial property owners or managers provide real insight into their capabilities. Don’t hesitate to ask for client testimonials, particularly from properties similar to yours.

Clear contract terms demonstrate professionalism and transparency. A reputable public adjuster provides a clear, easy-to-understand contract outlining their services, fees, and the scope of their representation. Never sign a blank contract or agree to vague terms.

Professional conduct standards matter in this industry. Learn about professional conduct standards from TAPIA, as the Texas Association of Public Insurance Adjusters sets high ethical and professional standards for its members.

Texas fee regulations protect you from excessive charges. In Texas, a public adjuster’s fee cannot exceed 10% of the claim settlement. Be wary of anyone quoting higher percentages. These fees are often negotiable based on the complexity and size of your claim, giving you room to find an arrangement that works for both parties.

Frequently Asked Questions about Public Adjusters

Property owners in Waco often have questions about working with a public adjuster. Let’s address the most common concerns we hear from commercial property managers, apartment complex owners, and religious institutions.

What types of claims can a Waco public adjuster help with?

As your Waco public adjuster, we focus exclusively on commercial property damage claims where our expertise can make the biggest difference. We handle the complex claims that can devastate your business operations or disrupt your tenants’ lives.

Fire and smoke damage claims are among our most common cases. Even a small electrical fire can create extensive damage throughout a building. Beyond the obvious flame damage, smoke infiltrates HVAC systems, penetrates walls, and leaves lingering odors that require professional remediation. We ensure your claim covers not just the visible damage, but also the hidden costs of soot removal, air quality restoration, and temporary relocation expenses.

Water and flood damage requires immediate attention and thorough documentation. Whether it’s a burst pipe during a Texas freeze, storm damage to your roof, or flooding from heavy rains, water intrusion can compromise structural integrity and create mold problems. We understand the urgency of these claims and work quickly to document all damage, including areas that might not show problems for weeks or months.

Wind and tornado damage is unfortunately common in our area. Texas storms can strip roofs, shatter windows, and send debris through building facades. We’ve handled claims from minor wind damage to complete tornado destruction, ensuring every aspect of the loss is properly valued and documented.

Freeze damage has become increasingly important after recent severe winter storms. When temperatures plummet, pipes burst and HVAC systems fail, often causing more damage than the original weather event. We help property owners steer these complex claims where the damage might not be finded until days or weeks later.

Business interruption coverage is often overlooked but can be crucial for commercial properties. When your building is damaged and you can’t operate normally, you’re entitled to compensation for lost income and additional expenses. This might include temporary relocation costs, extra utility expenses, or lost rental income from displaced tenants.

We specifically focus on property damage claims and don’t handle health insurance matters. Our expertise lies in the physical restoration of your commercial property and getting your business back to normal operations.

How much does a public adjuster charge for their services?

One of the biggest advantages of working with us is our contingency fee structure. This means you never pay us a dime unless we successfully recover money for your claim.

No upfront costs means you can get expert representation immediately, even when you’re dealing with the financial stress of property damage. We don’t require retainers, hourly fees, or any payment to begin working on your case.

Our “no recovery, no fee” guarantee aligns our interests perfectly with yours. We only succeed when you succeed. If we can’t improve your settlement or get your denied claim approved, you owe us absolutely nothing.

When we do recover funds for you, our fee is a percentage of the total settlement. This percentage is always clearly outlined in our contract before we begin work. The exact percentage can vary based on the complexity of your claim, the amount of work required, and the size of the potential recovery.

Texas law caps our fees at 10% of the settlement amount, which protects property owners from excessive charges. Many cases settle for fees lower than this maximum, especially for larger commercial claims where even a small percentage represents significant compensation for our work.

This fee structure means the better we do for you, the better we do for ourselves. It’s a partnership where everyone wins when we maximize your settlement.

Can a public adjuster help if my claim was already denied?

Absolutely! Some of our most rewarding work involves turning denied claims into substantial settlements. Insurance companies deny legitimate claims for many reasons, and most of these denials can be successfully challenged with proper documentation and expertise.

Reopening your claim starts with a thorough review of the denial letter and the insurance company’s file. We examine their reasoning, identify weaknesses in their decision, and develop a strategy to address their concerns. Often, we find that the denial was based on incomplete information or a misunderstanding of your policy coverage.

Submitting new evidence is where our expertise really shines. We conduct our own comprehensive property inspection, often uncovering damage that was missed or minimized in the original assessment. Using advanced documentation techniques and industry-standard estimating software, we build a compelling case that’s difficult for the insurance company to ignore.

Overturning denials requires understanding both the technical aspects of property damage and the legal requirements of insurance policies. We know how to present evidence in a way that addresses the specific reasons for denial while demonstrating that your claim clearly falls within your policy coverage.

Correcting underpayments is just as important as overturning denials. If your claim was approved but the settlement offer is inadequate, we can demonstrate the true cost of restoration and negotiate for proper compensation. Many property owners accept lowball offers because they don’t realize how much their claim is actually worth.

The key is acting quickly. Even if your claim was denied months ago, we can often reopen it and present new evidence that leads to a successful resolution. Don’t let a denial letter be the final word on your property damage claim.

Get the Expert Claim Support Your Waco Property Deserves

When property damage strikes your commercial building, apartment complex, or religious institution in Waco, you’re facing more than just repair costs. You’re dealing with business interruption, tenant concerns, and the overwhelming task of navigating complex insurance policies while trying to keep your operations running.

The truth is, you shouldn’t have to fight this battle alone. Insurance companies have entire departments dedicated to minimizing payouts, but as a Waco public adjuster, we level that playing field completely.

By partnering with Insurance Claim Recovery Support, you gain expert advocacy that works exclusively for your interests. We’re not just another service provider – we’re your dedicated champion in what can often feel like an unfair fight. Our team understands the unique challenges facing property owners and managers in Texas, from sudden freeze damage to devastating storms that seem to appear out of nowhere.

Maximized recovery isn’t just a promise – it’s what we deliver consistently. 747% higher payout statistic? That’s the real-world difference between facing your insurance company alone and having professional representation. We use advanced tools like Matterport 3D imaging and industry-standard Xactimate software to document every dollar of damage, ensuring nothing gets overlooked or undervalued.

Perhaps most importantly, we provide peace of mind during one of the most stressful times you’ll face as a property owner. While we handle the complexities of your claim – from initial documentation through final settlement – you can focus on what matters most: getting your property restored and your tenants or congregation back to normal.

Our extensive Texas expertise serves clients throughout the state, including Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Round Rock, Georgetown, and Lakeway. We stay current with local building codes, weather patterns, and the specific challenges each region faces. This isn’t just knowledge – it’s the kind of local insight that makes the difference between a fair settlement and leaving money on the table.

Don’t let your insurance claim drag on for months or turn into expensive litigation. Take control of your recovery process and ensure you receive every dollar you’re entitled to under your policy. The contingency fee model means there’s no risk to you – we only succeed when you do.