Navigating Your Austin Property Claim

When your public insurance adjuster austin search brings you here, you’re likely facing property damage and need expert representation to steer your insurance claim. Here’s what owners and managers of commercial and multifamily properties need to know:

Quick Answer: What is a Public Insurance Adjuster in Austin?

- Who They Work For: Public insurance adjusters represent you, the policyholder—not the insurance company

- What They Do: Document damage, interpret your policy, prepare your claim, and negotiate with your insurer for maximum settlement

- When to Hire: Immediately after damage occurs, when you receive a low offer, or if your claim is denied or delayed

- Cost Structure: Contingency fee basis (typically capped at 10% in Texas)—no recovery means no fee

- Types of Claims: Fire, hail, hurricane, tornado, freeze, flood, wind, lightning, vandalism, and business interruption

- Property Types Served: Commercial buildings, multifamily complexes, apartment complexes, HOAs, religious institutions, retail centers, office buildings, hospitals, and manufacturing facilities

For owners and managers of commercial and multifamily properties in Austin, navigating a property damage insurance claim can feel overwhelming. Between managing your operations and dealing with insurance company adjusters who work for the insurer—not you—policyholders often find themselves underpaid, delayed, or wrongfully denied. The insurance claim process is complex, filled with policy language that favors insurers, and requires thorough documentation that most policyholders don’t have time to manage while running their organizations.

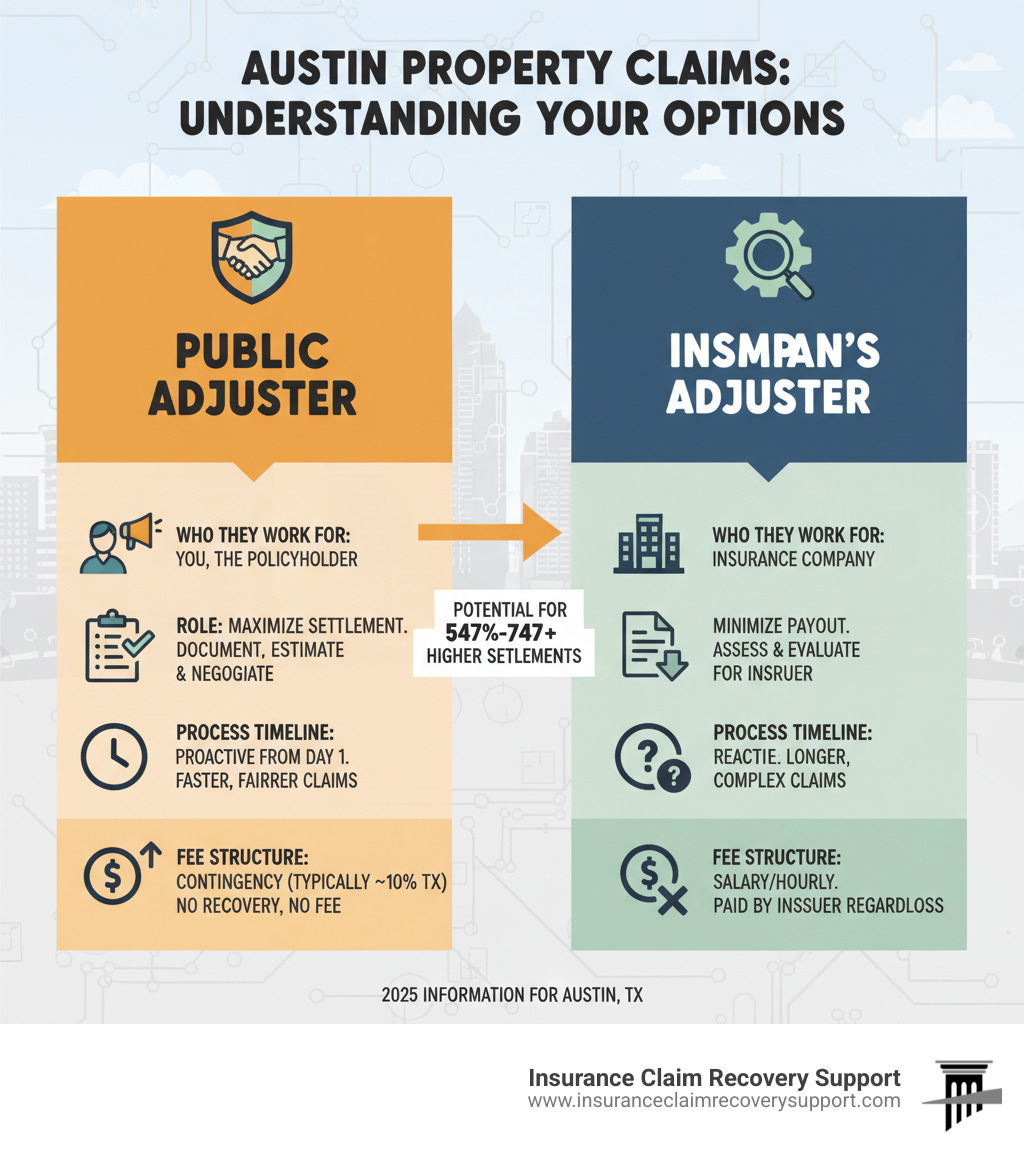

Studies consistently show that policyholders receive significantly higher settlements when represented by a public adjuster—some government research indicates increases of 547% to 747%, with some claims seeing improvements of over 3,000% from initial offers. This dramatic difference exists because public insurance adjusters exclusively represent your interests, understand the intricacies of commercial policies, and know how to document and present claims to secure every dollar you’re entitled to under your coverage.

For Austin commercial and multifamily owners and managers facing fire damage, storm-damaged roofs, freeze-related losses, or any disaster affecting multifamily properties, commercial buildings, or religious institutions, the decision often comes down to this: handle the claim yourself against experienced insurance company adjusters, hire an attorney and face lengthy litigation, or engage a public adjuster who specializes in maximizing property damage settlements through expert negotiation. The third option consistently proves faster, more cost-effective, and more successful than the alternatives—and often helps you avoid unnecessary litigation.

I’m Scott Friedson, a multi-state licensed public insurance adjuster austin property owners trust, and as CEO of Insurance Claim Recovery Support (ICRS), I’ve settled hundreds of millions in commercial and multifamily property damage claims across Texas and nationwide. Over 15 years and 500+ large-loss claims, I’ve built a track record of overturning wrongful denials, negotiating fair settlements, and helping policyholders avoid unnecessary litigation while increasing recoveries by 30% to over 3,800%.

Why You Need a Public Insurance Adjuster in Austin

When disaster strikes your commercial or multifamily property in Austin, the aftermath can be chaotic. Owners and managers are left dealing with significant damage, business interruptions, and the daunting task of filing an insurance claim. This is where the expertise of a public insurance adjuster Austin becomes invaluable. We simplify the process and protect your rights as a policyholder while helping you avoid unnecessary litigation.

The Critical Difference: Public Adjuster vs. Company Adjuster

Understanding the fundamental difference between a public adjuster and an insurance company’s adjuster is the first step toward safeguarding your financial recovery. It’s a distinction that can literally mean the difference between a minimal payout and a maximized settlement.

What is a public insurance adjuster in Austin and how do they differ from an insurance company’s adjuster?

Simply put, we, as public adjusters, are your dedicated advocates. Our sole allegiance is to you, the policyholder. We work exclusively on your behalf, carefully documenting every detail of your loss, interpreting the nuances of your insurance policy, and expertly negotiating with your insurance company to achieve the best possible settlement. We are licensed professionals, regulated by the Texas Department of Insurance (TDI), and bound by strict ethical guidelines to serve your interests.

On the other hand, the insurance company’s adjuster—whether they are a staff adjuster (an employee of the insurer) or an independent adjuster (contracted by the insurer)—works for the insurance company. Their primary objective, while professional, is to assess the damage and determine the lowest amount legally permissible for the insurer to pay out under the terms of your policy. They are paid by the insurance company, and their loyalties lie with their employer’s bottom line. This inherent conflict of interest often leaves policyholders feeling overwhelmed and underpaid.

Consider it this way: when you go to court, you hire an attorney to represent your interests. When you’re dealing with a complex insurance claim, a public adjuster serves a similar role, ensuring you have an expert on your side to level the playing field. We speak the language of insurance, understand the tactics often used to minimize payouts, and possess the technical knowledge to accurately value your loss.

For a deeper dive into these roles, you can explore our resources: Public Adjuster vs. Insurance Company for Property Damage Claim and What Does a Claims Adjuster Do?.

Why should a commercial or multifamily owner or manager in Austin hire a public insurance adjuster?

Hiring a public insurance adjuster Austin property owners can trust is a strategic decision that offers numerous benefits:

- Expert Representation: We bring specialized knowledge of insurance policies, construction costs, and negotiation strategies.

- Maximized Settlements: As documented by various studies, policyholders often receive significantly higher payouts with a public adjuster’s help.

- Time Savings: We handle all the paperwork, communication, and negotiations, allowing you to focus on operations and occupants.

- Reduced Stress: We manage the process end-to-end so you can focus on recovery.

- Unbiased Assessment: We ensure nothing is overlooked or undervalued by the insurer.

How a Public Adjuster Maximizes Your Financial Recovery

Our primary goal at Insurance Claim Recovery Support is to help you, the policyholder, maximize your financial recovery after a property loss. This isn’t just about getting a settlement; it’s about getting the full and fair settlement you deserve, enabling you to rebuild, repair, and recover without incurring significant out-of-pocket expenses.

How can an Austin public adjuster help maximize a property owner’s financial recovery after a loss?

Our approach combines meticulous documentation, expert policy interpretation, and skilled negotiation:

- Thorough Damage Documentation: We use advanced tools like thermal imaging and drones to uncover all visible and hidden damages. We prepare a detailed scope of loss using industry-standard software to create precise estimates for repairs and replacements.

- In-depth Policy Interpretation: We review coverages, endorsements, and potential avenues for recovery, including items like matching requirements, business interruption, loss of income, and loss of rents—critical for commercial and multifamily properties.

- Expert Negotiation: With a thoroughly documented claim and a clear understanding of your policy, we engage in robust negotiations with your insurance company to counter undervaluation or denials.

- Proven Results: Government studies indicate that policyholders receive 547% to 747% more for their claims when using a public adjuster. Our clients have seen settlements increase by over 3,000% from the initial offer.

To learn more about how we achieve these results, visit How to Maximize Your Commercial Property Damage Claim and Commercial Property Damage.

The Claims Process: Public Adjuster vs. Lawsuit

When faced with an underpaid or denied property damage claim in Austin, owners and managers often consider two main paths beyond handling it themselves: hiring a public insurance adjuster Austin specialist or pursuing litigation. While both aim for a fair settlement, their processes, timelines, and costs differ significantly. For most property damage claims, engaging a public adjuster is a more sensible and effective path than immediate litigation—and often avoids it altogether.

What are the benefits of using a public adjuster versus pursuing litigation for a property damage claim in Austin?

| Feature | Public Adjuster Process | Litigation Process |

|---|---|---|

| Approach | Collaborative & Negotiatory | Adversarial & Confrontational |

| Timeline | Faster resolution (typically months) | Slower, lengthy process (can take years) |

| Cost | Contingency fee (no recovery, no fee) | Upfront retainers, hourly attorney fees, court costs |

| Focus | Policy expertise & damage valuation | Legal battle & procedural rules |

| Outcome | Maximized settlement through negotiation | Court judgment or pre-trial settlement |

By preparing a complete, professional claim package up front, a public adjuster can often resolve disputes before they escalate—helping commercial and multifamily owners and managers avoid unnecessary litigation, delays, and costs.

FAQ and Fact vs. Myth for Commercial & Multifamily Policyholders

-

Myth: I should hire a lawyer first for a property claim.

Fact: Most property damage claims can be resolved without a lawsuit. Public adjusters focus on negotiating a fair settlement within the policy so you can avoid costly, time-consuming litigation. If litigation becomes necessary, we coordinate a clean handoff to your attorney and do not represent you in court. -

FAQ: Will hiring a public adjuster antagonize my insurer?

Answer: No. Public adjusters are licensed and regulated by TDI and are a normal, permitted part of the claims process. -

FAQ: When should I bring in a public adjuster?

Answer: Immediately after a loss, when documentation is critical; or any time you face delays, denials, or low offers. -

FAQ: What do you charge in Texas?

Answer: We work on a contingency fee, typically capped at 10% in Texas. No recovery, no fee. -

Myth: Using a public adjuster will slow down my claim.

Fact: A complete, well-documented claim usually speeds resolution because it reduces back-and-forth and disputes. -

FAQ: Can I have both a public adjuster and an attorney?

Answer: Yes, but roles differ. Public adjusters handle pre-litigation claim preparation and negotiation; attorneys handle legal disputes and court actions if needed.