Why Public Adjuster Schools Matter for Your Career

Public adjuster schools provide the essential training and licensing preparation needed to launch a career as a policyholder advocate in the property insurance industry. If you’re looking for public adjuster training programs, here’s what you need to know:

Quick Answer: Finding Public Adjuster Schools

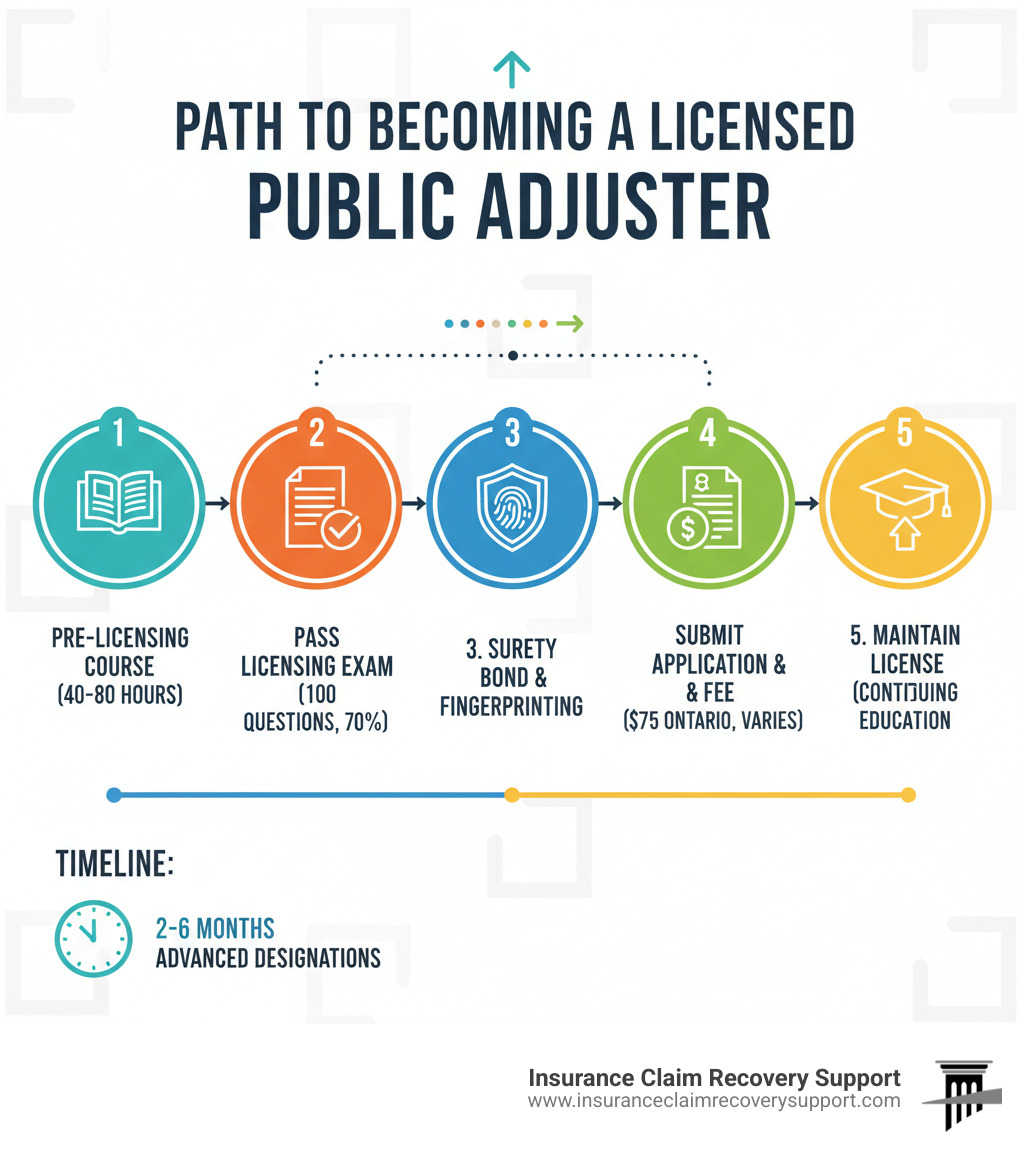

- Pre-licensing courses: State-specific training programs (typically 40-80 hours) covering property insurance, legal codes, and claim evaluation

- Top training providers: The Academy of Adjusters, Public Adjuster Academy, CATI, and state-approved online programs

- Average costs: $250-$500 for pre-licensing courses; continuing education $50-$75 per webinar

- Pass rates: Leading schools report 90-95% first-attempt pass rates on state licensing exams

- Timeline: Most programs can be completed in weeks; advanced designations like SPPA® take 6-9 months

- Requirements vary by state: Texas, Florida, Illinois, Ontario, and other jurisdictions have unique licensing requirements

A career as a public adjuster offers financial independence and the chance to help property owners steer the complex insurance claim process after disasters. Unlike adjusters who work for insurance companies, public adjusters represent the policyholder, ensuring fair settlements. Entering this profession requires proper training, licensing, and a deep understanding of insurance policies and state regulations.

Fact: Public adjuster schools build the skills to advocate effectively for commercial and multifamily property owners facing large-loss claims. ✅

Myth: You can become a successful public adjuster through on-the-job training alone. ��

Reality: While experience matters, formal education through accredited public adjuster schools provides the foundation in policy analysis, negotiation techniques, and ethical standards that separate qualified professionals from untrained contractors who illegally attempt to handle claims.

The path to becoming a licensed public adjuster typically involves completing state-approved coursework, passing a licensing exam, obtaining a surety bond, and fulfilling continuing education requirements. States like Texas, Florida, and Illinois, and provinces like Ontario, have specific regulatory bodies—such as the Texas Department of Insurance (TDI) or Ontario’s Financial Services Regulatory Authority (FSRA)—that oversee adjuster licensing.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. With over 15 years of experience settling large-loss claims, I know that quality training from reputable public adjuster schools is essential. Understanding what top programs offer is your first step toward becoming a trusted advocate for policyholders.

Your Guide to a Career as a Public Adjuster

Picture this: A commercial building owner stands before their fire-damaged property, holding a settlement offer that won’t cover half the repairs. This is where a public adjuster steps in.

A public adjuster is a licensed professional who advocates exclusively for the policyholder during an insurance claim. While insurance company adjusters work to minimize payouts, public adjusters work to maximize what you receive.

At Insurance Claim Recovery Support, we help businesses recover from major property losses. We represent a wide range of commercial clients, from apartment investors and HOAs to industrial facilities and retail centers. When disaster strikes—whether it’s fire, hurricane, or freeze damage—we become your advocate, interpreting policy language, documenting damage, and negotiating with your insurance carrier.

The role requires deep expertise in property insurance, damage assessment, and negotiation. This is why training from reputable public adjuster schools isn’t just helpful—it’s essential.

Differentiating Adjusters: Public, Staff, and Independent

Not all adjusters are on your side. Understanding who represents whom is critical for a fair settlement.

Staff adjusters are employees of insurance companies. Their job is to investigate claims for their employer and determine how much the insurance company should pay.

Independent adjusters work on a contract basis for insurance companies, often during catastrophic events. Though not full-time employees, they are still hired and paid by the insurer and represent the insurer’s interests.

Public adjusters are the only type of adjuster who works exclusively for the policyholder. At Insurance Claim Recovery Support, we are paid by our clients, not insurance companies. Our sole focus is to prepare, present, and negotiate your claim to achieve the maximum possible settlement. When you hire us, you level the playing field.

This distinction matters when you’re facing a large-loss commercial claim. The insurance company has trained professionals working to minimize their payout. Shouldn’t you have an expert working to maximize your recovery?

Professional standards and ethical conduct are paramount in public adjusting. The career demands technical knowledge and unwavering integrity, as we are trusted during a property owner’s most stressful moments. Specialized training from accredited public adjuster schools provides the foundation in policy analysis, damage assessment, and ethical practices that define a qualified professional.

What to Expect from Top Public Adjuster Schools

Top public adjuster schools offer more than a certificate; they provide a comprehensive foundation for a successful career. They focus on pre-licensing education for passing state exams but also extend into career development and networking opportunities. These programs are designed to equip you with the knowledge and practical skills to handle diverse property claims.

Core Curriculum and Essential Skills

The curriculum at leading public adjuster schools is designed to build a robust skill set. You’ll dig deep into:

- Property Insurance Policies: Learning to interpret complex policy language, endorsements, and exclusions.

- Claim Evaluation and Damage Assessment: Understanding how to properly assess and document various types of property damage, from fire and water to hurricanes.

- Negotiation Techniques: Mastering the art of negotiation to advocate effectively for policyholders.

- State Legal Codes: Familiarizing yourself with the specific laws governing insurance claims in your state, such as those in Texas, Florida, and Georgia.

Beyond basic licensing, many professionals pursue advanced training. The Senior Professional Public Adjuster (SPPA®) designation, offered by The Institutes, is a prime example. This specialized program strengthens practical claims handling skills and typically takes 6-9 months to complete. It focuses on property policy knowledge, coverage analysis, negotiation techniques, and clear communication for faster claim resolution.

Key skills emphasized in these programs include:

- Communication: For clear policyholder interactions and effective negotiation.

- Critical Thinking: To analyze complex claim scenarios and policy details.

- Time Management: To efficiently handle multiple claims and meet deadlines.

How Public Adjuster Schools Help with Exam Prep and Licensing

Licensing requirements vary significantly by state. In Texas, for example, the Texas Department of Insurance (TDI) oversees licensing, while states like Florida and Georgia have their own regulations. Reputable public adjuster schools are experts in these state-specific requirements and are pivotal in preparing you for the licensing process.

Many schools report pass rates over 90% on the first attempt. This success is attributed to comprehensive exam preparation, which includes:

- Simulated Exams: Practice tests that mimic the actual state exam format (often 100 questions).

- Detailed Curriculum: Covering all necessary topics, including property insurance terms and state legal codes.

- Application Assistance: Guiding students through requirements like obtaining a surety bond and fingerprinting.

- Support Services: Offering post-class consulting during the application process.

The typical state exam has 100 questions, and license application fees vary by state (e.g., $75 in Ontario). Choosing a school that understands these nuances is crucial for your success.

Choosing the Right Public Adjuster Schools for Your Career Goals

Selecting the right public adjuster school is a critical decision. Consider the program types available:

- Online Courses: Offer flexibility to study at your own pace, with many top providers offering state-specific courses for jurisdictions like Texas and Florida.

- In-Person Classes: Provide a structured environment with direct interaction with instructors and peers.

- On-the-Job Training: While valuable, it often lacks the foundational knowledge and structured exam prep that specialized schools provide.

Pre-licensing courses typically range from $250 to $500. Continuing education (CE) courses, required to maintain your license, might cost $50-$75 per webinar. Some schools and organizations offer scholarships or free courses for members.

Look for schools with experienced instructors and consider what career support or professional networks they offer. These resources can be instrumental in launching your career.

Fact: Specialized public adjuster schools provide a structured, comprehensive education that significantly increases your chances of passing licensing exams. ✅

Myth: On-the-job training is just as effective as formal education from public adjuster schools for initial licensing. ��

Reality: While practical experience is essential, dedicated schools offer focused exam preparation and in-depth knowledge of policy and legal codes that on-the-job training often can’t match for initial licensing.

Launching Your Career and Supporting Policyholders

Once you’ve completed your training and secured your license through one of the many excellent public adjuster schools, a fulfilling career awaits. The trajectory for a public adjuster is one of continuous professional growth. At ICRS, we understand our role extends beyond settling claims; it’s about helping property owners rebuild their operations and move forward with confidence after devastating losses.

Job Outlook and Earning Potential

The job outlook for public adjusters is strong and stable, driven by the constant need for expert advocacy in property insurance claims. Disasters like hurricanes in Texas and Florida or fires nationwide ensure the demand for skilled adjusters remains consistent.

Salary potential varies by experience and location. As of 2024, the average salary for insurance claims adjusters ranges from $61,000 to $92,000 annually, with median earnings around $88,855. Entry-level adjusters can expect a solid income, but experienced professionals specializing in complex, large-loss commercial claims—the kind we handle at ICRS—can earn significantly more.

Career stability is high in this profession. The need for claims resolution remains constant regardless of economic conditions, making public adjusting an attractive long-term career path.

The Public Adjuster’s Role in Fair Claim Resolution

Our core mission at ICRS is advocating for policyholders. For owners of commercial and multifamily properties, facing large-loss claims from fire, hurricanes, or winter storms can be devastating. This is where the expertise from quality public adjuster schools becomes invaluable.

We represent you, the policyholder—never the insurance company. Our specialization in commercial property claims ensures your loss is properly documented, valued, and presented to maximize your settlement and minimize stress. A key benefit is reducing delays; without an expert, claims can drag on for months, creating cash flow problems for recovering businesses.

Most importantly, a skilled public adjuster helps you avoid the costly trap of unnecessary litigation. When an insurer undervalues or denies a claim, many property owners feel an insurance claim lawsuit is their only option. This path, however, involves mounting legal fees, lengthy court battles, and stressful depositions, all while your property sits unrepaired and your business suffers.

An insurance claim lawsuit for property damage means hiring attorneys, paying fees, and enduring years of stressful litigation with an uncertain outcome. This diverts your focus from your business and operations, taking a significant financial and emotional toll.

In contrast, using a public adjuster provides an expert to handle the entire claim process: documentation, damage assessment, policy analysis, and negotiation. We understand insurance policies and carrier tactics, aiming to secure a fair settlement quickly. This expert representation for large-loss claims helps you avoid litigation and focus on your business.

At ICRS, we maintain a 90% settlement success rate without resorting to unnecessary lawsuits. Our clients receive fair compensation through skilled negotiation and expert claim presentation—no courtrooms, no depositions, no years of waiting. We advocate for commercial and multifamily property owners throughout Texas, Florida, Georgia, and our other service states.

When disaster strikes your property, your path to recovery shouldn’t be complicated by legal battles. Our commitment is to ensure that path is as smooth and successful as possible.

More info about our public adjusting services for commercial properties