Why Property Damage Recovery Requires Expert Guidance

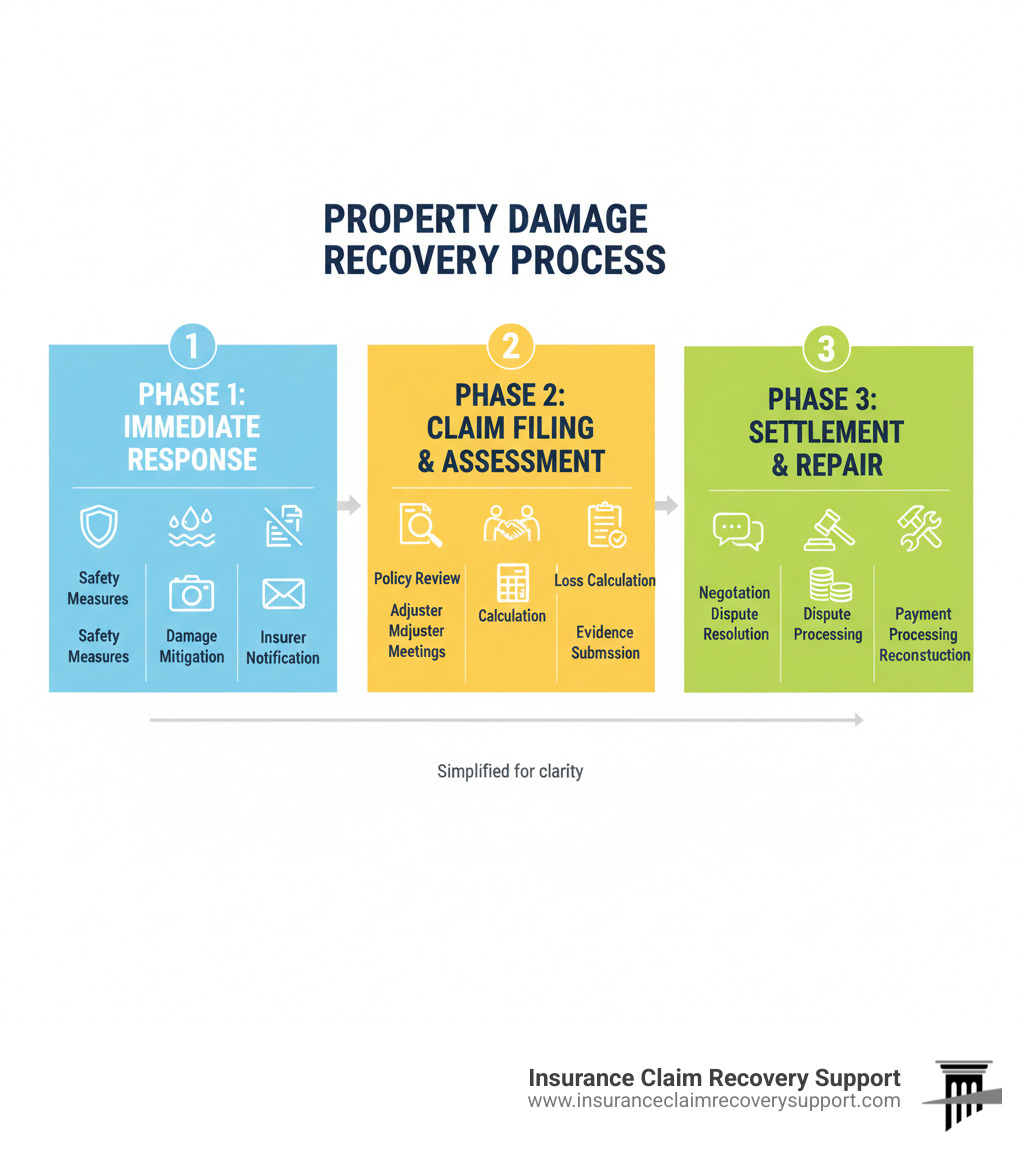

Property damage recovery is the process of securing compensation, repairing or replacing damaged assets, and restoring operations after a disaster damages your commercial building, multifamily property, or facility. When a fire, hail storm, hurricane, tornado, freeze, lightning strike, or flood strikes your property, the path to full recovery involves three critical phases:

Quick Answer: The Property Damage Recovery Process

- Immediate Response – Secure the property, document damage, and notify your insurer

- Claim Filing & Assessment – Steer policy coverage, meet with adjusters, and prove your losses

- Settlement & Repair – Negotiate fair compensation, resolve disputes, and rebuild

Fact vs. Myth: What You Need to Know ✅

Myth: Your insurance company’s adjuster works for you. ��

Fact: Company adjusters represent the insurance company’s interests, not yours. They’re paid by the insurer to assess damage and determine what the company will pay—which is why many property owners hire their own public adjuster to level the playing field.

Myth: You must accept the first settlement offer. ��

Fact: Initial offers are often substantially lower than what you’re entitled to. Most states give you 2-3 years to file a property damage lawsuit, but working with a public adjuster can help you avoid unnecessary litigation while still maximizing your settlement—often increasing recoveries by 30% to over 3,800%.

Myth: Filing a large claim means you’ll end up in court. ��

Fact: The vast majority of commercial property damage claims settle without litigation when policyholders have proper representation and documentation.

If you’re facing a complex commercial property claim, you’re not alone. The process can take up to two years, and the complexities of policy interpretation and loss calculation often leave owners undercompensated. You may be facing uncertainty with the claims process, frustration with low settlement offers, or fear of a wrongful denial.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, my firm has specialized in helping commercial and multifamily property owners recover from disasters. We’ve settled over 500 large-loss claims valued at more than $250 million by ensuring our clients receive fair settlements without unnecessary litigation.

Navigating the Commercial Property Damage Recovery Process

When disaster strikes your commercial building, apartment complex, or facility, the actions you take in the first few hours will shape your entire property damage recovery journey. Property owners in Texas, from storm-battered buildings in Fort Worth to fire-damaged complexes in Houston, who take immediate, strategic action recover fastest. This section outlines what to do to protect your financial interests from day one.

Immediate Steps After a Loss

In the chaos after a disaster, you need a clear plan.

First, ensure everyone is safe. Address injuries and evacuate if there are structural, electrical, or gas leak hazards. Once the area is secure, you must prevent further damage. This “duty to mitigate” is required by your policy. Tarp a damaged roof before it rains, or shut off the water after a pipe bursts to prevent mold. Document every mitigation step with photos and receipts, as failure to do so can reduce your settlement.

Next, begin comprehensive documentation. You cannot take too many photos or videos. Capture wide shots and close-ups of all damage before any cleanup. Create a detailed inventory of damaged items. Back up all business records, financial documents, and security footage to a cloud service. This evidence is the foundation of your claim.

Finally, notify your insurance company immediately as required by your policy. Delays can jeopardize your claim. When you call, have your policy number and a clear description of the event.

Make these essential first contacts right away:

- Emergency Services for injuries or immediate dangers.

- Your Insurance Agent or Broker to officially file the claim.

- A Public Adjuster for independent representation from the start.

- A Restoration Company for emergency repairs and mitigation.

Understanding Your Commercial Policy and Potential for Property Damage Recovery

Commercial property insurance policies are complex documents, but understanding your coverage is essential to recovering what you’re owed. Unlike a homeowner’s policy, a commercial policy protects your business operations, income stream, equipment, and inventory.

Your policy’s valuation method is critical. Replacement Cost Value (RCV) pays to replace damaged property with new materials of similar quality. Actual Cash Value (ACV) pays what the property was worth at the time of loss, factoring in depreciation. An ACV policy on a 15-year-old roof might only pay 50-60% of the replacement cost, leaving you with a significant shortfall. We always advocate for RCV coverage to make you whole.

Beyond physical repairs, your policy may include other vital coverages:

- Business Interruption Coverage: Replaces lost profits and covers ongoing operating expenses (like payroll and rent) while your business is shut down.

- Additional Living Expenses (ALE): For multifamily properties, this covers temporary housing and other increased costs for displaced residents.

- Inventory Loss: Covers the value of destroyed inventory, though valuation methods differ for manufacturers, wholesalers, and retailers.

Understanding these coverages is the first step in holding your insurer accountable. A public adjuster translates this complex policy language into the real dollars you are entitled to receive.

The Insurance Claims Process: What to Expect

Once you file a claim, your insurer assigns a company adjuster or a contracted independent adjuster. Both represent the insurance company’s interests, not yours. Their job is to investigate the loss and determine what the insurer will pay.

This is why hiring a public adjuster is a game-changer. A public adjuster from a firm like Insurance Claim Recovery Support works exclusively for you, the policyholder. We assess your damage independently, analyze your policy, and negotiate with the insurer to maximize your settlement. We level the playing field.

After inspection, the company adjuster creates a “scope of loss” detailing their estimate of damages. This scope often underestimates the damage or uses low-cost repair methods. We create our own detailed scope to challenge any discrepancies. Your insurer may also require a sworn “proof of loss” form, where accuracy is critical.

Eventually, the insurer will make a settlement offer, which is often just a starting point for negotiations. Complex commercial claims can take 18-24 months to resolve, especially after major disasters in areas like Houston or Dallas. Having a public adjuster manage this lengthy process allows you to focus on your business while we handle the follow-ups and paperwork.

Most importantly, expert representation can help you avoid litigation. While Texas law gives you years to file a lawsuit, the vast majority of our claims settle without going to court. Through expert negotiation and thorough documentation, we secure fair settlements efficiently, saving you the time and expense of a lawsuit.

Maximizing Your Settlement and Finalizing Your Claim

After the initial chaos, the most critical phase of property damage recovery begins: securing a full and fair settlement. This is where many property owners, going it alone, accept offers that fall short. Our mission is to ensure you recover every dollar you are owed.

Calculating and Proving Your Commercial Losses

A successful recovery depends on accurately calculating and proving the full financial impact of the disaster on your business. This goes far beyond simple repair costs.

Business interruption calculation is often the most complex part. We help you document:

- Lost profits: The income your business would have generated, based on financial history and market trends.

- Continuing expenses: Costs that don’t stop, such as payroll, insurance, and loan payments.

- Extra expenses: Additional costs incurred to minimize the shutdown, like renting temporary space or expediting inventory replacement.

Inventory loss valuation also requires careful attention, as the method varies by business type. A manufacturer might recover the full selling price of finished goods, while a retailer is typically limited to the wholesale replacement cost. This difference can be substantial.

To prove these losses, you need ironclad evidence:

- Financial documents: Tax returns, profit and loss statements, and payroll records.

- Repair estimates: Detailed estimates from multiple licensed contractors.

- Expert testimony: Reports from structural engineers or forensic accountants to validate complex losses.

- Visual proof: The photos and videos you took immediately after the loss.

We help clients across Texas and nationwide organize this evidence to build an unassailable case for your full property damage recovery.

Resolving Disputes: Public Adjuster vs. Insurance Claim Lawsuit

Disputes are common. You may receive a low settlement offer or an outright denial. When this happens, you have two main paths: hiring a public adjuster to negotiate or filing an insurance claim lawsuit.

Learn about the legal principle of foreseeability

The insurance claim lawsuit process is adversarial, expensive, and slow. It involves legal filings, findy, depositions, and potentially a trial. A lawsuit can cost tens of thousands of dollars and take 18 months to several years to resolve. In Texas, the statute of limitations generally gives you only two years from the date of damage to file a suit. Miss that deadline, and you forfeit your rights.

The public adjuster path is designed to achieve maximum property damage recovery without going to court. We use expert negotiation, backed by detailed evidence, to challenge the insurer’s position. Many policies also include an appraisal process or mediation as faster, less expensive alternatives to litigation for resolving valuation disputes. We leverage these tools to your advantage.

By presenting a professionally documented claim from the start, we dramatically increase the likelihood of a fair settlement without the time, stress, and cost of a lawsuit. For a commercial building owner in Austin or a multifamily HOA in Lubbock, this means getting back to business faster. We have successfully settled over 500 large-loss claims, with the vast majority resolved without litigation.

Common Questions About Property Damage Recovery

Navigating property damage recovery raises many questions. Here are answers to some common concerns.

Myth: Stigma damages are automatically included in settlements. ��

Fact: “Stigma damages”—the loss of market value for real estate due to its history—are rarely awarded by courts as they are considered too speculative. Proving a permanent, measurable loss is extremely difficult.

Myth: Additional living expenses just cover hotel costs. ��

Fact: For displaced multifamily residents, Additional Living Expenses (ALE) covers the increase in living costs beyond their normal expenses. This includes temporary housing, extra food costs, storage fees, and other necessary relocation expenses, up to the limits of the policy.

Myth: I have to pay out of pocket to bring my building up to current code. ��

Fact: This depends on whether your policy includes Ordinance or Law coverage. Without this specific endorsement, you are responsible for the costs of meeting new building codes during repair. With it, your policy helps cover these mandatory and often expensive upgrades.

It’s also important to understand betterment (upgrades the insurer won’t pay for) and recoverable depreciation. With a Replacement Cost Value (RCV) policy, your insurer may initially pay only the Actual Cash Value (ACV). The withheld amount, or recoverable depreciation, is paid only after you complete repairs and provide proof of cost. Accepting an initial check is usually an advance, not a final settlement, leaving you free to pursue the full amount owed.

Fact: A public adjuster transforms your position in all these situations. ✅

Our team at Insurance Claim Recovery Support acts as your advocate. We identify all applicable coverages, uncover hidden damages, and prepare detailed estimates to ensure you receive the maximum settlement you’re entitled to. We manage the entire process, from documentation to negotiation, so you can focus on your recovery. Whether your property is in Tarrant County, Travis County, or anywhere nationwide, we are committed to securing your full property damage recovery.